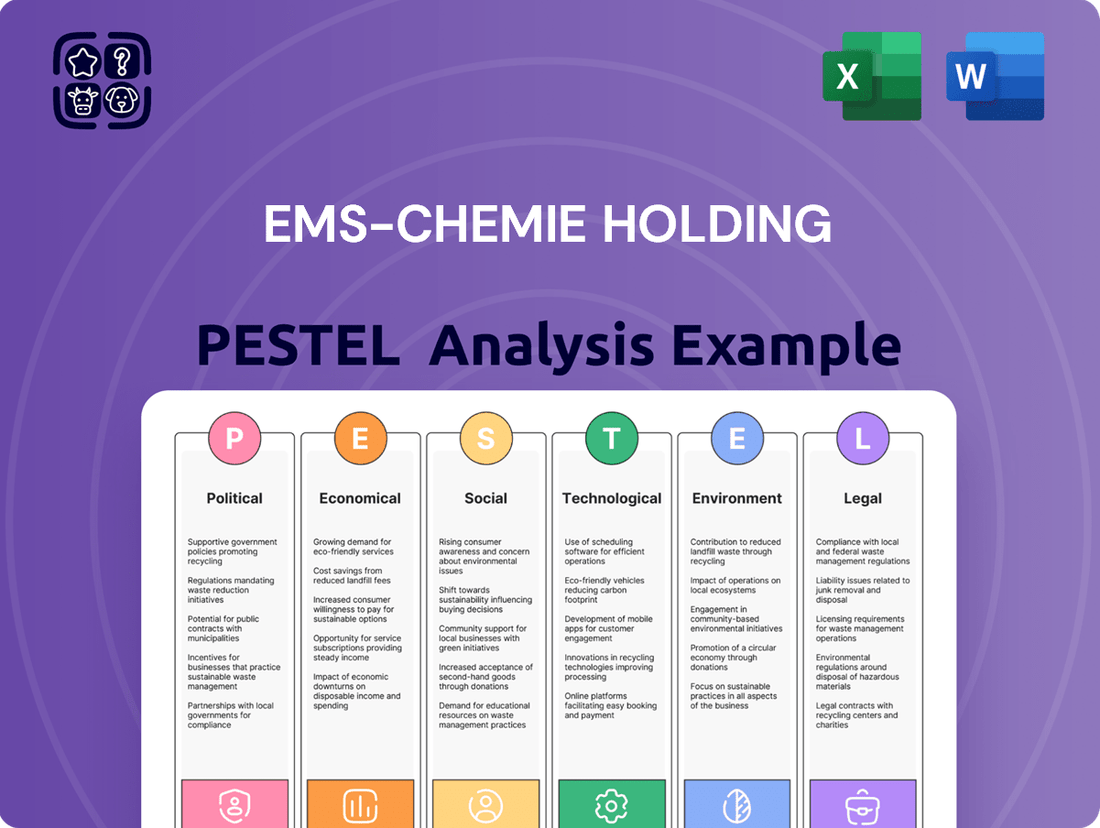

EMS-Chemie Holding PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EMS-Chemie Holding Bundle

Gain a critical understanding of the external forces shaping EMS-Chemie Holding's trajectory. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors impacting their operations and future growth. Equip yourself with actionable intelligence to navigate market complexities and seize opportunities. Download the full PESTLE analysis now for a strategic advantage.

Political factors

Geopolitical tensions and trade conflicts are a significant concern for EMS-Chemie Holding AG, as these global disruptions impact supply chains and create uncertainty for businesses and consumers alike. For instance, ongoing trade disputes between major economies can lead to increased tariffs, affecting the cost of raw materials and finished goods.

EMS-Chemie has taken steps to mitigate these risks by adapting its supply chains. A key strategy involves ensuring products sold in the USA are either manufactured domestically or are exempt from customs duties, a proactive measure to navigate potential international trade barriers. This approach helps maintain competitiveness and operational stability in a volatile global market.

Government policies, especially in the European Union and the United States, are increasingly steering businesses towards a circular economy model for plastics, directly impacting EMS-Chemie's operations. These regulations aim to reduce waste and promote sustainability.

The EU, for instance, has mandated that plastic bottles must contain a minimum of 25% recycled plastic by 2025. Furthermore, updated End-of-Life Vehicle (ELV) directives are setting targets for the inclusion of 20% recycled plastics in vehicles within the next six years.

The European Union's upcoming 2025 revision of the REACH regulation signals a significant tightening of controls on hazardous chemicals. This includes a comprehensive ban on per- and polyfluoroalkyl substances (PFAS) in consumer goods, a move that will directly affect chemical manufacturers such as EMS-Chemie Holding.

This regulatory evolution prioritizes broader, category-wide restrictions to expedite the phasing out of high-risk substances. The aim is to actively promote the adoption of safer chemical alternatives, fostering a more sustainable approach to chemical usage across industries.

Tariffs and Trade Barriers

Tariffs and trade barriers, especially those implemented by major economies like the United States on countries such as China, introduce significant volatility into international commerce. This can lead to companies stockpiling goods in anticipation of higher costs, disrupting established supply chains and creating a ripple effect across global trade. For instance, in 2023, the US continued to maintain tariffs on a wide range of Chinese goods, impacting various manufacturing sectors.

EMS-Chemie Holding has acknowledged the destabilizing impact of these trade policies, including the possibility of new punitive tariffs, on its global operations. The company has proactively responded by adapting its trade routes and logistics to lessen the adverse effects of these protectionist measures. This strategic adjustment aims to maintain the flow of materials and finished products despite the evolving trade landscape.

- Global Trade Uncertainty: Increased tariffs create a less predictable environment for international business operations.

- Supply Chain Disruption: Trade barriers can interrupt the smooth flow of goods and raw materials.

- Inventory Management Challenges: Companies may need to adjust inventory levels due to anticipated tariff increases.

- Strategic Adaptation: Businesses like EMS-Chemie are modifying their supply chain strategies to navigate these challenges.

National Energy Policies and Sustainability Initiatives

National energy policies are increasingly focused on promoting solar module localization and other sustainable practices. This trend directly fuels demand for specialized chemical materials. For EMS-Chemie, this represents a significant opportunity, particularly in supplying high-purity polysilicon and advanced fluorine-based etchants crucial for solar cell manufacturing.

The global shift towards clean energy is a powerful driver. For instance, in 2024, renewable energy sources accounted for an estimated 30% of global electricity generation, a figure projected to climb. This underscores the growing importance of circular economy principles within the chemical sector, influencing material sourcing and production methods.

- Growing Demand for Solar Materials: Policies encouraging domestic solar production are boosting the market for polysilicon and specialized etchants.

- Renewable Energy Growth: Renewables constituted roughly 30% of global electricity generation in 2024, highlighting the momentum of the clean energy transition.

- Circular Economy Influence: The push for sustainability is reshaping chemical industry supply chains and material utilization.

Government regulations, particularly those concerning sustainability and chemical safety, are increasingly shaping the operational landscape for EMS-Chemie. The European Union's commitment to a circular economy, for example, mandates higher recycled content in products, directly influencing material sourcing and production processes. The EU's 2025 target for plastic bottles to contain at least 25% recycled plastic exemplifies this trend.

Furthermore, upcoming revisions to regulations like REACH in 2025 are set to impose stricter controls on hazardous substances, including potential bans on PFAS. This proactive regulatory environment necessitates that companies like EMS-Chemie invest in research and development for safer chemical alternatives to maintain compliance and market relevance.

Trade policies and tariffs continue to present significant challenges, with ongoing trade disputes creating volatility in global supply chains. For instance, the US maintained tariffs on a broad range of Chinese goods throughout 2023, impacting manufacturing costs and requiring strategic adjustments in logistics and sourcing. EMS-Chemie has responded by adapting trade routes to mitigate the effects of these protectionist measures.

| Regulation/Policy | Target Year | Impact on EMS-Chemie |

|---|---|---|

| EU Circular Economy (Plastic Bottles) | 2025 | Increased demand for recycled plastics; potential need to adapt product formulations. |

| EU REACH Revision (PFAS Ban) | 2025 | Direct impact on chemical production; necessitates development of PFAS-free alternatives. |

| US Tariffs on Chinese Goods | Ongoing (e.g., 2023) | Increased raw material costs; supply chain disruption; need for logistics adaptation. |

What is included in the product

This PESTLE analysis of EMS-Chemie Holding examines the influence of political, economic, social, technological, environmental, and legal factors on its operations, providing a comprehensive understanding of the external landscape.

It offers actionable insights for strategic decision-making, highlighting potential risks and opportunities arising from macro-environmental trends relevant to the chemical industry.

This PESTLE analysis for EMS-Chemie Holding provides a clear, summarized version of external factors, acting as a pain point reliever by offering easy referencing during strategic meetings and presentations.

Economic factors

The first quarter of 2025 saw a noticeable cooling in the global economy, impacting industrial production and consumer confidence worldwide. This general slowdown, exacerbated by elevated regulatory and structural expenses within Europe and a pressing need for consumer stimulus in China, contributed to a modest decline in EMS-Chemie's net sales compared to the prior year.

The Swiss Franc's notable appreciation against currencies like the Euro and US Dollar presents a significant headwind for EMS-Chemie. This strength means that when sales made in other currencies are converted back into Swiss Francs, their value is diminished, directly impacting reported net sales.

For the full year 2025, this currency dynamic is projected to keep net sales below the figures achieved in 2024. Despite this, EMS-Chemie has demonstrated resilience by focusing on high-margin specialty products and implementing stringent cost management strategies, which have helped sustain or even slightly improve operating income.

Persistent inflation, especially noted in the United States, alongside generally subdued price and cost levels across the market, has created a demanding economic landscape for EMS-Chemie. This environment necessitates careful navigation by the company.

Despite these headwinds, EMS-Chemie has strategically prioritized enhancing cost efficiency and cultivating profitable new business ventures. This dual approach aims to counteract the market's inherent lower price and cost dynamics, as evidenced by their focus on margin improvement initiatives.

For instance, in 2024, the U.S. Consumer Price Index (CPI) saw an annual increase of 3.4% as of April, signaling ongoing inflationary pressures that impact input costs for companies like EMS-Chemie.

Demand from Key End-User Industries

Demand for EMS-Chemie's high-performance polymers and specialty chemicals is intrinsically linked to the health of its key end-user industries, including automotive, electronics, industrial, and packaging. The automotive sector, in particular, is a significant driver, with increasing adoption of lightweight plastics and materials for electric vehicles boosting demand. For instance, the global automotive plastics market was valued at approximately USD 35 billion in 2023 and is projected to grow significantly through 2030.

Conversely, broader industrial demand has faced headwinds. Global economic uncertainties and slower manufacturing output in certain regions have tempered growth in some industrial applications. However, the electronics sector continues to show resilience, fueled by ongoing innovation and demand for advanced materials in consumer electronics and semiconductors. The packaging industry also presents a stable demand base, with a growing emphasis on sustainable and high-performance solutions.

- Automotive Sector Growth: Driven by lightweighting and EV trends, contributing to strong demand for polymers.

- Electronics Resilience: Continued innovation in consumer electronics and semiconductors supports material demand.

- Industrial Demand Weakness: Global economic uncertainties have impacted overall industrial sector growth.

- Packaging Stability: Consistent demand from the packaging industry, with a focus on sustainable materials.

Capital Spending and Investment Environment

Capital spending within the chemical industry showed resilience in 2024, with notable growth in projects despite elevated borrowing costs. However, projections for 2025 indicate a slowdown due to persistent high interest rates, ongoing tariff disputes, and a prevailing climate of significant economic uncertainty.

EMS-Chemie Holding's financial strength is underscored by its capacity to sustain profitability even with these economic headwinds. This resilience points to a solid financial foundation, characterized by substantial equity and a debt-free structure.

- 2024 Chemical Industry Capital Expenditure: Saw growth, defying higher borrowing costs.

- 2025 Outlook: Expected slowdown in capital spending due to interest rates, tariffs, and uncertainty.

- EMS-Chemie's Financial Position: Robust profitability, high equity, and no debt.

The global economic landscape in early 2025 presented mixed signals, with a general slowdown affecting industrial output and consumer sentiment. This, coupled with specific regional challenges like increased regulatory costs in Europe and a need for stimulus in China, contributed to a modest year-over-year decline in EMS-Chemie's net sales.

The Swiss Franc's strength against major currencies like the Euro and US Dollar continued to be a significant factor, diminishing the value of foreign-denominated sales when converted back to Swiss Francs. This currency headwind is projected to keep 2025 net sales below 2024 levels, although EMS-Chemie's focus on high-margin specialties and cost management has helped maintain operating income.

Persistent inflation, particularly in the United States where the CPI saw a 3.4% annual increase by April 2024, alongside generally subdued price levels elsewhere, created a challenging environment. This necessitates careful strategic navigation by the company to enhance cost efficiency and develop profitable new business ventures, counteracting lower market price dynamics.

| Economic Factor | Impact on EMS-Chemie | Data Point/Trend |

|---|---|---|

| Global Economic Slowdown | Reduced industrial production and consumer confidence, impacting net sales. | Modest decline in net sales in Q1 2025 compared to prior year. |

| Swiss Franc Appreciation | Decreased value of foreign sales upon conversion, lowering reported net sales. | Projected to keep 2025 net sales below 2024 figures. |

| Inflation | Increased input costs and necessitates careful pricing strategies. | US CPI annual increase of 3.4% as of April 2024. |

| Interest Rates & Tariffs | Dampened capital spending outlook for the chemical industry in 2025. | Projected slowdown in 2025 capital expenditure due to high rates and trade disputes. |

Full Version Awaits

EMS-Chemie Holding PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of EMS-Chemie Holding delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. You'll gain a clear understanding of the external forces shaping the specialty chemicals market.

Sociological factors

Consumers are increasingly prioritizing sustainability, with a significant portion willing to pay more for eco-friendly products. This trend is driving demand for recycled materials and reduced carbon emissions across industries.

In 2023, the global market for sustainable products reached an estimated $150 billion, with projections indicating continued strong growth. This societal shift directly impacts companies like EMS-Chemie, encouraging innovation in bio-based polymers and circular economy initiatives to align with evolving consumer values.

The automotive sector's pivot towards electric vehicles (EVs) and lightweight construction is a major societal shift. This directly plays into EMS-Chemie's strengths, as advanced polymers are crucial for both. For instance, by 2024, global EV sales are projected to exceed 15 million units, a substantial increase from previous years, highlighting the growing demand for materials that enhance battery range and vehicle efficiency.

Lightweighting, essential for improving fuel economy in internal combustion engine vehicles and extending range in EVs, relies heavily on plastics and composites. These materials can replace heavier metal components, contributing to significant weight reduction. By 2025, the automotive lightweight materials market is expected to reach over $200 billion, underscoring the immense opportunity for companies like EMS-Chemie that supply these innovative solutions.

Growing public awareness and concern over the health and environmental impacts of chemicals like PFAS are significantly influencing consumer choices and regulatory landscapes. This societal pressure is compelling companies like EMS-Chemie to prioritize product safety and explore sustainable alternatives, impacting R&D investments and supply chain management.

For instance, the European Chemicals Agency (ECHA) has been actively considering restrictions on PFAS, with proposals for a broad ban on thousands of these substances gaining momentum through 2024 and into 2025. This regulatory environment directly affects industries relying on fluorinated chemicals, pushing for innovation in non-fluorinated materials to meet evolving safety standards and maintain market access.

Urbanization and Infrastructure Development

Global urbanization continues at a rapid pace, with projections indicating that by 2050, nearly 70% of the world's population will reside in urban areas. This demographic shift fuels substantial government investments in infrastructure development worldwide. For instance, the United Nations estimates that global infrastructure spending needs to reach $94 trillion by 2040 to support sustainable development and economic growth.

These infrastructure projects, encompassing everything from transportation networks and energy grids to water systems and housing, directly increase demand for specialty chemicals. EMS-Chemie's product portfolio, which includes high-performance polymers and adhesives crucial for construction, automotive, and electronics sectors, is well-positioned to benefit from this trend. The company's materials are integral to creating more durable, efficient, and sustainable infrastructure solutions.

- Urban Population Growth: Expected to reach 6.7 billion by 2050, driving demand for urban infrastructure.

- Infrastructure Investment Needs: Global requirement estimated at $94 trillion by 2040.

- Sectoral Demand: Increased need for chemicals in construction, automotive, and electronics due to infrastructure projects.

Workforce Skills and Development

The chemical sector, including companies like EMS-Chemie, absolutely relies on a highly skilled workforce. This expertise is crucial for pushing innovation and keeping their advanced manufacturing operations running smoothly. In 2024, the demand for specialized chemical engineers and technicians remained robust, with reports indicating a 4.5% increase in job postings for these roles compared to the previous year.

EMS-Chemie's strategic emphasis on growing its team, particularly in technical sales and development, underscores this need. They are actively investing in people to support their expansion into niche markets and the development of new business ventures. This focus on talent acquisition and retention is a key driver for their long-term success.

The company's commitment to its apprenticeship programs further illustrates its dedication to cultivating future talent. These programs are vital for building a pipeline of skilled professionals who understand the intricacies of the chemical industry and can contribute to EMS-Chemie's growth. In 2025, EMS-Chemie reported that over 15% of its new hires in technical roles came directly from its apprenticeship initiatives.

- Skilled Workforce: Chemical industry innovation and advanced manufacturing depend on specialized expertise.

- Personnel Expansion: EMS-Chemie prioritizes growth in technical sales and development roles.

- Talent Development: Apprenticeship programs are key to fostering internal talent for future business needs.

- Industry Demand: Job postings for chemical engineers and technicians saw a 4.5% rise in 2024.

Societal shifts toward sustainability are a significant driver for EMS-Chemie, with consumers increasingly favoring eco-friendly products. This trend is amplified by growing concerns over chemical safety, as evidenced by regulatory scrutiny of substances like PFAS, pushing companies toward safer alternatives.

The global push for electric vehicles and lightweight construction directly benefits EMS-Chemie, given the critical role of advanced polymers in these areas. Likewise, rapid urbanization worldwide necessitates substantial infrastructure investment, creating a strong demand for the specialty chemicals and high-performance polymers that EMS-Chemie provides.

| Societal Factor | Trend/Impact | Relevance to EMS-Chemie | Data Point (2024/2025) |

|---|---|---|---|

| Sustainability Focus | Consumer preference for eco-friendly products | Drives demand for bio-based and recycled materials | Global sustainable products market projected to grow significantly |

| Chemical Safety Concerns | Public awareness of health/environmental impacts (e.g., PFAS) | Necessitates product safety innovation and exploration of alternatives | ECHA's ongoing consideration of broad PFAS restrictions |

| Urbanization & Infrastructure | Global population shift to urban areas | Increases demand for construction, automotive, and electronics materials | Global infrastructure spending needs estimated at $94 trillion by 2040 |

Technological factors

Continuous advancements in polymer science are enabling the creation of novel high-performance polymers. These materials boast superior mechanical strength, improved chemical resistance, and enhanced thermal stability, directly impacting product development across sectors.

Innovations such as bio-based and recycled polymers are becoming increasingly vital. For EMS-Chemie, these developments are crucial for addressing the growing market demand for lightweight, durable, and sustainable materials, particularly in the automotive and electronics industries where material efficiency is paramount.

EMS-Chemie's competitive edge is increasingly tied to its adoption of advanced manufacturing techniques. The company utilizes methods like gas-assisted injection molding and multi-shot molding, which are vital for creating intricate, lightweight plastic components essential for industries such as automotive and electronics. These processes enhance precision and minimize material waste, directly supporting EMS-Chemie's capacity for delivering highly customized solutions efficiently.

The relentless drive towards smaller, more powerful electronic devices fuels the demand for sophisticated chemicals and materials. Miniaturization in semiconductors, for instance, requires ultra-high purity substances for etching and deposition processes, areas where EMS-Chemie's expertise in specialty chemicals is crucial.

The burgeoning field of flexible electronics, seen in wearable tech and foldable displays, further amplifies this need. These applications often rely on novel polymers and conductive materials, presenting significant growth opportunities for companies like EMS-Chemie that can supply these advanced components. The global flexible electronics market was valued at approximately $15 billion in 2023 and is projected to reach over $40 billion by 2030, showcasing the immense potential.

Digitalization and Industry 4.0

The chemical and automotive plastics sectors are increasingly embracing digitalization and Industry 4.0 principles. This involves integrating technologies like the Internet of Things (IoT) for automation, advanced sensors, and artificial intelligence (AI) directly into manufacturing. These advancements are crucial for optimizing production efficiency and elevating quality control, directly impacting competitiveness.

For EMS-Chemie, adopting these trends is paramount. By streamlining operations through smart manufacturing, the company can achieve significant gains. For instance, AI-driven predictive maintenance can reduce downtime, while IoT sensors offer real-time process monitoring, leading to fewer defects and more consistent product quality. This technological evolution is not just about efficiency; it's about building a more resilient and responsive supply chain.

- Increased Automation: Industry 4.0 adoption in manufacturing is projected to boost global manufacturing output by up to 15% by 2030, according to various industry reports, with automation playing a key role.

- Data-Driven Decisions: Real-time data from sensors and connected devices enables faster, more informed decision-making, reducing errors and improving resource allocation.

- Enhanced Quality Control: AI and machine learning algorithms can identify anomalies in production faster and more accurately than traditional methods, minimizing product defects.

- Supply Chain Visibility: IoT integration provides end-to-end visibility across the supply chain, allowing for better inventory management and logistics optimization.

Recycling Technologies and Circularity

Breakthroughs in recycling technologies, such as enzymatic recycling and advanced chemical processes that convert waste into reusable polymers, are significantly propelling the global circular economy for plastics. These innovations are making it more feasible to create high-quality recycled materials, reducing reliance on virgin resources.

EMS-Chemie's commitment to sustainable solutions directly benefits from these technological leaps. By integrating recycled content into its product lines, the company not only aligns with environmental goals but also enhances its market position in an increasingly sustainability-conscious industry. For instance, the company is actively exploring ways to incorporate post-consumer recycled (PCR) materials into its high-performance polymers.

- Advancements in chemical recycling are enabling the breakdown of complex plastic waste into its original monomers, which can then be repolymerized into virgin-quality plastics.

- Enzymatic recycling offers a biological approach to breaking down specific plastic types, like PET, into their constituent parts for reuse.

- The global plastic recycling market was valued at approximately USD 45 billion in 2023 and is projected to grow significantly in the coming years, driven by technological innovation and regulatory pressure.

- EMS-Chemie's strategy includes investing in research and development to optimize the use of recycled feedstocks in its production processes, aiming to increase the percentage of recycled content in its offerings.

Technological advancements are reshaping material science, with innovations in polymer chemistry leading to high-performance materials possessing superior strength and thermal stability. The increasing demand for lightweight, durable, and sustainable plastics, particularly in the automotive and electronics sectors, is a direct result of these material science breakthroughs, presenting significant opportunities for companies like EMS-Chemie.

The integration of Industry 4.0 principles, including AI and IoT, is revolutionizing manufacturing processes. These technologies enhance automation, improve data-driven decision-making, and elevate quality control, leading to increased efficiency and reduced defects. For EMS-Chemie, adopting these smart manufacturing techniques is crucial for maintaining a competitive edge and optimizing production.

Breakthroughs in recycling technologies, such as enzymatic and chemical recycling, are driving the circular economy for plastics. These innovations enable the creation of high-quality recycled materials, reducing reliance on virgin resources and aligning with growing market demand for sustainable solutions. EMS-Chemie's investment in R&D for recycled feedstocks positions it favorably within this evolving landscape.

| Technological Trend | Impact on EMS-Chemie | Key Data/Projections |

|---|---|---|

| Advanced Polymer Science | Development of novel high-performance polymers for automotive and electronics. | Market for specialty polymers expected to grow significantly. |

| Industry 4.0 & AI | Enhanced automation, efficiency, and quality control in manufacturing. | Industry 4.0 adoption projected to boost global manufacturing output. |

| Recycling Technologies | Increased use of recycled content, supporting sustainability goals. | Global plastic recycling market projected for significant growth. |

| Flexible Electronics | Demand for new polymers and conductive materials. | Flexible electronics market projected to reach over $40 billion by 2030. |

Legal factors

The upcoming 2025 revision of the EU's REACH regulation will impose more rigorous chemical safety standards, particularly concerning the restriction of hazardous substances across various product groups. This necessitates that chemical producers, including EMS-Chemie, update their product documentation and Safety Data Sheets, alongside reinforcing their risk management strategies to comply with these evolving requirements.

The 2025 REACH revision is significantly impacting chemical industries by proposing stricter regulations on PFAS. A key aspect is the move towards a broad ban on these substances in consumer goods, forcing companies like EMS-Chemie to adapt.

While certain critical industrial applications may be exempted under 'essential use' criteria if no alternatives are available, EMS-Chemie must proactively manage these evolving legal landscapes. This includes investing in research and development to create PFAS-free alternatives, ensuring compliance and market access.

New End-of-Life Vehicle (ELV) directives are significantly impacting the automotive industry by mandating increased recycled plastic content. These regulations require 20% recycled plastics, including 10% from post-consumer sources, within six years, escalating to 25% within ten years. This creates a strong incentive for automakers and their suppliers, such as EMS-Chemie, to enhance their use of recycled polymers.

Product Labeling and Information Transparency

New European Union regulations, specifically the updated rules on the Classification, Labelling and Packaging (CLP) of chemicals, are set to significantly influence product labeling and information transparency for companies like EMS-Chemie. These regulations, with key dates of September 1, 2025, for classification and labeling, and July 1, 2026, for broader industry obligations, aim to bolster chemical safety and ensure consumers have clearer access to essential information. This means EMS-Chemie will need to adapt its communication strategies to comply with these enhanced transparency requirements.

The CLP updates mandate that websites must clearly present the hazardous properties of chemicals, and even advertisements will need to include hazard information. This directly impacts how EMS-Chemie markets its products, requiring a more upfront and detailed disclosure of any potential risks. For instance, if a particular polymer compound from EMS-Chemie is classified as a skin irritant, this information will need to be readily accessible on its product pages and potentially mentioned in marketing materials, adding a layer of complexity to their communication efforts.

- Enhanced Chemical Safety: New EU CLP regulations from September 1, 2025, and July 1, 2026, will increase chemical safety standards.

- Information Transparency Mandate: Websites must clearly display hazardous properties, affecting product communication strategies.

- Advertising Requirements: Advertisements will also need to contain hazard information, necessitating careful message crafting.

- Compliance Impact: EMS-Chemie must adapt its product labeling and online presence to meet these new transparency obligations.

International Trade Laws and Tariffs

Changes in international trade laws and the imposition of tariffs, like those seen in recent years from major economies, directly affect global supply chains and the trade relationships of chemical companies. For instance, the US initiated tariffs on various goods, impacting import and export costs. EMS-Chemie, a player in the specialty chemicals sector, has proactively adjusted its supply chain and manufacturing footprints to navigate these trade barriers and customs complexities.

These strategic adaptations are crucial for maintaining competitiveness. For example, by diversifying production locations, EMS-Chemie can reduce its reliance on single-source supply chains vulnerable to geopolitical shifts or sudden tariff increases. This approach helps to buffer against the financial impact of trade disputes and ensures more stable access to key markets.

- Impact of Tariffs: US tariffs on goods from China, for example, have led to increased costs for many industries, including chemicals, by raising the price of imported raw materials and intermediate products.

- Supply Chain Resilience: Companies like EMS-Chemie are investing in regionalizing production to mitigate risks associated with international trade disruptions.

- Trade Agreements: The evolution of trade agreements, such as potential updates to existing pacts or new bilateral deals, can significantly alter market access and regulatory landscapes for chemical exports.

- Customs Regulations: Stricter customs enforcement and evolving documentation requirements can add administrative burdens and delays to cross-border chemical shipments.

The upcoming 2025 revision of EU regulations, particularly the REACH and CLP frameworks, will significantly heighten chemical safety standards and demand greater transparency in product information. These legal shifts necessitate that companies like EMS-Chemie meticulously update safety data sheets and product labeling, with new CLP rules impacting websites and advertising from September 2025 and July 2026 respectively.

Furthermore, evolving End-of-Life Vehicle (ELV) directives are pushing for higher recycled plastic content, with mandates for 20% recycled plastics (10% post-consumer) within six years and 25% within ten. This legal push creates a strong incentive for EMS-Chemie to integrate more recycled polymers into its automotive material offerings.

International trade law, including recent tariff impositions by major economies, directly impacts global supply chains. For instance, US tariffs have increased import costs for many sectors. EMS-Chemie has strategically adapted by diversifying production to mitigate risks from trade disruptions and customs complexities, aiming for greater supply chain resilience.

Environmental factors

The global drive toward a circular economy for plastics is intensifying, creating a strong demand for recycled polymers and more sustainable production methods. This environmental shift directly impacts companies like EMS-Chemie, encouraging innovation in material sourcing and product design to meet evolving market expectations.

EMS-Chemie's strategic emphasis on developing advanced solutions and tailored products positions them well to capitalize on this trend. Their commitment to reducing plastic waste and increasing the incorporation of post-consumer recycled (PCR) materials aligns with key circular economy principles, potentially boosting their market share in environmentally conscious sectors.

For instance, the European Union's ambitious targets, aiming for 100% of plastic packaging to be reusable or economically recyclable by 2030, underscore the urgency and scale of this environmental factor. This regulatory push, coupled with growing consumer awareness, creates a fertile ground for companies offering genuinely circular solutions.

Stricter emissions regulations and the global push for carbon footprint reduction are significantly shaping industries like automotive and manufacturing. This trend directly impacts demand for lightweight materials and sustainable production methods. For example, the European Union's CO2 emission standards for new cars, targeting an average of 95g CO2/km for 2020 and aiming for further reductions by 2030, underscore this regulatory pressure.

EMS-Chemie's high-performance polymers play a crucial role in addressing these environmental concerns. By enabling lighter vehicle components, these materials contribute to improved fuel efficiency and a subsequent decrease in CO2 emissions. In 2023, the automotive sector continued its drive towards electrification and lightweighting, with many manufacturers setting ambitious targets for emission reductions, directly benefiting suppliers of advanced polymer solutions.

The global polymer industry faces increasing pressure to improve waste management and recycling infrastructure, a trend directly impacting companies like EMS-Chemie. By 2024, the European Union aims to increase its recycling rate for plastic packaging to 55%, with a target of 70% by 2030, underscoring the need for robust recycling capabilities.

Innovations in chemical recycling, which can break down plastics into their original monomers, offer significant opportunities for EMS-Chemie to incorporate a higher percentage of recycled materials into its high-performance polymers. Investments in this area are growing, with the global chemical recycling market projected to reach approximately $2.7 billion by 2027, signaling a substantial shift towards circular economy principles.

Resource Scarcity and Sustainable Sourcing

Growing concerns over resource scarcity, particularly for fossil fuel-based feedstocks, are compelling the chemical industry to prioritize sustainable sourcing. This environmental pressure is accelerating the development and adoption of bio-based chemicals and renewable alternatives. For instance, projections indicate the global bio-based chemicals market could reach approximately USD 400 billion by 2027, underscoring this significant industry shift.

Companies like EMS-Chemie are therefore incentivized to invest in research and development for more eco-friendly materials and processes. This includes exploring novel feedstocks and optimizing resource efficiency throughout their value chain to mitigate risks associated with dwindling conventional resources.

- Market Shift: The global bio-based chemicals market is projected to grow substantially, indicating a strong demand for sustainable alternatives.

- Resource Dependency: Reliance on finite fossil fuels presents a long-term risk for chemical manufacturers.

- Innovation Driver: Environmental regulations and consumer demand for sustainable products are pushing innovation in feedstock sourcing and production methods.

- Efficiency Focus: Companies are increasingly adopting resource-efficient practices to reduce waste and energy consumption.

Environmental Impact of Chemical Production

The chemical industry, including companies like EMS-Chemie, faces significant environmental scrutiny due to its potential for hazardous waste generation and pollution. For instance, in 2023, the European Environment Agency reported that the chemical sector remained a key contributor to industrial emissions, although there was a noted decrease in certain pollutants compared to previous years.

Regulatory frameworks such as REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) and CLP (Classification, Labelling and Packaging) are crucial in managing these environmental risks. These regulations compel chemical producers to demonstrate the safety of their substances and implement responsible manufacturing processes, impacting operational costs and product development strategies.

Adherence to these stringent environmental protection standards requires substantial investment in sustainable technologies and waste management. For example, EMS-Chemie's commitment to environmental responsibility is reflected in its ongoing efforts to optimize production processes, aiming to reduce energy consumption and greenhouse gas emissions. In 2024, the company highlighted its progress in achieving a 15% reduction in CO2 emissions per ton of product compared to its 2020 baseline.

- Hazardous Waste: Chemical production inherently generates by-products that require careful handling and disposal to prevent soil and water contamination.

- Pollution Control: Air and water pollution from chemical plants are major concerns, driving the need for advanced filtration and treatment systems.

- Regulatory Compliance: REACH and CLP regulations in the EU, and similar laws globally, mandate rigorous testing and reporting on chemical safety and environmental impact, adding to operational complexity and cost.

- Sustainability Initiatives: Companies are increasingly investing in green chemistry principles and circular economy models to minimize their environmental footprint and meet evolving stakeholder expectations.

The push for a circular economy is a significant environmental factor, driving demand for recycled plastics and sustainable manufacturing. EMS-Chemie's focus on advanced, tailored solutions and incorporating post-consumer recycled materials aligns with this trend, positioning them to capture market share in eco-conscious sectors.

Stricter emissions regulations, particularly in the automotive sector, favor lightweight materials that improve fuel efficiency. EMS-Chemie's high-performance polymers contribute to this by enabling lighter vehicle components, directly supporting manufacturers' goals for emission reductions. For example, many automotive companies set ambitious targets for emission reductions in 2023, benefiting suppliers of advanced polymer solutions.

Resource scarcity, especially concerning fossil fuel feedstocks, is accelerating the adoption of bio-based chemicals. Projections indicate the global bio-based chemicals market could reach approximately USD 400 billion by 2027, highlighting the industry's shift towards renewable alternatives and incentivizing companies like EMS-Chemie to invest in eco-friendly materials.

The chemical industry faces scrutiny over hazardous waste and pollution, necessitating adherence to strict environmental standards like REACH and CLP. EMS-Chemie's reported 15% reduction in CO2 emissions per ton of product by 2024, compared to a 2020 baseline, demonstrates their commitment to sustainable practices and regulatory compliance.

| Environmental Factor | Key Trend | Impact on EMS-Chemie | Supporting Data/Example |

| Circular Economy | Increasing demand for recycled plastics | Opportunity for growth with PCR materials | EU target: 55% plastic packaging recycling by 2024 |

| Emissions Regulations | Demand for lightweight materials | Benefit from high-performance polymers in automotive | Automotive sector's 2023 emission reduction targets |

| Resource Scarcity | Shift to bio-based chemicals | Incentive for R&D in eco-friendly feedstocks | Bio-based chemicals market projected at USD 400 billion by 2027 |

| Pollution & Waste Management | Stringent environmental standards | Investment in sustainable tech and process optimization | EMS-Chemie's 15% CO2 reduction per ton by 2024 (vs. 2020) |

PESTLE Analysis Data Sources

Our PESTLE Analysis for EMS-Chemie Holding is built on a robust foundation of data from official financial reports, industry-specific market research, and reputable news outlets. We meticulously gather insights on political stability, economic forecasts, technological advancements, and regulatory changes impacting the chemical sector.