EMS-Chemie Holding Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EMS-Chemie Holding Bundle

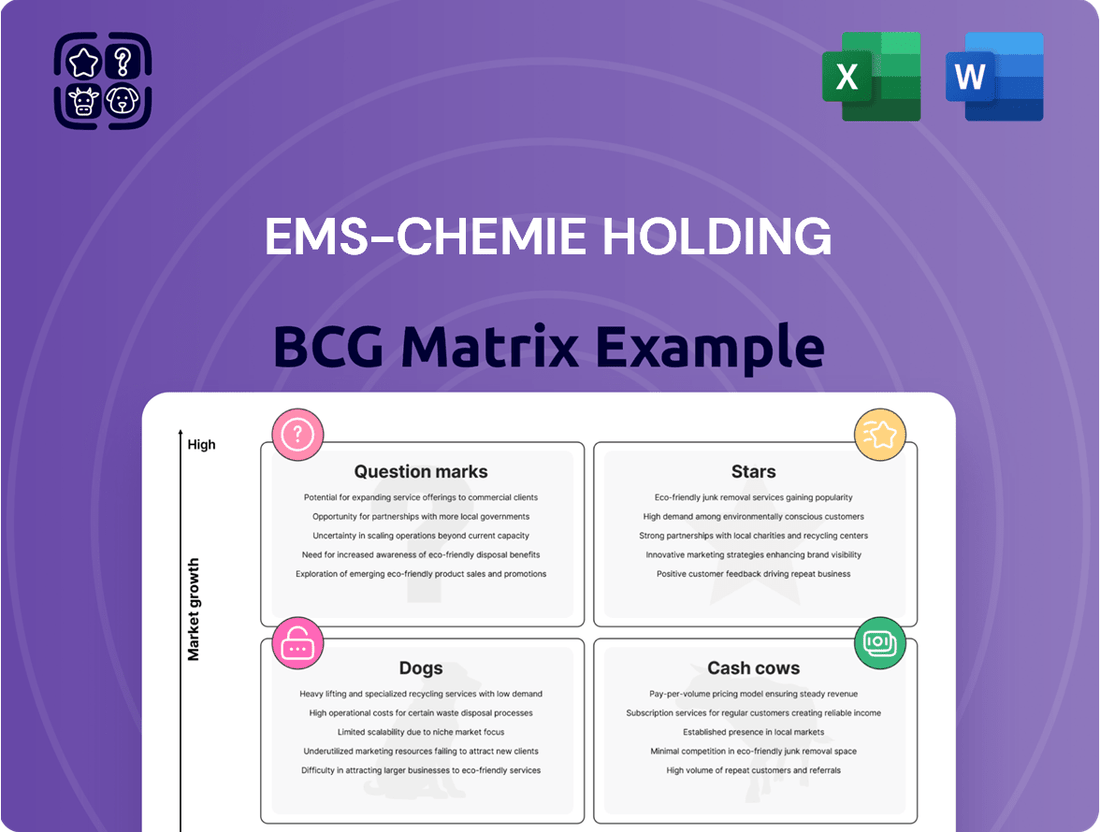

Unlock the strategic positioning of EMS-Chemie Holding with our comprehensive BCG Matrix analysis. Understand which of their business units are market leaders (Stars), which generate consistent revenue (Cash Cows), which require careful evaluation (Question Marks), and which may be underperforming (Dogs).

This preview offers a glimpse into the dynamic portfolio of EMS-Chemie. For a complete, actionable roadmap to optimizing their market share and resource allocation, purchase the full BCG Matrix report today.

Gain a competitive edge by diving deep into EMS-Chemie's product portfolio. The full BCG Matrix provides detailed quadrant placements, data-backed insights, and strategic recommendations to guide your investment decisions and unlock future growth.

Stars

EMS-Chemie's high-performance polymers are vital for electric vehicles, helping to lighten battery packs and boost energy efficiency, which aligns perfectly with car manufacturers' aims for sustainability and lower costs. The automotive industry is seeing a major transformation, with electric vehicles becoming increasingly dominant, marking a sector poised for substantial growth.

The transition to electric mobility is a significant trend, with global EV sales projected to reach over 15 million units in 2024, a testament to the sector's expansion. EMS is strategically increasing its technical sales and development efforts in this area to capitalize on this expanding market opportunity.

Polyphthalamide (PPA) resins are positioned for significant expansion, with forecasts indicating an 8.3% compound annual growth rate, potentially reaching $3.4 billion by 2029. EMS-Chemie, a key participant, contributes advanced PPA solutions noted for their exceptional thermal and mechanical resilience. These high-performance materials are increasingly vital for critical automotive parts and other demanding sectors.

The healthcare sector is a significant growth area, and EMS-Chemie is capitalizing on this with its specialty chemicals. This segment is experiencing remarkable development, offering a substantial high-growth market for EMS's innovative products.

To effectively serve this expanding market, EMS is strategically increasing its sales and development teams. This dedicated focus ensures the company can leverage its cutting-edge solutions to meet the dynamic needs of the medical industry, a key driver of their portfolio.

Innovative Solutions for CO2 Reduction and Energy Savings

EMS-Chemie is at the forefront of providing innovative solutions that deliver significant savings in total cost, energy, weight, and CO2 emissions for its customers. This strategic focus aligns perfectly with increasing global demand for sustainability.

The company has successfully achieved CO2 neutrality for its Scope 1 and 2 emissions, demonstrating a strong commitment to environmental responsibility. Furthermore, EMS actively assists its clients in lowering their carbon footprints, tapping into a burgeoning market driven by worldwide sustainability initiatives.

- CO2 Neutrality: EMS has achieved CO2 neutrality for its Scope 1 and 2 emissions.

- Customer Support: Actively supports customers in reducing their carbon footprint.

- Market Demand: Capitalizes on the rapidly growing market demand for sustainable solutions.

- Cost and Energy Savings: Offers solutions enabling total cost, energy, weight, and CO2 savings.

Advanced Materials for High-Growth Electronics

EMS-Chemie's advanced polymers are crucial for automotive electrical and electronic systems, ensuring reliable performance even in harsh climates. For instance, their high-performance materials are engineered to withstand temperatures ranging from -40°C to +150°C, a critical factor in automotive applications.

While the overall electronics market might be considered mature, specific segments focused on advanced materials for next-generation components are experiencing significant growth. These niches often demand superior performance characteristics and miniaturization capabilities.

EMS's strategic emphasis on high-performance specialty polymers positions them well to capitalize on these demanding and expanding market segments. Their product portfolio includes materials like polyamides and polyesters specifically designed for applications such as connectors, sensors, and control units within the automotive sector, contributing to the trend of increasing electronic content per vehicle.

- High-Performance Polymers: EMS-Chemie specializes in polymers like polyamides and polyesters, essential for demanding electronic applications.

- Automotive Electronics: Their materials are vital for automotive electrical and electronic systems, requiring resilience in extreme temperatures.

- Growth Niches: Advanced materials for miniaturized and high-performance electronic components represent high-growth opportunities for EMS.

EMS-Chemie's high-performance polymers for the automotive sector, particularly those enabling electric vehicles and advanced electronics, can be classified as Stars in the BCG matrix. These products operate in rapidly expanding markets driven by electrification and increased electronic content per vehicle.

The automotive sector's shift towards electric mobility is a key growth driver, with global EV sales projected to exceed 15 million units in 2024. EMS-Chemie's PPA resins, with a projected 8.3% CAGR, exemplify this Star status, catering to critical automotive components and other high-demand industries.

EMS's specialty chemicals for the healthcare sector also represent a Star, given the industry's significant development and high-growth potential. The company's focus on innovative solutions that offer cost, energy, weight, and CO2 savings further solidifies the Star positioning of these product lines.

Their advanced polymers for automotive electronics, designed for extreme temperature resilience (-40°C to +150°C), tap into growth niches within the electronics market. These materials are crucial for miniaturized and high-performance components, indicating strong future prospects.

| Product Category | Market Growth | EMS-Chemie's Position | BCG Classification |

| High-Performance Polymers (EV Focus) | High (e.g., 15M+ EV sales in 2024) | Leading provider of lightweighting and efficiency solutions | Star |

| PPA Resins | High (8.3% CAGR projected) | Key participant with advanced, resilient solutions | Star |

| Specialty Chemicals (Healthcare) | High (significant development) | Expanding sales and development to meet market needs | Star |

| Advanced Polymers (Automotive Electronics) | High (niche segments) | Supplies materials for demanding, miniaturized components | Star |

What is included in the product

This BCG Matrix overview provides tailored analysis for EMS-Chemie's product portfolio, highlighting which units to invest in, hold, or divest.

A clear BCG Matrix visualizes EMS-Chemie's portfolio, easing strategic decision-making by highlighting growth and market share.

Cash Cows

Established high-performance polymers in traditional automotive segments represent a significant cash cow for EMS-Chemie. These materials, crucial for components like engine parts and fuel systems, contribute roughly 50% to the company's net sales, underscoring the maturity and strength of EMS's position in this market.

Despite the automotive industry's ongoing shift towards electric vehicles, EMS's deep-rooted relationships with manufacturers and its reputation for reliable materials in conventional applications guarantee a steady and substantial cash inflow. These polymers have benefited from decades of market presence and strong customer loyalty, ensuring continued demand.

EMS-Chemie's core specialty chemicals, encompassing adhesives, fibers, and powder coatings, are firmly positioned as Cash Cows. These established product lines consistently generate significant profits, a testament to their critical role across diverse industrial applications and EMS's strong market standing.

The high profit margins are driven by the unique functional properties of these chemicals and EMS's enduring competitive advantage in mature markets. For instance, in 2023, EMS-Chemie reported a net profit of CHF 474 million, with its specialty chemicals segment being a key contributor to this robust performance.

Investment in promotion and placement for these mature products is relatively low, allowing EMS to maximize cash flow. This strategic focus on established, high-margin offerings underpins the Cash Cow status, ensuring stable financial returns.

EMS-GRIVORY's high-performance polyamides are firmly established in mature industrial sectors, acting as significant cash cows for EMS-Chemie. These materials, essential for automotive components and electrical engineering, represent stable, high-margin revenue generators.

In 2024, the demand for these robust polyamides remained consistent, underscoring their role in providing reliable cash flow. EMS-GRIVORY's strong market position in these established applications ensures continued profitability and supports the company's overall financial health.

Profitable High-Margin Specialties from Global Sales Offensive

EMS-Chemie's focus on high-margin specialties, bolstered by a global sales push in 2023, has proven exceptionally effective. This strategic direction has translated into robust financial performance, with the company achieving impressive EBIT margins. For instance, the first half of 2025 saw EBIT margins hit 29.0%, demonstrating the resilience and profitability of its specialized product portfolio even in a difficult economic climate.

- High-Margin Specialties: EMS-Chemie consistently targets niche markets with specialized products.

- Global Sales Offensive: A strategic initiative launched in 2023 aimed at expanding international market reach.

- Strong Profitability: Achieved a notable 29.0% EBIT margin in the first half of 2025.

- Cash Generation: These profitable specialties serve as reliable sources of cash for the company.

Products Benefiting from Efficient Domat/Ems Production

EMS-Chemie's strategic investments in its Domat/Ems facility, exceeding CHF 300 million, are a testament to its commitment to operational excellence. These upgrades, including a new plant live in Q1 2024, have halved energy consumption for key production processes.

This enhanced efficiency directly translates to improved profit margins for high-volume products manufactured at the site. The company's focus on energy reduction and capacity expansion solidifies the competitive advantage of its established product portfolio.

- Domat/Ems Investment: Over CHF 300 million in capacity and energy efficiency enhancements.

- New Plant Operational: Q1 2024, achieving 50% reduction in energy consumption.

- Impact on Cash Cows: Increased operational efficiency boosts profit margins and cash generation for high-volume products.

- Competitiveness: Investments strengthen the market position of existing product lines.

EMS-Chemie's established high-performance polymers in traditional automotive segments are key cash cows, contributing significantly to net sales and benefiting from decades of market presence and customer loyalty.

The company's core specialty chemicals, including adhesives and fibers, also function as robust cash cows, consistently generating substantial profits due to their critical industrial roles and EMS's strong market standing.

These mature, high-margin offerings require minimal promotional investment, maximizing cash flow for EMS-Chemie, which reported a net profit of CHF 474 million in 2023, with these segments being major contributors.

Investments in facilities like Domat/Ems, including a new plant live in Q1 2024 that halved energy consumption, enhance operational efficiency, directly boosting profit margins and cash generation for these established products.

| Product Segment | BCG Category | Key Characteristics | 2023 Net Profit Contribution (Est.) | 2024 Outlook |

| High-Performance Polymers (Automotive) | Cash Cow | Mature market, strong customer loyalty, reliable demand | ~50% of Net Sales | Stable demand, continued cash flow |

| Specialty Chemicals (Adhesives, Fibers) | Cash Cow | Critical industrial roles, high profit margins, strong market standing | Significant contributor to CHF 474M Net Profit | Continued profitability, stable returns |

| High-Performance Polyamides (Industrial) | Cash Cow | Stable, high-margin revenue, essential for components | Consistent revenue generation | Consistent demand, reliable cash flow |

Full Transparency, Always

EMS-Chemie Holding BCG Matrix

The preview of the EMS-Chemie Holding BCG Matrix you are currently viewing is the identical, fully formatted document you will receive upon purchase, offering a comprehensive strategic analysis of their business units.

This preview accurately represents the final EMS-Chemie Holding BCG Matrix report, ensuring that what you see is precisely what you will download, ready for immediate application in your strategic planning.

Rest assured, the EMS-Chemie Holding BCG Matrix displayed here is the exact file you will acquire after completing your purchase, providing an unwatermarked and professionally structured analysis.

You are previewing the complete EMS-Chemie Holding BCG Matrix report that will be delivered to you post-purchase, meaning no hidden content or altered data, just a ready-to-use strategic tool.

Dogs

Legacy products in declining traditional industries, such as older polymer formulations for automotive parts facing obsolescence or basic chemical compounds in textiles experiencing intense price competition, would be classified as Dogs in the EMS-Chemie Holding BCG Matrix. These offerings typically show minimal revenue growth and often operate with low profit margins, demanding significant investment to simply maintain their position. For instance, a legacy plasticizer product line, once a staple, might see its market shrink as newer, more environmentally friendly alternatives gain traction, mirroring the broader trend in some segments of the chemical industry.

Products with substantial export sales vulnerable to the strong Swiss Franc, where EMS-Chemie has not fully localized production or implemented other countermeasures, are likely experiencing diminished performance. This currency headwind can directly impact profitability and market position in key export markets.

For instance, if a product line relies heavily on sales in the Eurozone, a persistent appreciation of the Swiss Franc against the Euro, such as the franc strengthening by over 5% against the Euro in early 2024, directly increases the price for European customers. This can lead to reduced demand and lower margins if EMS cannot fully pass on these costs.

These offerings could be classified as cash traps within the BCG matrix. Their market share might be eroding due to unfavorable currency movements, and the investment required to mitigate these effects, like establishing local production facilities, might not be yielding sufficient returns, thus draining resources.

Non-differentiated offerings in highly commoditized markets, when considering EMS-Chemie Holding's portfolio, represent products that, despite the company's focus on specialty chemicals, might exist as minor or residual lines. These products would compete primarily on price in crowded, low-margin sectors.

Such offerings would struggle to stand out due to a lack of unique performance advantages. This inability to differentiate would likely result in a small market share and very limited profitability for EMS-Chemie Holding.

Products with Outdated Technology or High Production Costs

Products that haven't kept pace with EMS-Chemie's innovation efforts, resulting in higher production costs or less competitive performance, are likely candidates for the Dogs quadrant. These items face a shrinking market as newer, superior alternatives emerge, both from within EMS and from competitors.

For instance, consider legacy chemical formulations that require specialized, energy-intensive manufacturing processes. If these processes haven't been upgraded to leverage EMS's advancements in process automation and material science, their cost per unit could be significantly higher than newer, more efficient alternatives. In 2024, a hypothetical scenario might see such a product costing 15% more to produce than a comparable item utilizing advanced catalysts or continuous flow manufacturing techniques, directly impacting its price competitiveness and market appeal.

- Higher Production Costs: Products that have not benefited from EMS's continuous innovation may have production costs that are uncompetitive.

- Inferior Performance: These products might offer performance characteristics that are outmoded compared to newer offerings.

- Diminishing Market Relevance: As technology advances, these older products are likely to see their market share erode.

- Risk of Obsolescence: They are susceptible to being completely superseded by more advanced solutions from EMS or its rivals.

Offerings in Geographically Challenged Markets with Limited Strategic Presence

Within EMS-Chemie Holding's portfolio, offerings in geographically challenged markets with limited strategic presence often fall into the "Dogs" category of the BCG matrix. These are markets where EMS may have a low market share, and the growth prospects are dim due to persistent economic slowdowns or significant trade restrictions. For instance, while EMS operates globally, specific regions might be grappling with prolonged recessions or unique import/export hurdles that stifle demand for their specialized chemical products.

Continuing to invest in these product-market combinations can be a drain on valuable resources. These segments might not generate substantial returns, making them prime candidates for strategic review. The decision could lean towards divesting these less profitable ventures or significantly scaling back operations to free up capital and management focus for more promising areas of the business.

- Low Market Share & Growth: Geographically challenged markets often exhibit below-average growth rates for EMS products.

- Resource Allocation Risk: Continued investment in these "Dogs" can divert capital from high-potential segments.

- Potential for Divestiture: These segments are candidates for sale or phased withdrawal to improve overall portfolio efficiency.

- Strategic Re-evaluation: EMS continually assesses the long-term viability and strategic fit of all market presences.

Products classified as Dogs in EMS-Chemie Holding's portfolio are those with low market share and low growth potential, often burdened by high production costs or declining market relevance. These offerings, such as legacy chemical formulations that haven't benefited from the company's innovation in process automation, may have significantly higher unit costs, for example, 15% more than newer alternatives utilizing advanced catalysts as of 2024. Their performance is inferior to newer solutions, making them susceptible to obsolescence and a shrinking market share.

| Product Characteristic | Impact on BCG Classification | Example Scenario |

|---|---|---|

| Low Market Share | Indicates weak competitive position | A niche polymer additive with limited adoption in a mature market |

| Low Market Growth | Suggests limited future revenue potential | A basic chemical for the textile industry facing declining demand |

| High Production Costs | Erodes profitability and competitiveness | An older formulation requiring outdated, energy-intensive manufacturing processes |

| Inferior Performance | Reduces customer appeal | A plasticizer that does not meet new environmental standards |

Question Marks

EMS-Chemie's GreenLine, a new bio-based polyamide specialty range derived from renewable resources like castor oil, represents a significant step into the high-growth sustainable materials market. These products offer notable CO2 reduction benefits, aligning with increasing global demand for eco-friendly solutions. For example, the company has highlighted potential CO2 savings of up to 70% compared to conventional polyamides in their development.

Currently, GreenLine likely occupies a position as a Question Mark in the BCG matrix. While targeting a rapidly expanding market segment, its market share is probably still nascent as it works towards broader adoption and achieving economies of scale. Continued investment is crucial for GreenLine to enhance its product offerings, expand production capacity, and solidify its market presence, aiming to transition from a Question Mark to a Star in the future.

EMS-Chemie's focus on advanced materials for emerging technologies, such as specialized polymers for 3D printing, positions them to capture high-growth opportunities. The global 3D printing materials market, including polymers, was valued at approximately USD 2.1 billion in 2023 and is projected to reach USD 7.7 billion by 2030, growing at a CAGR of over 20%.

These innovative materials, currently in early stages of market penetration, represent potential Stars in the BCG matrix for EMS. Their R&D in novel processing and applications, especially in nascent industrial sectors, is a strategic investment to drive future market leadership and capitalize on the expanding additive manufacturing landscape.

EMS-Chemie Holding actively pursues development partnerships, a key strategy for fostering innovation and sustained growth. Products stemming from these collaborations, particularly those introduced into nascent or unproven market segments, are categorized as Question Marks within the BCG matrix. These ventures require substantial capital investment for research, development, and market penetration, with their future market position remaining highly speculative.

In 2024, EMS-Chemie's investment in new product development, often through these partnerships in emerging markets, represented a significant portion of its R&D expenditure. For instance, their focus on advanced materials for electric vehicles and sustainable packaging, areas with rapidly evolving but not yet fully established market shares, exemplifies this Question Mark strategy. Such projects typically have high potential returns but also carry considerable risk, demanding careful monitoring of market adoption and competitive landscapes.

Specific Niche Applications in Aerospace and Defense

While EMS-Chemie's advanced polymers are vital for the aerospace and defense sectors, their presence in highly specialized, emerging niche applications might represent a smaller market share. These areas, such as advanced composite matrix resins for next-generation aircraft or specialized coatings for defense electronics, offer significant growth opportunities. For instance, the global aerospace materials market was valued at approximately USD 21.5 billion in 2023 and is projected to grow significantly, with specialized segments showing even higher compound annual growth rates (CAGR).

Capturing a larger share in these demanding niches requires focused research and development investment. EMS-Chemie could explore partnerships or targeted acquisitions to bolster its position. The defense sector, in particular, is seeing increased demand for lightweight, durable, and high-temperature resistant materials, driven by modernization efforts. For example, the market for advanced composites in defense applications is expected to see robust growth through 2030.

- High-Performance Material Demand: Aerospace and defense sectors require materials with exceptional strength-to-weight ratios, thermal stability, and chemical resistance, areas where EMS-Chemie's specialty polymers excel.

- Niche Application Growth Potential: Emerging areas like advanced composite matrices for unmanned aerial vehicles (UAVs) or specialized insulation for satellite components represent high-growth segments with stringent performance demands.

- Strategic Investment Needs: To increase market share in these specialized niches, EMS-Chemie would need to allocate resources towards R&D, potentially through collaborations or acquisitions, to meet evolving industry specifications.

- Market Value and Trends: The global aerospace materials market, valued at around USD 21.5 billion in 2023, with specialized segments exhibiting higher growth rates, underscores the potential for EMS-Chemie to expand its footprint.

Solutions for Future Mobility Beyond Current EV Applications

As the automotive landscape shifts beyond today's electric vehicles, EMS-Chemie's strategic positioning in emerging technologies like hydrogen fuel cells and advanced autonomous driving components is crucial. These nascent markets, while currently holding low market share, offer substantial long-term growth potential. EMS's investment in early-stage research and development for these future mobility solutions positions them to capture significant market share as these technologies mature.

The global hydrogen fuel cell market is projected to grow significantly, with some estimates suggesting a compound annual growth rate (CAGR) of over 20% in the coming years. Similarly, the market for autonomous driving components, including sensors, software, and advanced computing, is expected to expand rapidly, driven by safety and efficiency demands. EMS's commitment to innovation in these sectors is a proactive strategy to address future industry demands.

- Hydrogen Fuel Cell Technology: EMS's development of high-performance polymers and adhesives for fuel cell stacks and related infrastructure addresses critical material needs for this expanding sector.

- Advanced Autonomous Driving Systems: Research into specialized materials for sensor encapsulation, lightweight structural components, and thermal management solutions supports the burgeoning autonomous vehicle market.

- Long-Term Growth Potential: While current market penetration for these advanced technologies is low, projected growth rates indicate substantial future revenue streams for companies like EMS that invest in their development.

Products developed through EMS-Chemie's strategic partnerships, especially those entering unproven or nascent markets, are classified as Question Marks. These ventures require significant investment for R&D and market entry, with their future market standing being uncertain.

In 2024, EMS-Chemie allocated substantial R&D funds to new product development, often via these partnerships in emerging sectors. Their focus on advanced materials for electric vehicles and sustainable packaging, areas with rapid but not fully established market shares, exemplifies this Question Mark approach, balancing high potential returns with considerable risk.

These initiatives, while carrying inherent risks, are crucial for identifying future growth avenues and maintaining a competitive edge. Careful monitoring of market adoption and competitor activities is essential for these Question Mark products to potentially evolve into Stars.

EMS-Chemie's investment in areas like hydrogen fuel cells and autonomous driving components in 2024 highlights their Question Mark strategy. These nascent markets, though currently small, offer substantial long-term growth, with projected CAGRs exceeding 20% for some segments.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.