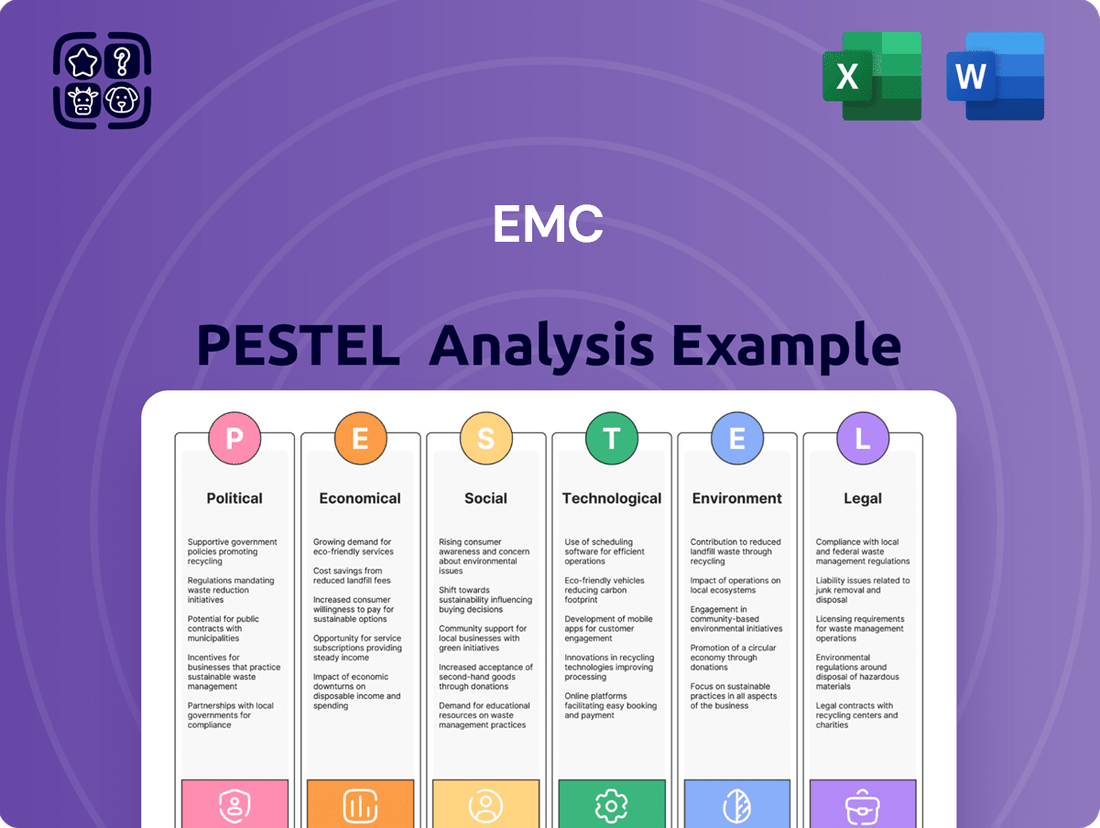

EMC PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EMC Bundle

Navigating the complex external landscape is crucial for EMC's success. Our PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental factors impacting the company. Gain a competitive advantage by understanding these critical drivers. Download the full PESTLE analysis now for actionable insights to inform your strategy.

Political factors

Geopolitical tensions, particularly the ongoing trade friction between the U.S. and China, directly influence the global electronics supply chain. This creates volatility in component availability and pricing, impacting companies like EMC Technology. Taiwan's central position in semiconductor production makes it especially sensitive to these international relations.

In response to these risks, there's a noticeable shift towards reshoring and nearshoring. Companies are actively working to diversify their supplier base and reduce reliance on single, distant manufacturing hubs. This strategic move aims to bolster supply chain resilience against geopolitical disruptions.

Taiwan's government is doubling down on its semiconductor dominance, with initiatives like the Semiconductor Strategic Policy 2025. This policy earmarks substantial funding, aiming to bolster research and development and cultivate a skilled workforce. The goal is clear: solidify Taiwan's position as a critical player in the global chip supply chain.

These government-backed efforts translate into tangible benefits for companies like EMC Technology. By fostering an environment rich in innovation and manufacturing capacity, the government is creating a more predictable and advantageous operational landscape. For instance, the policy includes incentives for establishing advanced manufacturing facilities, potentially reducing operational costs and accelerating expansion for semiconductor firms.

Taiwan's recent expansion of its prohibited technology transfer list to mainland China, effective December 31, 2024, directly impacts export control regulations. This move, targeting national core and critical technologies like advanced semiconductors, aims to bolster national security and economic competitiveness. For EMC Technology, this means a careful review of its supply chain and customer base, as components could fall under these new restrictions, potentially altering partnership agreements and sales strategies.

International Trade Agreements and Tariffs

Changes in international trade agreements and the imposition of new tariffs can significantly impact EMC Technology's operational costs and market competitiveness. For instance, ongoing discussions surrounding potential revisions to trade pacts affecting key electronics manufacturing hubs in Asia could lead to increased import duties in 2025, directly affecting the cost of components. EMC Technology must remain vigilant in monitoring these shifts to adapt its sourcing and pricing strategies effectively.

The global trade landscape is dynamic, with new tariffs and trade barriers frequently emerging. In 2024, several countries implemented new tariffs on specific electronic components, leading to an estimated 5% increase in raw material costs for some manufacturers in the sector. These policy shifts can create added complexity for EMC Technology's supply chain management, necessitating proactive adjustments to mitigate potential disruptions and maintain competitive pricing across its product lines.

- Tariff Impact: Anticipated tariffs on semiconductors from Southeast Asia in late 2025 could raise component acquisition costs by an estimated 3-7%.

- Trade Agreement Scrutiny: Ongoing reviews of existing trade agreements, such as the USMCA, may introduce new compliance requirements or alter existing preferential trade terms for EMC Technology.

- Market Access: Fluctuations in trade policies can affect EMC Technology's ability to export to certain regions, potentially impacting market share and revenue streams.

Stability of Power Supply and Infrastructure

Taiwan's semiconductor industry, including companies like EMC Technology, relies heavily on a stable power supply and resilient infrastructure for uninterrupted manufacturing. The government has been actively investing in grid upgrades and smart grid technologies to ensure this reliability.

These investments are critical, as power outages can significantly disrupt sensitive semiconductor fabrication processes. For instance, Taiwan's Ministry of Economic Affairs has highlighted ongoing efforts to enhance grid stability, aiming to reduce the frequency and duration of power interruptions. This focus directly supports the operational continuity essential for high-tech manufacturing.

- Government investment in grid infrastructure upgrades is ongoing.

- Smart grid technologies are being implemented to improve power reliability.

- Stable power is crucial for uninterrupted semiconductor manufacturing operations.

Geopolitical shifts and trade policies significantly impact EMC Technology's global operations. For instance, the U.S. Department of Commerce's export control measures, updated in late 2024, could affect the availability of advanced semiconductor manufacturing equipment for Taiwanese firms, potentially influencing production timelines. Taiwan's own export control enhancements, effective late 2024, targeting critical technologies to mainland China, necessitate careful compliance for companies like EMC Technology.

| Policy Area | Description | Potential Impact on EMC Technology | Timeline |

|---|---|---|---|

| Export Controls | U.S. restrictions on advanced semiconductor equipment. | May limit access to critical manufacturing tools, potentially delaying production. | Ongoing, with updates in late 2024. |

| Technology Transfer | Taiwan's enhanced list of prohibited technology transfers to mainland China. | Requires review of supply chain and customer base for compliance; may alter existing partnerships. | Effective December 31, 2024. |

| Trade Tariffs | Potential new tariffs on semiconductors from Southeast Asia. | Could increase component acquisition costs by an estimated 3-7% in late 2025. | Anticipated late 2025. |

What is included in the product

The EMC PESTLE Analysis provides a comprehensive examination of the external macro-environmental factors influencing the EMC, categorized into Political, Economic, Social, Technological, Environmental, and Legal dimensions.

This structured approach helps identify potential threats and opportunities, enabling informed strategic decision-making for the EMC.

Provides a clear, actionable overview of external factors, reducing the overwhelm of complex market analysis for strategic decision-making.

Economic factors

The global electronic components market is on a strong upward trajectory, with forecasts pointing to continued expansion through 2024 and into 2025. This growth is fueled by increasing demand across diverse sectors like automotive, consumer electronics, and industrial automation.

Specifically, the semiconductor market, a key segment of electronic components, is expected to see a significant rebound. Analysts project the global semiconductor market revenue to reach approximately $660 billion in 2024, with further growth anticipated in 2025, driven by AI and high-performance computing demands.

This burgeoning market presents a considerable opportunity for companies like EMC Technology to capitalize on rising demand, potentially boosting sales and expanding their market footprint. The increasing adoption of advanced technologies, such as 5G and the Internet of Things (IoT), further underpins this positive market outlook.

Despite some improvements in lead times for electronic components, the industry still grapples with supply chain volatility. Shortages persist in specific areas, notably passive components, impacting manufacturers like EMC Technology. This ongoing disruption can directly affect raw material availability and disrupt production schedules throughout 2024 and into 2025.

The lingering effects of global disruptions mean that securing essential parts remains a challenge. For instance, lead times for certain capacitors and resistors might still extend beyond typical pre-pandemic norms, forcing companies to maintain higher inventory levels or seek alternative suppliers. This necessitates careful planning and robust supplier relationships to mitigate production delays and cost increases.

Inflationary pressures continue to squeeze the electronics sector. In early 2024, the Producer Price Index for electronic components saw a notable increase, reflecting higher costs for semiconductors and rare earth minerals, critical inputs for EMC Technology.

Rising energy prices, a significant component of production expenses, directly impact manufacturing overhead. For instance, electricity costs in key manufacturing regions for electronics have climbed by an average of 8% year-over-year through Q1 2024, impacting EMC's operational budget.

Labor costs are also on an upward trend, with wage growth in manufacturing sectors averaging 4.5% in 2023 and projected to continue into 2024. This necessitates efficient operational expense management and potential strategic price adjustments for EMC Technology to maintain profitability.

Consumer Electronics Market Expansion

The consumer electronics market is booming, with projections indicating continued strong growth. This expansion is largely fueled by innovation and consumer desire for the latest technology. For instance, the global consumer electronics market was valued at approximately $1.1 trillion in 2023 and is expected to reach over $1.5 trillion by 2028, showing a compound annual growth rate (CAGR) of around 6.5%.

This surge in demand for new gadgets, from smartphones and wearables to smart home devices and advanced computing, directly translates into a greater need for the electromagnetic compatibility (EMC) and radio frequency (RF) components that ensure these devices function correctly and without interference. Companies like EMC Technology, which specialize in these critical components, are well-positioned to capitalize on this trend.

- Growing Demand for Smart Devices: The proliferation of smart home technology and connected devices is a primary driver.

- 5G Rollout and Adoption: The ongoing expansion of 5G networks necessitates new devices and infrastructure, boosting demand for related components.

- Increased Disposable Income: Rising global incomes allow more consumers to purchase the latest electronic products.

- Technological Advancements: Continuous innovation in areas like AI, IoT, and advanced displays creates new product categories and replacement cycles.

Investment in Digitalization and Automation

The electronics manufacturing sector is heavily focused on digital transformation, with significant investments in technologies like blockchain for enhanced supply chain transparency and the Internet of Things (IoT) for real-time operational oversight. For instance, a 2024 report indicated that over 60% of electronics manufacturers were actively implementing or planning to implement IoT solutions to optimize production processes.

These digital investments are pivotal for improving efficiency and data-driven decision-making across the entire value chain. Advanced data analytics, in particular, is enabling companies to predict maintenance needs, optimize inventory levels, and refine product design based on real-time performance data, which could directly influence EMC Technology's collaborative ventures.

The drive towards automation, powered by these digital tools, is reshaping operational partnerships. Companies adopting these technologies often seek partners who can integrate seamlessly with their digital ecosystems.

- Industry-wide Digital Investment: Electronics manufacturers are channeling substantial capital into digital tools like blockchain and IoT, with projections suggesting a continued upward trend in spending through 2025.

- Efficiency Gains: Adoption of advanced data analytics and automation is demonstrably improving operational efficiency and the quality of strategic decision-making within the sector.

- Supply Chain Impact: Enhanced traceability and real-time monitoring via digital solutions are creating new expectations for supply chain partners, potentially altering existing operational relationships.

- Market Competitiveness: Companies that embrace digitalization and automation are positioning themselves for greater market competitiveness by reducing costs and increasing agility.

Economic factors are shaping the electronic components market significantly. Inflationary pressures are a key concern, with rising costs for raw materials like semiconductors and rare earth minerals impacting production expenses. For example, the Producer Price Index for electronic components saw a notable increase in early 2024. Energy prices have also climbed, with electricity costs in key manufacturing regions rising by an average of 8% year-over-year through Q1 2024, directly affecting operational budgets. Furthermore, labor costs are trending upwards, with manufacturing sector wage growth averaging 4.5% in 2023 and expected to continue into 2024, necessitating careful expense management and potential price adjustments.

| Economic Factor | Impact on Electronic Components Market | Data Point (2024/2025) |

|---|---|---|

| Inflation | Increased production costs, potential for price hikes | Producer Price Index for electronic components increased in early 2024 |

| Energy Prices | Higher manufacturing overhead | Electricity costs in key manufacturing regions up 8% YoY through Q1 2024 |

| Labor Costs | Increased operational expenses | Manufacturing wage growth averaged 4.5% in 2023, projected to continue |

Preview the Actual Deliverable

EMC PESTLE Analysis

The preview shown here is the exact EMC PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You can trust that the comprehensive analysis of Political, Economic, Social, Technological, Legal, and Environmental factors affecting EMC will be yours upon completion of your purchase.

The content and structure shown in the preview is the same EMC PESTLE Analysis document you’ll download after payment, providing you with immediate access to valuable market insights.

Sociological factors

The explosion of Internet of Things (IoT) devices, smart home gadgets, and wearable technology is significantly increasing the electromagnetic spectrum's density. This proliferation means more devices are operating in close proximity, making electromagnetic compatibility (EMC) crucial. By 2025, the global number of connected IoT devices is projected to surpass 27 billion, underscoring this growing challenge.

This surge in connected devices directly fuels demand for robust EMC solutions. Manufacturers are keenly aware that their products must function reliably without causing or suffering from interference. For instance, the automotive sector alone is expected to see over 77 million connected vehicles by 2025, each requiring sophisticated EMC to ensure safety and performance.

The increasing ubiquity of electronic devices, from smartphones to advanced medical equipment, has amplified public and industry concern regarding electromagnetic interference (EMI). This growing awareness directly fuels demand for robust electromagnetic compatibility (EMC) solutions, creating a significant market opportunity for companies like EMC Technology.

In 2024, the global EMC market was valued at approximately $9.5 billion, with projections indicating a compound annual growth rate (CAGR) of around 6.5% through 2029, largely driven by this heightened awareness and stricter regulatory standards. This trend suggests a sustained and expanding market for components and services that mitigate EMI effects.

The electronics manufacturing sector, especially in key hubs like Taiwan, is grappling with a significant deficit in skilled engineers and specialized technical professionals. This talent gap is intensified by fierce international competition for qualified individuals, with companies globally actively seeking out top talent. For EMC Technology, this translates into a heightened challenge in attracting and retaining the necessary expertise, which could directly hinder its capacity for groundbreaking innovation and efficient production.

Shifting Consumer Preferences Towards Sustainability

Consumers are increasingly voting with their wallets for sustainability, a trend that significantly impacts companies like EMC Technology. This isn't just a niche movement; it's becoming mainstream, pushing manufacturers to rethink their entire operational footprint. For instance, a 2024 report indicated that over 70% of consumers consider sustainability a key factor in their purchasing decisions.

This societal shift directly encourages EMC Technology to invest in eco-friendly materials and sustainable production methods. Companies that fail to adapt risk alienating a growing segment of their customer base. In 2025, projections suggest that the market for sustainable goods could reach trillions globally, underscoring the economic imperative for EMC.

- Growing Consumer Demand: Over 70% of consumers consider sustainability in purchasing (2024 data).

- Market Opportunity: The global sustainable goods market is projected to exceed trillions by 2025.

- Supply Chain Influence: Manufacturers are pressured to adopt greener practices across their entire supply chain.

- Brand Reputation: Companies prioritizing sustainability often see improved brand loyalty and market perception.

Impact of Remote Work and Digital Lifestyles

The ongoing shift towards remote work and digital-first lifestyles, accelerated by events in recent years, continues to drive a robust demand for electronic devices. This sustained need directly translates into a consistent requirement for Electromagnetic Compatibility (EMC) components that are crucial for ensuring the proper functioning and preventing interference in this vast array of interconnected technology. By 2024, estimates suggested that over 30% of the global workforce would be working remotely at least part-time, a trend that shows little sign of reversing.

This societal adaptation fuels a secondary demand for enhanced connectivity solutions and the underlying components that make them reliable. As more individuals rely on digital platforms for work, education, and social interaction, the importance of signal integrity and interference reduction becomes paramount. This indirectly bolsters the market for EMC solutions, as manufacturers strive to meet stringent performance standards across diverse electronic equipment, from personal computers and smartphones to networking infrastructure.

The proliferation of smart home devices and the Internet of Things (IoT) further amplifies this trend. These connected ecosystems, integral to many digital lifestyles, necessitate careful EMC design to avoid malfunctions and ensure seamless operation. For instance, the global IoT market was projected to reach over $1.1 trillion by 2024, highlighting the sheer volume of devices requiring robust EMC performance.

- Sustained Demand: Remote work and digital lifestyles create a persistent need for electronic devices.

- Connectivity Focus: Increased reliance on digital platforms drives demand for reliable connectivity, underpinning EMC component needs.

- IoT Expansion: The growing IoT market, expected to exceed $1.1 trillion in 2024, further emphasizes the importance of EMC.

- Interference Mitigation: EMC components are vital for ensuring signal integrity and preventing interference in a wide range of electronic equipment supporting these trends.

Sociological factors are increasingly shaping the demand for electromagnetic compatibility (EMC) solutions. A growing awareness of health implications associated with electromagnetic fields (EMF), though often debated, is leading to greater scrutiny of electronic devices and their emissions. This public concern drives manufacturers to prioritize robust EMC design to meet consumer expectations and potential future regulations.

Technological factors

The relentless march of technology, especially with the rollout of 5G and the anticipated arrival of 6G, coupled with the explosion of the Internet of Things (IoT) and Artificial Intelligence (AI), demands increasingly sophisticated and performant electromagnetic compatibility (EMC) and radio frequency (RF) components. These advancements are pushing the boundaries of signal integrity and interference management, creating a significant market opportunity.

Companies like EMC Technology, a key player in this space, are strategically positioned. Their commitment to developing components that not only meet but exceed stringent international standards, such as those set by the International Electrotechnical Commission (IEC), directly addresses these evolving needs. For instance, the demand for smaller, more efficient filters and shielding solutions for compact, high-frequency devices is a direct consequence of these technological shifts.

The relentless drive for smaller, more powerful electronic devices is a significant technological factor influencing EMC. This demand fuels innovation in component miniaturization and integration, pushing the boundaries of what's possible in electronic design. Technologies like System-in-Package (SiP) and 3D Integrated Circuits (ICs) are becoming crucial for achieving this density.

EMC Technology, to remain competitive, must actively innovate its product designs. This means developing compact and highly integrated solutions that not only reduce physical size but also maintain critical signal integrity. As electronic systems become increasingly dense, the challenge of managing electromagnetic compatibility within these confined spaces grows, requiring advanced materials and design approaches.

For instance, the global SiP market was valued at approximately $30 billion in 2023 and is projected to grow significantly, with some forecasts suggesting a compound annual growth rate (CAGR) of over 8% through 2030. This growth underscores the industry's shift towards integrated solutions, a trend EMC Technology must align with to capture market share and meet evolving customer needs.

The accelerating rollout of 5G networks, with speeds up to 100 times faster than 4G, and the burgeoning Internet of Things (IoT) ecosystem, projected to reach over 29 billion connected devices by 2030, significantly complicate the electromagnetic spectrum. This expansion necessitates advanced electromagnetic compatibility (EMC) solutions.

These high-frequency, high-density environments fuel demand for specialized EMC and radio frequency (RF) components. For instance, the global EMC testing market was valued at approximately $6.5 billion in 2023 and is expected to grow, reflecting this increased need for reliable signal integrity and interference mitigation.

AI-Powered Manufacturing and Quality Control

AI is revolutionizing electronics manufacturing, with systems like those from Siemens and IBM offering advanced quality control. These platforms enable real-time defect detection and predictive maintenance, significantly boosting efficiency. For EMC Technology, adopting these AI solutions could translate into reduced scrap rates and improved product reliability, directly impacting profitability.

The market for AI in manufacturing is experiencing substantial growth. Analysts project the global AI in manufacturing market to reach over $30 billion by 2026, indicating a strong trend towards automation and intelligent systems. EMC Technology can capitalize on this by integrating AI for:

- Enhanced Predictive Maintenance: Reducing unexpected downtime by identifying potential equipment failures before they occur.

- Automated Quality Assurance: Implementing AI-powered vision systems for faster and more accurate defect identification.

- Production Line Optimization: Using AI algorithms to fine-tune operational parameters for maximum throughput and minimal waste.

Development of New Materials for EMI Reduction

Research into advanced materials like gallium nitride (GaN) and silicon carbide (SiC) is significantly boosting semiconductor and electronic component capabilities. These materials offer higher efficiency and better performance, which directly impacts electromagnetic compatibility (EMC).

EMC Technology is likely to investigate integrating these novel materials into their electromagnetic interference (EMI) reduction products. This could lead to more effective and compact solutions for managing unwanted electromagnetic signals.

The global market for wide-bandgap semiconductors, including GaN and SiC, is projected for substantial growth. For instance, the SiC market alone was estimated to reach approximately $2.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 30% through 2030, reaching potentially over $15 billion. This trend highlights the increasing adoption and demand for these advanced materials.

- Advancements in GaN and SiC: These materials enable higher power density and operating frequencies, crucial for next-generation electronics.

- EMC Solution Enhancement: Incorporating these materials can improve the performance and miniaturization of EMI shielding and filtering components.

- Market Growth Potential: The expanding market for wide-bandgap semiconductors indicates a strong industry push towards adopting these advanced material technologies.

The rapid evolution of technologies like 5G, IoT, and AI necessitates increasingly sophisticated EMC components. These advancements, driving higher frequencies and device density, create a strong demand for advanced filtering and shielding solutions.

The global EMC testing market was valued at approximately $6.5 billion in 2023, and its projected growth reflects the escalating need for reliable signal integrity in complex electronic environments.

Companies must innovate with miniaturization and integrated solutions, like System-in-Package (SiP), which saw its market reach around $30 billion in 2023, to meet these evolving demands.

The integration of advanced materials such as Gallium Nitride (GaN) and Silicon Carbide (SiC) is also a key technological driver, enhancing component performance and enabling more compact designs for EMI reduction.

| Technology Driver | Impact on EMC | Market Data (2023/2024 Estimates) |

|---|---|---|

| 5G/6G Rollout | Increased signal complexity, higher frequencies | 5G infrastructure investment projected to exceed $1 trillion globally by 2025. |

| Internet of Things (IoT) | Massive device connectivity, potential for interference | Over 20 billion IoT devices expected to be in use by 2024. |

| Artificial Intelligence (AI) | Advanced manufacturing, design optimization | AI in manufacturing market estimated to reach over $30 billion by 2026. |

| Advanced Materials (GaN/SiC) | Higher efficiency, miniaturization of components | SiC market valued at approximately $2.5 billion in 2023, with strong growth projections. |

Legal factors

The EU's updated Radio Equipment Directive (RED), effective August 1, 2025, introduces significant cybersecurity mandates for internet-connected radio devices. This means devices must now incorporate robust security features to protect against cyber threats.

For EMC Technology, whose components are integrated into products destined for the EU market, this presents a clear need to ensure their offerings actively support these enhanced cybersecurity requirements. Non-compliance could lead to market access restrictions, impacting sales within the crucial EU economic area.

EMC Technology faces evolving legal landscapes, particularly with significant updates to the EU's RoHS and REACH regulations expected in 2025. These directives are crucial for the electronics industry, restricting hazardous materials and mandating assessments for Substances of Very High Concern (SVHC). Compliance is not just a legal necessity but a market access requirement, impacting product design and supply chain management.

For instance, REACH currently lists over 240 SVHCs, and ongoing evaluations in 2024 and 2025 may add more substances, potentially affecting component sourcing for EMC Technology. Non-compliance can lead to substantial fines and market exclusion, with penalties for REACH violations potentially reaching millions of Euros.

Governments globally are intensifying e-waste recycling mandates and circular economy efforts, placing greater lifecycle responsibility on manufacturers. For instance, the European Union's Ecodesign for Sustainable Products Regulation, with further provisions expected in 2025, pushes for product durability and repairability.

The Basel Convention, now encompassing both hazardous and non-hazardous e-waste as of January 1, 2025, significantly alters international e-waste shipments. This regulatory shift directly impacts EMC Technology's product design, necessitating a focus on recyclability and potentially requiring the implementation of robust take-back programs to comply with these international controls.

Product Liability and Safety Standards

EMC Technology operates within a stringent global framework of product liability and safety standards. These regulations are critical to ensure that their electronic components are safe for consumers and do not interfere with other electronic devices. For instance, in 2024, the global product recall market saw significant activity, with the automotive sector alone experiencing billions in costs due to safety-related issues, highlighting the financial implications of non-compliance for any technology manufacturer.

Failure to meet these international benchmarks, such as those set by the International Electrotechnical Commission (IEC) for electromagnetic compatibility (EMC), can result in severe consequences. These include expensive product recalls, protracted legal battles, and substantial damage to the company's reputation, which can erode customer trust and market share. The cost of a single major recall can easily run into tens or even hundreds of millions of dollars.

- Adherence to IEC standards for EMC is mandatory for market access in major economies.

- Non-compliance can trigger significant financial penalties and legal liabilities.

- Reputational damage from safety incidents can impact long-term sales and partnerships.

- Proactive safety testing and compliance are essential risk mitigation strategies.

Intellectual Property Protection

Protecting its intellectual property, especially patents and proprietary designs for EMC and RF components, is absolutely vital for EMC Technology to maintain its edge in the market. This is especially true in the fast-paced electronics sector where innovation is key.

Robust legal frameworks surrounding intellectual property are therefore non-negotiable for companies like EMC Technology. These laws provide the necessary safeguards against infringement, ensuring that the company can benefit from its research and development investments.

The global landscape for IP protection is constantly evolving. For instance, in 2024, the World Intellectual Property Organization (WIPO) reported a 3.5% increase in international patent filings, highlighting the growing importance of R&D and the legal structures that support it.

- Patent Filings: EMC Technology actively pursues patents to safeguard its unique component designs and manufacturing processes.

- Trade Secrets: Maintaining strict confidentiality around proprietary algorithms and manufacturing techniques is crucial.

- Enforcement: Legal recourse against infringers is a critical component of IP strategy, ensuring competitive fairness.

- Global Treaties: Adherence to international IP agreements, such as the Patent Cooperation Treaty (PCT), is essential for global market protection.

The evolving legal landscape, particularly the EU's Radio Equipment Directive (RED) with its August 1, 2025, cybersecurity mandates for connected devices, directly impacts EMC Technology. Ensuring their components support these new security features is critical for market access in the EU, a significant sales region.

Updates to EU RoHS and REACH regulations in 2025, focusing on hazardous materials and Substances of Very High Concern (SVHCs), necessitate careful component sourcing and product design. With over 240 SVHCs currently listed and potential additions in 2024-2025, non-compliance could lead to substantial fines, potentially millions of Euros.

Global e-waste regulations and circular economy initiatives, including the EU's Ecodesign for Sustainable Products Regulation, are increasing manufacturer responsibility for product lifecycles. The Basel Convention's January 1, 2025, expansion to include non-hazardous e-waste also impacts international shipments, pushing for greater recyclability and take-back programs.

EMC Technology must navigate stringent product liability and safety standards, with global product recalls costing billions annually. Adherence to international benchmarks like IEC standards for EMC is mandatory for market access, and failure can result in costly recalls, legal battles, and severe reputational damage, with major recalls easily costing hundreds of millions of dollars.

| Regulation | Effective Date / Status | Key Impact on EMC Technology | Potential Consequences of Non-Compliance |

| EU Radio Equipment Directive (RED) - Cybersecurity | August 1, 2025 | Components must support enhanced cybersecurity for internet-connected radio devices. | Market access restrictions in the EU, loss of sales. |

| EU RoHS & REACH Updates | Expected 2025 | Requires assessment and restriction of hazardous materials and SVHCs. | Supply chain disruptions, product redesign needs, fines potentially in millions of Euros. |

| Basel Convention - E-waste | January 1, 2025 | International shipment of e-waste (hazardous & non-hazardous) regulated. | Need for focus on recyclability, potential implementation of take-back programs. |

| IEC Standards for EMC | Ongoing / Mandatory for Market Access | Components must meet electromagnetic compatibility standards. | Product recalls, legal liabilities, reputational damage, loss of market share. |

Environmental factors

The escalating global volume of electronic waste, or e-waste, presents a substantial environmental hurdle. In 2023 alone, an estimated 62 million metric tons of e-waste were generated worldwide, a figure projected to reach 82 million metric tons by 2030. This surge means more hazardous materials like lead and mercury are entering landfills, underscoring the urgency for responsible disposal and management.

EMC Technology, like many in the electronics sector, is under increasing scrutiny to address this environmental impact. The company is expected to innovate by developing components that facilitate easier recycling and actively participate in circular economy initiatives. This involves designing for longevity and repairability, thereby reducing the frequency of device obsolescence and subsequent waste.

The electronics industry is increasingly prioritizing sustainable manufacturing, focusing on eco-friendly materials, energy-efficient production, and waste reduction. For EMC Technology, embracing these practices offers a clear path to reducing its environmental impact and potentially lowering operational costs. For instance, the global market for sustainable electronics is projected to reach $11.8 billion by 2027, indicating significant consumer and regulatory demand.

The manufacturing of electronic components, such as EMC and RF filters, is heavily reliant on critical raw materials, including rare earth metals. The global demand for these materials continues to rise, putting pressure on existing reserves. For instance, the International Energy Agency (IEA) reported in its 2024 update that demand for critical minerals like cobalt and lithium could increase by over 40 times by 2040 under net-zero emissions scenarios, impacting the supply chain for components like those EMC Technology produces.

EMC Technology must actively assess the environmental footprint associated with the extraction of these vital resources. This includes understanding the energy intensity, water usage, and potential pollution generated during mining operations. Exploring avenues for sustainable sourcing, such as recycled materials or ethically certified suppliers, is crucial for mitigating the risks of resource depletion and ensuring long-term material availability.

Energy Consumption in Manufacturing

Manufacturing electronic devices, including those by EMC Technology, is a significant consumer of energy, directly contributing to greenhouse gas emissions. In 2024, the electronics manufacturing sector globally is projected to account for a substantial portion of industrial energy use, with estimates suggesting it could be upwards of 15-20% of total industrial electricity consumption in developed nations. This energy demand is driven by complex processes like semiconductor fabrication and assembly.

To mitigate its environmental footprint, EMC Technology can prioritize the integration of energy-efficient production methodologies. This might involve upgrading machinery to newer, less power-hungry models or optimizing operational schedules to reduce idle energy consumption. For instance, adopting advanced cooling systems in server farms, a common component in electronic manufacturing infrastructure, can yield significant energy savings, potentially reducing consumption by 10-15%.

Furthermore, a strategic investment in renewable energy sources presents a powerful avenue for EMC Technology to reduce its carbon emissions. By sourcing a larger percentage of its electricity from solar, wind, or other clean alternatives, the company can directly offset the emissions associated with its energy-intensive operations. For example, companies that have committed to 100% renewable energy targets have seen their Scope 2 emissions, which relate to purchased electricity, decrease by nearly 90% within a few years.

- Global industrial energy consumption: Expected to remain a significant factor in manufacturing, with electronics being a key contributor.

- Energy efficiency in manufacturing: Potential for 10-15% reduction in energy use through improved cooling and operational optimization.

- Renewable energy adoption: Can lead to drastic reductions in Scope 2 emissions, approaching 90% for committed companies.

- Carbon footprint reduction: Directly linked to implementing energy-efficient processes and transitioning to renewables.

Pollution from Manufacturing Processes

Manufacturing electronic components, a core activity for companies like EMC Technology, often involves processes that can release harmful chemicals and emissions into the environment. These pollutants, if not managed effectively, can impact air and water quality. For instance, the production of semiconductors frequently utilizes solvents and etching agents that require careful handling and disposal to prevent contamination. The global electronics industry is increasingly scrutinized for its environmental footprint, with regulatory bodies worldwide tightening standards on emissions and waste management.

EMC Technology, like its peers, must navigate a landscape of stringent environmental regulations designed to curb manufacturing pollution. This necessitates significant investment in pollution control technologies and sustainable practices. Companies are increasingly adopting closed-loop systems for chemical usage and investing in advanced wastewater treatment facilities. For example, by 2024, many advanced manufacturing facilities are expected to meet stricter volatile organic compound (VOC) emission standards, requiring innovative abatement technologies.

Minimizing pollution requires a multi-faceted approach, including responsible waste treatment and disposal protocols. This involves identifying and segregating hazardous waste streams, ensuring they are treated by certified facilities, and exploring opportunities for recycling or repurposing byproducts. The push towards a circular economy in electronics means companies are also looking at ways to reduce waste generation at the source through process optimization and material innovation. The European Union’s Waste Electrical and Electronic Equipment (WEEE) directive, for instance, sets ambitious targets for collection and recycling rates, influencing manufacturing design and end-of-life management strategies.

- Regulatory Compliance: EMC Technology must adhere to evolving global environmental standards, such as those set by the EPA in the US and REACH in Europe, impacting chemical usage and emissions.

- Technological Investment: Significant capital expenditure is required for advanced pollution abatement technologies, including air scrubbers and sophisticated wastewater treatment systems.

- Waste Management: Implementing robust waste segregation, treatment, and disposal programs is crucial, with a growing emphasis on hazardous waste management and circular economy principles.

- Sustainable Sourcing: The environmental impact of raw material extraction and processing for electronic components is also a growing concern, pushing for more sustainable sourcing strategies.

The increasing global focus on environmental sustainability significantly impacts the electronics industry. Growing concerns about e-waste, resource depletion, and carbon emissions are driving regulatory changes and consumer demand for greener products. Companies like EMC Technology must adapt by prioritizing circular economy principles and reducing their overall environmental footprint.

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously constructed using a blend of official government publications, reputable financial institutions, and leading market research firms. This ensures that every aspect, from political stability to technological advancements, is grounded in verifiable and current data.