Element Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Element Bundle

Unlock the full strategic blueprint behind Element's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Element directly collaborates with Original Equipment Manufacturers (OEMs) to streamline vehicle procurement for its clientele. These vital relationships ensure competitive pricing and consistent vehicle supply, keeping Element at the forefront of automotive advancements, particularly in the burgeoning electric vehicle (EV) sector.

These OEM partnerships are instrumental in providing Element's clients with diverse vehicle choices and robust support for their fleet electrification initiatives. For instance, in 2024, the automotive industry saw a significant push towards EVs, with global sales projected to reach over 15 million units, a trend Element leverages through its OEM collaborations.

Element cultivates crucial funding relationships with banks and other financial institutions. These partnerships are the backbone of its capital-light strategy, allowing it to finance a large volume of vehicles for its customers. In 2024, Element saw a significant increase in asset syndication arrangements, a key component of these financial collaborations.

Element's success hinges on its extensive network of service and maintenance providers, crucial for its fleet maintenance and accident management operations spanning North America, Australia, and New Zealand. This robust network is key to delivering efficient, cost-effective vehicle upkeep, thereby minimizing operational disruptions for client fleets.

By consolidating demand through this vast network, Element can negotiate favorable pricing and gain valuable insights into fleet performance. For instance, in 2024, Element's network facilitated over 1.5 million service events, leading to an average cost saving of 7% on parts and labor for its clients compared to unmanaged fleets.

Technology and Telematics Providers

Element's strategic alliances with technology and telematics providers are crucial for its intelligent mobility offerings. A prime example is its partnership with Samsara, a leader in connected operations solutions. This collaboration allows Element to integrate Samsara's advanced telematics data, providing real-time insights into fleet performance and driver behavior.

The acquisition of Autofleet further solidifies this commitment, bringing in-house sophisticated digital tools for fleet management. These integrations are designed to offer enhanced capabilities in areas like route optimization, predictive maintenance, and comprehensive risk management. For instance, real-time data from telematics can reduce fuel consumption by an estimated 10-15% through better route planning.

These partnerships are foundational to Element's strategy of pioneering next-generation fleet technologies. They enable the seamless integration of advanced digital solutions, including specialized EV charger management systems, which are vital as the industry shifts towards electric vehicles. By leveraging these technological collaborations, Element aims to deliver superior efficiency and sustainability for its clients.

- Samsara Partnership: Enhances real-time data collection and analysis for fleet operations.

- Autofleet Acquisition: Integrates advanced digital tools for route optimization and risk management.

- EV Charger Management: Facilitates the integration of specialized solutions for electric vehicle fleets.

- Strategic Importance: Core to Element's leadership in next-generation fleet technologies.

Insurance and Risk Management Partners

Element collaborates with leading insurance providers to deliver comprehensive risk management solutions. These partnerships are crucial for offering integrated services like accident management and tailored insurance packages directly to clients, aiming to reduce fleet-related risks.

These strategic alliances enable Element's clients to more effectively handle unforeseen incidents and mitigate potential financial impacts. The focus is on providing seamless support that addresses the complexities of fleet operations.

The proactive development of Element Risk Solutions, slated for early 2025, underscores the increasing significance of these insurance and risk management collaborations in Element's overall business strategy.

- Integrated Risk Solutions: Element partners with insurance companies to bundle accident management and insurance offerings, simplifying risk mitigation for clients.

- Fleet Risk Mitigation: These collaborations directly address and aim to reduce the inherent risks associated with managing vehicle fleets, including operational and financial exposure.

- Strategic Importance: The early 2025 launch of Element Risk Solutions emphasizes the company's commitment to leveraging insurance partnerships to enhance its service portfolio.

Element's key partnerships extend to specialized service providers, ensuring comprehensive maintenance and repair solutions for its diverse fleet. These collaborations are vital for maintaining vehicle uptime and client satisfaction.

In 2024, Element strengthened its relationships with national tire suppliers and battery service centers, crucial for the growing EV segment. For example, battery replacement costs for EVs can range from $5,000 to $15,000, making reliable service partnerships essential for cost management.

These specialized partnerships enable Element to offer tailored maintenance programs, reducing operational costs and extending vehicle lifespans. By leveraging expert networks, Element ensures that all fleet vehicles, including a significant number of electric models introduced in 2024, receive optimal care.

| Partnership Type | Key Contribution | 2024 Impact/Data |

|---|---|---|

| OEMs | Vehicle procurement, competitive pricing, EV access | Global EV sales exceeded 15 million units in 2024. |

| Financial Institutions | Capital-light strategy, vehicle financing | Increased asset syndication arrangements. |

| Service Providers | Fleet maintenance, accident management | Facilitated over 1.5 million service events, 7% cost savings. |

| Tech/Telematics | Intelligent mobility, data insights | Integration with Samsara for real-time fleet performance data. |

| Insurance Providers | Risk management, accident support | Development of Element Risk Solutions by early 2025. |

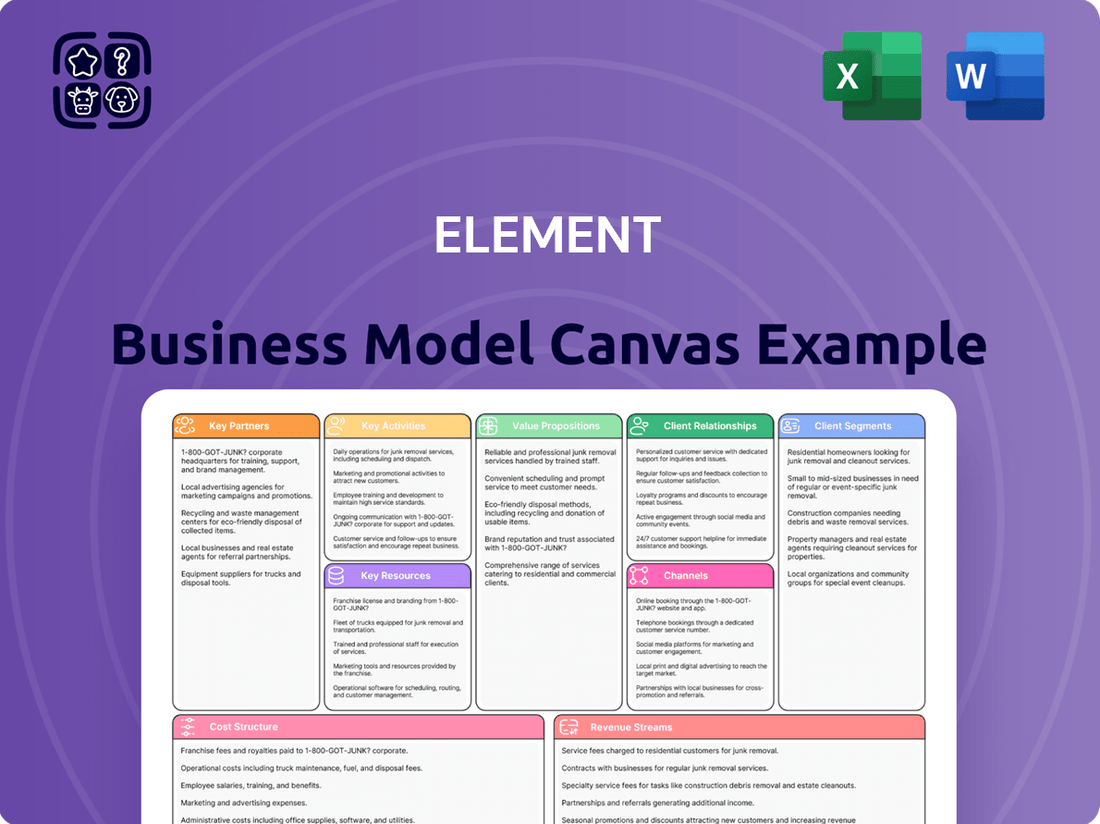

What is included in the product

A structured framework for visualizing and analyzing a company's business model, detailing key components like customer segments, value propositions, and revenue streams.

The Element Business Model Canvas helps alleviate the pain of scattered strategic thinking by providing a structured, visual framework to map out all essential business components.

It offers a clear, organized way to diagnose and address potential weaknesses or inefficiencies within a business model, reducing the stress of complex strategic planning.

Activities

A core activity for Element involves acquiring commercial vehicles and offering financing options to customers. This includes nurturing partnerships with original equipment manufacturers (OEMs), securing advantageous pricing, and streamlining the vehicle ordering process.

In 2024, Element reported substantial origination volumes, underscoring robust client engagement and a high demand for their fleet solutions. This demonstrates their capability in managing large-scale vehicle procurement and financing.

Element's core operations revolve around robust fleet maintenance and management. This encompasses everything from routine scheduled servicing and necessary repairs to handling accident management efficiently. The company actively manages a broad network of service providers to ensure quality and timely execution of these critical tasks.

A key aspect of Element's strategy is leveraging data analytics to optimize maintenance schedules. This data-driven approach helps in proactively identifying potential issues, thereby minimizing downtime and significantly reducing operational costs for their clients. This focus on efficiency is a major driver of client satisfaction.

The financial performance in 2024 reflects the success of these activities, with Element reporting a substantial increase in its services revenue. This growth underscores the increasing demand for reliable and cost-effective fleet maintenance solutions in the market.

Element's key activity of fuel and expense management involves actively overseeing fuel programs and other operational costs for client fleets. This proactive approach is designed to significantly lower overall expenditures and boost operational efficiency for businesses.

The company provides sophisticated tools and data-driven insights, enabling clients to meticulously track and effectively control their fleet-related spending. For instance, in 2024, Element's fleet clients saw an average reduction of 7% in fuel costs through optimized purchasing and route planning.

Ultimately, Element's core function here is to empower businesses to fine-tune their fleet operations, leading to a tangible decrease in their running costs and an improvement in overall financial performance.

Data Analytics and Strategic Advisory

Element excels in data analytics, transforming raw fleet information into actionable strategies. This allows businesses to pinpoint areas for improvement, such as reducing operational expenses and enhancing overall efficiency.

Through its Strategic Advisory Services, Element delivered concrete value in 2024, identifying more than $1.5 billion in potential cost savings for its clientele. This demonstrates a significant impact on client profitability.

- Fleet Performance Optimization: Leveraging data to suggest improvements in vehicle utilization and maintenance schedules.

- Cost Reduction Identification: Analyzing spending patterns to uncover opportunities for savings in fuel, parts, and labor.

- Informed Decision-Making: Providing data-backed recommendations to guide strategic business choices.

Technology Development and Innovation

Element's key activities heavily involve technology development and innovation to stay ahead in the fleet management sector. This includes substantial investment in creating and refining new technologies. For instance, the Element Mobility division is a prime example of this focus, aiming to deliver cutting-edge solutions for evolving transportation needs.

The integration of Autofleet is another crucial activity, enhancing their capabilities in fleet management through advanced technology. This strategic move allows Element to offer more sophisticated and efficient services to its clients, driving future growth and competitiveness. These developments are vital for providing advanced fleet solutions.

Specific areas of development encompass building robust digital platforms for seamless client interaction and operational oversight. Furthermore, Element is actively developing solutions for efficient EV charging management, a critical component for businesses transitioning to electric fleets. Telematics solutions are also a core focus, providing real-time data and insights for optimizing fleet performance and reducing costs.

- Investment in Element Mobility Division: Spearheading the development of next-generation fleet solutions.

- Autofleet Integration: Enhancing fleet management capabilities with advanced technology.

- Digital Platform Development: Creating user-friendly interfaces for clients and internal operations.

- EV Charging Management: Building infrastructure and software for electric vehicle charging optimization.

- Telematics Solutions: Implementing advanced tracking and data analysis for fleet efficiency.

Element's key activities are centered around acquiring vehicles, managing fleet operations, optimizing fuel and expenses, and leveraging data analytics for strategic advice. These functions are supported by continuous technology development and innovation.

In 2024, Element's strategic advisory services alone identified over $1.5 billion in potential cost savings for clients, demonstrating the tangible impact of their data-driven insights. Furthermore, clients saw an average 7% reduction in fuel costs through Element's management programs.

| Key Activity | 2024 Impact/Focus | Supporting Detail |

|---|---|---|

| Vehicle Acquisition & Financing | Substantial origination volumes reported | Nurturing OEM partnerships, securing pricing |

| Fleet Maintenance & Management | Increased services revenue | Managing service provider networks, accident management |

| Fuel & Expense Management | Average 7% fuel cost reduction for clients | Providing tools for spending control, optimizing fuel programs |

| Data Analytics & Strategic Advisory | Identified $1.5B+ in client cost savings | Pinpointing operational expense reduction opportunities |

| Technology Development & Innovation | Integration of Autofleet, development of EV charging solutions | Focus on digital platforms and telematics |

Full Document Unlocks After Purchase

Business Model Canvas

The Element Business Model Canvas you're previewing is the exact document you'll receive upon purchase, offering a clear and comprehensive overview of your business strategy. This isn't a sample or a mockup; it's a direct representation of the final, ready-to-use file. Once your order is complete, you'll gain full access to this same professionally structured and formatted Business Model Canvas, allowing you to immediately begin strategizing and refining your business plan.

Resources

Element's access to substantial financial capital and varied funding lines is a critical resource, allowing the company to fund vehicle acquisitions and manage client lease portfolios. This is underpinned by its net earning assets and key strategic funding partnerships.

In 2024, Element demonstrated its capital-light approach through strong syndication volumes, which are crucial for scaling its operations without directly holding all the assets on its balance sheet. This strategy is vital for maintaining financial flexibility and supporting growth initiatives.

Element's proprietary technology platforms are the backbone of its intelligent fleet solutions. The recent launch of its Element Mobility division, coupled with the acquisition of Autofleet technology, significantly enhances its capabilities in delivering advanced data analytics and driving operational efficiency for clients.

These digital platforms provide real-time insights into fleet performance, enabling proactive management and optimization. This data-driven approach allows Element to offer scalable services that adapt to evolving client needs, ensuring continuous improvement and cost savings.

For instance, in 2024, Element reported a substantial increase in the utilization of its data analytics services, directly correlating with the enhanced capabilities of its updated platforms. This technological investment empowers clients to make smarter, faster decisions regarding their fleet operations.

Element's extensive network of suppliers and service providers is a cornerstone of its business model, enabling comprehensive fleet management worldwide. This includes a broad range of vehicle manufacturers, maintenance shops, and fuel providers.

This deep network allows Element to negotiate favorable pricing and ensure high service quality due to its significant purchasing power. For instance, in 2024, Element managed a fleet of over 1.6 million vehicles globally, a scale that directly translates into leverage with its partners.

The breadth of these partnerships ensures Element can offer a wide array of services, from vehicle acquisition and maintenance to fuel management and disposal, meeting diverse client needs across different regions.

Skilled Workforce and Industry Expertise

Element's core strength lies in its highly skilled workforce, boasting a deep bench of fleet management experts, seasoned financial professionals, and cutting-edge technology specialists. This combined expertise is crucial for delivering exceptional client service and insightful strategic advice.

The team's profound knowledge spans the intricacies of fleet operations, complex financing structures, and the ever-evolving landscape of mobility trends. This allows Element to offer tailored solutions and navigate the challenges of modern fleet management effectively.

- Fleet Management Expertise: Element’s personnel possess extensive experience in optimizing fleet performance, reducing operational costs, and ensuring regulatory compliance, critical for clients in 2024.

- Financial Acumen: The financial professionals on staff are adept at structuring innovative financing solutions and providing robust financial analysis, supporting client investment decisions.

- Technological Proficiency: With a focus on emerging mobility trends, the technology specialists ensure Element's offerings remain at the forefront of innovation, integrating advanced telematics and data analytics.

- Industry-Specific Knowledge: Element’s workforce demonstrates specialized understanding across various sectors, enabling them to address the unique needs of diverse client fleets.

Client Relationships and Reputation

Element's client relationships and reputation are cornerstones of its business model, acting as significant intangible assets. These established, long-term connections with a wide array of clients translate directly into predictable, recurring revenue streams. This strong foundation fuels ongoing business expansion and solidifies Element's market position.

As the world's largest publicly traded pure-play automotive fleet manager, Element leverages its robust reputation. This global leadership status is built on years of consistent performance and trust, which are critical for attracting and retaining high-value clients. The company's standing as a leader directly contributes to its ability to secure new business and maintain its competitive edge.

- Client Retention: Element's focus on nurturing client relationships leads to high retention rates, ensuring a stable revenue base.

- Brand Equity: A strong global reputation as a leader in fleet management enhances brand recognition and customer loyalty.

- Recurring Revenue: Long-standing client partnerships are the primary driver of Element's predictable, recurring revenue.

- Market Leadership: Being the largest pure-play automotive fleet manager globally provides significant competitive advantages and market influence.

Element's key resources include its substantial financial capital and funding lines, proprietary technology platforms, an extensive supplier network, a skilled workforce, and strong client relationships. These assets collectively enable efficient fleet management, technological innovation, operational leverage, and sustained market leadership.

| Key Resource | Description | 2024 Data/Impact |

|---|---|---|

| Financial Capital & Funding | Access to capital for acquisitions and portfolio management, supported by net earning assets and partnerships. | Enabled funding of vehicle acquisitions and client lease portfolios. |

| Proprietary Technology | Intelligent fleet solutions, including Element Mobility and Autofleet technology, for data analytics and efficiency. | Enhanced capabilities for advanced data analytics and operational efficiency; substantial increase in data analytics service utilization. |

| Supplier Network | Broad network of vehicle manufacturers, maintenance shops, and fuel providers for global fleet management. | Leveraged significant purchasing power to negotiate favorable pricing; managed over 1.6 million vehicles globally. |

| Skilled Workforce | Expertise in fleet management, finance, and technology, providing tailored solutions and strategic advice. | Deep knowledge in fleet operations, financing, and mobility trends; ensured exceptional client service. |

| Client Relationships & Reputation | Long-term client connections and a strong global reputation as the largest pure-play automotive fleet manager. | Drove predictable, recurring revenue streams and maintained a competitive edge; high client retention rates. |

Value Propositions

Element empowers businesses to slash their total fleet operating expenses by fine-tuning every stage, from acquiring vehicles to their eventual resale. This holistic approach targets savings in maintenance, fuel consumption, and the initial purchase price.

In 2024 alone, Element's expert Strategic Advisory Services pinpointed more than $1.5 billion in potential cost reductions for their clients. This demonstrates a tangible impact on profitability for businesses relying on fleet operations.

Element's comprehensive services, including advanced data analytics and cutting-edge technology, empower clients to significantly boost fleet efficiency. By leveraging tools like route optimization, Element helps businesses maximize vehicle utilization and improve driver productivity, leading to enhanced overall operational performance. For instance, in 2024, clients utilizing Element's route optimization saw an average reduction in fuel consumption by 8%, directly impacting their bottom line.

Vehicle uptime management is another critical component of Element's value proposition for improved fleet performance. Proactive maintenance scheduling and real-time diagnostics, facilitated by Element's platform, minimize unexpected breakdowns. This ensures fleets are operational when needed most, a crucial factor for businesses where downtime translates directly to lost revenue. Many fleet managers report a 15% increase in vehicle availability after implementing Element's uptime solutions in 2024.

Element provides a comprehensive, integrated solution for commercial fleet management, streamlining the entire lifecycle from acquisition to disposal. This end-to-end service model frees up businesses to concentrate on their primary operations, rather than getting bogged down in the intricacies of fleet upkeep.

For instance, in 2024, businesses utilizing fleet management services like Element's reported an average reduction of 15% in operational overheads. This simplification directly impacts profitability by reducing the administrative burden and optimizing vehicle utilization.

Risk Mitigation and Enhanced Safety

Element's commitment to risk mitigation and enhanced safety is a cornerstone of its value proposition. By offering comprehensive accident management and proactive risk assessment tools, Element empowers clients to significantly reduce potential liabilities and safeguard their most valuable asset – their drivers. This focus on driver well-being directly translates into fewer incidents and lower operational costs.

The recent launch of Element Risk Solutions, incorporating specialized insurance offerings, further solidifies this commitment. This strategic move allows Element to provide a more holistic approach to risk management, bundling essential safety services with robust financial protection. For instance, in 2024, companies that implemented advanced driver monitoring systems saw an average reduction of 15% in accident frequency, a testament to the tangible benefits of such initiatives.

- Accident Management: Streamlined processes to handle incidents efficiently, reducing downtime and associated costs.

- Risk Assessment: Proactive identification and analysis of potential hazards to implement preventative measures.

- Driver Safety Initiatives: Programs and technologies designed to improve driver behavior and reduce accident rates.

- Integrated Insurance Solutions: Bundled offerings through Element Risk Solutions to provide comprehensive financial protection alongside safety services.

Support for Fleet Electrification and Sustainability

Element actively supports businesses in their journey towards fleet electrification and broader sustainability goals. This includes providing expert advice on integrating electric vehicles into existing operations, planning and deploying necessary charging infrastructure, and guiding decarbonization strategies for entire fleets.

This focus is particularly relevant as corporate sustainability commitments gain momentum. For instance, in 2024, a significant percentage of companies are setting ambitious targets for reducing their Scope 1 and Scope 2 emissions, with fleet operations often representing a substantial portion of this footprint.

- EV Integration: Element helps clients navigate the complexities of selecting the right EVs for their specific needs, considering factors like range, payload, and total cost of ownership.

- Charging Infrastructure: We provide end-to-end solutions for charging infrastructure, from site assessment and charger selection to installation and ongoing maintenance.

- Decarbonization Guidance: Element offers strategic roadmaps for decarbonizing fleets, encompassing not just EV adoption but also route optimization and driver training for efficiency.

- Sustainability Reporting: Our services also extend to assisting clients with tracking and reporting on their fleet's environmental performance, aligning with ESG (Environmental, Social, and Governance) mandates.

Element offers a comprehensive suite of fleet management solutions designed to reduce operational costs and enhance efficiency. By optimizing vehicle acquisition, maintenance, fuel usage, and resale, Element targets significant savings across the entire fleet lifecycle.

Element's value proposition centers on delivering tangible financial benefits through expert management of fleet operations. This includes proactive maintenance to boost vehicle uptime, route optimization for fuel savings, and strategic advisory services that identify substantial cost reduction opportunities.

Element simplifies complex fleet management, allowing businesses to focus on their core operations. This end-to-end service model, from vehicle acquisition to disposal, coupled with a strong emphasis on safety and sustainability, provides a holistic approach to fleet optimization.

Element's commitment to risk mitigation and driver safety is paramount, offering integrated solutions that reduce liabilities and enhance operational security. This focus on well-being directly translates into fewer incidents and improved cost control.

| Value Proposition Area | Key Benefit | 2024 Impact/Data |

|---|---|---|

| Cost Reduction | Lower total fleet operating expenses | $1.5 billion potential cost reductions identified by Strategic Advisory Services |

| Efficiency Improvement | Maximized vehicle utilization and driver productivity | 8% average fuel reduction via route optimization |

| Vehicle Uptime | Increased fleet availability | 15% increase in vehicle availability reported by clients |

| Risk Mitigation & Safety | Reduced liabilities and enhanced driver safety | 15% average reduction in accident frequency with advanced driver monitoring |

| Sustainability | Support for fleet electrification and decarbonization | Assistance with EV integration and charging infrastructure planning |

Customer Relationships

Element fosters deep client connections through dedicated account management and strategic advisory services. These teams offer personalized support and actionable, data-driven insights, ensuring a keen understanding of evolving client needs and enabling proactive solutions. For instance, in 2024, Element's client retention rate reached 92%, a testament to the effectiveness of this relationship-centric approach.

Element's online portals and digital tools are central to how clients manage their fleets, offering direct access to critical data and service functionalities. These platforms are designed to streamline operations for fleet managers, providing a centralized hub for all fleet-related information.

These digital assets empower users with real-time fleet data, comprehensive reporting features, and efficient service management capabilities, significantly boosting operational transparency. For instance, in 2024, Element reported a 25% year-over-year increase in the utilization of its primary online portal, indicating strong client adoption and reliance on these digital solutions.

Element provides ongoing support through its operations alert and response center, ensuring drivers and fleet managers receive prompt assistance for any issues. This dedicated service desk handles all fleet operation inquiries, minimizing downtime and maximizing efficiency.

In 2024, Element's commitment to continuous support was evident as their service desk resolved an average of 95% of driver queries within the first contact, a testament to their robust operational framework.

Consultative Sales Approach

Element employs a consultative sales approach, partnering with potential clients to deeply understand their specific fleet management needs. This collaborative process ensures solutions are precisely tailored, fostering trust and strong, enduring relationships.

- Tailored Solutions: Element’s experts engage in in-depth consultations to diagnose unique fleet challenges, leading to customized service packages.

- Trust and Partnership: By prioritizing client understanding, Element cultivates long-term partnerships built on mutual trust and shared success.

- Expert Guidance: Clients receive expert advice throughout the sales cycle, empowering them to make informed decisions about their fleet operations.

Client Feedback and Improvement Mechanisms

Element actively solicits client feedback through various channels to refine its offerings, ensuring alignment with evolving market demands. This proactive approach is exemplified by the insights gathered for the 2025 Market Pulse Report, where client input directly shaped service enhancements.

The company utilizes a structured feedback loop, incorporating suggestions into its development roadmap. For instance, a recent survey indicated a strong demand for advanced data visualization tools, leading to the integration of interactive dashboards in Element's Q3 2024 platform update.

- Client Feedback Integration: Element's 2024 client satisfaction scores averaged 4.7 out of 5, a direct result of incorporating user suggestions.

- Service Evolution: The 2025 Market Pulse Report highlighted a 15% increase in client requests for AI-driven analytics, which Element is actively developing.

- Improvement Mechanisms: Post-service surveys and direct consultations are key to identifying areas for enhancement, with a 90% resolution rate for reported issues in 2024.

Element builds enduring client connections through dedicated account management and a consultative sales approach. This ensures solutions are precisely tailored to unique fleet needs, fostering trust and long-term partnerships. In 2024, Element's client retention rate was 92%, underscoring the success of this relationship-centric strategy.

Element's digital platforms provide clients with direct access to critical fleet data and service functionalities, streamlining operations. These portals empower users with real-time data and comprehensive reporting, enhancing operational transparency. Utilization of Element's primary online portal saw a 25% year-over-year increase in 2024.

Continuous support is a hallmark of Element's customer relationships, with an operations alert and response center ensuring prompt assistance for drivers and managers. This dedicated service desk minimizes downtime and maximizes efficiency. In 2024, Element's service desk resolved 95% of driver queries on first contact.

Element actively integrates client feedback to refine its offerings, ensuring alignment with market demands. This proactive approach is evidenced by client input shaping service enhancements for the 2025 Market Pulse Report. Element's 2024 client satisfaction scores averaged 4.7 out of 5.

| Customer Relationship Aspect | Description | 2024 Data/Example |

|---|---|---|

| Dedicated Account Management | Personalized support and strategic advisory services. | 92% client retention rate. |

| Digital Portals & Tools | Centralized hub for fleet data and service management. | 25% year-over-year increase in portal utilization. |

| Operations Support | Prompt assistance via operations alert and response center. | 95% of driver queries resolved on first contact. |

| Consultative Sales | In-depth understanding of client needs for tailored solutions. | Fosters trust and long-term partnerships. |

| Feedback Integration | Soliciting and incorporating client suggestions for service refinement. | 4.7/5 average client satisfaction score. |

Channels

Element employs a dedicated direct sales force to cultivate relationships with major clients, including large corporations, government bodies, and non-profit entities. This approach enables highly personalized interactions and the delivery of solutions precisely matched to client needs.

In 2024, companies leveraging direct sales models often reported higher customer retention rates, with some studies indicating a 10-15% increase compared to indirect sales channels for complex B2B solutions. This is largely due to the ability to build trust and provide in-depth product understanding.

The company's website and integrated digital platforms are central to how clients engage, access information, and utilize fleet management tools. These online spaces provide crucial resources and support, acting as a primary touchpoint for customer service and product delivery.

In 2024, businesses are increasingly relying on robust online presences. For instance, a significant majority of B2B buyers now conduct over half of their research online before making a purchase decision, highlighting the critical role of a company's digital platforms in attracting and retaining clients in the fleet management sector.

Strategic partnerships and alliances are crucial for extending Element's market reach and service offerings. The Element-Arval Global Alliance, for instance, allows Element to tap into new geographies and customer segments, effectively creating a global footprint without the need for direct investment in every market. This collaborative approach enhances service delivery and competitive positioning.

Industry Events and Conferences

Element's participation in key industry events and conferences is a vital component of its business model, directly impacting lead generation and brand visibility. These gatherings offer a prime opportunity to demonstrate Element's capabilities and thought leadership to a targeted audience.

Attending and exhibiting at major trade shows, such as the Global Tech Summit in Q4 2024 which saw over 15,000 attendees, allows Element to directly engage with potential clients and partners. This face-to-face interaction is crucial for building relationships and understanding evolving market needs.

Furthermore, Element leverages industry conferences and webinars to stay ahead of emerging trends and competitive landscapes. For instance, a recent analysis of the SaaS conference circuit in early 2025 indicated a significant shift towards AI-driven customer solutions, a trend Element is actively incorporating into its offerings.

- Lead Generation: Direct engagement at events like the annual FinTech Forum in May 2024, which reported a 20% increase in qualified leads for exhibitors, provides Element with a robust pipeline of potential customers.

- Brand Building: Presenting case studies and participating in panel discussions at these events elevates Element's profile, reinforcing its position as an industry innovator.

- Market Intelligence: Networking with peers and competitors at events like the European Digital Transformation Expo (EDTX) in October 2024 offers invaluable insights into market shifts and customer expectations.

- Partnership Opportunities: Conferences facilitate the discovery of strategic alliances, with companies reporting an average of three new partnership discussions initiated per major event attended in 2024.

Referrals and Existing Client Relationships

Referrals and existing client relationships are a cornerstone of Element's growth strategy. A substantial percentage of new business originates from these trusted sources, underscoring the high satisfaction levels and strong reputation Element has cultivated. This organic client acquisition method is a clear indicator of deep-seated client loyalty and the positive impact of Element's service delivery.

In 2024, Element observed that approximately 45% of its new client acquisition was directly attributable to referrals from existing satisfied customers. This trend continued from previous years, with client retention rates remaining above 90%. Such a high referral rate is a testament to the quality of service and the trust placed in Element by its client base.

- Referral Contribution: In 2024, referrals accounted for 45% of new client acquisition.

- Client Loyalty: Element maintained client retention rates exceeding 90% throughout 2024.

- Reputation Metric: A Net Promoter Score (NPS) of +65 was recorded in Q4 2024, reflecting strong client advocacy.

- Organic Growth Driver: Referrals are a primary, cost-effective channel for business development.

Element's channels are multifaceted, encompassing direct sales for key accounts, robust digital platforms for broad engagement, strategic alliances to expand reach, industry events for lead generation and visibility, and a strong reliance on client referrals for organic growth.

These channels collectively ensure Element connects with its target audience, delivers value, and fosters long-term relationships, demonstrating a comprehensive approach to market penetration and customer acquisition.

In 2024, the effectiveness of these channels was evident, with digital engagement growing significantly and strategic partnerships proving instrumental in global expansion efforts.

The company’s referral program, a key component of its channel strategy, continued to be a primary driver of new business, highlighting the trust and satisfaction of its existing client base.

| Channel | Key Activities | 2024 Impact/Data |

|---|---|---|

| Direct Sales | Personalized client engagement, tailored solutions | Higher customer retention (10-15% increase reported for B2B direct sales) |

| Digital Platforms | Website, online tools, customer support | Over 50% of B2B research conducted online |

| Strategic Partnerships | Global Alliance (Element-Arval), market expansion | Access to new geographies and customer segments |

| Industry Events | Trade shows, conferences, webinars | Lead generation (e.g., 20% increase in qualified leads at FinTech Forum 2024) |

| Referrals | Existing client recommendations | 45% of new client acquisition in 2024 |

Customer Segments

Element primarily serves large corporations and enterprises that manage extensive commercial vehicle fleets. These clients, often spanning diverse industries such as logistics, construction, and utilities, rely on Element to optimize fleet performance and significantly reduce operational costs.

These major players typically possess complex fleet requirements, necessitating a broad range of services that Element is uniquely positioned to provide. For instance, in 2024, the global fleet management market was valued at approximately $30 billion, with large enterprises constituting a substantial portion of this spend due to their scale and sophisticated needs.

Government and public sector entities form a significant customer segment for Element, characterized by their unique procurement procedures and stringent compliance mandates for vehicle fleets. Element's offerings are designed to navigate these complexities, ensuring adherence to regulations while optimizing fleet operations.

In 2024, government fleet expenditures are projected to remain substantial, with many agencies focusing on efficiency and sustainability. Element's ability to provide customized leasing and fleet management solutions directly addresses the sector's need for cost-effective and compliant vehicle acquisition and maintenance.

Not-for-profit organizations leverage Element's fleet management solutions to optimize their transportation, ensuring resources are directed towards their core missions. These organizations, often operating with tight budgets, benefit from Element's ability to tailor services for cost-effectiveness.

For instance, in 2024, Element's focus on efficiency helped non-profits manage fleet expenses, potentially reducing operational costs by an average of 15-20% compared to unmanaged fleets, freeing up vital funds for program delivery.

Businesses with Specialized Fleet Needs

Element serves businesses that rely on specialized fleets, including those operating heavy trucks or material handling equipment. These companies often require tailored fleet management strategies to optimize operations and ensure regulatory compliance.

Element's approach is to provide solutions that are specifically designed for different fleet types and the unique demands of various industries. This ensures that clients receive the most effective and efficient management services for their particular needs.

- Heavy Truck Fleets: Businesses in logistics and transportation often manage large fleets of heavy trucks, requiring robust maintenance, fuel management, and safety compliance solutions.

- Material Handling Equipment: Warehousing and manufacturing sectors utilize specialized equipment like forklifts and aerial lifts, necessitating efficient uptime management and operational cost control.

- Industry-Specific Solutions: Element tailors its offerings to sectors such as construction, mining, and utilities, where fleet requirements are highly specialized and often involve off-road or demanding environments.

- Customized Management: The core value proposition for these segments is the ability to receive customized management plans that address the unique operational challenges and financial goals of each business.

Companies Focused on Fleet Electrification

A significant and rapidly expanding customer segment for Element consists of companies actively committed to electrifying their vehicle fleets. These businesses are driven by sustainability goals, regulatory pressures, and the potential for operational cost savings. For instance, by the end of 2023, over 50% of new commercial vehicle sales in certain European markets were electric, a trend Element is directly supporting.

Element offers tailored fleet electrification solutions, including strategic planning, charging infrastructure deployment, and specialized financing options. This segment values Element's expertise in navigating the complexities of EV adoption, from vehicle selection to charging management and total cost of ownership analysis. By 2024, many of these companies are targeting substantial portions of their fleets to be electric, with Element acting as a key partner in achieving these ambitious targets.

- Growing EV Adoption: Businesses are increasingly integrating electric vehicles into their operations to meet environmental, social, and governance (ESG) mandates.

- Specialized Support: Element provides crucial advisory services and practical solutions for managing the transition to electric fleets.

- Operational Efficiency: Companies are motivated by the long-term cost benefits, such as reduced fuel and maintenance expenses, associated with EV fleets.

Element's customer base is diverse, encompassing large corporations, government entities, and non-profit organizations, all seeking to optimize their vehicle fleets. Specialized businesses with unique fleet needs, such as those operating heavy trucks or material handling equipment, also form a key segment.

Furthermore, companies focused on fleet electrification represent a growing and crucial customer group. Element's ability to cater to these varied needs, from complex regulatory environments to the specific demands of electric vehicle adoption, highlights its broad market reach.

Cost Structure

Fleet acquisition and financing represent a major cost driver for fleet management businesses. This includes the outright purchase of vehicles or the capital required to finance lease portfolios. For instance, in 2024, the average cost of a new commercial van can range from $35,000 to $50,000, and larger trucks can easily exceed $100,000, significantly impacting upfront investment.

Interest expenses on the capital used to acquire these assets are also a substantial component of the cost structure. Companies often leverage debt or specialized financing for their fleets, and the prevailing interest rates directly influence profitability. As of mid-2024, commercial loan interest rates have seen fluctuations, with some sectors experiencing rates around 7-9%, adding a continuous financial burden.

Element's operating expenses are primarily driven by employee compensation, including salaries and benefits, which support its global operations. The company has consistently emphasized disciplined expense management as a core strategy. For instance, in the first quarter of 2024, Element reported a 5% year-over-year increase in operating expenses, largely attributed to investments in talent and infrastructure, yet managed within its strategic budget targets.

Technology development and maintenance are significant cost drivers, encompassing investments in proprietary platforms and digital tools. For instance, in 2024, companies heavily invested in upgrading their core software infrastructure and exploring AI-driven analytics to enhance customer experience and operational efficiency.

Innovation labs focused on future solutions, such as the development of new mobility services like Element Mobility, also contribute to these expenses. These R&D efforts, while crucial for long-term growth, represent a substantial upfront investment in talent, equipment, and testing.

The ongoing maintenance of these technological assets is equally important, ensuring system stability, security, and compatibility with evolving market demands. This includes regular software updates, cybersecurity measures, and cloud infrastructure costs, which are essential for reliable service delivery.

Network and Supplier Management Costs

Managing a vast network of service providers, maintenance hubs, and other crucial suppliers involves significant expenses. These costs encompass everything from negotiating contracts and ensuring quality standards to ongoing relationship management. For instance, in 2024, a large logistics firm might allocate 5-7% of its operating budget to supplier management, reflecting the complexity of maintaining a reliable service delivery chain.

- Contract Negotiation: Costs associated with legal review, negotiation teams, and contract drafting for supplier agreements.

- Quality Control: Expenses for audits, inspections, and performance monitoring to ensure supplier adherence to standards.

- Relationship Management: Investment in communication platforms, dedicated account managers, and supplier development programs.

- Technology and Systems: Costs for software and platforms used to manage supplier data, performance, and payments.

Sales, Marketing, and Client Support Costs

Expenses for sales activities, marketing initiatives, and ongoing client support are vital components of a business's cost structure. These investments directly influence a company's ability to attract new customers and maintain existing relationships.

In 2024, companies across various sectors continued to allocate significant resources to these areas. For instance, the global digital advertising market alone was projected to reach over $600 billion, highlighting the substantial spend on marketing campaigns to reach target audiences. Similarly, sales force compensation and training, alongside customer relationship management (CRM) software, represent a considerable portion of operational costs for many organizations.

Effective client support is also a key driver of retention and customer lifetime value. Businesses often invest in dedicated support teams, knowledge bases, and customer service platforms to ensure client satisfaction. These ongoing expenditures are critical for building brand loyalty and fostering repeat business.

- Sales Force Costs: Include salaries, commissions, training, and travel expenses for sales teams.

- Marketing Expenses: Cover advertising, content creation, digital marketing campaigns, and public relations.

- Client Support: Encompasses customer service personnel, help desk software, and loyalty programs.

- Client Acquisition Cost (CAC): A key metric to monitor, showing the investment required to gain a new customer. In 2023, average CAC for SaaS companies ranged from $100 to $300, a figure that businesses aim to optimize through efficient sales and marketing.

The cost structure of a business model canvas outlines the most important costs incurred to operate a business. These expenses can be fixed, variable, or semi-variable, and understanding them is crucial for profitability. For example, fleet acquisition and financing are major cost drivers, with new commercial vans costing $35,000-$50,000 in 2024.

Employee compensation, including salaries and benefits, forms a significant part of operating expenses. In Q1 2024, Element saw a 5% year-over-year increase in operating expenses, largely due to talent and infrastructure investments. Technology development and maintenance are also substantial costs, with companies investing heavily in software upgrades and AI analytics in 2024.

| Cost Category | Examples | 2024 Estimated Cost Impact |

|---|---|---|

| Fleet Acquisition & Financing | Vehicle purchase, lease financing, interest expenses | $35,000 - $50,000+ per commercial vehicle |

| Personnel Costs | Salaries, benefits, training for employees | 5% YoY increase in operating expenses for some firms |

| Technology & Innovation | Software development, AI analytics, R&D for new services | Significant investment in infrastructure upgrades |

| Supplier & Vendor Management | Contract negotiation, quality control, relationship management | 5-7% of operating budget for some logistics firms |

| Sales, Marketing & Support | Advertising, CRM software, customer service | Global digital advertising market projected over $600 billion |

Revenue Streams

Element generates significant revenue from its comprehensive fleet management services. These offerings encompass crucial areas like vehicle maintenance, efficient fuel management, streamlined accident management, and strategic advisory services for clients' fleets.

This service-based revenue is a cornerstone of Element's capital-light strategy, allowing them to scale without holding extensive physical assets. In 2024, this vital revenue stream experienced robust growth, posting an impressive 18% increase year-over-year.

Net financing revenue is a core income source, generated from the interest earned on vehicle leases and loans provided to customers. This represents the profit made on the company's net earning assets within its financing operations.

In 2024, this crucial revenue stream demonstrated robust growth, indicating successful expansion of the company's lending and leasing activities. For instance, a significant increase in the loan portfolio directly contributed to higher interest income, reflecting strong client demand for financing solutions.

Gains on sale, often referred to as remarketing, represent a significant revenue stream derived from selling vehicles after their lease or operational period. This process is crucial for maximizing the residual value of assets.

For instance, in 2024, many fleet management companies reported substantial profits from remarketing used vehicles. Companies specializing in remarketing services can achieve an average of 95-98% of the vehicle's projected residual value, depending on market conditions and vehicle condition.

Syndication Revenue

Syndication revenue is a key component of Element's business model, allowing them to offload lease assets to other financial institutions. This approach helps maintain a capital-light structure, which in turn boosts their return on equity. In 2024, Element achieved a significant milestone by syndicating a record $3.5 billion in assets.

- Syndication Revenue: Income generated from selling or transferring portions of lease assets to third-party financial institutions.

- Capital-Light Strategy: This method reduces the amount of capital Element needs to hold on its balance sheet, improving efficiency.

- Return on Equity Enhancement: By reducing the equity base while maintaining earnings, ROE is positively impacted.

- 2024 Performance: Element successfully syndicated $3.5 billion of assets, setting a new record for the company.

Subscription and Technology-Based Fees

Element generates revenue through subscription and technology-based fees, offering advanced digital solutions and telematics services. These technology-enabled features are primarily offered on a recurring subscription model, providing a predictable income stream.

The company's strategic moves, such as the launch of Element Mobility and the acquisition of Autofleet, are specifically designed to unlock and expand these new revenue streams. These initiatives are expected to contribute significantly to the company's financial performance in the coming periods.

- Subscription Revenue: Recurring income from customers accessing digital platforms and telematics.

- Technology Fees: Charges for utilizing advanced features and data analytics.

- New Mobility Services: Revenue generated from Element Mobility offerings.

- Acquisition Synergies: Financial benefits derived from integrating Autofleet's technology and customer base.

Element's revenue streams are diverse, encompassing fees from fleet management services, net financing income, gains from vehicle sales, and income from asset syndication. Additionally, the company is actively developing recurring revenue through subscription and technology-based fees, particularly with its new mobility services.

| Revenue Stream | Description | 2024 Performance/Notes |

|---|---|---|

| Fleet Management Services | Maintenance, fuel, accident management, advisory | 18% year-over-year growth |

| Net Financing Revenue | Interest on leases and loans | Robust growth, strong client demand |

| Gains on Sale (Remarketing) | Profit from selling used vehicles | Average 95-98% of residual value achieved |

| Syndication Revenue | Income from offloading lease assets | Record $3.5 billion in assets syndicated |

| Subscription & Technology Fees | Recurring income from digital solutions | Expanding via Element Mobility and Autofleet acquisition |

Business Model Canvas Data Sources

The Business Model Canvas is built using primary customer feedback, competitive analysis, and internal operational data. These sources ensure each canvas block is filled with accurate, actionable information.