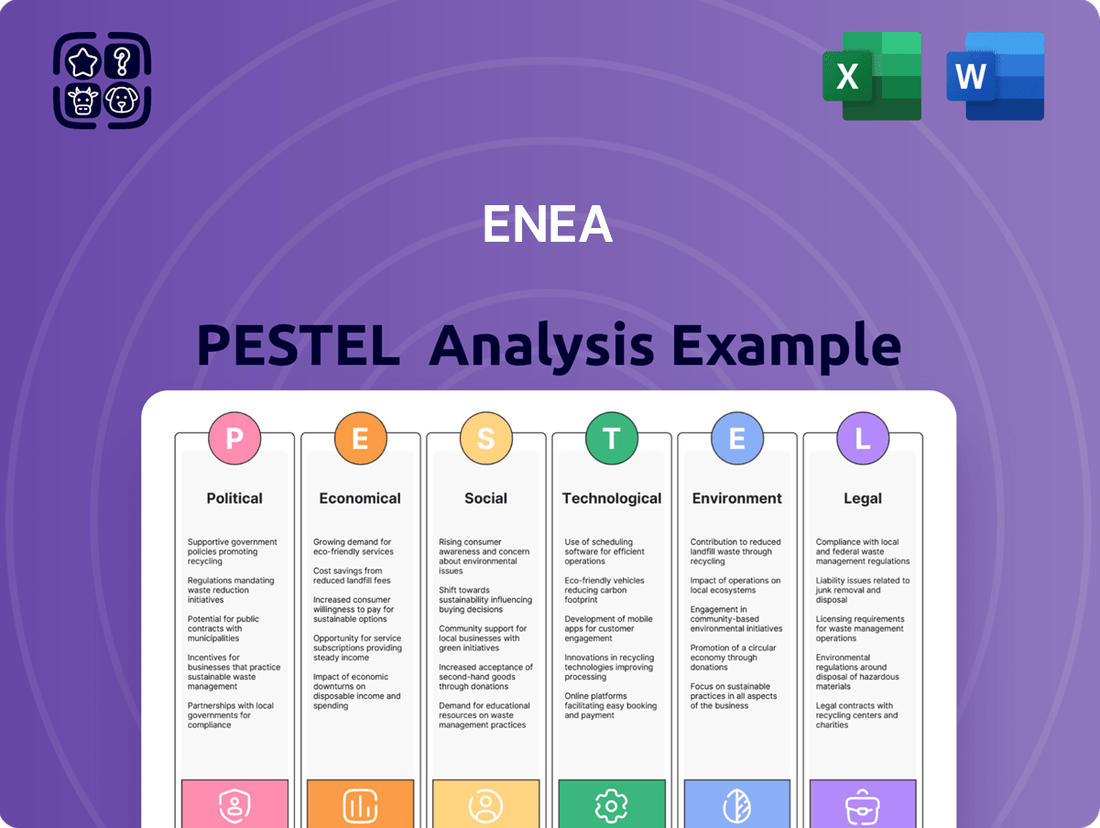

Enea PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enea Bundle

Uncover the critical external factors shaping Enea's trajectory with our comprehensive PESTLE analysis. From evolving political landscapes to burgeoning technological advancements, understand the forces that will drive or hinder their success. Equip yourself with actionable intelligence to make informed strategic decisions. Download the full PESTLE analysis now and gain a crucial competitive advantage.

Political factors

Governments globally are prioritizing 5G and the nascent 6G development through significant investment and policy support. For instance, the European Union's Digital Decade targets aim for gigabit connectivity for all citizens by 2030, with substantial funding allocated to 5G infrastructure deployment. These initiatives often involve streamlined spectrum allocation processes and direct subsidies for network build-out, creating a favorable environment for companies like Enea that supply essential software for these advanced networks.

The escalating threat landscape is driving governments worldwide to implement robust cybersecurity regulations. For instance, the EU's NIS 2 Directive, DORA, and CRA, alongside the US's CIRCIA, are placing significant compliance burdens on critical infrastructure operators and software vendors, demanding enhanced security measures and transparent reporting.

Enea, operating in the cybersecurity appliance and services sector, must remain agile to meet these evolving national and international security mandates. This continuous adaptation is crucial for maintaining market access and trust, especially as cyber threats become more sophisticated, impacting sectors from telecommunications to defense.

International trade policies, including tariffs and sanctions, directly impact Enea's operational costs and market access. For instance, the ongoing trade disputes between major economies in 2024-2025 could lead to increased import duties on critical components, affecting Enea's product pricing and profitability.

Geopolitical tensions, such as those in Eastern Europe and the Asia-Pacific region, create uncertainty and can disrupt global supply chains. Enea's reliance on a distributed manufacturing and supply network means these tensions could lead to delays or increased logistics expenses, impacting its ability to deliver solutions promptly.

The push for 'Clean Networks,' aiming to exclude certain technology providers, presents both challenges and opportunities for Enea. While it may limit competition from specific regions, it also opens avenues for trusted vendors like Enea to gain market share, provided they meet stringent security and origin requirements set by governments in 2024-2025.

Digital Governance and Regulatory Certainty

The evolving landscape of digital governance, encompassing data localization mandates and internet content regulation, directly shapes the operational environment for companies like Enea. Uncertainty in these areas, particularly regarding the influence of major digital platforms, can create significant challenges.

Regulatory certainty and a well-defined, comprehensive strategy for digital networks are paramount for fostering investment and driving innovation within the telecommunications sector. Enea thrives in environments where stable and predictable regulatory frameworks are in place, enabling effective long-term planning and market expansion.

- Data Localization: Many countries are implementing or considering data localization laws, requiring data to be stored within national borders. For instance, the EU's General Data Protection Regulation (GDPR) has influenced global data handling practices, and similar trends are seen in regions like Southeast Asia and Latin America.

- Internet Content Regulation: Governments worldwide are increasingly scrutinizing and regulating online content, impacting how digital services are delivered and managed. This can affect Enea's ability to deploy and manage network solutions that facilitate content delivery.

- Platform Dominance: The significant market power of large digital platforms poses regulatory questions about competition, data access, and infrastructure usage, which can indirectly influence the business models of network technology providers.

Government Investment in Digital Infrastructure

Governments worldwide are significantly boosting investment in digital infrastructure, extending beyond 5G to encompass fiber optics and data centers. This push aims to bolster connectivity and accelerate digital transformation initiatives. For instance, the US government's Broadband Equity, Access, and Deployment (BEAD) program allocated $42.45 billion in 2024 to expand high-speed internet access, directly benefiting companies like Enea by increasing the need for advanced network solutions.

These substantial government outlays create fertile ground for Enea's offerings in network virtualization and traffic intelligence. As nations prioritize enhanced digital frameworks, the demand for sophisticated software platforms that manage and optimize these networks escalates. This includes critical areas such as smart cities and the Internet of Things (IoT), where Enea's specialized solutions are poised to play a vital role in enabling seamless data flow and management.

- $42.45 billion allocated to the US BEAD program for broadband expansion in 2024.

- Governments are investing in fiber optic networks and data centers to improve connectivity.

- Smart city and IoT initiatives are key drivers for Enea's specialized software demand.

- Enea's solutions in network virtualization and traffic intelligence align with these infrastructure investments.

Governmental focus on digital infrastructure, including 5G and future 6G networks, drives significant investment and supportive policies. Initiatives like the EU's Digital Decade and the US BEAD program, with its $42.45 billion allocation in 2024, directly fuel demand for Enea's network software solutions.

Heightened cybersecurity regulations, such as the EU's NIS 2 Directive and the US's CIRCIA, impose strict compliance requirements on technology providers like Enea, necessitating continuous adaptation and enhanced security measures.

International trade dynamics and geopolitical tensions in 2024-2025 can impact Enea's operational costs and supply chain stability, influencing product pricing and delivery timelines.

The global push for 'Clean Networks' presents opportunities for trusted vendors like Enea to increase market share, contingent on meeting evolving government security and origin mandates.

What is included in the product

The Enea PESTLE Analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing Enea's operating environment.

The Enea PESTLE Analysis provides a structured framework to identify and understand external factors, relieving the pain point of navigating complex market dynamics by offering clarity and foresight for strategic decision-making.

Economic factors

The global telecommunications market is on a solid growth trajectory, with annual revenue increases estimated around 3%. Regions like Asia Pacific and EMEA are showing even stronger expansion, creating a positive backdrop for companies like Enea. This rising demand for connectivity and data fuels the need for the very infrastructure and mobile broadband solutions Enea specializes in.

Enea's own network business revenue has reflected this upward trend, demonstrating a direct correlation with the broader industry's expansion. As more people and devices connect, the demand for efficient and robust telecom networks, Enea's area of expertise, naturally increases.

The global cybersecurity market is experiencing a significant expansion, with forecasts showing a jump from an estimated $268 billion in 2024 to over $300 billion in 2025. This upward trend is fueled by the increasing frequency and sophistication of cyber threats, alongside the ongoing digital transformation across industries.

This market growth presents a substantial opportunity for Enea, as its cybersecurity solutions are well-positioned to capitalize on the heightened demand for robust security measures. The projected market size reaching $878 billion by 2034 underscores the long-term potential for revenue generation in this sector.

Telecom operators are heavily investing in 5G deployment and future network technologies, with global capital expenditures expected to reach hundreds of billions of dollars through 2025. These investments cover network modernization, edge computing infrastructure, and advanced equipment to support the growing demand for data and new services.

Despite these substantial outlays, operators are keenly focused on cost optimization and finding ways to monetize their significant network investments. This dual focus on expansion and efficiency is a key driver in the current telecom landscape.

Enea's solutions are designed to support operators in this environment by improving network performance and operational efficiency. This allows them to maximize the return on their capital expenditure and extract greater value from their ongoing network upgrades.

Inflation and Interest Rate Impact

Rising interest rates and inflationary pressures present significant challenges for the telecom industry, impacting Enea's cost of capital for crucial infrastructure investments and potentially lowering company valuations, especially for those with substantial debt. As of the first quarter of 2024, many central banks continued their efforts to curb inflation through monetary policy adjustments, leading to higher borrowing costs across the board.

Enea, recognizing these macroeconomic headwinds, has strategically focused on improving its financial health. The company has actively worked to reduce its net debt, a move that directly translates to lower interest expenses. For instance, Enea reported a reduction in its net debt in its 2023 annual report, strengthening its balance sheet against rising interest rate environments.

- Cost of Capital: Higher interest rates increase the cost of borrowing for new projects and refinancing existing debt.

- Valuation Impact: Increased discount rates due to higher interest rates can negatively affect the present value of future cash flows, impacting company valuations.

- Debt Management: Companies like Enea with significant debt face higher interest payments, potentially squeezing profit margins.

- Operational Efficiency: Maintaining operational efficiency becomes even more critical to offset increased financial costs and preserve profitability.

Cost Optimization and Operational Efficiency Drive

The telecommunications sector faces relentless pressure to reduce expenditures and enhance operational efficiency, all while accommodating surging data consumption. This persistent challenge fuels a strong demand for software that automates workflows, fine-tunes network performance, and minimizes energy usage. For instance, in 2024, many operators are investing heavily in AI-driven network management to predict and prevent outages, aiming for up to a 15% reduction in operational costs.

Enea's strategic direction, emphasizing cloud-native architectures, network virtualization, and advanced traffic intelligence, directly addresses these industry imperatives. These technologies enable telecom providers to achieve greater agility and scalability, crucial for managing dynamic data traffic and optimizing resource allocation. The global market for network virtualization is projected to reach over $70 billion by 2025, highlighting the significant shift towards these solutions.

- Cost Reduction Focus: Telecom operators are actively seeking ways to lower their operating expenses, with a significant portion of these savings targeted at network infrastructure and management.

- Efficiency Gains: Automation and intelligent network optimization are key to improving efficiency, allowing companies to do more with less and respond faster to market changes.

- Enea's Alignment: Enea's portfolio of cloud-native solutions and traffic intelligence software directly supports these efficiency and cost-saving objectives for telecom companies.

- Market Growth: The increasing adoption of virtualized network functions and AI in network operations underscores the market's validation of these efficiency-driving technologies.

Economic factors significantly shape the telecommunications landscape. Rising interest rates, as seen in early 2024, increase borrowing costs for infrastructure projects, impacting companies like Enea. Inflationary pressures also challenge profitability by raising operational expenses. Enea's focus on debt reduction, as evidenced by its 2023 annual report, is a strategic response to these macroeconomic headwinds, aiming to bolster its financial resilience.

Same Document Delivered

Enea PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Enea PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the external forces shaping Enea's strategic landscape with this detailed report.

Sociological factors

Societal reliance on digital tools is soaring. The global population's dependence on mobile phones and internet for everything from remote work to online learning fuels a constant need for strong communication infrastructure. This trend directly benefits companies like Enea, whose technologies are integral to this digital ecosystem.

Enea's impact is substantial, supporting over 4.5 billion individuals worldwide in their daily mobile and internet activities. This widespread adoption underscores the deep societal dependence on reliable connectivity, a demand Enea is well-positioned to meet with its specialized solutions.

Public and corporate awareness regarding data breaches, privacy concerns, and cyberattacks has significantly increased. In 2024, reports indicated a substantial rise in cybercrime incidents, with the average cost of a data breach reaching an estimated $4.73 million globally, a figure that climbed from $4.35 million in 2023. This growing apprehension directly fuels a greater demand for sophisticated cybersecurity solutions.

Consequently, organizations are compelled to allocate more resources towards safeguarding their digital assets and critical infrastructure. This societal shift means businesses are actively seeking ways to bolster their defenses against an evolving threat landscape, leading to increased investment in cybersecurity technologies and services.

Enea's core business, specializing in cybersecurity appliances and services, is perfectly positioned to capitalize on this intensified societal concern and the resulting market demand. Their offerings directly address the need for robust protection that this heightened awareness necessitates.

Consumers and businesses alike are demanding more from their network connections, expecting them to be not just fast, but also exceptionally secure and consistently dependable. This surge in expectations is driven by a world awash in data-heavy applications, a growing ecosystem of Internet of Things (IoT) devices, and the critical nature of modern communication systems.

The sheer volume and complexity of data now flowing through networks, coupled with the ever-present threat of cyberattacks, mean that standard solutions are no longer sufficient. Advanced network capabilities are essential to manage this intricate traffic flow and provide robust protection against evolving security threats.

Enea's product portfolio directly addresses these evolving user needs. Their solutions are designed to significantly boost network performance, bolster security measures, and ensure unwavering reliability, making them well-positioned to capture this growing market demand.

Talent Gap in Cybersecurity and Telecom

The cybersecurity and telecommunications industries are grappling with a significant talent shortage. This gap makes it difficult for companies to recruit individuals with the necessary expertise to manage and secure increasingly sophisticated network infrastructures. For instance, a 2024 report indicated that the global cybersecurity workforce needed to grow by 65% to adequately defend organizations, highlighting the severity of the skills deficit.

This persistent skills gap directly fuels the demand for automated and intelligent software solutions. Such technologies are crucial for augmenting the capabilities of existing human workforces and streamlining complex operational tasks. Companies are actively seeking tools that can compensate for the lack of specialized personnel and improve overall efficiency.

Enea's advanced software platforms are well-positioned to address this challenge. By offering more efficient and intelligent tools, Enea can help organizations overcome the limitations imposed by the talent shortage. These solutions can automate critical functions, reduce the reliance on highly specialized personnel for routine tasks, and ultimately enhance network security and performance.

- Talent Shortage: A significant skills gap exists in cybersecurity and telecom, making it hard to find qualified professionals.

- Demand for Automation: This shortage drives the need for intelligent software that can enhance human capabilities and streamline operations.

- Enea's Role: Enea's advanced software platforms can help mitigate these challenges by providing efficient and intelligent tools for network management and security.

- Industry Impact: Reports from 2024 show a critical need for a 65% increase in the cybersecurity workforce globally to meet demand.

Societal Adoption of Emerging Technologies

The increasing integration of advanced technologies into everyday life, such as artificial intelligence (AI), the Internet of Things (IoT), and augmented/virtual reality (AR/VR), directly fuels the demand for robust network infrastructure. Enea's expertise in mobile broadband and embedded applications positions it to benefit from this trend, as these technologies require sophisticated underlying software to function efficiently.

Societal acceptance and adoption rates are critical indicators. For instance, the global IoT market was projected to reach $1.8 trillion by 2024, showcasing a massive societal embrace of connected devices. This widespread adoption necessitates the very network capabilities Enea provides.

- AI and Machine Learning: Expected to grow significantly, driving demand for high-speed data processing and low-latency networks.

- IoT Devices: Billions of connected devices worldwide require scalable and efficient network management solutions.

- AR/VR Adoption: As these immersive technologies become more mainstream in gaming, education, and remote work, they will place greater strain on network bandwidth and performance.

- 5G Rollout: The continued expansion of 5G networks is a direct response to and enabler of these societal technology shifts, creating opportunities for Enea's software.

Societal reliance on digital tools is soaring, with billions of people worldwide depending on mobile and internet connectivity for daily activities. This trend directly benefits companies like Enea, whose technologies are integral to this digital ecosystem, supporting over 4.5 billion individuals in their mobile and internet usage.

Public and corporate awareness regarding data breaches and privacy concerns has significantly increased, fueling demand for cybersecurity solutions. The average cost of a data breach globally reached an estimated $4.73 million in 2024, a rise from $4.35 million in 2023, prompting organizations to invest more in digital asset protection.

A significant talent shortage exists in cybersecurity and telecommunications, with a 2024 report indicating a 65% global need to grow the cybersecurity workforce. This gap drives demand for automated and intelligent software solutions to augment human capabilities and streamline operations, a challenge Enea's advanced platforms are positioned to address.

The increasing integration of advanced technologies like AI, IoT, and AR/VR fuels demand for robust network infrastructure, with the global IoT market projected to reach $1.8 trillion by 2024. Enea's expertise in mobile broadband and embedded applications allows it to benefit from this trend, as these technologies require sophisticated underlying software.

| Sociological Factor | Description | Impact on Enea | Relevant Data (2024/2025) |

| Digital Dependence | Increasing reliance on mobile and internet for all aspects of life. | Drives demand for Enea's connectivity solutions. | Over 4.5 billion individuals globally rely on mobile/internet activities supported by Enea. |

| Cybersecurity Awareness | Heightened concern over data breaches and privacy. | Increases demand for Enea's cybersecurity appliances and services. | Average cost of data breach: $4.73 million globally (up from $4.35 million in 2023). |

| Talent Shortage | Deficit of skilled professionals in cybersecurity and telecom. | Boosts demand for Enea's automated and intelligent software solutions. | Global cybersecurity workforce needs to grow by 65% to meet demand. |

| Technology Adoption | Growing integration of AI, IoT, AR/VR into daily life. | Requires robust network infrastructure, benefiting Enea's specialized solutions. | Global IoT market projected to reach $1.8 trillion by 2024. |

Technological factors

The global rollout of 5G continues, with projections indicating over 1.5 billion 5G connections by the end of 2024, a significant jump from previous years. This expansion fuels demand for sophisticated software solutions in mobile core networks and network virtualization, areas where Enea excels.

Simultaneously, the groundwork for 6G is being laid, with research focusing on achieving speeds up to 1 terabit per second and near-zero latency. This technological leap will necessitate even more advanced traffic intelligence and software-defined networking capabilities, directly aligning with Enea's strategic focus and product development.

Artificial intelligence (AI) and machine learning (ML) are revolutionizing telecom and cybersecurity. These technologies are crucial for boosting network efficiency, automating complex tasks, and strengthening defenses against cyber threats. For instance, in 2024, the global AI in cybersecurity market was valued at approximately $25.7 billion and is projected to grow significantly, highlighting its increasing importance.

AI-driven solutions are transforming cybersecurity by enabling faster threat detection, automating responses to incidents, and providing predictive analytics to anticipate future attacks. This proactive approach is vital in combating evolving cyber risks. Enea can capitalize on these trends by integrating AI and ML into its software, thereby delivering more sophisticated and responsive solutions to its clients.

The telecommunications industry is rapidly embracing cloud-native architectures and network virtualization, with Software-Defined Networking (SDN) and Network Function Virtualization (NFV) at the forefront. These advancements are crucial for creating more agile, scalable, and cost-effective networks. For instance, the global NFV market was valued at approximately $20.5 billion in 2023 and is projected to reach $75.8 billion by 2030, growing at a CAGR of 20.5% during this period, according to Mordor Intelligence. This signifies a substantial market opportunity driven by the demand for flexible network solutions.

Enea is strategically positioned to capitalize on this technological shift. The company offers cloud-native solutions and 5G-ready products specifically designed for mobile core networks and network virtualization. This specialization allows Enea to provide the building blocks for next-generation telecommunications infrastructure, enabling operators to deploy services more efficiently and adapt quickly to evolving market demands. Their focus on these key areas aligns directly with the industry's move towards more software-driven and virtualized network environments.

Increased Demand for Network Performance and Traffic Intelligence

The exponential growth in data traffic, fueled by the widespread adoption of 5G, the proliferation of Internet of Things (IoT) devices, and the emergence of data-intensive applications, has created an urgent need for sophisticated network performance management. This surge means that simply moving data isn't enough; networks must intelligently handle and optimize this traffic for peak efficiency.

Traffic intelligence and analytics have become non-negotiable for maintaining network reliability, bolstering security, and ensuring overall operational efficiency. Without deep insights into traffic patterns, service providers struggle to guarantee quality of service and prevent bottlenecks.

Enea's core competency in traffic intelligence directly aligns with this escalating demand from telecommunications providers. The global mobile data traffic is projected to grow significantly, with Cisco estimating a compound annual growth rate (CAGR) of around 22% between 2021 and 2026, reaching over 200 exabytes per month by 2026. This translates to a massive market opportunity for solutions that can manage this complexity.

- 5G Rollout: The continued expansion of 5G networks is a primary driver, enabling higher speeds and lower latency, which in turn generates more traffic.

- IoT Expansion: Billions of connected IoT devices, from smart home gadgets to industrial sensors, contribute to a constant stream of data, requiring intelligent aggregation and management.

- Video Streaming Dominance: Video content continues to be the largest contributor to mobile data traffic, with its demand for bandwidth constantly increasing due to higher resolutions and more immersive formats.

- Edge Computing Growth: The shift towards edge computing, processing data closer to its source, necessitates robust traffic management at distributed network points.

Cybersecurity Innovations and Threat Evolution

The cybersecurity landscape is in constant flux, with threats like AI-driven phishing and ransomware-as-a-service becoming increasingly sophisticated. This rapid evolution demands that Enea continuously innovate its security offerings.

For instance, the global cybersecurity market is projected to reach $372 billion by 2027, highlighting the significant investment in this sector. Enea's ability to integrate advanced threat detection and response (XDR) capabilities into its portfolio is crucial for staying competitive and effective against these evolving threats.

- AI-powered cyberattacks are on the rise, targeting both individuals and organizations.

- Ransomware-as-a-service (RaaS) models lower the barrier to entry for cybercriminals.

- Social engineering tactics are becoming more personalized and harder to detect.

- The global cybersecurity market is expected to grow substantially in the coming years.

The ongoing 5G expansion, with over 1.5 billion connections expected by the end of 2024, directly fuels Enea's business in mobile core networks and network virtualization. Simultaneously, the development of 6G, aiming for terabit speeds, will require advanced traffic intelligence, a core area for Enea.

AI and machine learning are transforming telecom and cybersecurity, with the AI in cybersecurity market valued at approximately $25.7 billion in 2024. Enea can leverage these technologies to enhance network efficiency and security.

The telecommunications industry's shift to cloud-native architectures and virtualization, with the NFV market projected to reach $75.8 billion by 2030, presents a significant opportunity for Enea's specialized solutions.

Exponential data growth, driven by 5G and IoT, necessitates sophisticated traffic intelligence, a key strength for Enea, as mobile data traffic is expected to grow at a CAGR of around 22% through 2026.

Legal factors

Global data privacy regulations, such as the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA), are significantly shaping how companies handle personal information. These laws mandate strict controls over data collection, storage, processing, and protection, impacting businesses across all sectors.

For Enea, which operates in the telecommunications software space and likely handles substantial communication data, compliance is paramount. Failure to adhere to these evolving privacy laws can result in substantial financial penalties; for instance, GDPR violations can lead to fines of up to €20 million or 4% of annual global turnover, whichever is higher. Maintaining robust data privacy practices is therefore crucial for Enea to avoid reputational damage and maintain customer trust.

Governments worldwide are tightening cybersecurity incident reporting rules, especially for critical sectors. For instance, the US Cybersecurity Incident Reporting for Critical Infrastructure Act (CIRCIA) mandates reporting within specific timeframes, and the EU's Digital Operational Resilience Act (DORA) imposes similar obligations on financial entities.

As Enea operates in the cybersecurity space, its clients, including those in critical infrastructure and finance, are directly impacted by these evolving mandates. Enea's solutions are designed to bolster their defenses and provide the necessary visibility and logging to ensure timely and accurate reporting of any security incidents, thereby aiding compliance.

Beyond general data privacy, sectors like healthcare and finance face stringent, industry-specific cybersecurity mandates. For instance, HIPAA in healthcare and PCI DSS in finance dictate detailed security protocols that Enea's solutions must support.

Enea's telecom and cybersecurity offerings may need to achieve certifications like ISO 27001 or FedRAMP to gain access to government contracts or highly regulated enterprise clients, demonstrating a commitment to robust security practices.

Compliance with these specialized standards, such as those for critical infrastructure protection in telecommunications, is crucial for Enea to operate effectively and secure business opportunities within these sensitive markets.

Product Cybersecurity Legislation and 'Security by Design'

New regulations like the EU Cyber Resilience Act (CRA) are fundamentally reshaping product cybersecurity. This legislation mandates a 'security by design' approach for all products with digital components, including software. This means Enea must integrate cybersecurity from the very beginning of its development processes.

Meeting these stringent requirements necessitates a proactive stance on Enea's part. The company will need to bolster its incident response capabilities and enhance its vulnerability management programs to align with the CRA's mandates, ensuring its offerings are secure by default.

- EU Cyber Resilience Act (CRA): Focuses on product cybersecurity, requiring 'security by design'.

- 'Security by Design': Cybersecurity must be embedded from the initial stages of software development.

- Impact on Enea: Requires enhancement of incident response and vulnerability management programs.

Supply Chain Security Regulations

The increasing frequency of supply chain attacks is prompting regulators worldwide to enhance their oversight of vendor networks and third-party risk. For companies like Enea, deeply integrated into critical communication infrastructure, this translates to more stringent mandates for assessing and fortifying their supply chains. This heightened scrutiny means ensuring all suppliers meet rigorous, industry-specific compliance standards is no longer optional but a core operational requirement.

In 2024, for instance, the European Union's NIS2 Directive significantly expanded its scope to cover more sectors and entities within critical infrastructure, including those providing digital services. This directive places a stronger emphasis on supply chain security, requiring organizations to implement robust measures to manage risks arising from their suppliers and service providers. Failure to comply can result in substantial fines, impacting financial performance and market reputation.

- Increased Regulatory Scrutiny: Governments are enacting stricter laws, like the NIS2 Directive in the EU, to mandate supply chain security for critical infrastructure providers.

- Third-Party Risk Management: Companies must now proactively assess and mitigate security risks associated with their vendors and partners, especially those handling sensitive data or operating critical systems.

- Compliance Burden: Enea and similar firms face growing obligations to ensure their entire supply chain adheres to evolving cybersecurity standards and industry-specific regulations.

- Financial and Reputational Impact: Non-compliance can lead to significant penalties, operational disruptions, and damage to a company's trustworthiness in the market.

Enea must navigate a complex web of evolving legal frameworks governing data privacy, cybersecurity, and supply chain integrity. Recent legislation like the EU's Cyber Resilience Act (CRA) mandates a 'security by design' approach, requiring cybersecurity to be integrated from the earliest stages of product development. Furthermore, directives such as the NIS2 Directive in the EU are intensifying scrutiny on supply chain security, compelling companies to rigorously assess and fortify their vendor networks to avoid substantial penalties and reputational damage.

Environmental factors

The telecommunications sector, encompassing data centers and network infrastructure, is a substantial electricity user, directly impacting carbon footprints. Global data center electricity consumption was projected to reach 1.8% of total worldwide electricity demand in 2023, a figure expected to rise with increasing digital service adoption.

As the appetite for data-intensive applications like AI and cloud computing escalates, so does the energy demand from these critical digital hubs. This trend necessitates innovative solutions to mitigate environmental impact.

Enea's software offerings, particularly in areas of network optimization and virtualization, are designed to enhance operational efficiency for telecom providers. By enabling smarter resource allocation and reducing idle capacity, Enea's technology can play a role in lowering the overall energy consumption of network operations.

Telecom operators are under immense pressure to slash their carbon emissions, with many setting ambitious net-zero targets. This push comes from governments, investors demanding ESG compliance, and consumers who increasingly favor environmentally conscious brands. For instance, in 2024, the European Telecommunications Network Operators' Association (ETNO) reported that its members are committed to achieving climate neutrality by 2030, a significant acceleration of previous goals.

This environmental imperative directly fuels demand for energy-efficient network equipment and innovative sustainable operational strategies. Companies like Enea are well-positioned to capitalize on this trend by providing solutions that enhance network efficiency. Their software can optimize resource allocation, reducing the energy consumed by base stations and data centers, a critical area for operators aiming to meet their 2025 and beyond climate commitments.

The disposal of outdated telecommunications equipment generates significant electronic waste, a growing global concern. In 2023, the global e-waste volume reached an estimated 62 million metric tons, according to the Global E-waste Monitor 2024 report, highlighting the scale of this environmental challenge.

There's an increasing emphasis on circular economy principles, driving the development of robust recycling programs and the integration of eco-friendly materials into new product designs. For instance, the European Union's Ecodesign Directive continues to push for greater product longevity and repairability.

While Enea's core business is software, its solutions can play a crucial role in supporting these environmental efforts. By enabling software upgrades and optimizing resource management, Enea's technology can extend the operational lifespan of hardware, thereby reducing the frequency of device replacement and subsequent e-waste generation.

Sustainable Practices in Supply Chain and Operations

Telecom companies are extending their environmental focus beyond direct energy use to encompass their entire supply chains and operational activities. A key area of attention is the electrification of vehicle fleets, aiming to reduce dependence on diesel fuel. For instance, in 2024, many major telecom operators announced ambitious targets for transitioning their vehicle fleets to electric, with some aiming for over 50% electric vehicles by 2027.

This commitment also involves ensuring that suppliers adhere to sustainable practices, creating a ripple effect of environmental responsibility. Enea, as a software solutions provider, plays a role by maintaining sustainable operations within its own business and by offering tools that help its clients enhance their environmental consciousness. For example, Enea's solutions can optimize network energy consumption, a critical factor for telcos looking to reduce their Scope 1 and Scope 2 emissions.

- Fleet Electrification: Many telecom firms are investing heavily in electric vehicles for their field operations, with projections indicating a significant increase in EV adoption rates for these fleets throughout 2024-2025.

- Supplier Sustainability Audits: Companies are increasingly implementing rigorous environmental, social, and governance (ESG) criteria for supplier selection, pushing for greater sustainability across the value chain.

- Software's Role in Efficiency: Enea's software can contribute to reduced environmental impact by optimizing network resource allocation and energy usage, potentially leading to substantial energy savings for operators.

- Circular Economy Initiatives: Beyond operations, there's a growing trend in the telecom sector to adopt circular economy principles for equipment, focusing on repair, refurbishment, and recycling to minimize waste.

Regulatory and Reporting Requirements for Environmental Impact

Governments worldwide are stepping up environmental regulations, demanding more granular reporting on carbon emissions and other sustainability metrics. For instance, the EU's Corporate Sustainability Reporting Directive (CSRD), fully applicable from 2024 for many companies, mandates extensive disclosure of environmental impacts. This heightened regulatory landscape means telecom companies like Enea's clients must demonstrate robust environmental stewardship.

This increased scrutiny directly impacts Enea's market by creating a need for solutions that facilitate compliance and enhance transparency. Companies will require tools to accurately measure, monitor, and report their environmental performance to meet these evolving legal obligations. The demand for such capabilities is expected to grow significantly as more jurisdictions implement similar stringent reporting frameworks.

- Increased Regulatory Scrutiny: New directives like the CSRD (effective 2024 for many) require detailed environmental impact reporting.

- Telecom Sector Impact: Companies in the telecom sector face growing pressure to disclose carbon footprints and sustainability initiatives.

- Demand for Compliance Solutions: Enea's clients will increasingly seek solutions to meet these reporting mandates, driving demand for environmental performance management tools.

- Global Trend: Similar regulatory pushes are occurring globally, creating a broad market opportunity for sustainability-focused technology.

The telecommunications industry faces significant environmental pressures, from the energy consumption of data centers, projected to consume 1.8% of global electricity in 2023, to the challenge of electronic waste, which reached 62 million metric tons globally in 2023. These factors drive demand for energy-efficient solutions and circular economy practices.

Companies are responding by electrifying their vehicle fleets, with many aiming for over 50% electric vehicles by 2027, and implementing stricter supplier sustainability audits. Furthermore, evolving regulations, such as the EU's CSRD fully applicable from 2024, necessitate detailed environmental impact reporting, creating a market for compliance and performance management tools.

| Environmental Factor | Impact on Telecom Sector | Enea's Potential Role |

| Energy Consumption | High electricity usage by data centers and networks; pressure to reduce carbon footprint. | Network optimization software to lower energy use. |

| Electronic Waste (E-waste) | Disposal of outdated equipment; growing global concern. | Software solutions enabling hardware lifespan extension, reducing replacement needs. |

| Fleet Electrification | Transitioning company vehicle fleets to electric to cut emissions. | Indirectly supports by enabling efficient network operations, reducing overall infrastructure needs. |

| Regulatory Compliance | Increasingly stringent reporting requirements on environmental performance (e.g., CSRD). | Providing tools for monitoring, measuring, and reporting environmental data. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is meticulously constructed using a blend of official government publications, reputable economic databases, and leading industry research reports. This comprehensive data foundation ensures that every insight into political, economic, social, technological, legal, and environmental factors is accurate and current.