EMS-Chemie Holding Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EMS-Chemie Holding Bundle

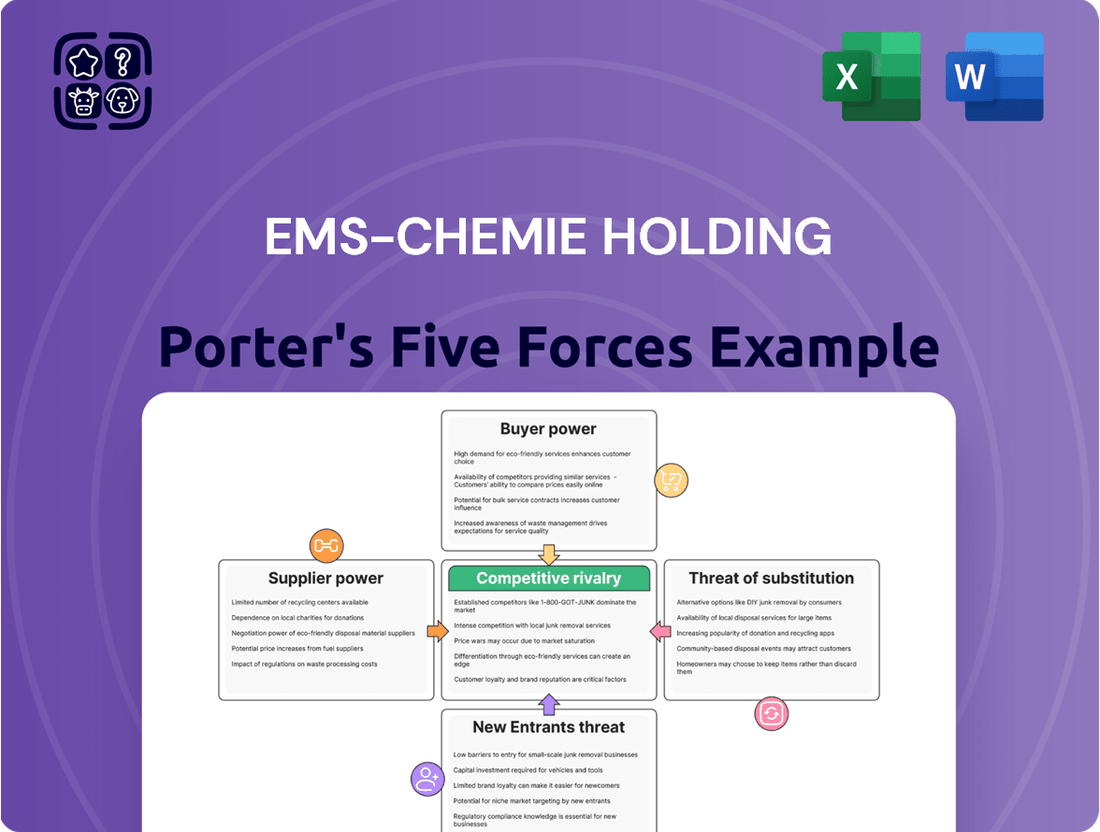

EMS-Chemie Holding operates in a dynamic market shaped by intense competition, significant buyer power, and the constant threat of substitutes. Understanding these forces is crucial for navigating its strategic landscape.

The complete report reveals the real forces shaping EMS-Chemie Holding’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for EMS-Chemie Holding is significantly shaped by the concentration within its raw material supply chain. If a small number of companies dominate the provision of essential high-performance polymers or specialized chemical components, those suppliers gain considerable leverage to dictate terms and pricing. For instance, in 2024, the global market for certain advanced engineering plastics saw a notable consolidation, with the top three producers controlling over 60% of the market share, potentially increasing their pricing influence on downstream manufacturers like EMS-Chemie.

The availability of substitute raw materials significantly influences the bargaining power of EMS-Chemie's suppliers. If EMS-Chemie can easily source comparable materials from different vendors, it reduces the dependence on any single supplier, thereby weakening their leverage. For instance, in 2023, the global specialty chemicals market saw increased competition, with several new entrants offering alternative polymer compounds, giving buyers like EMS-Chemie more options.

High switching costs for EMS-Chemie to change raw material suppliers significantly bolster supplier bargaining power. These costs can be substantial, encompassing expenses related to re-tooling production lines to accommodate new materials, the rigorous process of re-qualifying alternative substances to meet stringent quality standards, and the potential disruption to established, efficient supply chains. For instance, if a new polymer requires extensive testing and validation to ensure it meets EMS-Chemie's performance specifications, the supplier of that polymer gains leverage.

Uniqueness of Raw Materials

The uniqueness and proprietary nature of the raw materials supplied to EMS-Chemie significantly influence supplier bargaining power. When suppliers offer patented or highly specialized chemicals and polymers that are essential for EMS-Chemie's innovative product lines, their leverage increases substantially.

EMS-Chemie's strategic emphasis on developing advanced, innovative solutions often necessitates reliance on these specialized inputs. This dependence means suppliers of these unique materials hold considerable sway in pricing and terms.

- Proprietary Polymers: EMS-Chemie's core business relies on high-performance polymers, many of which are developed through proprietary processes or are protected by patents.

- Limited Supplier Pool: For these specialized materials, the number of qualified suppliers is often limited, concentrating power among a few key providers.

- R&D Collaboration: In some cases, EMS-Chemie may collaborate with suppliers on research and development, further solidifying the supplier's unique position and potential for increased bargaining power.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into EMS-Chemie's core business of producing high-performance polymers and specialty chemicals is a significant concern. If suppliers were to enter this manufacturing space, they could directly compete with EMS-Chemie, thereby increasing their bargaining power and potentially disrupting the market. This scenario is more plausible for suppliers involved in less complex downstream processes within the chemical value chain.

For instance, if a key raw material supplier for EMS-Chemie's advanced polymer compounds also possessed the technology and capital to produce those compounds, they could choose to bypass EMS-Chemie and sell directly to end-users. This would not only reduce EMS-Chemie's customer base but also give the supplier greater control over pricing and market access. The overall market size for specialty chemicals and high-performance polymers is substantial, with global revenues projected to reach hundreds of billions of dollars annually by 2024, making the prospect of direct market entry attractive for some suppliers.

- Supplier Forward Integration Risk: Suppliers may leverage their position to enter EMS-Chemie's core polymer and specialty chemical production.

- Increased Bargaining Power: Successful forward integration by suppliers would enhance their leverage in negotiations with EMS-Chemie.

- Complexity Threshold: The threat is generally more pronounced for suppliers dealing with less intricate downstream manufacturing stages.

The bargaining power of suppliers for EMS-Chemie Holding is amplified by the specialized nature of its raw materials, particularly high-performance polymers. When suppliers offer unique, patented, or proprietary materials essential for EMS-Chemie's advanced product lines, their leverage in pricing and terms increases significantly. This dependence is further heightened if the supplier pool for these critical inputs is limited, as was observed in 2024 with certain advanced engineering plastics where the top three producers held over 60% market share.

The potential for suppliers to integrate forward into EMS-Chemie's core business also strengthens their bargaining position. If suppliers can manufacture the finished polymers themselves, they could bypass EMS-Chemie and compete directly. This threat is more pronounced for suppliers involved in less complex manufacturing stages within the chemical value chain. The substantial global specialty chemicals market, projected to exceed hundreds of billions in revenue by 2024, makes direct market entry an attractive prospect for some suppliers.

| Factor | Impact on EMS-Chemie | 2024 Data/Observation |

|---|---|---|

| Supplier Concentration | High leverage for dominant suppliers | Top 3 advanced engineering plastic producers controlled >60% market share. |

| Availability of Substitutes | Weakens supplier power | Increased competition in specialty chemicals with new entrants in 2023. |

| Switching Costs | Bolsters supplier power | Costs include re-tooling, re-qualification, and supply chain disruption. |

| Uniqueness of Materials | Increases supplier leverage | Reliance on proprietary, patented, or highly specialized polymers. |

| Forward Integration Threat | Enhances supplier bargaining power | Suppliers could enter EMS-Chemie's core polymer production. |

What is included in the product

This analysis delves into the competitive forces shaping EMS-Chemie Holding's market, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the specialty chemicals sector.

Instantly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces, allowing for proactive strategic adjustments.

Customers Bargaining Power

The concentration of EMS-Chemie's customers plays a significant role in their bargaining power. If a few major clients account for a substantial percentage of the company's revenue, these large customers can leverage their purchasing volume to negotiate more favorable pricing and terms. For instance, a significant portion of EMS-Chemie's sales in the automotive sector might come from a handful of major car manufacturers, giving them considerable influence.

Customer switching costs for high-performance polymers and specialty chemicals are a key factor in assessing customer bargaining power. If these costs are low, customers can more easily switch to competitors, which strengthens their negotiating position. For instance, if a client can transition to another supplier of specialty polymers with minimal investment in new equipment or retraining, their ability to demand better pricing or terms from EMS-Chemie increases.

In 2024, the specialty chemicals market continued to see innovation, with many players offering comparable solutions. This competitive landscape, combined with a general trend towards modularity in manufacturing processes, can contribute to lower switching costs for many customers. If EMS-Chemie’s products can be readily substituted by readily available alternatives without significant integration challenges, customers hold more sway.

However, EMS-Chemie's strategy often involves developing highly customized polymer solutions tailored to specific client needs and applications. This bespoke approach can significantly raise switching costs for customers. Migrating to a competitor would likely require substantial re-engineering, testing, and validation of new materials, thereby locking in existing clients and reducing their bargaining power.

Customer price sensitivity is a major factor in how much power buyers have. When products are easily compared and competition is fierce on price, customers tend to push harder for lower costs from suppliers like EMS-Chemie. This is especially true in sectors where EMS-Chemie's materials are used.

For instance, the automotive sector, a significant market for EMS-Chemie, saw average profit margins in the low single digits for many manufacturers in 2024, making them highly attuned to component costs. Similarly, the electronics industry, another key customer base, often operates on thin margins, amplifying customer pressure on pricing for raw materials and specialized polymers.

Customers' Threat of Backward Integration

The threat of customers integrating backward into the production of high-performance polymers or specialty chemicals directly enhances their bargaining power against EMS-Chemie. This possibility becomes more pronounced when the manufacturing processes are not overly complex or when the customer operates at a substantial scale, allowing them to absorb production costs more efficiently.

For instance, a large automotive manufacturer, a key customer for EMS-Chemie, might consider in-house production if the capital expenditure for polymer synthesis is justifiable against the ongoing supply costs. This leverage allows them to negotiate better pricing or terms with EMS-Chemie, knowing they have an alternative. In 2024, the trend of vertical integration among major industrial players seeking greater supply chain control continues, particularly in sectors reliant on advanced materials.

- Customer Scale: Larger customers with significant volume requirements are more likely to explore backward integration.

- Process Complexity: Simpler production processes reduce the barrier to entry for customers.

- Specialization Impact: The threat is lower for highly specialized or proprietary materials where EMS-Chemie holds a technological advantage.

- Market Dynamics: Broader market trends favoring supply chain resilience can encourage customer integration efforts.

Availability of Substitute Products for Customers

The availability of substitute products for customers is a significant factor influencing EMS-Chemie Holding's bargaining power. When customers have access to alternative materials or products that can fulfill similar needs, their ability to negotiate prices and terms with EMS-Chemie increases. This is particularly true if these substitutes offer comparable performance at a more attractive cost point.

For instance, if customers can readily switch to different types of polymers, advanced metals, or even composite materials that deliver equivalent functionality, EMS-Chemie's leverage in pricing discussions is naturally reduced. This competitive landscape forces EMS-Chemie to remain price-competitive and innovative to retain its market share and pricing power.

- Increased Customer Choice: Customers can choose from a wider array of materials, reducing reliance on any single supplier.

- Price Sensitivity: The presence of substitutes makes customers more sensitive to price increases from EMS-Chemie.

- Performance Parity: If substitutes offer similar or even superior performance, customer switching costs may be low.

- Market Dynamics: In 2024, the global specialty chemicals market, where EMS-Chemie operates, continued to see innovation in material science, potentially introducing new substitutes.

The bargaining power of EMS-Chemie's customers is influenced by their concentration and the ease with which they can switch suppliers. In 2024, the automotive sector, a key market for EMS-Chemie, faced margin pressures, making its major manufacturers highly sensitive to component costs, thus increasing their negotiating leverage.

The availability of substitutes and the potential for customers to integrate backward into production also bolster their power. For example, if a large client can develop similar high-performance polymers internally without prohibitive costs, they gain significant leverage over EMS-Chemie.

EMS-Chemie's ability to mitigate this power lies in creating highly specialized, customized solutions that raise switching costs for its clients, thereby locking them in and reducing their ability to negotiate aggressively on price or terms.

| Factor | Impact on Customer Bargaining Power | EMS-Chemie Mitigation Strategy |

|---|---|---|

| Customer Concentration | High for large, few customers | Develop customized solutions |

| Switching Costs | Low if alternatives are readily available | Increase product specialization |

| Price Sensitivity | High in low-margin industries (e.g., Automotive 2024) | Offer value-added services |

| Backward Integration Threat | Moderate for complex processes | Maintain technological lead |

Full Version Awaits

EMS-Chemie Holding Porter's Five Forces Analysis

This preview displays the complete, professionally written Porter's Five Forces Analysis for EMS-Chemie Holding, offering a deep dive into the competitive landscape of the specialty chemicals sector. You're examining the exact document that will be available to you instantly upon purchase, ensuring you receive a fully formatted and actionable strategic tool. This analysis meticulously breaks down the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within EMS-Chemie's operating environment.

Rivalry Among Competitors

The high-performance polymers and specialty chemicals sectors are highly competitive, featuring numerous significant global participants. Key players such as BASF SE, DuPont, Solvay, Evonik Industries, and Victrex plc operate within the high-performance polymers market, indicating a robust competitive environment.

The growth rate within the high-performance polymers and specialty chemicals sectors directly impacts competitive rivalry. The high-performance polymers market is projected to expand at a compound annual growth rate of approximately 6.35% from 2025 to 2035, indicating a healthy expansion.

Furthermore, the specialty chemicals industry is anticipated to reach a substantial USD 1 trillion by 2025. Such robust growth, however, can be a double-edged sword, potentially luring new competitors into the market and consequently intensifying the competitive landscape among established firms.

The level of product differentiation in the high-performance polymers and specialty chemicals markets significantly influences competitive rivalry. EMS-Chemie's strategy centers on developing innovative and tailored solutions to stand out from competitors.

However, if rivals can readily imitate these specialized products, the intensity of competition will persist. For instance, in 2024, the specialty chemicals market saw ongoing innovation, with companies like BASF and Dow investing heavily in R&D to create unique material properties, a trend that directly impacts EMS-Chemie's differentiation efforts.

Switching Costs for Customers

Low switching costs for customers in the high-performance polymers and specialty chemicals market can significantly heat up competition. When it's easy and inexpensive for customers to switch suppliers, companies must work harder to keep them, often through aggressive pricing or innovation. This dynamic means competitors are constantly trying to win over market share.

EMS-Chemie recognizes this and actively works to create stronger customer relationships. By focusing on tailored solutions and excellent service, they aim to make it less appealing for customers to switch to another provider, thereby fostering loyalty.

- Low Switching Costs: Customers can easily move between suppliers of high-performance polymers and specialty chemicals without incurring substantial financial or operational penalties.

- Intensified Rivalry: This ease of switching encourages competitors to aggressively compete for market share, often through price wars or enhanced product offerings.

- EMS-Chemie's Strategy: The company focuses on developing customer-centric solutions and building strong relationships to increase customer retention and mitigate the impact of low switching costs.

- Market Dynamics: In 2024, the specialty chemicals sector saw continued demand for customized solutions, making supplier reliability and innovation key factors in customer retention, even with low inherent switching costs.

Exit Barriers

High exit barriers in the high-performance polymers and specialty chemicals sectors significantly intensify competitive rivalry. Companies are often locked into substantial capital investments in specialized production facilities, requiring extensive technical expertise and often involving long-term customer contracts. This makes it economically challenging to simply cease operations or divest assets, compelling firms to remain and compete vigorously even during periods of economic downturn or low profitability.

For instance, the specialty chemicals industry is characterized by high fixed costs associated with research and development, manufacturing plants, and regulatory compliance. In 2023, the global specialty chemicals market was valued at approximately $700 billion, with significant portions dedicated to R&D and capital expenditures. Companies like EMS-Chemie, heavily invested in these areas, face substantial penalties or losses if they attempt to exit prematurely, thus perpetuating intense competition among remaining players.

- High Capital Investment: Specialized manufacturing equipment and advanced R&D facilities represent substantial sunk costs, making divestment difficult.

- Specialized Knowledge and Technology: Proprietary processes and skilled labor are not easily transferable, increasing the cost of exit.

- Long-Term Customer Contracts: Commitments to supply key clients can bind companies to the market, even when returns are suboptimal.

- Regulatory and Environmental Obligations: Decommissioning plants and managing environmental liabilities add further complexity and cost to exiting the industry.

The competitive rivalry within the high-performance polymers and specialty chemicals sectors is substantial, driven by the presence of major global players like BASF, DuPont, and Evonik. These companies actively invest in R&D, as evidenced by the specialty chemicals market's projected USD 1 trillion valuation by 2025, which fuels continuous innovation and product differentiation efforts.

The market's growth, with the high-performance polymers sector expected to grow at a CAGR of approximately 6.35% from 2025 to 2035, attracts new entrants and intensifies competition. Low switching costs for customers exacerbate this, compelling firms like EMS-Chemie to focus on tailored solutions and strong relationships to retain business.

High exit barriers, including significant capital investments in specialized facilities and R&D, further entrench existing competitors, ensuring rivalry remains fierce even during economic downturns. For instance, the global specialty chemicals market’s substantial value in 2023 underscores the deep financial commitments that make exiting the industry costly.

| Key Competitors (Examples) | Market Segment | 2024 R&D Focus (Illustrative) | Customer Retention Strategy |

|---|---|---|---|

| BASF SE | Specialty Chemicals, High-Performance Polymers | New material properties, sustainable solutions | Customized product development, technical support |

| DuPont | High-Performance Polymers, Specialty Materials | Advanced composites, electronic materials | Application-specific solutions, global supply chain |

| Evonik Industries | Specialty Chemicals, High-Performance Polymers | Lightweight materials, bio-based chemicals | Collaborative innovation, long-term partnerships |

| Solvay | Specialty Polymers, Advanced Materials | Aerospace applications, battery materials | High-performance solutions, regulatory expertise |

| Victrex plc | High-Performance Polymers (PEEK) | Wear resistance, thermal stability | Technical expertise, application development support |

SSubstitutes Threaten

The threat of substitutes for EMS-Chemie's high-performance polymers hinges on the price-performance balance of alternative materials. If advanced metals, ceramics, or even different plastic formulations can deliver comparable functionality at a reduced cost, customers might shift their allegiance. For instance, the automotive sector, a key market for EMS-Chemie, continually seeks lighter and stronger materials to improve fuel efficiency, creating opportunities for substitutes if they offer a compelling value proposition.

Customer propensity to substitute for EMS-Chemie's products is influenced by how aware customers are of other options, how easy it is to switch, and any rules or regulations. For instance, the automotive sector's push for lighter vehicles and the growing emphasis on sustainability are making customers more open to exploring new, environmentally friendly materials that could replace traditional plastics.

Technological advancements are rapidly introducing new materials that could replace EMS-Chemie's products. For instance, the development of bio-based polymers and biodegradable plastics offers alternatives with potentially lower environmental impact and competitive pricing. In 2024, the global bioplastics market is projected to reach over $10 billion, demonstrating significant growth and the increasing viability of these substitutes.

Availability and Cost of Raw Materials for Substitutes

The availability and cost of raw materials for potential substitute products directly impact their attractiveness to EMS-Chemie's customers. If the key inputs for alternative materials become more readily available or significantly cheaper, these substitutes gain a competitive edge.

For instance, if the price of crude oil, a primary feedstock for many plastics, were to drop substantially, it could make petroleum-based polymers more cost-effective compared to EMS-Chemie's specialty polymers. This shift would increase the threat of substitution.

- Raw Material Cost Fluctuations: Changes in the price of key commodities like crude oil, natural gas, or specialized chemical precursors can alter the cost competitiveness of substitute materials.

- Supply Chain Stability: Disruptions in the supply chains for raw materials used in substitutes can either increase their cost or limit their availability, thereby affecting the threat level.

- Technological Advancements in Material Sourcing: Innovations in extracting or producing raw materials for substitutes can lead to cost reductions or improved performance, making them more viable alternatives.

- Geopolitical Factors: Global events impacting the supply or cost of raw materials in major producing regions can indirectly influence the threat of substitutes for EMS-Chemie.

Regulatory and Environmental Pressures

Increasing regulatory and environmental pressures are a significant factor driving the threat of substitutes for EMS-Chemie. Governments worldwide are implementing stricter regulations concerning material sourcing, production processes, and end-of-life product management, particularly focusing on sustainability and recyclability. This regulatory push directly encourages the development and adoption of alternative materials that better align with these evolving environmental standards.

For instance, in 2024, the European Union continued to advance its Circular Economy Action Plan, with proposed legislation aiming to increase the recycled content in various products and restrict the use of certain non-recyclable plastics. These initiatives make it more attractive for manufacturers to explore and integrate substitute materials that meet these new requirements, potentially impacting demand for EMS-Chemie's traditional offerings.

EMS-Chemie's own strategic focus on sustainability, including its commitment to CO2 neutrality by 2040, is a direct acknowledgment of this trend. However, this proactive stance also highlights the broader market shift. As more companies and consumers prioritize eco-friendly alternatives, the competitive landscape intensifies, with substitute materials gaining traction due to their perceived environmental benefits and compliance with future regulations.

The accelerating adoption of sustainable and recyclable materials represents a continuous threat. Consider the automotive sector, a key market for EMS-Chemie. By 2024, many major automakers were actively increasing their use of bio-based or recycled polymers in vehicle components to meet both regulatory demands and consumer expectations for greener vehicles. This trend directly challenges the market share of conventional high-performance polymers if substitutes offer comparable performance with a better environmental profile.

- Regulatory Push: Growing government mandates for recycled content and reduced environmental impact favor substitute materials.

- Consumer Demand: Increasing consumer preference for sustainable products drives manufacturers towards eco-friendly alternatives.

- Industry Response: EMS-Chemie's own sustainability goals reflect the broader market shift, indicating the pressure from substitutes.

- Market Dynamics: The automotive industry, for example, is increasingly incorporating bio-based and recycled polymers, directly impacting traditional material markets.

The threat of substitutes for EMS-Chemie's high-performance polymers is significant, driven by advancements in alternative materials and evolving customer preferences. If new materials offer comparable performance at a lower cost, or possess superior environmental credentials, customers may switch. For example, the automotive industry's pursuit of lightweighting and sustainability in 2024 continues to fuel demand for bio-based and recycled polymers, directly challenging traditional plastics.

Technological progress is a key enabler for these substitutes. The global bioplastics market, projected to exceed $10 billion in 2024, highlights the growing viability and adoption of eco-friendly alternatives. Furthermore, regulatory pressures, such as the EU's Circular Economy Action Plan, encourage the use of recycled content and restrict non-recyclable plastics, making substitutes more attractive.

| Substitute Material Type | Key Drivers | 2024 Market Relevance |

|---|---|---|

| Bio-based Polymers | Sustainability, reduced carbon footprint | Growing adoption in automotive and packaging |

| Recycled Polymers | Circular economy initiatives, cost-effectiveness | Increasing regulatory mandates for recycled content |

| Advanced Composites (e.g., carbon fiber) | High strength-to-weight ratio | Continued use in aerospace and high-performance automotive |

| Engineered Metals | Durability, specific performance characteristics | Potential replacement in niche applications where polymers fall short |

Entrants Threaten

EMS-Chemie Holding operates in a sector where establishing new production facilities for high-performance polymers and specialty chemicals demands substantial upfront investment. These capital requirements act as a formidable barrier, effectively deterring many potential new entrants from entering the market.

The need for significant capital extends to crucial areas like research and development (R&D), acquiring specialized machinery, and mastering complex manufacturing processes. For instance, a new entrant might need to invest hundreds of millions of dollars to build a state-of-the-art production plant capable of competing with established players like EMS-Chemie.

Existing players like EMS-Chemie benefit from significant economies of scale in production, procurement, and distribution. This cost advantage makes it difficult for new entrants to match their pricing, as they would need to achieve comparable scale rapidly. For instance, in 2023, EMS-Chemie's net sales reached CHF 2.39 billion, reflecting a mature operational footprint that new competitors would struggle to replicate without substantial upfront investment.

New entrants would require massive initial capital outlays to build production facilities, establish supply chains, and gain market share to offset the cost advantages of established firms. Without achieving this scale quickly, their product costs would likely be higher, hindering their ability to compete effectively against incumbents like EMS-Chemie, which has a long-established global presence.

EMS-Chemie's dedication to groundbreaking solutions and tailor-made products is built upon its proprietary technology and deep industry knowledge. This forms a robust defense against potential newcomers looking to enter the high-performance polymer and specialty chemical markets.

Establishing a similar level of capability demands substantial investment in research and development, coupled with specialized technical skills and a thorough grasp of client needs. For instance, in 2023, EMS-Chemie reported R&D expenses amounting to CHF 247 million, underscoring their commitment to maintaining a technological edge.

Access to Distribution Channels

Securing reliable distribution channels is a significant hurdle for newcomers in the high-performance polymers and specialty chemicals sector. Established companies like EMS-Chemie have cultivated deep, long-standing relationships with critical industries, making it difficult for new entrants to replicate this access.

The challenge is amplified by the need for specialized logistics and technical support, which new players may lack. For instance, in 2024, the specialty chemicals market continued to see consolidation, with fewer independent distributors available, further concentrating power among existing players.

- Distribution Network Strength: EMS-Chemie's established global network provides a significant competitive advantage, limiting access for new entrants.

- Customer Relationships: Long-term ties with key industries, built over years, are hard for new companies to penetrate.

- Logistical Complexity: The specialized handling and technical support required for high-performance polymers add another layer of difficulty for new market participants.

- Market Concentration: In 2024, the distribution landscape showed increasing concentration, with fewer independent channels available, favoring established players.

Government Policy and Regulations

Government policy and regulations significantly impact the threat of new entrants in the chemical sector, including companies like EMS-Chemie. Strict environmental regulations, such as those governing emissions and waste management, necessitate substantial upfront capital for compliance, deterring many potential new players. For instance, the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation requires extensive data and testing, adding considerable cost and complexity for new chemical producers.

The chemical industry also faces stringent safety standards for production processes and product handling. New entrants must invest heavily in safety infrastructure and training to meet these requirements, creating a high barrier to entry. In 2024, the ongoing focus on sustainability and circular economy principles by governments worldwide further elevates these compliance costs.

- High Capital Investment: Complying with environmental and safety regulations in the chemical industry requires significant financial resources, making it difficult for new companies to enter.

- Operational Complexity: Navigating and adhering to complex regulatory frameworks, such as REACH in Europe, demands specialized expertise and can be a major hurdle.

- Ongoing Compliance Costs: Beyond initial setup, continuous adherence to evolving regulations, including those related to sustainability and waste disposal, adds to operational expenses for all players.

The threat of new entrants for EMS-Chemie Holding is relatively low due to significant barriers. High capital requirements for production facilities and R&D, estimated in the hundreds of millions of dollars for a new plant, deter many potential competitors. Furthermore, established economies of scale, as evidenced by EMS-Chemie's CHF 2.39 billion in net sales in 2023, provide a cost advantage that new entrants struggle to match.

Proprietary technology and deep industry knowledge, backed by substantial R&D investments like EMS-Chemie's CHF 247 million in 2023, create a technological moat. Securing distribution channels is also challenging, as EMS-Chemie benefits from long-standing customer relationships and specialized logistics, a situation exacerbated by market concentration observed in 2024.

Stringent government regulations, including environmental and safety standards, coupled with ongoing compliance costs related to sustainability, further elevate entry barriers. Navigating complex frameworks like REACH demands significant expertise and financial commitment, making market entry arduous for new players.

| Barrier Type | Description | Example Data (EMS-Chemie) |

|---|---|---|

| Capital Requirements | High investment needed for plants, R&D, and machinery. | New plant costs potentially hundreds of millions of USD. |

| Economies of Scale | Cost advantages from large-scale production and procurement. | Net Sales: CHF 2.39 billion (2023) |

| Technology & Know-how | Proprietary processes and specialized technical skills. | R&D Expenses: CHF 247 million (2023) |

| Distribution Channels | Established networks and strong customer relationships. | Market concentration trend in 2024 favors incumbents. |

| Regulatory Compliance | Adherence to environmental, safety, and chemical regulations. | REACH compliance adds significant cost and complexity. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for EMS-Chemie Holding is built upon a foundation of robust data, including the company's annual reports, investor presentations, and official press releases. We also leverage industry-specific market research reports and financial databases to capture comprehensive insights into the competitive landscape.