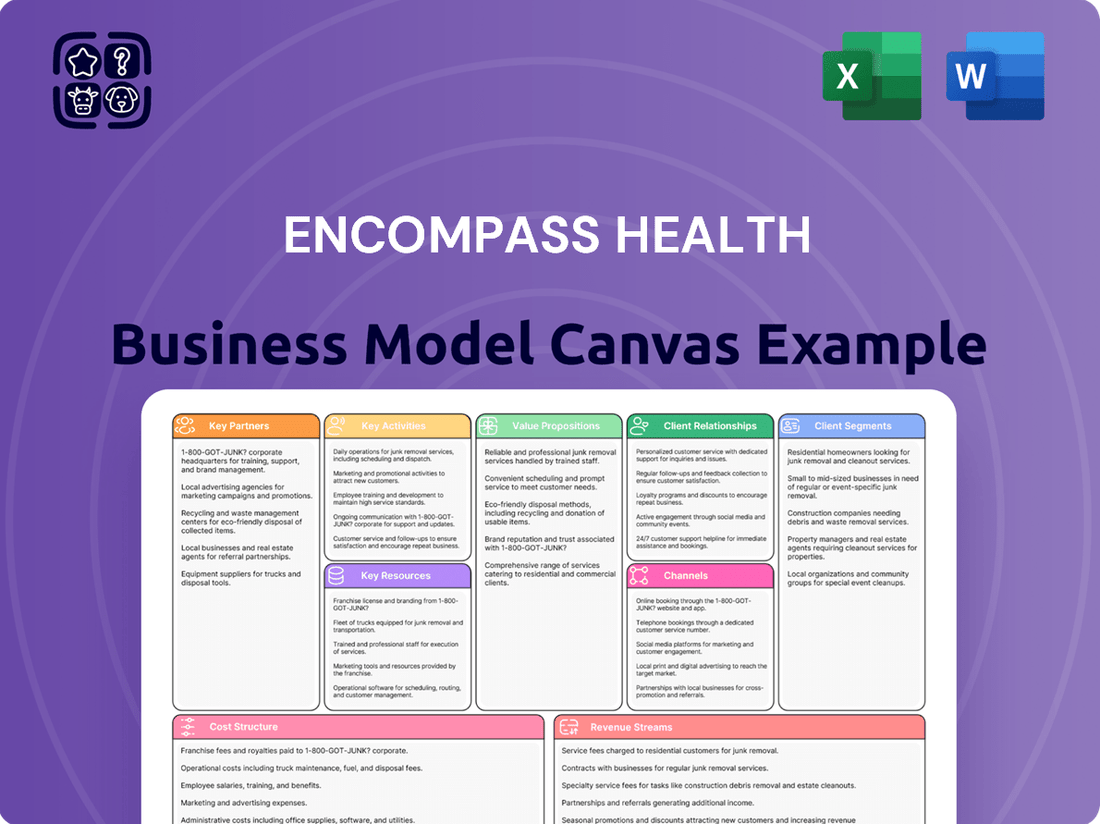

Encompass Health Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Encompass Health Bundle

Uncover the strategic framework behind Encompass Health's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their key customer segments, value propositions, and revenue streams, offering a clear roadmap for their operations. Gain actionable insights into how Encompass Health effectively delivers healthcare services and manages its extensive network of facilities.

Ready to dissect Encompass Health's winning strategy? Our full Business Model Canvas provides an in-depth look at their core partnerships, key resources, and cost structure, essential for understanding their competitive advantage. Download the complete, professionally crafted document to elevate your own strategic planning and market analysis.

Partnerships

Encompass Health's strategic alliances with acute care hospitals are foundational to its patient acquisition strategy. These collaborations, often structured as joint ventures or referral agreements, are vital for channeling patients needing post-acute rehabilitation services directly to Encompass Health facilities. This symbiotic relationship ensures a consistent stream of admissions for specialized care following initial hospital treatment.

The reliance on these acute care hospital partnerships is significant, with approximately 91% of Encompass Health's hospital admissions originating from such referral networks. This high percentage underscores the critical role these hospitals play in Encompass Health's operational success and patient volume management.

Encompass Health's success hinges on strong ties with physicians and specialist groups, including neurologists and orthopedists. These collaborations ensure seamless patient transitions and appropriate care pathways, directly impacting discharge success rates.

In 2024, Encompass Health reported that its integrated approach, which emphasizes close communication with referring physicians, contributed to a significant portion of its patients successfully returning to their communities. This physician partnership is a cornerstone for maintaining high-quality, continuous care.

Encompass Health's success hinges on strong relationships with managed care organizations and payers, including Medicare Advantage plans and private insurers. These partnerships are critical for securing reimbursement for the company's extensive healthcare services.

The company actively showcases its value proposition to these payers by highlighting superior patient outcomes. For instance, Encompass Health consistently achieves higher discharge-to-community rates and shorter lengths of stay compared to industry benchmarks, demonstrating efficiency and effectiveness in patient care.

In 2024, Encompass Health's commitment to value-based care continued to resonate with payers. Their focus on improving patient recovery and reducing readmissions directly translates into favorable network agreements, ensuring continued access to patients covered by these managed care entities.

Technology and Medical Equipment Providers

Encompass Health forms strategic alliances with technology and medical equipment providers to ensure its hospitals are equipped with the latest advancements. These partnerships are crucial for delivering state-of-the-art rehabilitation care, integrating cutting-edge tools for physical, occupational, and speech therapies. For instance, in 2024, Encompass Health continued to invest in advanced robotic therapy devices and virtual reality systems to enhance patient engagement and recovery outcomes.

These collaborations directly impact treatment efficacy and patient recovery by providing access to innovative equipment. By partnering with leading manufacturers, Encompass Health ensures its clinicians have the best resources available. This focus on technology allows for more personalized and effective treatment plans, contributing to better patient results and operational efficiency.

- Strategic alliances with technology and medical equipment providers are vital for offering advanced rehabilitation care.

- Partnerships ensure Encompass Health facilities are equipped with the latest tools for physical, occupational, and speech therapies.

- These collaborations enhance treatment efficacy and improve patient recovery outcomes.

- In 2024, investments were made in robotic therapy and virtual reality systems to boost patient engagement.

Community Organizations and Home Health Agencies

Encompass Health actively partners with community organizations and home health agencies. These collaborations are crucial for ensuring patients have a smooth transition after leaving their inpatient rehabilitation facilities. By working together, they help patients continue their recovery journey in a familiar and supportive environment, ultimately aiding their return home and fostering independence.

These partnerships are vital for extending care beyond the hospital walls. For instance, in 2024, Encompass Health emphasized its commitment to integrated care models, which heavily rely on these external relationships to manage post-discharge needs effectively. This approach directly supports Encompass Health's core mission of helping patients regain their lives.

- Seamless Transitions: Collaborations ensure patients receive necessary support and services upon returning home.

- Continued Recovery: Partnerships facilitate ongoing care, promoting patient independence and well-being.

- Integrated Care: Encompass Health leverages these relationships to create a holistic patient journey.

- Community Support: Working with local entities strengthens the support network available to patients.

Encompass Health's key partnerships are the bedrock of its patient acquisition and care continuum. These include deep ties with acute care hospitals, which funnel a significant majority of patients, and crucial relationships with physicians and specialist groups ensuring smooth care transitions. Furthermore, strong alliances with managed care organizations and payers are essential for reimbursement, while collaborations with technology providers ensure state-of-the-art rehabilitation services. Finally, partnerships with community organizations and home health agencies facilitate seamless post-discharge care.

| Partner Type | Significance | 2024 Data/Impact |

|---|---|---|

| Acute Care Hospitals | Patient acquisition, referral network | ~91% of hospital admissions originate from these networks |

| Physicians & Specialists | Care pathways, patient transition | Contributes to successful community returns |

| Managed Care & Payers | Reimbursement, network access | Value-based care focus enhances favorable agreements |

| Technology & Equipment Providers | State-of-the-art care, treatment efficacy | Investments in robotic therapy and VR systems |

| Community Orgs & Home Health | Post-discharge support, integrated care | Facilitates continued recovery and independence |

What is included in the product

This Encompass Health Business Model Canvas provides a detailed blueprint of their strategy, outlining key customer segments, value propositions, and revenue streams within the healthcare rehabilitation sector.

It offers a clear, actionable framework for understanding Encompass Health's operational strengths, competitive advantages, and strategic direction for growth.

Encompass Health's Business Model Canvas acts as a pain point reliever by streamlining complex operational strategies into a clear, one-page visual.

It offers a structured approach to identify and address inefficiencies, making it easier to pinpoint and solve challenges within their integrated healthcare delivery system.

Activities

Encompass Health's core activity in inpatient rehabilitation is delivering comprehensive therapy and medical care. This includes intensive physical, occupational, and speech therapies, all supported by 24-hour nursing and physician oversight. The focus is on treating patients with complex conditions like stroke, brain injury, and spinal cord injuries, aiming for significant functional recovery.

In 2024, Encompass Health operated over 160 inpatient rehabilitation hospitals across the United States. These facilities are designed to provide a higher level of care than traditional skilled nursing facilities, with an average patient stay typically ranging from two to three weeks. The company reported that a significant portion of its patient population consists of individuals recovering from orthopedic procedures, strokes, and other neurological conditions.

Encompass Health's key activities revolve around the meticulous day-to-day management of its extensive national network of rehabilitation hospitals. This includes ensuring adequate staffing levels with qualified professionals, maintaining facilities to the highest standards, and rigorously adhering to all healthcare regulations and compliance requirements. For instance, in 2023, Encompass Health operated 157 inpatient rehabilitation hospitals across 37 states, highlighting the scale of their operational undertaking.

The efficiency of these operational activities directly impacts the quality and consistency of patient care delivered across every single one of their locations. In 2024, the company continued to focus on optimizing workflows and resource allocation to enhance patient outcomes and operational profitability. This dedication to operational excellence is fundamental to their business model, ensuring a reliable and high-standard patient experience.

Encompass Health's key activities in patient acquisition and admissions revolve around building strong relationships with referral sources, such as physicians and hospitals. They actively market their rehabilitation services to these partners to ensure a consistent influx of patients. In 2024, a significant portion of their patient volume is expected to originate from these established referral networks.

Managing the admission process is another critical activity, involving thorough patient screening and assessment to determine suitability for their specialized rehabilitation programs. This streamlined process ensures that patients receive timely care. Encompass Health's operational efficiency in admissions directly impacts their ability to serve a growing patient base.

Coordinating care with referring hospitals is paramount for a smooth transition of patients. This involves clear communication and collaboration to understand each patient's specific needs and medical history. This seamless handover is vital for continuity of care and positive patient outcomes, contributing to Encompass Health's reputation.

Clinical Outcome Management and Quality Improvement

Encompass Health actively monitors and refines patient care pathways to enhance recovery and reduce the likelihood of readmission. This involves a constant evaluation of key performance indicators, ensuring the highest quality of care is delivered consistently across their facilities.

A core activity is the data-driven assessment of clinical effectiveness. By meticulously tracking metrics like discharge-to-community rates and patient satisfaction scores, Encompass Health validates the impact of its interventions and identifies areas for further improvement. For instance, in 2023, Encompass Health reported a discharge-to-community rate of 88.7%, a testament to their focus on successful patient transitions.

- Patient Outcome Tracking: Continuously monitoring metrics such as readmission rates and patient satisfaction.

- Quality Improvement Initiatives: Implementing evidence-based strategies to enhance care delivery.

- Data Analysis: Utilizing clinical data to demonstrate treatment efficacy and identify trends.

- Care Pathway Optimization: Refining patient journeys to improve recovery and reduce complications.

Capacity Expansion and New Hospital Development

Encompass Health is strategically expanding its healthcare network to address the growing need for post-acute care. This involves both building new hospitals from the ground up, known as 'de novo' developments, and increasing the capacity within its existing facilities by adding more beds.

This expansion is a direct response to rising demand for specialized rehabilitation and home health services. For instance, in 2023, Encompass Health reported opening several new de novo hospitals and adding beds to existing locations, reflecting a commitment to accessible care.

- De Novo Hospital Openings: Encompass Health continues to invest in new facilities to serve underserved markets.

- Bed Capacity Increases: Strategic additions of beds to current hospitals enhance service delivery and patient throughput.

- Meeting Demand: These activities are driven by the increasing patient need for post-acute and rehabilitative care services.

Encompass Health's key activities include managing its extensive network of inpatient rehabilitation hospitals, ensuring high-quality patient care, and driving operational efficiency. They focus on patient acquisition through strong referral relationships and streamline admissions for timely care. The company also emphasizes clinical effectiveness by tracking outcomes and optimizing care pathways.

In 2024, Encompass Health operated over 160 inpatient rehabilitation hospitals nationwide, with a significant portion of patients recovering from orthopedic procedures and neurological conditions. The company's commitment to operational excellence underpins its ability to deliver consistent, high-standard patient experiences. In 2023, they reported an 88.7% discharge-to-community rate, highlighting successful patient transitions.

Strategic expansion is another core activity, involving the development of new de novo hospitals and increasing bed capacity in existing facilities to meet the growing demand for post-acute care. This expansion strategy is crucial for broadening access to their specialized rehabilitation and home health services.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Hospital Network Management | Overseeing national operations, staffing, and regulatory compliance. | Operated 157 inpatient rehab hospitals in 2023; over 160 in 2024. |

| Patient Acquisition & Admissions | Building referral relationships and managing patient intake. | Significant patient volume expected from established referral networks in 2024. |

| Clinical Effectiveness | Monitoring outcomes and refining care pathways. | Reported 88.7% discharge-to-community rate in 2023. |

| Network Expansion | Building new facilities and increasing bed capacity. | Opened several new de novo hospitals and added beds in 2023. |

Delivered as Displayed

Business Model Canvas

The Encompass Health Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the comprehensive business model analysis, ready for your immediate use. You'll gain full access to this detailed framework, allowing you to implement Encompass Health's strategic insights without any alterations to its structure or content.

Resources

Encompass Health's most significant physical asset is its extensive network of inpatient rehabilitation hospitals. As of July 2025, they operate 169 hospitals strategically located across 38 states and Puerto Rico, forming the backbone of their service delivery.

This vast infrastructure is crucial, enabling Encompass Health to provide specialized inpatient rehabilitation services to a wide patient base. The sheer scale of this network underscores their commitment to accessibility and comprehensive care delivery in the United States.

Encompass Health's business model hinges on its highly skilled healthcare professionals. This includes specialized nurses, physical therapists, occupational therapists, speech-language pathologists, and physicians. These experts deliver the crucial, hands-on care that drives patient recovery and rehabilitation.

In 2024, Encompass Health continued to invest in its workforce, recognizing these professionals as a core asset. The quality of care provided by these individuals directly impacts patient outcomes and, consequently, the company's reputation and reimbursement rates.

Encompass Health's commitment to advanced rehabilitation technology is a cornerstone of its business model. This includes significant investment in state-of-the-art equipment and specialized therapy spaces, such as in-house dialysis suites and activities of daily living suites. These facilities are crucial for providing comprehensive and effective patient care, enabling a higher quality of rehabilitation.

In 2024, Encompass Health continued to prioritize capital expenditures on enhancing its technological capabilities. For example, the company reported spending approximately $600 million on property, plant, and equipment, a portion of which directly supports the acquisition and upgrading of advanced rehabilitation technologies. This investment directly translates into improved patient outcomes and a competitive edge in the healthcare market.

Clinical Data and Outcome Measurement Systems

Encompass Health leverages proprietary systems for the meticulous collection, analysis, and reporting of clinical outcomes data. This capability is fundamental to demonstrating the tangible value of their services to both payers and referral sources, solidifying their position in the healthcare market.

The insights derived from these systems are instrumental in driving continuous quality improvement initiatives across their facilities. For instance, in 2024, Encompass Health reported that data-driven enhancements led to a 5% reduction in average patient length of stay for specific rehabilitation programs, directly impacting cost-effectiveness.

- Proprietary Clinical Data Systems: Essential for tracking patient progress and treatment efficacy.

- Value Demonstration: Crucial for negotiating contracts with insurance providers and attracting new patient referrals.

- Quality Improvement: Data analytics identify areas for enhanced patient care and operational efficiency.

- 2024 Performance Insight: A reported 5% decrease in average length of stay for certain rehabilitation services, attributed to data-informed care strategies.

Brand Reputation and Expertise in Post-Acute Care

Encompass Health's brand reputation as a leader in post-acute care, particularly inpatient rehabilitation, is a cornerstone of its business model. This strong standing is built on a foundation of high-quality, compassionate patient care, which directly influences patient acquisition and professional recruitment. In 2024, the company continued to leverage this reputation, with its inpatient rehabilitation facilities consistently ranking among the top providers nationally.

This established expertise attracts a steady stream of patients seeking specialized rehabilitation services, contributing significantly to patient volume and revenue. Furthermore, the company's reputation for excellence makes it a preferred employer for skilled healthcare professionals, ensuring a high-caliber workforce. For instance, Encompass Health's commitment to clinical outcomes has been a key differentiator, with many of its facilities achieving high patient satisfaction scores and positive recovery rates, as reported in industry benchmarks throughout 2024.

- Patient Trust: Encompass Health's strong brand reputation fosters patient trust, leading to higher referral rates and patient choice in post-acute care settings.

- Talent Magnet: The company's recognized expertise attracts and retains top-tier rehabilitation specialists and nurses, crucial for delivering quality care.

- Market Leadership: Consistently high rankings in quality and patient outcomes reinforce its position as a market leader, driving competitive advantage.

- Referral Networks: A trusted reputation strengthens relationships with referring physicians and hospitals, ensuring a consistent flow of patients.

Encompass Health's key resources include its extensive network of 169 inpatient rehabilitation hospitals across 38 states and Puerto Rico, providing a vast physical infrastructure for care delivery. Complementing this is a highly skilled workforce of nurses, therapists, and physicians, who are central to the quality of rehabilitation services. The company also prioritizes investment in advanced rehabilitation technology and equipment, including specialized therapy spaces, to enhance patient care and outcomes.

Proprietary clinical data systems are a vital resource, enabling the tracking of patient progress and demonstrating the value of services to payers and referral sources, which in 2024 contributed to a 5% reduction in average patient length of stay for certain programs. The company's strong brand reputation as a leader in post-acute care further solidifies its market position, attracting patients and top talent. This established expertise is crucial for maintaining strong referral networks and a competitive edge.

| Key Resource | Description | 2024 Impact/Data |

| Hospital Network | 169 inpatient rehabilitation hospitals across 38 states and Puerto Rico. | Forms the core physical asset for service delivery. |

| Skilled Healthcare Professionals | Nurses, physical therapists, occupational therapists, speech-language pathologists, physicians. | Delivered hands-on care, impacting patient outcomes and company reputation. |

| Advanced Rehabilitation Technology | State-of-the-art equipment and specialized therapy spaces. | Supported by approximately $600 million in capital expenditures on property, plant, and equipment in 2024. |

| Proprietary Clinical Data Systems | Systems for collecting, analyzing, and reporting clinical outcomes data. | Drove a 5% reduction in average patient length of stay for specific programs in 2024. |

| Brand Reputation | Leader in post-acute care and inpatient rehabilitation. | Attracted patients and talent, reinforcing market leadership and referral relationships throughout 2024. |

Value Propositions

Encompass Health excels in providing highly specialized and intensive rehabilitation programs. These are meticulously designed for complex conditions such as stroke, traumatic brain injury, and spinal cord injury, ensuring patients receive the focused care they need.

This comprehensive approach is crucial for maximizing patient recovery. For instance, in 2023, Encompass Health’s inpatient rehabilitation hospitals served over 300,000 patients, with a significant portion benefiting from specialized programs.

The ultimate goal is to empower patients to regain independence. Data from 2023 shows that Encompass Health patients achieved an average of 15 days in their rehabilitation program, demonstrating the intensive nature of the care and its effectiveness in restoring function.

Encompass Health’s commitment to superior patient outcomes is clearly demonstrated by their impressive discharge-to-community rates. This metric highlights their success in rehabilitating patients effectively, allowing them to return home rather than requiring further acute care. In 2024, a significant 83.6% of patients were discharged directly to their communities, a testament to the quality of care provided.

Encompass Health's rehabilitation services offer a significant cost advantage by reducing the need for extended stays in more expensive acute care facilities. For instance, in 2024, the average cost of a day in an inpatient rehabilitation hospital is substantially lower than that of a traditional hospital stay, directly benefiting patients and payers.

By focusing on effective recovery, Encompass Health plays a crucial role in preventing costly readmissions to acute care. This proactive approach not only improves patient outcomes but also alleviates the financial burden on the healthcare system, making it a more economical choice for post-acute care needs.

Patient-Centered and Compassionate Environment

Encompass Health prioritizes a patient-centered approach, cultivating a compassionate environment where individual needs and recovery goals are paramount. This dedication to high-quality, supportive care directly enhances patient satisfaction and fosters more positive recovery journeys.

In 2023, Encompass Health reported a patient satisfaction score of 92%, a testament to their focus on compassionate care. This emphasis on a supportive environment is a cornerstone of their value proposition, aiming to improve patient outcomes and build trust.

- Patient-Centric Care: Focus on individual needs and goals.

- Compassionate Environment: Creating a supportive and empathetic setting.

- Improved Recovery Experiences: Enhancing patient well-being and outcomes.

- High Patient Satisfaction: Achieving a 92% satisfaction rate in 2023.

Accessibility Through a National Network

Encompass Health’s extensive national network of hospitals provides patients with convenient access to specialized rehabilitation services. This broad footprint, spanning numerous states, means care is often available closer to home, reducing travel burdens for individuals and their families.

In 2024, Encompass Health operated over 150 inpatient rehabilitation hospitals across 37 states. This wide reach underscores their commitment to making high-quality rehabilitation care accessible to a diverse patient population nationwide.

- National Reach: Operates over 150 inpatient rehabilitation hospitals in 37 states as of 2024.

- Patient Convenience: Facilitates access to specialized care closer to patients' homes.

- Broad Accessibility: Serves a wide patient population across the country.

- Specialized Services: Offers focused rehabilitation programs in multiple locations.

Encompass Health's value proposition centers on delivering specialized, intensive rehabilitation for complex conditions, aiming to maximize patient independence and recovery. Their commitment to superior outcomes is evident in high discharge-to-community rates, with 83.6% of patients returning home in 2024. This specialized care also offers a cost advantage by reducing the need for more expensive acute care stays.

| Value Proposition Aspect | Description | Supporting Data (2023/2024) |

|---|---|---|

| Specialized Rehabilitation | Intensive programs for stroke, TBI, spinal cord injuries. | Served over 300,000 patients in inpatient rehab hospitals in 2023. |

| Improved Patient Outcomes | Focus on regaining independence and functional recovery. | 83.6% of patients discharged to community in 2024. Average 15-day stay in 2023. |

| Cost-Effectiveness | Reduces need for acute care, lowering overall healthcare costs. | Lower average daily cost compared to traditional hospital stays in 2024. |

| Patient-Centric Care | Compassionate environment focused on individual needs. | Achieved 92% patient satisfaction score in 2023. |

| National Accessibility | Extensive network of hospitals across the US. | Operated over 150 inpatient rehab hospitals in 37 states in 2024. |

Customer Relationships

Encompass Health cultivates strong customer relationships through highly personalized patient care and unwavering support. This commitment is evident in their individualized care plans, tailored to each patient's unique rehabilitation needs and goals. For instance, in 2024, Encompass Health reported a patient satisfaction score of 92%, reflecting the effectiveness of their one-on-one therapy sessions and dedicated support systems.

Encompass Health actively nurtures its ties with acute care hospitals and referring physicians by maintaining open lines of communication, showcasing positive patient outcomes, and ensuring smooth admission procedures. This consistent engagement builds a foundation of trust, which in turn drives a steady stream of patient referrals.

Encompass Health's relationships with payers like Medicare, Medicare Advantage, and private insurers are built on demonstrating tangible value. This means showcasing strong clinical outcomes and efficient cost management to secure continued coverage and favorable reimbursement terms. For instance, in 2023, Encompass Health reported that its inpatient rehabilitation facilities achieved an average patient satisfaction score of 93.2%, a key metric for payers evaluating quality of care.

These partnerships are crucial for patient access and the company's financial health. By consistently proving their ability to deliver high-quality care that leads to better patient recovery and reduced readmissions, Encompass Health strengthens its position for negotiating favorable payment agreements. This focus on value-based care is becoming increasingly important as payers shift towards models that reward outcomes rather than just volume of services.

Community Outreach and Education

Encompass Health actively engages local communities through educational programs and outreach. These initiatives aim to raise awareness about their rehabilitation and home health services, positioning the company as a dependable healthcare partner. This approach directly contributes to patient acquisition and strengthens referral networks.

In 2024, Encompass Health continued to emphasize community engagement. For instance, their hospital-based programs often include educational sessions for patients and their families on managing post-acute care needs, fostering trust and encouraging continued care within their system. These efforts are crucial for driving patient volume and solidifying their market presence.

- Community Education Programs: Encompass Health hosted numerous health fairs and educational workshops across its service areas in 2024, focusing on topics like stroke recovery, cardiac rehabilitation, and fall prevention.

- Referral Partnerships: Building strong relationships with acute care hospitals and physician groups through targeted outreach programs in 2024 led to a notable increase in direct patient referrals.

- Patient Testimonials: Sharing success stories and patient testimonials from their community programs in 2024 helped to build credibility and attract new patients seeking specialized care.

- Online Resources: Expanding their digital outreach in 2024 with informative webinars and accessible online content further solidified their role as a trusted healthcare resource for the public.

Post-Discharge Follow-up and Support

Encompass Health actively maintains contact with patients post-discharge, often leveraging partnerships with home health agencies. This proactive approach allows for continuous monitoring of patient recovery and provides essential ongoing support. This focus on continued care not only aids patient well-being but also strengthens the patient relationship, fostering loyalty and potentially driving future business through positive word-of-mouth and referrals.

This commitment to post-discharge follow-up is crucial for patient adherence to care plans and can significantly impact readmission rates. For instance, studies have shown that robust post-discharge programs can reduce hospital readmissions by as much as 20-30%. By ensuring patients have the necessary resources and support at home, Encompass Health demonstrates a dedication that extends beyond the acute care setting.

- Extended Care: Partnerships with home health providers ensure continued patient support after leaving an Encompass Health facility.

- Progress Monitoring: Regular follow-ups allow for tracking patient recovery and identifying any potential issues early on.

- Relationship Reinforcement: This ongoing engagement builds trust and strengthens the bond with patients, encouraging satisfaction.

- Referral Generation: Positive post-discharge experiences are a key driver for patient and family referrals to Encompass Health services.

Encompass Health prioritizes strong patient relationships through personalized care and post-discharge support, aiming for high satisfaction and encouraging repeat business. They also foster crucial partnerships with hospitals, physicians, and payers by demonstrating value through positive outcomes and efficient care, which in turn drives referrals and secures favorable reimbursement. Community engagement via educational programs further solidifies their role as a trusted healthcare provider, enhancing patient acquisition and referral networks.

| Relationship Type | Key Engagement Strategy | 2024 Data/Focus | Impact |

|---|---|---|---|

| Patients | Personalized care plans, post-discharge support | 92% patient satisfaction score | Loyalty, word-of-mouth referrals |

| Hospitals & Physicians | Open communication, outcome reporting, smooth admissions | Increased direct patient referrals | Steady patient volume |

| Payers (Medicare, Insurers) | Demonstrating value (outcomes, cost management) | Securing favorable reimbursement terms | Financial stability, continued coverage |

| Community | Educational programs, outreach | Health fairs, workshops on recovery topics | Patient acquisition, strengthened referral networks |

Channels

Direct referrals from acute care hospitals represent Encompass Health's cornerstone for patient acquisition, feeding their post-acute rehabilitation services. These hospitals, facing capacity pressures and seeking seamless transitions for their patients, rely on Encompass Health for specialized care. In 2024, Encompass Health continued to emphasize building and maintaining strong relationships with these hospital systems, recognizing them as the most crucial link in their patient journey.

Physician networks and medical groups are crucial channels for Encompass Health, acting as key referral sources. Building strong relationships with these healthcare providers ensures a steady stream of patients needing specialized care. In 2024, Encompass Health continued to focus on these partnerships, recognizing their vital role in patient acquisition and the delivery of high-quality post-acute care.

These medical professionals, from independent practitioners to large group practices, recommend Encompass Health based on their trust in the organization's expertise and their assessment of patient needs. This trust is built through consistent positive outcomes and effective communication, ensuring patients receive the appropriate level of care following acute events.

Encompass Health's participation as an in-network provider for numerous Medicare Advantage plans and other managed care organizations is a vital channel. This allows a significant portion of their patient population, those with these specific insurance plans, to readily access Encompass Health's rehabilitation and home health services.

In 2024, Medicare Advantage enrollment continued its upward trend, with projections indicating over 32 million beneficiaries. This growing segment represents a substantial opportunity for Encompass Health to serve patients through these established managed care networks.

By aligning with these organizations, Encompass Health not only secures a consistent flow of patients but also benefits from streamlined administrative processes and potentially favorable reimbursement rates, reinforcing the channel's importance in their business model.

Online Presence and Digital Marketing

Encompass Health leverages its online presence as a crucial channel for communication and patient connection. Their corporate website acts as a central hub for information, offering details on services, locations, and career opportunities. Digital marketing efforts, including social media engagement, are employed to reach a wider audience and foster community interaction.

The company utilizes its digital platforms to share valuable health resources and patient success stories, aiming to build trust and provide support. This digital outreach not only informs potential patients but also engages existing ones, reinforcing the brand's commitment to care. For instance, in 2023, Encompass Health reported a significant increase in website traffic and social media engagement, reflecting the growing importance of these channels in their patient acquisition and retention strategies.

- Corporate Website: Serves as a primary information source for services, locations, and patient resources.

- Social Media Engagement: Platforms like Facebook and LinkedIn are used for community building and information dissemination.

- Digital Marketing: Targeted campaigns aim to reach new patients and promote health awareness.

- Patient Testimonials and Resources: Online content includes success stories and educational materials to support patients.

Community Liaisons and Outreach Programs

Community liaisons and robust outreach programs are vital for Encompass Health, acting as direct conduits to potential patients, their families, and the broader healthcare community. These initiatives are designed to build awareness about Encompass Health's specialized rehabilitation and home health services, ensuring that those in need can easily identify and access the care they require. In 2024, Encompass Health continued to invest in these relationships, recognizing their impact on patient acquisition and community integration.

These dedicated liaisons foster strong connections with local hospitals, physicians' offices, and community organizations. This proactive engagement helps to streamline the referral process and ensures that Encompass Health is top-of-mind when patients require post-acute care. The outreach efforts directly translate into increased inquiries and admissions, as evidenced by the consistent growth in patient volumes observed in their key markets throughout 2024.

- Community Liaisons: Dedicated personnel focused on building relationships with referral sources and patient support networks.

- Outreach Programs: Events, health fairs, and educational sessions designed to inform the public about Encompass Health's services.

- Referral Growth: These programs directly contribute to an increase in patient referrals from hospitals and physicians.

- Patient Access: Facilitating easier access to specialized care for individuals recovering from illness or injury.

Encompass Health's channels are diverse, encompassing direct referrals from acute care hospitals and strong partnerships within physician networks. Their in-network status with Medicare Advantage plans, which saw over 32 million beneficiaries in 2024, is a significant patient acquisition driver. Furthermore, digital presence and community outreach programs are actively utilized to connect with patients and referral sources.

Customer Segments

Encompass Health's core customer segment comprises individuals undergoing recovery from significant medical challenges. This includes patients dealing with the aftermath of strokes, spinal cord injuries, brain injuries, amputations, and intricate orthopedic issues. These individuals necessitate a high level of specialized and intensive rehabilitation to regain function and independence.

In 2024, the demand for post-acute care services, particularly for complex conditions, remained robust. For instance, the Centers for Disease Control and Prevention (CDC) reported that approximately 800,000 people experience a stroke each year in the United States, with many requiring extensive rehabilitation. Similarly, the National Spinal Cord Injury Statistical Center documented over 17,000 new spinal cord injuries annually, highlighting a consistent need for specialized care.

These patients, often facing prolonged recovery periods, benefit from Encompass Health's integrated approach, which combines medical expertise with therapeutic interventions. The focus is on restoring mobility, cognitive function, and overall quality of life, making this segment the primary driver for the company's specialized rehabilitation services.

The geriatric population, especially those enrolled in Medicare and Medicare Advantage, forms a substantial segment of Encompass Health's patient base. This group frequently needs specialized post-acute care services following hospital stays for conditions like strokes, hip fractures, and cardiac events. In 2024, Medicare beneficiaries accounted for a significant portion of the healthcare spending in the U.S., highlighting the importance of this demographic for providers like Encompass Health.

Patients requiring post-surgical rehabilitation, particularly those undergoing major orthopedic procedures like joint replacements, represent a significant customer segment. These individuals need structured, intensive therapy to regain strength, mobility, and independence. In 2024, the demand for these services remained robust, with millions of Americans undergoing elective orthopedic surgeries annually, many of whom require extensive post-operative care.

Families and Caregivers of Patients

Families and caregivers are vital to a patient's recovery journey, even if they aren't the direct recipients of care. Encompass Health recognizes their significant role in decision-making and their unwavering commitment to securing the best outcomes for their loved ones. In 2024, approximately 53 million adults in the U.S. provided unpaid care to an adult or child, highlighting the pervasive need for support for this demographic.

Encompass Health focuses on empowering these crucial stakeholders through accessible information and dedicated support. This includes providing resources that demystify complex medical processes and offer practical advice for managing care at home. The company understands that informed families and caregivers contribute to better patient adherence and overall satisfaction.

- Support and Education: Providing resources and information to help families and caregivers understand patient conditions and care plans.

- Decision Influence: Acknowledging that families and caregivers are key influencers in healthcare choices.

- Caregiver Burden: Recognizing the significant time and emotional investment made by unpaid caregivers.

- Patient Advocacy: Empowering families to advocate effectively for their loved ones' needs within the healthcare system.

Referring Healthcare Providers (Hospitals, Physicians)

Referring healthcare providers, such as acute care hospitals and physicians, represent a critical customer segment for Encompass Health, even though they are not the direct recipients of its rehabilitation services. Their role as the primary source of patient referrals makes their trust and satisfaction paramount to the company's ongoing success and patient volume. In 2024, Encompass Health continued to strengthen relationships with these providers, recognizing that a steady stream of high-quality referrals is fundamental to its business continuity and growth.

The company actively engages with these referring entities to ensure they understand the value proposition of Encompass Health's post-acute care solutions. This engagement is crucial because the quality of care provided by Encompass Health directly reflects on the referring physician or hospital. Maintaining strong partnerships means that these providers feel confident in directing their patients to Encompass Health facilities, knowing they will receive excellent care that contributes positively to patient outcomes and their own reputation.

- Key Referral Sources: Acute care hospitals and physicians are the gatekeepers for patient admissions into Encompass Health's rehabilitation facilities.

- Trust and Satisfaction: The confidence these providers have in Encompass Health's quality of care directly influences their referral patterns.

- Business Continuity: A consistent flow of referrals from these established healthcare partners ensures operational stability and revenue generation.

- Partnership Development: Encompass Health prioritizes building and maintaining strong, collaborative relationships with its referring provider network.

Encompass Health's primary customer base consists of patients needing intensive rehabilitation following serious medical events. This includes individuals recovering from strokes, brain injuries, amputations, and complex orthopedic conditions, all requiring specialized care to regain independence.

The company also serves a significant portion of the geriatric population, particularly those covered by Medicare and Medicare Advantage, who frequently require post-acute care after hospitalizations for conditions such as hip fractures or cardiac issues.

Patients needing post-surgical rehabilitation, especially after major orthopedic procedures like joint replacements, form another key segment, benefiting from Encompass Health's structured therapy programs.

Families and caregivers are crucial indirect customers, influencing decisions and requiring support and education throughout the patient's recovery journey.

Referring healthcare providers, including acute care hospitals and physicians, are vital partners, as their trust and satisfaction directly drive patient referrals and Encompass Health's operational success.

Cost Structure

Salaries, wages, and benefits for healthcare professionals are the most significant cost for Encompass Health. This includes the compensation for nurses, therapists, and physicians who are vital to patient care.

Effectively managing these labor expenses while ensuring the company can attract and keep skilled staff is an ongoing priority. In 2024, these personnel costs represented 54.2% of Encompass Health's total revenue.

Facility operations and maintenance are major expenses for Encompass Health, encompassing utilities, rent, property taxes, and ongoing upkeep for its extensive hospital network. In 2023, Encompass Health reported total operating expenses of $4.2 billion, with a substantial portion dedicated to these facility-related costs.

Encompass Health's cost structure is significantly impacted by the procurement and upkeep of medical supplies and equipment. This includes everything from everyday consumables like bandages and syringes to specialized pharmaceuticals and advanced rehabilitation machinery, such as specialized therapy equipment and in-house dialysis units.

In 2024, the healthcare industry, including rehabilitation services, continued to face rising costs for medical supplies and pharmaceuticals. For instance, the average cost of pharmaceuticals per patient day in inpatient rehabilitation facilities can fluctuate, but industry reports from late 2023 and early 2024 indicated a general upward trend in drug pricing, impacting operational budgets.

Furthermore, the investment in and maintenance of sophisticated rehabilitation equipment represents a substantial capital expenditure. This technology is crucial for delivering effective patient care and maintaining a competitive edge, but it also necessitates ongoing costs for calibration, repair, and eventual replacement, directly contributing to Encompass Health's overall expense base.

Administrative and Corporate Overhead

Encompass Health's administrative and corporate overhead encompasses the essential functions that keep its national network of healthcare facilities running smoothly. These costs cover everything from the executives guiding the company's strategy to the IT systems managing patient data and the teams handling billing and collections. In 2023, Encompass Health reported selling, general, and administrative (SG&A) expenses of $1.6 billion, which includes these vital administrative functions.

These overhead expenses are crucial for maintaining compliance, supporting clinical operations, and ensuring efficient financial management across the organization. They include significant investments in:

- Corporate Management: Salaries and benefits for executive leadership and corporate staff.

- IT Infrastructure: Costs associated with maintaining and upgrading technology systems, including electronic health records and data security.

- Billing and Collections: Expenses related to processing patient claims, managing insurance reimbursements, and optimizing revenue cycle management.

- Legal and Compliance: Costs for legal counsel, regulatory adherence, and risk management.

New Hospital Development and Expansion Capital Expenditures

Encompass Health's cost structure heavily features significant capital outlays for developing new hospitals and expanding existing facilities. This investment is crucial for increasing patient capacity and extending their market presence. In 2024 alone, the company allocated over $450 million towards these vital capacity expansions.

These capital expenditures are fundamental to Encompass Health's growth strategy, enabling them to serve more patients and enter new geographic markets. The ongoing investment reflects a commitment to maintaining and growing their network of inpatient rehabilitation and home health facilities.

- New Hospital Construction: Costs associated with land acquisition, design, and building new healthcare facilities.

- Expansion and Renovation: Expenses for increasing the size or modernizing existing hospital infrastructure.

- Equipment Purchases: Investment in medical technology and operational equipment for new and expanded sites.

- Related Infrastructure: Costs for utilities, parking, and other necessary support systems for facilities.

Encompass Health's cost structure is dominated by personnel expenses, which accounted for 54.2% of revenue in 2024, reflecting the critical role of skilled healthcare professionals. Facility operations and maintenance, encompassing utilities and upkeep, also represent a significant expenditure, with total operating expenses reaching $4.2 billion in 2023.

The company also incurs substantial costs for medical supplies and equipment, with pharmaceutical prices showing an upward trend in early 2024, impacting operational budgets. Furthermore, administrative and corporate overhead, including IT and billing, totaled $1.6 billion in SG&A expenses for 2023, supporting the national network.

Capital expenditures for facility development and expansion are a key component, with over $450 million allocated in 2024 to increase patient capacity and market reach.

| Cost Category | 2023 Data | 2024 Data |

|---|---|---|

| Personnel Expenses (as % of Revenue) | N/A | 54.2% |

| Total Operating Expenses | $4.2 Billion | N/A |

| SG&A Expenses | $1.6 Billion | N/A |

| Capital Expenditures | N/A | > $450 Million |

Revenue Streams

Encompass Health's inpatient rehabilitation services are its core revenue generator. This revenue stems directly from the comprehensive care patients receive within their specialized hospitals, encompassing a range of therapies, skilled nursing, and essential medical oversight.

The financial performance of this segment is robust, as evidenced by a significant increase in Q1 2025. Inpatient revenue climbed by 10.5%, reaching an impressive $1.42 billion during that quarter, underscoring the demand for and value of these critical healthcare services.

Medicare reimbursement forms a significant revenue stream for Encompass Health, encompassing both traditional Fee-for-Service and Medicare Advantage plans. This vital segment saw robust growth, with Medicare discharges climbing 8.8% in Q3 2024, and Medicare Advantage discharges experiencing an even more impressive 12.6% increase during the same period.

Encompass Health also earns revenue through commercial and managed care reimbursement. This means they receive payments from private insurance companies and organizations that manage healthcare plans for groups of people. They actively work to negotiate favorable rates and prove the value of their services to these payers.

The company saw a notable increase in this area, with managed care discharges growing by 8.9% in the fourth quarter of 2024, highlighting the importance of these partnerships for their financial performance.

Other Patient Revenue (e.g., Co-pays, Deductibles)

This revenue stream captures direct patient financial contributions, encompassing co-payments, deductibles, and other out-of-pocket costs that insurance plans do not fully cover. These payments are crucial for managing the overall revenue cycle and reflect the patient's responsibility in their healthcare expenses.

For Encompass Health, these patient payments, while often smaller individually, collectively represent a significant portion of their revenue. In 2023, Encompass Health reported that patient accounts receivable, which includes these direct payments, was approximately $1.2 billion. This highlights the consistent flow of funds directly from the patient base.

- Co-payments: Fixed amounts patients pay for covered healthcare services after they've met their deductible.

- Deductibles: The amount patients must pay out-of-pocket for covered healthcare services before their insurance plan starts to pay.

- Out-of-Pocket Maximums: The most a patient will have to pay for covered services in a plan year, after which their insurance plan pays 100% of the allowed amount.

- Non-covered Services: Payments for services not included in the patient's insurance plan, which are entirely the patient's responsibility.

Joint Venture Income

Encompass Health generates revenue through joint venture income, recognizing its significance in its operational model. Many of its hospitals function as partnerships, meaning a portion of the company's earnings originates from these collaborative ventures.

For instance, in the second quarter of 2024, Encompass Health anticipated an increase in income attributable to non-controlling interests as a result of integrating an existing Georgia hospital into a joint venture with Piedmont. This highlights how strategic partnerships directly contribute to the company's financial performance.

- Joint Venture Income: Revenue derived from partnerships where Encompass Health shares ownership and operational responsibilities of its facilities.

- Strategic Partnerships: The company actively engages in joint ventures to expand its reach and operational capacity.

- Q2 2024 Impact: The Georgia hospital addition to the Piedmont joint venture was projected to boost income attributable to non-controlling interests.

Encompass Health's revenue streams are diverse, primarily driven by its inpatient rehabilitation services, which saw a 10.5% increase in Q1 2025, reaching $1.42 billion. Medicare reimbursement, including traditional Fee-for-Service and Medicare Advantage, is a substantial contributor, with Medicare discharges up 8.8% and Medicare Advantage discharges up 12.6% in Q3 2024. Commercial and managed care reimbursements also play a vital role, with managed care discharges growing 8.9% in Q4 2024. Additionally, direct patient payments like co-payments and deductibles contribute, with patient accounts receivable around $1.2 billion in 2023, and joint venture income from strategic partnerships further bolsters earnings, as seen with the Piedmont joint venture in Q2 2024.

| Revenue Stream | Description | Key Data Point |

|---|---|---|

| Inpatient Rehabilitation Services | Core revenue from specialized patient care. | 10.5% revenue increase in Q1 2025; $1.42 billion revenue in Q1 2025. |

| Medicare Reimbursement | Payments from Medicare Fee-for-Service and Medicare Advantage. | 8.8% increase in Medicare discharges (Q3 2024); 12.6% increase in Medicare Advantage discharges (Q3 2024). |

| Commercial & Managed Care Reimbursement | Payments from private insurance and managed care organizations. | 8.9% increase in managed care discharges (Q4 2024). |

| Direct Patient Payments | Co-payments, deductibles, and out-of-pocket expenses. | Approx. $1.2 billion in patient accounts receivable (2023). |

| Joint Venture Income | Earnings from strategic partnerships and shared ownership of facilities. | Projected income increase from Piedmont joint venture (Q2 2024). |

Business Model Canvas Data Sources

The Encompass Health Business Model Canvas is informed by a blend of internal financial statements, operational data from their extensive network of facilities, and external market research on healthcare trends and competitor strategies.