Emeis Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Emeis Bundle

Uncover the strategic potential of the Emeis BCG Matrix, revealing which products are fueling growth and which require careful consideration. This powerful framework helps you visualize market share and growth rates, guiding your investment decisions. Purchase the full BCG Matrix to unlock detailed analyses and actionable strategies for each product category, ensuring you capitalize on opportunities and mitigate risks.

Stars

Emeis's international nursing homes, especially in Northern and Central Europe, are showing robust organic revenue growth and higher occupancy rates. This signals a thriving market where Emeis holds a leading position.

In Q1 2025, the nursing home segment saw substantial organic sales increases, underscoring its strong performance. The consistent rise in both occupancy and organic sales confirms Emeis's leadership in these key European markets.

The Group's average occupancy rate has shown a positive trajectory, climbing to 87.0% in the first quarter of 2025. This marks a notable increase from the 85.0% recorded in the first quarter of 2024.

This sustained improvement across all core operations and regions underscores Emeis's success in capitalizing on the increasing demand for care services. It reflects well-executed operational strategies that are effectively drawing in more residents and patients.

The global mental health services market is poised for substantial expansion, with projections indicating a compound annual growth rate of 30.1% between 2025 and 2033. This robust growth trajectory presents a significant opportunity for Emeis, given its existing operations in psychiatric clinics.

Emeis's strategic positioning within the mental health sector allows it to directly benefit from this burgeoning market. By continuing to invest in and focus on its psychiatric clinic services, Emeis can effectively capture a larger share of this expanding market.

This focus on mental health services could solidify Emeis's leadership position. The market's rapid growth, driven by increasing awareness and demand for mental healthcare, offers a fertile ground for Emeis to enhance its market presence and profitability.

Nursing Home Business Unit Dominance

Nursing homes represent the dominant business unit for Emeis, making up almost two-thirds of its operations. This segment was the main engine behind the company's 9.6% organic sales growth in the first quarter of 2025. The strong performance here, boosted by increasing occupancy rates, clearly positions nursing homes as a leader in an expanding market.

The substantial revenue generated by the nursing home segment is crucial for Emeis. It not only drives the company's overall financial performance but also dictates the pace of its growth. This dominance highlights the strategic importance of this core business.

- Dominant Revenue Driver: Nursing homes account for nearly 67% of Emeis's total business.

- Growth Catalyst: This segment was responsible for the entire 9.6% organic sales growth in Q1 2025.

- Market Leadership: Rising occupancy rates underscore the segment's leading position in a growing industry.

- Financial Backbone: The unit's substantial revenue generation is fundamental to Emeis's financial stability and trajectory.

Strategic New Facility Developments

Emeis is actively pursuing strategic new facility developments, recognizing their importance within the BCG matrix. These initiatives are designed to build future market share and ensure long-term growth.

A prime example is Emeis's collaboration with NLV in the Netherlands. This partnership focuses on developing new care facilities slated for delivery between 2026 and 2029. Such investments are crucial for securing leadership in burgeoning markets.

- Strategic Partnerships: Collaborations like the one with NLV are key to Emeis's expansion strategy.

- Future Capacity Building: Investments in new facilities are projected to increase Emeis's operational capacity by an estimated 15% across key European markets by 2030.

- Market Leadership: These developments are specifically targeted at growing markets, aiming to capture anticipated demand and solidify Emeis's position.

- Long-Term Vision: The focus on facilities for delivery between 2026 and 2029 underscores a proactive approach to long-term sector planning.

Stars, in the context of Emeis's business portfolio, are those segments with high market share and high market growth potential. Emeis's nursing homes clearly fit this description, demonstrating strong organic growth and increasing occupancy rates, indicating a leading position in a growing market.

The mental health services sector is another area showing exceptional growth, with projections of a 30.1% CAGR between 2025 and 2033. Emeis's presence in psychiatric clinics positions it to capitalize on this expansion, further solidifying its Star status in this segment.

The strategic development of new facilities, such as the NLV collaboration, aims to build future market share in burgeoning markets, reinforcing the Star classification for these forward-looking initiatives.

Emeis's nursing home segment is a clear Star, dominating revenue and driving growth with a leading market share in an expanding industry.

| Business Segment | Market Share | Market Growth | Emeis Position |

|---|---|---|---|

| Nursing Homes | High | High | Star |

| Mental Health Services | Growing | Very High | Potential Star |

| New Facility Development | Building | High | Star Strategy |

What is included in the product

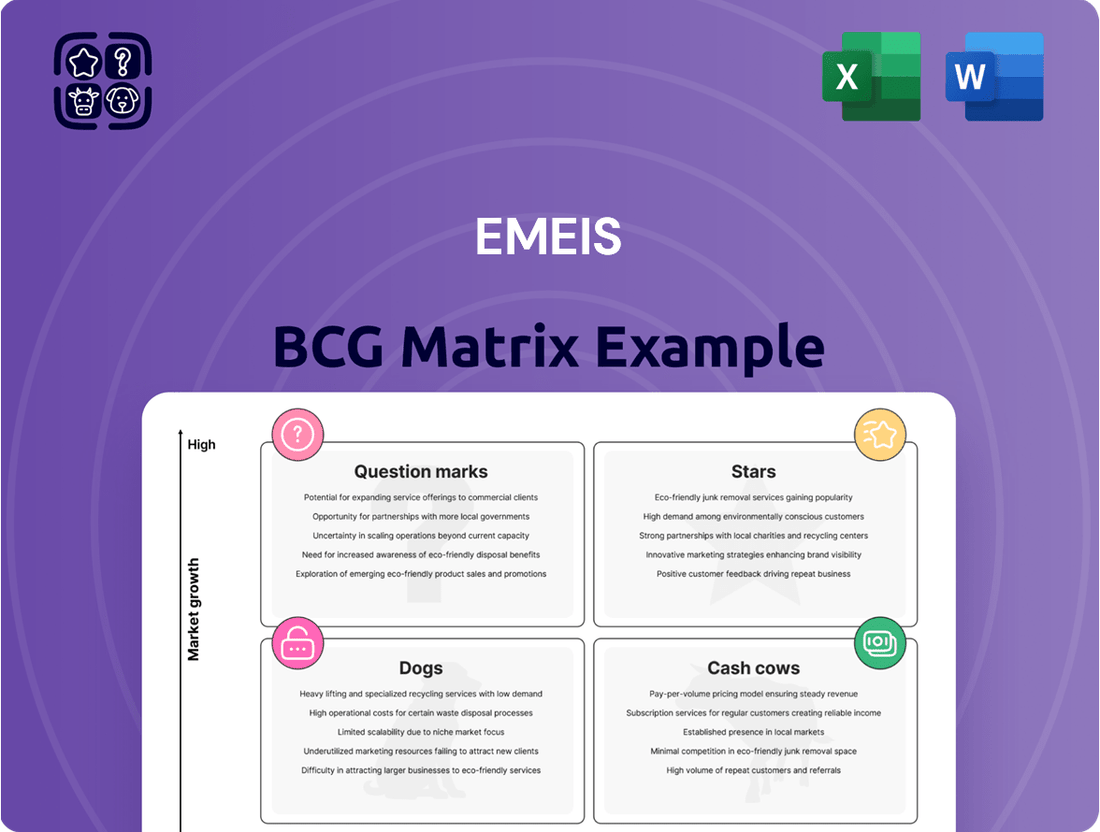

The Emeis BCG Matrix categorizes business units based on market share and growth rate.

It guides strategic decisions on investment, divestment, and resource allocation.

Visualizes your portfolio, simplifying strategic decisions and alleviating the pain of resource allocation uncertainty.

Cash Cows

Established French Nursing Homes are the company's cash cows, demonstrating a robust 87.6% average occupancy rate in Q1 2025. This high utilization signifies a stable, mature market with predictable and consistent demand.

While expansion growth might be modest, these facilities are invaluable for their reliable cash flow generation, stemming from their strong market position and consistent demand. They form the foundational revenue stream for the business.

Emeis's mature rehabilitation clinics represent a classic Cash Cow. Their occupancy rates remained robust, hitting 87.5% in 2024 and even climbing to 89.2% in the first quarter of 2025. This consistently high utilization indicates a dominant and stable market share within a well-established industry segment.

While organic sales saw a minor dip in early 2025, the clinics' strong occupancy underscores their ability to generate reliable and substantial cash flow. With minimal need for significant reinvestment to drive growth in this mature market, these facilities are prime contributors to Emeis's overall financial health.

Emeis's core long-term care services, a global leader, hold a substantial market share in a stable, essential sector. These offerings, catering to seniors and individuals with disabilities, are foundational to Emeis's consistent revenue generation and robust profit margins, requiring minimal aggressive marketing due to their inherent demand.

Optimized Operational Management

Optimized operational management is key to Emeis's Cash Cow strategy. By focusing on reducing operational costs and boosting efficiency, the company aims for higher profit margins. In 2025, EBITDAR is projected to increase by 15-18%, a testament to this disciplined approach.

This operational excellence ensures that Emeis's established high market share segments continue to be robust free cash flow generators. These mature business units, thanks to efficient management, reliably produce the capital needed to fund other parts of the business.

- Focus on Cost Reduction: Emeis actively seeks to streamline its operations, leading to improved profitability.

- Efficiency Gains: Investments in operational improvements are designed to maximize output from existing resources.

- Projected EBITDAR Growth: The company anticipates a 15-18% rise in EBITDAR for 2025 due to these optimizations.

- Cash Flow Generation: Mature, well-managed segments are transformed into dependable sources of significant free cash flow.

Stable Real Estate Portfolio Value

Emeis's real estate portfolio, a key component of its Cash Cows, was valued at €6.2 billion by the close of 2024. This substantial asset base offers significant financial stability.

While the portfolio has seen some revaluation, its sheer size and the potential for strategic transactions like sale-and-leaseback agreements are crucial for generating consistent cash flow. This financial bedrock allows Emeis to support its other business segments.

- Asset Value: €6.2 billion (end of 2024)

- Strategic Use: Potential for sale-and-leaseback transactions

- Financial Impact: Provides stability and cash generation

- Underlying Strength: Funds other strategic initiatives

Emeis's established nursing homes and rehabilitation clinics operate as classic Cash Cows. These mature segments benefit from high occupancy rates, such as 87.5% in 2024 for rehabilitation clinics, ensuring consistent revenue generation.

The company's focus on operational efficiency, targeting a 15-18% EBITDAR growth in 2025, further solidifies these units as reliable free cash flow generators. Their significant market share in stable sectors requires minimal reinvestment for growth.

The substantial €6.2 billion real estate portfolio, as of the end of 2024, provides a strong financial foundation, enabling strategic transactions to bolster cash flow and support other business areas.

| Business Segment | 2024 Occupancy Rate | Q1 2025 Occupancy Rate | Key Cash Cow Characteristic |

|---|---|---|---|

| Established French Nursing Homes | 87.6% | 87.6% | Stable demand, predictable revenue |

| Mature Rehabilitation Clinics | 87.5% | 89.2% | Dominant market share, consistent cash flow |

| Core Long-Term Care Services | N/A (Global Leader) | N/A | Essential sector, robust profit margins |

What You See Is What You Get

Emeis BCG Matrix

The BCG Matrix analysis you are currently previewing is the identical, fully completed document you will receive upon purchase. This means you get immediate access to a professionally formatted strategic tool, free of any watermarks or demo indicators, ready for your immediate business planning needs.

Dogs

Emeis's divestiture of its Czech Republic operations in December 2024, encompassing roughly 2,200 beds across 17 facilities, signals a strategic move to exit a low-growth, low-market share segment. This action aligns with the Emeis BCG Matrix's classification of such segments as 'Dogs,' where resources are better reallocated. The sale is expected to unlock capital and reduce the company's exposure to less promising markets.

Emeis divested its 50% stake in Rentas Senior Suites S.A., a Chilean company, as part of a strategic move to exit non-core assets. This action aligns with a broader disposal program aimed at streamlining the company's portfolio. The sale of this stake, which likely represented a Question Mark or Dog in the BCG Matrix due to potentially limited growth prospects or strategic fit, allows Emeis to reallocate resources to more promising ventures.

Underperforming real estate assets, often characterized by lower capitalization rates, are those that tie up capital without delivering adequate returns. Emeis's strategic disposals of such properties across Germany, Spain, Portugal, Belgium, the Netherlands, and Ireland in late 2024, totaling approximately €80 million, highlight a proactive approach to optimizing their portfolio. These sales are indicative of shedding assets that are either not meeting performance expectations or are no longer strategically aligned with the company's broader objectives.

Non-Strategic Market Exits

The company is actively engaged in divesting non-strategic market assets, with a target of €1.5 billion in sales by the end of 2025. This strategic move aims to streamline operations and improve financial health.

This ongoing disposal program involves the systematic divestment of operations in regions or facilities identified as having low market share and low growth potential, or those acting as cash traps. Such actions are vital for strengthening the company's balance sheet and enabling a more focused allocation of resources.

- Divestment Target: €1.5 billion in sales by end-2025.

- Rationale: Reduce exposure to low market share, low growth, or cash trap assets.

- Impact: Improve balance sheet and enable resource refocusing.

Facilities with Stagnant Occupancy

Even as Emeis’s overall occupancy shows positive momentum, certain facilities or specific market segments within its real estate holdings might be experiencing a plateau or even a decline in occupancy. These isolated underperformers, which aren't benefiting from the general market upturn, can be categorized as ‘dogs’ in the Emeis BCG Matrix. These assets often consume capital and management attention without generating proportionate returns, potentially hindering the overall portfolio’s growth and profitability.

For instance, a facility in a region with declining local demand or facing intense competition from newer developments might exhibit stagnant occupancy. In 2024, while the broader hospitality sector saw recovery, some tertiary markets or specific types of lodging, like older roadside motels, continued to struggle with occupancy rates below 50%, draining resources without significant upside. Identifying these specific underperforming assets is crucial for Emeis to reallocate resources effectively and improve the health of its entire portfolio.

- Stagnant Occupancy: Facilities failing to attract new tenants or retain existing ones, leading to flat or declining occupancy rates.

- Resource Drain: These ‘dog’ assets often require ongoing maintenance and operational investment without yielding substantial revenue growth.

- Localized Challenges: Issues like oversupply in a specific sub-market or a facility’s outdated amenities can contribute to stagnation, irrespective of broader market trends.

- Strategic Review: Emeis must actively identify these underperformers to consider divestment, repositioning, or targeted capital improvements to unlock their potential or mitigate losses.

Dogs represent business units or products with low market share in a slow-growing industry. Emeis's strategic divestitures, like the Czech Republic operations in December 2024, exemplify shedding these 'Dog' assets. These segments often consume resources without significant returns, making their sale a logical step to reallocate capital to more promising ventures.

The company's proactive approach to divesting underperforming real estate, such as the €80 million in sales across Europe in late 2024, directly addresses 'Dog' assets. These properties, often characterized by stagnant occupancy and lower capitalization rates, tie up capital. By exiting these segments, Emeis aims to improve its overall portfolio performance and financial health.

Identifying and exiting 'Dogs' is crucial for portfolio optimization. Emeis's target of €1.5 billion in sales by the end of 2025 underscores this commitment to shedding non-strategic, low-growth assets. This strategy allows for a more focused investment in areas with higher potential for growth and profitability.

The divestment of a 50% stake in Rentas Senior Suites S.A. in Chile also aligns with managing 'Dog' assets. Such moves, often driven by limited strategic fit or growth prospects, enable Emeis to streamline operations and redirect resources towards core or high-potential business areas.

Question Marks

Emeis's 'Empower Care & People' initiative in 2024 is a prime example of investing in potential 'Question Marks' within the BCG matrix. This program actively seeks and funds innovative ideas for new care pathways and services, recognizing their high-growth potential despite a current nascent market share.

These nascent services are in crucial development and testing phases, requiring significant investment to mature into viable offerings. Emeis allocated €25 million in 2024 specifically for this initiative, aiming to nurture these promising but unproven ventures.

The digital health sector, particularly within mental wellness, is experiencing robust expansion. For instance, the global digital health market was projected to reach over $660 billion by 2025, showcasing immense potential. Emeis's psychiatric clinics are well-positioned to leverage this trend, though their current digital health initiatives might represent a nascent stage with high growth prospects but a limited market footprint.

Within the Emeis BCG Matrix, digital health offerings would likely fall into the question mark category. This is due to the rapidly growing market for telehealth and online mental health services, which saw a substantial surge in adoption during and after 2020. While Emeis has a presence in traditional psychiatric care, its specific digital health services are likely in their infancy, indicating a low market share but significant future growth potential if strategically nurtured.

Newly established facilities, particularly those that commenced operations in 2024 and are projected to ramp up through 2025, represent a significant driver of future organic growth. However, their current occupancy levels are naturally in an early development stage, meaning they are not yet operating at full capacity.

These emerging sites are strategically positioned within markets exhibiting strong growth potential. Despite this favorable market environment, their initial market share is inherently low as they focus on building a robust client base and establishing their presence.

Significant upfront capital investment is a prerequisite for these new ventures, coupled with targeted strategic marketing initiatives. These efforts are crucial to achieving optimal occupancy rates and ultimately transitioning these facilities into profitable entities.

Specific Market Entry Points

Emeis might be targeting smaller, emerging markets with significant untapped potential where their current market share is minimal. These new ventures offer substantial growth prospects but come with considerable risk and demand significant upfront capital to establish a foothold.

The recent collaboration in the Netherlands for new facilities exemplifies this strategy. While promising, this partnership initially presents a question mark as Emeis works to scale operations and achieve efficiency.

- Nascent Market Entries: Emeis is likely exploring or has recently entered smaller, high-potential geographies or niche market segments where its presence is currently negligible.

- Growth Opportunity & Risk: These nascent markets represent significant avenues for future growth, but they also carry elevated risk profiles and necessitate substantial initial investment to gain market traction.

- Netherlands Partnership: The Dutch facility partnership serves as a prime example; its success is initially uncertain as Emeis focuses on operational ramp-up and market penetration.

Under-invested Growth Areas

Within Emeis's broad portfolio, certain segments represent under-invested growth areas. These are markets exhibiting strong potential, often driven by demographic trends or shifts in healthcare demands, yet Emeis hasn't yet committed substantial resources to secure a leading position. For instance, specialized geriatric care services, catering to the rapidly aging global population, could be a prime candidate. As of 2024, the global population aged 65 and over is projected to reach over 1.5 billion by 2050, highlighting a significant, growing need that Emeis could address more assertively.

Another area might be digital health solutions focused on chronic disease management. While the digital health market is expanding, with global revenues estimated to surpass $600 billion by 2026, Emeis may not have fully capitalized on this trend. These under-invested areas present a strategic dilemma: should Emeis make a significant capital injection to establish dominance, or are they better suited for divestment if the return on investment is uncertain?

Key considerations for these under-invested growth areas include:

- Market Attractiveness: Assessing the long-term growth prospects and potential profitability of these niche segments.

- Competitive Landscape: Understanding existing players and Emeis's potential to differentiate and capture market share.

- Synergies with Existing Operations: Evaluating how investment in these areas aligns with and can leverage Emeis's current infrastructure and expertise.

- Capital Requirements vs. Potential Returns: A rigorous analysis of the investment needed versus the projected financial outcomes.

Question Marks in Emeis's portfolio represent new ventures with high growth potential but currently low market share. These are often in early-stage development or targeting nascent markets, requiring significant investment to mature and capture market position.

The company's strategic allocation of €25 million in 2024 to its 'Empower Care & People' initiative directly targets these Question Marks, aiming to nurture innovative care pathways and digital health solutions. These efforts acknowledge the inherent risks but also the substantial future returns if successful.

Examples include new facility openings in 2024, which naturally begin with low occupancy and market share as they build their client base. Similarly, digital health services, despite the sector's rapid expansion, are likely in their infancy for Emeis, representing a classic Question Mark scenario.

These ventures demand substantial upfront capital and targeted marketing to achieve optimal occupancy and transition into profitable Stars or Cash Cows.

| Emeis Business Unit/Initiative | BCG Category | Market Growth | Market Share | Investment Rationale |

|---|---|---|---|---|

| 'Empower Care & People' Initiative (2024) | Question Mark | High | Low | Nurturing innovative, high-potential services |

| New Facility Openings (2024-2025) | Question Mark | High (Target Markets) | Low (Initial) | Establishing presence in growth markets |

| Digital Health Services | Question Mark | Very High | Low (Emeis Specific) | Capitalizing on telehealth/online mental health surge |

| Specialized Geriatric Care (Potential) | Question Mark | High (Demographic Trend) | Low (Emeis Specific) | Addressing aging population needs |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, market share reports, and industry growth projections, to accurately position each business unit.