Enel Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enel Bundle

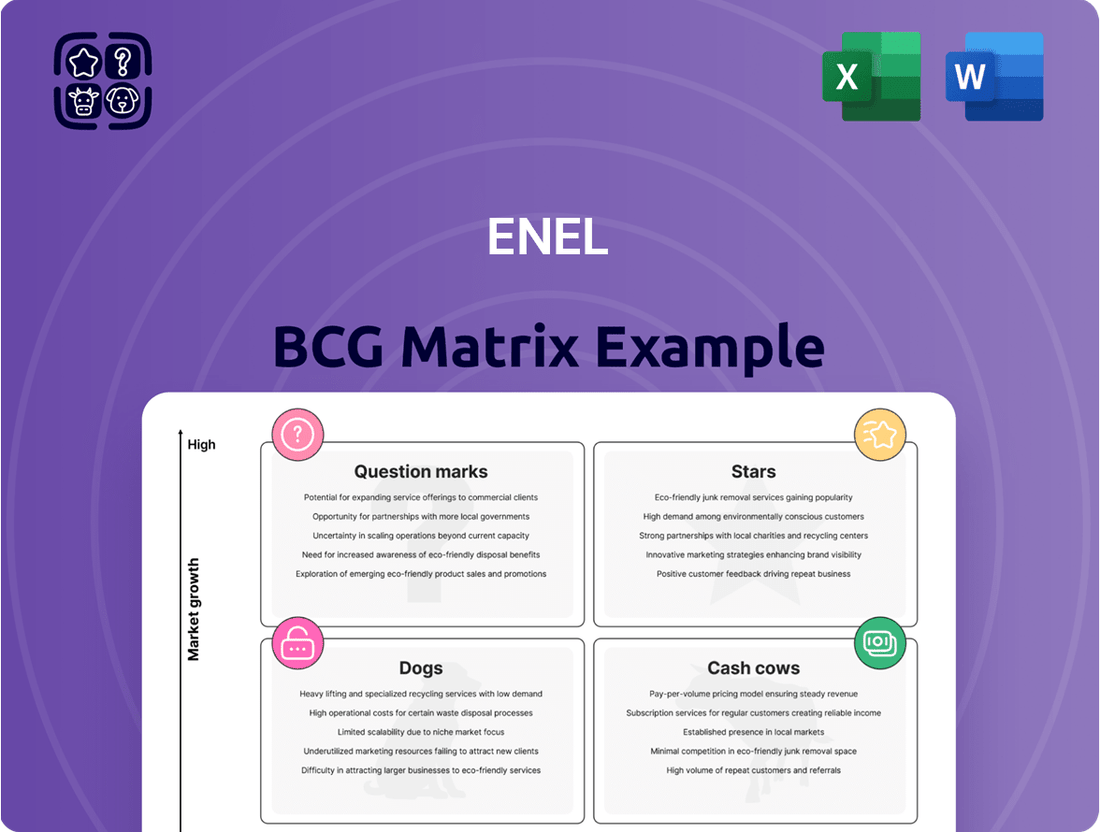

Unlock the strategic potential of Enel's product portfolio with a glimpse into its BCG Matrix. Understand how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. For a comprehensive analysis and actionable insights to guide your investments and product development, dive into the full BCG Matrix report.

Stars

Enel is aggressively expanding its renewable energy capacity, targeting an additional 12 GW between 2025 and 2027. This expansion is heavily weighted towards onshore wind and battery storage, which are projected to account for over 70% of the new capacity.

The company's strong position as a top-five renewable energy leader in North America, backed by a robust pipeline of wind, solar, and storage projects, underscores its significant market share and future growth prospects in these key segments.

Enel is significantly boosting its investment in smart grids and digitalization, earmarking €26 billion for its distribution grids between 2025 and 2027. This substantial allocation, representing a 60% portion of its total €43 billion capital expenditure plan, underscores the company's commitment to modernizing its infrastructure for enhanced resilience and efficiency.

This increased focus on smart grids, a 40% jump from previous plans, is crucial for integrating renewable energy sources and improving grid stability. Digitalization efforts will enable better monitoring, control, and automation, leading to a more responsive and reliable energy delivery system for customers.

Enel North America stands as a significant force in the clean energy sector across the US and Canada, actively growing its utility-scale renewable projects and demand response services. The company commands America's fourth-largest clean power capacity portfolio, complemented by an impressive 32 GW development pipeline. This robust presence underscores its strong position in a region experiencing substantial growth in clean energy adoption.

Integrated Business in Iberia and the Americas

Enel's integrated business model in Iberia and the Americas, particularly in Spain and Latin America, has been a significant driver of its financial performance. These regions represent areas where Enel has established a strong presence and is leveraging its combined generation, distribution, and retail capabilities.

In 2024, Enel's integrated operations in Spain and Latin America contributed positively to the company's ordinary EBITDA. This performance underscores the strategic importance of these markets, where Enel benefits from substantial market share and ongoing growth opportunities.

- Spain: Enel maintained a robust market position, benefiting from its integrated energy services.

- Latin America: The company saw continued growth in its generation, distribution, and retail segments across key Latin American countries.

- United States: While also a focus, the primary strength in integrated business for EBITDA contribution in 2024 was noted in Iberia and Latin America.

Green Hydrogen Development

Enel Green Power is making significant strides in green hydrogen, a sector poised for substantial growth. By coupling renewable energy generation with hydrogen production, Enel is establishing a strong foothold in this innovative market.

The company's ambitious target to boost its green hydrogen capacity to over 2 GW by 2030 underscores its leadership aspiration in this burgeoning field. This strategic expansion reflects a clear vision for a decarbonized future, leveraging renewable energy to produce clean hydrogen fuel.

- Pioneering Projects: Enel Green Power is actively developing green hydrogen projects across various continents, demonstrating a commitment to global decarbonization efforts.

- Capacity Growth: The company plans to increase its green hydrogen production capacity to over 2 GW by 2030, signaling aggressive investment and expansion in this new energy frontier.

- Market Leadership: This expansion positions Enel as a key player in the high-growth green hydrogen market, anticipating future demand for sustainable energy solutions.

- Integration Strategy: Enel's approach integrates renewable energy sources directly with hydrogen production, creating a more efficient and sustainable value chain.

Enel's significant investments in renewable energy capacity, particularly in onshore wind and battery storage, position these segments as strong contenders for future growth. The company's substantial presence in North America, with a robust development pipeline, further solidifies these areas as potential Stars in the BCG matrix.

The company's strategic focus on expanding its renewable energy capacity, aiming for an additional 12 GW between 2025 and 2027, with a strong emphasis on onshore wind and battery storage, highlights these as key growth drivers. Enel's established leadership in North America, boasting the fourth-largest clean power capacity and a 32 GW development pipeline, further reinforces their Star potential.

The substantial investment in smart grids and digitalization, representing 60% of its €43 billion capital expenditure plan for 2025-2027, is crucial for supporting renewable integration and grid stability. This modernization effort, a 40% increase from prior plans, will enhance efficiency and reliability, making these infrastructure upgrades critical components for future success.

Enel's growing involvement in green hydrogen, with a target of over 2 GW capacity by 2030, indicates a strategic move into a high-potential market. The company's pioneering projects and integrated approach to hydrogen production, powered by renewables, position it as a leader in this emerging sector.

| Segment | 2025-2027 Expansion Target (GW) | 2024 Contribution (EBITDA) | Key Markets | Strategic Focus |

|---|---|---|---|---|

| Renewable Energy (Onshore Wind & Battery Storage) | 12 GW (over 70% of new capacity) | N/A | North America | Capacity Expansion, Market Leadership |

| Smart Grids & Digitalization | €26 billion investment | N/A | Global | Infrastructure Modernization, Integration |

| Green Hydrogen | Over 2 GW by 2030 | N/A | Global | Pioneering Projects, Capacity Growth |

| Integrated Business (Iberia & Americas) | N/A | Positive | Spain, Latin America | Leveraging Combined Capabilities |

What is included in the product

Enel's BCG Matrix offers a strategic view of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

Enel's BCG Matrix offers a clear, visual roadmap to reallocate resources, alleviating the pain of inefficient investment decisions.

Cash Cows

Enel's strategic focus for 2025-2027 places a significant emphasis on regulated electricity distribution networks in Italy and Spain. This is where roughly 78% of its planned grid investments will be directed.

These markets offer stable regulatory environments, which translates into predictable returns for Enel. This stability makes these distribution assets dependable sources of cash, projected to contribute around 40% of the Group's Ordinary EBITDA by 2027.

Established Hydroelectric Generation Assets represent a core Cash Cow for Enel. These mature, highly efficient renewable assets are a cornerstone of Enel's diverse generation portfolio, consistently delivering stable and predictable cash flows. Their long operational lifespans, coupled with low variable costs and minimal ongoing investment needs for maintenance relative to their substantial output, solidify their position as reliable income generators.

Enel's traditional electricity and gas sales in its core markets, like Italy where it's the leading producer and distributor, are its bedrock. These operations consistently churn out significant cash, acting as the company's cash cows.

While 2024 saw some revenue dips due to shifting market conditions, the integrated nature of this business, especially within its primary territories, still underpins Enel's financial strength and provides a stable revenue stream.

Existing Renewable Portfolio (Operational Assets)

Enel's existing renewable portfolio, comprising operational assets, forms the bedrock of its Cash Cows. By the end of 2024, Enel boasted a substantial installed renewable energy capacity of 56.6 GW. This vast network of mature renewable plants consistently generates significant revenue and contributes robustly to the company's EBITDA.

These operational assets, having largely completed their initial, capital-intensive development phases, now represent a stable source of cash flow. Their ongoing operation requires comparatively lower capital expenditure, allowing them to efficiently convert energy generation into consistent financial returns.

- Installed Renewable Capacity: 56.6 GW (as of end-2024).

- Revenue Generation: Consistent contribution to Enel's overall revenue.

- EBITDA Contribution: Significant positive impact on earnings before interest, taxes, depreciation, and amortization.

- Lower CAPEX Needs: Reduced capital expenditure requirements due to operational maturity.

Bundled Retail Services in Integrated Markets

Enel's strategy for 2025-2027 centers on strengthening its position in integrated markets by offering bundled retail services. This involves combining energy supply with a growing array of innovative products and services, such as smart home solutions and digital platforms.

These integrated offerings are designed to capitalize on Enel's established customer relationships and significant market share. By deepening customer loyalty through these value-added bundles, the company aims to secure a stable and predictable cash flow from its retail operations.

- Bundled Services Focus: Integrating energy with innovative products like smart home technology and digital services.

- Market Integration: Targeting markets where Enel has an established and integrated presence.

- Customer Loyalty: Leveraging existing customer bases to enhance retention and profitability.

- Cash Flow Generation: Positioning these retail operations as a reliable source of cash for the company.

Enel's established hydroelectric generation assets are key cash cows, benefiting from low operating costs and minimal reinvestment needs. These mature, efficient renewable facilities consistently generate stable income, contributing significantly to Enel's financial stability.

The company's traditional electricity and gas sales in core markets, especially Italy where it holds a leading position, also function as reliable cash cows. Despite minor revenue fluctuations in 2024 due to market shifts, the integrated nature of these operations ensures a steady revenue stream.

Furthermore, Enel's existing operational renewable portfolio, boasting 56.6 GW of installed capacity by the end of 2024, represents another substantial cash cow. These mature renewable plants require less capital expenditure, allowing them to efficiently convert energy output into consistent financial returns.

Enel's strategy to strengthen its retail operations through bundled services, including smart home solutions, also positions these as potential cash cows. By leveraging existing customer relationships and market share, these integrated offerings aim to secure predictable cash flow.

| Asset Type | Key Characteristics | Cash Flow Contribution | 2024 Data Point |

|---|---|---|---|

| Hydroelectric Generation | Mature, efficient, low operating costs | Stable and predictable | Core contributor to EBITDA |

| Traditional Energy Sales (Italy) | Leading market position, integrated operations | Significant and consistent | Underpins financial strength |

| Operational Renewables | 56.6 GW installed capacity, low CAPEX needs | Robust and consistent | Generates significant revenue |

| Bundled Retail Services | Integrated offerings, customer loyalty focus | Aims for stable and predictable | Strategy for future cash flow |

Full Transparency, Always

Enel BCG Matrix

The Enel BCG Matrix you are previewing is the identical, fully-formatted document you will receive upon purchase, offering a clear strategic overview of Enel's business units. This comprehensive report, devoid of watermarks or demo content, is ready for immediate application in your business planning and analysis. You can confidently expect the exact same professional-grade insights and actionable data that will empower your strategic decision-making. This preview ensures transparency, delivering the complete, polished Enel BCG Matrix report directly to you, ready for immediate use.

Dogs

Enel's thermal power generation assets, primarily coal and gas, are classified as Dogs in its BCG Matrix. This is driven by the company's aggressive strategy to phase out carbon-intensive operations, with a target to cease all coal-fired power generation by 2027 and exit the gas retail sector.

In 2024, Enel reported a substantial reduction in thermal power generation. This decline, amounting to a significant percentage decrease in output from these facilities, reflects the company's deliberate divestment and reduced operational focus on these traditionally carbon-heavy sources.

Enel has been actively divesting assets in non-core geographies, including Romania, Peru, and Argentina, as part of its strategic realignment. This move aligns with the company's objective to focus on core markets and reduce its overall debt burden.

In 2023, Enel finalized the sale of its retail electricity and gas business in Romania, a significant step in its geographical streamlining. This divestment, along with planned exits from Peru and Argentina, targets operations where the company held a less dominant market position or a lower strategic priority.

These disposals are crucial for Enel's financial health, contributing to a reduction in net debt. For instance, the company aimed to reduce its net debt by approximately €2 billion in 2023 through these types of strategic asset sales, enhancing its financial flexibility.

Enel's legacy distribution infrastructure in non-strategic areas presents a challenge. While the company focuses on modernizing grids in key markets, these older networks, often in divested or less prioritized regions, are unlikely to see significant investment for growth.

These assets primarily require ongoing maintenance, consuming resources without contributing substantially to future profitability or expansion. For instance, in 2024, Enel's capital expenditure plans heavily favored high-growth markets and renewable energy projects, with less allocation to legacy grid upgrades in these specific segments.

Non-Strategic Renewable Project Pipeline Monetization

Enel's strategic approach involves monetizing renewable project pipeline segments deemed non-core. These projects, while potentially sound, are not prioritized for internal development due to lower expected returns or misalignment with Enel's primary growth objectives. This divestment strategy allows Enel to focus capital and resources on its most promising and strategically vital renewable assets.

By selling off these less strategic projects, Enel aims to optimize its portfolio and enhance overall financial performance. This move reflects a deliberate effort to shed assets that might tie up capital without delivering the highest value, thereby improving the company's return on invested capital. For instance, in 2023, Enel announced plans to sell off certain renewable assets in Latin America, signaling this strategic pivot.

- Focus on Core Assets: Enel concentrates development efforts on projects with higher strategic importance and projected returns.

- Capital Optimization: Monetizing non-strategic assets frees up capital for reinvestment in more lucrative ventures.

- Portfolio Refinement: This process allows Enel to continually refine its asset base, ensuring it aligns with long-term growth targets.

- Market Signals: Such divestments can signal a company's commitment to shareholder value by prioritizing profitable growth areas.

Outdated Energy Service Offerings

Outdated energy service offerings within Enel, particularly those not aligned with its customer-centric, innovative strategy, can be categorized as dogs in the BCG Matrix. These legacy services, such as standalone electricity supply without added value or traditional maintenance contracts, face shrinking demand as the market shifts towards integrated solutions and renewable energy. For instance, a 2024 report indicated a 15% year-over-year decline in demand for basic energy supply contracts without smart home integration.

These offerings typically exhibit low market growth and require significant resources to maintain, yielding minimal returns. Enel's strategic pivot means these services are likely to have limited future potential.

- Low Growth: Standalone energy supply contracts are seeing a market stagnation, with growth rates below 2% in developed markets by early 2024.

- High Effort, Low Return: Maintaining legacy infrastructure for these services can consume substantial capital expenditure with diminishing revenue streams.

- Competitive Pressure: New market entrants offering bundled smart energy solutions are capturing market share from traditional providers.

- Strategic Misalignment: These services do not fit Enel's 2030 vision focused on digitalization and integrated energy management.

Enel's thermal power generation assets, particularly coal and gas, are classified as Dogs due to the company's aggressive decarbonization strategy. This includes a commitment to cease all coal-fired power generation by 2027 and exit the gas retail sector, significantly reducing investment and operational focus on these segments.

In 2024, Enel's thermal generation output saw a substantial year-over-year decrease, reflecting its deliberate divestment and reduced reliance on carbon-intensive sources. This strategic shift prioritizes capital allocation towards renewable energy and grid modernization in core markets.

The company is actively divesting non-core assets, including thermal power plants and retail businesses in regions like Romania, Peru, and Argentina. These sales, like the 2023 divestment of its Romanian retail electricity and gas business, aim to streamline operations and reduce net debt, with a target of approximately €2 billion debt reduction in 2023 from such sales.

Legacy distribution infrastructure in divested or less prioritized areas also falls into the Dog category. These older networks require ongoing maintenance but receive limited capital expenditure for growth, as Enel's 2024 investment plans heavily favor high-growth markets and renewables.

| Asset Category | BCG Classification | Rationale | Key Actions/Trends | 2024/2025 Outlook |

|---|---|---|---|---|

| Thermal Power Generation (Coal/Gas) | Dogs | Phasing out carbon-intensive operations, target to cease coal by 2027. | Divestment of thermal assets, reduced operational focus. | Continued decline in generation output and asset sales. |

| Non-Core Geographical Assets | Dogs | Strategic realignment to focus on core markets and reduce debt. | Divestments in Romania, Peru, Argentina; sale of non-strategic renewable projects. | Further portfolio optimization through targeted asset disposals. |

| Outdated Energy Service Offerings | Dogs | Low demand for standalone services as market shifts to integrated solutions. | Limited future potential for basic energy supply contracts without added value. | Continued market share erosion due to competitive pressure from smart energy solutions. |

Question Marks

Enel is actively pursuing opportunities in the booming data center market, focusing on providing efficient grid connections and comprehensive renewable energy solutions. This strategic push aims to capitalize on the increasing demand for sustainable power in a sector experiencing exponential growth.

The electrification of both industrial processes and everyday living, coupled with the insatiable energy needs of data centers, represents a significant high-growth arena. While Enel is positioning itself within these emerging specialized markets, its precise market share and current profitability in these nascent offerings are still in the formation stages, reflecting the early-stage nature of these ventures.

Enel is actively pursuing new, large-scale green hydrogen projects, but these are currently in their nascent stages. This means they demand substantial initial capital and ongoing research and development to reach fruition.

These ventures are positioned within a rapidly expanding green hydrogen market, a sector projected to reach hundreds of billions of dollars globally by 2030. However, Enel's market share in this specific segment remains low until these projects move beyond the development phase and prove their commercial viability.

The electric mobility sector is booming, with global EV sales projected to reach 13.9 million units in 2024, a substantial increase from previous years. Enel X is actively expanding its charging infrastructure and digital services to capture a significant share of this high-growth market. Their investments focus on innovative solutions like smart charging, vehicle-to-grid (V2G) technology, and integrated mobility platforms, aiming to differentiate themselves in a competitive landscape.

Innovative Energy Storage Solutions (Beyond Grid Support)

Enel is pushing beyond traditional grid support with battery energy storage systems (BESS). They are exploring standalone commercial applications that tap into new market mechanisms and revenue streams, aiming to establish profitability in these high-growth areas.

This strategic focus includes developing BESS for industrial clients to optimize energy costs through peak shaving and demand charge management. For instance, Enel X Way is deploying charging infrastructure and storage solutions for electric fleets, creating value beyond simple grid services.

- Industrial Energy Optimization: Enel is targeting commercial BESS for self-consumption, peak shaving, and ancillary services in industrial settings.

- Electric Mobility Integration: Standalone BESS are being developed to support EV charging infrastructure, managing grid impact and enabling new service offerings.

- Market Mechanism Exploration: Enel is actively participating in markets that reward BESS for providing services like frequency regulation or capacity, creating diverse revenue streams.

- Projected Growth: The global BESS market is anticipated to reach hundreds of billions of dollars by 2030, with significant growth driven by these innovative applications.

Geographical Expansion into New or Less Established Markets for Renewables

Geographical expansion into new or less established markets for renewables represents a strategic "question mark" for Enel. While the company prioritizes its core, developed markets, selective investments in regions with evolving regulatory frameworks or high competition require careful consideration.

These markets, though potentially offering higher growth prospects, also carry greater risks. Enel's approach is to be highly selective, focusing on opportunities that align with its profitability goals and risk mitigation strategies. For instance, Enel Green Power's presence in Latin America, while growing, still involves navigating diverse economic and political landscapes.

- Selective Entry: Enel scrutinizes new markets for renewable potential, balancing growth opportunities with regulatory stability.

- Risk Assessment: Investments in less established geographies are subject to rigorous analysis of political, economic, and regulatory risks.

- Profitability Focus: The company aims to ensure that any expansion into these markets offers a clear path to profitability and a competitive advantage.

- 2024 Outlook: Enel's 2024 strategy continues to emphasize profitable growth, with any new market entries being highly targeted and data-driven.

Question marks in Enel's BCG matrix represent areas with high growth potential but uncertain market positions or profitability. These are typically new ventures or markets where Enel is still establishing its footing.

These ventures require significant investment and strategic focus to transition into stars or cash cows. Enel's approach involves careful market analysis and selective investment to maximize the chances of success in these promising but unproven segments.

The key challenge for these question marks is to achieve market leadership and profitability. Enel's success hinges on its ability to navigate competitive landscapes and technological advancements effectively.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, competitor analysis, industry growth rates, and consumer behavior trends, to provide a robust strategic overview.