Estee Lauder Companies PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Estee Lauder Companies Bundle

Unlock the strategic advantages hidden within Estee Lauder Companies's external environment. Our PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental factors shaping their future. Equip yourself with actionable intelligence to navigate market complexities and identify growth opportunities. Download the full, expertly crafted analysis today and gain the competitive edge.

Political factors

Global trade policies and the potential for tariff changes, like those previously considered under former US President Trump's administration, pose a significant risk to Estée Lauder's cost of goods and overall profitability. With operations spanning approximately 150 countries and a diverse global supply chain for ingredients, the company is highly exposed to shifts in cross-border trade regulations and duties.

Geopolitical tensions, such as ongoing conflicts and trade disputes, can significantly disrupt Estée Lauder's global supply chains, affecting raw material sourcing and product distribution. For instance, the continued instability in Eastern Europe and the Middle East, as of mid-2025, poses risks to logistics and increases operational costs in affected regions.

These global security issues also impact consumer sentiment, potentially leading to reduced discretionary spending on beauty products in markets experiencing heightened uncertainty. Estée Lauder actively monitors these evolving macro-environmental factors to anticipate market shifts and adjust its strategies accordingly, ensuring resilience in its operations across key international markets.

Government regulations significantly shape the cosmetics industry, impacting Estée Lauder's operations. For instance, the European Union's Cosmetic Regulation (EC) No 1223/2009 mandates stringent safety assessments and ingredient transparency, a framework Estée Lauder must navigate for its products sold within the EU. Similarly, the US FDA's oversight of cosmetics, while less prescriptive than the EU's, still requires adherence to labeling and safety standards.

Political Stability in Key Markets

Political stability in key markets directly influences consumer spending on discretionary items like beauty products. For Estée Lauder, instability in regions such as mainland China and the crucial Asia travel retail sector has presented significant headwinds. This was evident in fiscal year 2024, impacting sales performance, and this trend is expected to persist into fiscal year 2025.

The geopolitical landscape and government policies in major markets can also shape regulatory environments, affecting product approvals, marketing practices, and import/export dynamics. For instance, trade relations and consumer sentiment tied to political events in Asia can swiftly alter demand patterns for Estée Lauder's premium brands.

- Impact on Consumer Confidence: Political uncertainty in regions like mainland China and Asia travel retail has demonstrably dampened consumer confidence, leading to reduced discretionary spending on beauty products in FY2024.

- Anticipated FY2025 Headwinds: Projections indicate that these political stability concerns will continue to pose challenges for Estée Lauder's sales performance throughout fiscal year 2025.

- Regulatory Environment: Shifting political climates can introduce new regulatory hurdles or opportunities related to product safety, labeling, and market access across Estée Lauder's global operations.

Government Economic Stimulus Measures

Government economic stimulus measures, particularly in key markets like China, are a significant political factor for Estée Lauder. While these initiatives aim for long-term market stabilization and growth, their immediate impact and precise timing on the prestige beauty sector can introduce near-term uncertainties. Estée Lauder actively monitors these evolving policies to anticipate potential market shifts and adjust its strategies accordingly.

For instance, China's economic policies in 2024 and 2025 are being closely watched. The country's focus on boosting domestic consumption through various stimulus packages could indirectly benefit the beauty sector. However, the effectiveness and specific allocation of these funds will determine the extent of this benefit. Estée Lauder's performance is thus tied to the success of these governmental interventions in fostering a robust consumer environment.

- China's GDP growth forecasts for 2024 and 2025: Analysts project continued, albeit moderated, growth, with stimulus measures aiming to support this trajectory.

- Government spending on consumer goods: Stimulus packages often include incentives for domestic spending, which can translate to increased demand for discretionary items like beauty products.

- Regulatory environment for foreign investment: Changes in regulations related to foreign companies operating in China can impact Estée Lauder's market access and operational costs.

Political stability in key markets directly impacts consumer spending on discretionary items like beauty products. For Estée Lauder, instability in regions like mainland China and the crucial Asia travel retail sector presented significant headwinds in fiscal year 2024, and these concerns are projected to continue into fiscal year 2025.

Government economic stimulus measures, particularly in China, are closely watched. While aimed at long-term growth, their immediate impact on the prestige beauty sector introduces near-term uncertainties, with Estée Lauder's performance tied to the success of these interventions in fostering a robust consumer environment.

Shifting political climates can introduce new regulatory hurdles or opportunities related to product safety, labeling, and market access across Estée Lauder's global operations, requiring constant adaptation to evolving legal frameworks.

| Market | Political Stability Concern | Impact on Estée Lauder (FY2024/2025 Projection) |

|---|---|---|

| Mainland China | Moderate political stability, focus on domestic consumption stimulus | Potential for increased demand via stimulus, but tempered by broader economic and geopolitical factors. |

| Asia Travel Retail | Geopolitical tensions and regional security concerns | Continued disruption to travel patterns and consumer spending, impacting sales in key transit hubs. |

| European Union | Stringent and evolving regulatory environment (e.g., Cosmetic Regulation (EC) No 1223/2009) | Requires ongoing compliance investment and adaptation to ingredient safety and labeling standards. |

What is included in the product

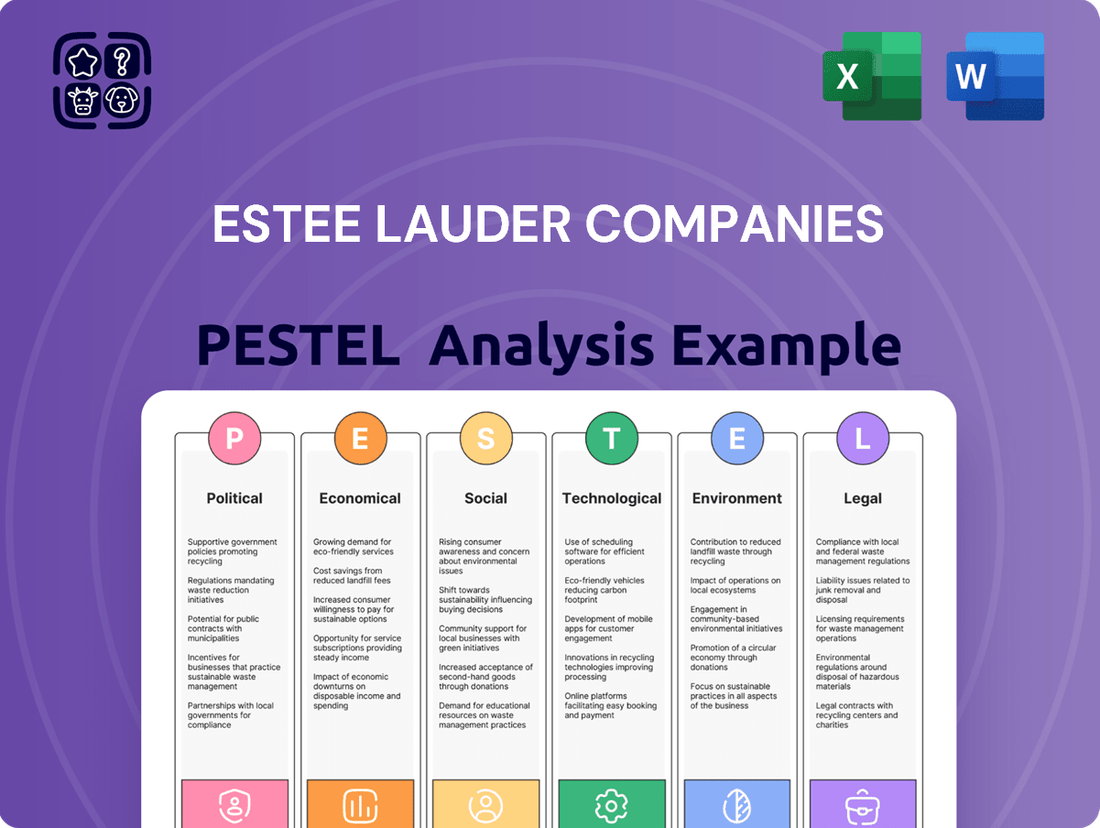

This PESTLE analysis delves into the external macro-environmental forces impacting Estee Lauder Companies, examining Political, Economic, Social, Technological, Environmental, and Legal factors.

It provides a comprehensive understanding of how these dynamics create both challenges and strategic advantages for the beauty giant.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear understanding of external factors impacting Estee Lauder.

Helps support discussions on external risk and market positioning during planning sessions, by highlighting key political, economic, social, technological, environmental, and legal influences.

Economic factors

A global economic slowdown and declining consumer confidence, especially in crucial markets like mainland China, have negatively impacted Estée Lauder's sales and profit projections for fiscal year 2025. This trend directly affects consumer spending on premium beauty items.

For instance, Estée Lauder's fiscal year 2024 results showed a net sales decline of 10% to $15.51 billion, with a significant portion attributed to softness in Asia travel retail and mainland China. This highlights the sensitivity of their business to macroeconomic headwinds and consumer sentiment shifts.

Rising inflation significantly impacts Estée Lauder's operational costs. For instance, the company has noted that higher costs for raw materials and transportation are affecting its bottom line. This inflationary pressure directly increases the expense of manufacturing, sourcing ingredients, and moving finished goods, potentially squeezing profit margins.

To combat these rising expenses, Estée Lauder has implemented cost-saving initiatives. In its fiscal year 2024, the company announced plans to cut approximately 5% of its global workforce, a move directly linked to streamlining operations and managing its cost base amid economic headwinds.

Fluctuations in currency exchange rates present a significant challenge for Estée Lauder, impacting its reported net sales and profitability due to its widespread international presence. For instance, in the first quarter of fiscal year 2024, the company reported that foreign currency headwinds negatively impacted its net sales by 1%, highlighting the tangible effects of currency volatility.

Managing these currency swings is a constant endeavor for Estée Lauder, requiring strategic hedging and careful financial planning to mitigate potential adverse impacts on its financial performance and global market competitiveness.

Travel Retail Performance

The global travel retail sector, a crucial segment for Estée Lauder, has faced considerable headwinds. For the fiscal year 2023, Estée Lauder reported that its travel retail channel saw a significant decline, contributing to a broader slowdown in their Asia Pacific business. This channel, once a powerhouse, experienced a sharp contraction, especially when compared to pre-pandemic levels.

Specifically, the performance in Asia, a key market for travel retail, has been particularly challenging. This downturn directly impacted Estée Lauder's top-line figures in recent fiscal periods. The company's financial reports for the latter half of 2023 and early 2024 indicated ongoing struggles in this segment.

- Asia's travel retail slump: The region's travel retail performance has been a primary drag on Estée Lauder's sales.

- Revenue impact: This channel, which previously represented a significant revenue stream, has seen a marked decrease.

- Fiscal year 2023 data: Estée Lauder's fiscal year 2023 results highlighted the negative contribution of travel retail to overall company performance.

E-commerce Growth vs. Brick-and-Mortar Decline

The beauty industry is witnessing a significant shift, with brick-and-mortar store traffic stabilizing and even declining in certain areas. This trend underscores the growing dominance of e-commerce and social selling platforms. Estée Lauder's future performance is intrinsically linked to its agility in harnessing these digital avenues and responding to evolving consumer preferences.

For instance, in 2023, global e-commerce sales in the beauty sector continued their upward trajectory, with online channels accounting for a substantial portion of revenue. Estée Lauder reported that its online sales channels demonstrated robust growth, reflecting the broader market trend. This digital acceleration necessitates strategic investments in online marketing, user experience, and efficient supply chain management to cater to the digitally native consumer.

- 2024 E-commerce Projections: Analysts predict continued double-digit growth for online beauty sales through 2025, driven by convenience and personalized shopping experiences.

- Social Selling Impact: Influencer marketing and direct-to-consumer sales via social media platforms are increasingly influencing purchasing decisions, particularly among younger demographics.

- Estée Lauder's Digital Focus: The company has been actively expanding its direct-to-consumer (DTC) capabilities and investing in its e-commerce infrastructure to capture a larger share of the online market.

- Shifting Retail Landscape: While physical stores remain important for brand experience, their role is evolving towards experiential hubs rather than primary sales channels, demanding a more integrated omnichannel approach.

Macroeconomic factors significantly shape Estée Lauder's performance, with global economic slowdowns and inflation directly impacting consumer spending on premium beauty products. For fiscal year 2024, the company reported a 10% net sales decline to $15.51 billion, partly due to reduced consumer confidence in key markets like China.

Rising inflation increases operational costs, affecting raw material and transportation expenses, while currency fluctuations also present challenges, with a 1% negative impact on net sales reported in Q1 FY24 due to foreign currency headwinds.

The travel retail sector, a vital channel for Estée Lauder, experienced a significant slump in fiscal year 2023, particularly impacting the Asia Pacific region, which previously contributed substantially to revenue.

The shift towards e-commerce and social selling continues to grow, with online beauty sales projected for double-digit growth through 2025, prompting Estée Lauder to invest in its digital capabilities and direct-to-consumer channels.

Full Version Awaits

Estee Lauder Companies PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing the Estee Lauder Companies PESTLE analysis. This comprehensive report covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the beauty giant. You'll gain a deep understanding of the external forces shaping their business strategy.

Sociological factors

Consumers are increasingly prioritizing eco-conscious choices, demanding transparency, ethical sourcing, and sustainable packaging from beauty brands. This shift is a significant sociological factor influencing the beauty industry.

Estée Lauder is actively responding to these evolving preferences. For instance, the company is on track to achieve its water withdrawal targets ahead of schedule, demonstrating a commitment to environmental stewardship.

Furthermore, Estée Lauder has made substantial progress in its sustainable palm oil objectives, a key area of concern for environmentally aware consumers. These actions align with the growing demand for ethical and sustainable practices in the beauty sector.

Consumers increasingly expect products and experiences tailored to their individual needs, moving away from generic offerings. This shift is evident in the beauty industry, where personalized skincare routines and makeup recommendations are highly sought after. For instance, a 2024 survey indicated that over 60% of Gen Z and Millennial consumers are willing to pay a premium for customized beauty products, directly impacting Estée Lauder's strategy to invest in AI-driven recommendation engines and bespoke formulations.

Social media platforms, particularly TikTok and Instagram, are now major drivers of beauty product discovery and purchase decisions. Estée Lauder must actively engage on these platforms, utilizing immersive content to connect with consumers, drive sales, and build lasting brand loyalty. For instance, in 2023, influencer marketing spend in the beauty sector reached an estimated $2.2 billion, with a significant portion directed towards short-form video content.

Emphasis on Inclusivity and Diversity in Beauty

Consumers increasingly seek beauty brands that reflect their own identities and needs, driving demand for products catering to a wide spectrum of skin tones, hair textures, and cultural beauty rituals. This societal evolution is a significant factor for Estée Lauder, pushing the company to innovate its offerings and marketing to resonate with a more diverse global customer base. For instance, by the end of fiscal year 2023, Estée Lauder had expanded its shade ranges across several brands, with some foundation lines now offering over 50 shades, reflecting this direct consumer demand.

This emphasis on inclusivity directly impacts product development and brand messaging. Companies are investing more in research and development to create formulations suitable for varied skin types and concerns, moving beyond traditional, often narrower, beauty standards. Marketing campaigns are also shifting, featuring a broader representation of individuals, which strengthens brand loyalty among previously underserved demographics.

- Expanding Shade Palettes: Estée Lauder brands like MAC and Clinique have continued to broaden their foundation and concealer shade offerings, with many now exceeding 50 shades to accommodate a wider range of skin tones.

- Culturally Relevant Marketing: The company is increasing its focus on marketing campaigns that authentically represent diverse ethnicities and beauty practices, aiming to build deeper connections with global consumers.

- Product Innovation for Diverse Needs: Investment in R&D is directed towards developing products that address specific concerns prevalent in different ethnic groups, such as hyperpigmentation or specific hair textures.

- Consumer Demand for Authenticity: Reports indicate that over 70% of consumers, particularly Gen Z and Millennials, consider a brand's commitment to diversity and inclusion when making purchasing decisions.

Rise of 'Skinimalism' and Wellness Integration

The growing trend of 'skinimalism' is reshaping consumer preferences, with a notable shift towards simpler skincare routines that prioritize fewer, high-quality, and multi-functional products. This minimalist approach is driven by a desire for efficiency and efficacy, moving away from overly complex, multi-step regimens.

Consumers are increasingly integrating beauty with broader wellness goals, actively seeking products that support long-term health and healthy aging. This includes a strong preference for formulations with scientifically-backed benefits, demonstrating a conscious choice for products that contribute to overall well-being.

- Minimalist Skincare: Consumers favor fewer, high-performance products, reducing clutter and simplifying routines.

- Wellness Integration: Beauty products are increasingly viewed as extensions of health and wellness practices.

- Healthy Aging Focus: Demand is rising for products that promote long-term skin health and age-defying benefits.

- Scientific Efficacy: Consumers prioritize products with proven, scientifically validated ingredients and results.

Societal shifts towards inclusivity are profoundly impacting the beauty industry. Estée Lauder is responding by expanding its shade ranges, with brands like MAC and Clinique now offering over 50 shades in foundations and concealers, reflecting a commitment to serving a broader customer base. This focus on diversity is further evidenced by marketing campaigns that authentically represent various ethnicities and beauty practices, aiming to foster deeper connections with a global audience.

The growing emphasis on personalization means consumers expect tailored beauty solutions. A 2024 survey revealed that over 60% of Gen Z and Millennials are willing to pay more for customized beauty products, prompting Estée Lauder to invest in AI-driven recommendations and bespoke formulations. This trend is amplified by social media platforms like TikTok and Instagram, which are crucial for product discovery, with influencer marketing in beauty reaching an estimated $2.2 billion in 2023.

Consumers are increasingly integrating beauty with wellness, seeking products that support healthy aging and long-term skin health. This drives demand for scientifically backed ingredients and efficacy. Simultaneously, a 'skinimalism' trend favors fewer, high-quality, multi-functional products, simplifying routines and aligning with a desire for efficiency.

| Sociological Factor | Estée Lauder Response/Impact | Supporting Data (2023-2024) |

|---|---|---|

| Inclusivity & Diversity | Expanded shade ranges (e.g., MAC, Clinique >50 shades) | 70%+ consumers consider brand diversity in purchase decisions. |

| Personalization | Investment in AI for recommendations, bespoke formulations | 60%+ Gen Z/Millennials pay premium for custom beauty. |

| Social Media Influence | Active engagement on TikTok/Instagram for discovery | Beauty influencer marketing spend: $2.2 billion (2023). |

| Wellness & 'Skinimalism' | Focus on scientifically backed, multi-functional products | Growing consumer preference for simplified, effective routines. |

Technological factors

Estée Lauder is actively integrating generative AI into its operations, notably through a partnership with Microsoft to establish an AI Innovation Lab. This collaboration aims to accelerate product development cycles by quickly identifying and responding to emerging consumer trends.

The company is also leveraging generative AI to significantly enhance its global marketing efforts. This includes the creation of highly personalized marketing campaigns and the extraction of deeper data insights, which are crucial for understanding and engaging diverse customer segments in 2024 and beyond.

Estée Lauder is significantly boosting its digital and e-commerce operations to capture growth in these key areas. For instance, in fiscal year 2023, the company saw its online sales contribute a substantial portion of its overall revenue, reflecting a strategic focus on digital channels.

The company is actively expanding its presence on major e-commerce platforms, such as launching brands on Amazon's U.S. Premium Beauty store. This move aims to reach a wider consumer base and leverage the established infrastructure of these digital marketplaces.

Furthermore, Estée Lauder is investing in enhancing its digital capabilities to improve consumer targeting and streamline its supply chain. This includes leveraging data analytics to personalize marketing efforts and optimize inventory management, a critical factor in the fast-paced beauty industry.

Technological advancements are reshaping Estée Lauder's supply chain, enabling greater efficiency and responsiveness. For instance, the adoption of AI-powered demand forecasting tools can significantly reduce inventory holding costs and prevent stockouts, a critical factor in the fast-paced beauty industry. In 2024, companies leveraging advanced analytics saw an average reduction of 15% in supply chain disruptions.

Real-time tracking and visibility solutions, powered by IoT sensors and blockchain technology, are also vital for Estée Lauder. These technologies allow for better monitoring of goods from production to consumer, helping to mitigate risks associated with tariffs and geopolitical instability. The global supply chain visibility market was valued at approximately $3.5 billion in 2023 and is projected to grow substantially.

Data Analytics for Consumer Insights

Estée Lauder is significantly enhancing its consumer understanding by employing advanced data analytics, particularly through conversational AI. This technology allows the company to process vast amounts of proprietary and database information related to product performance and consumer claims. By doing so, they can identify emerging consumer demands and preferences with greater speed and precision.

This data-driven approach directly impacts Estée Lauder's ability to develop and launch marketing campaigns that resonate with local markets. For instance, in 2024, the company continued to invest in digital transformation initiatives aimed at improving customer engagement and personalization. The insights gleaned from data analytics enable them to tailor product offerings and messaging, leading to more effective and efficient market penetration.

- AI-driven insights: Estée Lauder utilizes conversational AI to analyze product and claim data, accelerating the identification of consumer needs.

- Faster campaign launches: This analytical capability allows for the quicker development and deployment of locally relevant marketing strategies.

- Personalization: The company aims to leverage data to personalize consumer experiences, a key trend in the beauty industry for 2024-2025.

Innovation in Sustainable Packaging Technologies

Technological advancements in sustainable packaging are crucial for Estée Lauder's commitment to environmental responsibility. Innovations like reusable, refillable, and easily recyclable packaging components are central to achieving their ambitious sustainability targets. For instance, by the end of fiscal year 2024, Estée Lauder aimed to have 75% of its packaging be recyclable, refillable, or made with recycled content, a significant step towards their 2025 goal of 100%.

The company is actively investing in and expanding its take-back programs and exploring novel materials to reduce its environmental footprint. These initiatives are not just about compliance but are driven by consumer demand for eco-conscious products. In 2023, Estée Lauder reported a 4% reduction in virgin plastic use across its packaging portfolio compared to their 2018 baseline, demonstrating tangible progress.

Key technological drivers include:

- Development of biodegradable and compostable materials: Research into plant-based plastics and other organic materials is ongoing to replace traditional petroleum-based plastics.

- Advancements in refillable systems: Designing durable and aesthetically pleasing refillable containers that are convenient for consumers is a major focus.

- Improved recyclability of existing materials: Innovations in sorting and processing technologies are making it easier to recycle complex packaging structures.

- Digitalization for supply chain transparency: Utilizing technology to track the lifecycle of packaging and ensure responsible sourcing and disposal.

Estée Lauder is significantly enhancing its consumer understanding by employing advanced data analytics, particularly through conversational AI, to process vast amounts of product and consumer claim data. This accelerates the identification of emerging consumer demands and preferences, allowing for faster deployment of locally relevant marketing strategies and personalized consumer experiences, a key trend for 2024-2025.

Technological advancements are reshaping Estée Lauder's supply chain, with AI-powered demand forecasting tools helping to reduce inventory holding costs. Real-time tracking solutions, powered by IoT and blockchain, enhance visibility from production to consumer, mitigating risks. Companies leveraging advanced analytics saw an average 15% reduction in supply chain disruptions in 2024.

The company is also focusing on technological innovations in sustainable packaging, aiming for 75% of its packaging to be recyclable, refillable, or made with recycled content by the end of fiscal year 2024, moving towards its 2025 goal of 100%. In 2023, they achieved a 4% reduction in virgin plastic use compared to their 2018 baseline.

| Key Technological Initiatives | Description | Impact/Goal |

| Generative AI & AI Innovation Lab | Partnership with Microsoft to accelerate product development and enhance global marketing with personalized campaigns. | Faster identification of trends, deeper data insights, improved consumer engagement. |

| Digital & E-commerce Expansion | Boosting online sales presence, launching brands on platforms like Amazon's U.S. Premium Beauty store. | Capture growth in digital channels, reach wider consumer base. Fiscal year 2023 saw substantial online revenue contribution. |

| Supply Chain Technology | AI-powered demand forecasting, IoT sensors, blockchain for real-time tracking. | Greater efficiency, reduced inventory costs, prevention of stockouts, mitigation of geopolitical risks. 2024 saw average 15% reduction in supply chain disruptions for analytics users. |

| Sustainable Packaging Technology | Development of biodegradable/compostable materials, refillable systems, improved recyclability. | Achieve 75% recyclable/refillable/recycled content packaging by FY24, moving towards 100% by 2025. Reduced virgin plastic use by 4% in 2023. |

Legal factors

Estée Lauder faces a complex web of product safety and ingredient regulations globally. For instance, the European Union's Cosmetic Regulation (EC) No 1223/2009 mandates rigorous safety assessments and ingredient declarations, impacting how Estée Lauder formulates and markets its products in the region. The company actively manages compliance with evolving ingredient glossaries and maintains transparency for consumers regarding product composition.

Intellectual property protection is paramount for Estée Lauder, safeguarding its extensive collection of prestige beauty brands, unique formulations, and cutting-edge technological advancements. This legal framework, encompassing patents, trademarks, and trade secrets, underpins the company's sustained competitive edge in the dynamic beauty market.

In 2023, Estée Lauder continued its proactive approach to IP, with a significant portion of its research and development investments directed towards securing and defending its innovations. While specific figures for IP litigation costs are not publicly itemized, the company's consistent emphasis on brand integrity and product originality highlights the ongoing importance of these legal protections.

Estée Lauder must navigate a complex web of advertising and marketing regulations worldwide, ensuring all claims about their beauty products are truthful and substantiated. This means careful scrutiny of promotional materials to prevent misleading consumers about product efficacy or ingredients, a critical factor given the global reach of their brands.

For instance, in 2024, regulatory bodies like the U.S. Federal Trade Commission (FTC) continue to emphasize transparency in influencer marketing and digital advertising. Estée Lauder's compliance with these evolving standards directly influences how they launch and market new, innovative products across diverse international markets, impacting their go-to-market strategies.

Labor Laws and Employment Regulations

Estée Lauder, as a global entity, navigates a complex web of labor laws and employment regulations across its international operations. This is particularly critical when undertaking workforce adjustments, such as those seen in restructuring plans. For instance, in 2023, the company announced significant restructuring efforts, which would inevitably involve navigating varying notice periods, severance pay requirements, and consultation obligations with employee representatives in different jurisdictions.

Compliance with these diverse legal frameworks is paramount to avoid penalties and maintain positive employee relations. These regulations cover a broad spectrum of employment practices:

- Minimum Wage Laws: Adherence to the legally mandated minimum wages in each operating country, which can vary significantly. For example, the US federal minimum wage remains $7.25 per hour, but many states and cities have much higher rates.

- Working Hours and Overtime: Regulations dictating maximum working hours and compensation for overtime work, such as the EU Working Time Directive setting a 48-hour average weekly limit.

- Discrimination and Equal Opportunity: Laws prohibiting discrimination based on age, gender, race, religion, disability, and other protected characteristics, enforced by bodies like the Equal Employment Opportunity Commission (EEOC) in the United States.

- Termination and Redundancy Procedures: Specific legal requirements for dismissing employees, including notice periods, consultation processes, and severance packages, which differ greatly by country.

Data Privacy and Consumer Protection Laws

Estée Lauder faces a growing landscape of data privacy and consumer protection regulations globally. As digital interactions and personalized marketing become more central to their strategy, the company must meticulously manage customer data, adhering to stringent requirements for collection, storage, and usage. Failure to comply can lead to significant fines and reputational damage. For instance, the General Data Protection Regulation (GDPR) in Europe and similar legislation in other regions, like the California Consumer Privacy Act (CCPA), impose strict rules on how personal information is handled. In 2023, companies faced substantial penalties for data breaches and privacy violations, highlighting the critical need for robust compliance frameworks.

Navigating these evolving legal frameworks is paramount for Estée Lauder's sustained success. Key considerations include:

- Compliance with GDPR and CCPA: Ensuring all data processing activities align with these comprehensive privacy laws.

- Data Security Measures: Implementing advanced security protocols to protect sensitive customer information from breaches.

- Transparency and Consent: Clearly communicating data usage policies and obtaining explicit consent from consumers for data collection.

- Cross-border Data Transfers: Managing the complexities of transferring personal data across different jurisdictions in compliance with international regulations.

Estée Lauder must adhere to a complex array of global advertising and marketing regulations, ensuring all product claims are truthful and substantiated. For example, in 2024, regulatory bodies like the U.S. FTC continue to focus on transparency in influencer marketing, directly impacting Estée Lauder's promotional strategies for new product launches.

The company's commitment to intellectual property protection is vital, safeguarding its brand portfolio and proprietary formulations. This legal framework, encompassing patents and trademarks, underpins its competitive advantage in the beauty sector, with ongoing investment in R&D to defend its innovations.

Data privacy regulations, such as GDPR and CCPA, are critical for Estée Lauder, requiring meticulous management of customer data for personalized marketing. Non-compliance in 2023 resulted in significant penalties for many companies, underscoring the need for robust data security and transparent consent practices.

Labor laws and employment regulations across Estée Lauder's global operations are also a key legal consideration, especially during restructuring. Navigating varying notice periods and severance requirements, as seen in 2023 restructuring plans, is essential for compliance and maintaining employee relations.

Environmental factors

Estée Lauder is actively pursuing sustainable packaging, aiming for a significant portion of its packaging to be recyclable, refillable, reusable, made from recycled content, or recoverable by 2025. This commitment is backed by concrete goals, with the company reporting that 80% of its packaging was recyclable, made with recycled content, or recoverable as of 2023.

To further this objective, Estée Lauder is investing in innovative solutions and developing take-back programs to encourage circularity within its product lifecycle. These initiatives are crucial for meeting evolving consumer expectations and regulatory pressures concerning environmental impact.

The Estée Lauder Companies have proactively addressed water conservation, achieving their 2025 water withdrawal reduction goals ahead of schedule at direct manufacturing sites. This accomplishment highlights their dedication to preserving vital water resources through the implementation of advanced water-efficient technologies and robust sustainable practices across operations.

Estée Lauder is actively tackling climate change through its Climate Transition Plan, a comprehensive strategy aimed at significantly cutting greenhouse gas (GHG) emissions throughout its entire value chain. The company is committed to achieving carbon neutrality and establishing itself as a leader in renewable energy adoption.

In line with its 2030 goals, Estée Lauder aims to reduce absolute Scope 1 and 2 GHG emissions by 50% and Scope 3 GHG emissions by 30%. By the end of fiscal year 2023, the company reported a 22% reduction in absolute Scope 1 and 2 GHG emissions compared to its 2018 baseline, demonstrating tangible progress toward its targets.

Responsible Sourcing and Ingredient Transparency

Estée Lauder Companies places a significant emphasis on responsible sourcing and ingredient transparency as a key environmental consideration. This commitment extends to ensuring that raw materials and packaging are acquired in ways that minimize negative impacts on ecosystems and communities. For instance, the company has been actively working towards its palm oil sustainability goals, aiming for 100% RSPO certified palm oil derivatives by the end of 2023, a target that underscores their dedication to ethical procurement practices.

This focus on transparency and sustainability is increasingly important to consumers and investors alike. In 2023, over 70% of consumers stated that sustainability is an important factor when making purchasing decisions, a trend that directly influences brand loyalty and market share. Estée Lauder's efforts in this area are therefore not just about environmental stewardship but also about building trust and meeting evolving market demands.

The company's approach involves:

- Sustainable Palm Oil Procurement: Actively working towards sourcing certified sustainable palm oil derivatives to mitigate deforestation and biodiversity loss.

- Ingredient Traceability: Enhancing transparency in the supply chain to understand the origin and environmental footprint of key ingredients.

- Ethical Material Sourcing: Implementing policies to ensure that all materials, including packaging, are sourced responsibly and ethically.

Waste Reduction and Circular Economy Principles

Estée Lauder is actively pursuing a zero industrial waste-to-landfill goal across its global manufacturing sites. In 2023, the company reported diverting 91% of its industrial waste from landfills, a significant step towards its sustainability objectives.

The company is embedding circular economy principles throughout its value chain, particularly in packaging design and operational efficiency. This includes exploring recycled content and reducing overall material usage.

- Waste Diversion Rate: 91% of industrial waste diverted from landfills in 2023.

- Circular Economy Focus: Emphasis on recycled content and material reduction in packaging.

- Operational Goals: Progressing towards zero industrial waste-to-landfill across global operations.

Estée Lauder is making strides in environmental sustainability, aiming for 100% recyclable, refillable, reusable, or recoverable packaging by 2025, with 80% achieved by 2023. The company also met its 2025 water withdrawal reduction goals early, showcasing advanced water efficiency. Furthermore, Estée Lauder is committed to reducing GHG emissions, targeting a 50% cut in Scope 1 and 2 by 2030, and had already achieved a 22% reduction by fiscal year 2023 from its 2018 baseline.

Responsible sourcing, particularly for palm oil, is a key focus, with a goal of 100% RSPO certified derivatives by the end of 2023. Consumer demand for sustainability is high, with over 70% of consumers in 2023 considering it important in purchasing decisions. The company is also working towards zero industrial waste to landfill, diverting 91% of industrial waste in 2023.

| Environmental Goal | Target Year | 2023 Status/Progress |

|---|---|---|

| Sustainable Packaging | 2025 | 80% recyclable, refillable, reusable, or recoverable |

| Water Withdrawal Reduction | 2025 | Achieved ahead of schedule |

| Scope 1 & 2 GHG Emissions Reduction | 2030 | 22% reduction from 2018 baseline (FY23) |

| RSPO Certified Palm Oil Derivatives | 2023 | 100% target |

| Industrial Waste Diversion | Ongoing | 91% diverted from landfills (FY23) |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Estée Lauder Companies is meticulously crafted using data from reputable sources including financial reports from regulatory bodies like the SEC, global economic outlooks from institutions such as the IMF and World Bank, and industry-specific market research from firms like Statista and Euromonitor.