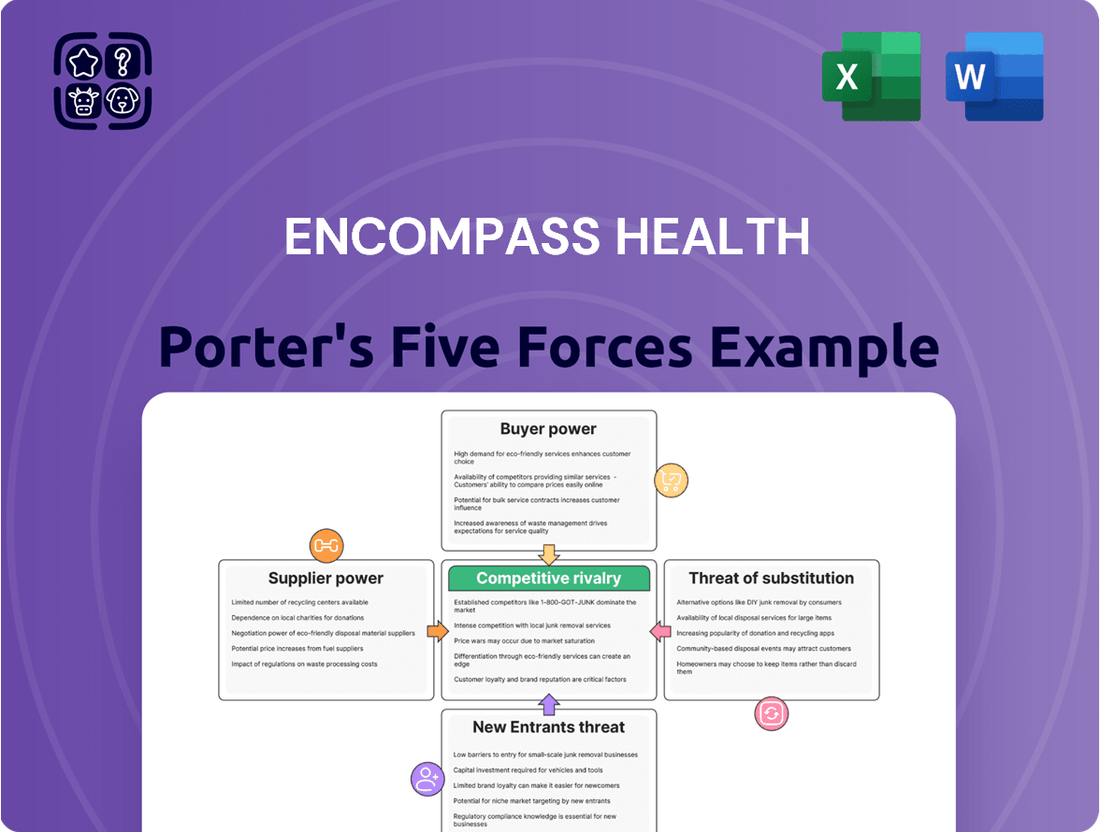

Encompass Health Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Encompass Health Bundle

Encompass Health navigates a healthcare landscape shaped by intense competition, significant buyer power from insurers, and the constant threat of new entrants. Understanding these dynamics is crucial for any stakeholder.

The complete report reveals the real forces shaping Encompass Health’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of highly specialized medical equipment, like advanced rehabilitation robotics and sophisticated diagnostic tools, can exert moderate bargaining power over Encompass Health. The proprietary nature of these technologies often means few alternatives exist, potentially driving up costs. For instance, a new, cutting-edge robotic therapy system might have only one or two manufacturers globally, giving them leverage.

However, this power is not absolute. Encompass Health can mitigate supplier leverage by diversifying its equipment sources for less specialized items or by leveraging its significant purchasing volume to negotiate better terms. In 2024, the healthcare equipment market saw continued innovation, but also consolidation, meaning some specialized suppliers might have increased sway, while bulk purchasing power for more common items remains a strong counter-force.

The bargaining power of pharmaceutical and general medical supply suppliers for a company like Encompass Health is typically moderate to low. This is largely because Encompass Health, as a significant player in the healthcare industry, makes substantial volume purchases, and there are often numerous suppliers available for many standard drugs and medical necessities. For instance, in 2024, the U.S. pharmaceutical market saw continued competition among generic drug manufacturers, which helps to keep prices in check for widely used medications.

Furthermore, the widespread use of Group Purchasing Organizations (GPOs) by large healthcare providers like Encompass Health significantly diminishes individual supplier leverage. GPOs aggregate the purchasing power of many member organizations, enabling them to negotiate more aggressive pricing and more favorable terms. This consolidated demand effectively shifts power towards the buyer.

However, this dynamic can shift considerably when dealing with patented or essential medications that have no readily available substitutes or are supplied by a single source. In such specialized cases, the bargaining power of those specific suppliers can become quite high, potentially impacting Encompass Health's costs for critical treatments.

The market for highly specialized healthcare professionals, such as physical therapists, occupational therapists, speech-language pathologists, and rehabilitation physicians, acts as a significant supplier of labor for companies like Encompass Health. A persistent shortage of these skilled professionals, especially in certain regions, can significantly amplify their bargaining power. This often translates into upward pressure on wages and can create substantial recruitment hurdles for healthcare providers.

In 2024, the demand for rehabilitation services continued to outpace the supply of qualified therapists. For instance, the U.S. Bureau of Labor Statistics projected a 15% growth for physical therapists between 2022 and 2032, faster than the average for all occupations. This scarcity directly impacts Encompass Health's ability to attract and retain the necessary talent, making competitive compensation and strong employee retention strategies paramount for operational success.

Real Estate and Facility Management Services

Suppliers of real estate and facility management services for Encompass Health exert a moderate level of bargaining power. The availability of suitable healthcare-specific properties can be limited, and long-term lease agreements, such as those often seen in the healthcare sector, can anchor costs. For instance, in 2024, the commercial real estate market continued to see fluctuations, with healthcare facility leases often requiring specialized build-outs, increasing supplier leverage.

The specialized nature of healthcare facility construction and maintenance also plays a role. Finding vendors with the requisite expertise and certifications for healthcare environments can narrow the competitive landscape for Encompass Health. This specialization means fewer suppliers can meet the stringent requirements, potentially giving them more pricing influence.

However, Encompass Health's ability to mitigate this power lies in its strategic approach. A broad and diversified real estate portfolio across various geographic locations can reduce reliance on any single supplier. Furthermore, forging strong, long-term partnerships with key facility management providers can lead to more favorable terms and cost efficiencies.

- Moderate Supplier Power: Real estate and facility management suppliers hold moderate bargaining power due to specialized healthcare facility needs.

- Lease Commitments: Long-term leases for hospital facilities or land can lock Encompass Health into specific terms, influencing costs.

- Specialized Services: The limited pool of qualified vendors for healthcare construction and maintenance enhances supplier leverage.

- Mitigation Strategies: Diversified property portfolios and strategic vendor partnerships help Encompass Health manage these supplier costs.

Information Technology and Cybersecurity Providers

The bargaining power of information technology and cybersecurity providers for Encompass Health is significant and growing. As healthcare increasingly relies on digital infrastructure and sensitive patient data, these suppliers hold considerable sway. For instance, the healthcare IT market was valued at over $38 billion in 2023 and is projected to grow substantially, indicating strong demand and supplier leverage.

The complexity of healthcare IT systems, coupled with the paramount importance of data security and regulatory compliance (like HIPAA), creates high switching costs for providers like Encompass Health. Specialized vendors offering robust cybersecurity solutions and integrated IT platforms can therefore command premium pricing, as finding and implementing alternatives is both time-consuming and expensive. Encompass Health's commitment to maintaining secure and efficient systems, including significant investments in cybersecurity measures, underscores this dependence.

- Growing reliance on digital health: The healthcare sector's digital transformation is accelerating, increasing demand for IT and cybersecurity services.

- High switching costs: Implementing and integrating new healthcare IT systems is complex and costly, making it difficult for companies to switch vendors.

- Specialized expertise: Cybersecurity and healthcare IT require specialized knowledge, giving vendors with proven track records significant leverage.

- Regulatory compliance: Adherence to regulations like HIPAA necessitates sophisticated IT security, further empowering specialized providers.

Suppliers of specialized medical equipment, like advanced rehabilitation robotics, can exert moderate bargaining power due to the proprietary nature of these technologies, limiting alternatives and potentially driving up costs. For instance, a new, cutting-edge robotic therapy system might have only one or two manufacturers globally, giving them leverage.

However, Encompass Health can mitigate this power by diversifying its equipment sources for less specialized items and leveraging its significant purchasing volume to negotiate better terms. In 2024, the healthcare equipment market saw continued innovation and consolidation, meaning some specialized suppliers might have increased sway, while bulk purchasing power for more common items remains a strong counter-force.

The bargaining power of pharmaceutical and general medical supply vendors for Encompass Health is typically moderate to low, given the company's substantial volume purchases and the availability of numerous suppliers for standard items. For example, the U.S. pharmaceutical market in 2024 continued to benefit from competition among generic drug manufacturers, helping to control prices for widely used medications.

Additionally, the widespread use of Group Purchasing Organizations (GPOs) by large healthcare providers like Encompass Health significantly diminishes individual supplier leverage by aggregating purchasing power for more aggressive pricing negotiations.

The market for highly specialized healthcare professionals, such as therapists and physicians, acts as a significant supplier of labor. A persistent shortage of these skilled professionals, especially in certain regions, can significantly amplify their bargaining power, leading to upward pressure on wages and recruitment challenges. In 2024, the demand for rehabilitation services continued to outpace the supply of qualified therapists, with the U.S. Bureau of Labor Statistics projecting a 15% growth for physical therapists between 2022 and 2032, faster than the average for all occupations.

Suppliers of real estate and facility management services for Encompass Health exert moderate bargaining power due to the limited availability of suitable healthcare-specific properties and long-term lease agreements. In 2024, healthcare facility leases often required specialized build-outs, increasing supplier leverage, and the limited pool of qualified vendors for healthcare construction and maintenance further enhanced this power.

The bargaining power of information technology and cybersecurity providers for Encompass Health is significant and growing, as healthcare increasingly relies on digital infrastructure and sensitive patient data. The healthcare IT market was valued at over $38 billion in 2023, indicating strong demand and supplier leverage, and the complexity of these systems coupled with regulatory compliance creates high switching costs.

| Supplier Category | Bargaining Power | Key Factors Influencing Power | Encompass Health Mitigation Strategies | 2024 Market Context |

| Specialized Medical Equipment | Moderate to High | Proprietary technology, limited alternatives, innovator status | Diversified sourcing, volume purchasing, long-term partnerships | Continued innovation and market consolidation |

| Pharmaceuticals & General Medical Supplies | Low to Moderate | Numerous suppliers, high volume purchases, GPO utilization | Leveraging GPOs, competitive bidding, strategic sourcing | Strong competition among generic drug manufacturers |

| Skilled Healthcare Professionals | High | Shortages in specific disciplines, high demand, specialized skills | Competitive compensation, strong retention programs, training initiatives | Demand exceeding supply for rehabilitation services |

| Real Estate & Facility Management | Moderate | Limited specialized properties, long-term leases, specialized vendor requirements | Diversified property portfolio, strategic vendor partnerships, lease negotiation | Fluctuations in commercial real estate, specialized build-out needs |

| IT & Cybersecurity | High and Growing | Complex systems, data security imperative, regulatory compliance, high switching costs | Robust vendor selection, phased implementation, strong internal IT governance | Accelerating digital transformation in healthcare |

What is included in the product

This analysis delves into the competitive forces shaping Encompass Health's market, examining the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the threat of substitutes.

Instantly identify and mitigate competitive threats with a clear, actionable overview of Encompass Health's industry landscape.

Customers Bargaining Power

Government payers like Medicare and Medicaid wield significant bargaining power over post-acute care providers such as Encompass Health. In 2024, these government programs continue to be the primary sources of revenue for many healthcare facilities, allowing them to set reimbursement rates and influence operational practices. For instance, Medicare's Prospective Payment System (PPS) directly impacts how Encompass Health is compensated for its services, requiring constant adaptation to evolving payment models.

Private insurance companies and managed care organizations wield significant bargaining power over healthcare providers like Encompass Health. This power stems from their ability to steer patient volumes and negotiate reimbursement rates, directly impacting Encompass Health's revenue streams. In 2024, the healthcare payer landscape continued to consolidate, with major insurers often representing a substantial portion of a provider's patient mix, amplifying their negotiating leverage.

While patients are the direct recipients of Encompass Health's services, their individual bargaining power is generally limited. This is largely because their selection of a post-acute care provider is often guided by recommendations from their acute care hospital, their insurance network's approved providers, and their specific medical requirements. For instance, a patient discharged from a hospital might be directed to a facility within their insurance plan's network to minimize out-of-pocket costs.

However, patients and their families wield indirect influence. High patient satisfaction and positive clinical outcomes are crucial for Encompass Health's reputation, which in turn drives future referrals and helps secure favorable contracts with insurance providers. In 2023, patient satisfaction scores, often measured through surveys like HCAHPS (Hospital Consumer Assessment of Healthcare Providers and Systems) for inpatient rehabilitation facilities, remain a key performance indicator for healthcare providers, directly impacting their ability to attract and retain patients.

Referral Sources (Acute Care Hospitals, Physicians)

Referral sources, primarily acute care hospitals and physicians, hold significant bargaining power over Encompass Health. These entities act as crucial gatekeepers, directing patients to Encompass Health's rehabilitation and home health services. Their ability to select from a range of post-acute care providers means Encompass Health must actively compete for these valuable referrals.

To maintain and grow patient volume, Encompass Health focuses on cultivating robust relationships with these referral sources. Demonstrating superior clinical outcomes, evidenced by patient recovery rates and satisfaction scores, is paramount. Furthermore, ensuring a smooth and efficient transition of care from the acute setting to Encompass Health's facilities is essential for securing consistent business.

- Referral Volume: In 2023, Encompass Health reported that approximately 75% of its inpatient rehabilitation admissions came from hospital referrals, highlighting the critical reliance on this channel.

- Physician Influence: Physicians often play a direct role in recommending specific post-acute care providers, making their satisfaction and trust key drivers of patient flow.

- Competitive Landscape: The post-acute care market is fragmented, with numerous hospitals and independent providers vying for physician and hospital referrals, intensifying the bargaining power of these sources.

- Value-Based Care: As the healthcare industry shifts towards value-based care, hospitals and physicians are increasingly scrutinizing post-acute providers based on overall patient outcomes and cost-effectiveness, further empowering their decision-making.

Employer Groups and Self-Insured Plans

Employer groups, especially those managing self-insured health plans, wield significant sway over healthcare decisions for their workforce. These groups actively seek providers offering both quality care and cost efficiency, often engaging in direct negotiations with post-acute care facilities or utilizing third-party administrators to manage these arrangements. For Encompass Health, showcasing tangible value and consistently positive patient outcomes is paramount to securing and maintaining these crucial contracts.

The bargaining power of these employer groups is amplified by their ability to aggregate patient volumes. For instance, a large employer group can represent thousands of potential patients, giving them leverage in negotiating rates and service level agreements. This concentration of demand means providers like Encompass Health must be highly responsive to the specific needs and cost parameters set by these influential buyers.

- Self-insured employers are a growing segment of the healthcare market, seeking to control costs and quality.

- Negotiations with employer groups often focus on bundled payments and value-based care arrangements.

- Encompass Health's success in attracting these groups depends on demonstrating strong clinical outcomes and efficient resource utilization.

- In 2024, the trend of employers taking on more direct responsibility for healthcare costs continued, increasing their bargaining power.

Government payers like Medicare and Medicaid continue to exert substantial bargaining power over post-acute care providers such as Encompass Health. In 2024, these programs remain primary revenue sources, enabling them to dictate reimbursement rates and operational standards. Encompass Health must continually adapt to evolving payment models, like Medicare's Prospective Payment System (PPS), which directly influences compensation.

Private insurers and managed care organizations hold considerable sway due to their ability to direct patient flow and negotiate reimbursement rates. The ongoing consolidation within the healthcare payer landscape in 2024 means larger insurers represent a significant portion of a provider's patient mix, amplifying their negotiating leverage.

While individual patients have limited direct bargaining power, their collective influence through satisfaction and outcomes is significant. High patient satisfaction scores, a key metric in 2023, directly impact Encompass Health's reputation and ability to secure favorable contracts with insurers.

| Customer Type | Bargaining Power | Key Factors | 2024 Trend Impact |

| Government Payers (Medicare/Medicaid) | High | Reimbursement rates, payment models (PPS) | Continued influence on pricing and operations |

| Private Insurers/Managed Care | High | Patient steering, rate negotiation, payer consolidation | Increased leverage due to market concentration |

| Patients (Individual) | Low | Referral dependence, insurance network restrictions | Indirect influence via satisfaction and outcomes |

| Referral Sources (Hospitals/Physicians) | High | Patient volume control, clinical outcome demonstration | Critical for maintaining patient flow |

| Employer Groups (Self-Insured) | Moderate to High | Cost efficiency demands, volume aggregation | Growing influence as they manage costs directly |

What You See Is What You Get

Encompass Health Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The Encompass Health Porter's Five Forces Analysis meticulously details the competitive landscape, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the healthcare industry. This comprehensive breakdown offers actionable insights into Encompass Health's strategic positioning and potential challenges.

Rivalry Among Competitors

The inpatient rehabilitation sector is a highly competitive landscape. Encompass Health faces formidable rivals such as Select Medical Holdings and Kindred Healthcare, which is now integrated with Humana and Fresenius Kabi. This intense rivalry means companies must constantly differentiate themselves.

Competition hinges on more than just price; it's driven by superior clinical outcomes, exceptional patient satisfaction, extensive geographic presence, strong payer partnerships, and specialized treatment programs. For instance, Select Medical Holdings, a major competitor, reported over $5.7 billion in revenue for 2023, highlighting its significant market share and operational scale.

This fierce competition often translates into considerable pricing pressures and necessitates robust marketing and business development efforts to attract both patients and healthcare providers. Companies must invest heavily in quality improvement and patient care to maintain a competitive edge.

The post-acute care sector, including inpatient rehabilitation, is experiencing growth driven by an aging demographic and a rise in chronic illnesses. However, the intensity of competition within specific geographic markets can differ significantly. For instance, in 2024, while the overall US healthcare spending was projected to reach $4.7 trillion, the concentration of inpatient rehabilitation facilities (IRFs) in certain urban areas means Encompass Health faces more direct rivalry there.

In more mature markets, where the number of providers is already high, Encompass Health likely encounters fiercer competition as companies battle for existing patient volumes. Conversely, in areas with rapidly expanding demand, the competitive landscape might be less cutthroat, offering greater opportunities for Encompass Health to establish or expand its presence without intense head-to-head battles.

Providers differentiate themselves through specialized rehabilitation programs targeting specific conditions like stroke, spinal cord injuries, and traumatic brain injuries. Encompass Health leverages its commitment to evidence-based care and cutting-edge technologies to set its services apart.

Demonstrating superior patient outcomes is a critical competitive lever. Encompass Health's ability to showcase clinical excellence and impressive patient recovery rates, for instance, by achieving a 91.1% overall patient satisfaction score in their inpatient rehabilitation facilities in 2023, provides a significant competitive edge.

Geographic Reach and Network Density

Encompass Health's vast network of rehabilitation hospitals, spanning numerous states, offers a significant competitive edge. This broad geographic reach facilitates strong referral relationships and ensures greater patient accessibility across diverse regions. As of late 2023, Encompass Health operated over 150 inpatient rehabilitation hospitals, a substantial footprint that competitors with more localized operations find challenging to match.

While Encompass Health benefits from its extensive network, the healthcare landscape is dynamic. Competitors can and do expand their presence, particularly in lucrative or underserved markets, thereby increasing rivalry in specific locales. For instance, a competitor might strategically open several new facilities in a high-growth metropolitan area where Encompass Health also has a strong presence, intensifying local competition for both patients and skilled staff.

- Geographic Advantage: Encompass Health's nationwide presence creates a formidable barrier to entry and a competitive advantage through established referral networks.

- Network Density Impact: A denser network in key regions allows for greater economies of scale and potentially better negotiating power with payors.

- Local Rivalry: Despite overall reach, intense competition can emerge in specific markets where other providers are actively expanding or consolidating.

Integration with Acute Care and Post-Acute Continuum

The capacity to integrate smoothly with acute care hospitals for patient referrals and to coordinate care across the entire post-acute spectrum, including home health and skilled nursing facilities, is increasingly shaping competition. Providers that can offer a more unified and efficient patient experience from hospital discharge to home recovery are gaining a significant advantage.

Encompass Health, for instance, has been actively strengthening its continuum of care. In 2023, their inpatient rehabilitation hospitals saw a continued focus on expanding capacity and improving referral relationships with acute care partners. This integration is crucial for capturing patients who require specialized post-acute services.

- Enhanced Patient Flow: Seamless integration reduces patient leakage and ensures continuity of care, leading to better outcomes.

- Referral Stream Stability: Strong relationships with acute care hospitals provide a more predictable and consistent referral base.

- Market Share Growth: Providers offering comprehensive post-acute solutions are better positioned to capture a larger share of the market.

- Operational Efficiency: Coordinated care pathways can streamline administrative processes and reduce overall costs.

The competitive rivalry within the inpatient rehabilitation sector is intense, with Encompass Health facing significant challenges from established players like Select Medical Holdings and the integrated Kindred Healthcare/Humana/Fresenius Kabi. Differentiation is key, moving beyond price to focus on clinical outcomes, patient satisfaction, and geographic reach, as evidenced by Select Medical's $5.7 billion revenue in 2023.

Pricing pressures are a constant, demanding substantial investment in quality care and marketing to secure both patient and provider referrals. While the overall US healthcare spending was projected at $4.7 trillion for 2024, the concentration of facilities in urban areas means Encompass Health faces heightened competition in those specific markets.

Providers distinguish themselves through specialized programs and demonstrable patient recovery rates; Encompass Health achieved a 91.1% patient satisfaction score in 2023, a critical differentiator. Their extensive network, operating over 150 inpatient rehabilitation hospitals as of late 2023, offers a substantial advantage against more localized competitors.

| Competitor | 2023 Revenue (approx.) | Key Differentiators |

| Select Medical Holdings | $5.7 billion | Extensive geographic presence, specialized programs |

| Kindred Healthcare (integrated) | Varies (part of Humana/Fresenius Kabi) | Integrated care continuum, broad service offerings |

| Encompass Health | $4.6 billion (2023) | Nationwide network, strong referral relationships, focus on clinical excellence |

SSubstitutes Threaten

Skilled nursing facilities (SNFs) present a significant threat of substitution for inpatient rehabilitation services, particularly for patients who do not require the full intensity of daily therapy. These facilities often operate at a lower cost point, making them an attractive alternative for individuals needing less intensive rehabilitation or primarily custodial nursing care. In 2023, the average daily rate for SNFs was substantially lower than that of inpatient rehabilitation facilities, which can influence payer and provider decisions.

Home health agencies present a significant threat of substitutes for traditional inpatient rehabilitation facilities. These agencies offer rehabilitation services directly in a patient's home, providing unparalleled convenience and often a preferred recovery environment for individuals stable enough to leave the hospital but still needing therapy. This convenience is a strong driver for patients seeking alternatives to facility-based care.

The increasing viability of home health as a substitute, particularly for less complex rehabilitation needs, directly impacts the demand for inpatient services. As technology in remote patient monitoring and telehealth continues to advance, the capabilities of home health agencies expand, making them a more attractive option. For instance, the U.S. home healthcare market was valued at approximately $140 billion in 2023 and is projected to grow significantly, indicating a strong shift towards home-based care models.

Furthermore, the broader shift towards value-based care models incentivizes and supports home-based recovery. These models often prioritize cost-effectiveness and patient outcomes, which can be more favorably achieved in a home setting for many patients. This trend makes home health agencies a potent substitute, challenging the market share of inpatient rehabilitation providers by offering a more integrated and patient-centric approach to post-acute care.

Outpatient rehabilitation centers present a significant threat of substitutes for inpatient facilities. These centers provide therapy services without requiring overnight stays, making them an attractive alternative for patients who don't need constant medical monitoring or the intensive daily therapy of an inpatient program. For instance, a patient recovering from a non-critical injury might opt for outpatient physical therapy instead of a full inpatient rehabilitation stay, potentially saving on costs and allowing them to maintain their home life.

Long-Term Acute Care Hospitals (LTACHs)

The threat of substitutes for Long-Term Acute Care Hospitals (LTACHs) primarily comes from other post-acute care settings. While LTACHs specialize in complex, medically unstable patients requiring extended acute care, facilities like inpatient rehabilitation hospitals and skilled nursing facilities (SNFs) can serve as alternatives for certain patient populations. For instance, a patient who might initially be a candidate for an LTACH could transition to an inpatient rehabilitation hospital once medically stable, if their rehabilitation needs are the primary focus.

In 2024, the Centers for Medicare & Medicaid Services (CMS) continued to adjust reimbursement policies affecting LTACHs, influencing their competitive landscape against other post-acute providers. These policy shifts can make SNFs or rehabilitation hospitals more financially attractive for certain patient types, thereby increasing the substitutability.

- LTACHs versus Inpatient Rehabilitation Facilities (IRFs): IRFs focus on intensive, multidisciplinary rehabilitation for patients with significant functional deficits. While LTACHs provide acute medical care, IRFs concentrate on restoring function.

- LTACHs versus Skilled Nursing Facilities (SNFs): SNFs offer a lower level of care than LTACHs, typically for patients requiring skilled nursing services and therapy but who are medically stable.

- Impact of Policy Changes: CMS payment rules, such as those under the Prospective Payment System (PPS) for LTACHs, can shift patient volumes towards or away from LTACHs based on their relative profitability compared to other post-acute care options.

- Patient Acuity: The primary differentiator remains patient acuity; LTACHs are designed for the most medically complex patients who require prolonged, intensive medical management alongside rehabilitative services.

Technology-Enabled Remote Monitoring and Tele-Rehabilitation

The increasing adoption of technology-enabled remote monitoring and tele-rehabilitation services poses a growing threat of substitutes for traditional facility-based care. These advancements enable patients to receive therapy and have their progress tracked from the comfort of their homes, potentially reducing the demand for in-person visits for certain conditions or as a post-discharge follow-up. While these solutions are unlikely to fully replace the need for intensive inpatient rehabilitation, they could influence the overall delivery model and contribute to shorter average lengths of stay in facilities.

The market for telehealth services, which includes tele-rehabilitation, has seen significant expansion. For example, in 2023, the global telehealth market was valued at approximately $115.7 billion, with projections indicating continued growth. This suggests a tangible shift in patient preference and accessibility towards remote care options.

- Tele-rehabilitation platforms offer virtual therapy sessions, reducing the need for patients to travel to physical therapy centers.

- Remote patient monitoring devices allow healthcare providers to track patient recovery and vital signs from afar, enabling early intervention and potentially preventing readmissions.

- These technologies are particularly impactful for patients with chronic conditions or those in rural areas with limited access to specialized care.

- While not a complete replacement for acute inpatient care, they represent a viable alternative for ongoing recovery and management, potentially impacting Encompass Health's patient volume and length of stay metrics.

Skilled nursing facilities (SNFs) and home health agencies are significant substitutes for inpatient rehabilitation, especially for patients needing less intensive care. In 2023, SNFs offered a lower average daily rate than inpatient rehab facilities, making them a cost-effective choice. The growing home healthcare market, valued around $140 billion in 2023, further highlights the shift towards convenient, home-based recovery options.

Outpatient rehabilitation centers also serve as a substitute by providing therapy without overnight stays, appealing to patients who are medically stable. Tele-rehabilitation and remote monitoring are emerging substitutes, leveraging technology to deliver care remotely. The global telehealth market, valued at approximately $115.7 billion in 2023, demonstrates the increasing patient acceptance of these virtual care models.

| Substitute Type | Key Characteristics | 2023 Market Data/Impact |

|---|---|---|

| Skilled Nursing Facilities (SNFs) | Lower cost, less intensive therapy, custodial care | Substantially lower average daily rates than IRFs |

| Home Health Agencies | Convenience, home-based care, growing technology integration | U.S. market valued at ~$140 billion |

| Outpatient Rehabilitation | No overnight stay, flexible scheduling | Attracts patients not requiring constant monitoring |

| Tele-rehabilitation/Remote Monitoring | Virtual sessions, remote tracking, accessibility | Global telehealth market valued at ~$115.7 billion |

Entrants Threaten

Establishing a new inpatient rehabilitation hospital demands a substantial upfront capital investment, often running into tens of millions of dollars for facilities, advanced medical equipment, and sophisticated technology. For instance, building a new facility can easily exceed $50 million, creating a significant financial barrier.

Furthermore, navigating the complex web of regulatory requirements presents a formidable challenge. Many states still enforce Certificate of Need (CON) laws, which require potential new entrants to demonstrate a community need before they can build or expand, adding layers of approval and potential delays.

Federal licensing and accreditation processes, such as those required by The Joint Commission, also add to the complexity and cost. These stringent standards ensure quality but can extend the development timeline and increase operational expenses for any new player entering the market.

The need for specialized medical staff and clinical expertise presents a significant barrier for new entrants in the inpatient rehabilitation hospital sector. Successfully operating such facilities requires a highly skilled workforce, including rehabilitation physicians, specialized nurses, and a variety of therapists like physical, occupational, and speech therapists. For instance, as of early 2024, the demand for physical therapists in the US outstripped supply, with the Bureau of Labor Statistics projecting a 15% growth in employment for physical therapists from 2022 to 2032, which is much faster than the average for all occupations. This high demand, coupled with the extensive training and certification required, makes it difficult and expensive for new competitors to quickly assemble a competent clinical team.

Established entities like Encompass Health have already cultivated robust talent acquisition strategies and built strong reputations, giving them an advantage in attracting and retaining this critical workforce. This existing talent pipeline and established brand recognition create a substantial hurdle for any new player attempting to enter the market and compete on clinical quality and patient outcomes. The cost and time investment to replicate this specialized human capital are considerable, acting as a deterrent to potential new entrants.

New entrants into the healthcare sector, particularly in post-acute care like Encompass Health, face a significant hurdle in establishing the extensive referral networks that are vital for patient flow. These networks involve building trust and consistent relationships with acute care hospitals, physicians, and various other healthcare providers. For instance, in 2024, the continued consolidation of hospital systems means fewer, larger entities that new entrants must court for referrals, a process that can take years to yield substantial results.

Existing operators, such as Encompass Health, benefit immensely from decades of cultivated relationships and a proven track record, fostering a level of trust that new competitors struggle to replicate quickly. This established credibility directly translates into a more stable and predictable patient admission volume, a critical advantage in a service-intensive industry. Securing favorable contracts with major payers, both government and private, is another protracted and intricate undertaking, often requiring extensive negotiation and demonstration of quality outcomes, which new entrants may find challenging to achieve in their initial years of operation.

Economies of Scale and Cost Advantages

Large, established healthcare providers like Encompass Health leverage significant economies of scale. This allows them to negotiate better prices for supplies and equipment, streamline administrative processes, and invest in advanced technology, ultimately lowering their per-patient operational costs. For instance, in 2023, Encompass Health reported a net service revenue of $4.8 billion, demonstrating the scale of their operations.

New entrants often face a substantial cost disadvantage because they cannot immediately achieve the same level of operational efficiency. Without the volume to spread fixed costs across a larger patient base, smaller organizations may find it difficult to match the pricing or profitability of incumbents. This cost disparity acts as a considerable barrier, making it challenging for new players to gain market traction.

- Economies of Scale: Encompass Health's large operational footprint allows for cost savings in purchasing, administration, and technology.

- Cost Advantages: Lower per-patient costs for established players translate into competitive pricing and higher profit margins.

- Barrier to Entry: New entrants struggle to replicate these cost efficiencies, facing a significant disadvantage in price competition.

- 2023 Financials: Encompass Health's $4.8 billion in net service revenue highlights the scale that creates these cost advantages.

Brand Reputation and Clinical Outcomes Data

The threat of new entrants in the healthcare sector, particularly for rehabilitation services, is significantly mitigated by the substantial investment required to build a strong brand reputation and accumulate verifiable clinical outcomes data. Encompass Health has spent years cultivating trust with patients, families, and referring physicians through consistent delivery of high-quality care. This established credibility is a formidable barrier for newcomers who must first prove their efficacy and reliability.

New entrants face the arduous task of replicating Encompass Health's established reputation for positive clinical outcomes. For instance, in 2024, the demand for specialized rehabilitation services continues to grow, yet new facilities struggle to gain patient referrals without a proven track record. This lack of immediate, demonstrable success makes it difficult for them to attract the patient volume necessary to achieve profitability and scale.

- Brand Reputation: Encompass Health's long-standing commitment to quality care has built significant patient and provider trust.

- Clinical Outcomes Data: Verifiable positive outcomes are essential for attracting patients and referrals, a hurdle for new entrants.

- Time and Investment: Establishing a strong reputation and outcomes data requires substantial time and consistent performance, representing a high barrier to entry.

- Referral Networks: Existing providers benefit from established relationships with physicians and hospitals, which new entrants must build from scratch.

The threat of new entrants for Encompass Health is generally low due to significant barriers. High capital requirements for facilities and equipment, often exceeding $50 million, create a substantial financial hurdle. Additionally, stringent federal and state regulations, including Certificate of Need laws in many areas, add complexity and time to market entry.

The need for specialized medical staff, coupled with a competitive labor market as seen with the projected 15% growth in physical therapist employment from 2022 to 2032, makes assembling a skilled team difficult and costly for newcomers. Established players like Encompass Health benefit from existing talent pipelines and strong reputations, which are hard for new entrants to replicate quickly.

Furthermore, building robust referral networks with acute care hospitals and physicians takes years, a process complicated by ongoing hospital system consolidation. Securing favorable payer contracts also presents a protracted challenge. Encompass Health's 2023 net service revenue of $4.8 billion underscores the economies of scale that new entrants struggle to match, impacting their ability to compete on cost and efficiency.

| Barrier Type | Description | Impact on New Entrants | Encompass Health Advantage |

|---|---|---|---|

| Capital Requirements | Building new rehabilitation hospitals costs tens of millions of dollars. | High financial barrier. | Established financial resources. |

| Regulatory Hurdles | Certificate of Need laws and federal licensing add complexity. | Extended timelines and approval processes. | Experience navigating regulations. |

| Skilled Workforce | Demand for specialized staff like physical therapists is high. | Difficulty in recruiting and retaining talent. | Established recruitment strategies and brand appeal. |

| Referral Networks | Cultivating relationships with referring physicians and hospitals is crucial. | Time-consuming and challenging to establish. | Decades of cultivated relationships and trust. |

| Economies of Scale | Large operational volume leads to cost efficiencies. | Disadvantage in pricing and profitability. | Lower per-patient costs due to scale (e.g., $4.8B revenue in 2023). |

Porter's Five Forces Analysis Data Sources

Our Encompass Health Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Encompass Health's annual reports and SEC filings, alongside industry-specific research from firms like IBISWorld and government health statistics.