Estee Lauder Companies Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Estee Lauder Companies Bundle

The Estee Lauder Companies operates in a dynamic beauty market, facing moderate threats from new entrants and substitutes due to brand loyalty and high switching costs in premium segments. However, intense rivalry among established players and significant buyer power from large retailers exert considerable pressure.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Estee Lauder Companies’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Estée Lauder's reliance on specialized, often proprietary ingredients for its prestige beauty products places significant weight on its suppliers. When these unique components come from a small, concentrated group of providers, those suppliers gain considerable leverage. This is because Estée Lauder, as a leader in the beauty industry, often has limited alternatives for its high-performance formulations, potentially leading to increased input costs or less favorable contract terms.

Estée Lauder faces significant bargaining power from suppliers due to high switching costs associated with its diverse product formulations. Changing suppliers for critical raw materials or complex compounds can incur substantial expenses. These include the cost of reformulating products, rigorous re-testing to ensure efficacy and safety, and obtaining necessary regulatory approvals. For instance, a shift in a key active ingredient for a popular serum might necessitate months of development and testing, impacting production timelines.

These switching costs are particularly high for specialized ingredients or proprietary compounds that are integral to the performance and brand identity of Estée Lauder's extensive portfolio, which spans skincare, makeup, fragrance, and hair care. Suppliers of these essential, integrated components, therefore, hold considerable leverage. This strength is amplified when these suppliers have invested heavily in R&D and have established long-term supply agreements, making it difficult and costly for Estée Lauder to find and integrate alternative sources without compromising product quality or facing production delays.

Suppliers of premium, ethically sourced ingredients, particularly those with strong brand reputations for quality and consistency, wield significant bargaining power. For Estée Lauder, whose prestige beauty sector relies heavily on product efficacy and brand integrity, these suppliers are crucial. In 2023, Estée Lauder reported net sales of $15.91 billion, underscoring the importance of maintaining product quality that aligns with its premium brand image.

Threat of Forward Integration by Suppliers

The threat of key suppliers moving into the prestige beauty market, known as forward integration, is a less common but significant concern for Estée Lauder. If a supplier develops proprietary technology or unique ingredients, they could potentially launch their own branded products. This would place them in direct competition with Estée Lauder, compelling the cosmetics giant to foster robust supplier relationships and potentially agree to less advantageous terms to ensure a consistent supply of critical components.

For instance, a high-end fragrance ingredient supplier with exclusive access to a rare botanical could decide to bottle and market its own perfume. This scenario directly impacts Estée Lauder's ability to negotiate pricing and supply volume for that specific ingredient. In 2023, the global fragrance market was valued at approximately $50 billion, highlighting the potential profitability of this sector for new entrants.

- Forward Integration Threat: Suppliers might launch their own beauty products, directly competing with Estée Lauder.

- Impact on Bargaining Power: This would increase supplier leverage, potentially leading to less favorable terms for Estée Lauder.

- Ingredient Dependency: For suppliers with unique technology or ingredients, this threat is more pronounced.

Impact of Regional Supply Chain Initiatives

Estée Lauder's strategic push to regionalize its supply chain is a direct response to global volatility, aiming to lessen reliance on single-source or geographically concentrated suppliers. This diversification is intended to dilute supplier power by creating alternative sourcing options.

However, the effectiveness of this strategy hinges on the actual availability of qualified, specialized suppliers within targeted regions. If certain critical components or raw materials are still sourced from a limited number of regional experts, supplier power may remain concentrated, presenting a nuanced challenge to Estée Lauder's efforts to reduce overall supplier leverage.

- Regionalization as a Risk Mitigation Tool: Estée Lauder's regional supply chain initiatives are designed to buffer against disruptions, thereby potentially reducing the bargaining power of suppliers by increasing sourcing flexibility.

- Concentration Risk in Specialized Markets: Despite regionalization, if specialized inputs remain dominated by a few regional suppliers, Estée Lauder could still face significant supplier power in those specific niches.

- Impact on Sourcing Costs: The success of regionalization in curbing supplier power will directly influence Estée Lauder's cost of goods sold, a key metric for profitability.

Estée Lauder's suppliers of specialized, high-quality ingredients, particularly those with unique formulations or ethical sourcing certifications, hold considerable bargaining power. This is amplified by the high switching costs associated with reformulating and re-testing products, which can be substantial for a company with a vast product portfolio like Estée Lauder. For instance, a key supplier of a proprietary active ingredient for a popular skincare line could dictate terms due to the complexity and time involved in finding and validating an alternative.

| Key Factor | Impact on Estée Lauder | Supporting Data/Example |

| Supplier Concentration | Increased leverage for suppliers with unique or limited offerings. | Limited number of suppliers for rare botanical extracts used in prestige skincare. |

| Switching Costs | High costs deter Estée Lauder from changing suppliers for critical ingredients. | Costs include reformulation, re-testing, and regulatory approval for new ingredients. |

| Forward Integration Threat | Potential for suppliers to become competitors. | A high-end fragrance oil supplier could launch its own branded perfumes, impacting raw material negotiation. |

| Brand Reputation of Suppliers | Suppliers with strong quality and ethical sourcing reputations command higher power. | Estée Lauder's emphasis on prestige and efficacy makes it reliant on trusted, high-quality ingredient providers. |

What is included in the product

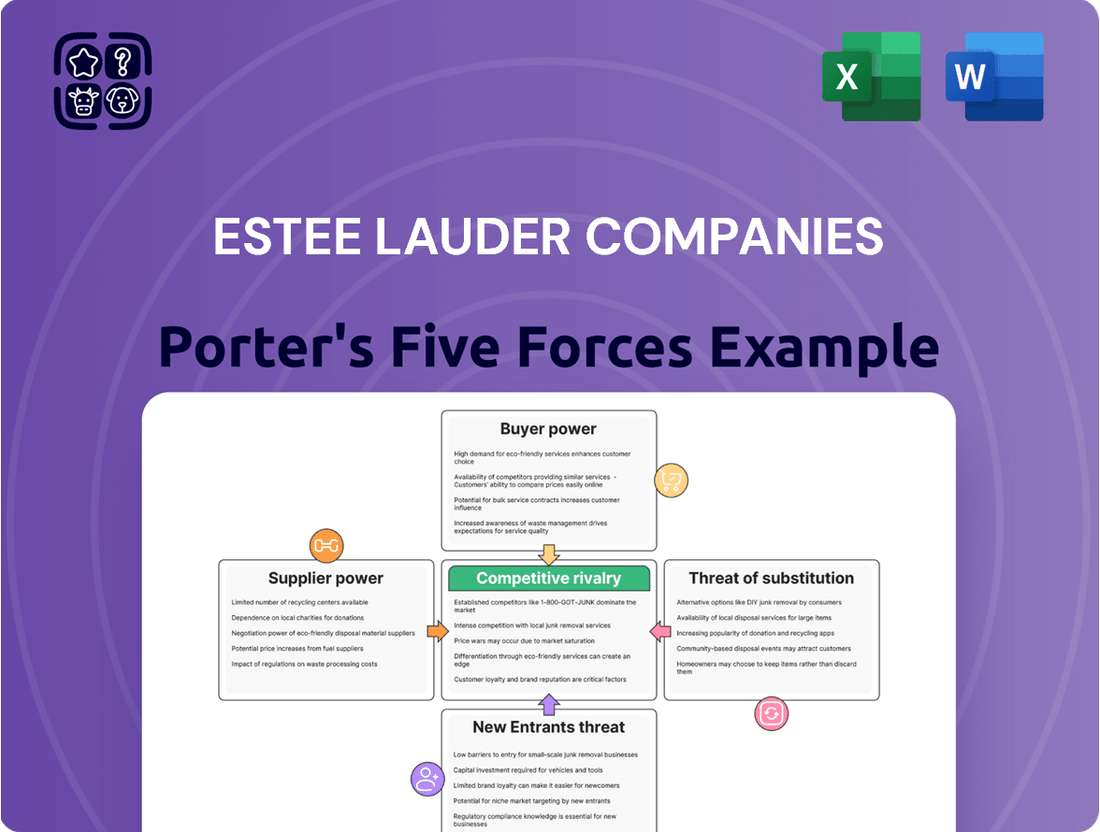

Uncovers key drivers of competition, customer influence, and market entry risks tailored to The Estée Lauder Companies' position in the beauty industry.

Instantly visualize competitive intensity across the beauty industry, allowing Estee Lauder to proactively address threats and capitalize on opportunities.

Customers Bargaining Power

Estée Lauder's extensive reach through diverse distribution channels like department stores, specialty retailers, its own stores, e-commerce, and travel retail significantly impacts customer bargaining power. This broad network serves a vast and varied global consumer base, meaning no single channel or consumer group holds overwhelming sway over sales volume. This fragmentation inherently limits the ability of any one customer segment to dictate terms or demand significant concessions.

In the prestige beauty sector, consumers often demonstrate significant brand loyalty. This loyalty stems from factors like perceived product quality, proven effectiveness, and the overall brand experience, which can be particularly strong for Estée Lauder's established names such as Estée Lauder, Clinique, and La Mer.

This ingrained loyalty significantly lessens customers' price sensitivity and their inclination to switch brands. Consequently, the collective bargaining power of individual consumers or even smaller retail partners is considerably weakened, providing Estée Lauder with a more stable customer base.

The proliferation of digital platforms and social media has dramatically amplified consumer knowledge. This accessibility, coupled with the growing trend of 'dupe culture,' where consumers actively seek out and promote less expensive alternatives to high-end products, particularly in fragrance and mass beauty, significantly shifts power towards the buyer. For instance, in 2024, the global beauty market continued to see robust growth, with online sales channels playing an increasingly dominant role, further facilitating the comparison and discovery of product alternatives.

Price Sensitivity and Economic Climate

While consumers of prestige beauty products often show less concern about price compared to those in the mass market, prevailing economic uncertainties can prompt more deliberate purchasing choices. This heightened value consciousness means customers are increasingly evaluating whether products truly deliver on their advertised claims.

This scrutiny translates into a greater demand for clearly articulated benefits and tangible incentives, which directly influences Estée Lauder's pricing strategies. For instance, in 2024, reports indicated a general trend of consumers seeking demonstrable value, even within premium segments, as economic headwinds persist.

- Consumer Value Consciousness: Economic uncertainties in 2024 led to a noticeable increase in consumers actively seeking demonstrable value, even in the prestige beauty sector.

- Product Efficacy Scrutiny: Customers are more closely examining whether high-end beauty products deliver on their promised benefits, impacting brand loyalty and purchasing decisions.

- Demand for Incentives: This trend fuels a demand for clear advantages and tangible rewards, forcing brands like Estée Lauder to adapt their pricing and promotional strategies accordingly.

Influence of Large Retailers and E-commerce Platforms

Large retail partners and dominant e-commerce platforms exert considerable influence over Estée Lauder Companies. Their extensive reach and vast customer traffic mean they can dictate terms, often demanding favorable margins and significant promotional support. For instance, Amazon, a key platform for brands like Clinique, can leverage its market position to negotiate advantageous arrangements, impacting Estée Lauder's pricing strategies and overall profitability.

These powerful distribution channels also possess the ability to demand valuable data insights, which can shape Estée Lauder's product development and marketing efforts. The bargaining power of these entities is amplified by their control over shelf space and digital visibility, forcing Estée Lauder to adapt its sales strategies to meet their requirements.

- Dominant Retailers: Major department stores and beauty retailers often represent a substantial portion of a brand's sales, giving them leverage in negotiations.

- E-commerce Giants: Platforms like Amazon and Sephora.com can command significant attention and sales volume, enabling them to influence terms.

- Margin Pressure: Retailers may push for lower wholesale prices or higher margins, directly impacting Estée Lauder's gross profit.

- Promotional Demands: Significant investment in co-op advertising, in-store displays, and online promotions is often required by these partners.

The bargaining power of customers for Estée Lauder is a mixed bag, influenced by brand loyalty in prestige segments and increased price sensitivity due to economic factors and readily available alternatives. While loyal customers of premium brands like La Mer or Clinique are less price-sensitive, the broader market, particularly influenced by digital trends, empowers consumers to seek value and compare options more easily.

In 2024, the global beauty market continued its upward trajectory, with Statista projecting it to reach approximately $716.60 billion. This growth, however, is accompanied by heightened consumer awareness. The rise of social media and online review platforms means that product efficacy and value propositions are under constant scrutiny, giving consumers more leverage to demand transparency and tangible benefits from brands like Estée Lauder.

| Factor | Impact on Estée Lauder | 2024 Context |

|---|---|---|

| Brand Loyalty (Prestige) | Weakens customer bargaining power due to strong emotional connection and perceived value. | Estée Lauder's heritage brands maintain strong appeal, mitigating price sensitivity among core clientele. |

| Price Sensitivity (Mass Market/Economic Headwinds) | Increases customer bargaining power, leading to demand for discounts and value-driven alternatives. | Persistent inflation in 2024 encouraged consumers to seek promotions and compare prices more rigorously across all segments. |

| Digital Information & Alternatives | Empowers customers with knowledge, facilitating comparisons and the discovery of "dupes" or similar products. | Online sales channels, which constituted a significant portion of the beauty market in 2024, amplified this effect, making it easier for consumers to find alternatives. |

What You See Is What You Get

Estee Lauder Companies Porter's Five Forces Analysis

This preview showcases the Estee Lauder Companies Porter's Five Forces analysis, detailing the competitive landscape and strategic positioning within the beauty industry. The document you see here is the exact, fully formatted analysis you'll receive immediately after purchase, providing comprehensive insights into industry rivalry, buyer power, supplier power, threat of new entrants, and threat of substitutes. Rest assured, there are no placeholders or mockups; what you're previewing is the complete, ready-to-use document for your strategic planning needs.

Rivalry Among Competitors

The prestige beauty market is a crowded arena, with giants like L'Oréal, Shiseido, and Coty constantly battling for dominance. This intense competition is further amplified by a surge of nimble direct-to-consumer brands and specialized niche players, all vying for consumer attention and market share. Estée Lauder must continuously innovate and invest heavily in marketing to stand out in this dynamic environment.

The beauty industry, including Estée Lauder's domain, thrives on a relentless cycle of innovation. Companies are locked in a fierce battle to capture consumer attention through a constant stream of new product introductions across skincare, makeup, and fragrance. This intense focus means Estée Lauder must continually pour resources into research and development.

To stay ahead, Estée Lauder needs to pioneer cutting-edge products and swiftly adapt to shifting consumer preferences. Trends like hyper-personalization and the growing emphasis on 'skinification' demand agile responses. Failing to innovate and adapt risks losing market relevance and competitive standing in this dynamic sector.

Estée Lauder operates in a highly competitive beauty industry where significant marketing and advertising investments are essential for brand visibility and consumer appeal. In 2024, the company continued to allocate substantial resources to campaigns across various channels, including digital, social media, and traditional advertising, to maintain its market presence.

Competitors are also heavily invested in aggressive marketing strategies, utilizing platforms like TikTok and influencer collaborations to reach younger demographics. This creates a high-spending environment, intensifying the rivalry and requiring continuous innovation in promotional activities to capture consumer attention.

Global Market Saturation and Regional Challenges

The global beauty market, while generally expanding, faces significant competitive pressure in specific, previously high-growth regions. Mainland China and Asia travel retail, for instance, have seen a noticeable slowdown, indicating a degree of market saturation. This has intensified the battle for consumer attention and spending among established players and emerging brands alike.

Estée Lauder Companies has directly felt this increased rivalry, reporting sales declines in these key markets during fiscal year 2024. This performance underscores the challenges of navigating a more crowded and discerning consumer landscape, necessitating agile strategies to differentiate and recapture market share.

- Regional Softness: Mainland China and Asia travel retail experienced market saturation in 2024, intensifying competition.

- Estée Lauder's Performance: The company reported sales declines in these crucial markets, reflecting the competitive pressures.

- Strategic Imperative: Adaptive regional strategies are essential for Estée Lauder to address market saturation and reignite growth.

High Exit Barriers Due to Brand Value and Assets

The prestige beauty industry, where Estée Lauder operates, presents substantial exit barriers. These are largely driven by the immense capital invested in building strong brand equity, which takes years and significant marketing spend to cultivate. For instance, Estée Lauder's brands like Estée Lauder, Clinique, and MAC Cosmetics have global recognition, representing billions in intangible assets.

Furthermore, companies in this sector often possess specialized manufacturing facilities and extensive, deeply entrenched distribution networks, including partnerships with high-end department stores and specialty beauty retailers. Divesting these assets or unwinding these relationships can be incredibly costly and complex, making a complete market exit a challenging proposition. This situation means that even during periods of economic downturn or intense competitive pressure, companies are more likely to remain in the market rather than exit, thereby perpetuating a high level of rivalry.

- Brand Equity: Estée Lauder's portfolio includes brands with decades of heritage and significant consumer loyalty, representing a substantial barrier to exit.

- Physical Assets: Investments in specialized manufacturing plants and global supply chains are considerable, making them difficult to liquidate without significant loss.

- Distribution Networks: Established relationships with premium retailers worldwide are crucial and hard to replicate or abandon, locking companies into the market.

- Sustained Competition: High exit barriers encourage companies to weather difficult market conditions, leading to continuous and often intense competition for Estée Lauder.

The competitive rivalry within the prestige beauty sector is exceptionally fierce, characterized by a constant influx of new products and aggressive marketing campaigns. Estée Lauder Companies faces direct competition from major global players such as L'Oréal and Shiseido, alongside a growing number of agile direct-to-consumer (DTC) brands. In 2024, this rivalry intensified, particularly in key markets like Mainland China and Asia travel retail, which experienced a slowdown and increased saturation, leading to noticeable sales declines for Estée Lauder in these regions.

| Key Competitor | Market Position | 2024 Focus Areas |

|---|---|---|

| L'Oréal | Global Leader in Beauty | Innovation in skincare, digital marketing expansion |

| Shiseido | Strong presence in Asia | Rebranding efforts, focus on premium skincare |

| Coty | Diversified portfolio (fragrance, cosmetics) | Revitalizing luxury fragrance brands, influencer marketing |

| DTC Brands (e.g., Glossier, Drunk Elephant) | Niche market focus, direct consumer engagement | Community building, sustainable ingredient focus |

SSubstitutes Threaten

The growing availability of high-quality, yet more affordable mass-market and 'masstige' beauty products presents a considerable threat to Estée Lauder. These alternatives frequently deliver comparable benefits at a fraction of the cost, directly impacting consumer purchasing decisions and potentially eroding market share for Estée Lauder's premium offerings.

The burgeoning 'dupe culture,' especially prevalent in fragrances and makeup, further amplifies this threat. Consumers are increasingly adept at identifying and purchasing perceived equivalents to Estée Lauder's prestige products, leading to a diversion of sales and a challenge to brand loyalty. For instance, in 2024, the global beauty market saw continued growth in the accessible luxury segment, with brands like e.l.f. Beauty reporting strong sales increases, indicating consumer willingness to opt for value-driven alternatives.

The rise of clean beauty presents a significant threat of substitutes for Estée Lauder. Consumers are increasingly seeking products with natural, organic, and ethically sourced ingredients, driving demand for brands that specialize in these areas. This shift means that traditional prestige formulations, which may contain synthetic ingredients, face competition from these emerging alternatives.

For instance, the global natural and organic personal care market was valued at over $40 billion in 2023 and is projected to grow substantially. Brands like Ilia Beauty, Kosas, and Tower 28 have gained considerable traction by focusing on clean formulations, directly challenging established players like Estée Lauder. Estée Lauder's response to this trend, including its acquisition of brands like Dr. Jart+ which has strong dermocosmetic and ingredient-focused appeal, indicates an awareness of this competitive pressure.

For some consumers, particularly those favoring simpler routines or looking for budget-friendly alternatives, do-it-yourself (DIY) beauty solutions and home remedies present a viable substitute. This trend, gaining traction as consumers explore natural ingredients and cost savings, can chip away at demand for Estee Lauder's more elaborate prestige products.

While not directly replacing the efficacy of scientifically formulated skincare and makeup, the appeal of accessible, natural ingredients found in home remedies can influence purchasing decisions. For instance, a 2023 survey indicated that over 30% of consumers aged 18-34 reported trying at least one DIY beauty treatment in the past year, driven by cost and ingredient transparency concerns.

Aesthetic Treatments and Procedures

The increasing accessibility and popularity of aesthetic treatments, such as injectables and laser therapies, pose a significant threat of substitution for Estée Lauder's skincare portfolio. Consumers increasingly seek quicker, more dramatic results than topical treatments can provide, leading them to professional procedures. For instance, the global medical aesthetics market, which includes these treatments, was valued at approximately $15.5 billion in 2023 and is projected to grow substantially, indicating a strong shift in consumer preference.

This trend directly impacts Estée Lauder as consumers may bypass their skincare products in favor of these more invasive or semi-invasive options. The perceived efficacy and speed of results from treatments like Botox or dermal fillers can make them a more attractive alternative for addressing aging concerns or skin imperfections. This diversion of consumer spending away from skincare products and towards aesthetic procedures represents a considerable challenge for the company's revenue streams within this segment.

Key considerations regarding this threat include:

- Growing Market for Aesthetic Procedures: The medical aesthetics market continues its upward trajectory, with significant growth anticipated in the coming years, drawing consumer interest and investment.

- Consumer Demand for Immediate Results: A segment of consumers prioritizes rapid and visible improvements, which aesthetic treatments often deliver more effectively than daily skincare routines.

- Technological Advancements: Ongoing innovation in aesthetic technology makes procedures safer, more accessible, and potentially more appealing to a broader consumer base.

Wellness and Holistic Approaches to Beauty

The growing emphasis on holistic wellness presents a significant threat of substitutes for Estee Lauder. Consumers are increasingly viewing beauty not just through topical products but as a result of overall health and lifestyle choices. This means that investments in supplements, healthy eating, and fitness can be seen as direct alternatives to purchasing traditional beauty items, diverting consumer spending away from Estee Lauder’s core offerings.

This shift means that categories like nutritional supplements and wellness services are becoming indirect competitors for a portion of the consumer's discretionary spending allocated to personal care and enhancement. For instance, the global dietary supplements market was valued at approximately $177.7 billion in 2023 and is projected to grow, indicating a substantial and expanding market that directly competes for consumer dollars that might otherwise be spent on cosmetics or skincare.

- Holistic Wellness Trend: Consumers are prioritizing overall health, seeing beauty as an outcome of lifestyle rather than solely product application.

- Budget Allocation: This trend allows wellness products and services to compete directly for the same discretionary spending that previously went to beauty products.

- Market Data: The global dietary supplements market, a key substitute category, reached an estimated $177.7 billion in 2023, highlighting the scale of this competitive pressure.

The threat of substitutes for Estée Lauder is substantial, driven by accessible luxury brands, clean beauty alternatives, DIY solutions, aesthetic procedures, and a growing focus on holistic wellness. These substitutes directly challenge Estée Lauder's premium positioning by offering comparable benefits at lower price points, catering to evolving consumer preferences for natural ingredients, or providing more immediate results through professional treatments. The increasing consumer interest in overall well-being also diverts spending towards supplements and fitness, competing for discretionary income previously allocated to beauty products.

| Substitute Category | Example Brands/Treatments | Market Data (2023/2024 Estimates) | Impact on Estée Lauder |

|---|---|---|---|

| Mass-Market/Masstige Beauty | e.l.f. Beauty, Revolution Beauty | Global beauty market growth continues, with accessible luxury segments showing strong performance. | Erodes market share for premium products due to price-value perception. |

| Clean Beauty | Ilia Beauty, Kosas, Tower 28 | Global natural and organic personal care market valued over $40 billion in 2023. | Challenges traditional formulations, appealing to ingredient-conscious consumers. |

| DIY Beauty | Home remedies using natural ingredients | Over 30% of 18-34 year olds tried DIY beauty treatments in 2023. | Reduces demand for elaborate prestige products among budget-conscious consumers. |

| Aesthetic Procedures | Botox, dermal fillers, laser treatments | Global medical aesthetics market valued around $15.5 billion in 2023. | Bypasses skincare products, diverting spending towards more invasive treatments for perceived faster results. |

| Holistic Wellness | Dietary supplements, fitness programs | Global dietary supplements market valued at $177.7 billion in 2023. | Competes for discretionary spending, positioning health and lifestyle as alternatives to beauty products. |

Entrants Threaten

The prestige beauty sector demands significant upfront investment. Newcomers must allocate substantial funds towards research and development to create innovative products, alongside considerable marketing budgets to build brand awareness and secure shelf space in high-end retail environments.

For instance, Estée Lauder reported research and development expenses of $1.3 billion in fiscal year 2023, underscoring the continuous investment needed to maintain a competitive edge.

This high barrier to entry, particularly in building brand equity and achieving economies of scale in R&D and manufacturing, deters many potential new players from seriously challenging established giants like Estée Lauder.

Estée Lauder's formidable collection of globally recognized and trusted brands, such as Estée Lauder, MAC, and Clinique, acts as a substantial barrier for any new players entering the prestige beauty market. This brand equity, built over decades, fosters deep customer loyalty, particularly among discerning consumers who associate these names with quality and efficacy.

New entrants face an uphill battle in replicating this level of brand recognition and cultivating the same ingrained customer loyalty. Without significant, sustained investment in marketing and product development, it is exceedingly difficult for newcomers to carve out a meaningful market share against Estée Lauder's established presence and consumer trust.

Newcomers face significant challenges in securing shelf space within Estée Lauder's established and often exclusive distribution networks. These include prime locations in high-end department stores, curated specialty multi-brand retailers, and the lucrative travel retail sector.

Existing strong relationships and long-term contracts with these premium retailers act as a formidable barrier. For instance, in 2023, Estée Lauder reported that its net sales were significantly driven by its presence in prestige retail channels, highlighting the importance of these partnerships.

This makes it difficult for new beauty brands to gain visibility and reach the discerning prestige consumer, who often associates these channels with quality and luxury.

Economies of Scale in Manufacturing and Procurement

Estée Lauder Companies benefits immensely from substantial economies of scale in its manufacturing, procurement, and overall supply chain operations. This scale translates directly into lower per-unit production costs and enhanced negotiating power with suppliers, particularly for specialized ingredients and packaging.

These cost advantages create a significant barrier for new entrants. A smaller competitor would struggle to match Estée Lauder's purchasing volume, making it challenging to secure favorable pricing for raw materials or achieve the same production efficiencies. For instance, in fiscal year 2023, Estée Lauder reported net sales of $15.61 billion, underscoring the sheer volume of its operations.

- Economies of Scale: Estée Lauder leverages its size for cost savings in production and sourcing.

- Procurement Power: Large-scale purchasing allows for better negotiation with suppliers, securing lower prices for ingredients and materials.

- Manufacturing Efficiency: High production volumes lead to optimized manufacturing processes and reduced overhead per unit.

- Barrier to Entry: New companies face significant challenges in replicating Estée Lauder's cost structure and supply chain advantages.

Regulatory Hurdles and Intellectual Property Protection

The beauty industry, especially for skincare and fragrances, faces significant regulatory complexities. Products must meet stringent safety standards, advertising claims must be substantiated, and ingredient sourcing needs to comply with various international regulations. This creates a substantial barrier for new companies looking to enter the market.

Established companies like Estée Lauder Companies have built extensive intellectual property portfolios, including patents for unique formulations and proprietary technologies. Navigating and challenging these existing patents requires considerable legal expertise and financial resources, further deterring potential new entrants.

- Regulatory Compliance Costs: New entrants must invest heavily in testing, documentation, and legal counsel to meet global regulatory standards for product safety and marketing claims, a significant hurdle in markets like the EU and the US.

- Intellectual Property Landscape: Estée Lauder's vast patent library, covering innovative ingredients and application methods, presents a formidable challenge, requiring substantial R&D investment and potential licensing fees for competitors.

- Brand Reputation and Trust: Building consumer trust and a strong brand reputation, which Estée Lauder has cultivated over decades, is a non-quantifiable but critical barrier that new entrants must overcome through sustained quality and marketing efforts.

The threat of new entrants for Estée Lauder Companies is moderate due to high capital requirements and established brand loyalty. Significant investments are needed for R&D, marketing, and securing premium distribution channels, making it challenging for newcomers to compete effectively against Estée Lauder's established market presence and trusted brands.

The company's substantial economies of scale in manufacturing and procurement, coupled with a vast intellectual property portfolio and stringent regulatory compliance, further solidify its competitive position. While the prestige beauty market offers high margins, the barriers to entry remain considerable, requiring new players to possess substantial resources and innovative strategies to gain traction.

| Factor | Impact on New Entrants | Estée Lauder's Advantage |

|---|---|---|

| Capital Requirements | High (R&D, Marketing, Distribution) | Established infrastructure and brand investment |

| Brand Loyalty & Equity | Difficult to replicate | Decades of building trusted brands (e.g., MAC, Clinique) |

| Economies of Scale | Challenging to achieve | Lower per-unit costs from high volume ($15.61B net sales FY23) |

| Distribution Channels | Limited access to premium retailers | Strong existing relationships and shelf space |

| Intellectual Property & Regulation | Costly to navigate and innovate | Extensive patent portfolio and compliance expertise |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Estee Lauder Companies is built upon a foundation of reliable data, including their annual reports, SEC filings, and industry-specific market research from firms like Statista and IBISWorld. This comprehensive approach ensures a deep understanding of competitive dynamics.