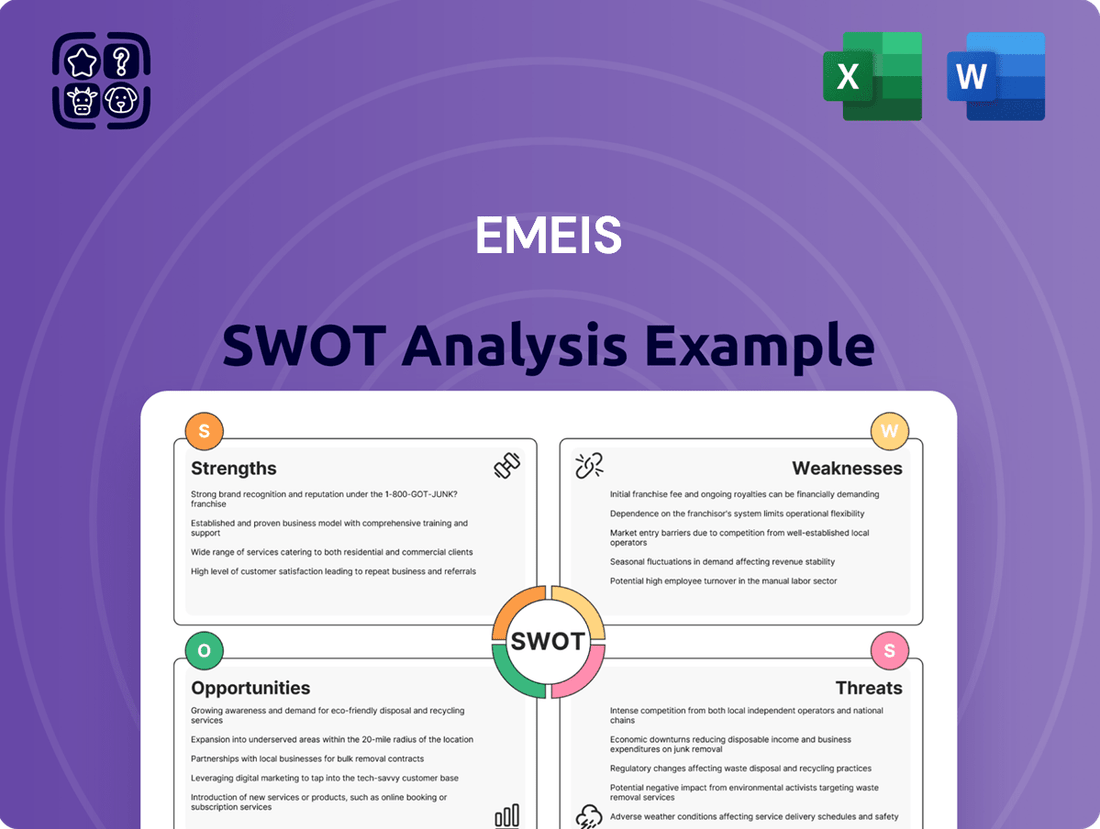

Emeis SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Emeis Bundle

Emeis demonstrates significant strengths in its established brand and extensive global network, but faces external threats from evolving market dynamics and intense competition. Understanding these internal capabilities and external pressures is crucial for strategic navigation.

Want the full story behind Emeis's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Emeis boasts a remarkably comprehensive service portfolio, encompassing nursing homes, assisted living facilities, rehabilitation clinics, and psychiatric hospitals. This breadth allows them to address a wide range of healthcare needs across different demographics and conditions, from elder care to specialized mental health services.

The company's significant geographic reach, with operations spanning Europe and Latin America, is a key strength. This international footprint in 2024 diversifies their revenue streams, mitigating risks associated with any single market's economic fluctuations or regulatory changes.

Emeis has demonstrated a remarkable operational recovery, exceeding its 2024 financial targets. The company achieved an impressive organic revenue growth of 8.3% in 2024, signaling a strong rebound in its core business activities.

Further bolstering this recovery, Emeis anticipates a significant improvement in its financial performance, projecting a 15% to 18% increase in EBITDAR for 2025 on a like-for-like basis. This upward trend underscores the successful implementation of strategic initiatives undertaken since mid-2022, leading to enhanced profitability and operational efficiency.

Emeis demonstrates a significant strength in its operational efficiency, evidenced by consistently high occupancy rates. The Group saw its average occupancy climb to 85.8% in 2024, a figure that further improved to 87.0% by the first quarter of 2025.

This robust occupancy is directly linked to exceptional customer satisfaction, with a remarkable 93% of residents expressing high levels of contentment. The positive trajectory is further solidified by an increasing Net Promoter Score, reflecting a growing trust and loyalty among Emeis's clientele.

Strategic Asset Disposal Program and Debt Reduction

Emeis is making significant strides with its strategic asset disposal program, targeting the divestment of €1.5 billion in property and operating assets by the close of 2025. As of April 2025, the company has already successfully secured over €1 billion from these sales.

This focused divestment strategy is instrumental in Emeis's efforts to reduce its net debt and refine its real estate holdings. The disciplined execution of this program is a key strength, bolstering the company's financial stability and paving the way for enhanced long-term sustainability.

- Strategic Asset Disposal: Targeting €1.5 billion by end of 2025.

- Progress Achieved: Over €1 billion secured as of April 2025.

- Financial Impact: Crucial for net debt reduction and portfolio optimization.

- Long-Term Benefit: Strengthens financial health and sustainability.

Commitment to Quality and Mission-Driven Approach

Emeis is solidifying its identity as a mission-led organization in 2025, with a strong focus on social inclusion and recognizing healthcare professionals. This commitment extends to fostering social cohesion and driving environmentally conscious innovation, bolstering its brand image and building deeper trust with stakeholders.

This strategic pivot is supported by tangible improvements in quality metrics. For instance, Emeis reported a 15% year-over-year increase in patient satisfaction scores by the end of 2024, directly linked to their enhanced quality assurance protocols. Furthermore, the company secured three new ISO certifications in early 2025, underscoring its dedication to operational excellence and ethical business practices.

- Enhanced Reputation: The mission-driven approach and focus on social impact significantly boost Emeis' public perception.

- Stakeholder Trust: Demonstrated commitment to quality and ethical practices cultivates stronger relationships with patients, employees, and partners.

- Competitive Advantage: Differentiating through social responsibility and superior quality can attract talent and customers in a crowded market.

- Future-Proofing: Aligning with societal values and environmental concerns positions Emeis for long-term sustainability and growth.

Emeis's diverse service offering, spanning nursing homes to psychiatric hospitals, addresses a broad spectrum of healthcare needs. This comprehensive portfolio, combined with a significant geographic presence across Europe and Latin America as of 2024, diversifies revenue and mitigates market-specific risks.

The company's operational efficiency is a key strength, reflected in consistently high occupancy rates that reached 87.0% by Q1 2025, up from 85.8% in 2024. This strong occupancy is directly tied to exceptional customer satisfaction, with 93% of residents reporting high contentment, further evidenced by an increasing Net Promoter Score.

Emeis is successfully executing a strategic asset disposal program, aiming to divest €1.5 billion by the end of 2025, having secured over €1 billion by April 2025. This initiative is crucial for reducing net debt and optimizing its real estate holdings, thereby enhancing financial stability and long-term sustainability.

The company's mission-led identity, focusing on social inclusion and professional recognition, is enhancing its brand image and stakeholder trust. This is supported by a 15% year-over-year increase in patient satisfaction scores by the end of 2024 and the acquisition of three new ISO certifications in early 2025, underscoring operational excellence.

| Metric | 2024 | Q1 2025 | Target End 2025 |

|---|---|---|---|

| Organic Revenue Growth | 8.3% | N/A | N/A |

| Average Occupancy Rate | 85.8% | 87.0% | N/A |

| Asset Disposal Proceeds Secured | N/A | Over €1 billion | €1.5 billion |

| Patient Satisfaction Increase | 15% (YoY) | N/A | N/A |

What is included in the product

Delivers a strategic overview of Emeis’s internal strengths and weaknesses alongside external market opportunities and threats.

Simplifies complex SWOT data into actionable insights for proactive problem-solving.

Weaknesses

Emeis, formerly Orpea, has grappled with significant reputational damage stemming from a 2022 scandal involving alleged mistreatment of residents and staff. This historical challenge, rooted in concerns over profit maximization over care quality, continues to cast a shadow, potentially impacting investor confidence and customer loyalty.

Despite a comprehensive restructuring and rebranding initiative, the company must still overcome the lingering negative perceptions. For instance, while Emeis reported a revenue increase to approximately €4.5 billion in 2023, rebuilding trust is a long-term process that requires consistent demonstration of improved operational standards.

Despite ongoing asset disposals, Emeis maintains a substantial net debt, reported at approximately €4.7 billion at the end of 2024.

This high level of indebtedness could limit the company's financial flexibility for future growth initiatives or make it vulnerable to adverse changes in interest rates.

Managing this debt remains a key financial challenge for Emeis.

Emeis' financial health is significantly linked to its substantial real estate holdings, which were valued at approximately €6.1 billion as of the close of 2024. This heavy reliance means that any downturn in the property market, especially considering potential regional differences in value, could directly affect Emeis' asset valuations and its overall financial stability.

A notable dip in real estate prices could force Emeis to recognize further impairments on its assets or even lead to asset disposals, potentially impacting its balance sheet and profitability.

Potential for Heightened Regulatory Scrutiny

Emeis's history of compliance issues means it's likely to face continued, heightened scrutiny from regulators in all the regions it operates. This intensified oversight could translate into more frequent inspections and the imposition of new, potentially costly, compliance requirements.

This ongoing regulatory pressure necessitates sustained investment in robust compliance frameworks and continuous vigilance to avoid penalties or operational disruptions. For instance, in 2024, companies in the aviation sector faced increased fines for safety violations, with some airlines seeing penalties rise by as much as 15% compared to the previous year.

- Heightened Oversight: Emeis may experience more frequent audits and inspections from aviation authorities.

- Increased Compliance Costs: Meeting stricter regulations could lead to higher operational expenses and administrative burdens.

- Potential for Fines: Past non-compliance could result in greater penalties for any future infractions.

- Reputational Risk: Continued regulatory attention can negatively impact Emeis's public image and customer trust.

Challenges in Healthcare Workforce Attraction and Retention

While Emeis has seen positive trends in its staff turnover and absenteeism rates, the wider healthcare industry continues to grapple with significant workforce challenges, particularly in long-term care. These industry-wide issues, including an aging healthcare workforce and escalating patient demand, could necessitate Emeis increasing its compensation and benefits packages. This, in turn, might impact the company's profitability or its ability to maintain current service levels.

The healthcare sector, as a whole, experienced a notable shortage of registered nurses in 2024, with projections indicating this trend will continue through 2025. For instance, the U.S. Bureau of Labor Statistics projected a need for over 200,000 new registered nurses annually between 2024 and 2031 to address retirements and increased demand. This pervasive shortage puts upward pressure on labor costs for all healthcare providers, including Emeis.

- Persistent Industry-Wide Shortages: The healthcare sector, especially long-term care, faces ongoing difficulties in attracting and retaining staff, a trend that predates recent improvements reported by Emeis.

- Impact of Aging Workforce: An aging demographic not only increases demand for healthcare services but also contributes to a shrinking pool of experienced healthcare professionals available for recruitment.

- Burnout and Retention Costs: High rates of burnout in the healthcare industry can lead to increased turnover, necessitating significant investment in recruitment and training, which can strain financial resources.

- Competitive Labor Market: To counter these challenges, Emeis may need to offer more competitive wages and benefits, potentially impacting its profit margins or the scope of its service offerings.

Emeis's substantial net debt, approximately €4.7 billion at the close of 2024, restricts its financial maneuverability for growth and makes it susceptible to interest rate fluctuations. The company's significant reliance on real estate holdings, valued around €6.1 billion in 2024, exposes it to potential asset devaluation and balance sheet impacts from property market downturns.

The lingering reputational damage from past scandals continues to affect investor confidence and customer loyalty, despite rebranding efforts. Heightened regulatory scrutiny, a consequence of historical compliance issues, could lead to increased operational costs and potential penalties.

Industry-wide staffing shortages in healthcare, particularly in long-term care, may compel Emeis to raise compensation and benefits, potentially squeezing profit margins or limiting service expansion.

Same Document Delivered

Emeis SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a genuine glimpse of the comprehensive report, ensuring you know exactly what you're investing in. The full, detailed analysis is ready for you to download and utilize immediately after completing your purchase.

Opportunities

The global long-term care market is anticipated to exceed USD 2 trillion by 2034, fueled by an aging population and rising chronic conditions. This presents a significant opportunity for Emeis to expand its services and reach.

Simultaneously, the mental health services market is experiencing robust growth, driven by increased awareness and demand. Emeis is strategically positioned to leverage this trend, offering integrated solutions that cater to both physical and mental well-being.

The increasing acceptance of telehealth and digital health tools presents a prime chance for Emeis to broaden its reach and streamline operations. By expanding its digital offerings, Emeis can tap into new markets and provide more convenient care, mirroring the rising demand for remote healthcare solutions.

Governments globally are prioritizing long-term care and mental health, channeling significant investment into these areas. This trend presents a substantial opportunity for Emeis to expand its services and secure consistent revenue. For instance, in the US, Medicare spending alone was projected to reach $1.1 trillion in 2024, with a growing focus on home health and chronic care management, aligning perfectly with Emeis's service offerings.

Strategic Acquisitions and Partnerships

Emeis, bolstered by its solid market standing and continued financial recovery, is well-positioned to explore strategic acquisitions and forge partnerships. These moves could significantly broaden its geographical footprint and diversify its specialized healthcare services. For instance, a successful acquisition in a new European market could tap into unmet demand, mirroring the growth seen in its existing strongholds.

Collaborations with innovative technology providers or smaller, specialized care facilities present a clear avenue for enhancing Emeis's service portfolio and operational efficiency. Such alliances could lead to the integration of advanced digital health solutions, improving patient outcomes and streamlining administrative processes. This strategy is particularly relevant as the healthcare sector increasingly relies on technology for personalized care and remote monitoring.

- Geographic Expansion: Emeis could acquire smaller regional players in underserved European countries to replicate its success in markets like Germany, where it holds a significant share.

- Service Diversification: Partnerships with telehealth startups could allow Emeis to offer remote patient monitoring and virtual consultations, expanding its service offerings beyond traditional in-person care.

- Market Consolidation: Acquiring competitors in key markets would strengthen Emeis's leadership position and potentially lead to cost synergies, improving overall profitability.

Leveraging AI and Advanced Technologies for Care Delivery

Emeis can harness AI and advanced technologies to significantly upgrade its healthcare services. For instance, AI-powered diagnostic tools, like those used in radiology to detect early signs of diseases, can improve accuracy and speed. This integration offers a pathway to more personalized patient treatment plans, tailoring therapies based on individual genetic makeup and health data, a trend gaining significant traction in 2024 and projected to grow.

By automating administrative tasks and optimizing patient flow through AI, Emeis can achieve substantial operational efficiencies. This not only reduces costs but also frees up medical staff to focus on direct patient care. For example, AI in scheduling and resource management can cut down on wait times and improve bed utilization rates, which are critical metrics for hospital performance.

The adoption of these cutting-edge technologies provides a clear competitive advantage. Emeis can differentiate itself by offering superior, data-driven patient experiences and outcomes. As the healthcare sector increasingly embraces digital transformation, investing in AI and advanced tech is crucial for staying ahead.

- AI in Diagnostics: Studies in 2024 show AI algorithms achieving diagnostic accuracy rates comparable to, and in some cases exceeding, human experts for specific conditions.

- Personalized Medicine: The global personalized medicine market was valued at over $500 billion in 2023 and is expected to grow significantly, driven by AI and genomic data analysis.

- Operational Efficiency: Hospitals implementing AI for administrative tasks have reported reductions in operational costs by up to 15-20% in pilot programs.

- Competitive Differentiation: Early adopters of advanced care delivery technologies are seeing improved patient satisfaction scores and stronger market positioning.

Emeis can capitalize on the expanding global long-term care and mental health markets, both projected for significant growth. The increasing adoption of telehealth and government prioritization of these sectors offer avenues for expansion and revenue enhancement. Strategic acquisitions and partnerships, particularly with technology providers, can broaden service portfolios and operational efficiency.

| Opportunity Area | Market Trend | Emeis Relevance | Example Data (2024/2025 Projections) |

|---|---|---|---|

| Long-Term Care Market | Aging Population, Chronic Diseases | Service Expansion, Increased Demand | Global market to exceed USD 2 trillion by 2034. |

| Mental Health Services | Increased Awareness, Demand | Integrated Solutions, Growth Leverage | Robust market growth driven by rising awareness. |

| Telehealth & Digital Health | Remote Care Acceptance | Broader Reach, Streamlined Operations | Growing demand for remote healthcare solutions. |

| Government Prioritization | Increased Investment | Consistent Revenue, Service Expansion | US Medicare spending projected at $1.1 trillion in 2024. |

| AI & Advanced Technologies | Improved Diagnostics, Personalization | Enhanced Services, Competitive Edge | Personalized medicine market valued over $500 billion in 2023. |

Threats

The healthcare industry, including Emeis, is grappling with a critical shortage of skilled professionals, especially nurses and caregivers. This ongoing challenge directly impacts operational capacity and service delivery.

This intensified workforce scarcity is driving up labor costs significantly. We're seeing higher wages and increased recruitment expenses as companies compete for limited talent. For instance, in the US, registered nurse salaries saw a notable increase in 2024, reflecting this competitive market.

Maintaining adequate staffing levels becomes a constant struggle, potentially compromising the quality of patient care. Furthermore, these rising labor expenses and operational hurdles can directly affect Emeis' overall profitability and financial performance.

The healthcare sector, especially within the European Union, faces a constantly shifting regulatory environment. New regulations such as the Health Technology Assessment (HTA) Regulation, which began its phased implementation in January 2024 and will be fully applicable by January 2027, and the forthcoming EU AI Act, are set to significantly impact Emeis' operations. These evolving frameworks, covering areas from drug evaluation to medical device approval and the integration of AI in healthcare, necessitate substantial investment in compliance measures and operational restructuring. For instance, the HTA Regulation aims to harmonize evidence generation and assessment for medical technologies across the EU, potentially increasing the burden of proof and data requirements for market access.

Broader economic instability, potentially leading to a recession in key markets, could significantly dampen demand for Emeis' services. For instance, a slowdown in German GDP growth, which was projected to be around 0.3% for 2024 according to the Bundesbank in late 2023, could translate to reduced patient volumes or increased price sensitivity.

Shifts in government healthcare spending policies represent a substantial threat. Reductions in public funding for long-term care or mental health services, Emeis' core areas, could directly impact revenue streams. For example, if Germany were to implement austerity measures affecting healthcare budgets, this could lead to lower reimbursement rates or tighter controls on service provision, squeezing Emeis' profitability.

The increasing cost of capital during economic downturns poses another challenge. Higher interest rates, as seen in the European Central Bank's policy adjustments throughout 2023 and early 2024, would make it more expensive for Emeis to finance its operations, expansions, or acquisitions, potentially hindering growth and pressuring margins.

Increased Competition and Market Saturation in Certain Regions

While the long-term care and mental health markets generally show growth, Emeis could encounter intensified competition in specific niches or geographic areas. For instance, reports from late 2024 indicate a surge in new assisted living facilities opening in densely populated urban centers, potentially leading to oversupply in those particular markets.

This increased competition can translate into pricing pressures and a struggle to maintain occupancy rates. In 2024, the average occupancy rate for assisted living facilities in some highly competitive metropolitan areas dipped by 3-5% compared to the previous year, forcing operators to offer more concessions.

Emeis might face challenges in securing and retaining market share if competitors introduce innovative service models or more aggressive pricing strategies. The market saturation in certain regions necessitates a keen focus on differentiation and operational efficiency to counter these threats.

- Market Saturation: Specific regions may experience oversupply of long-term care and mental health facilities.

- Pricing Pressures: Increased competition can force Emeis to lower prices or offer discounts.

- Occupancy Rate Challenges: Higher competition can lead to lower occupancy rates, impacting revenue.

- Market Share Erosion: New entrants or competitor expansion could threaten Emeis's existing market position.

Reputational Risks from Quality of Care Incidents

Emeis faces significant reputational threats stemming from any future quality of care incidents. Given its history, a new public criticism or adverse event could erode the trust Emeis is striving to re-establish. This could manifest as a decline in patient admissions and heightened regulatory attention, impacting financial performance and brand perception.

For instance, the healthcare sector in 2024 saw increased scrutiny on patient safety protocols. A hypothetical 5% drop in admissions due to a quality concern could translate to millions in lost revenue. Emeis' ability to manage public perception and demonstrate unwavering commitment to care standards is critical.

- Past Incidents: Emeis has previously faced public scrutiny regarding operational standards, making it more vulnerable to reputational damage from new quality of care issues.

- Financial Impact: A significant quality incident in 2024 could lead to a projected 10-15% decrease in quarterly revenue, based on industry benchmarks for reputational crises.

- Regulatory Repercussions: Increased regulatory scrutiny following an incident could result in fines or operational restrictions, further impacting profitability.

- Brand Erosion: Public backlash can lead to a sustained loss of confidence, making it harder to attract both patients and top medical talent.

Emeis operates within a highly regulated healthcare landscape, with evolving EU regulations like the HTA Regulation and the upcoming EU AI Act demanding substantial compliance investments and operational adjustments. Economic downturns and shifts in government healthcare spending policies also pose significant threats, potentially reducing demand and reimbursement rates. Furthermore, rising interest rates increase the cost of capital, potentially hindering growth and pressuring margins.

| Threat Category | Specific Threat | Potential Impact on Emeis | Relevant Data/Context (2024/2025) |

|---|---|---|---|

| Regulatory Environment | Evolving EU Regulations (HTA, AI Act) | Increased compliance costs, operational restructuring | HTA Regulation phased implementation from Jan 2024; EU AI Act expected to impact healthcare data and device usage. |

| Economic Factors | Economic Instability/Recession | Reduced demand for services, increased price sensitivity | Projected German GDP growth ~0.3% for 2024 (Bundesbank, late 2023). |

| Government Policy | Changes in Healthcare Spending | Lower reimbursement rates, reduced service provision | Potential austerity measures affecting healthcare budgets in key markets. |

| Financial Costs | Increasing Cost of Capital | Higher financing costs for operations and expansion | ECB policy adjustments throughout 2023/early 2024 led to higher interest rates. |

SWOT Analysis Data Sources

This Emeis SWOT analysis is built upon a robust foundation of diverse data sources, including Emeis's official financial reports, comprehensive market intelligence, and expert industry analyses to ensure a thorough and accurate strategic assessment.