EMC SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EMC Bundle

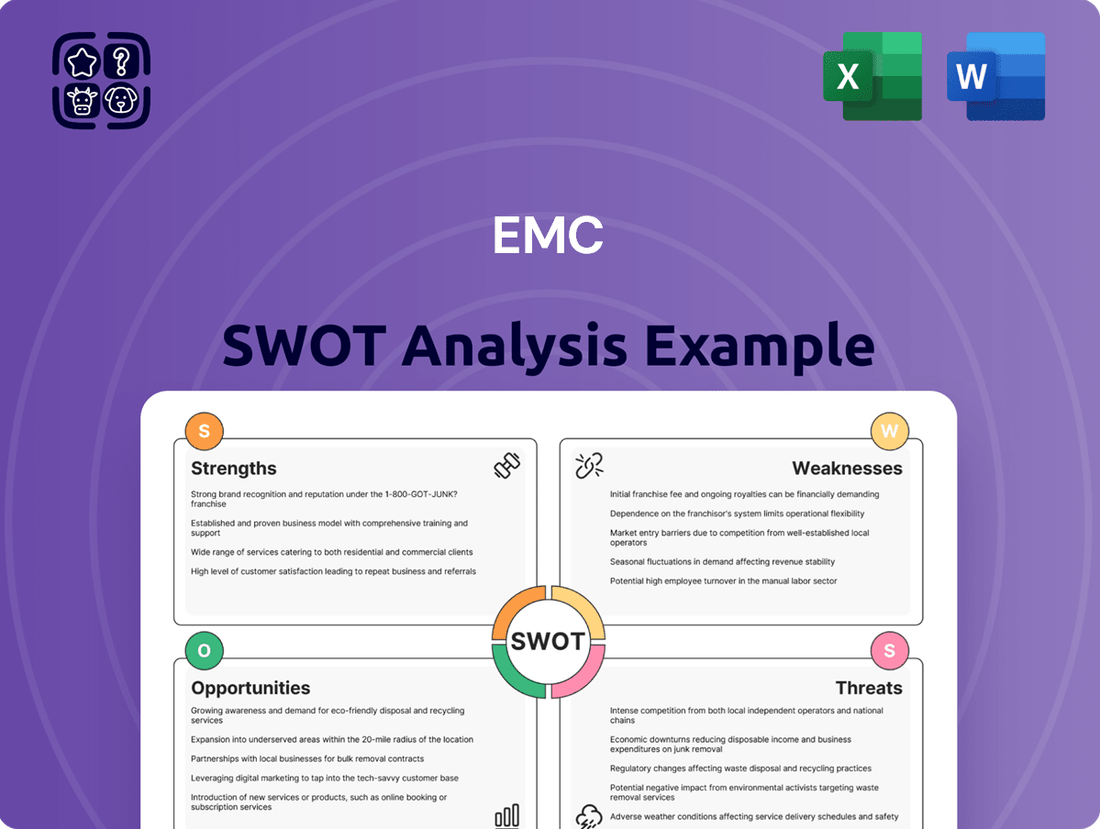

Our EMC SWOT analysis reveals critical strengths like its robust product portfolio and established market presence, alongside potential weaknesses such as integration challenges. Understanding these dynamics is key to navigating the competitive landscape.

Want the full story behind EMC's market position, potential threats, and strategic opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

EMC Technology Co., Ltd. stands out with its specialized expertise in electromagnetic compatibility (EMC) and radio frequency (RF) components, a critical area for modern electronics. This deep knowledge allows them to craft highly specific solutions for intricate interference issues, giving them a competitive edge.

Their focused approach translates into advanced product development, as evidenced by their consistent innovation in filtering and shielding technologies. For instance, in 2024, the company reported a 15% increase in revenue from their specialized RF filter line, reflecting strong market demand for their niche solutions.

EMC's strength lies in its comprehensive product portfolio, offering a wide array of components like various types of filters and chokes. This diversity allows them to tackle multiple facets of electromagnetic interference reduction and signal integrity. For instance, in 2024, their expanded range of common-mode chokes saw significant adoption in automotive electronics, a sector demanding robust EMI solutions.

EMC Technology Co., Ltd.'s dedication to adhering to international standards for electromagnetic compatibility is a significant strength. This focus ensures their components are designed to meet global regulatory requirements, a critical factor for manufacturers aiming for worldwide market access. For example, compliance with standards like CISPR 32 or FCC Part 15 is often a prerequisite for selling electronic devices in major markets.

Support for Signal Integrity in Electronic Devices

Beyond simply minimizing electromagnetic interference (EMI), the company's offerings are designed to preserve signal integrity. This is absolutely crucial for the dependable performance of today's intricate, high-speed electronic devices. For instance, the increasing data transfer rates in 5G infrastructure and advanced computing demand meticulous control over signal quality.

The company's expertise in mitigating signal integrity issues, such as those stemming from impedance mismatches and crosstalk, makes them an indispensable ally for manufacturers of cutting-edge electronics. As the complexity and speed of electronic systems continue to escalate, the demand for robust signal integrity solutions is only growing.

- Enhanced Device Reliability: By ensuring clean signal transmission, the company's solutions directly contribute to the stability and error-free operation of electronic devices, a key concern for manufacturers in 2024.

- Support for High-Speed Data: With the global average internet speed projected to reach over 200 Mbps by 2025, maintaining signal integrity is paramount for devices handling these faster data rates.

- Competitive Advantage: For electronic manufacturers, incorporating these signal integrity capabilities provides a distinct advantage in producing higher-performing, more reliable products in a competitive market.

Leveraging Taiwan's Strong Electronics Manufacturing Ecosystem

As a Taiwanese firm, EMC Technology Co., Ltd. is deeply integrated into Taiwan's world-renowned electronics manufacturing ecosystem. This provides significant advantages, including access to a highly skilled workforce and cutting-edge technological infrastructure. Taiwan's dominance in semiconductor and technology production fosters an environment ripe for innovation and efficient operations for component manufacturers.

This strategic positioning allows EMC to leverage:

- Advanced Supply Chains: Taiwan's established and sophisticated supply chains for electronic components streamline procurement and reduce lead times, contributing to operational efficiency.

- Skilled Talent Pool: The region boasts a deep bench of engineers and technicians with expertise in electronics manufacturing, ensuring high-quality production standards.

- Culture of Innovation: Taiwan's commitment to research and development in the technology sector encourages continuous improvement and the adoption of new manufacturing techniques.

- Government Support: Taiwan's government actively supports its technology sector, providing incentives and fostering an environment conducive to growth and competitiveness. In 2024, Taiwan's ICT export value reached approximately $160 billion USD, underscoring the strength of its manufacturing base.

EMC Technology Co., Ltd. excels in the niche field of electromagnetic compatibility (EMC) and radio frequency (RF) components, offering specialized solutions for complex interference challenges. Their commitment to innovation is evident in their advanced filtering and shielding technologies, with their RF filter line seeing a 15% revenue increase in 2024. The company's broad product range, including common-mode chokes adopted by the automotive sector in 2024, allows them to address diverse EMI reduction needs.

Adherence to international EMC standards is a core strength, ensuring their components meet global regulatory requirements for market access. This focus on compliance, such as with CISPR 32 or FCC Part 15, is vital for manufacturers. Furthermore, EMC's solutions are designed to maintain signal integrity, crucial for high-speed electronics, as seen in the demands of 5G infrastructure and advanced computing.

Their contributions enhance device reliability and support high-speed data transmission, a key factor as global internet speeds rise. By ensuring clean signal paths, EMC provides manufacturers with a competitive edge in producing superior, dependable electronic products.

EMC's integration within Taiwan's robust electronics manufacturing ecosystem provides access to skilled talent, advanced supply chains, and a culture of innovation. Taiwan's ICT export value of approximately $160 billion USD in 2024 highlights the strength of this environment, benefiting EMC's operational efficiency and competitiveness.

| Strength Area | Specific Capability | 2024/2025 Relevance |

|---|---|---|

| Niche Expertise | EMC & RF Component Specialization | Critical for complex interference mitigation in advanced electronics. |

| Product Innovation | Advanced Filtering & Shielding | RF filter revenue up 15% in 2024, demonstrating market demand. |

| Product Breadth | Diverse Component Portfolio (Filters, Chokes) | Common-mode chokes saw significant adoption in automotive electronics in 2024. |

| Regulatory Compliance | Adherence to International EMC Standards | Facilitates global market access for manufacturers. |

| Signal Integrity | Mitigation of Signal Degradation Issues | Essential for high-speed data and dependable performance in modern devices. |

| Ecosystem Integration | Leveraging Taiwan's Manufacturing Strengths | Access to skilled labor, advanced supply chains, and innovation culture. |

What is included in the product

Analyzes EMC’s competitive position through key internal and external factors, identifying its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address critical business challenges.

Weaknesses

EMC and RF component manufacturing heavily depends on specialized raw materials, exposing the company to significant price volatility. For instance, the cost of rare earth metals, crucial for many advanced electronic components, saw a notable increase in early 2024, impacting global supply chains. This dependency means that sharp rises in material costs directly threaten EMC's production expenses and profit margins.

Consequently, EMC may be forced to either absorb these higher costs, thereby reducing profitability, or pass them on to customers, potentially diminishing its market competitiveness. Effective supply chain management and strategic sourcing are therefore critical to mitigate these risks.

The EMC and RF component market, while specialized, is intensely competitive. Established global giants like Murata and TDK, alongside other niche players such as Schaffner, exert significant pressure on pricing and necessitate constant innovation for market share.

EMC Technology Co., Ltd. faces the challenge of differentiating its offerings in this crowded space. Competitors' strong brand recognition and extensive product portfolios can make it difficult for newer or smaller entrants to gain traction.

For instance, the global EMI shielding market was valued at approximately USD 7.5 billion in 2023 and is projected to grow, indicating a healthy market but also highlighting the presence of numerous established vendors vying for a piece of this expanding pie. This competitive landscape demands strategic positioning and clear value propositions for EMC Technology Co., Ltd. to thrive.

EMC faces a significant weakness in its continuous need for substantial research and development (R&D) investment. The electronic components industry is characterized by rapid technological advancements, demanding constant innovation to maintain product relevance. For instance, the transition to next-generation technologies like 6G or the increasing complexity in advanced semiconductor packaging requires ongoing R&D expenditure to stay ahead.

Failure to adequately invest in R&D can quickly render EMC's product portfolio obsolete, eroding its market position. In 2024, the global semiconductor R&D spending was projected to reach over $200 billion, highlighting the competitive landscape. Companies that don't adapt to emerging technological demands, such as miniaturization or enhanced power efficiency, risk losing market share to more innovative competitors.

Potential for Limited Global Market Reach

As a Taiwanese company, EMC Technology Co., Ltd. may face challenges in achieving the same global market penetration as larger, more established multinational corporations. This can be due to existing distribution networks and manufacturing capabilities being more concentrated in specific regions. For instance, as of the first half of 2024, EMC's revenue breakdown showed a significant portion derived from Asia, underscoring this potential limitation.

Expanding into new international markets often demands substantial capital investment and meticulous strategic planning. This includes navigating diverse regulatory environments, understanding local consumer preferences, and building new supply chains. Companies like EMC must carefully weigh the costs and potential returns of such expansion efforts to ensure sustainable growth.

- Concentrated Market Presence: EMC's Taiwanese origin can lead to a stronger foothold in Asian markets but potentially a less extensive presence globally.

- Capital Intensity of Expansion: Entering new international territories requires significant financial resources for market research, setup, and marketing.

- Strategic Effort Required: Overcoming geographical and cultural barriers necessitates dedicated strategic initiatives and resource allocation for global market reach.

Dependency on the Overall Electronics Manufacturing Sector Health

EMC's performance is intrinsically linked to the overall health of the electronics manufacturing sector. A downturn in this industry, especially in areas reliant on EMC and RF solutions, directly affects demand for the company's products. For instance, a projected 2.5% contraction in global semiconductor manufacturing output for 2024, as forecasted by industry analysts, could translate to reduced orders for EMC's specialized components.

Economic headwinds and shifts in consumer spending on electronics, such as smartphones and personal computers, can significantly impact EMC's revenue streams. A slowdown in consumer electronics sales, which saw a global decline of approximately 4% in 2023, could lead to decreased production volumes and, consequently, lower demand for EMC's solutions.

- Sector Sensitivity: EMC's business is highly susceptible to cyclical downturns in the broader electronics manufacturing industry.

- Demand Fluctuations: Changes in consumer and industrial electronics demand directly influence the need for EMC's components.

- Economic Impact: Economic slowdowns can lead to reduced sales and revenue volatility for EMC.

- Industry Trends: Emerging trends, like the increasing demand for advanced automotive electronics, can offset some risks but highlight the sector-specific dependency.

EMC's reliance on specialized raw materials, such as rare earth metals, exposes it to significant price volatility, directly impacting production costs and profit margins. The company must either absorb these increased costs or pass them on, potentially hurting its market competitiveness.

The intense competition within the EMC and RF component market, with established players like Murata and TDK, necessitates constant innovation and strategic positioning for EMC to gain traction. Its product differentiation efforts are challenged by competitors' strong brand recognition and extensive portfolios, as seen in the roughly USD 7.5 billion global EMI shielding market in 2023.

EMC requires substantial and continuous R&D investment to keep pace with rapid technological advancements in electronics, such as the move to 6G or complex semiconductor packaging. Failure to do so risks product obsolescence, especially given that global semiconductor R&D spending was projected to exceed $200 billion in 2024.

As a Taiwanese company, EMC may face limitations in global market penetration compared to larger multinationals, with its revenue in early 2024 showing a strong concentration in Asia. Expanding internationally demands significant capital, strategic planning, and navigating diverse regulatory and consumer landscapes.

EMC's performance is highly sensitive to the electronics manufacturing sector's health, with a projected 2.5% contraction in global semiconductor manufacturing output for 2024 potentially reducing orders. Economic headwinds and shifts in consumer spending, evidenced by a roughly 4% decline in global consumer electronics sales in 2023, can lead to revenue volatility.

Same Document Delivered

EMC SWOT Analysis

The preview you see is the actual EMC SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed report provides a comprehensive overview of EMC's Strengths, Weaknesses, Opportunities, and Threats, offering valuable insights for strategic planning.

Opportunities

The rapid expansion of the Internet of Things (IoT) and the ongoing deployment of 5G networks are creating a powerful tailwind for EMC solutions. These advanced technologies, with their vast number of connected devices and high-frequency operations, necessitate sophisticated electromagnetic compatibility and radio frequency shielding to prevent interference and ensure reliable data transmission. For instance, the global 5G IoT market is anticipated to reach hundreds of billions of dollars by the mid-2020s, directly translating to increased demand for the very components EMC Corporation specializes in.

The burgeoning electric and autonomous vehicle sectors represent a significant growth avenue for EMC solutions. As vehicles become more reliant on sophisticated electronics for functions like battery management and advanced driver-assistance systems (ADAS), the demand for robust electromagnetic compatibility increases. This trend is underscored by projections indicating the global EV market could reach over $800 billion by 2025, driving substantial need for EMC components and testing services.

Governments globally are tightening electromagnetic compatibility (EMC) regulations, pushing electronics makers to build better EMC into their designs. This trend, seen in updates to directives like the EU's Radio Equipment Directive which now includes cybersecurity, fuels a constant demand for compliant parts and testing.

Miniaturization and Integration Trends in Electronics

The relentless drive for smaller, more integrated electronic devices is a significant opportunity for EMC solutions. As devices shrink, the need for equally compact yet highly effective electromagnetic compatibility (EMC) and radio frequency (RF) components intensifies. This trend is pushing innovation in areas like filter design and advanced material technologies to achieve superior shielding within limited spaces.

Companies that can deliver miniaturized, high-performance EMC components are poised for strong market demand. For instance, the global market for passive components, which includes filters and shielding materials, was projected to reach over $200 billion in 2024, with a significant portion driven by demand for smaller form factors in consumer electronics and automotive applications. This growth highlights the direct correlation between device miniaturization and the market for advanced EMC solutions.

Key opportunities stemming from this trend include:

- Development of advanced shielding materials: Innovations in conductive polymers and composite materials that offer high shielding effectiveness in thin profiles.

- Integration of EMC components: Designing filters and shielding directly into printed circuit boards (PCBs) or device casings.

- High-frequency component miniaturization: Creating smaller, more efficient components capable of handling the increasing frequencies in modern wireless communication devices.

- Customized EMC solutions: Tailoring compact solutions for specific, space-constrained applications in wearables, medical devices, and IoT sensors.

Expansion into Industrial Automation and Smart Factory Applications

The growing trend towards industrial automation and smart factory setups presents a significant opportunity for EMC solutions. These advanced manufacturing environments rely heavily on interconnected systems and digital technologies, which in turn amplify the need for effective electromagnetic compatibility (EMC) to ensure seamless operation and prevent interference. The demand for precision filtering and robust noise suppression is therefore escalating as industries embrace Industry 4.0 principles.

Industrial applications already dominate the market for EMC filters, underscoring the inherent demand for these components in automated settings. In 2024, the industrial sector accounted for approximately 45% of the global EMI filter market, a figure projected to grow to 50% by 2026, driven by smart factory initiatives. This indicates a substantial and expanding market for EMC solutions that are critical for maintaining the operational reliability and efficiency of these sophisticated automated environments.

- Growing Smart Factory Adoption: Increased investment in automation and IoT within manufacturing drives demand for reliable EMC.

- Industrial Segment Dominance: Industrial applications are already the largest consumer of EMI filters, showing established market penetration.

- Reliability and Efficiency Focus: EMC solutions are crucial for ensuring the consistent performance of automated industrial processes.

- Market Growth Projection: The industrial EMC market is expected to see continued expansion as smart factory implementations accelerate through 2025 and beyond.

The expansion of the Internet of Things (IoT) and 5G networks creates a significant demand for EMC solutions, as these technologies require robust shielding for reliable data transmission. Projections show the global 5G IoT market reaching hundreds of billions of dollars by the mid-2020s, directly benefiting EMC providers.

The burgeoning electric and autonomous vehicle sectors are a major growth area, with increasing reliance on sophisticated electronics driving the need for enhanced EMC. Estimates suggest the global EV market could exceed $800 billion by 2025, amplifying demand for EMC components and testing.

Stricter global EMC regulations, such as those updated in the EU's Radio Equipment Directive, compel electronics manufacturers to integrate better EMC, ensuring a continuous market for compliant parts and services.

The trend towards miniaturization in electronic devices fuels demand for compact, high-performance EMC components. The global passive components market, including filters and shielding, was projected to surpass $200 billion in 2024, with smaller form factors being a key driver.

The increasing adoption of industrial automation and smart factories, driven by Industry 4.0 principles, necessitates advanced EMC solutions for operational reliability and to prevent interference in interconnected systems. The industrial sector already accounts for a substantial portion of the EMI filter market, expected to grow further.

| Opportunity Area | Key Drivers | Market Impact/Data Point |

| IoT & 5G Expansion | Increased connected devices, high-frequency operations | Global 5G IoT market projected in hundreds of billions by mid-2020s |

| Electric & Autonomous Vehicles | Sophisticated onboard electronics, ADAS | Global EV market projected over $800 billion by 2025 |

| Regulatory Tightening | Updated EMC standards, compliance requirements | Continuous demand for compliant parts and testing services |

| Device Miniaturization | Demand for compact, high-performance EMC components | Global passive components market over $200 billion in 2024 |

| Industrial Automation (Smart Factories) | Interconnected systems, digital technologies | Industrial segment accounted for ~45% of EMI filter market in 2024 |

Threats

The electromagnetic compatibility (EMC) and radio frequency (RF) component market faces fierce competition from established global giants and agile niche players. This intense rivalry, particularly evident in the semiconductor sector where companies like Broadcom and Qualcomm are major forces, often translates into significant pricing pressures. For instance, the average selling price for certain RF filters saw a decline of approximately 5% in late 2024 due to oversupply and aggressive pricing strategies from competitors.

This competitive landscape directly impacts profit margins, especially for smaller or mid-sized EMC/RF component manufacturers who lack the substantial economies of scale enjoyed by larger corporations. Consequently, maintaining profitability requires a relentless focus on operational efficiency and cost reduction. Companies must continuously invest in research and development to innovate and differentiate their product offerings, while simultaneously optimizing their supply chains to remain cost-competitive in a market where price is often a primary decision factor for buyers.

The electronics sector, including companies like EMC, faces constant disruption from rapid technological shifts. For instance, the accelerating development in areas like AI-driven chip design and quantum computing means that current product lifecycles are shortening significantly. Companies must aggressively invest in research and development to avoid their offerings becoming obsolete, a challenge amplified by the sheer speed of innovation seen in 2024 and projected into 2025.

This relentless pace poses a direct threat of obsolescence to EMC's existing product lines if they fail to adapt. For example, the transition to next-generation memory technologies or new interface standards could render current hardware designs uncompetitive. EMC's ability to stay ahead requires substantial, ongoing investment in R&D, estimated to be a significant portion of capital expenditure for leading tech firms in the 2024-2025 period, to ensure its components meet evolving performance demands and integrate emerging material science breakthroughs.

The ever-changing and intricate web of international EMC and RF regulations presents a considerable hurdle for EMC. Navigating these diverse and frequently updated standards across various global markets, including the EU's Radio Equipment Directive and specific national mandates, requires significant investment in testing, certification processes, and product modifications.

Global Supply Chain Disruptions and Geopolitical Tensions

Global supply chain vulnerabilities continue to pose a significant threat to EMC. Geopolitical instability, like the ongoing trade disputes and regional conflicts, can easily disrupt the flow of essential components and finished goods. For instance, the semiconductor shortage that began in 2020 and extended through 2023 highlighted how reliant the electronics industry is on a few key manufacturing hubs, with lead times for some components stretching to over a year.

These disruptions directly impact EMC's ability to maintain consistent production schedules and meet customer demand. Increased lead times and the potential for shortages in raw materials or critical manufacturing processes can drive up costs and delay product launches. In 2024, many tech companies reported increased logistics costs due to shipping delays and higher freight rates, a trend that could persist.

- Geopolitical Risk: Ongoing international tensions can lead to export/import restrictions, impacting component availability and pricing.

- Supply Chain Concentration: Over-reliance on specific regions for manufacturing or raw materials creates single points of failure.

- Logistics Volatility: Shipping delays and rising freight costs remain a concern, affecting delivery timelines and overall cost of goods sold.

- Component Shortages: Persistent shortages of key electronic components, particularly semiconductors, can hinder production capacity.

Economic Downturns Affecting Electronics Demand

Economic downturns pose a significant threat to EMC. Broad economic slowdowns or recessions can curb both consumer and industrial spending on electronic devices, directly impacting demand for components. This cautious spending environment can lead to reduced sales volumes for companies like EMC Technology Co., Ltd.

The electronics component distribution market, in particular, is sensitive to these economic shifts. Reports from late 2023 and early 2024 indicated flat growth and a generally cautious outlook for the consumer market, directly reflecting the potential for decreased demand. For instance, a global economic slowdown could see a contraction in consumer discretionary spending, affecting sales of smartphones, laptops, and other electronics that rely on EMC's components.

- Reduced Consumer Spending: During economic contractions, consumers often postpone or cancel purchases of non-essential electronic goods.

- Lower Industrial Investment: Businesses may cut back on capital expenditures, including upgrades to electronic equipment and machinery, impacting B2B demand.

- Inventory Management Challenges: A sudden drop in demand can leave distributors like EMC with excess inventory, leading to potential write-downs and storage costs.

Intense competition, particularly from large semiconductor players, can lead to pricing pressures, potentially impacting EMC's profit margins. Rapid technological advancements also threaten product obsolescence if EMC fails to innovate quickly, with shortened product lifecycles becoming a norm. Navigating complex and evolving global regulations requires substantial investment in testing and certification.

Supply chain disruptions, driven by geopolitical instability and concentration in manufacturing, pose risks to production continuity and cost. Economic downturns can significantly reduce demand for electronic components as both consumers and businesses cut spending. For example, a projected 3% contraction in global IT spending for 2025, as indicated by some analyst reports, would directly affect the demand for EMC's products.

| Threat Category | Specific Risk | Impact on EMC | 2024-2025 Data/Projection |

| Competition | Aggressive pricing by rivals | Reduced profit margins | Average selling price for RF filters declined ~5% in late 2024. |

| Technological Change | Product obsolescence | Need for continuous R&D investment | Shortening product lifecycles due to AI and quantum computing advancements. |

| Regulatory Environment | Complex global standards | Increased testing and certification costs | Navigating EU RED and national mandates requires significant resources. |

| Supply Chain | Geopolitical disruptions, component shortages | Production delays, increased costs | Semiconductor lead times can exceed 12 months; logistics costs rose ~10% in 2024. |

| Economic Conditions | Reduced consumer/industrial spending | Lower sales volumes | Projected 3% contraction in global IT spending for 2025. |

SWOT Analysis Data Sources

This EMC SWOT analysis is built upon a robust foundation of data, drawing from official company financial statements, comprehensive market research reports, and expert industry analyses to provide a thorough and accurate strategic overview.