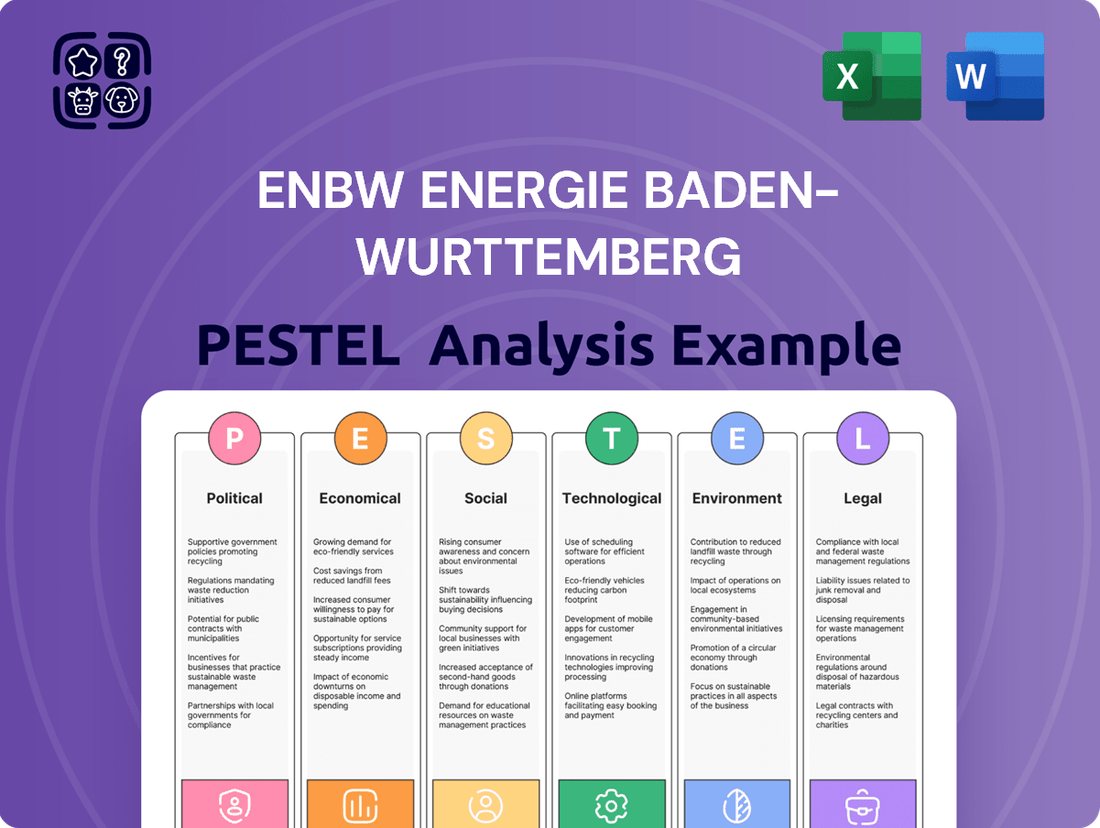

EnBW Energie Baden-Wurttemberg PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EnBW Energie Baden-Wurttemberg Bundle

Navigate the complex external forces shaping EnBW Energie Baden-Württemberg's future with our comprehensive PESTLE analysis. Uncover critical political, economic, social, technological, legal, and environmental factors that could impact your investments or strategic planning. Gain a competitive edge by understanding these dynamics.

Ready to make informed decisions about EnBW Energie Baden-Württemberg? Our PESTLE analysis provides the actionable intelligence you need, from regulatory shifts to emerging technologies. Don't get left behind; download the full, expertly crafted report now and empower your strategy.

Political factors

Germany's commitment to a carbon-neutral electricity sector by 2040 significantly shapes EnBW's strategic path. This ambitious target, coupled with the government's power plant strategy, directly influences EnBW's investment decisions and operational focus.

EnBW's own goal of achieving climate neutrality by 2035 for its direct emissions is a clear response to these overarching political directives. This alignment underscores the critical role government policy plays in driving the company's transformation towards sustainability.

The political environment necessitates substantial capital allocation towards renewable energy sources and the modernization of grid infrastructure. For instance, Germany's renewable energy expansion targets for 2030 aim for at least 80% of electricity consumption from renewables, a figure EnBW is actively working to meet and exceed.

Germany's Energy Industry Act (EnWG) is a cornerstone of EnBW's operational landscape, dictating much of its investment and development strategy. This regulatory framework directly influences how quickly EnBW can expand its renewable energy capacity and upgrade its grid infrastructure, crucial for the energy transition.

The pace of new grid projects is often hindered by lengthy permitting processes, a significant bottleneck for EnBW's ambitious transformation plans. For instance, the expansion of high-voltage direct current (HVDC) lines, vital for transporting renewable energy, can face multi-year delays in obtaining approvals, impacting the overall timeline for grid modernization.

EnBW consistently advocates for a predictable and supportive energy policy. The company stresses that clear investment conditions and a stable regulatory environment are essential to underwrite the massive capital expenditures required for its large-scale projects, such as offshore wind farms and hydrogen infrastructure.

European Union energy policies, like the Renewable Energy Directive (RED III), significantly shape EnBW's strategic direction, particularly its investment in renewables. For instance, RED III aims for at least 42.5% renewable energy by 2030, pushing companies like EnBW to accelerate their green energy projects.

The EU Prospectus Regulation also impacts EnBW by setting stringent requirements for financial transparency, especially when issuing new securities to fund its ambitious energy transition. This means EnBW must ensure its sustainability reporting is robust and compliant, a critical factor for investor confidence in 2024 and beyond.

These overarching EU frameworks act as both a catalyst and a set of rules for EnBW's decarbonization journey. They define the playing field for its expansion in offshore wind and other sustainable energy sources, influencing capital allocation and operational standards.

Subsidies and Investment Incentives

Government subsidies and investment incentives play a crucial role in shaping EnBW's strategic decisions and project feasibility. These policies directly influence the financial attractiveness of renewable energy projects and investments in new technologies.

While EnBW's He Dreiht offshore wind farm is proceeding without direct state subsidies, demonstrating market competitiveness, other government initiatives are vital. For instance, Germany's commitment of €3 billion towards building a national hydrogen core network is a key enabler for EnBW's expansion into the hydrogen economy. This type of infrastructure support de-risks investments and encourages companies like EnBW to commit capital to future-oriented energy solutions.

- Government funding for hydrogen infrastructure: Germany's €3 billion allocation for the hydrogen core network directly supports EnBW's strategic investments in this sector.

- Shifting subsidy landscape: While some projects like He Dreiht offshore wind are subsidy-free, the overall policy environment for critical infrastructure remains a significant factor.

- Impact on investment decisions: The availability and structure of state support directly influence the economic viability and pace of EnBW's project development, particularly in nascent energy markets.

Affordability and Security of Supply

Recent political discussions are increasingly emphasizing the affordability and reliability of energy alongside climate targets. This dual focus is shaping energy policy, aiming to balance environmental goals with the need for accessible and secure power for consumers and businesses.

EnBW's leadership, including its CEO, has stressed the importance of policy adjustments to maintain cost-effectiveness during the energy transition and ensure a consistent energy supply. This perspective directly impacts EnBW's strategic planning and investment decisions.

This political landscape influences EnBW's strategic choices, such as investing in hydrogen-ready gas power plants. These facilities are designed to provide crucial grid stability as renewable energy sources become more prevalent, addressing concerns about intermittency.

- Policy Prioritization: Governments are balancing climate goals with energy affordability and supply security.

- CEO's Stance: EnBW's CEO advocates for policy changes to ensure a cost-effective and stable energy transition.

- Strategic Response: EnBW is developing hydrogen-ready gas power plants to bolster grid stability.

Germany's ambitious climate targets, such as achieving carbon neutrality by 2040, directly mandate EnBW's strategic pivot towards renewables and grid modernization. The German government's energy policy, including the renewable energy expansion targets for 2030 aiming for at least 80% renewable electricity, significantly influences EnBW's investment decisions and operational focus, driving substantial capital allocation towards green energy sources and infrastructure upgrades.

European Union directives, like the Renewable Energy Directive (RED III) setting a 2030 target of at least 42.5% renewable energy, further shape EnBW's expansion strategies in sustainable energy. The EU Prospectus Regulation also imposes stringent financial transparency requirements, impacting how EnBW funds its transition and maintains investor confidence.

Government support, such as Germany's €3 billion commitment to a national hydrogen core network, is crucial for EnBW's strategic investments in the hydrogen economy, de-risking future-oriented energy solutions. While some projects like He Dreiht offshore wind are subsidy-free, the broader policy environment for critical infrastructure remains a key determinant for project viability and the pace of EnBW's development.

Political discussions increasingly emphasize balancing climate goals with energy affordability and supply security, prompting EnBW to develop hydrogen-ready gas power plants for grid stability. EnBW's CEO has highlighted the need for policy adjustments to ensure a cost-effective and stable energy transition, underscoring the critical link between political direction and EnBW's strategic planning.

| Political Factor | Impact on EnBW | Relevant Data/Target | Year |

| German Carbon Neutrality Target | Drives investment in renewables and grid modernization | Carbon neutral electricity by 2040 | 2040 |

| German Renewable Energy Expansion Target | Influences capital allocation and operational focus | At least 80% renewable electricity | 2030 |

| EU Renewable Energy Directive (RED III) | Shapes expansion in sustainable energy | At least 42.5% renewable energy | 2030 |

| German Hydrogen Infrastructure Funding | Supports strategic investments in hydrogen economy | €3 billion for hydrogen core network | 2024 |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting EnBW Energie Baden-Württemberg, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making by highlighting potential threats and opportunities derived from current market and regulatory dynamics.

A concise PESTLE analysis for EnBW simplifies complex external factors, acting as a pain point reliver by offering clear insights for strategic decision-making and risk mitigation.

This analysis, presented in an easily digestible format, helps alleviate the pain of navigating multifaceted market dynamics by highlighting key political, economic, social, technological, environmental, and legal influences.

Economic factors

EnBW is undertaking its most substantial investment initiative ever, earmarking over €40 billion, with potential to reach €50 billion, to reshape the energy landscape between 2024 and 2030.

These substantial capital outlays are strategically focused on scaling up renewable energy generation, upgrading and extending electricity grids, and building out a foundational hydrogen infrastructure.

EnBW demonstrated solid financial performance in 2024, reporting an adjusted EBITDA of €4.9 billion, which met its own projections. This strong financial footing is crucial for the company's ambitious green transformation strategy.

Looking ahead to 2025, EnBW anticipates continued high earnings, reinforcing its capacity to finance significant investments in renewable energy and grid infrastructure. These stable earnings are the bedrock for executing its long-term development plans.

EnBW has demonstrated a robust approach to funding its significant investment plans. A key highlight was the successful completion of a €3.1 billion rights issue in July 2025, a move that clearly signaled strong backing from its investors and reinforced market confidence in the company's strategic direction.

Looking ahead, EnBW is proactively diversifying its financing strategies to ensure sustained capital availability. The company is actively engaging in the issuance of green bonds and is exploring additional capital injection opportunities. These efforts are crucial for securing the substantial funding required to support its ambitious project pipeline through the end of the decade, up to 2030.

Energy Market Price Fluctuations

EnBW, despite its broad range of energy sources, still faces challenges from fluctuating energy market prices. For instance, after a period of unusually high earnings, EnBW saw a normalization of its financial results in 2023, highlighting this sensitivity. Effectively navigating these price swings is vital for EnBW's ongoing profitability and its capacity to fund significant, long-term investments in the energy transition.

The profitability of EnBW's different business units is directly impacted by these market dynamics. For example, while renewable energy generation often benefits from higher wholesale prices, the company's grid and sales segments can experience different pressures depending on supply and demand balances. This means that managing price volatility is not just about overall earnings, but also about maintaining a healthy financial structure across all operational areas.

- 2023 Earnings Normalization: EnBW's adjusted EBITDA for 2023 was €2.7 billion, a significant decrease from the exceptionally high €3.2 billion in 2022, illustrating the impact of normalizing energy market prices.

- Renewable Energy Contribution: Renewables accounted for a substantial portion of EnBW's generation in 2023, underscoring the importance of stable renewable energy prices for future growth.

- Investment Capacity: The company plans to invest around €10 billion in expanding its renewable energy business and grid infrastructure by 2028, making financial stability through price management critical.

Focus on Cost Efficiency

EnBW's strategic focus on cost efficiency is crucial for navigating Germany's energy transition. Studies commissioned by EnBW suggest that Germany could reach its net-zero goals more affordably by refining its energy transition strategy, potentially saving substantial sums by 2045. This highlights EnBW's commitment to optimizing its investments and operations to provide sustainable energy at a lower cost.

This internal drive for efficiency directly influences EnBW's investment decisions, aiming to balance ambitious climate targets with economic viability. The company's approach emphasizes finding the most cost-effective pathways to decarbonization, ensuring that the energy transition is not only environmentally sound but also financially sustainable for consumers and the business.

- Cost Savings Potential: EnBW's analysis points to potential savings of hundreds of billions of euros by 2045 through optimized energy transition plans.

- Investment Strategy: The company prioritizes cost-efficient investment strategies to deliver affordable sustainable energy solutions.

- Net-Zero Targets: EnBW's efficiency focus supports Germany's net-zero objectives by making the transition more economically feasible.

Economic factors significantly influence EnBW's strategic direction and financial performance. Fluctuating energy market prices, as seen in the normalization of earnings from 2022 to 2023, directly impact profitability across different business segments. EnBW's substantial investment plans, exceeding €40 billion through 2030, are heavily reliant on stable earnings and efficient cost management to fund the expansion of renewables and grid infrastructure.

The company's ability to secure financing, evidenced by a €3.1 billion rights issue in July 2025 and ongoing green bond issuances, is critical for achieving its ambitious green transformation. Furthermore, EnBW's focus on cost efficiency, aiming for potential savings of hundreds of billions of euros by 2045 through optimized energy transition strategies, underpins its commitment to delivering affordable sustainable energy.

| Metric | 2023 Value | 2024 Forecast | 2025 Outlook |

|---|---|---|---|

| Adjusted EBITDA (€ billion) | 2.7 | 4.9 | High earnings anticipated |

| Total Investment (2024-2030) (€ billion) | >40 | >40 | >40 |

| Rights Issue (July 2025) (€ billion) | N/A | N/A | 3.1 |

What You See Is What You Get

EnBW Energie Baden-Wurttemberg PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting EnBW Energie Baden-Württemberg. Understand the external forces shaping their strategic landscape.

Sociological factors

Public acceptance is a critical hurdle for large-scale energy projects like EnBW's new wind farms and transmission lines. For instance, in Germany, a significant portion of the population expressed support for renewable energy expansion in recent surveys, with a 2024 poll indicating over 70% backing for wind power development, though local opposition can still cause delays.

EnBW recognizes this by proactively engaging with local communities during the planning of solar parks, striving for a comprehensive approach that balances environmental considerations with social impacts. This community dialogue is essential for building trust, which directly impacts how smoothly projects proceed and are integrated into the local landscape.

Societal preferences are increasingly leaning towards electric mobility, a trend that directly impacts EnBW's strategic direction. This growing demand for electric vehicles (EVs) is a key driver for EnBW's investments in charging infrastructure.

EnBW is actively expanding its fast-charging network, a crucial component for supporting EV adoption. The company plans to operate over 20,000 fast-charging points by 2030, a substantial increase aimed at catering to the burgeoning EV market and facilitating sustainable transportation solutions across Germany.

EnBW is actively developing and marketing sustainable and digital energy solutions designed for various customer segments, including homes, businesses, and industries. These offerings encompass home energy management systems, photovoltaic installations, and digital services for e-mobility, reflecting a growing customer preference for environmentally friendly energy choices and enhanced energy control. For instance, by the end of 2023, EnBW reported a significant increase in its renewable energy portfolio, with installed capacity reaching new heights, directly catering to this rising demand for greener solutions.

Workforce Transformation and Employment

The energy transition is fundamentally reshaping EnBW's workforce. This means a significant shift away from fossil fuel expertise towards skills in renewable energy generation, grid modernization, and digital solutions. EnBW is actively investing in reskilling and upskilling its employees to navigate this evolving landscape.

EnBW's commitment to a just transition is evident in its focus on maintaining stable employment. By adapting employee skill sets to new technologies and business models, the company aims to ensure its workforce is well-prepared for the future. For instance, as of 2024, EnBW has been heavily involved in training programs for offshore wind technicians and digital grid specialists.

- Workforce Reskilling: EnBW is implementing extensive training programs to equip employees with skills in areas like solar PV installation, battery storage management, and smart grid technologies.

- Digitalization Focus: A key aspect of the transformation involves enhancing digital literacy and data analytics capabilities across various departments to support new operational models.

- Job Security Initiatives: The company is prioritizing internal mobility and redeployment for employees transitioning from traditional energy sectors to green energy roles, aiming to minimize redundancies.

- Investment in Future Skills: EnBW's 2025 strategic outlook includes significant investment in talent development, targeting an increase in employees with expertise in renewable energy and digital infrastructure by 15%.

Societal Drive for Climate Neutrality

The widespread societal demand for climate action is a significant force pushing companies like EnBW towards decarbonization. This public expectation directly influences EnBW's strategic decisions and its commitment to achieving climate neutrality. For instance, by 2023, EnBW had already reduced its Scope 1 and 2 emissions by 43% compared to 2018 levels, demonstrating a tangible response to this societal drive.

EnBW actively communicates its progress on sustainability and climate goals, acknowledging that public opinion and the global movement towards a sustainable future are key shapers of its corporate direction. This societal pressure not only reinforces EnBW's existing sustainability targets but also encourages the setting of more ambitious ones, aligning business practices with broader environmental aspirations.

- Public Demand: Growing consumer and investor pressure for environmentally responsible business practices.

- Policy Influence: Societal advocacy often translates into stricter climate regulations, which EnBW must adhere to and anticipate.

- Corporate Reputation: Demonstrating commitment to climate neutrality enhances EnBW's brand image and stakeholder trust.

- Innovation Driver: The push for sustainability encourages investment in green technologies and renewable energy solutions.

Societal shifts towards sustainability and climate action are profoundly influencing EnBW's strategic direction, driving demand for renewable energy and electric mobility solutions. Public acceptance of large-scale energy projects remains crucial, with surveys in 2024 showing over 70% support for wind power in Germany, though local opposition can still pose challenges.

EnBW's proactive community engagement in projects like solar parks aims to build trust and facilitate smoother integration. The company's expansion of its EV charging network, targeting over 20,000 fast-charging points by 2030, directly addresses the growing societal preference for electric mobility.

Furthermore, EnBW's workforce is adapting to the energy transition, with a focus on reskilling employees for renewable energy and digital roles, as seen in its 2024 training programs for offshore wind technicians and digital grid specialists. This aligns with the company’s commitment to a just transition and maintaining stable employment.

EnBW's significant reduction in Scope 1 and 2 emissions by 43% (compared to 2018 levels) by 2023 reflects a direct response to widespread societal demand for climate action and decarbonization.

| Sociological Factor | EnBW's Response/Data | Impact |

|---|---|---|

| Public Acceptance of Renewables | 70%+ support for wind power (2024 German survey) | Influences project timelines and community relations strategies |

| Demand for Electric Mobility | Target: 20,000+ fast-charging points by 2030 | Drives investment in charging infrastructure and e-mobility services |

| Workforce Transition | Training programs for offshore wind, digital grid specialists (2024) | Ensures workforce readiness for new energy technologies |

| Climate Action Demand | 43% reduction in Scope 1 & 2 emissions (vs. 2018) by 2023 | Reinforces sustainability targets and drives decarbonization efforts |

Technological factors

EnBW is significantly expanding its renewable energy portfolio, particularly in wind and solar power. The company currently has around 1.7 GW of renewable capacity under construction, a clear indicator of its commitment to technological advancement in this sector.

This strategic focus is further underscored by EnBW's ambitious target: by 2030, it aims for 75-80% of its total installed generation capacity to be derived from renewables. This substantial shift highlights EnBW's proactive embrace of cleaner energy technologies.

EnBW is heavily investing in energy storage to counter the unpredictable nature of renewable sources like wind and solar. This is crucial for grid stability.

A prime example is their commitment to building one of Germany's largest battery storage facilities at the Philippsburg Energy Park. This facility is slated to have a capacity of 800 MWh, a substantial amount designed to absorb excess energy and release it when needed, thereby smoothing out supply fluctuations.

EnBW is actively shaping Germany's hydrogen future, with plans to invest approximately €1 billion by 2032 in a national hydrogen core network. This significant investment will involve repurposing existing natural gas pipelines and building new infrastructure to transport green hydrogen.

The goal is to deliver this clean energy source to key industrial hubs and power generation facilities, thereby supporting crucial decarbonization efforts across Germany.

Smart Grid Technologies and Digitalization

EnBW is channeling substantial capital into upgrading and extending its electricity grids. A prime example is the SuedLink project, a massive undertaking aimed at better integrating renewable energy sources and bolstering grid resilience. This initiative underscores EnBW's commitment to a smarter, more robust energy infrastructure.

The digitalization of grid operations is a key focus, leading to significant improvements in efficiency and reliability. For instance, EnBW's investments in smart meter rollouts and advanced grid management systems are designed to optimize energy flow and reduce outages. By 2024, EnBW aimed to have over 1.5 million smart meters installed, with a target of reaching full deployment by the end of 2025, enhancing real-time data collection and control.

- Grid Modernization Investments: EnBW's capital expenditure for grid infrastructure is projected to exceed €1 billion annually through 2025, with a significant portion allocated to smart grid technologies.

- SuedLink Project: This high-voltage direct current (HVDC) link, with an estimated cost of €10 billion, is crucial for transporting wind power from northern Germany to the south, enhancing grid stability.

- Digitalization Initiatives: EnBW is investing €500 million by 2026 in digital transformation, including AI-driven grid analytics and automated fault detection, to improve operational efficiency by an estimated 15%.

- Smart Meter Deployment: The company plans to equip 4.5 million customers with smart meters by 2025, enabling better demand-side management and more accurate billing.

Advancements in E-mobility Charging Infrastructure

EnBW is actively enhancing its e-mobility charging infrastructure by integrating cutting-edge technologies. The company is a major player in Germany's fast-charging network expansion, aiming for user-friendly and efficient charging experiences.

Technological advancements are central to EnBW's strategy. This includes the development of sophisticated digital tools like the EnBW mobility+ app, which streamlines the charging process for electric vehicle owners. Furthermore, EnBW is investigating dynamic electricity tariffs designed to optimize charging times and costs for users, aligning with grid needs and potentially lowering expenses.

- Network Expansion: EnBW operates one of Germany's largest fast-charging networks, with over 1,000 High Power Charging (HPC) locations as of early 2024.

- Digital Integration: The EnBW mobility+ app boasts millions of downloads, facilitating seamless charging access and payment across numerous charging points.

- Tariff Innovation: Exploration of dynamic tariffs aims to leverage real-time electricity price fluctuations, potentially offering savings of up to 30% for EV drivers during off-peak hours.

EnBW is heavily investing in advanced battery storage solutions to support grid stability, with plans for an 800 MWh facility at Philippsburg Energy Park. The company is also a key player in developing Germany's hydrogen infrastructure, earmarking approximately €1 billion by 2032 for a national hydrogen core network. This strategic push into hydrogen transportation and utilization is designed to support industrial decarbonization efforts.

Technological advancements are driving EnBW's grid modernization, with annual capital expenditure on grid infrastructure exceeding €1 billion through 2025, focusing on smart grid technologies. The SuedLink project, an estimated €10 billion HVDC link, is vital for integrating northern wind power into the southern grid, enhancing overall stability. EnBW's digital transformation includes a €500 million investment by 2026 in AI-driven grid analytics and automated fault detection, aiming for a 15% operational efficiency improvement.

EnBW is expanding its e-mobility charging network, operating over 1,000 High Power Charging (HPC) locations as of early 2024. The EnBW mobility+ app, with millions of downloads, simplifies charging access and payments. The company is also exploring dynamic tariffs, potentially offering EV drivers up to 30% savings by leveraging real-time electricity price fluctuations during off-peak hours.

| Technology Focus | Key Initiatives & Investments | Target/Status (as of mid-2025) |

|---|---|---|

| Renewable Energy Expansion | Wind and Solar Power Development | ~1.7 GW capacity under construction; 75-80% of installed capacity targeted from renewables by 2030. |

| Energy Storage | Battery Storage Facilities | 800 MWh facility at Philippsburg Energy Park. |

| Hydrogen Infrastructure | National Hydrogen Core Network | ~€1 billion investment by 2032. |

| Grid Modernization & Digitalization | Smart Grid Technologies, SuedLink HVDC, Digital Transformation | >€1 billion annually on grid infrastructure through 2025; €500 million by 2026 for digital transformation; SuedLink estimated €10 billion. |

| E-Mobility | Fast-Charging Network, Mobility App | >1,000 HPC locations; millions of app downloads; exploring dynamic tariffs for potential 30% savings. |

Legal factors

The German Energy Industry Act (EnWG) is a cornerstone for EnBW, dictating much of its grid development and operational framework. This legislation governs the expansion and maintenance of energy networks, directly impacting EnBW's ability to invest in and deploy new infrastructure, especially for renewable energy integration.

Permitting delays under the EnWG can significantly hinder EnBW's strategic goals. For instance, the lengthy approval processes for new wind farm or grid connection projects can push back revenue generation and increase overall project costs. This regulatory environment underscores the critical need for streamlined and predictable permitting procedures to maintain competitiveness and achieve decarbonization targets.

EnBW is integrating the European Sustainability Reporting Standards (ESRS) into its 2024 financial year reporting, signaling a significant legal push for detailed and transparent sustainability information. This means a specific sustainability statement is now a mandatory part of their annual reports, aligning with the EU's expanding regulatory landscape.

The ESRS framework requires EnBW to provide extensive disclosures covering environmental, social, and governance (ESG) impacts, with the first ESRS-compliant report expected in 2025 covering the 2024 fiscal year. This move reflects a broader legal trend across the EU emphasizing corporate accountability for sustainability performance.

The EU Prospectus Regulation has significantly streamlined capital raising for companies like EnBW. For instance, EnBW successfully utilized a simplified procedure under this regulation for its €3.1 billion capital increase in early 2024, demonstrating its effectiveness in facilitating large-scale financing. This legal framework is vital for companies undertaking substantial investments, such as EnBW's ambitious energy transition projects, by enabling faster access to capital markets.

Climate Protection Targets and Legal Compliance

EnBW's commitment to climate protection is underscored by its Scope 1 and 2 emissions targets, which have been validated by the Science Based Targets initiative (SBTi) as being consistent with the Paris Agreement's 1.5°C trajectory. This validation signifies a strong alignment with global efforts to mitigate climate change and adhere to stringent environmental regulations.

Furthermore, EnBW actively manages its responsibilities concerning environmental and human rights due diligence. This proactive approach ensures compliance with evolving legal landscapes and ethical expectations, demonstrating a commitment to sustainable and responsible business practices across its operations.

- SBTi Validation: EnBW's Scope 1 and 2 targets align with the 1.5°C goal of the Paris Agreement.

- Due Diligence: The company upholds its obligations for environmental and human rights due diligence.

- Legal Frameworks: Adherence to international environmental standards and broader legal and ethical frameworks is a priority.

Anti-monopoly and Competition Regulations

EnBW, as a significant player in the German energy sector, must navigate a complex web of anti-monopoly and competition regulations. These rules are designed to prevent market abuse and ensure a level playing field for all participants, from large utilities to smaller renewable energy providers. Compliance is not just a legal necessity but a strategic imperative, shaping how EnBW approaches market entry, pricing, and potential mergers or acquisitions.

The European Union's competition framework, enforced by bodies like the European Commission, directly impacts EnBW's operations. For instance, the EU's focus on liberalizing energy markets aims to foster competition, which can influence EnBW's strategies in generation, grid access, and retail supply. Failure to adhere to these regulations can result in substantial fines and operational restrictions, impacting profitability and market share.

Key aspects of anti-monopoly and competition regulations relevant to EnBW include:

- Prohibition of cartels and anti-competitive agreements: EnBW must ensure its commercial practices do not involve collusion with other energy companies that could distort competition.

- Regulation of dominant market positions: If EnBW holds a dominant position in certain segments, it faces stricter scrutiny regarding pricing and access to infrastructure to prevent abuse.

- Merger control: Acquisitions or joint ventures undertaken by EnBW are subject to approval by competition authorities to assess their impact on market concentration.

EnBW's operations are heavily shaped by German and EU energy laws, particularly the Energy Industry Act (EnWG), which governs grid development and renewable integration. The company is also adapting to new European Sustainability Reporting Standards (ESRS), with its first ESRS-compliant report due in 2025, reflecting a growing legal emphasis on corporate environmental and social accountability. Furthermore, the EU Prospectus Regulation has facilitated EnBW's capital raising efforts, as seen in its successful €3.1 billion capital increase in early 2024.

EnBW must also navigate stringent anti-monopoly and competition regulations, both nationally and within the EU, to prevent market abuse and ensure fair competition. These regulations impact pricing, market access, and any potential mergers or acquisitions, with non-compliance risking significant penalties.

| Legal Area | Key Regulation/Standard | Impact on EnBW | 2024/2025 Relevance |

| Energy Sector | Energy Industry Act (EnWG) | Grid development, renewable integration framework | Ongoing compliance for infrastructure projects |

| Sustainability Reporting | ESRS | Mandatory detailed ESG disclosures | First report due 2025 (for FY 2024) |

| Capital Markets | EU Prospectus Regulation | Streamlined capital raising | Facilitated €3.1bn capital increase in early 2024 |

| Competition Law | EU Competition Framework | Market conduct, merger control, pricing scrutiny | Constant vigilance required for operational strategy |

Environmental factors

EnBW is aggressively pursuing climate neutrality, aiming to eliminate its direct and indirect operational emissions (Scopes 1 and 2) by 2035. This aligns with a broader objective of an 83% absolute reduction in emissions by the same timeframe.

This commitment is a cornerstone of EnBW's environmental strategy, heavily influencing its investment decisions and day-to-day operations as it navigates the evolving energy landscape.

EnBW is aggressively expanding its renewable energy portfolio, a key part of its environmental strategy. The company has set a target for renewables to make up between 75% and 80% of its installed generation capacity by 2030. This substantial increase in wind and solar power is vital for reducing EnBW's carbon footprint.

EnBW is actively decarbonizing its generation portfolio, a key environmental strategy. The company is phasing out coal-fired power plants, a significant step towards reducing its carbon footprint. For instance, the final operational year for EnBW's coal power generation was 2021, marking a crucial milestone in this transition.

The company is strategically shifting towards cleaner energy sources, moving from coal to natural gas and then to climate-neutral hydrogen. This transition includes investing in new gas power plants designed to be hydrogen-ready, ensuring future flexibility and alignment with climate goals. EnBW's commitment to a greener energy mix is a direct response to increasing environmental regulations and market demands for sustainable energy solutions.

CO2 Emission Reduction Performance

EnBW Energie Baden-Württemberg AG is actively working to lower its carbon footprint. The company has set ambitious goals, aiming to cut its Scope 1 and 2 CO2 emissions by half by 2030, using 2018 as a baseline. This shows a clear commitment to reducing direct and indirect emissions.

Furthermore, EnBW is targeting a 42.5% reduction in its Scope 3 emissions by 2035. These targets are in line with broader international efforts to combat climate change and demonstrate a strategic approach to environmental responsibility.

- CO2 Intensity Reduction: Progress made in lowering CO2 intensity.

- Scope 1 & 2 Target: Aim to halve emissions by 2030 (vs. 2018).

- Scope 3 Target: Aim to reduce emissions by 42.5% by 2035.

- Alignment with Climate Goals: Targets support global climate objectives.

Environmental Considerations in Project Development

EnBW is deeply committed to environmental stewardship in its project development, especially for solar initiatives. They champion innovative sustainability practices, such as the utilization of climate-neutral solar modules and the integration of second-life battery storage systems to enhance circular economy principles. This forward-thinking approach aims to significantly reduce the carbon footprint associated with their energy generation projects.

Biodiversity is a core component of EnBW's project planning, ensuring that ecological impacts are minimized. This includes strategies for habitat preservation and restoration around their development sites, demonstrating a commitment to protecting local ecosystems. For instance, their solar park projects often incorporate measures to support native flora and fauna, such as planting wildflower meadows or creating insect hotels.

EnBW's dedication to environmental responsibility is further evidenced by their investment in renewable energy sources. By 2025, the company aims to have over 50% of its generation capacity derived from renewables, a significant increase from previous years. This strategic shift directly addresses environmental concerns and aligns with global decarbonization efforts. Their focus on sustainable materials and processes, like the use of recycled components in battery storage, underscores this commitment.

- Climate-Neutral Modules: EnBW is actively sourcing and implementing solar modules that have achieved climate-neutral certification, reducing embodied carbon in their installations.

- Second-Life Batteries: The company is a pioneer in utilizing batteries from electric vehicles for stationary energy storage, extending the life cycle of valuable resources and reducing waste.

- Biodiversity Integration: Projects are designed with ecological considerations, including land management plans that support local biodiversity and minimize disruption to natural habitats.

- Renewable Energy Targets: EnBW's strategic goal of exceeding 50% renewable energy generation capacity by 2025 highlights their commitment to environmental sustainability.

EnBW is making significant strides in its environmental strategy, aiming for climate neutrality by 2035 with a substantial reduction in operational emissions. The company is aggressively expanding its renewable energy portfolio, targeting 75% to 80% of its generation capacity from renewables by 2030, a move that includes phasing out coal power plants and investing in hydrogen-ready gas plants. EnBW is also focusing on sustainable project development, incorporating climate-neutral solar modules and second-life battery storage, while actively preserving biodiversity around its sites.

| Environmental Target | Current Status/Goal | Year |

|---|---|---|

| Climate Neutrality (Scopes 1 & 2) | Achieve neutrality | 2035 |

| Absolute Emissions Reduction (Scopes 1 & 2) | 83% reduction | 2035 |

| Renewable Energy Capacity | 75-80% of installed capacity | 2030 |

| Scope 1 & 2 CO2 Emissions Reduction | Halve emissions | 2030 (vs. 2018) |

| Scope 3 Emissions Reduction | 42.5% reduction | 2035 |

| Renewable Energy Generation Capacity | Over 50% | 2025 |

PESTLE Analysis Data Sources

Our EnBW PESTLE Analysis is built upon a comprehensive review of official government publications, energy sector reports, and reputable economic and environmental databases. We incorporate data from regulatory bodies, market analysis firms, and technological trend forecasts to ensure a holistic understanding of the macro-environment.