Element PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Element Bundle

Unlock a deeper understanding of Element's operating environment with our comprehensive PESTLE analysis. Discover how political stability, economic shifts, and technological advancements are shaping its future. Equip yourself with actionable intelligence to navigate these external forces and strengthen your strategic planning. Download the full report now for immediate insights.

Political factors

Governments across North America, Australia, and New Zealand are tightening emissions regulations, particularly for commercial fleets. California, for instance, through the Air Resources Board (CARB), is pushing for zero-emission vehicle (ZEV) adoption, directly impacting fleet management companies like Element.

These mandates are accelerating the transition to ZEVs, compelling companies like Element Fleet Management to adapt their fleet composition and service offerings to meet these new environmental standards, a trend expected to continue through 2025.

Shifting trade policies and the imposition of tariffs represent a significant political factor impacting Element. For instance, proposed 25% tariffs on Canadian and Mexican auto imports, as discussed in 2024, could directly influence vehicle pricing and disrupt established supply chains. This would inevitably increase Element's vehicle acquisition costs and, consequently, the overall cost of fleet operations for its clients.

Governments worldwide are increasingly offering incentives, grants, and funding to encourage the adoption of electric vehicles (EVs) and sustainable fleet technologies. For instance, the U.S. government's Inflation Reduction Act of 2022 includes significant tax credits for commercial clean vehicles, potentially up to $40,000 for qualifying EVs purchased by businesses. These programs aim to lower the upfront cost of electrification, making greener fleets more financially accessible for companies.

Element can strategically leverage these government initiatives to support its clients' transition to sustainable fleets. By identifying and helping clients access relevant programs, such as state-level rebates or federal grants for charging infrastructure, Element can significantly reduce the financial burden associated with fleet electrification. This proactive approach not only accelerates the adoption of cleaner technologies but also enhances the overall cost-effectiveness of green fleet solutions for businesses.

Political Stability in Key Regions

Element's core markets in North America, Australia, and New Zealand benefit from generally stable political environments, which is vital for predictable business operations and investment. For instance, in 2024, Australia's federal government budget projected continued investment in infrastructure and a focus on economic growth, signaling regulatory continuity. However, potential shifts in government policy, such as changes to environmental regulations or trade agreements, could introduce volatility.

Geopolitical events, even those occurring outside these primary regions, can indirectly affect Element. For example, global supply chain disruptions stemming from international conflicts, as seen in various regions throughout 2023 and continuing into 2024, can impact raw material availability and logistics costs. Element's strategic planning must account for this external risk, even when its direct operations are in stable jurisdictions.

Key considerations for Element's political landscape include:

- Regulatory Predictability: Consistent and transparent regulatory frameworks in North America, Australia, and New Zealand support Element's long-term planning and capital allocation.

- Government Policy Impact: Changes in fiscal policy, trade agreements, or industry-specific regulations can directly influence Element's profitability and market access.

- Geopolitical Risk Mitigation: Strategies to manage supply chain vulnerabilities and currency fluctuations are essential due to the interconnected nature of global politics and economics.

- Election Cycles: Upcoming elections in these key regions in 2024 and 2025 will be monitored for potential policy shifts that could affect Element's operating environment.

Data Protection and Privacy Laws

Data protection and privacy laws are increasingly shaping how companies like Element operate, especially with the rise of telematics and AI in fleet management. These regulations are becoming more rigorous, demanding strict adherence to safeguard sensitive information. For Element, this means meticulously managing driver data and vehicle performance metrics to build and maintain trust with clients and avoid significant legal penalties.

In 2024, the global data privacy software market was valued at approximately $2.7 billion and is projected to grow substantially. This highlights the critical importance of compliance. Element must navigate a complex web of regulations, such as the GDPR in Europe and various state-level privacy laws in the US, ensuring their data handling practices are robust and transparent. Failure to comply can result in hefty fines; for instance, GDPR violations can reach up to 4% of annual global turnover or €20 million, whichever is higher.

- GDPR Compliance: Element must ensure all data processing activities involving EU residents adhere to GDPR, particularly concerning consent, data minimization, and the right to be forgotten.

- Driver Data Security: Protecting driver information, including location history and driving behavior, is paramount. Robust encryption and access controls are essential.

- AI Ethics and Transparency: As AI is integrated into fleet analytics, Element needs to be transparent about how algorithms use data and ensure fairness in their application.

- Cross-Border Data Transfers: For international operations, Element must comply with regulations governing the transfer of personal data across borders, such as the EU-US Data Privacy Framework.

Governmental support for electric vehicle (EV) adoption is a significant political factor, with initiatives like the US Inflation Reduction Act offering substantial tax credits for commercial clean vehicles, potentially up to $40,000 per qualifying EV in 2024. These incentives directly reduce the upfront cost of electrification for businesses utilizing fleet services.

Stricter emissions regulations, such as California's zero-emission vehicle mandates, are compelling fleet management companies like Element to adapt their vehicle portfolios. These regulations are projected to accelerate the transition to cleaner fleets through 2025, impacting fleet composition and service offerings.

Shifting trade policies, including potential tariffs on imported vehicles discussed in 2024, can directly increase acquisition costs and disrupt supply chains, affecting the overall cost of fleet operations. Geopolitical events can also indirectly impact Element through global supply chain disruptions, influencing raw material availability and logistics costs.

What is included in the product

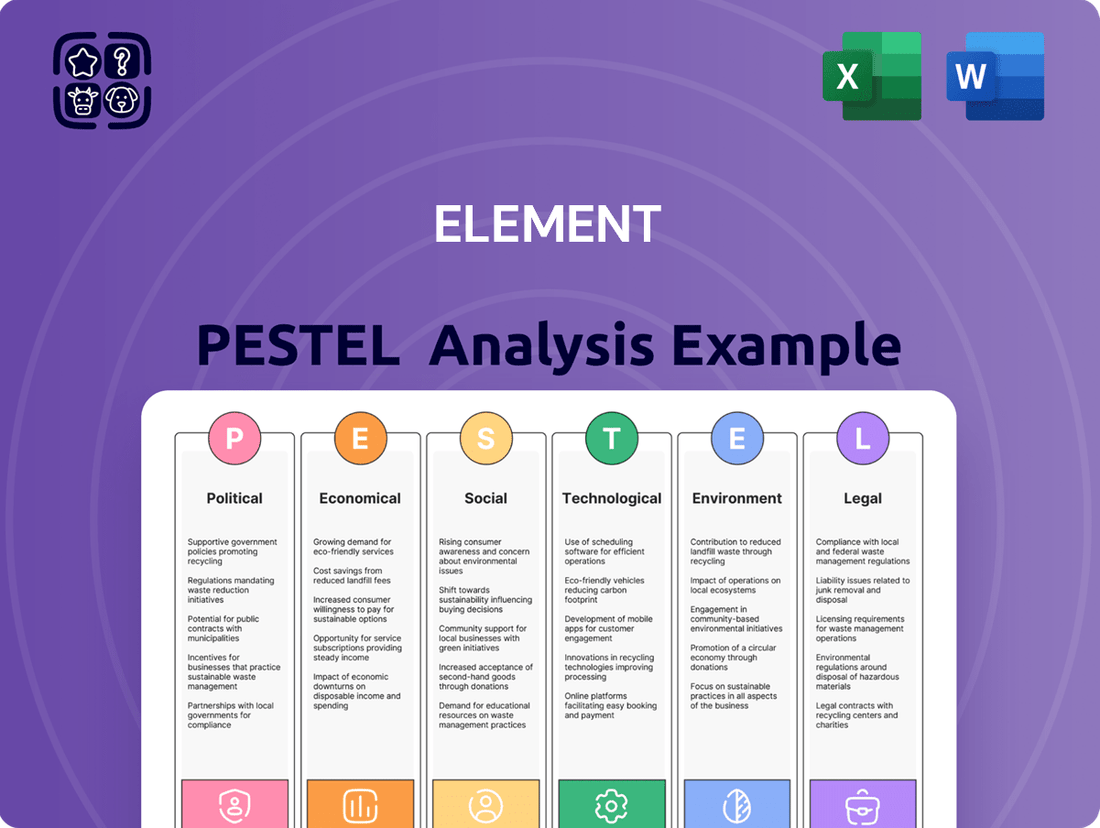

The Element PESTLE Analysis dissects the external macro-environmental factors influencing an Element across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

This comprehensive framework provides actionable insights for strategic decision-making by identifying potential threats and opportunities within the Element's operating landscape.

The Element PESTLE Analysis provides a structured framework to identify and understand external factors, alleviating the pain of uncertainty and enabling more informed strategic decisions.

Economic factors

Interest rate fluctuations significantly influence the cost of capital for businesses like Element, impacting vehicle acquisition and leasing expenses. As of early 2025, interest rates remained a key consideration, though Element's resilience was evident.

For instance, while the Federal Reserve maintained a hawkish stance through much of 2024, signaling potential for higher borrowing costs, Element demonstrated robust financial health. Their ability to navigate these higher rate environments, as reflected in their strong performance indicators, suggests effective cost management and a stable demand for their fleet management services.

Rising inflation significantly impacts Element Fleet Management by increasing operational costs. For instance, the average cost of vehicle maintenance and repair parts saw a notable increase in 2024, driven by supply chain issues and higher raw material prices. This means Element must absorb or pass on these higher expenses for services like vehicle upkeep and replacement parts.

To counter these inflationary pressures, Element Fleet Management is focusing on optimizing its supply chain and negotiating better terms with vendors. Labor costs, particularly for skilled technicians, are also on the rise, impacting the affordability of comprehensive fleet solutions. Strategic cost management is therefore crucial for maintaining profitability and competitive pricing in the evolving market.

The global commercial vehicle market is projected to reach $2.2 trillion by 2027, a significant increase fueled by the booming e-commerce sector and the ever-growing need for efficient last-mile delivery solutions. This surge in demand directly translates into a greater need for sophisticated fleet management systems, which are crucial for optimizing operations and reducing costs for businesses relying on these vehicles.

In 2024, the demand for light commercial vehicles (LCVs) in North America alone saw a robust year-over-year growth of 8%, largely attributed to increased online retail activity. This trend is expected to continue, with projections indicating a further 6% expansion in LCV sales through 2025, directly benefiting companies like Element that provide essential services to these growing fleets.

Fuel Price Volatility

Fluctuations in fuel prices directly impact Element's fleet operating costs, underscoring the importance of effective fuel management. In 2024, global oil prices have shown significant swings, with Brent crude averaging around $83 per barrel for the year to date, impacting transportation expenses. This volatility makes Element's optimization solutions and exploration of alternative fuels increasingly crucial for clients aiming to mitigate these unpredictable costs.

Element's value proposition is enhanced by its capacity to address the challenges posed by energy market instability. For instance, the increasing adoption of electric vehicles (EVs) in commercial fleets, with EV sales projected to grow by 30% globally in 2024 according to industry reports, offers a hedge against fossil fuel price shocks.

- Rising Fuel Costs: Global fuel price volatility directly increases operational expenses for companies relying on transportation.

- Demand for Efficiency: Clients are actively seeking solutions to optimize fuel consumption and reduce their carbon footprint.

- Alternative Fuel Growth: The market for alternative fuels, including electric and hydrogen, is expanding, presenting new opportunities.

- Supply Chain Impact: Fuel price shocks can disrupt supply chains, affecting delivery times and overall business continuity.

Vehicle Availability and Supply Chain

Supply chain disruptions continue to impact vehicle availability. For instance, in early 2024, the automotive industry still faced lingering effects from semiconductor shortages, leading to extended wait times for certain models. This directly affects fleet operators like Element, potentially delaying crucial vehicle replacements and expansion plans, which can strain client service levels.

Element's success hinges on its ability to manage these supply chain complexities. By securing consistent vehicle supply, even amidst these challenges, Element can ensure client satisfaction and maintain its operational efficiency. For example, proactive partnerships with manufacturers and diversified sourcing strategies are key to mitigating these risks.

- Semiconductor Shortages: While easing, shortages persisted into 2024, impacting production volumes for many manufacturers.

- Logistics Bottlenecks: Port congestion and transportation issues, particularly in late 2023 and early 2024, added to delivery delays.

- Inventory Levels: New vehicle inventory for many popular models remained below pre-pandemic levels throughout much of 2024, affecting immediate availability.

- Fleet Replacement Cycles: Delays in receiving new vehicles can push back essential fleet upgrades, impacting operational costs and vehicle uptime.

Economic factors significantly shape Element's operational landscape. Interest rate hikes in 2024, with the Federal Reserve maintaining a hawkish stance, increased borrowing costs, yet Element demonstrated resilience. Inflation also posed challenges, driving up maintenance costs; for example, vehicle parts saw notable price increases in early 2024, impacting Element's operational expenses.

The commercial vehicle market's growth, projected to reach $2.2 trillion by 2027, fuels demand for fleet management. North American light commercial vehicle sales grew 8% year-over-year in 2024, with further 6% expansion anticipated in 2025, directly benefiting Element. Fuel price volatility, with Brent crude averaging around $83 per barrel in 2024, underscores the need for Element's fuel management solutions and EV adoption, which saw a 30% global sales growth in 2024.

Supply chain issues, including lingering semiconductor shortages into 2024 and logistics bottlenecks, continued to affect vehicle availability, delaying fleet replacements. Element's proactive sourcing strategies are crucial to navigate these disruptions and maintain client service levels amidst below-pre-pandemic inventory levels for many vehicles.

Full Version Awaits

Element PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive Element PESTLE Analysis template will help you explore the Political, Economic, Social, Technological, Legal, and Environmental factors impacting your business. Understand the external forces shaping your industry with this detailed and actionable framework.

The content and structure shown in the preview is the same document you’ll download after payment, providing a complete and professional tool for your strategic planning.

Sociological factors

There's a significant societal push towards sustainability, with consumers and businesses alike prioritizing environmental impact. This growing awareness directly fuels demand for eco-friendly transportation options, impacting fleet management decisions.

For instance, in 2024, the global electric vehicle (EV) market is projected to reach over $1.5 trillion, demonstrating a clear financial commitment to greener mobility. Element's focus on EV management and sustainability reporting directly taps into this burgeoning market, aligning with corporate goals to reduce carbon footprints.

This shift means companies are increasingly looking to adopt electric and hybrid vehicles to meet both regulatory pressures and public expectations, creating a strong market for Element's solutions.

Companies are increasingly prioritizing driver safety and well-being, driving demand for advanced fleet management solutions. For instance, in 2024, the adoption of driver monitoring systems saw a significant uptick, with reports indicating a 25% increase in installations across commercial fleets. This trend is directly linked to a desire to reduce accident rates, which cost the trucking industry an estimated $100 billion annually in 2023.

Element can leverage this societal shift by integrating cutting-edge safety technologies into its service offerings. By providing features such as fatigue detection and real-time driver behavior analysis, Element can help its clients mitigate risks, leading to lower insurance premiums and fewer operational disruptions. This proactive approach to driver welfare not only enhances safety but also strengthens Element's value proposition in a competitive market.

The workforce is increasingly embracing remote and hybrid models, significantly altering traditional commuting patterns. In 2024, a significant portion of the global workforce continued to operate in hybrid arrangements, impacting daily vehicle usage. This shift means Element needs to reassess fleet utilization strategies, potentially seeing reduced demand for daily commuter vehicles but increased need for flexible or specialized fleet options for project-based or occasional travel.

Preference for Efficient and Reliable Services

Businesses are increasingly prioritizing fleet management solutions that promise not just operational efficiency but also a tangible reduction in costs. This preference is driven by a desire for optimal performance across their vehicle assets.

Element's strategic focus on helping clients enhance fleet performance and slash operational expenses directly aligns with this critical market demand. For instance, by 2024, the global fleet management market was projected to reach over $30 billion, with a significant portion attributed to the demand for cost-saving technologies.

This societal shift towards valuing reliability and efficiency is reshaping how companies approach their logistics and transportation needs, making solutions that offer clear ROI paramount.

- Demand for Cost Reduction: Companies are actively seeking ways to lower fuel consumption, maintenance expenses, and overall vehicle operating costs.

- Emphasis on Uptime: Reliable fleet operations are crucial, minimizing downtime and ensuring consistent service delivery.

- Efficiency as a Competitive Edge: Streamlined logistics and optimized routes contribute directly to a company's ability to compete effectively.

- Technological Adoption: There's a growing acceptance and expectation for technology-driven solutions that provide real-time data and predictive analytics for better decision-making.

Adoption of Shared Mobility Models

Societal shifts are increasingly favoring shared mobility, impacting traditional fleet ownership models. For instance, by 2023, ride-sharing services like Uber and Lyft saw continued strong user engagement, with Uber reporting over 1.8 billion rides globally in Q4 2023 alone. This trend suggests a potential long-term decrease in demand for personal vehicle ownership and, consequently, for traditional fleet management services.

The growing acceptance of car-sharing and subscription-based vehicle access, particularly among younger demographics, presents a significant sociological factor. A 2024 study indicated that over 40% of urban millennials and Gen Z are open to or actively using shared mobility options, viewing it as a more convenient and cost-effective alternative to owning a car. This evolving preference could reshape how companies like Element approach fleet utilization and customer engagement.

While fully autonomous vehicles are still in their nascent stages, the societal anticipation and gradual integration of these technologies will inevitably influence future transportation landscapes. Element should monitor the public's perception and adoption rates of autonomous shared fleets, as this could lead to new service opportunities or necessitate adaptation of existing fleet strategies to remain competitive.

The environmental consciousness of consumers is also a key sociological driver, pushing for more sustainable transportation solutions. Shared mobility, when optimized, can reduce the number of vehicles on the road, thereby lowering carbon emissions. This aligns with growing public demand for eco-friendly options, potentially making shared models more attractive than traditional private fleet ownership.

Societal attitudes are increasingly prioritizing sustainability and environmental responsibility, directly influencing consumer and business choices in transportation. This is evident in the robust growth of the electric vehicle market, projected to exceed $1.5 trillion globally by 2024, signaling a strong financial commitment to greener mobility solutions.

Driver safety and well-being are paramount, driving demand for advanced fleet management technologies. By 2024, the adoption of driver monitoring systems saw a 25% increase, reflecting a concerted effort to reduce accident rates, which cost the trucking industry an estimated $100 billion annually in 2023.

The rise of remote and hybrid work models in 2024 has altered traditional commuting patterns, impacting vehicle usage and necessitating flexible fleet strategies. Simultaneously, a societal emphasis on cost reduction and operational efficiency, supported by a global fleet management market projected to exceed $30 billion by 2024, makes Element's focus on performance enhancement and expense reduction highly relevant.

Shared mobility is gaining traction, with services like Uber reporting over 1.8 billion rides globally in Q4 2023. This trend, coupled with a 2024 study showing over 40% of urban millennials and Gen Z open to shared options, suggests a potential shift away from traditional fleet ownership models.

| Sociological Factor | Impact on Fleet Management | Relevant Data (2023-2025 Projections) |

|---|---|---|

| Sustainability & Environmentalism | Increased demand for EVs, eco-friendly operations, and carbon footprint reduction. | Global EV market projected to exceed $1.5 trillion by 2024. |

| Driver Safety & Well-being | Adoption of safety technologies, driver monitoring systems, and improved driver behavior. | 25% increase in driver monitoring system installations (2024); $100 billion annual cost of accidents in trucking (2023). |

| Remote/Hybrid Work | Shift in vehicle utilization patterns, demand for flexible fleet solutions. | Continued prevalence of hybrid work arrangements impacting daily commuting. |

| Cost Consciousness & Efficiency | Focus on reducing operational expenses, fuel consumption, and maintenance costs. | Global fleet management market projected to exceed $30 billion by 2024. |

| Shared Mobility & Access | Potential decrease in personal vehicle ownership, rise of ride-sharing and car-sharing. | Uber reported over 1.8 billion rides globally in Q4 2023; 40%+ urban millennials/Gen Z open to shared mobility (2024). |

Technological factors

Artificial intelligence and machine learning are transforming fleet management. These technologies automate decisions, optimize routes, and bolster predictive maintenance, directly impacting operational efficiency and safety. Element is strategically positioned to harness AI analytics, aiming to significantly cut fuel costs and minimize vehicle downtime for its clients.

Telematics technology is rapidly evolving, moving beyond simple GPS tracking to incorporate sophisticated real-time diagnostics, detailed driver behavior analysis, and precise fuel efficiency monitoring. This evolution directly benefits Element's service offerings, allowing for a much deeper understanding of vehicle performance.

These advancements empower Element to provide more insightful data, enabling proactive vehicle management and predictive maintenance strategies. For instance, by 2024, the global telematics market was projected to reach over $40 billion, with a significant portion driven by fleet management solutions that leverage these advanced capabilities.

The automotive industry is undergoing a seismic shift with the rapid expansion of electric vehicles (EVs) and the steady progress of autonomous driving. By the end of 2024, global EV sales are projected to reach approximately 17 million units, a significant jump from previous years, highlighting a clear trend towards electrification.

Element is strategically positioned to capitalize on this transition, offering vital EV services such as charging infrastructure development and decarbonization consulting. These services are particularly critical for Element's operations in North America, Australia, and New Zealand, regions demonstrating strong consumer interest and government support for EV adoption.

Development of 5G Connectivity and IoT

The ongoing expansion of 5G connectivity is a significant technological driver, directly impacting fleet operations. This advanced network infrastructure allows for substantially faster data transfer rates compared to previous generations, enabling more robust and responsive communication between vehicles and central management systems. For Element, this translates into enhanced real-time monitoring capabilities, crucial for optimizing logistics and operational efficiency.

The proliferation of the Internet of Things (IoT) further amplifies these benefits. Vehicles equipped with IoT sensors can collect and transmit a vast array of data points, from engine diagnostics and fuel consumption to driver behavior and cargo status. This constant stream of information, facilitated by 5G, empowers Element with granular insights for proactive maintenance, improved safety protocols, and dynamic route adjustments. By mid-2024, it's estimated that over 30 billion IoT devices are in use globally, a number projected to grow significantly, underscoring the increasing importance of this technology in sectors like transportation.

These advancements directly contribute to greater efficiency in fleet operations managed by Element. Instantaneous alerts regarding potential issues, such as mechanical failures or traffic congestion, allow for immediate intervention, minimizing downtime and delays. Furthermore, the ability to dynamically reroute vehicles based on real-time traffic and weather data, powered by 5G and IoT, ensures optimal journey planning, reducing fuel costs and delivery times. The automotive industry, for instance, saw a significant increase in connected vehicle shipments in 2024, with projections indicating continued strong growth as 5G deployment accelerates.

- 5G's speed enables near-instantaneous data exchange for vehicle-to-infrastructure and vehicle-to-vehicle communication.

- IoT sensors provide real-time data on vehicle performance, location, and cargo, enhancing monitoring for Element.

- Dynamic route optimization, driven by 5G and IoT data, leads to reduced fuel consumption and improved delivery schedules.

- Proactive maintenance is facilitated by continuous data streams, minimizing unexpected breakdowns and operational disruptions.

Predictive Maintenance Technologies

Predictive maintenance, fueled by AI and IoT data, is revolutionizing fleet management by forecasting vehicle problems before they lead to costly breakdowns. This technology allows for proactive servicing, significantly reducing unexpected downtime.

Element can leverage these advancements to boost operational efficiency. By anticipating maintenance needs, Element can schedule repairs strategically, thereby minimizing disruptions to client operations and lowering overall repair expenditures.

The adoption of predictive maintenance is projected to yield substantial cost savings. For instance, studies suggest that predictive maintenance can reduce maintenance costs by up to 30% and decrease unplanned downtime by as much as 50% in the coming years.

- Reduced Downtime: Minimizing unexpected vehicle failures ensures consistent service delivery for clients.

- Cost Savings: Proactive repairs are generally less expensive than emergency fixes, leading to lower overall maintenance bills.

- Extended Vehicle Lifespan: Addressing minor issues before they escalate helps preserve the longevity of client vehicles.

- Enhanced Service Value: Offering a more reliable and cost-effective fleet management solution increases client satisfaction and loyalty.

Technological advancements are fundamentally reshaping fleet management, with AI and IoT driving unprecedented efficiency. The increasing integration of 5G networks further amplifies these capabilities, enabling faster data transfer for real-time diagnostics and dynamic route optimization. Element's strategic adoption of these technologies positions it to deliver superior service through predictive maintenance and reduced operational costs.

| Technology | Impact on Fleet Management | Element's Strategic Advantage |

|---|---|---|

| Artificial Intelligence (AI) & Machine Learning (ML) | Automates decisions, optimizes routes, predictive maintenance | Enhanced operational efficiency, reduced fuel costs, minimized downtime |

| Telematics | Real-time diagnostics, driver behavior analysis, fuel efficiency monitoring | Deeper understanding of vehicle performance, proactive management |

| 5G Connectivity | Faster data transfer for real-time communication and monitoring | Improved logistics, enhanced operational efficiency |

| Internet of Things (IoT) | Collection and transmission of vast vehicle data (diagnostics, fuel, driver behavior) | Granular insights for proactive maintenance, safety, and dynamic routing |

| Electric Vehicles (EVs) & Autonomous Driving | Shift towards electrification and automated driving | Opportunities in EV services, decarbonization consulting |

Legal factors

Stricter emissions regulations, including mandates for zero-emission vehicles (ZEVs), are a significant legal factor influencing Element's operations. Many regions, like California, have aggressive ZEV mandates, such as requiring 100% of new passenger car sales to be zero-emission by 2035. This directly shapes the types of vehicles fleets can acquire and necessitates Element's support in transitioning fleets to cleaner alternatives.

Regulations concerning vehicle safety standards are a critical legal factor for Element. These standards, covering everything from braking systems to occupant protection, are not static; they are continuously updated by bodies like the National Highway Traffic Safety Administration (NHTSA) in the US and UNECE globally. For instance, the NHTSA's Federal Motor Vehicle Safety Standards (FMVSS) are frequently revised, with significant updates often focusing on areas like crashworthiness and the integration of new technologies.

Element must ensure its managed vehicles and services facilitate client compliance with these evolving safety mandates. This involves staying abreast of new requirements and integrating technologies that proactively address them. The increasing emphasis on Advanced Driver Assistance Systems (ADAS), such as automatic emergency braking and lane-keeping assist, is a prime example, with many jurisdictions mandating their inclusion in new vehicle sales by 2025 and beyond. Furthermore, driver monitoring systems are gaining traction as a legal and safety imperative, particularly in commercial fleet management.

Data privacy laws, like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA), are becoming more complex, directly impacting how companies like Element handle telematics data. Failure to comply can result in significant fines; for instance, GDPR violations can reach up to 4% of global annual revenue or €20 million, whichever is higher. This necessitates Element to invest heavily in robust data governance and security measures to safeguard sensitive client and driver information, ensuring adherence to evolving global privacy standards.

Labor Laws Impacting Drivers and Operations

Labor laws significantly shape fleet operations, particularly concerning driver hours and working conditions. Regulations like those governing the U.S. Department of Transportation's Hours of Service (HOS) directly impact how many miles a truck can cover daily, influencing scheduling and overall efficiency. For instance, the 2024 landscape continues to see scrutiny on driver fatigue, with potential adjustments to HOS rules under consideration by bodies like the Federal Motor Carrier Safety Administration (FMCSA) to enhance safety.

Employment classifications, such as distinguishing between employees and independent contractors, also carry substantial legal and financial weight. Misclassification can lead to significant penalties, including back wages, benefits, and taxes. In 2024, the ongoing debate around gig economy worker status, exemplified by California's AB5 and its subsequent revisions, highlights the evolving legal landscape for drivers, directly affecting operational costs and flexibility for fleet managers.

Staying compliant requires constant vigilance. Element must monitor changes in labor legislation, such as potential increases in minimum wage or new requirements for benefits, which can directly impact the cost of employing drivers. For example, as of early 2025, several states are expected to implement higher minimum wages, a factor that fleet operators must factor into their budgeting and operational models.

- Driver Hours Regulations: The FMCSA's Hours of Service rules limit driving time to 11 hours within a 14-hour window, followed by a 10-hour off-duty period, directly impacting delivery schedules and route planning.

- Employment Classification: The distinction between employee and independent contractor status can lead to substantial cost differences, with employees typically requiring benefits, payroll taxes, and workers' compensation coverage, unlike independent contractors.

- Wage and Benefit Laws: Minimum wage laws, overtime regulations, and mandated benefits (like paid sick leave in some jurisdictions) directly influence driver compensation and overall fleet operating expenses.

- Safety and Working Conditions: Compliance with workplace safety standards, including those related to vehicle maintenance and loading/unloading procedures, is crucial to avoid fines and ensure driver well-being.

Leasing and Financing Regulations

Element's financial services, particularly vehicle acquisition and financing, are governed by stringent leasing and financial regulations. These rules vary by jurisdiction, requiring Element to maintain compliance across all operating countries to offer transparent and lawful financial products. For instance, in 2024, the financial services sector globally saw increased scrutiny on consumer protection laws, impacting how leasing agreements are structured and disclosed.

Adherence to these legal frameworks is critical for Element's business model. Failure to comply can result in significant penalties and reputational damage. The company must continuously monitor and adapt to evolving financial legislation to ensure its leasing and financing operations remain sound and trustworthy.

Key regulatory areas impacting Element's financial operations include:

- Consumer Credit Protection Laws: Ensuring fair lending practices and transparent disclosure of terms and conditions for all financing arrangements.

- Leasing Regulations: Specific rules governing the terms, duration, and end-of-lease processes for vehicle leases.

- Financial Services Authority (FSA) or equivalent oversight: Compliance with capital adequacy requirements and operational standards set by financial regulators in relevant markets.

- Data Privacy and Security Laws: Protecting sensitive customer financial information in accordance with regulations like GDPR or CCPA, which became even more critical in 2024 with rising cyber threats.

Legal factors significantly shape Element's operational landscape, from environmental mandates to driver welfare. Stricter emissions standards, including aggressive zero-emission vehicle (ZEV) targets in regions like California, necessitate Element's role in fleet electrification. Simultaneously, evolving vehicle safety regulations, such as NHTSA's FMVSS updates and the increasing mandating of Advanced Driver Assistance Systems (ADAS) by 2025, require continuous adaptation in fleet management. Data privacy laws, like GDPR and CCPA, impose strict requirements on handling telematics data, with non-compliance carrying substantial financial penalties, underscoring the need for robust data governance.

Labor laws, particularly Hours of Service (HOS) regulations and employment classification debates, directly impact fleet efficiency and costs. The ongoing scrutiny of driver fatigue and the classification of gig workers, as seen in California's AB5, highlight the dynamic legal environment. Furthermore, wage and benefit laws, including anticipated minimum wage increases in 2025, directly influence driver compensation and overall operating expenses, demanding careful financial planning from fleet operators.

Element's financial services are also heavily regulated, covering leasing and financing. Compliance with consumer credit protection, leasing regulations, and financial oversight bodies is paramount. The emphasis on transparent disclosure and data security for financial transactions, especially in light of increased cyber threats in 2024, requires continuous adaptation to evolving financial legislation to maintain trust and legality.

| Legal Factor | Impact on Element | Relevant Data/Regulation |

| Emissions Regulations | Fleet electrification, transition to cleaner alternatives | California's ZEV mandate: 100% new passenger car sales by 2035. |

| Vehicle Safety Standards | Integration of ADAS, compliance with evolving safety mandates | NHTSA FMVSS updates, ADAS mandates by 2025. |

| Data Privacy Laws | Robust data governance and security for telematics data | GDPR fines up to 4% of global annual revenue; CCPA compliance. |

| Labor Laws (HOS) | Route planning, scheduling efficiency, driver fatigue management | FMCSA HOS rules: 11-hour driving limit in 14-hour window. |

| Employment Classification | Operational costs, driver flexibility, potential penalties | California AB5 and subsequent revisions impacting gig economy workers. |

| Wage and Benefit Laws | Driver compensation, operational expenses | Anticipated minimum wage increases in several states by early 2025. |

| Financial Regulations | Transparent leasing and financing, consumer protection | Increased scrutiny on consumer protection in financial services globally (2024). |

Environmental factors

Companies face mounting pressure from investors, customers, and governments to shrink their carbon emissions. For instance, in 2024, the global average temperature was approximately 1.48°C above pre-industrial levels, highlighting the urgency. Element aids businesses in this endeavor by providing tools for greener fleet management, route optimization, and the adoption of vehicles with lower emissions.

The global automotive industry is rapidly transitioning towards electrification, with electric vehicles (EVs) and alternative fuels becoming increasingly mainstream. By the end of 2023, global EV sales surpassed 13 million units, a significant increase from previous years, reflecting a strong consumer and regulatory push for decarbonization. This trend is particularly evident in commercial fleets, where companies are actively exploring and adopting natural gas, propane, and electric powertrains to reduce their environmental impact and operational costs.

Element's business model is strategically positioned to capitalize on this shift. Their services, encompassing EV acquisition, financing solutions tailored for electric fleets, and comprehensive EV management programs, directly address the growing demand from businesses seeking to integrate sustainable transportation options. This alignment ensures Element is well-placed to support companies navigating the complexities of fleet electrification and the broader adoption of alternative fuels.

The expansion of electric vehicle (EV) charging infrastructure is a critical environmental factor influencing EV adoption. As of early 2024, the United States had over 170,000 public charging ports, a figure projected to grow significantly. Element assists clients by navigating the complexities of charging solutions, from home installations to public network access, recognizing that this development directly impacts the feasibility of EV transitions.

Waste Reduction and Recycling Initiatives

Waste reduction and recycling are increasingly critical environmental factors for fleet operations. Element's approach to vehicle remarketing and parts management can significantly minimize environmental impact. For instance, by focusing on extending vehicle life and efficiently managing end-of-life vehicles, Element helps clients reduce landfill waste and promote a circular economy.

Element's commitment to sustainability is evident in its efforts to integrate eco-friendly practices across the entire vehicle lifecycle. This includes exploring options for vehicle refurbishment and parts reuse, which not only cuts down on waste but also offers cost savings. As of early 2024, the automotive industry is seeing a growing emphasis on remanufactured parts, with some sectors reporting significant reductions in material consumption and energy usage through these practices.

- Fleet Lifecycle Management: Implementing strategies to reduce waste through vehicle remarketing and responsible disposal.

- Parts Management: Prioritizing the reuse and recycling of vehicle components to minimize new material sourcing.

- Circular Economy Principles: Aligning fleet operations with sustainable practices that reduce environmental footprint.

- Eco-Friendly Operations: Incorporating greener alternatives throughout vehicle maintenance and end-of-life processes.

Corporate Sustainability Goals and Reporting

Businesses are increasingly prioritizing ambitious corporate sustainability goals, with a significant portion now required to report on their environmental performance. For instance, in 2024, over 70% of S&P 500 companies are expected to issue sustainability reports, up from roughly 50% in 2020. Element can bolster its clients' efforts by offering data and services that directly aid in achieving these sustainability objectives and enable clear, verifiable environmental reporting.

This support can manifest in several key areas:

- Data Provision for ESG Metrics: Supplying clients with accurate, granular data on energy consumption, waste generation, and carbon emissions, crucial for Environmental, Social, and Governance (ESG) reporting frameworks like GRI or SASB.

- Lifecycle Assessment Tools: Offering advanced tools to analyze the environmental impact of products and services throughout their entire lifecycle, helping clients identify areas for improvement and reduction.

- Supply Chain Transparency Solutions: Providing platforms that enhance visibility into supply chains, allowing clients to assess and manage the environmental risks and performance of their suppliers, a growing concern for investors and regulators alike.

- Reporting Software and Analytics: Delivering integrated software solutions that streamline the collection, analysis, and dissemination of environmental data, simplifying the complex process of regulatory and voluntary sustainability reporting.

Environmental factors are increasingly shaping business strategies, with a focus on sustainability and reduced emissions. Element supports this by offering solutions for greener fleet management and route optimization, aligning with the global push for decarbonization. The increasing adoption of electric vehicles (EVs), with over 13 million sold globally by the end of 2023, underscores this shift. Element's services, including EV acquisition and financing, directly address this growing market demand.

The expansion of EV charging infrastructure is a critical enabler, with over 170,000 public charging ports in the US by early 2024, a number projected to rise significantly. Element assists clients in navigating charging solutions, supporting the feasibility of EV transitions. Furthermore, waste reduction is paramount; Element's focus on vehicle remarketing and parts management minimizes environmental impact by extending vehicle life and promoting circular economy principles.

| Environmental Factor | Impact on Businesses | Element's Role |

|---|---|---|

| Climate Change & Emissions Reduction | Pressure to reduce carbon footprint, adopt sustainable practices | Fleet electrification, route optimization, lower emission vehicles |

| Transition to Electric Vehicles (EVs) | Growing EV adoption in commercial fleets, demand for EV support services | EV acquisition, financing, fleet management programs |

| EV Charging Infrastructure Development | Key for EV feasibility, need for integrated charging solutions | Guidance on charging solutions, home and public network access |

| Waste Reduction & Circular Economy | Focus on vehicle lifecycle management, parts reuse, and recycling | Vehicle remarketing, parts management, promoting circular economy |

PESTLE Analysis Data Sources

Our PESTLE analysis is informed by a comprehensive blend of official government publications, reputable economic databases, and leading industry research reports. This ensures that each factor, from political shifts to technological advancements, is grounded in accurate and current information.