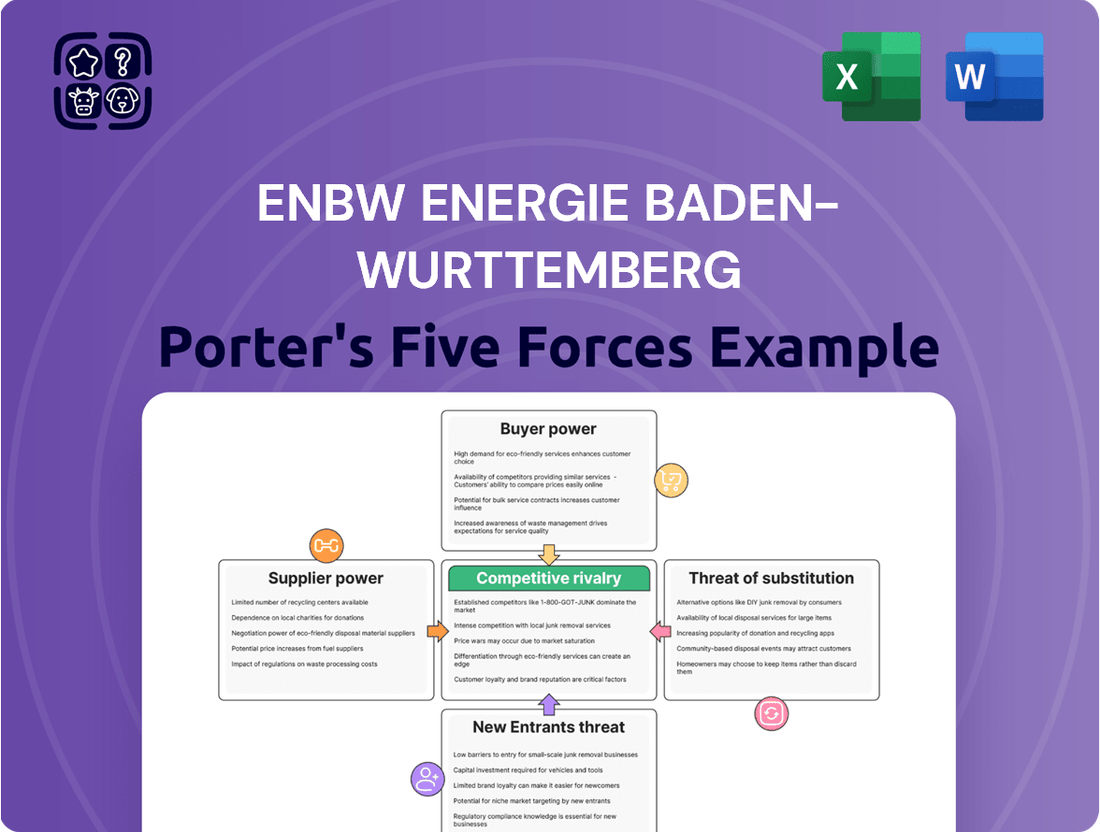

EnBW Energie Baden-Wurttemberg Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EnBW Energie Baden-Wurttemberg Bundle

EnBW Energie Baden-Württemberg faces a dynamic energy landscape, with intense rivalry among existing players and a growing threat from new entrants leveraging renewable technologies. Understanding the bargaining power of both suppliers and buyers is crucial for navigating this complex market. The threat of substitutes, particularly from decentralized energy solutions, also presents a significant challenge.

The complete report reveals the real forces shaping EnBW Energie Baden-Württemberg’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers for critical components, like specialized wind turbine manufacturers or advanced battery storage providers, can give them substantial bargaining power over EnBW. This means fewer options for EnBW, potentially leading to higher costs or less favorable terms.

For example, EnBW's reliance on specific technology providers is evident in projects like the He Dreiht offshore wind farm, which utilizes 15 MW Vestas wind turbines. The specialized nature of such equipment limits the number of viable suppliers, strengthening their negotiating position.

EnBW faces significant switching costs when procuring specialized equipment or services for its large-scale infrastructure projects, such as wind farms or power plants. These costs are amplified by the intricate integration required with existing energy generation technologies and grid infrastructure, making a change of supplier a complex and expensive undertaking. For instance, the development of offshore wind projects, a key area for EnBW's decarbonization efforts, involves highly specialized turbines and installation services where supplier relationships are often long-term and deeply embedded.

EnBW's operational efficiency hinges on the quality and reliability of its suppliers. This is particularly true for essential inputs like fuel for conventional power generation and components for its rapidly expanding renewable energy portfolio, such as wind turbines and solar panels. For instance, in 2023, EnBW continued its significant investments in renewables, aiming to further decarbonize its energy mix.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers in the German energy sector, specifically for a company like EnBW, is generally low. While a supplier of highly specialized technology or equipment could theoretically move into energy generation or distribution, the immense capital requirements and stringent regulatory landscape in Germany present significant barriers to entry. For instance, establishing a new power plant or distribution network demands billions of euros in investment and navigating complex permitting processes, making such a move economically unfeasible for most suppliers.

However, the bargaining power of suppliers can be indirectly influenced by their ability to offer integrated solutions or services that reduce EnBW's operational costs or enhance efficiency. For example, a supplier offering advanced grid management software coupled with installation and maintenance services might gain leverage if it significantly improves EnBW's operational performance. In 2024, the German energy market continued to see significant investment in grid modernization and renewable energy integration, areas where specialized technology providers play a crucial role.

- Low Threat of Forward Integration: The capital intensity and regulatory complexity of the German energy market create high barriers, making it difficult for suppliers to integrate forward into generation or distribution.

- Specialized Suppliers: While rare, suppliers of highly specialized technology or equipment could theoretically pose a threat, but the practical challenges remain substantial.

- Indirect Influence: Suppliers can increase their bargaining power by offering integrated solutions that improve EnBW's operational efficiency and cost-effectiveness.

- Market Context: In 2024, investments in grid modernization and renewables highlighted the importance of technology suppliers, though direct forward integration remained unlikely.

Cost of Raw Materials and Fuels

Fluctuations in global commodity prices, like natural gas for thermal power generation and metals crucial for wind turbines and solar panels, directly affect EnBW's operational expenses. For instance, the significant drop in wholesale electricity and gas prices observed in 2023 and continuing into early 2024 has already impacted EnBW's profitability, as the cost of acquiring these essential inputs becomes more volatile.

- Impact of Energy Price Normalization: EnBW's earnings were notably influenced by the normalization of wholesale electricity and gas prices throughout 2023 and into 2024, a trend that directly correlates with the cost of raw materials and fuels.

- Raw Material Volatility: The cost of key inputs such as natural gas, essential for EnBW's thermal power plants, and metals like copper and aluminum, vital for renewable energy infrastructure, are subject to global market price swings.

- Procurement Cost Sensitivity: EnBW's profitability is directly sensitive to these price movements, as higher raw material and fuel costs translate into increased procurement expenses for energy generation.

EnBW's bargaining power with suppliers is influenced by the concentration of specialized providers for critical components, such as advanced wind turbine manufacturers. High switching costs, due to the integration of specialized equipment into existing infrastructure, further bolster supplier leverage. While forward integration by suppliers is unlikely due to high capital and regulatory barriers in Germany, their ability to offer integrated solutions can enhance their influence.

| Factor | Impact on EnBW | 2023/2024 Relevance |

|---|---|---|

| Supplier Concentration | Increases supplier bargaining power, potentially raising costs. | High for specialized renewable components. |

| Switching Costs | High due to integration complexity, reinforcing supplier position. | Significant for offshore wind projects and grid infrastructure. |

| Forward Integration Threat | Low due to capital and regulatory barriers in Germany. | Minimal for energy generation and distribution. |

| Integrated Solutions | Can increase supplier leverage if they improve EnBW's efficiency. | Growing importance in grid modernization and renewables. |

What is included in the product

This analysis deeply examines the competitive forces impacting EnBW Energie Baden-Württemberg, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its strategic positioning.

Easily identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces impacting EnBW's strategic positioning.

Customers Bargaining Power

Customer price sensitivity is a significant factor for EnBW in the German energy market. With government efforts focused on reducing electricity costs, both residential and business clients are becoming more attuned to pricing. This means EnBW must remain competitive, potentially through attractive tariffs and adaptable pricing structures to retain its customer base.

Customers increasingly have access to alternative energy solutions, which directly impacts their bargaining power with traditional energy providers like EnBW. For instance, the proliferation of rooftop solar photovoltaic (PV) installations means many households can generate their own electricity, reducing their need to purchase power from the grid. This trend is supported by data showing a significant increase in installed solar capacity across Germany.

Beyond self-generation, energy efficiency measures and the adoption of alternative heating systems, such as heat pumps, further diminish customer dependence on established energy suppliers. These choices empower consumers to control their energy consumption and costs, thereby strengthening their position when negotiating with companies like EnBW for grid-supplied energy.

In Germany's liberalized energy market, customers often face minimal costs and administrative hurdles when changing electricity or gas suppliers. This low barrier allows consumers to readily switch providers to secure more favorable pricing or to align with their preferences for renewable energy sources.

For instance, in 2023, the average household in Germany spent around €1,400 on electricity, creating a significant incentive for consumers to shop around for better rates given the ease of switching. This readily available market competition directly enhances the bargaining power of customers.

Access to Information and Market Transparency

Increased transparency in energy pricing and service offerings, especially with readily available online comparisons, significantly boosts customer bargaining power. For instance, by mid-2024, consumers in many European markets could easily access aggregated data on electricity tariffs, allowing for direct comparisons of unit prices and contract terms. This ease of access empowers customers to switch providers for better deals, forcing companies like EnBW to remain competitive.

Greater consumer awareness regarding renewable energy options and energy efficiency measures further strengthens the customer's hand. As more individuals understand the benefits and cost-effectiveness of green energy, they can demand these services or seek providers who offer them. This shift in consumer preference means customers are less likely to accept standard, less sustainable offerings, thus increasing their leverage in negotiations.

- Enhanced Price Comparison: Customers can readily compare electricity and gas prices across multiple providers, often finding significant differences in unit costs.

- Awareness of Green Alternatives: Growing knowledge about renewable energy sources and efficiency incentives allows customers to seek out and demand these options.

- Informed Decision-Making: Access to information empowers customers to make choices based on value, service, and sustainability, not just availability.

Regulatory Support for Consumer Choice

German energy policy actively champions consumer choice and competition. Regulations are specifically crafted to make it easier for customers to switch providers and embrace new energy technologies, thereby increasing their leverage.

This supportive regulatory framework significantly bolsters the bargaining power of customers in the energy market. For instance, in 2023, the German Federal Network Agency reported that over 10 million customers switched electricity providers, highlighting the active engagement driven by these policies.

- Increased Provider Competition: Regulations foster a competitive landscape, giving customers more options and the ability to demand better terms.

- Simplified Switching Processes: Rules designed to streamline switching empower consumers to move to more favorable offers without significant hassle.

- Support for New Technologies: Policies encouraging renewable energy and smart grids give consumers more control and choice over their energy sources and consumption.

Customers in Germany possess significant bargaining power due to increased price sensitivity and readily available alternatives. The ease of switching providers, coupled with a growing awareness of green energy options and efficiency measures, compels companies like EnBW to offer competitive pricing and services.

The German energy market is characterized by a high degree of customer choice, further amplified by regulatory support for competition and simplified switching processes. This environment allows consumers to actively seek better deals and choose providers aligned with their values, such as those offering renewable energy solutions.

In 2023, the average German household spent approximately €1,400 on electricity, making price a key consideration. With over 10 million customers switching electricity providers in the same year, the impact of customer bargaining power is evident in the market dynamics.

| Factor | Impact on EnBW | Supporting Data (2023/2024) |

|---|---|---|

| Price Sensitivity | High; necessitates competitive tariffs. | Average household electricity spend: ~€1,400. |

| Availability of Alternatives | Increases switching likelihood. | Proliferation of rooftop solar PV. |

| Ease of Switching | Lowers barriers to competitor entry. | Over 10 million electricity provider switches in 2023. |

| Consumer Awareness (Green Energy) | Drives demand for sustainable options. | Growing consumer preference for renewable sources. |

What You See Is What You Get

EnBW Energie Baden-Wurttemberg Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for EnBW Energie Baden-Württemberg, offering a detailed examination of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, providing actionable insights into EnBW's strategic landscape. No placeholders or samples; this is the full deliverable, ready for your immediate use and strategic decision-making.

Rivalry Among Competitors

EnBW navigates a fiercely competitive German energy landscape, characterized by established giants like E.ON and RWE, alongside a multitude of smaller, specialized firms. RWE, in particular, holds a significant and often dominant presence within the German electricity sector. This intense rivalry means EnBW must constantly innovate and optimize its operations to maintain market share and profitability.

The German energy market, while mature overall, is experiencing a surge in competitive rivalry driven by the massive push for decarbonization. This energy transition, central to Germany's climate goals, is creating new growth avenues, particularly in renewable energy generation and grid infrastructure. Companies like EnBW are pouring substantial capital into these emerging sectors, intensifying the battle for market share as the nation shifts away from fossil fuels.

Companies in the energy sector, including EnBW, are increasingly competing by differentiating their products and services beyond simply supplying electricity and gas. This includes offering integrated solutions like smart home energy management systems and investing heavily in e-mobility infrastructure, such as charging stations.

EnBW, for instance, highlights its comprehensive portfolio and significant investments in forward-looking technologies. In 2023, EnBW reported a substantial increase in its renewable energy capacity, reaching over 7.5 GW, underscoring its commitment to sustainable energy services and a key differentiator in a competitive market.

High Fixed Costs and Exit Barriers

The energy sector, including companies like EnBW, faces intense competitive rivalry often fueled by high fixed costs. Building and maintaining power generation facilities and extensive grid networks requires massive upfront investment. For instance, in 2023, the European Union continued to see significant investment in renewable energy infrastructure, with Germany alone allocating billions towards grid expansion and renewable energy projects to meet its climate goals.

These substantial capital outlays create significant exit barriers. Once a company has invested heavily in such assets, it becomes exceedingly difficult and costly to divest or cease operations. This economic reality compels existing players to stay in the market and fight for market share, even when profitability is squeezed, leading to a more aggressive competitive landscape.

The competitive rivalry is further intensified by the nature of these high fixed costs and exit barriers, which can be summarized as:

- Significant Capital Investment: The energy industry demands enormous upfront capital for power plants and transmission infrastructure, creating a high barrier to entry and exit.

- Operational Continuity Incentive: High fixed costs encourage existing firms to operate at high capacity to spread these costs, leading to aggressive pricing and competition.

- Limited Strategic Flexibility: The specialized and immobile nature of energy assets restricts companies' ability to pivot or exit the market easily, reinforcing the competitive pressure among incumbents.

Strategic Investments in Future Technologies

Competitive rivalry within the energy sector is intensifying as companies like EnBW pour substantial capital into future technologies. This aggressive investment strategy is a direct response to the high stakes involved in securing a leading position in the energy transition.

EnBW's commitment to investing up to €50 billion in energy transition projects by 2030 underscores the fierce competition. These investments are not just about capacity; they are about innovation in areas like offshore wind, grid modernization, and green hydrogen production.

- Massive Capital Deployment: Companies are channeling billions into renewable energy projects, signaling an arms race for market share.

- Technological Advancement Focus: Investments target critical areas such as advanced battery storage, smart grid technologies, and hydrogen infrastructure development.

- Strategic Partnerships and Acquisitions: Firms are actively seeking collaborations and acquisitions to bolster their technological capabilities and market reach.

- Geographic Expansion: Competitors are also expanding their operational footprints into new regions to capture emerging market opportunities.

The German energy market is a battleground with giants like E.ON and RWE fiercely contesting market share, forcing EnBW to constantly innovate. This rivalry is amplified by Germany's ambitious decarbonization goals, driving massive investments in renewables and grid infrastructure. For instance, in 2023, EnBW significantly expanded its renewable capacity, surpassing 7.5 GW, a move mirrored by competitors seeking to capitalize on the energy transition.

High fixed costs associated with power generation and grid networks create substantial exit barriers, compelling companies to maintain high operational capacity and often engage in aggressive pricing strategies. This economic reality, evident in continued EU investments in grid expansion and renewables throughout 2023, reinforces the intense competition among established players.

Companies are increasingly differentiating themselves through integrated solutions and technological advancements, such as smart home energy management and e-mobility infrastructure. EnBW's commitment to investing up to €50 billion in energy transition projects by 2030 highlights this strategic focus on securing a leading position in emerging sectors like offshore wind and green hydrogen.

| Competitor | Key Investment Area (2023-2024 Focus) | Renewable Capacity (Approx. GW) |

|---|---|---|

| EnBW | Offshore Wind, Grid Modernization, Green Hydrogen | > 7.5 GW (as of end 2023) |

| RWE | Renewable Energy Development, Battery Storage | > 10 GW (as of end 2023) |

| E.ON | Grid Infrastructure, Customer Solutions, Renewables | > 5 GW (as of end 2023) |

SSubstitutes Threaten

The rise of decentralized renewable energy generation presents a significant threat of substitutes for traditional utility providers like EnBW. As more homes and businesses install rooftop solar panels, they become less reliant on purchasing electricity from the grid. For instance, in Germany, solar PV capacity saw a substantial increase, with approximately 14.7 GW added in 2023, contributing to a growing number of self-sufficient energy producers.

Advancements in energy efficiency technologies are significantly impacting EnBW by offering viable alternatives to traditional grid-supplied energy. For instance, the increasing adoption of smart home devices and building management systems, coupled with improved insulation and more efficient appliances, directly reduces the need for electricity and gas from utility providers.

These efficiency gains translate into a tangible threat. In 2023, Germany saw a notable increase in renewable energy installations for self-consumption, with rooftop solar photovoltaic capacity growing by approximately 15% compared to the previous year, according to preliminary data from the Bundesnetzagentur. This trend indicates a growing segment of consumers less reliant on EnBW's core offerings.

The threat of substitutes for EnBW's traditional heating and cooling services is growing, driven by a significant shift towards alternative solutions. Heat pumps, for instance, are becoming increasingly popular, offering an energy-efficient replacement for gas boilers. In 2023, Germany saw a substantial increase in heat pump installations, with over 350,000 units sold, a testament to their rising adoption.

Furthermore, the expansion of district heating networks, especially those utilizing renewable energy sources like biomass or geothermal, presents another strong substitute. These networks can provide centralized, often more sustainable, heating and cooling to a wider area, directly competing with EnBW's individual building solutions. German energy policy actively encourages this transition, aiming to decarbonize the heating sector.

Emergence of Hydrogen as an Energy Carrier

Germany's ambitious drive to establish a hydrogen economy, backed by significant investment in infrastructure and production, presents a potent threat of substitution for natural gas. The country aims to build extensive hydrogen pipeline networks and numerous production facilities, signaling a long-term shift away from traditional fossil fuels in industrial applications and potentially beyond.

EnBW's strategic investment in hydrogen-ready power plants directly addresses this emerging threat. This proactive approach positions the company to leverage the transition to hydrogen, mitigating the risk of its existing natural gas infrastructure becoming obsolete.

- Hydrogen Infrastructure Investment: Germany plans to invest billions in hydrogen infrastructure, including pipelines and electrolysis plants, to support its green hydrogen strategy.

- Industrial Demand Shift: Industries heavily reliant on natural gas, such as steel and chemical manufacturing, are exploring hydrogen as a cleaner alternative, potentially reducing demand for natural gas.

- EnBW's Hydrogen Strategy: EnBW is actively participating in hydrogen projects and developing capabilities to integrate hydrogen into its energy portfolio, including hydrogen-ready gas turbines.

Energy Storage Solutions

The threat of substitutes for EnBW's energy services is amplified by the increasing availability and adoption of energy storage solutions. These technologies, ranging from large-scale battery farms to individual home battery systems, offer consumers and businesses alternative ways to manage their energy consumption and reduce reliance on traditional grid supply.

For instance, distributed energy resources, including solar panels paired with battery storage, allow users to generate and store their own power, directly substituting for electricity purchased from the grid. This trend is accelerating; by the end of 2023, global installed battery storage capacity was projected to surpass 140 GW, a significant jump from previous years.

- Growing Battery Deployment: The global market for battery energy storage systems is experiencing robust growth, with projections indicating continued expansion through 2024 and beyond.

- Energy Independence: Residential and commercial battery systems empower users to store excess solar energy or off-peak grid electricity, reducing their immediate demand from EnBW's grid.

- Grid Flexibility Alternative: These storage solutions can provide grid services, such as frequency regulation or peak shaving, potentially substituting for services traditionally offered by large utility providers like EnBW.

- Cost Reduction: As battery technology costs continue to decline, these storage solutions become increasingly economically viable as substitutes for conventional energy supply.

The rise of decentralized energy generation, particularly rooftop solar, poses a significant threat to EnBW's traditional utility model. Germany saw approximately 14.7 GW of solar PV capacity added in 2023, increasing self-sufficiency among consumers. Energy efficiency technologies, like smart homes and better insulation, also reduce demand for EnBW's services.

Alternative heating and cooling solutions, such as heat pumps, are gaining traction; over 350,000 units were sold in Germany in 2023. Furthermore, the expansion of district heating networks, especially those using renewables, offers a direct substitute for EnBW's offerings. Germany's push for a hydrogen economy also signals a potential shift away from natural gas.

Energy storage solutions, like battery systems, further empower consumers to reduce reliance on the grid. By the end of 2023, global installed battery storage capacity was projected to exceed 140 GW. These technologies enable users to store self-generated power or off-peak electricity, acting as a direct substitute for grid-supplied energy.

Entrants Threaten

The energy sector, especially for establishing large-scale generation facilities and maintaining extensive grid infrastructure, necessitates substantial capital investments. This high financial barrier significantly deters potential new entrants from easily entering the market.

For instance, EnBW Energie Baden-Württemberg has outlined an ambitious investment plan of up to €50 billion by 2030, underscoring the sheer scale of financial commitment required to compete effectively in this industry.

The German energy sector operates under a stringent regulatory and licensing framework, demanding extensive permits and adherence to complex compliance standards. For instance, the Renewable Energy Sources Act (EEG) dictates feed-in tariffs and grid connection procedures, creating significant hurdles for newcomers.

Established grid infrastructure and distribution networks represent a significant barrier to entry for new companies in the energy sector. Incumbent utilities, such as EnBW, have invested billions over decades to build and maintain extensive transmission and distribution systems for electricity and gas. For instance, in 2023, German grid operators collectively invested approximately €10.7 billion in expanding and modernizing their networks, a figure that highlights the scale of existing infrastructure.

New entrants would face immense capital expenditure and regulatory hurdles to replicate or gain access to these critical assets. Building a comparable network from scratch is prohibitively expensive and time-consuming, often taking years to secure permits and construct. This entrenched infrastructure effectively locks in existing players and makes it difficult for newcomers to compete on a level playing field.

Economies of Scale and Experience Curve Advantages

Existing major energy companies like EnBW leverage significant economies of scale, particularly in generation and procurement. This scale allows them to spread fixed costs over a larger output, leading to lower per-unit costs. For instance, EnBW's substantial renewable energy portfolio benefits from bulk purchasing of components and optimized operational management, making it challenging for smaller, newer players to achieve similar cost efficiencies.

The experience curve also plays a crucial role. As companies like EnBW have operated for decades, they've accumulated invaluable knowledge in managing complex energy infrastructure, navigating regulatory landscapes, and optimizing supply chains. This accumulated expertise translates into smoother operations, reduced waste, and more reliable service delivery, creating a competitive advantage that new entrants would need considerable time and investment to replicate.

- Economies of Scale: EnBW's large-scale renewable projects, such as its offshore wind farms, benefit from bulk purchasing and optimized logistics, reducing per-megawatt costs.

- Experience Curve: Decades of operational experience in managing diverse energy generation and distribution networks allow EnBW to operate more efficiently and with fewer unforeseen issues compared to new entrants.

- Pricing Power: The cost advantages derived from scale and experience enable EnBW to offer competitive pricing, making it difficult for new, smaller companies to enter the market with comparable offers.

- Infrastructure Investment: The massive capital investment required for establishing new, large-scale energy generation and distribution infrastructure acts as a significant barrier to entry for potential competitors.

Brand Recognition and Customer Loyalty

The threat of new entrants for EnBW Energie Baden-Württemberg is significantly mitigated by strong brand recognition and deep-seated customer loyalty. In the essential energy sector, consumers often prioritize reliability and trust built over time. EnBW has cultivated this trust, making it challenging for newcomers to gain a foothold.

For instance, in 2023, EnBW reported a significant portion of its customer base remained with the company, demonstrating the effectiveness of its long-standing brand presence. New competitors face the considerable hurdle of not only offering competitive pricing but also convincing consumers to switch from a trusted, established provider.

- Established Brand Trust: EnBW's years of operation have fostered a perception of reliability and quality, a critical factor in the energy market.

- Customer Loyalty: High customer retention rates indicate that switching costs, both perceived and actual, are substantial for consumers.

- Barriers to Entry: New entrants must invest heavily in marketing and customer acquisition to overcome EnBW's established brand equity.

The threat of new entrants in the energy sector, particularly for companies like EnBW, is considerably low due to immense capital requirements and established infrastructure. EnBW's planned investment of up to €50 billion by 2030 for its energy transition highlights the scale of financial commitment needed, a barrier that deters most potential newcomers.

Furthermore, the sector's complex regulatory landscape and the sheer cost of replicating existing grid networks, where German grid operators invested around €10.7 billion in 2023 alone for network expansion and modernization, create substantial hurdles. New entrants must also overcome EnBW's economies of scale and decades of accumulated operational expertise, which translate into cost efficiencies and reliable service that are difficult to match.

Established brand trust and customer loyalty also play a significant role, as seen in EnBW's high customer retention rates in 2023. New competitors face the considerable challenge of building brand recognition and convincing consumers to switch from a trusted provider, requiring substantial marketing investment to overcome EnBW's established market position.

| Barrier Type | Description | Example/Data Point |

|---|---|---|

| Capital Requirements | Extremely high initial investment needed for generation and grid infrastructure. | EnBW's investment plan up to €50 billion by 2030. |

| Infrastructure Access | Difficulty in building or accessing existing transmission and distribution networks. | German grid operators' €10.7 billion investment in 2023 for network modernization. |

| Economies of Scale & Experience | Established players benefit from lower per-unit costs and operational expertise. | EnBW's large-scale renewable projects offer cost advantages through bulk purchasing. |

| Brand Loyalty & Switching Costs | Consumer preference for established, reliable providers makes customer acquisition difficult. | High customer retention rates for EnBW in 2023 indicate strong brand trust. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for EnBW utilizes a comprehensive approach, drawing from EnBW's annual reports, investor presentations, and regulatory filings. This is supplemented by industry-specific market research reports and data from reputable energy sector publications to capture current market dynamics.