Enea Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enea Bundle

Unlock the strategic potential of this company's product portfolio by understanding its position within the Enea BCG Matrix. See which products are driving growth, which are generating steady revenue, and which might be holding the company back. Purchase the full BCG Matrix for a comprehensive analysis and actionable insights to optimize your investment strategy.

Stars

Enea's Stratum, a key offering in their 5G Core and Network Data Layer solutions, is strategically placed in a rapidly expanding market. This growth is fueled by the ongoing global deployment of 5G networks and the industry-wide shift towards cloud-native network functions, creating a fertile ground for innovation and adoption.

The telco cloud infrastructure software market is expected to see robust expansion, with projections indicating a compound annual growth rate (CAGR) of over 20% through 2028, underscoring the significant market potential for Enea's solutions. This trend suggests a substantial opportunity for revenue generation and market share capture.

Enea has already solidified its market standing by securing significant multi-year contracts with major Tier 1 operators. These agreements, valued in the tens of millions of dollars, are a testament to Enea's strong market position, the reliability of its technology, and the trust placed in its capabilities by leading telecommunications providers.

Enea's Qosmos ixEngine stands as a cornerstone in embedded traffic intelligence, leveraging Deep Packet Inspection (DPI) to achieve a dominant position in its specialized market. This technology is fundamental for managing escalating data traffic and navigating increasingly complex networks, powering essential functions like network analytics and cybersecurity.

Major global telecom equipment manufacturers and network operators rely heavily on Qosmos ixEngine, a testament to its significant market penetration and established industry standard status. This widespread adoption highlights the critical role DPI plays in modern network infrastructure.

The growing demand for sophisticated traffic management and enhanced cybersecurity solutions, driven by the continuous surge in data consumption, directly benefits Enea's Qosmos ixEngine. This trend is expected to continue as networks evolve and the need for granular traffic visibility intensifies.

Enea is strategically positioning its AI-powered threat detection and network protection solutions, like the Messaging Firewall and Threat Detection SDK, for high growth. This focus is driven by the increasing sophistication of cyber threats and the market's demand for advanced, AI-enhanced security tools. The cybersecurity market is booming, with AI playing a significant role in this expansion.

Traffic Management Software

Enea's Traffic Management solutions are a significant contributor to its Networks business growth, meeting the escalating need for efficient network resource use and improved user experience. The company's expertise in this domain is a critical factor in its robust market position and ongoing expansion within the fast-paced telecom sector.

Telecom operators are actively looking to optimize their networks as data traffic continues to surge. Enea's established track record in traffic management directly addresses this demand.

- Market Demand: Growing need for efficient network resource utilization and enhanced user experience.

- Enea's Role: Key growth driver in the Networks business, leveraging proven capabilities.

- Industry Trend: Telecom operators focus on network optimization amidst rising data traffic.

Solutions for Network Automation and Cloud Migration

The telecom industry is seeing massive growth driven by network automation and cloud migration, and Enea's solutions are perfectly aligned with these trends. Their software helps telecom operators manage and utilize real-time data, which is crucial for AI applications and understanding network infrastructure. This positions Enea to benefit from a market that urgently needs efficient and high-performing tools.

Enea's focus on enabling data-driven operations for AI and network discovery directly addresses the evolving needs of the telecom sector. For instance, the global network automation market was valued at approximately $15 billion in 2023 and is projected to reach over $40 billion by 2030, showcasing the immense opportunity. Enea's offerings are designed to support this expansion by providing the foundational software for these advanced capabilities.

- Network Automation Growth: The market is expanding rapidly, with significant investment in automating network functions.

- Cloud Migration Imperative: Telecom operators are increasingly moving their infrastructure to cloud environments for flexibility and scalability.

- Enea's Data Solutions: Enea provides software for real-time data collection, management, and application, essential for AI and network insights.

- Market Positioning: Enea is well-positioned to capture market share by addressing the critical need for efficient and high-performance solutions in these growth areas.

Stars represent Enea's offerings in high-growth markets where they hold a strong competitive position. These products, like their 5G Core solutions and embedded traffic intelligence, are in sectors experiencing rapid expansion due to technological advancements and increasing demand.

Enea's Stratum, for example, is in the telco cloud infrastructure software market, projected to grow at over 20% CAGR through 2028. This makes it a prime candidate for the Star category, given its strong market traction, evidenced by multi-million dollar contracts with Tier 1 operators.

Similarly, the Qosmos ixEngine, a leader in Deep Packet Inspection (DPI), benefits from the escalating data traffic and the need for advanced network analytics and cybersecurity, further solidifying its Star status.

Enea's AI-powered cybersecurity solutions also fall into this category, capitalizing on the booming cybersecurity market and the demand for advanced threat detection tools.

| Enea Product/Solution | Market Segment | Growth Drivers | Enea's Position | Market Data Point |

|---|---|---|---|---|

| Stratum (5G Core) | Telco Cloud Infrastructure | 5G Deployment, Cloud-Native Functions | Strong market standing, multi-year contracts | Telco cloud infrastructure software market CAGR >20% (through 2028) |

| Qosmos ixEngine (DPI) | Embedded Traffic Intelligence | Data Traffic Surge, Network Analytics, Cybersecurity | Dominant position, industry standard | Critical for network visibility and management |

| AI-Powered Cybersecurity | Cybersecurity Solutions | Sophisticated Cyber Threats, AI-Enhanced Security | High growth focus | AI in cybersecurity market is booming |

What is included in the product

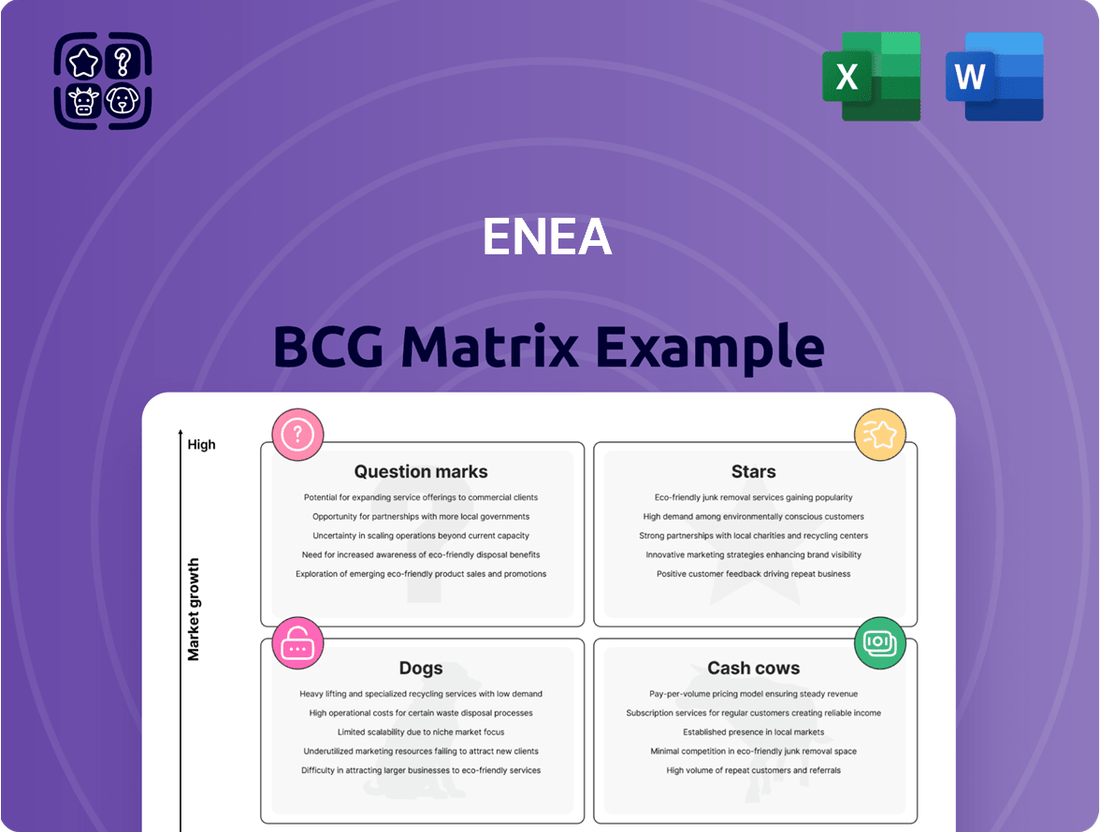

The Enea BCG Matrix analyzes Enea's product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide strategic investment decisions.

The Enea BCG Matrix provides a clear, visual overview of your portfolio, instantly highlighting areas needing attention and reducing the stress of complex strategic decisions.

Cash Cows

Enea's position as a leading player in the Real-Time Operating Systems (RTOS) market solidifies its RTOS segment as a cash cow. This niche, while established, generates steady revenue streams with minimal reinvestment needed for aggressive expansion. For instance, in 2024, Enea continued to be a dominant force in this specialized sector, leveraging its strong brand and established customer base.

Legacy Embedded Application Development Tools are typically considered Cash Cows. These are established products with a strong, loyal user base in mature markets, meaning growth is minimal. For instance, imagine a tool that has been the go-to for a specific type of industrial control system for decades; its market may not be expanding, but its existing users continue to renew licenses and support contracts.

These tools, despite limited new market expansion, maintain a significant market share within their niche. Think of them as the reliable workhorses of the embedded world. Their value lies in their stability and predictable revenue, requiring little in the way of new investment for promotion or substantial feature development, much like a well-oiled machine that continues to perform without needing constant upgrades.

Mature network virtualization components, like established virtualized network functions (VNFs) for core telecom services, often find themselves in a low-growth market. Despite this, their widespread adoption means they maintain high market penetration, ensuring consistent revenue streams from ongoing maintenance and support contracts.

These components are critical for supporting existing telecom infrastructure, acting as reliable generators of stable, predictable income. For instance, while the initial deployment of virtualized Evolved Packet Core (vEPC) solutions may have peaked, the ongoing operational expenditure for these systems remains a significant revenue source for providers.

Given their mature status and established market presence, these components typically require minimal additional investment for aggressive expansion. Instead, resources can be strategically allocated to newer, high-growth areas within network virtualization, such as 5G network slicing or edge computing solutions, which demand more significant R&D and market development funding.

Standard Support & Maintenance Services for Established Products

Standard Support & Maintenance Services for Established Products are Enea's cash cows. These services, crucial for Enea's mature software offerings, form a substantial part of its recurring revenue. The company benefits from a large installed base, ensuring predictable cash flow with relatively low investment needs compared to developing new products.

This segment of Enea's business is characterized by its stability and consistent generation of funds. The high market share in this area is a direct result of Enea's established presence and the ongoing need for support for its deployed solutions.

- High Recurring Revenue: These services contribute significantly to Enea's predictable income streams.

- Strong Market Share: A large installed base of Enea's solutions drives this segment's dominance.

- Predictable Cash Flow: The nature of support and maintenance ensures a steady influx of cash.

- Lower Growth Investments: Compared to new product development, these services require less capital for expansion.

Certain Fixed-Term Recurring Licenses for Stable Deployments

Fixed-term recurring licenses for stable deployments represent Enea's cash cows. These are contracts for software that is deeply embedded and essential for existing customer operations, ensuring consistent revenue. For instance, Enea's network function virtualization (NFV) solutions, which are critical for telecom operators, often fall into this category.

These mature offerings typically hold a significant market share in their specific niches, generating reliable cash flow. This stability means Enea can leverage these earnings to fund growth initiatives in other areas of its business. In 2024, Enea reported continued strong performance in its software licensing segment, reflecting the value of these established revenue streams.

- Stable Revenue: Fixed-term licenses provide predictable income, crucial for financial planning.

- Deep Integration: Software is critical to customer operations, reducing churn risk.

- High Market Share: Mature solutions dominate their deployed environments.

- Cash Generation: These products fund investment in new technologies and market expansion.

Enea's established RTOS solutions are prime examples of cash cows. These mature products, while not experiencing rapid growth, consistently generate substantial revenue with minimal need for further investment. This stability allows Enea to allocate resources to more dynamic areas of its business.

Similarly, legacy embedded development tools, deeply integrated into existing systems, represent a reliable income stream. Their established user base ensures continued demand for licenses and support, making them predictable revenue generators for the company.

Mature network virtualization components, like virtualized Evolved Packet Core (vEPC) solutions, also function as cash cows. Despite the market for these specific components maturing, their widespread deployment means ongoing maintenance and support contracts provide a steady and predictable cash flow for Enea.

Standard support and maintenance services for Enea's broad portfolio of established products are a significant cash cow. These services, vital for customers relying on Enea's mature software, contribute heavily to recurring revenue with relatively low investment requirements.

Fixed-term recurring licenses for Enea's deeply embedded and essential software offerings, such as network function virtualization (NFV) solutions, are also cash cows. These provide consistent revenue from critical customer operations, bolstering overall financial stability.

What You’re Viewing Is Included

Enea BCG Matrix

The Enea BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase, ensuring no surprises and full usability. This comprehensive analysis, designed for strategic decision-making, will be delivered to you without any watermarks or demo content, ready for immediate integration into your business planning. You're seeing the exact strategic tool that will empower your team with clear insights into Enea's product portfolio performance. Once purchased, this professionally designed report is yours to edit, present, or utilize for in-depth competitive analysis.

Dogs

Software products or versions that Enea has phased out or no longer actively supports would be classified as dogs in the BCG matrix. These offerings typically possess both a low market share and negligible growth prospects.

Such legacy products often become cash traps, consuming resources for maintenance without yielding substantial new revenue. For instance, if Enea's operating system segment, which currently holds a high niche share, experiences continued decline and market share erosion, it could transition into this dog category.

Enea's strategy for these products would likely involve minimizing investment, seeking to divest them, or phasing them out entirely to reallocate resources to more promising areas of the business.

Enea's offerings directly challenged by strong open-source alternatives would be classified as Dogs in the Enea BCG Matrix. For instance, if customers are increasingly adopting open-source solutions for network function virtualization (NFV) infrastructure, Enea's proprietary NFV solutions in that specific segment could see declining market share and growth. This shift is a common trend across the telecom software landscape, with many companies exploring open-source options for cost and flexibility benefits.

Niche solutions, while valuable to a specific customer segment, often face significant hurdles in market expansion. These offerings, tailored for very particular needs, might find their addressable market too small to support substantial growth. For instance, a highly specialized software for a single type of industrial machinery, even if it captures 90% of that small market, will struggle to scale if the overall demand for that machinery is low.

In the Enea BCG Matrix, such products typically fall into the Dogs category, especially if their current market share is also low. Consider a bespoke cybersecurity solution designed for a handful of legacy government systems. While critical for those users, its limited applicability means it’s unlikely to attract a broader customer base or see significant revenue increases, mirroring the characteristics of a Dog portfolio item.

Offerings Negatively Impacted by Rapid Technological Obsolescence

In the dynamic telecom and cybersecurity sectors, rapid technological advancements can quickly render products outdated, impacting market share and growth. Offerings that struggle to keep pace with new standards or paradigms, without successful transitions or updates, would likely fall into the Dogs category of the Enea BCG Matrix. For instance, in 2024, the shift towards 5G Advanced features and the increasing sophistication of AI-driven cyber threats necessitate continuous product evolution. Companies failing to invest in R&D for these areas risk seeing their legacy products become less competitive.

Products heavily reliant on older network protocols or security architectures, which are being superseded by more efficient or robust alternatives, are particularly vulnerable. If Enea has such offerings that have not been effectively modernized, they would be classified as Dogs. This means they likely have low market share and low market growth potential. For example, a cybersecurity solution designed for 3G networks, without a clear upgrade path to 5G or beyond, would face significant obsolescence in 2024.

- Technological Obsolescence: Products in telecom and cybersecurity face a high risk of becoming outdated due to rapid innovation, such as the ongoing rollout of 5G Advanced and the evolution of AI-powered cyber threats.

- Market Share Decline: Offerings that cannot adapt to new standards or paradigms, like transitioning from older network protocols to newer ones, will see their market share diminish.

- Low Growth Potential: Without successful updates or transitions, these products will exhibit low market growth rates, fitting them into the Dogs quadrant of the BCG Matrix.

- Investment Impact: Companies with significant Dog offerings may need to re-evaluate their product portfolio, potentially divesting or investing heavily in modernization to avoid further losses.

Underperforming Acquisitions Not Integrated Effectively

Underperforming acquisitions that haven't been integrated effectively can become significant drains on resources. If Enea has acquired product lines that are struggling to gain market share or achieve growth, these would be classified as dogs. This means the company might have capital tied up in these ventures with little to no return, hindering overall performance.

For instance, if a newly acquired software suite failed to integrate with Enea's existing offerings or didn't resonate with customers, it could exhibit characteristics of a dog. This situation would likely manifest as minimal revenue contribution and a declining market presence, despite the initial strategic intent behind the acquisition.

- Stagnant Growth: Acquired product lines failing to achieve projected market penetration or revenue targets.

- Low Market Share: Resulting in a weak competitive position within their respective segments.

- Capital Tied Up: Resources invested in these underperforming assets yield negligible returns.

- Integration Challenges: Ineffective merging of acquired technologies, teams, or market strategies.

Products that are no longer supported or have been phased out by Enea, like older versions of their embedded software that lack critical updates for emerging network standards, would be considered Dogs. These offerings typically have a very small market share and are unlikely to grow, often becoming a drain on resources without generating significant new revenue.

For example, a legacy operating system Enea provided for specialized industrial equipment, which is now being replaced by more modern, connected solutions, would fit this description. By 2024, many industrial sectors are prioritizing IoT integration and real-time data processing, making older, isolated systems less relevant.

Enea's strategy for such products would focus on minimizing ongoing support costs, potentially through limited maintenance agreements or by encouraging customers to migrate to newer, more capable platforms. The goal is to free up resources for investments in areas with higher growth potential.

Products facing intense competition from rapidly evolving open-source alternatives, particularly in areas like network function virtualization (NFV) infrastructure, could also be classified as Dogs. If Enea's proprietary solutions in this segment struggle to differentiate or offer a compelling value proposition compared to free, community-driven options, they risk declining market share and growth. The adoption of open-source in telecom infrastructure has accelerated, with many carriers in 2024 actively exploring these more flexible and cost-effective solutions.

| Product Category | Market Share (2024 Estimate) | Market Growth Rate (2024-2025 Estimate) | Enea BCG Classification |

|---|---|---|---|

| Legacy Embedded OS (Specific Niche) | <0.5% | -5% | Dog |

| Proprietary NFV Solutions (vs. Open Source) | 3-5% | 1-2% | Dog |

| Outdated Cybersecurity for 3G Networks | <0.1% | -10% | Dog |

Question Marks

Enea is actively enhancing its security offerings with new AI-driven features. These include real-time URL analysis and Restricted Image Detection for its Messaging Firewall, alongside AI integration into its Threat Detection SDK.

This strategic move targets a rapidly expanding market fueled by increasingly sophisticated cyber threats. For instance, the global cybersecurity market was projected to reach $345.4 billion in 2024, with AI in cybersecurity expected to grow significantly within that.

While Enea is positioned in a high-growth area, its specific market share within these niche, advanced AI security segments is likely still developing as the technology matures and adoption increases.

Enea views quantum computing as a significant future threat to current cybersecurity, a challenge they are actively preparing for. They are likely exploring solutions that could involve their Deep Packet Inspection (DPI) technology to detect and mitigate quantum-related threats as they emerge.

This positions Enea in a nascent but high-potential market. As the world transitions to post-quantum cryptography, Enea’s market share is currently minimal, reflecting the early stage of industry readiness and solution development.

Enea's strategy to introduce its existing solutions into new geographic markets or industry verticals falls under the Stars category of the BCG Matrix. This approach leverages proven product strength in untapped, potentially high-growth areas. For instance, if Enea's 5G core network solutions, which are performing well in established European markets, are introduced into a rapidly developing Asian market with a nascent 5G infrastructure, this would be a Star initiative.

Early-Stage Cloud-Native Network Function (CNF) Deployments beyond Core Telco

Early-stage cloud-native network function (CNF) deployments beyond traditional core telco, such as in private enterprise networks or edge computing environments, can be viewed as Question Marks within the Enea BCG Matrix. While Enea's 5G Core solutions are established Stars, these nascent areas represent significant future growth potential where Enea is actively expanding its footprint.

These emerging markets, though currently in their infancy, offer substantial upside. For instance, the global private LTE/5G market is projected to reach $15 billion by 2027, indicating a strong growth trajectory. Enea's investment in these areas reflects a strategy to capture future market share, even if current penetration is still developing.

- Emerging Markets: Focus on private enterprise networks, edge computing, and IoT solutions.

- Growth Potential: High future growth anticipated, mirroring the expansion of 5G and cloud adoption.

- Investment Required: Significant R&D and market development investment is needed to establish Enea's position.

- Strategic Importance: These deployments are crucial for Enea to diversify beyond its core telco business and tap into new revenue streams.

New Product Offerings from Recent Strategic Acquisitions

Enea has a robust history of strategic acquisitions, notably the acquisition of 4C Strategies in late 2023, which bolstered its portfolio in the enterprise strategy and portfolio management space. This move aligns with Enea's approach to complement organic growth with targeted external capabilities. The newly integrated product lines, particularly those focusing on advanced digital transformation consulting and cloud-native solutions, are positioned in high-growth segments of the telecommunications and enterprise markets.

These acquired offerings, while still in the early stages of market penetration, are considered potential future Stars within the Enea BCG Matrix. Their success hinges on Enea's ability to effectively integrate these technologies and drive market adoption. For instance, the 4C Strategies acquisition is expected to contribute to Enea's growing recurring revenue base, with initial projections indicating a significant uplift in service revenue in the fiscal year 2024.

- Integration of 4C Strategies: Enhances Enea's position in enterprise strategy and portfolio management, targeting high-growth segments.

- Focus on Cloud-Native Solutions: Acquired technologies are being positioned to capitalize on the increasing demand for cloud-based services in telecom and enterprise.

- Market Penetration Strategy: Enea is actively promoting these new offerings through targeted marketing campaigns and partnerships to accelerate adoption.

- Financial Impact: The acquisition is anticipated to contribute positively to Enea's revenue growth in 2024, particularly in its services division.

Question Marks in Enea's BCG Matrix represent areas with high growth potential but currently low market share. These are often new product lines or market entries where Enea is investing heavily to establish a foothold.

These initiatives require significant capital for research, development, and market penetration. For example, Enea's expansion into specialized cloud-native network functions for private enterprise networks fits this category, aiming to capture a share of a market projected to grow substantially.

The success of these Question Marks is uncertain, but if they gain traction, they could evolve into Stars, driving future revenue. Enea's strategic acquisitions, like 4C Strategies, are also being nurtured in these early-stage markets.

| BCG Category | Enea's Focus Areas | Market Growth | Market Share | Investment Need |

|---|---|---|---|---|

| Question Marks | Cloud-native network functions for private enterprise, Edge computing solutions, IoT security | High (e.g., Private LTE/5G market projected to reach $15 billion by 2027) | Low (Developing) | High (R&D, Market Development) |

| Question Marks | Post-quantum cryptography readiness | Nascent but high potential | Minimal (Early Stage) | Significant (Exploratory) |

BCG Matrix Data Sources

Our BCG Matrix leverages a blend of financial disclosures, market analytics, and industry expert opinions to provide a comprehensive view of business unit performance and market dynamics.