Encompass Health Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Encompass Health Bundle

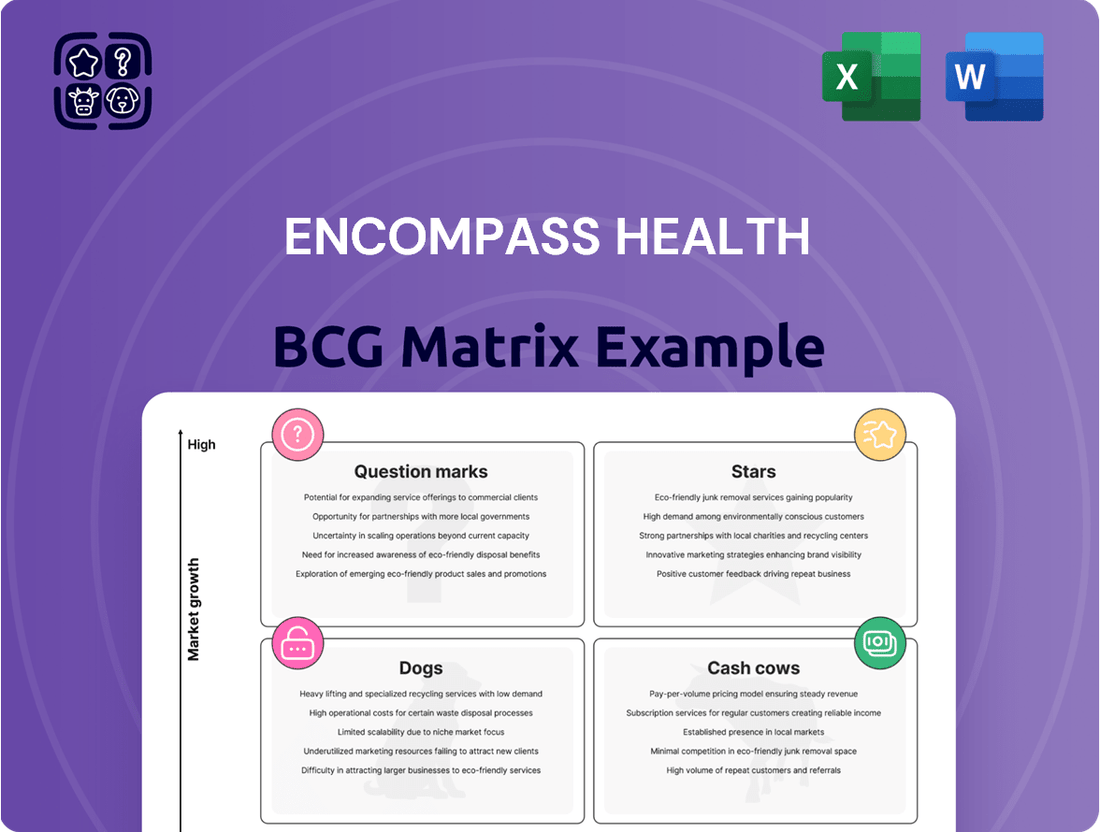

Unlock the strategic potential of Encompass Health's product portfolio with a clear understanding of its BCG Matrix. See which segments are driving growth and which require careful consideration.

This glimpse into Encompass Health's BCG Matrix is just the beginning. Purchase the full report to gain a comprehensive breakdown of Stars, Cash Cows, Dogs, and Question Marks, complete with actionable insights for optimizing your investments and product development strategies.

Stars

Encompass Health's aggressive de novo hospital expansion strategy is clearly demonstrated by its proactive approach to opening new inpatient rehabilitation facilities. For instance, the company is planning a 50-bed hospital in North Las Vegas, with an expected opening by 2028. This move into a high-growth market signifies a strategic push to secure new market share and broaden its established presence in specialized rehabilitation services.

Encompass Health's core rehabilitation services are firmly established as Stars in the BCG Matrix, evidenced by their impressive and consistent discharge growth. Total discharges saw a healthy 6.3% increase in the first quarter of 2025, building on a strong 7.8% rise in the fourth quarter of 2024. This upward trend in patient volume, including robust same-store growth, clearly indicates a surging demand for their specialized care and their operational capacity to meet it.

Encompass Health demonstrated robust revenue growth, with a 10.6% increase in Q1 2025 and a 12.7% rise in net operating revenue for Q4 2024. This strong financial performance, coupled with significant increases in adjusted EBITDA of 14.9% and 13.6% respectively, highlights a healthy demand for their inpatient rehabilitation services.

Capacity Expansion within Existing Hospitals

Encompass Health is not just building new hospitals; they're also strategically expanding their existing facilities. This approach is crucial for meeting the rising demand for their services without the full overhead of entirely new construction.

The company has outlined ambitious plans to increase bed capacity within its current hospital network. For 2025, the target is to add between 100 and 120 beds. Looking ahead, they anticipate adding approximately 120 beds in both 2026 and 2027.

- 2025 Expansion: 100-120 new beds planned.

- 2026 Expansion: Approximately 120 new beds.

- 2027 Expansion: Approximately 120 new beds.

- Strategic Rationale: Leverages existing infrastructure and high market share to meet growing patient needs efficiently.

Advanced Therapy Technologies and Clinical Innovation

Encompass Health is actively investing in advanced rehabilitation technologies and evidence-based clinical practices to significantly improve patient outcomes. This commitment to innovation, evident in their 2023 Investor Day discussions and a projected increase in research grants for 2025, solidifies their position as an industry leader. By embracing cutting-edge treatments, Encompass Health not only strengthens its market standing but also attracts patients seeking superior care.

Their strategic focus on therapy technology is a key driver for growth and market differentiation.

- Investment in Advanced Rehabilitation Technologies: Encompass Health allocates significant resources to acquire and implement state-of-the-art equipment and digital platforms for therapy.

- Evidence-Based Clinical Practices: The company prioritizes the integration of research-backed treatment protocols to ensure the highest quality of patient care and measurable results.

- Focus on Innovation: Discussions at their 2023 Investor Day highlighted a strong emphasis on developing and adopting new therapeutic approaches.

- Increased Research Grants (Projected 2025): Anticipated growth in research funding signals a continued commitment to advancing rehabilitation science and patient care.

Encompass Health's rehabilitation services are firmly positioned as Stars within the BCG Matrix, demonstrating high market share and strong growth potential. This is supported by consistent increases in patient discharges, with a 6.3% rise in Q1 2025 and a 7.8% increase in Q4 2024, indicating robust demand and effective service delivery.

Financially, these services are performing exceptionally well. Encompass Health reported a 10.6% revenue increase in Q1 2025 and a 12.7% rise in net operating revenue for Q4 2024, accompanied by substantial EBITDA growth of 14.9% and 13.6% respectively.

| Metric | Q4 2024 | Q1 2025 | 2025 Projection (Bed Additions) |

|---|---|---|---|

| Discharge Growth | 7.8% | 6.3% | N/A |

| Net Operating Revenue Growth | 12.7% | 10.6% | N/A |

| Adjusted EBITDA Growth | 13.6% | 14.9% | N/A |

| New Beds Planned | N/A | 100-120 | 100-120 |

What is included in the product

Encompass Health's BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

Encompass Health's BCG Matrix provides a clear, one-page overview of business unit performance, alleviating the pain of complex strategic analysis.

Cash Cows

Encompass Health's extensive inpatient rehabilitation network, the largest in the nation with 168 facilities across 38 states and Puerto Rico, functions as a significant cash cow. This vast presence ensures a consistent and substantial revenue stream from a mature and essential healthcare service.

Serving approximately one in three U.S. patients requiring inpatient rehabilitative care, Encompass Health leverages its dominant market share to generate robust and predictable cash flow. This established position in a vital segment of the healthcare industry solidifies its cash cow status.

Encompass Health's established operations are true cash cows, consistently delivering strong profit margins and substantial free cash flow. The company saw its adjusted free cash flow more than double in Q4 2024, reaching $190.5 million.

Further demonstrating this strength, free cash flow increased by $54.8 million between Q1 2024 and Q1 2025. This reliable cash generation fuels growth, covers operational expenses, and benefits shareholders, highlighting the efficiency and profitability of these mature business segments.

Encompass Health’s focus on high patient discharge to community rates positions its rehabilitation services as a strong cash cow. In Q1 2025, the company reported an impressive 84% discharge-to-community rate, significantly outperforming the industry average.

This high success rate in patient rehabilitation translates directly into efficient patient throughput, meaning beds are freed up more quickly for new admissions. This operational efficiency supports a consistent and dependable revenue stream from their established rehabilitation facilities.

The robust clinical outcomes not only ensure continued patient referrals from hospitals and physicians but also solidify Encompass Health's reputation for quality care, further reinforcing the stability of these operations.

Strong Payer Relationships and Reimbursement Stability

Encompass Health's established market leadership in inpatient rehabilitation has fostered deep-seated relationships with key payers, notably Medicare. This long-standing presence ensures a stable and predictable revenue stream, crucial for consistent operational planning and strategic investments. In 2023, Medicare represented a substantial portion of Encompass Health's net patient service revenue, underscoring its role as a foundational cash generator.

- Medicare Reimbursement: A primary driver of stable cash flow due to Encompass Health's market position.

- Payer Relationships: Long-standing ties with major insurers enhance reimbursement predictability.

- Mature Market Segment: The inpatient rehabilitation sector offers reliable, consistent revenue generation.

- Operational Stability: Predictable cash flows facilitate consistent operational planning and investment decisions.

Operational Efficiency and Cost Management

Encompass Health actively pursues operational efficiencies within its established hospital network. A key strategy involves meticulous management of labor expenses, a significant component of healthcare operating costs. By optimizing staffing levels and improving scheduling, the company aims to control expenditures without compromising patient care quality.

Furthermore, Encompass Health is expanding its in-house service offerings, such as hemodialysis. This vertical integration allows the company to reduce reliance on third-party providers, thereby cutting down on external costs and capturing additional revenue streams. These initiatives are crucial for maintaining robust profit margins and generating substantial cash flow from its mature business segments.

- Focus on Labor Cost Management: Encompass Health prioritizes controlling labor expenses, a critical factor in hospital profitability.

- In-house Service Expansion: The company is increasing its provision of services like hemodialysis internally to lower external spending.

- Margin Maintenance: These efficiency drives are designed to preserve high profit margins on existing assets.

- Cash Flow Generation: The ultimate goal is to maximize cash flow from mature hospital operations.

Encompass Health’s inpatient rehabilitation services are its quintessential cash cows, benefiting from a mature, stable market and the company's dominant position. The sheer scale of its network, comprising 168 facilities across 38 states, ensures consistent patient volume and revenue. This established infrastructure, coupled with strong payer relationships, particularly with Medicare, provides a predictable and substantial cash flow.

In 2023, Encompass Health reported total revenue of $4.5 billion, with its inpatient rehabilitation segment being a significant contributor. The company's adjusted free cash flow more than doubled in Q4 2024, reaching $190.5 million, showcasing the strong cash-generating capabilities of these mature operations.

The high discharge-to-community rate of 84% in Q1 2025 further enhances efficiency, leading to quicker bed turnover and sustained revenue generation. Strategic cost management, including labor expense optimization and in-house service expansion like hemodialysis, bolsters profit margins and reinforces the cash cow status of these facilities.

These factors collectively position Encompass Health's rehabilitation business as a reliable source of substantial and consistent cash, enabling strategic investments and shareholder returns.

| Metric | 2023 (Actual) | Q1 2024 | Q1 2025 | Q4 2024 (Adjusted) |

|---|---|---|---|---|

| Total Revenue | $4.5 Billion | $1.1 Billion | $1.15 Billion | N/A |

| Adjusted Free Cash Flow | N/A | N/A | N/A | $190.5 Million |

| Discharge to Community Rate | N/A | ~83% | 84% | N/A |

Delivered as Shown

Encompass Health BCG Matrix

The Encompass Health BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means you'll get the complete strategic analysis without any watermarks or demo content, ready for your immediate use. You can trust that the insights and structure presented here are precisely what you'll be working with to inform your business decisions. This ensures a seamless transition from preview to actionable strategy, empowering you with the tools you need.

Dogs

Encompass Health's recent financial disclosures, particularly for 2024, do not pinpoint any specific underperforming segments or hospitals. The company consistently emphasizes the robust growth and positive contributions from its core inpatient rehabilitation services. This suggests a strategic focus on areas demonstrating strong market presence and consistent revenue generation.

Encompass Health's July 2022 spin-off of Enhabit Home Health & Hospice, though outside the immediate 2024-2025 window, highlights a strategic divestiture of non-core assets. This move aimed to streamline operations and sharpen focus on their core rehabilitation services, which are generally considered to be in a stronger market position.

This divestiture positions Encompass Health to concentrate resources on its rehabilitation hospitals, often viewed as cash cows or potential stars within a BCG framework, given their established market presence and consistent revenue generation. By separating Enhabit, Encompass Health can better allocate capital and management attention to areas with higher growth potential or stronger competitive advantages.

Encompass Health's strategy of continuous investment in its existing rehabilitation hospital network, rather than divesting, positions these facilities as Stars within the BCG Matrix. This approach focuses on enhancing productivity and efficiency through bed additions and infrastructure upgrades. For instance, in 2023, the company reported opening approximately 300 net new beds, a testament to this ongoing expansion and improvement strategy.

Dominant Market Position Mitigates 'Dog' Risk

Encompass Health's dominant position as the largest owner and operator of inpatient rehabilitation facilities significantly buffers against the risk of having widespread 'Dog' business units. This substantial market share, particularly in their core rehabilitation services, acts as a strong protective moat.

Their established brand recognition, deep clinical expertise, and robust referral networks create significant competitive advantages. These factors are crucial in preventing individual service lines from declining into the 'Dog' category, which represents low growth and low market share.

For instance, as of the first quarter of 2024, Encompass Health operated 161 inpatient rehabilitation hospitals across 37 states. This extensive footprint and market leadership provide a strong foundation that makes it less probable for many of their operations to become underperforming 'Dogs'.

- Market Leadership: Encompass Health is the largest provider of inpatient rehabilitation services in the U.S.

- Competitive Advantages: Strong brand, clinical expertise, and established referral networks.

- Reduced 'Dog' Risk: High market share in core services mitigates the likelihood of pervasive underperforming units.

- Operational Scale: 161 inpatient rehabilitation hospitals as of Q1 2024, demonstrating significant market penetration.

Focus on High-Acuity, Specialized Care

Encompass Health's strategic focus on high-acuity, specialized inpatient rehabilitation, particularly for conditions such as strokes and brain injuries, positions it favorably within the BCG Matrix. This specialization caters to a niche market with significant demand and a clear need for expert care.

This specialization inherently provides a buffer against the 'Dog' category. Unlike more generalized healthcare services, the complexity and specific skill sets required for rehabilitating patients with severe neurological impairments create a barrier to entry and competition. For instance, in 2024, inpatient rehabilitation facilities (IRFs) continued to see strong patient volumes, with Medicare Part B payments for IRFs remaining a significant revenue driver.

- High Demand for Specialized Care: Conditions like stroke and traumatic brain injury often require extended, intensive rehabilitation, driving consistent patient flow.

- Barriers to Entry: The need for highly trained medical professionals and specialized equipment makes it difficult for new entrants to compete in this segment.

- Resilience Against Commoditization: The intricate nature of these rehabilitation services prevents them from becoming easily interchangeable or price-driven commodities.

- Competitive Advantage: Encompass Health's established expertise and reputation in these complex areas solidify its market position.

Given Encompass Health's market leadership and strategic focus on specialized inpatient rehabilitation, the likelihood of widespread 'Dog' segments is significantly diminished. Their extensive network of 161 hospitals as of Q1 2024, coupled with strong brand recognition and deep clinical expertise, creates substantial competitive advantages. This robust market position and specialization in high-acuity care, such as stroke and brain injury rehabilitation, naturally buffers their operations against becoming low-growth, low-market-share 'Dogs'.

| BCG Category | Encompass Health's Position | Rationale |

|---|---|---|

| Dogs | Low Likelihood of Widespread 'Dogs' | Encompass Health's market dominance and specialized focus in inpatient rehabilitation minimize the probability of having significant underperforming units. |

| Market Share | Largest owner and operator of inpatient rehabilitation facilities in the U.S. (161 hospitals as of Q1 2024). | |

| Competitive Strengths | Established brand, clinical expertise, robust referral networks, and specialization in high-acuity conditions. |

Question Marks

Encompass Health's strategy of establishing new de novo hospitals in untapped markets like Wesley Chapel, Florida (2027), The Villages, Florida (Q3 2025), Danbury, Connecticut (Q3 2025), and North Las Vegas, Nevada (2028) positions these as potential 'Stars' in a BCG Matrix analysis. These ventures are characterized by high growth potential in areas where Encompass Health currently holds minimal or no market presence, necessitating substantial initial investment to build brand recognition and operational capacity.

Emerging specialized programs and the early adoption of advanced rehabilitation technologies, such as AI-powered diagnostic tools or robotic therapy systems, position Encompass Health's newer offerings as potential stars. These initiatives tap into a growing demand for cutting-edge care, even if currently concentrated in a few facilities.

For example, the global market for rehabilitation robotics was projected to reach $2.5 billion by 2024, indicating strong growth potential. Encompass Health's investment in these areas, while not yet dominant, reflects a strategic move into a high-growth segment that requires continued development and broader market penetration to solidify its position.

Encompass Health's strategy of forming joint ventures with acute care hospitals is a key move into potentially high-growth, new service areas. These ventures often begin with a low market share but a strong potential for expansion, fitting the profile of Question Marks in the BCG Matrix. For example, a new joint venture in a region where Encompass Health's brand is not yet established would require significant investment and strategic focus to build market share.

Increased Research and Development Grants

Encompass Health's strategic decision to boost its research and development grants for post-acute care innovation, reaching $60,000 by 2025, positions it to explore nascent market segments. These investments are geared towards fostering novel therapies and enhancing patient outcomes, signifying a commitment to high-risk, high-reward ventures.

This increased funding aligns with a BCG matrix approach by classifying these R&D initiatives as potential 'Question Marks'. The company is essentially investing in the future, acknowledging that while the immediate returns are uncertain, the long-term potential for market leadership in innovative healthcare solutions is substantial.

- Increased R&D Grants: Encompass Health is raising its research grant program to $60,000 by 2025.

- Focus on Innovation: The grants are specifically targeted at driving innovation within post-acute care.

- Future Growth Investment: This represents an investment in areas with uncertain but potentially high future returns.

- New Therapies & Outcomes: The initiatives aim to develop new treatments and improve patient results.

Expansion into New Payer Mixes or Patient Populations

Expansion into new payer mixes or patient populations for Encompass Health, beyond its core Medicare base, would likely be classified as a Question Mark in the BCG Matrix. This strategic direction presents a high-growth opportunity but also carries significant risk due to the need for substantial investment in marketing and operational adaptations to penetrate these new markets effectively.

While Encompass Health’s established strength lies in serving Medicare patients, which represents a stable, albeit perhaps slower-growing, market segment, venturing into areas with low current penetration, such as commercial insurance or specific underserved patient demographics, signals a Question Mark. For instance, if Encompass Health were to target a significant expansion into pediatric rehabilitation services, a market where their current presence is minimal, this would be a classic Question Mark scenario. Such a move necessitates developing specialized programs, building new referral networks, and potentially adapting facility infrastructure, all requiring considerable upfront capital and strategic planning.

- High Growth Potential: New payer mixes or patient populations could unlock substantial revenue streams and market share if Encompass Health successfully gains traction.

- Significant Investment Required: Entering these markets demands considerable financial resources for marketing, operational adjustments, and potentially new service line development.

- Strategic Risk: The success of penetrating new segments is uncertain, requiring careful market analysis and execution to overcome existing competition and established referral patterns.

- Operational Adaptation: Encompass Health would need to adapt its service delivery models, staffing, and potentially its technology infrastructure to meet the unique needs of different patient groups or insurance providers.

Encompass Health's investment in new de novo hospitals and specialized programs represent ventures into high-growth, uncertain markets, fitting the 'Question Mark' category in the BCG matrix. These initiatives, while requiring significant capital and strategic focus, aim to capture future market share and establish leadership in emerging healthcare trends.

The company's expansion into new payer mixes and patient populations, such as targeting commercial insurance or pediatric rehabilitation, also falls under Question Marks. These strategic moves demand substantial investment in marketing and operational adaptations, carrying inherent risks but offering the potential for significant future returns.

Encompass Health's commitment to increasing R&D grants to $60,000 by 2025 for post-acute care innovation further solidifies its pursuit of Question Mark opportunities. This funding fuels the exploration of novel therapies and technologies, positioning the company for potential long-term market leadership in innovative healthcare solutions.

BCG Matrix Data Sources

Our Encompass Health BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable insights.