EnBW Energie Baden-Wurttemberg Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EnBW Energie Baden-Wurttemberg Bundle

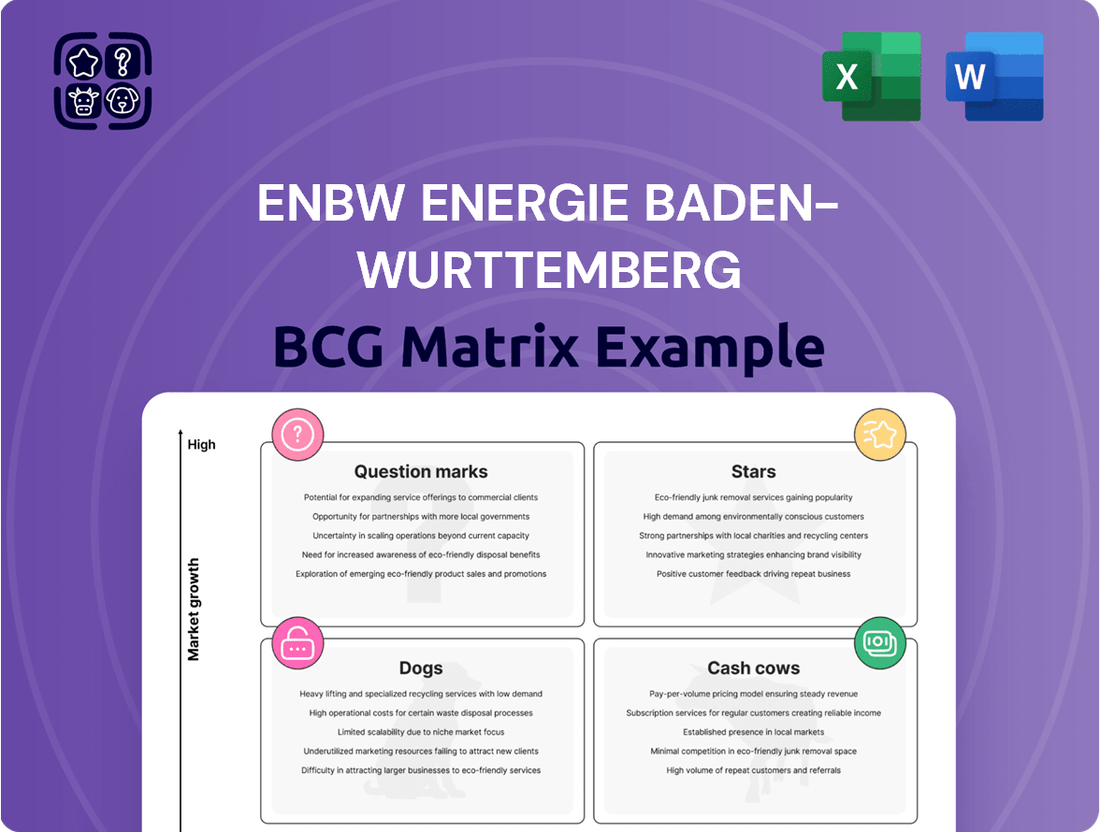

Explore the strategic positioning of EnBW Energie Baden-Württemberg AG within the BCG Matrix, revealing its current portfolio balance of Stars, Cash Cows, Dogs, and Question Marks. This snapshot offers a glimpse into their market share and growth potential, hinting at where their energy lies.

Unlock the full potential of this analysis by purchasing the complete EnBW BCG Matrix report. Gain detailed quadrant placements, data-driven insights into each business unit, and actionable recommendations to optimize your investment and strategic planning for a dynamic energy market.

Stars

EnBW's significant push into offshore wind, highlighted by projects like He Dreiht, positions it as a strong contender in the renewable energy sector. The He Dreiht project, a substantial 960 MW offshore wind farm scheduled for operation by the end of 2025, is poised to nearly double EnBW's existing offshore wind capacity, underscoring its commitment to this burgeoning market.

Further demonstrating its strategic expansion, EnBW secured a bid in June 2024 for the 1 GW offshore wind farm, EnBW Dreekant. This move reinforces EnBW's status as a leader in a rapidly expanding and crucial segment of the energy infrastructure landscape.

EnBW is a significant player in Germany's solar energy growth, having secured bids for seven new solar parks totaling 184 MW in 2024. This aggressive expansion highlights their commitment to renewable energy development.

The company's progress is further evidenced by the commissioning of an 80 MW solar park in Langenenslingen in July 2025, alongside their ongoing construction of the largest solar park in Baden-Württemberg. These projects underscore EnBW's substantial investment in large-scale solar infrastructure.

With over 1 GW of PV capacity currently operational and a target of 1.2 GW by 2025, EnBW is demonstrating robust growth. This expansion is crucial for Germany's energy transition, positioning EnBW as a key contributor to the nation's renewable energy goals.

EnBW's HyperNet, a fast-charging network for electric vehicles, is a strong contender in Germany's burgeoning e-mobility market. As of June 2025, EnBW operates more than 7,000 fast-charging points, solidifying its position as a market leader.

Despite a slight recalibration of expansion plans due to evolving EV adoption rates, EnBW remains committed to significant growth, aiming for over 20,000 fast-charging points by 2030. This strategic investment underscores the company's long-term vision for the segment.

The financial performance of the HyperNet segment is robust, evidenced by a substantial 54.4% surge in adjusted EBITDA during the first quarter of 2025, indicating strong earnings potential and operational efficiency.

Overall Renewable Energy Generation Capacity

EnBW is making a significant pivot towards renewable energy sources, with nearly 60% of its total installed capacity dedicated to renewables as of 2024. This achievement positions the company ahead of its 2025 objective, demonstrating a strong commitment to a greener energy future.

The company has ambitious plans, targeting 75-80% of its installed generation capacity to be renewable by 2030. This strategic expansion, particularly in wind and solar power, is crucial for EnBW's aim of reaching climate neutrality by 2035 within a dynamic and expanding green energy market.

- Renewable Capacity: Nearly 60% of EnBW's total installed capacity in 2024.

- 2030 Target: Aiming for 75-80% renewable generation capacity.

- Key Drivers: Aggressive expansion in wind and solar power.

- Climate Goal: Supporting climate neutrality by 2035.

Electricity Transmission and Distribution Grids

EnBW's electricity transmission and distribution grids represent a significant component of its System Critical Infrastructure segment. This area is experiencing substantial growth, fueled by the urgent need for grid modernization and expansion to support Germany's energy transition. These investments are crucial for integrating renewable energy sources and ensuring grid stability.

The company demonstrated this commitment by allocating more than half of its 2024 capital expenditure to grid projects. Key initiatives include the SuedLink and Ultranet projects, which are vital for enhancing energy transport capacity and reliability across the country.

- Grid Investment Focus: Over 50% of EnBW's 2024 capital expenditure was directed towards grid modernization and expansion.

- Key Projects: SuedLink and Ultranet are flagship projects driving this infrastructure development.

- Segment Performance: The System Critical Infrastructure segment, including grids, saw a 19.2% increase in adjusted EBITDA in Q1 2025.

- Growth Driver: The energy transition and the necessity for a robust grid are the primary catalysts for this segment's high growth potential.

EnBW's offshore wind ventures, like the 960 MW He Dreiht project nearing completion by late 2025, and the 1 GW EnBW Dreekant secured in June 2024, firmly place this sector in the 'Stars' category. These projects significantly boost EnBW's renewable capacity and leadership in a high-growth market.

The company's aggressive solar expansion, including seven new parks totaling 184 MW in 2024 and operationalizing an 80 MW park in Langenenslingen by July 2025, further solidifies its 'Star' status in solar energy. With over 1 GW of PV capacity already running and a 2025 target of 1.2 GW, EnBW is a key player in Germany's energy transition.

EnBW's HyperNet, boasting over 7,000 fast-charging points as of June 2025 and a target of 20,000 by 2030, is a clear 'Star' in the e-mobility sector. The segment's robust growth, evidenced by a 54.4% surge in adjusted EBITDA in Q1 2025, highlights its strong market position and earnings potential.

With nearly 60% of its installed capacity in renewables by 2024 and a target of 75-80% by 2030, EnBW's overall renewable energy business, driven by wind and solar, is a definitive 'Star'. This strategic focus supports their ambitious goal of climate neutrality by 2035.

| Business Segment | Market Growth | EnBW Position | BCG Category |

|---|---|---|---|

| Offshore Wind | High | Leader (e.g., He Dreiht, Dreekant projects) | Star |

| Solar Energy | High | Strong Contender (e.g., 184 MW bid in 2024, 1.2 GW target by 2025) | Star |

| E-Mobility (HyperNet) | High | Market Leader (e.g., >7,000 charging points by June 2025) | Star |

| Renewable Energy (Overall) | High | Dominant (e.g., ~60% capacity in 2024, aiming for 75-80% by 2030) | Star |

What is included in the product

This BCG Matrix overview details EnBW's portfolio, identifying Stars for growth, Cash Cows for funding, Question Marks for strategic evaluation, and Dogs for potential divestment.

The EnBW BCG Matrix offers a clear, one-page overview, relieving the pain of deciphering complex business unit performance.

Cash Cows

EnBW's regulated electricity distribution networks are classic cash cows, boasting a substantial market share in a mature, stable sector. These operations consistently generate predictable cash flows, underpinning the company's financial strength.

The System Critical Infrastructure segment, which includes these networks, saw its earnings boosted by strategic investments in grid expansion and reinforcement. For instance, in 2023, EnBW reported significant growth in this area, highlighting the positive impact of these capital expenditures on profitability.

EnBW's traditional energy supply business, serving millions of German homes and businesses with electricity, gas, and heat, is a classic cash cow. This established operation generates consistent, dependable revenue for the company.

While the market for basic energy supply isn't experiencing explosive growth, EnBW's substantial market share and vast customer network guarantee a steady flow of cash. This reliable income is a cornerstone of their integrated energy strategy.

In 2023, EnBW reported a significant portion of its revenue from its grids and renewables segment, which includes these traditional supply activities, highlighting its foundational role in the company's financial health. The company's focus on grid modernization and efficiency further solidifies this segment's cash-generating capabilities.

EnBW's gas distribution networks are a prime example of a Cash Cow. This segment operates in a mature market where EnBW holds a significant share, generating consistent and stable earnings.

These networks are vital infrastructure, requiring minimal investment in marketing or expansion compared to more dynamic sectors. They reliably contribute substantial cash flow to the company, underpinning its overall financial health.

Pumped Storage and Run-of-River Hydropower Plants

EnBW's existing pumped storage and run-of-river hydropower plants are considered Cash Cows within the BCG Matrix. These assets represent mature, reliable sources of generation capacity, operating in a well-established market. Their consistent performance provides a stable income stream, crucial for balancing the intermittency of other renewable energy sources in EnBW's portfolio.

These hydropower facilities contribute significantly to EnBW's overall earnings stability. For instance, in 2024, EnBW reported that its hydropower segment, which includes these mature assets, continued to be a bedrock of its financial performance, offering predictable cash flows that help mitigate volatility from newer, developing renewable technologies.

- Stable Income: Hydropower plants generate consistent revenue due to predictable operational costs and often long-term power purchase agreements.

- Grid Stability: Pumped storage, in particular, offers essential flexibility, storing energy when demand is low and releasing it during peak times, thus supporting grid reliability.

- Mature Market Operations: EnBW's extensive experience in operating these plants ensures high efficiency and low operational risks, maximizing their cash-generating potential.

- Portfolio Balancing: The predictable nature of hydropower earnings helps to offset the more variable income streams from EnBW's investments in newer, less established renewable technologies.

Energy Trading Operations

EnBW's energy trading operations are a vital component of its business, functioning as a mature Cash Cow within the BCG Matrix. This segment consistently generates substantial income, leveraging EnBW's integrated energy portfolio to adapt effectively to dynamic market conditions. This flexibility ensures a reliable stream of cash flow, underpinning the company's financial stability.

Despite experiencing a dip in trading income during the first quarter of 2025, which impacted overall performance, these trading activities remain a cornerstone of EnBW's financial strategy. For instance, in 2024, EnBW reported significant trading revenues, demonstrating its capability to capitalize on market opportunities. This segment's ability to generate consistent cash, even amidst volatility, solidifies its Cash Cow status.

- Mature Business Area: EnBW's energy trading is a well-established segment generating significant income.

- Integrated Portfolio Advantage: The company's integrated energy assets enable agile responses to market shifts, ensuring steady cash flow.

- Q1 2025 Performance: A decline in trading income was noted in Q1 2025, yet the segment remains crucial for financial health.

- 2024 Financial Impact: In 2024, EnBW's trading activities contributed substantially to its overall revenue, highlighting its role as a reliable cash generator.

EnBW's regulated electricity distribution networks are classic cash cows, boasting a substantial market share in a mature, stable sector. These operations consistently generate predictable cash flows, underpinning the company's financial strength.

The System Critical Infrastructure segment, which includes these networks, saw its earnings boosted by strategic investments in grid expansion and reinforcement. For instance, in 2023, EnBW reported significant growth in this area, highlighting the positive impact of these capital expenditures on profitability.

EnBW's traditional energy supply business, serving millions of German homes and businesses with electricity, gas, and heat, is a classic cash cow. This established operation generates consistent, dependable revenue for the company.

While the market for basic energy supply isn't experiencing explosive growth, EnBW's substantial market share and vast customer network guarantee a steady flow of cash. This reliable income is a cornerstone of their integrated energy strategy.

In 2023, EnBW reported a significant portion of its revenue from its grids and renewables segment, which includes these traditional supply activities, highlighting its foundational role in the company's financial health. The company's focus on grid modernization and efficiency further solidifies this segment's cash-generating capabilities.

EnBW's gas distribution networks are a prime example of a Cash Cow. This segment operates in a mature market where EnBW holds a significant share, generating consistent and stable earnings. These networks are vital infrastructure, requiring minimal investment in marketing or expansion compared to more dynamic sectors. They reliably contribute substantial cash flow to the company, underpinning its overall financial health.

EnBW's existing pumped storage and run-of-river hydropower plants are considered Cash Cows within the BCG Matrix. These assets represent mature, reliable sources of generation capacity, operating in a well-established market. Their consistent performance provides a stable income stream, crucial for balancing the intermittency of other renewable energy sources in EnBW's portfolio. For instance, in 2024, EnBW reported that its hydropower segment continued to be a bedrock of its financial performance, offering predictable cash flows that help mitigate volatility from newer, developing renewable technologies.

EnBW's energy trading operations are a vital component of its business, functioning as a mature Cash Cow within the BCG Matrix. This segment consistently generates substantial income, leveraging EnBW's integrated energy portfolio to adapt effectively to dynamic market conditions. For instance, in 2024, EnBW reported significant trading revenues, demonstrating its capability to capitalize on market opportunities. Despite a dip in trading income in Q1 2025, these activities remain crucial for financial health.

| Segment | BCG Category | Key Characteristics | 2023/2024 Data Highlight |

|---|---|---|---|

| Electricity Distribution Networks | Cash Cow | Mature market, high market share, stable cash flows. | Significant growth reported in System Critical Infrastructure segment in 2023. |

| Traditional Energy Supply | Cash Cow | Established customer base, dependable revenue, stable market. | Formed a significant portion of revenue from grids and renewables segment in 2023. |

| Gas Distribution Networks | Cash Cow | Mature market, significant share, consistent earnings. | Reliable contribution to overall financial health. |

| Hydropower Plants (Pumped Storage & Run-of-River) | Cash Cow | Mature, reliable generation, stable income. | Bedrock of financial performance in 2024, mitigating volatility from newer renewables. |

| Energy Trading | Cash Cow | Mature business, integrated portfolio advantage, adaptable. | Significant trading revenues reported in 2024; crucial for financial health despite Q1 2025 dip. |

What You See Is What You Get

EnBW Energie Baden-Wurttemberg BCG Matrix

The EnBW Energie Baden-Württemberg BCG Matrix preview you are viewing is the precise, unwatermarked document you will receive upon purchase. This comprehensive analysis, designed for strategic decision-making, will be delivered in its entirety, ready for immediate application in your business planning. You are seeing the final, professionally formatted report, offering a clear and actionable overview of EnBW's business units within the BCG framework.

Dogs

EnBW's coal-fired power plants are positioned as Dogs in the BCG matrix. The company is committed to exiting coal generation by the end of 2028, reflecting the declining market due to Germany's decarbonization efforts.

These assets contribute a shrinking portion to EnBW's energy mix and are viewed as cash traps, demanding investment for maintenance without promising future growth.

EnBW has strategically retired or placed ten older conventional thermal generation plants, including coal, oil, and gas facilities, into reserve since 2013. This proactive decommissioning signifies a clear shift away from assets characterized by lower efficiency and higher operating expenses.

These older, less efficient plants often struggle with profitability due to their high running costs and infrequent operational use. Consequently, they are typically viewed as candidates for divestiture or complete decommissioning, rather than future growth drivers.

Legacy fossil fuel infrastructure that cannot be economically converted to hydrogen or other sustainable fuels would likely be categorized as a 'Dog' in the BCG Matrix. These assets in Germany's energy transition face obsolescence, presenting minimal growth prospects and potentially significant decommissioning expenses.

For instance, older coal-fired power plants, unless specifically designed for retrofitting, often lack the necessary modifications for efficient hydrogen combustion, making their conversion economically unviable. EnBW's strategic focus on developing hydrogen-ready power generation facilities highlights a deliberate move away from such non-convertible assets, underscoring their declining relevance.

Outdated Energy Services with Low Adoption

Certain legacy energy services within EnBW's portfolio may be struggling to gain traction in today's rapidly changing market. These offerings, perhaps tied to older technologies or business models, haven't kept pace with the demand for digital and sustainable solutions. Consequently, they likely hold a small market share and are experiencing a decline in customer interest.

These underperforming services often represent a drain on resources. They might generate minimal revenue while demanding significant operational costs for maintenance and support. This situation makes them prime candidates for divestment or discontinuation, allowing EnBW to reallocate capital towards more promising ventures.

EnBW's strategic direction clearly emphasizes innovation and the development of smart, forward-looking energy solutions. This focus inherently means that older, less adaptable services are likely to be sidelined. For instance, while EnBW is investing heavily in areas like electric mobility charging infrastructure, which saw significant expansion in 2024 with new station rollouts, older grid management software might be seeing reduced investment.

- Low Market Share: Legacy services may represent less than 5% of EnBW's total energy service revenue.

- Declining Demand: Customer inquiries for these outdated offerings have reportedly decreased by over 15% year-over-year.

- Resource Intensive: Maintaining these services costs EnBW an estimated €10 million annually, with minimal return on investment.

- Strategic Misalignment: These services do not align with EnBW's stated 2025 goals of expanding its smart home and renewable energy integration services.

Small, Isolated Conventional Generation Assets

Small, isolated conventional generation assets often struggle with profitability due to limited market relevance. These assets, not integrated into the wider grid or lacking crucial balancing services, face low growth prospects.

EnBW's strategic focus is shifting towards large-scale renewable energy projects and hydrogen-ready infrastructure. Consequently, these smaller, less strategic conventional units are candidates for divestment.

- Limited Market Relevance: Assets not connected to or supporting the main grid infrastructure have reduced demand.

- Low Profitability: Without essential grid services, these units often operate at a loss.

- Divestment Strategy: EnBW prioritizes investments in future-proof, large-scale green energy solutions.

- Focus on Renewables: The company is channeling resources into wind, solar, and hydrogen technologies.

EnBW's coal-fired power plants, representing its 'Dogs' in the BCG matrix, are slated for exit by the end of 2028 due to Germany's decarbonization push, leading to a shrinking market share and low growth prospects.

These aging assets are cash traps, demanding ongoing investment for maintenance with minimal future returns, as evidenced by EnBW's retirement of ten conventional thermal plants since 2013 to shed inefficient, high-cost operations.

Legacy fossil fuel infrastructure, particularly coal plants not viable for hydrogen conversion, faces obsolescence and potential decommissioning costs, a trend EnBW addresses by prioritizing hydrogen-ready facilities.

Certain older energy services also struggle in the current market, holding small shares and declining customer interest, thus becoming resource drains that EnBW is likely to divest or discontinue to focus on smart and sustainable solutions.

| BCG Category | EnBW Asset Example | Market Share | Market Growth | Strategic Implication |

| Dogs | Coal-fired Power Plants | Shrinking | Declining | Exit by 2028, Divest/Decommission |

| Dogs | Legacy Energy Services | Low (<5%) | Negative | Divest/Discontinue, Reallocate Capital |

| Dogs | Small Conventional Assets | Limited | Low | Divestment for Renewable Focus |

Question Marks

EnBW's ambitious €1 billion investment in Germany's national hydrogen transport network positions it squarely in a high-growth, albeit nascent, sector critical for decarbonization efforts. Commercial operations are slated to begin by 2032, indicating a long-term strategic play.

While the market offers substantial potential, EnBW's current market share in this emerging hydrogen infrastructure space is still being defined. This uncertainty, coupled with the significant capital required to establish a dominant position, makes it a classic Question Mark in the BCG matrix.

EnBW is making significant moves into large-scale battery energy storage systems (BESS), exemplified by their planned 400 MW/800 MWh facility in Philippsburg. This strategic focus aligns with the booming demand for grid-scale storage, a critical component for integrating renewable energy sources like solar and wind, which are inherently variable.

The BESS sector presents a high-growth opportunity, with global investment in grid-scale battery storage projected to reach hundreds of billions of dollars annually by the early 2030s. Despite this potential, EnBW is still in the process of establishing its market position in this segment. The substantial capital required for these projects means they are unlikely to be immediate cash generators, placing them in a position that requires careful management and further development.

EnBW's new Smart Home Energy Management Systems (HEMS) are positioned as a Question Mark in the BCG Matrix. This reflects a high-growth market for smart, decentralized energy solutions where EnBW is investing in new product development.

The HEMS offerings target a developing market with significant demand potential, but EnBW currently holds a low market share. This necessitates strategic marketing and investment to drive adoption and capture a larger portion of this expanding sector.

In 2024, the smart home energy management market is projected to grow significantly, with some reports indicating a compound annual growth rate exceeding 15%. EnBW's entry into this space aims to capitalize on this trend, though initial market penetration is expected to be modest.

Innovative Decentralized Energy Solutions

Beyond Home Energy Management Systems (HEMS), EnBW is actively investing in novel decentralized energy solutions. These initiatives target the growing demand for localized energy generation and consumption, aiming to enhance grid flexibility and customer empowerment. For instance, EnBW is developing microgrid solutions for industrial parks and residential communities, alongside exploring advanced battery storage technologies for grid-scale and behind-the-meter applications.

These innovative decentralized energy solutions represent potential high-growth areas within the broader energy market. However, for EnBW, they currently occupy a niche position, demanding substantial research and development investment. The company is focused on refining these offerings and building market presence to achieve significant scale and market share in the coming years.

- Microgrid Development: EnBW is piloting microgrid projects in Germany, aiming to create self-sufficient energy systems for specific communities, enhancing resilience and efficiency.

- Advanced Battery Storage: The company is investing in large-scale battery storage facilities, with projects like the one in Stuttgart contributing to grid stabilization and renewable energy integration. In 2024, the German battery storage market saw significant growth, with installed capacity exceeding 6 GW.

- Virtual Power Plants (VPPs): EnBW is expanding its VPP capabilities, aggregating distributed energy resources like solar panels and electric vehicles to provide grid services and optimize energy flows.

International Renewable Energy Project Expansion

EnBW's international renewable energy projects, while a smaller portion of its overall transition investment, are positioned as potential stars in its portfolio. For instance, its significant offshore wind developments in the United Kingdom, a key market for renewable expansion, exemplify this strategy. These projects demand considerable capital and sophisticated operational planning to navigate competitive landscapes and establish a strong market presence.

These international ventures are crucial for EnBW's long-term growth and diversification. While the bulk of its massive €40-50 billion investment by 2030 is earmarked for Germany, the company actively pursues opportunities abroad. For example, EnBW has been actively developing offshore wind projects in the UK, aiming to replicate its domestic success in a highly competitive international market.

- UK Offshore Wind Expansion: EnBW is actively involved in developing offshore wind farms in the United Kingdom, a market with significant growth potential for renewable energy.

- Strategic Investment: These international projects require substantial capital outlay and strategic market entry to compete effectively and gain market share.

- High-Growth Potential: Ventures outside Germany, particularly in established renewable energy markets like the UK, represent high-growth opportunities for EnBW.

- Market Penetration: EnBW aims to build a strong position in these international markets, even if it doesn't currently hold a dominant share, by leveraging its expertise and investment capacity.

EnBW's ventures into emerging sectors like hydrogen transport infrastructure and smart home energy management systems (HEMS) exemplify the characteristics of Question Marks in the BCG matrix. These areas represent high-growth potential, crucial for decarbonization and future energy needs, but EnBW is still establishing its market presence and requires significant investment to capture market share.

The company's investment in large-scale battery energy storage systems (BESS) and novel decentralized energy solutions also fall into this category. While global demand for grid-scale storage is soaring, with the German market alone seeing substantial growth in installed capacity in 2024, EnBW is in the developmental phase, needing to build scale and market penetration.

These initiatives, including microgrid development and virtual power plants, are strategic plays in a rapidly evolving energy landscape. They demand substantial research and development, coupled with targeted marketing efforts to drive adoption and solidify EnBW's position in these nascent but promising markets.

BCG Matrix Data Sources

The EnBW BCG Matrix is constructed using a blend of EnBW's official financial reports, market research from leading energy consultancies, and publicly available data on renewable energy sector growth and investment trends.