Enel Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enel Bundle

Enel navigates a complex energy landscape, facing significant pressure from powerful buyers and intense rivalry among existing players. Understanding these dynamics is crucial for any stakeholder looking to grasp Enel's strategic position.

The complete report reveals the real forces shaping Enel’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Enel, a major player in the energy sector, sources essential inputs like natural gas, coal, uranium, turbines, solar panels, and grid components from a wide array of suppliers. The concentration of these suppliers directly influences their leverage. If only a few companies can provide a critical component, like advanced turbine technology, their bargaining power increases significantly, potentially driving up costs for Enel.

The uniqueness of inputs significantly shapes supplier power for Enel. While basic energy commodities like natural gas operate in broad global markets with numerous suppliers, specialized components essential for Enel's smart grid initiatives or advanced renewable energy technologies are often sourced from a select few providers. This reliance on niche suppliers for cutting-edge technology grants them considerable leverage.

Switching costs for Enel when changing suppliers are substantial, particularly for vital infrastructure and long-term supply agreements. These costs can involve re-engineering entire systems, the rigorous process of re-qualifying new vendors, or incurring penalties for terminating existing contracts.

For instance, if Enel needs to replace a supplier for a critical component in its renewable energy installations, the cost of testing and certifying a new supplier's product could run into millions of euros, not to mention potential project delays. These significant financial and operational hurdles empower established suppliers, giving them leverage to dictate terms and potentially increase prices, as Enel faces considerable difficulty in finding and integrating alternatives.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Enel's core business of power generation and distribution is typically low. This is largely due to the substantial capital requirements, intricate regulatory frameworks, and specialized technical knowledge needed to operate in the utility sector. For instance, a major wind turbine manufacturer would face significant hurdles in acquiring the necessary licenses and infrastructure to become a power producer itself.

However, in niche segments of the energy services market, such as localized solar installation or energy management solutions, the threat of forward integration by suppliers might be somewhat more pronounced. These areas often involve less stringent regulations and lower initial investment compared to traditional utility operations.

- Capital Intensity: Developing and operating power plants requires billions in investment; for example, a new large-scale renewable energy project can easily cost over $1 billion.

- Regulatory Hurdles: Gaining approval for power generation and grid connection involves navigating complex environmental, safety, and market regulations.

- Specialized Expertise: The utility sector demands deep knowledge in engineering, grid management, and energy trading, which suppliers may not possess.

Importance of Enel to Suppliers

Enel's immense scale, operating in over 30 countries, makes it a crucial customer for many of its suppliers, potentially giving it considerable bargaining power. This large customer base translates to significant revenue streams for suppliers, meaning the loss of Enel as a client could be a substantial financial impact. In 2023, Enel reported revenues of €99.7 billion, highlighting the sheer volume of its purchasing power.

However, this leverage isn't absolute. If a supplier offers a highly specialized, unique, or scarce component essential for Enel's operations, their importance to Enel might surpass Enel's importance to them. For instance, a company holding patents for advanced renewable energy technology critical for Enel's grid modernization projects would possess considerable sway.

- Enel's Global Reach: Operating in over 30 countries amplifies its purchasing volume.

- Revenue Dependence: Suppliers can be significantly impacted by losing Enel as a major client.

- Critical Resource Scarcity: Suppliers of unique or essential components can shift the bargaining balance.

The bargaining power of Enel's suppliers is influenced by several factors, including supplier concentration and the uniqueness of their offerings. While Enel's vast scale, evidenced by its €99.7 billion revenue in 2023, often gives it significant leverage, suppliers of critical, specialized components can command greater power.

High switching costs for Enel, due to the capital intensity and regulatory complexity of the energy sector, further empower suppliers. For example, replacing a supplier for a key turbine component could involve millions in re-engineering and certification, making it difficult for Enel to switch easily.

The threat of suppliers integrating forward into Enel's business is generally low due to high capital and expertise requirements, though it can be more pronounced in niche service areas.

| Factor | Impact on Enel's Supplier Bargaining Power | Example/Data Point |

|---|---|---|

| Supplier Concentration | High if few suppliers exist for critical inputs. | Advanced turbine technology often comes from a limited number of manufacturers. |

| Uniqueness of Input | High for specialized or patented components. | Proprietary smart grid technology components. |

| Switching Costs | High for Enel due to capital and integration needs. | Millions of euros in re-engineering and certification for new components. |

| Enel's Scale | Reduces supplier power due to large order volumes. | Enel's €99.7 billion revenue in 2023 signifies substantial purchasing power. |

| Forward Integration Threat | Generally low for core utility operations, higher in niche services. | High capital and regulatory barriers for suppliers entering power generation. |

What is included in the product

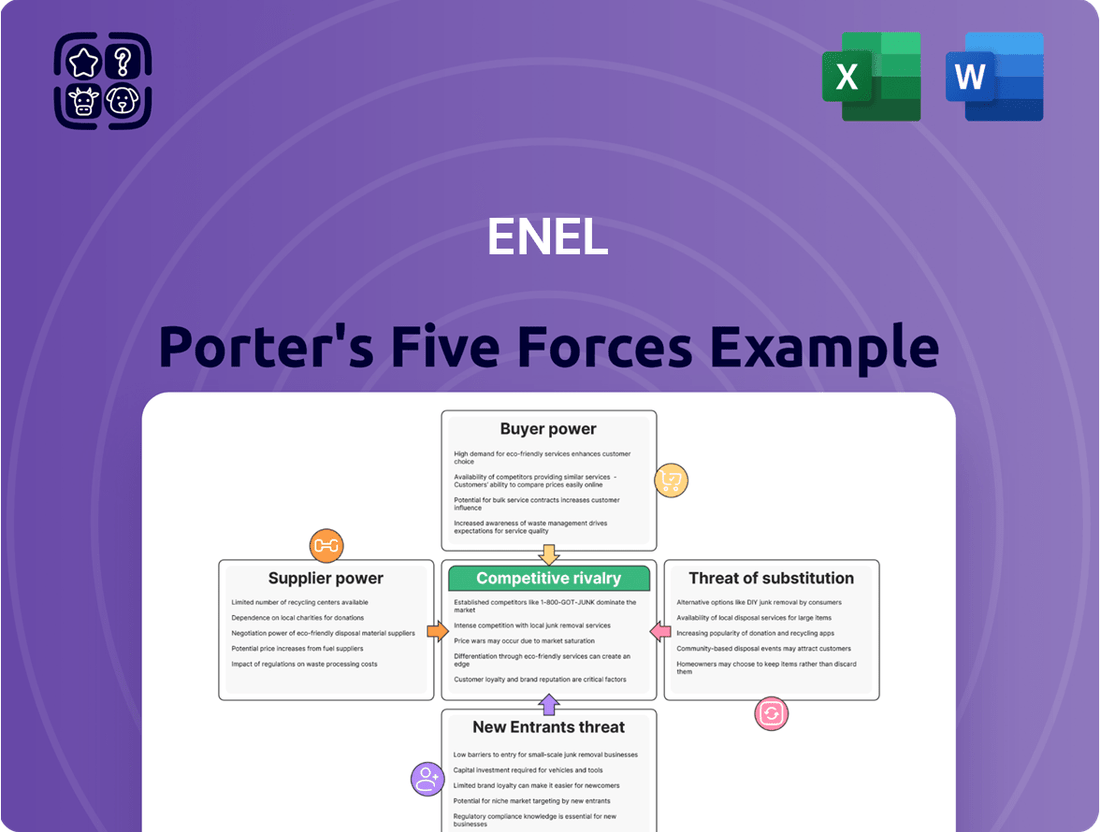

This analysis examines the five competitive forces impacting Enel, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the availability of substitutes within the energy sector.

Effortlessly identify and mitigate competitive threats with a visual breakdown of each force, allowing for targeted strategic adjustments.

Customers Bargaining Power

Enel's customer base is incredibly diverse, encompassing everything from massive industrial operations and entire municipalities to individual homes. This broad spectrum means bargaining power varies significantly. While a single household has minimal influence, a large industrial client consuming substantial energy can negotiate more favorable terms, impacting Enel's revenue streams.

The sheer volume of energy purchased by large commercial or municipal clients grants them considerable leverage. They can explore alternative energy suppliers or even invest in self-generation, presenting a credible threat that Enel must address. This reality is reflected in Enel's approach to customer relationship management, where tailored solutions are developed to retain these high-value accounts.

For residential consumers, the effort to switch electricity providers is typically minimal, often involving just a few administrative steps with little to no direct financial penalty. This low barrier to entry in many liberalized markets means customers can easily move to a competitor if they find a better offer.

However, for Enel's larger industrial and commercial clients, the decision to switch can be more involved. These customers may face more intricate contract terms, potential integration challenges with new suppliers, and the risk of operational disruptions, all of which contribute to higher switching costs.

Enel's strategic focus on expanding its free-market customer base in Italy and Spain highlights the dynamic nature of these energy markets. In 2023, Enel's Italian retail division, Enel Energia, served approximately 11 million customers, emphasizing the critical need for effective customer retention strategies in a competitive landscape.

Customers today have unprecedented access to information about energy prices, their own consumption habits, and the various alternative energy solutions available. This knowledge directly fuels their bargaining power.

Enel's significant investments in smart meters and digital platforms are a prime example of this trend. These technologies equip customers with detailed data, enhancing their ability to compare offers and negotiate more favorable terms with energy providers like Enel.

For instance, by mid-2024, a substantial portion of Enel's customer base in key European markets had smart meters installed, providing them with real-time consumption data. This transparency allows them to identify cost-saving opportunities and leverage this information in their discussions with Enel.

Price Sensitivity of Customers

Customer price sensitivity is a key factor influencing Enel's profitability. For essential services like residential electricity, demand tends to be inelastic in the short term, meaning price changes have a smaller impact on consumption. However, sustained price hikes can trigger public outcry and prompt regulatory action, as seen in various European markets.

Industrial clients, on the other hand, often exhibit high price sensitivity. Energy represents a substantial portion of their operating expenses, making them actively seek out the most competitive rates. This can lead to significant pressure on Enel to offer favorable pricing, especially when competing with alternative energy providers or when customers have the flexibility to switch suppliers.

In 2024, Enel has experienced this dynamic directly, with reports indicating reduced power prices for its Italian customer base. This suggests that competitive pressures and potentially regulatory interventions have compelled Enel to adjust its pricing strategies to retain market share and meet customer expectations for affordability.

- Customer Price Sensitivity Varies: Residential customers may be less sensitive in the short term for essential services, while industrial customers are highly sensitive due to energy costs being a significant operational expense.

- Inelastic Demand for Essentials: Short-term demand for residential electricity is relatively inelastic, but long-term price increases can lead to public and regulatory pressure.

- Industrial Customer Behavior: Industrial customers actively seek competitive pricing, putting pressure on energy providers like Enel to offer favorable rates.

- Enel's Italian Market Experience: Enel has faced reduced power prices for its Italian customers in 2024, reflecting the impact of price sensitivity and market competition.

Threat of Backward Integration by Customers

The increasing capability of large industrial customers to generate their own electricity presents a significant threat to Enel. This is amplified by the proliferation of distributed generation technologies, such as rooftop solar installations and advanced battery storage systems. For instance, in 2024, the global distributed solar market continued its robust expansion, with installations projected to reach new heights, directly impacting traditional utility customer bases.

Enel's strategic investments in renewable energy sources and the development of smart grid infrastructure, including substantial funding for battery storage solutions, serve as a proactive measure against this threat. By offering integrated energy solutions and enhancing grid flexibility, Enel aims to retain its customer base and mitigate the risk of customers opting for self-generation. This forward-looking approach is crucial as market trends indicate a growing demand for localized and resilient energy supply options.

- Growing Customer Self-Generation: Advancements in distributed generation technologies like rooftop solar and battery storage empower large industrial consumers to produce their own power, reducing reliance on traditional utilities.

- Enel's Strategic Response: Enel is investing in renewable energy and smart grids, including battery storage, to offer integrated solutions that counter the threat of customer backward integration.

- Market Trends: The global distributed solar market saw significant growth in 2024, underscoring the increasing viability and adoption of customer-owned generation.

Enel faces significant bargaining power from its diverse customer base, particularly large industrial and commercial clients who can negotiate better terms due to their substantial energy consumption. Residential customers also wield influence through the ease of switching providers in liberalized markets, a trend amplified by readily available price comparison information and smart meter data. In 2024, Enel's Italian operations saw reduced power prices, reflecting this customer-driven pressure.

| Customer Segment | Bargaining Power Drivers | Enel's Response/Impact |

|---|---|---|

| Large Industrial/Commercial | High volume purchase, potential for self-generation, price sensitivity | Tailored solutions, competitive pricing pressure, risk of customer backward integration |

| Residential | Low switching costs, access to information, price sensitivity for essential services | Focus on customer retention, need for competitive offers, regulatory scrutiny on price hikes |

| Overall Market (2024 Data) | Increased transparency via smart meters, growth in distributed generation | Investment in smart grids and renewables, pressure on pricing strategies |

Preview the Actual Deliverable

Enel Porter's Five Forces Analysis

This preview showcases the complete Enel Porter's Five Forces Analysis, identical to the document you will receive immediately after purchase. You can be confident that the insights into Enel's competitive landscape, including buyer and supplier power, threat of new entrants, substitutes, and industry rivalry, are fully intact and ready for your strategic planning. This professionally formatted analysis is your direct deliverable, with no hidden placeholders or missing sections.

Rivalry Among Competitors

The global energy arena where Enel competes is intensely crowded, populated by a multitude of substantial, all-encompassing energy providers as well as more niche, focused firms. Major rivals such as ENGIE, Uniper, and Iberdrola are prominent examples of these significant integrated players.

Enel's resilience in 2024, demonstrating strong financial results even with a dip in total revenues compared to 2023, underscores its capacity to effectively manage within this demanding competitive environment. This success is largely attributable to its expansion in renewable energy sources and its robust development of distribution networks.

The energy sector is experiencing a dynamic shift towards renewables and decarbonization, directly impacting industry growth rates. Enel's own strategic roadmap, spanning 2025-2027, highlights this trend with significant capital allocation towards grids and renewable energy infrastructure.

By 2027, Enel aims to expand its renewable energy capacity to an impressive 76 GW and increase renewable energy production by over 15%. This ambitious expansion underscores a rapidly expanding market segment, yet it simultaneously intensifies competition among players vying for new projects and a larger share of this evolving market.

While electricity is often seen as a commodity, Enel actively differentiates itself through a strong emphasis on renewable energy development, including significant investments in solar and wind power. For instance, by the end of 2023, Enel had approximately 73 GW of installed capacity, with renewables accounting for a substantial and growing portion of this portfolio. This focus on cleaner energy sources appeals to environmentally conscious customers and investors, setting Enel apart from competitors primarily reliant on traditional energy generation.

Exit Barriers

Exit barriers in the utility sector are significantly high, primarily due to the massive capital outlays required for infrastructure like power plants and extensive grid networks. These substantial, sunk costs, coupled with long-term contracts and stringent regulatory commitments, make it exceedingly difficult and costly for companies to exit the market. This immobility among existing players directly contributes to intensified competitive rivalry, as firms are essentially locked into their positions, fostering a stable but often aggressive market dynamic.

Enel's strategic financial planning underscores these high exit barriers. The company has earmarked a considerable €26 billion for investments in its infrastructure development and modernization for the period of 2025-2027. This significant commitment to its physical assets and operational framework further entrenches Enel within the sector, reinforcing the substantial financial and operational entanglements that deter any rapid departure.

- High Capital Investment: Utilities require vast sums for power generation and distribution infrastructure.

- Long-Term Contracts: Agreements with suppliers and customers create ongoing obligations.

- Regulatory Obligations: Compliance with government regulations adds complexity and cost to market exit.

- Enel's Infrastructure Commitment: €26 billion investment for 2025-2027 highlights significant sunk costs.

Diversity of Competitors

Enel navigates a crowded energy landscape marked by a wide array of competitors. These range from established fossil-fuel utilities still significant in many markets, to agile pure-play renewable energy developers aggressively expanding their portfolios. Furthermore, technology giants are increasingly venturing into energy services, adding another layer of complexity.

This broad spectrum of competitors means Enel must contend with diverse strategies and competitive tactics. For instance, while traditional utilities may focus on grid stability and legacy assets, renewable developers prioritize cost reduction and project execution speed. Technology companies often leverage digital platforms and data analytics to offer new energy solutions.

To effectively compete, Enel has strategically integrated its operations across the entire energy value chain. This approach allows the company to offer a more comprehensive suite of services, from generation and distribution to retail and innovative energy solutions. This vertical integration helps Enel counter both highly specialized competitors and those with broader, diversified business models.

- Traditional Utilities: Companies like Engie and Iberdrola, with significant fossil fuel assets and extensive grid infrastructure.

- Renewable Developers: Firms such as NextEra Energy and Ørsted, focused primarily on wind and solar power generation.

- Technology Entrants: Companies like Google (through Google Energy) and Amazon Web Services (AWS), offering energy management and cloud-based solutions for the energy sector.

- Enel's Integrated Model: Enel's strategy aims to leverage its strengths in renewables, grids, and digital services to compete across these diverse segments.

Competitive rivalry within the energy sector is intense, with Enel facing established giants like ENGIE and Iberdrola, alongside specialized renewable developers and emerging tech players. The drive towards decarbonization fuels this competition, pushing companies to innovate and expand their renewable portfolios rapidly. Enel's strategic focus on renewables and grid modernization, backed by significant investments, positions it to navigate this dynamic landscape, though market share battles are fierce.

SSubstitutes Threaten

The primary threat of substitutes for Enel's traditional electricity and gas offerings stems from the growing availability of alternative energy sources and technologies. On-site renewable generation, such as rooftop solar panels for homes and businesses, directly competes by allowing consumers to produce their own power. Advancements in energy storage solutions, like batteries, further bolster this threat by enabling greater energy independence and grid resilience for consumers.

The cost-effectiveness of substitutes poses a significant threat to Enel. As the price of renewable energy technologies, such as solar panels and battery storage, continues to fall, consumers are increasingly able to generate their own power or adopt alternative heating and cooling systems, making these options more financially appealing. For instance, the global average cost of electricity from utility-scale solar PV dropped by approximately 89% between 2010 and 2022, according to the International Renewable Energy Agency (IRENA).

This trend directly impacts Enel's traditional utility business model. When self-generation becomes cheaper than purchasing electricity from the grid, customers have a strong incentive to switch. Enel's strategic focus on expanding its renewable energy portfolio, including investments in distributed generation and smart grid technologies, is a direct response to this evolving competitive landscape, aiming to keep its services attractive and cost-competitive against these growing alternatives.

Customers are increasingly willing to switch to alternative energy sources, driven by a growing awareness of environmental issues and a desire for greater energy independence. For instance, in 2024, the global renewable energy market continued its robust expansion, with solar and wind power installations reaching record levels, indicating a strong consumer appetite for cleaner options.

Enel's strategic emphasis on sustainability and its ambitious target of achieving net-zero emissions by 2040 directly addresses these customer motivations. By positioning itself as a provider of environmentally responsible energy solutions, Enel can effectively capture this segment of the market, thereby reducing the perceived threat of substitutes by aligning its offerings with evolving customer values and preferences.

Performance and Quality of Substitutes

The performance and reliability of substitute technologies are steadily improving, presenting a growing threat. For instance, advancements in battery storage are making off-grid or semi-off-grid power solutions increasingly viable, potentially reducing dependence on traditional grid-supplied electricity. This trend directly challenges the core business model of utility providers like Enel.

Enel is actively addressing this by investing in smart grid development and integrating distributed generation. These strategies aim to harness technological progress, such as improved energy storage, to enhance grid resilience and offer more flexible energy solutions to consumers. By doing so, Enel seeks to mitigate the threat of substitutes by becoming a provider of integrated energy services rather than just grid power.

- Technological Advancements: Battery storage capacity and efficiency continue to rise, lowering costs and increasing the attractiveness of behind-the-meter solutions.

- Market Impact: The increasing feasibility of distributed generation, coupled with storage, can lead to reduced demand for grid electricity, particularly during peak hours.

- Enel's Response: Investments in smart grids and renewable integration are designed to adapt to and capitalize on these evolving energy landscapes.

Regulatory and Policy Support for Substitutes

Government policies and regulations play a crucial role in bolstering the threat of substitutes for traditional energy sources. Initiatives promoting renewable energy, energy efficiency, and distributed generation, such as solar and wind power, directly encourage consumer adoption of these alternatives. For instance, in 2024, many countries continued to offer substantial tax credits and subsidies for renewable energy installations, making self-generation increasingly economically viable for businesses and households.

Favorable grid connection policies and net metering arrangements further enhance the attractiveness of substitute energy solutions. These policies allow producers of renewable energy to sell excess electricity back to the grid, often at retail rates, thereby reducing the payback period for investments in self-generation equipment. By 2025, a significant portion of new energy capacity additions globally are expected to come from renewables, driven by these supportive regulatory environments.

Enel, as a major player in the energy sector, actively participates in shaping these regulatory frameworks. The company's engagement aims to ensure its strategic investments remain aligned with evolving energy transition goals and to capitalize on the growing market for sustainable energy solutions. This proactive approach helps Enel navigate the increasing threat posed by substitutes, which are often made more competitive through government support.

- Government incentives such as the U.S. Investment Tax Credit (ITC) and Production Tax Credit (PTC) continued to drive renewable energy deployment in 2024, making solar and wind power more competitive.

- Supportive grid policies like net metering and feed-in tariffs in various European nations incentivized distributed generation, increasing the appeal of self-consumption and local energy production.

- Energy efficiency mandates and building codes implemented in major economies in 2024 encouraged the adoption of technologies that reduce overall energy demand, acting as a substitute for increased energy supply.

- Enel's strategic focus on renewable energy development and grid modernization in 2024 reflects its adaptation to these policy-driven shifts, positioning the company to benefit from the growing market for cleaner energy alternatives.

The threat of substitutes for Enel's traditional energy offerings is substantial and growing. On-site generation, particularly rooftop solar, combined with increasingly affordable battery storage, allows consumers to produce and store their own power, reducing reliance on grid electricity. This trend is fueled by falling renewable energy costs; for example, global solar PV costs saw a dramatic decrease of around 89% between 2010 and 2022.

Customer willingness to adopt these alternatives is also rising, driven by environmental concerns and a desire for energy independence. The global renewable energy market continued its strong growth in 2024, with record installations in solar and wind power, underscoring this shift. As these technologies improve in performance and reliability, they present a direct challenge to Enel's established utility model.

Government policies, including tax credits and favorable grid connection rules like net metering, further enhance the competitiveness of substitutes. In 2024, many nations continued to offer significant incentives for renewable energy, making self-generation more economically attractive. Enel's strategy to invest in smart grids and renewable integration is a direct response to these evolving market dynamics and policy landscapes.

| Substitute Technology | Key Driver | Impact on Enel | 2024 Trend/Data Point |

|---|---|---|---|

| Rooftop Solar PV | Decreasing costs, environmental awareness | Reduced demand for grid electricity, potential for disintermediation | Continued strong installation growth globally, driven by incentives. |

| Battery Storage | Improved efficiency, lower prices, grid independence | Enhanced viability of off-grid solutions, peak shaving capabilities | Battery costs continued to decline, making home energy storage more accessible. |

| Energy Efficiency Measures | Cost savings, regulatory mandates | Lower overall energy consumption, reduced need for new generation capacity | Increased adoption of energy-efficient appliances and building standards. |

Entrants Threaten

The energy sector, especially power generation and distribution, demands enormous capital. New entrants face substantial hurdles due to the need for massive investments in infrastructure, cutting-edge technology, and adherence to strict regulatory frameworks.

For instance, Enel's strategic roadmap for 2025-2027 outlines multi-billion euro investments in grid modernization and renewable energy projects. These significant financial commitments create formidable barriers, making it exceptionally challenging for new companies to enter and compete effectively on a large scale.

The energy sector is a minefield of regulations, demanding intricate licensing, environmental clearances, and stringent safety protocols. These requirements act as significant deterrents for newcomers, demanding considerable time and specialized knowledge to overcome. For instance, Enel's continuous engagement in securing extensions for its power distribution licenses highlights the critical nature of these regulatory frameworks.

New companies entering the energy sector, particularly in electricity distribution and supply, face a formidable hurdle in accessing established networks. Established players like Enel have invested billions in building and maintaining extensive grid infrastructure, making it incredibly difficult and expensive for newcomers to replicate. For instance, Enel's significant capital expenditures, often running into billions of euros annually for grid modernization and expansion, highlight the scale of investment required to compete.

Gaining access to these crucial distribution channels is a major barrier to entry. New entrants often struggle to secure the necessary permits and agreements to connect to existing grids, or they must undertake the massive undertaking of building their own, which is both capital-intensive and time-consuming. Enel's ongoing efforts to digitalize its grids, enhancing efficiency and reliability, further solidify its control over these essential pathways.

Economies of Scale and Experience Curve

Enel's substantial economies of scale across its generation, transmission, and distribution networks create a significant barrier to entry. These scale advantages enable Enel to achieve lower per-unit costs, making it challenging for new, smaller competitors to match its pricing and profitability. For instance, in 2023, Enel reported a total installed capacity of approximately 73 GW, a figure that underscores its vast operational footprint.

The company's extensive experience curve, built over decades of operating in the complex energy sector, further deters new entrants. This accumulated knowledge in managing infrastructure, navigating regulatory landscapes, and optimizing operations is a valuable, intangible asset that newcomers cannot easily replicate. Enel's long-standing presence means it has refined its processes and risk management strategies, providing a competitive edge that takes years, if not decades, to build.

- Economies of Scale: Enel's vast operational scale in generation and distribution leads to cost efficiencies that new entrants struggle to achieve.

- Experience Curve Advantage: Decades of operational expertise in managing complex energy systems provide Enel with a significant competitive advantage.

- Capital Intensity: The high capital requirements for establishing large-scale energy infrastructure act as a substantial deterrent for potential new market participants.

- Regulatory Expertise: Enel's deep understanding and navigation of intricate energy regulations are difficult for new entrants to quickly acquire.

Brand Loyalty and Customer Relationships

Established energy providers like Enel benefit from deep-seated brand loyalty and robust customer relationships, making it challenging for new entrants. These incumbents have cultivated trust over years of service, often viewed as essential providers. For instance, in 2024, customer retention rates for major utilities remained exceptionally high, often exceeding 95%, a testament to these ingrained relationships.

New competitors face a significant hurdle in overcoming this inertia. They must commit substantial resources to marketing and customer acquisition campaigns to even begin building brand awareness and trust. This investment is crucial to demonstrate reliability and value propositions that can sway customers from their existing, trusted providers.

Enel actively works to solidify its customer base through enhanced services and integrated solutions. This strategy aims to increase customer stickiness and create switching costs, further deterring new entrants. For example, Enel's 2024 initiatives focused on smart home integration and personalized energy plans are designed to deepen these customer bonds.

- High Customer Retention: Utilities often see retention rates above 95% in 2024, a significant barrier for newcomers.

- Marketing Investment: New entrants need substantial marketing budgets to build brand recognition and trust.

- Switching Costs: Integrated services and loyalty programs create practical and psychological barriers to switching providers.

- Customer Service Focus: Companies like Enel invest in customer service to strengthen relationships and differentiate themselves.

The threat of new entrants for Enel is generally low due to the immense capital required for infrastructure development and regulatory compliance. For example, Enel's 2024-2028 strategic plan earmarks over €150 billion for investments in renewables and grid modernization, a sum few new players can match. Furthermore, navigating the complex web of licenses and environmental permits in the energy sector demands significant expertise and time, acting as a strong deterrent.

| Barrier to Entry | Description | Enel's Position (Illustrative) |

| Capital Requirements | Massive upfront investment in generation, transmission, and distribution infrastructure. | Enel's planned €150+ billion investment (2024-2028) highlights this barrier. |

| Regulatory Hurdles | Complex licensing, environmental approvals, and safety standards. | Enel's extensive experience in securing and maintaining permits demonstrates this. |

| Access to Distribution Networks | Difficulty in connecting to or replicating existing grid infrastructure. | Enel's vast, modernized grid represents a significant competitive advantage. |

| Economies of Scale | Lower per-unit costs due to large operational volume. | Enel's 2024 installed capacity exceeding 73 GW provides significant cost efficiencies. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages data from Enel's annual reports, investor presentations, and sustainability reports, alongside industry-specific market research and regulatory filings, to provide a comprehensive view of the competitive landscape.