Element Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Element Bundle

Element's competitive landscape is shaped by powerful forces, from intense rivalry to the looming threat of substitutes. Understanding these dynamics is crucial for any business operating within or considering entry into their market.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Element’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Supplier concentration significantly impacts the bargaining power of suppliers in the fleet management sector. Key suppliers include vehicle manufacturers (OEMs), telematics and AI technology providers, fuel companies, and maintenance service networks. When a few dominant players control a specific supply segment, their ability to dictate terms and prices escalates.

Element Fleet Management, with its substantial market presence and long-standing partnerships with major OEMs and service providers, can leverage its scale to negotiate more favorable terms. This strategic advantage helps to offset the increased bargaining power that concentrated suppliers might otherwise wield, ensuring cost efficiencies for Element and its clients.

The cost and effort for Element to switch between telematics and other service providers directly impacts supplier bargaining power. High switching costs, such as those involving complex system integration or data migration, can give suppliers leverage. For example, if a new telematics system requires extensive reprogramming of existing vehicle hardware, Element’s ability to negotiate favorable terms diminishes.

Element strategically mitigates this by cultivating a diverse network of service providers and prioritizing digital solutions that facilitate easier integration and data portability. This focus on interoperability reduces the financial and operational burden of switching, thereby lessening supplier power. In 2024, the automotive telematics market saw continued innovation, with many providers offering cloud-based platforms designed for quicker integration, a trend that benefits fleet management companies like Element by lowering switching barriers.

Suppliers who provide highly specialized or proprietary components, like advanced AI-powered telematics systems or unique electric vehicle charging infrastructure, often wield significant bargaining power. For instance, in 2024, the market for advanced semiconductor chips essential for autonomous driving saw a concentration of suppliers, allowing them to command higher prices due to limited alternatives.

Element's strategic advantage lies in its capacity to integrate a wide array of technologies and leverage its proprietary digital platforms. This integration strategy actively diminishes its reliance on any single supplier's unique offering, thereby mitigating the suppliers' potential leverage.

Threat of Forward Integration

The threat of suppliers integrating forward into fleet management services directly enhances their bargaining power. If a supplier, such as a vehicle manufacturer, can credibly threaten to offer their own fleet management solutions, they gain leverage over companies like Element. This is because such a move would allow them to capture more of the value chain, potentially bypassing existing intermediaries.

For instance, some major automotive manufacturers are increasingly exploring or have already launched their own fleet management platforms. This capability means they could directly compete with established players, presenting a significant challenge. In 2023, several large OEMs announced expansions of their connected vehicle services, which are foundational for fleet management. This trend suggests a growing potential for forward integration within the automotive supply chain.

- Forward Integration Threat: Suppliers like vehicle manufacturers can leverage their existing infrastructure and customer relationships to offer fleet management services directly.

- Impact on Bargaining Power: This credible threat forces fleet management companies to offer more competitive pricing and terms to retain suppliers.

- Element's Position: Element's robust market share, estimated to manage over 1.5 million vehicles globally as of early 2024, and its broad service portfolio serve as a significant deterrent against supplier forward integration.

- Competitive Landscape: The increasing digital capabilities of vehicle manufacturers, with many investing heavily in telematics and data analytics, amplify the potential for them to enter the fleet management space.

Importance of Element to Supplier

For a company like Element Fleet Management, managing a fleet of around 1.5 million vehicles as of early 2024, its sheer size makes it a crucial customer for many suppliers. This substantial volume of business grants Element considerable bargaining power.

Suppliers who rely heavily on Element for a significant portion of their sales are more likely to concede to Element's demands regarding pricing, terms, and service levels. This is because losing such a large client could severely impact their own revenue and market position.

- Element's fleet size (approx. 1.5 million vehicles in 2024) positions it as a key customer.

- This volume gives Element leverage in price negotiations with suppliers.

- Suppliers dependent on Element may offer more favorable terms to retain the business.

The bargaining power of suppliers in fleet management is influenced by their concentration and the availability of substitutes. When few suppliers dominate a segment, like specialized telematics providers or major OEMs, their ability to dictate terms increases significantly. For instance, the 2024 market for advanced automotive chips, crucial for fleet technology, saw a handful of suppliers holding considerable sway due to limited alternatives.

Element's substantial fleet size, managing approximately 1.5 million vehicles globally as of early 2024, makes it a vital customer. This scale grants Element considerable leverage in negotiating pricing and terms, as suppliers who depend on this volume are incentivized to offer more favorable conditions to retain such a significant client.

The threat of suppliers integrating forward into fleet management services, such as vehicle manufacturers offering their own platforms, directly amplifies their bargaining power. This potential competition forces fleet management companies to remain competitive with their offerings. In 2023, several large OEMs expanded their connected vehicle services, laying groundwork for potential direct fleet management entry.

| Factor | Impact on Supplier Bargaining Power | Element's Mitigation Strategy |

|---|---|---|

| Supplier Concentration | High concentration among key providers (e.g., OEMs, telematics) increases supplier leverage. | Leverages scale and long-term partnerships to negotiate favorable terms. |

| Switching Costs | High costs for integrating new systems or migrating data empower suppliers. | Focuses on interoperable digital solutions to reduce switching burdens. |

| Supplier Differentiation | Specialized or proprietary offerings (e.g., advanced AI, unique EV charging) give suppliers power. | Integrates diverse technologies and proprietary platforms to reduce reliance on single suppliers. |

| Forward Integration Threat | Suppliers offering direct fleet management services gain leverage. | Its large fleet size (approx. 1.5 million vehicles in 2024) deters supplier forward integration. |

What is included in the product

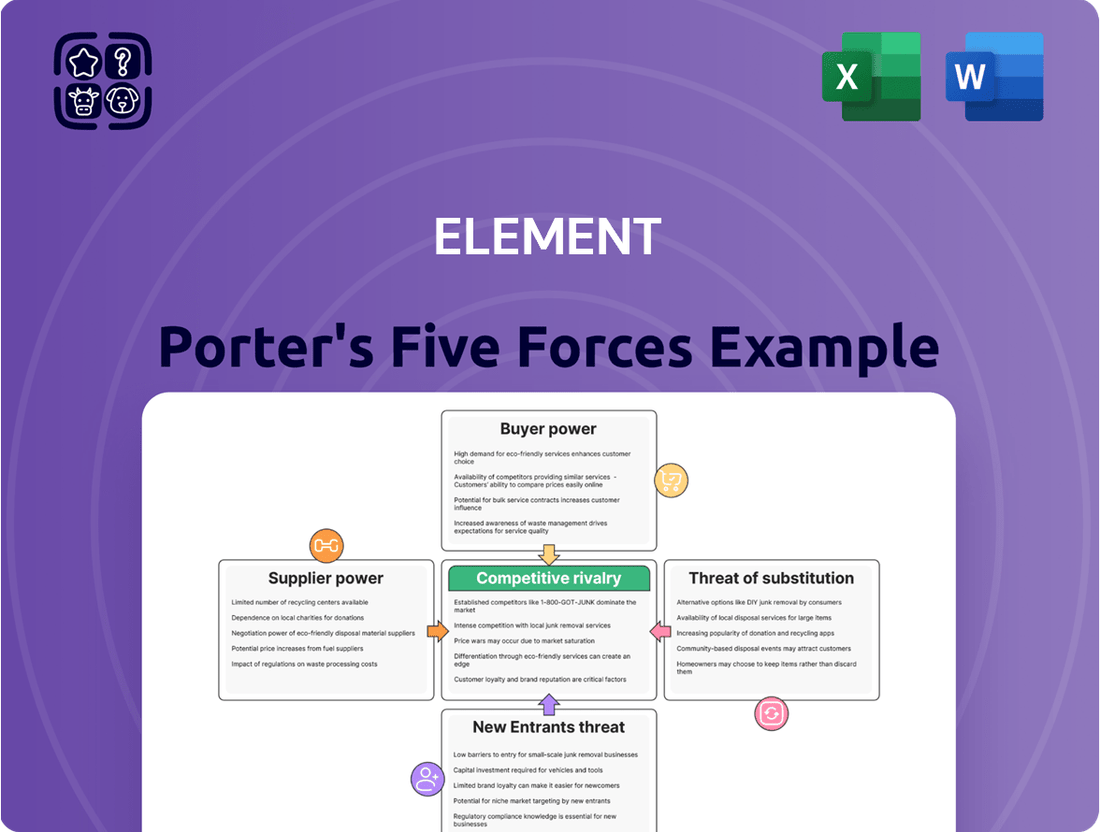

Porter's Five Forces Analysis examines the competitive intensity and attractiveness of a market by evaluating the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry among existing competitors.

Quickly identify and alleviate competitive pressures by visualizing the intensity of each Porter's Five Forces with an intuitive dashboard.

Customers Bargaining Power

Customer concentration, a key aspect of bargaining power, can arise when a significant portion of a company's revenue comes from a small number of large clients. For Element Fleet Management, serving a broad range of corporations, governments, and non-profits across North America, Australia, and New Zealand, this dynamic is particularly relevant. While the company boasts a diverse client portfolio, the presence of 'mega-fleets' that represent substantial revenue streams means these major customers could wield considerable influence.

In 2024, Element's focus on managing large-scale fleet operations means that the loss or renegotiation of terms with a few of its largest clients could have a disproportionate impact on its financial performance. This concentration of revenue from a select group of major customers inherently strengthens their bargaining position, allowing them to potentially negotiate more favorable pricing or service agreements.

Switching fleet management providers can be a significant undertaking for businesses. Costs often include migrating complex operational data, retraining personnel on new systems, and the potential for operational disruptions during the transition. These factors create a tangible barrier, increasing customer loyalty.

Element, a prominent player in fleet management, actively works to enhance customer 'stickiness'. By offering integrated, data-driven solutions and a focus on superior client experience, Element makes it more challenging and less appealing for clients to seek alternatives. This strategy directly addresses the bargaining power of customers by raising the perceived cost and effort of switching.

Customer price sensitivity is a critical factor in the fleet management industry, and Element is keenly aware of this. Large corporations, a key demographic for Element, are constantly looking to optimize their operational expenditures. This means they scrutinize every cost associated with their vehicle fleets, from purchasing new vehicles to ongoing maintenance and fuel expenses.

Element's fundamental promise is to reduce these total fleet operating costs for its clients. They aim to achieve significant savings, often in the range of 10% to 20%. This direct impact on the bottom line is precisely what resonates with price-sensitive customers, making Element's value proposition highly attractive in a competitive market.

Availability of Substitute Services

The availability of substitute services significantly impacts customer bargaining power in the fleet management industry. Customers can choose to manage their fleets internally, a common practice for many businesses, or opt for other third-party fleet management providers. This array of alternatives means that if a provider like Element is perceived as too expensive or not meeting specific needs, customers have viable paths to switch, thereby enhancing their leverage.

Element Financial Corporation, operating as Element Fleet Management, works to mitigate this by offering a suite of comprehensive services that aim to be more attractive than in-house solutions or competitor offerings. Their strategy leverages scale-driven purchasing power, allowing them to negotiate better rates on vehicles, fuel, and maintenance, which can translate into cost savings for clients. Furthermore, Element emphasizes its data-driven insights, providing customers with analytics to optimize fleet performance and reduce operational costs, creating a stickier value proposition.

- Customer Choice: Businesses can opt for in-house fleet management or select from various third-party providers, directly influencing their negotiating position.

- Element's Differentiation: Comprehensive service offerings, significant purchasing power due to scale, and advanced data analytics are key strategies to retain customers and reduce the threat of substitution.

- Impact on Bargaining Power: A wider availability of comparable or superior alternatives empowers customers to demand better pricing and service terms.

Customer Information Availability

In the current digital landscape, customers possess unprecedented access to pricing and service details from numerous fleet management providers. This heightened transparency significantly bolsters their bargaining power, enabling them to compare offerings more effectively. For instance, a 2024 survey indicated that 78% of fleet managers actively research multiple vendors before making a purchasing decision.

Element strategically addresses this by highlighting its distinct value proposition and demonstrable cost-saving benefits. They focus on showcasing how their integrated solutions and expertise deliver superior long-term value beyond just price comparisons. This approach aims to differentiate Element in a crowded market where information availability is high.

- Increased Customer Information: Customers can easily access and compare pricing, service features, and reviews across the fleet management industry.

- Empowered Purchasing Decisions: This readily available information allows customers to negotiate more effectively and demand better terms.

- Element's Counter-Strategy: Element emphasizes its unique value proposition, focusing on proven cost savings, operational efficiencies, and superior customer service to mitigate the impact of price-based competition.

The bargaining power of customers is a crucial element in Porter's Five Forces, indicating how much leverage buyers have over a company. In the fleet management sector, this power is influenced by factors like customer concentration, switching costs, and price sensitivity. Element Financial Corporation, as a major player, must continuously manage these dynamics to maintain its competitive edge and profitability.

In 2024, Element's large client base, while diverse, includes significant 'mega-fleets' whose business represents a substantial portion of revenue. This concentration means these key customers can exert considerable influence, potentially negotiating for better terms. For instance, if a few of Element's top clients were to renegotiate their contracts or switch providers, it could disproportionately affect Element's financial performance due to the revenue dependency.

| Factor | Impact on Element | 2024 Data/Observation |

|---|---|---|

| Customer Concentration | High concentration of revenue from a few large clients increases their bargaining power. | Element serves large corporations and governments, where a small number of clients can represent significant revenue streams. |

| Switching Costs | High switching costs (data migration, retraining) generally reduce customer bargaining power. | Element's integrated solutions and data management create complexity for clients looking to switch. |

| Price Sensitivity | Customers actively seek cost reductions, increasing pressure on pricing. | Element's value proposition centers on delivering 10-20% cost savings on total fleet operations. |

| Availability of Substitutes | Numerous alternative providers and in-house management options empower customers. | Element counters this by leveraging scale for better purchasing power and offering advanced data analytics. |

| Information Transparency | Easy access to competitor pricing and services strengthens customer negotiation ability. | A 2024 survey showed 78% of fleet managers research multiple vendors, highlighting this transparency. |

Preview the Actual Deliverable

Element Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis, offering a thorough examination of competitive forces within an industry. The document you see here is the exact, professionally formatted analysis you will receive instantly upon purchase, ensuring no surprises or missing information. You can confidently download and utilize this comprehensive report to understand your competitive landscape immediately after completing your transaction.

Rivalry Among Competitors

The North American fleet management sector, where Element Financial Corporation derives 87% of its income, is intensely competitive. Despite Element's leading position, it contends with a broad array of rivals, including established lease finance companies, manufacturer-backed captive finance entities, banking institutions, independent brokers, and a spectrum of other large and mid-sized fleet management providers.

The global fleet management market is projected to grow at a compound annual growth rate exceeding 16% from 2025 to 2034. This robust expansion fuels intense competition as existing players and new entrants vie for increasing market share. Such a dynamic environment often leads to aggressive pricing strategies and accelerated innovation cycles.

Companies in fleet management, including Element, differentiate through advanced telematics, AI, and EV capabilities. Element emphasizes a superior client experience, utilizing its scale for competitive pricing and delivering data-driven insights to lower clients' total cost of operations.

In 2024, the fleet management industry saw significant investment in technology. Element, for instance, continued to enhance its digital platforms, aiming to provide clients with real-time data for optimized fleet performance. This focus on technological advancement and client-centric solutions is crucial for standing out in a competitive landscape.

Exit Barriers

High exit barriers can indeed trap even unprofitable competitors within an industry, thereby increasing competitive rivalry. This situation often arises when companies have substantial investments in specialized fixed assets or are bound by long-term commitments, such as client contracts or service agreements. These factors make it financially difficult or impractical for them to cease operations and exit the market, even if they are not generating profits.

For Element, while specific exit barrier data isn't publicly detailed, the operational model suggests potential challenges. The company's involvement in fleet financing and the provision of long-term vehicle service agreements could represent significant fixed assets and contractual obligations. For instance, a large fleet of vehicles financed by Element represents a substantial capital investment. Similarly, multi-year service contracts create ongoing commitments that are not easily shed.

These potential exit barriers mean that even if certain segments of Element's business or specific competitors become less profitable, they might continue to operate. This sustained presence, driven by the difficulty of exiting, can lead to intensified competition as these entities strive to maintain market share or recover their investments, potentially impacting pricing and service levels across the industry.

Consider these points regarding exit barriers:

- Significant Capital Investments: Industries with high upfront costs for machinery, technology, or infrastructure create substantial financial hurdles for exiting firms.

- Long-Term Contracts: Commitments to clients or suppliers that span several years can lock companies into operations, making early termination costly.

- Employee Severance and Relocation Costs: The expense associated with laying off a workforce or closing facilities can deter companies from exiting.

- Governmental or Regulatory Restrictions: Certain industries may have regulations that make it difficult or time-consuming to shut down operations.

Strategic Stakes

The fleet management sector is experiencing a dynamic shift, fueled by technological advancements like electric vehicles (EVs), connected car technology, and the rise of shared mobility services. This innovation necessitates substantial strategic investments from companies aiming to secure their future market position.

These significant investments translate into heightened competitive rivalry. Companies are aggressively vying for market share in these emerging areas, leading to intense competition to establish a dominant presence. For instance, in 2024, major fleet management players are heavily investing in EV charging infrastructure and telematics solutions. Major players like Geotab reported a 20% increase in its connected vehicle data processing capacity in early 2024 to support the growing demand for real-time insights.

- Innovation-driven transformation: The fleet industry is rapidly evolving with EVs, connected tech, and shared mobility.

- Strategic investment race: Companies are pouring capital into new technologies to secure future growth.

- Aggressive competition: This investment fuels intense rivalry as firms battle for early market advantages.

- Market share battles: Competition is particularly fierce in areas like EV fleet conversion and advanced telematics.

Competitive rivalry in the fleet management sector is high due to a fragmented market with numerous players, including large corporations and niche providers.

Element Financial Corporation faces intense competition from established lease finance companies, manufacturer-backed entities, and independent brokers, all vying for market share in a sector projected for significant growth.

Companies differentiate through technological innovation, such as telematics and EV capabilities, and a focus on client experience and cost reduction, as seen with Element's data-driven insights.

The drive for market leadership in emerging areas like EV fleet management and advanced telematics intensifies competition, with companies like Geotab investing heavily in data processing capacity, reporting a 20% increase in early 2024.

| Competitor Type | Key Differentiators | 2024 Industry Trend |

|---|---|---|

| Established Lease Finance Companies | Scale, financial strength, broad service offerings | Investment in digital platforms and EV solutions |

| Manufacturer-Backed Captive Finance | Brand loyalty, integrated product/service packages | Focus on fleet electrification and connected services |

| Independent Brokers & Mid-Sized Providers | Niche expertise, personalized service, agility | Adoption of advanced telematics for data analytics |

| Element Financial Corporation | Scale, data-driven insights, client experience, EV capabilities | Enhancing digital platforms for real-time fleet optimization |

SSubstitutes Threaten

Businesses can manage their fleets internally, handling everything from vehicle purchases to upkeep. This direct approach serves as a substitute for outsourcing fleet management to companies like Element. For instance, a large logistics company might find it more economical to build its own maintenance facilities and employ dedicated fleet managers, especially if their fleet is highly specialized or geographically concentrated.

Element counters this threat by highlighting the substantial cost efficiencies and operational improvements it offers. By leveraging economies of scale in vehicle procurement and maintenance, Element can often secure better pricing and access specialized expertise that individual companies may struggle to replicate in-house. For example, Element's purchasing power in 2024 allowed its clients to benefit from an average of 15% savings on new vehicle acquisitions compared to standard retail pricing.

For businesses with less specialized transportation needs, the growing availability and affordability of public transportation and ride-sharing services present a viable substitute for maintaining a dedicated commercial fleet. For instance, in 2024, ride-sharing services like Uber and Lyft continued to expand their services, offering more flexible and cost-effective options for local deliveries or employee commutes in many urban areas, potentially reducing the need for companies to own and operate smaller vans or cars.

However, for businesses whose operations critically depend on specific vehicle types, such as refrigerated trucks for food distribution or heavy-duty vehicles for construction, public transportation and ride-sharing are generally not direct substitutes. The specialized nature and operational requirements of these core commercial fleets mean that external services often cannot replicate the necessary functionality, capacity, or scheduling flexibility.

The rise of Mobility-as-a-Service (MaaS) presents a significant threat of substitution for traditional fleet ownership. MaaS platforms integrate various transportation options, like ride-sharing, public transit, and bike rentals, offering consumers a convenient, on-demand alternative to owning and managing their own vehicles or relying solely on traditional fleet services.

Element, recognizing this shift, is actively innovating to integrate with or offer MaaS-like solutions, demonstrating an understanding of how these evolving models can disrupt the established market. For instance, by 2024, the global MaaS market was projected to reach over $100 billion, highlighting the substantial potential for these services to capture market share from traditional fleet operators.

Technology-Driven Self-Management Tools

The rise of technology-driven self-management tools presents a significant threat of substitution for traditional fleet management services. Businesses can now leverage advanced fleet management software and telematics directly, enabling them to oversee their operations more efficiently internally. This reduces the reliance on external comprehensive service providers.

Element's own digital solutions are a prime example, offering clients capabilities that allow for greater in-house control. For instance, by mid-2024, the adoption of AI-powered route optimization software in the logistics sector saw an estimated 15% increase in efficiency, demonstrating the power of these self-management tools.

- Increased In-House Fleet Management Capabilities: Businesses can now handle tasks like vehicle tracking, maintenance scheduling, and driver behavior monitoring with greater autonomy.

- Cost Reduction Potential: Implementing these tools can potentially lower operational costs by reducing the need for outsourced fleet management fees.

- Direct Control and Customization: Companies gain more direct control over their fleet operations, allowing for tailored solutions to specific business needs.

- Integration with Existing Systems: Many of these tools offer seamless integration with existing enterprise resource planning (ERP) systems, further enhancing in-house efficiency.

Cost-Effectiveness of Substitutes

The cost-effectiveness of potential substitutes significantly impacts Element's market position. If alternative solutions, such as in-house fleet management or simpler tracking software, offer comparable functionality at a lower price point, customers may switch. Element's stated value proposition of reducing total fleet operating costs by 10-20% is a direct challenge to the perceived cost benefits of these substitutes.

For instance, a small to medium-sized business might find that implementing a basic GPS tracking system and managing maintenance internally, while requiring more labor, presents a lower upfront capital expenditure than Element's comprehensive service. This cost-benefit analysis is crucial for potential clients. In 2024, the average cost of a basic fleet management system subscription can range from $15 to $30 per vehicle per month, whereas Element's pricing, while not publicly disclosed in detail, is positioned as a premium service offering greater ROI.

- Lower Upfront Costs: Many substitute solutions require less initial investment compared to Element's integrated platform.

- Perceived Value vs. Actual Cost: Customers weigh the total cost of ownership, including labor and potential inefficiencies, against Element's all-inclusive pricing.

- DIY Fleet Management: Businesses with existing IT infrastructure might opt for building their own less sophisticated tracking and management tools.

- Scalability of Substitutes: Simpler solutions may appear more attractive for businesses with smaller, less complex fleets, offering a more manageable cost structure.

The threat of substitutes for Element's fleet management services is multifaceted, encompassing both in-house capabilities and alternative transportation models. Businesses can opt to manage their fleets internally, handling all aspects from acquisition to maintenance. This approach can be particularly appealing for companies with highly specialized fleets or those seeking greater direct control over their operations.

Furthermore, the increasing accessibility and affordability of public transportation and ride-sharing services present viable substitutes, especially for businesses with less demanding transportation needs. The burgeoning Mobility-as-a-Service (MaaS) sector also offers integrated transportation solutions that can reduce reliance on traditional fleet ownership.

Technology-driven self-management tools, including advanced fleet management software and telematics, empower businesses to oversee their operations more efficiently internally, diminishing the need for comprehensive external service providers. The cost-effectiveness of these substitutes is a critical factor, as customers weigh the total cost of ownership against Element's all-inclusive pricing.

| Substitute Option | Description | Potential Impact on Element | Key Differentiator for Substitute | 2024 Relevance |

|---|---|---|---|---|

| In-house Fleet Management | Companies manage their own vehicles, maintenance, and operations. | Moderate to High | Direct control, potential for customization. | Continued adoption by large enterprises with specialized needs. |

| Public Transportation & Ride-Sharing | Utilizing public transit or services like Uber/Lyft for transport needs. | Low to Moderate | Cost-effectiveness for non-critical or low-volume transport. | Expansion of services in urban areas, offering flexible last-mile solutions. |

| Mobility-as-a-Service (MaaS) | Integrated platforms offering various transport modes. | Moderate to High | Convenience, on-demand access, reduced ownership burden. | Global MaaS market projected to exceed $100 billion by 2024. |

| Self-Management Software | Using fleet management software and telematics directly. | Moderate | Enhanced internal efficiency, potentially lower direct costs. | 15% increase in AI-powered route optimization adoption in logistics by mid-2024. |

Entrants Threaten

Entering the fleet management industry, particularly to compete with established players like Element, demands significant financial resources. This includes the capital needed for acquiring a large fleet of vehicles, establishing robust financing operations, and investing in advanced technology for fleet tracking and management. For instance, Element Financial Corporation reported $12.7 billion in assets as of the first quarter of 2024, illustrating the scale of investment required to operate effectively in this sector.

Element's substantial fleet size, encompassing roughly 1.5 million vehicles, creates a powerful barrier to entry through economies of scale. This vast scale enables Element to negotiate more favorable pricing with original equipment manufacturers (OEMs) and service providers, a significant cost advantage that new competitors would find extremely difficult to replicate.

Brand loyalty and the associated switching costs present a significant hurdle for new entrants in the fleet management sector, particularly for established companies like Element. Existing client relationships are frequently characterized by long-term contracts and deep integration into a client's operational framework. This makes the prospect of changing providers daunting due to the potential for substantial financial outlays and the risk of operational disruptions. For instance, in 2024, the average fleet management contract duration often extends beyond three years, with early termination penalties and the costs of re-implementing new systems representing considerable deterrents to switching.

Access to Distribution Channels

Element's established network for vehicle acquisition, maintenance, fuel, and remarketing presents a significant barrier. New entrants would struggle to build comparable infrastructure and supplier relationships, which are vital for efficient fleet operations.

For instance, in 2024, the complexity of managing a large fleet, including sourcing vehicles and negotiating maintenance contracts, requires substantial upfront investment and established partnerships. Element's existing agreements provide a competitive edge, making it difficult for newcomers to secure favorable terms.

Key challenges for new entrants include:

- Securing advantageous vehicle purchase agreements.

- Establishing nationwide maintenance and repair networks.

- Negotiating favorable fuel purchasing contracts.

- Developing efficient remarketing channels for used vehicles.

Regulatory Hurdles and Industry Expertise

The fleet management sector presents a significant barrier to entry due to stringent regulatory landscapes. Companies must master compliance with diverse rules governing vehicle emissions, driver hours, and safety standards, which vary considerably by region. For instance, in 2024, the EU’s updated General Safety Regulation mandates advanced driver-assistance systems (ADAS) in new vehicles, requiring substantial investment and technical know-how for fleet operators.

Developing the necessary industry expertise to manage these complex regulations is a formidable challenge for newcomers. This includes understanding evolving environmental mandates, such as the Euro 7 emissions standards, and ensuring all fleet operations adhere to them. The need for specialized knowledge in areas like telematics, fuel efficiency optimization, and driver training represents a steep learning curve.

- Regulatory Complexity: Navigating a patchwork of international, national, and local regulations related to vehicle safety, emissions, and operational permits.

- Expertise Requirement: Acquiring deep knowledge in areas such as vehicle maintenance, driver behavior monitoring, fuel management, and compliance software.

- Capital Investment: Significant upfront costs are often required for compliant vehicles, advanced tracking technology, and specialized personnel.

The threat of new entrants into the fleet management sector is generally low, largely due to the substantial capital requirements and established infrastructure of incumbents like Element. New players face significant hurdles in replicating the economies of scale, supplier relationships, and brand loyalty that Element has cultivated over time. These factors create a formidable competitive landscape, making it difficult for newcomers to gain traction without considerable investment and strategic planning.

| Barrier to Entry | Description | Relevance to Element |

|---|---|---|

| Capital Requirements | High initial investment for vehicle acquisition, technology, and operations. | Element's $12.7 billion in assets (Q1 2024) demonstrates the scale needed. |

| Economies of Scale | Lower per-unit costs due to large operational volume. | Element's ~1.5 million vehicles allow for better negotiation power. |

| Brand Loyalty & Switching Costs | Customer retention due to long-term contracts and integration. | Average contract durations in 2024 often exceed three years, with penalties for early termination. |

| Established Networks | Existing relationships with suppliers for vehicles, maintenance, and fuel. | Difficult for new entrants to build comparable infrastructure and supplier terms. |

| Regulatory Compliance | Navigating complex and evolving rules for emissions, safety, and operations. | New entrants need expertise to comply with regulations like EU's General Safety Regulation (2024). |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, incorporating information from industry-specific market research reports, company annual filings, and reputable financial news outlets to provide a comprehensive view of the competitive landscape.