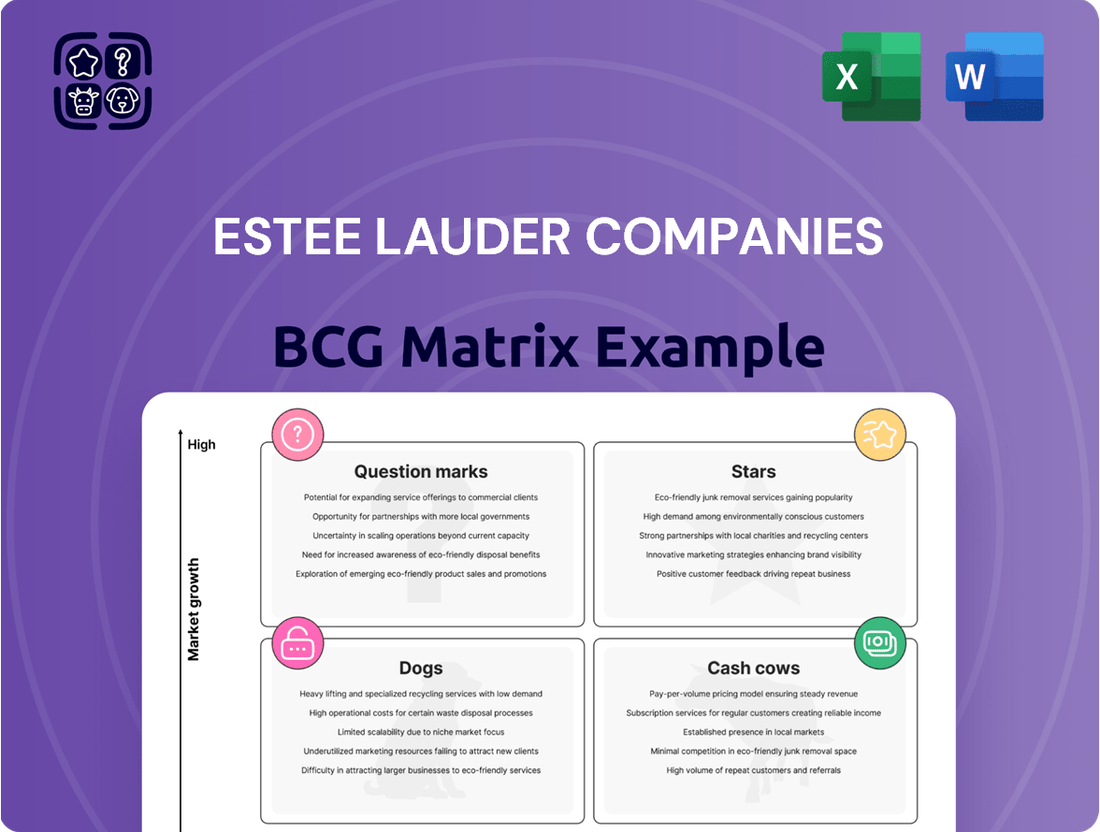

Estee Lauder Companies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Estee Lauder Companies Bundle

Curious about Estee Lauder's product portfolio performance? Our BCG Matrix analysis reveals which brands are soaring (Stars), consistently generating revenue (Cash Cows), lagging behind (Dogs), or hold untapped potential (Question Marks).

Don't miss out on crucial insights that can shape your investment and product development strategies. Purchase the full BCG Matrix report to unlock a comprehensive breakdown, actionable recommendations, and a clear roadmap for Estee Lauder's future success.

Stars

Le Labo, a premium fragrance house, is a strong performer within Estee Lauder Companies' portfolio. Its impressive double-digit growth, fueled by robust demand in Asia/Pacific and the Americas, positions it as a star. The brand's success is largely attributed to its popular Classic Collection and exclusive City Exclusive events, alongside a growing direct-to-consumer presence.

Jo Malone London is a standout performer within Estee Lauder Companies, exhibiting robust growth, particularly in Asia. The brand achieved double-digit growth in China and significant market share increases in Japan, highlighting its strong international appeal.

The brand's strategic expansion into the men's fragrance category, exemplified by products like Cypress & Grapevine, has been a key driver of its success. This focus taps into a burgeoning market, further solidifying Jo Malone London's position as a star performer.

Clinique's lip subcategory is a standout performer within Estee Lauder Companies, defying broader brand challenges. This segment achieved double-digit growth globally in Q1 fiscal 2025, underscoring its robust market position and consumer appeal.

The Ordinary and Dr. Jart+ (in specific regions/products)

The Ordinary and Dr. Jart+ are positioned as potential Stars within Estee Lauder Companies' portfolio. In the latter half of fiscal year 2024, both brands experienced robust double-digit growth. This surge is especially notable for Dr. Jart+, which saw significant traction in the EMEA and Americas regions, fueled by its popular Cicapair line and successful new product introductions.

- The Ordinary: Strong growth indicators suggest potential Star status, though specific regional performance is key.

- Dr. Jart+: Demonstrated double-digit growth in EMEA and Americas in H2 FY24, driven by Cicapair and innovation.

- Market Position: These brands are showing characteristics of Stars due to high growth in key markets.

- Future Outlook: Continued investment in innovation and marketing could solidify their Star positions.

Advanced Night Repair and Revitalizing Supreme+ (Estée Lauder brand)

Estée Lauder's Advanced Night Repair and Revitalizing Supreme+ product lines are key performers within the company's portfolio, demonstrating resilience and innovation in a competitive skincare landscape. These hero products have been instrumental in driving sales growth, particularly in the EMEA and Americas regions, despite broader challenges faced by the Estée Lauder brand in certain markets.

The continued strength of these franchises is a testament to their established brand equity and the company's focus on product development. For instance, Estée Lauder Companies reported net sales of $16.1 billion for fiscal year 2023, with skincare remaining a significant category, underscoring the importance of these flagship products.

- Advanced Night Repair and Revitalizing Supreme+ are considered Stars due to their strong market share and growth potential within the premium skincare segment.

- These products contribute significantly to Estée Lauder's overall revenue, particularly in key growth regions like EMEA and the Americas.

- Despite a highly competitive market, ongoing innovation in these franchises helps maintain their leading positions and customer loyalty.

- The performance of these hero products supports Estée Lauder's strategy to leverage its most successful brands for continued expansion.

Le Labo, Jo Malone London, Clinique's lip subcategory, Estee Lauder's Advanced Night Repair and Revitalizing Supreme+ lines are all identified as Stars in Estee Lauder Companies' BCG Matrix. These brands and product lines exhibit high growth and strong market share, indicating they are leaders in their respective categories and warrant continued investment.

| Brand/Product Line | Category | Growth Trajectory | Market Position |

|---|---|---|---|

| Le Labo | Fragrance | Double-digit growth (Asia/Pacific, Americas) | Strong performer, leader |

| Jo Malone London | Fragrance | Double-digit growth (China, Japan) | Standout performer, strong international appeal |

| Clinique (Lip Subcategory) | Skincare/Makeup | Double-digit growth (Global Q1 FY25) | Defying brand challenges, robust market position |

| Estee Lauder (ANR & Revitalizing Supreme+) | Skincare | Strong growth, resilience (EMEA, Americas) | Key performers, established brand equity |

What is included in the product

The Estee Lauder Companies BCG Matrix provides strategic insights into its diverse portfolio, highlighting which brands to invest in, hold, or divest based on market share and growth.

The Estee Lauder Companies BCG Matrix provides a clear, one-page overview, simplifying complex brand performance for strategic decision-making.

This export-ready design allows for quick drag-and-drop into presentations, streamlining C-level communication.

Cash Cows

Estée Lauder's overall skincare and makeup segments have long been the bedrock of the company's financial performance, consistently contributing a substantial portion to both revenue and market share within the prestige beauty sector. This enduring strength is a testament to the brand's deep-rooted consumer trust and its ability to maintain relevance across diverse beauty categories.

Despite encountering some recent market challenges, the Estée Lauder brand's established market position ensures it remains a reliable cash generator for the company. For instance, in fiscal year 2023, Estée Lauder Companies reported net sales of $15.91 billion, with its skincare category being a significant contributor, demonstrating its continued importance even amidst evolving consumer preferences and competitive landscapes.

La Mer, a cornerstone of Estee Lauder Companies' (ELC) prestige skincare, has long been recognized as a significant contributor. Its high market share within the established luxury skincare sector solidifies its position as a cash cow for the company.

Despite facing challenges, such as notable double-digit declines in the crucial Chinese market during certain periods, La Mer's overall strength in mature luxury segments allows it to generate substantial and consistent profits, funding other ventures within ELC's diverse brand portfolio.

M·A·C Cosmetics, a key brand within Estee Lauder Companies (ELC), functions as a Cash Cow in the BCG Matrix. It commands a substantial market share within the makeup industry, widely recognized for its comprehensive product offerings and strong appeal to makeup professionals.

While ELC's overall net sales saw a slight increase to $16.00 billion for the fiscal year ending June 30, 2023, M·A·C's contribution, though facing some regional sales dips, continues to be a stable revenue generator. This consistent cash flow is particularly notable in the mature makeup market where M·A·C has established a dominant presence.

Clinique (Overall Brand)

Clinique, a cornerstone of Estee Lauder Companies (ELC), demonstrates characteristics of a Cash Cow within the BCG matrix. Its widespread recognition in skincare and makeup, coupled with a substantial and loyal customer base, ensures consistent revenue generation. While certain innovative products might qualify as Stars, the overall Clinique brand benefits from a mature market position, providing a reliable income stream for ELC.

The brand's enduring appeal, often rooted in its dermatologist-developed, allergy-tested formulations, contributes to its stable market share. This stability translates into predictable cash flows. For instance, ELC's fiscal year 2023 saw strong performance in its skincare category, where Clinique plays a significant role, contributing to the company's overall robust financial health.

- Brand Recognition: Clinique enjoys high brand awareness globally.

- Market Maturity: The skincare and makeup markets are mature, with established players like Clinique.

- Revenue Stability: The brand consistently generates substantial revenue for Estee Lauder Companies.

- Profitability: Mature brands with efficient operations typically offer strong profit margins.

Origins

Origins, a brand within The Estée Lauder Companies (ELC) portfolio, established itself by focusing on natural ingredient-driven skincare. This approach resonated with consumers seeking gentler, more holistic beauty solutions, carving out a significant niche in the market.

The brand cultivated a dedicated following, a testament to its consistent product quality and its appeal to a demographic increasingly conscious of ingredient sourcing and efficacy. This loyalty translates into predictable sales, a key characteristic of a cash cow.

Origins operates within the mature skincare market, a segment known for its stability rather than rapid growth. Its established presence and consistent performance are crucial contributors to ELC's overall cash flow, providing a reliable financial base.

In fiscal year 2023, The Estée Lauder Companies reported net sales of $15.91 billion. While specific brand-level sales are not always disclosed, the consistent performance of established brands like Origins is vital for maintaining the company's financial health and funding investments in other areas.

- Brand Focus: Natural ingredient-focused skincare.

- Market Position: Strong presence in the mature skincare market.

- Financial Contribution: Consistent performance and reliable cash flow generator for ELC.

- Customer Base: Cultivated a loyal and engaged following.

The Estée Lauder brand itself, encompassing a broad range of skincare, makeup, and fragrance, functions as a significant Cash Cow for the company. Its extensive product portfolio and widespread distribution contribute to consistent, high-volume sales in the mature prestige beauty market.

Despite the dynamic nature of the beauty industry, the core Estée Lauder brand maintains a strong market presence, benefiting from decades of brand building and consumer trust. This stability allows it to reliably generate substantial profits, even as newer brands emerge.

In fiscal year 2023, Estée Lauder Companies reported net sales of $15.91 billion. The flagship Estée Lauder brand, as a primary revenue driver, plays a crucial role in this overall performance, underscoring its Cash Cow status by providing consistent financial resources.

The brand's ability to adapt and maintain relevance across various product categories, from anti-aging skincare to iconic fragrances, ensures its continued contribution to the company's financial health, funding innovation and expansion in other areas.

What You See Is What You Get

Estee Lauder Companies BCG Matrix

The Estee Lauder Companies BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This comprehensive analysis is designed for strategic clarity and professional application, offering no watermarks or demo content, ensuring you get exactly what you need for your business planning.

Dogs

Aveda, a brand within Estee Lauder Companies, is currently positioned as a Dog in the BCG Matrix. This classification stems from its declining hair care net sales, a trend largely attributed to a slowdown in both the salon channel and its direct-to-consumer distribution networks, particularly within North America.

The brand's performance reflects a low market share within a segment that is experiencing minimal growth. For instance, Estee Lauder's fiscal year 2023 results showed a net sales decline for the company overall, with specific brand performance often impacted by broader market dynamics and channel-specific challenges, which Aveda has evidently faced.

Too Faced, a brand within The Estée Lauder Companies, is categorized as a Dog in the BCG Matrix. This classification stems from its recent performance, where net sales saw a decline, particularly within the North American market.

The decrease in sales for Too Faced indicates a weakening market position, suggesting the brand is struggling to keep pace with competitors in the dynamic and highly saturated makeup industry. This underperformance is a key driver for its placement as a Dog.

Smashbox, a makeup brand within Estee Lauder Companies (ELC), is currently positioned as a potential 'Dog' in the BCG matrix. This classification suggests that Smashbox is operating in a low-growth market and holds a relatively low market share.

Recent performance indicators and strategic reviews by ELC have highlighted Smashbox's challenges. The brand's value might be less than its acquisition cost, prompting consideration for divestiture as part of ELC's ongoing portfolio optimization efforts. This move is driven by its limited growth prospects and a need to reallocate resources to more promising brands.

Certain underperforming makeup franchises

Within Estee Lauder Companies' (ELC) vast portfolio, certain makeup franchises have shown signs of underperformance. These aren't necessarily entire brands, but rather specific product lines or smaller, niche makeup brands that are struggling to gain traction. They typically exhibit low market share and minimal growth, placing them in the Dogs quadrant of the BCG Matrix.

For instance, a hypothetical underperforming makeup franchise might have seen its sales decline by 5% year-over-year in 2024, while the overall makeup market grew by 3%. This divergence indicates a loss of competitiveness. Such franchises often suffer from outdated product formulations, insufficient marketing investment, or a failure to adapt to evolving consumer trends in the beauty industry.

- Low Market Share: These franchises often hold less than 1% of the overall makeup market, struggling to compete with established leaders.

- Stagnant or Declining Growth: In 2024, these segments likely experienced flat or negative sales growth, contrasting with the industry's positive trajectory.

- Limited Innovation Pipeline: A lack of new product development or a failure to innovate in areas like clean beauty or sustainable packaging can lead to obsolescence.

- High Marketing Costs, Low ROI: Efforts to revitalize these franchises may be met with diminishing returns due to a lack of consumer interest or brand relevance.

Specific legacy brands with declining relevance

Estee Lauder Companies (ELC) faces the challenge of managing a diverse brand portfolio. Within this, specific legacy brands are showing declining relevance, potentially fitting the profile of Dogs in a BCG Matrix analysis. These brands often operate in mature or shrinking market segments, making growth difficult.

For example, brands that were once powerhouses but have seen market share erode due to changing consumer preferences or increased competition might be candidates. These brands typically require substantial investment for a turnaround, with no guarantee of success. In 2023, ELC reported a net sales decline, highlighting the need for strategic portfolio management.

The company's approach involves continuous evaluation of its brand performance and market dynamics. Identifying these "Dog" brands allows for more focused resource allocation, either towards revitalization or divestment, to support growth in other areas of the portfolio.

- Declining Market Share: Brands that have consistently lost market share in their respective categories.

- Stagnant or Shrinking Markets: Operating in segments that are not growing or are actively contracting.

- High Turnaround Costs: Requiring significant investment for revitalization efforts with uncertain outcomes.

- Low Growth Potential: Limited prospects for future revenue and profit growth.

Estee Lauder Companies (ELC) has several brands that fit the 'Dog' category in the BCG Matrix, characterized by low market share in low-growth markets. These brands struggle to gain traction and often require significant investment with uncertain returns. For instance, in fiscal year 2023, ELC's overall net sales saw a decline, underscoring the challenges faced by underperforming assets within its portfolio.

Brands like Aveda and Too Faced have experienced declining net sales, particularly in North America, reflecting a loss of market competitiveness. Smashbox is also considered a potential 'Dog' due to limited growth prospects and a need for resource reallocation. These situations highlight ELC's ongoing efforts to optimize its brand portfolio by identifying and addressing underperforming franchises.

These 'Dog' brands often exhibit declining market share and operate in stagnant or shrinking market segments. ELC's strategy involves evaluating these brands for potential revitalization or divestment to focus resources on more promising growth areas.

| Brand/Franchise | BCG Category | Key Performance Indicators (FY23/Early 2024 Trends) | Strategic Consideration |

| Aveda | Dog | Declining hair care net sales, slowdown in salon and DTC channels. | Potential revitalization or divestment. |

| Too Faced | Dog | Declining net sales, particularly in North America; struggles in a saturated makeup market. | Portfolio review for optimization. |

| Smashbox | Potential Dog | Low market share in a low-growth segment; limited growth prospects. | Resource reallocation, potential divestiture. |

| Underperforming Makeup Franchises | Dog | Negative sales growth (e.g., -5% in 2024) vs. market growth (e.g., +3% in 2024); outdated products. | Divestment or significant strategic overhaul. |

Question Marks

BALMAIN Beauty, launched by Estée Lauder Companies (ELC) in fiscal 2025, enters the luxury fragrance market as a Question Mark. This segment is experiencing robust growth, with the global luxury fragrance market projected to reach approximately $30 billion by 2027, growing at a CAGR of around 5.5%.

As a new entrant, BALMAIN Beauty possesses a low current market share. However, its strategic positioning within a high-growth category, coupled with ELC's established expertise in luxury brand management, presents a significant opportunity.

With substantial investment and effective market penetration strategies, BALMAIN Beauty has the potential to transition from a Question Mark to a Star, capturing a larger share of this expanding market and contributing significantly to ELC's portfolio.

Estée Lauder's Skin Longevity platform represents a strategic move into the burgeoning longevity market, a segment experiencing significant growth. This initiative involves new product innovations designed to tap into consumer interest in extending skin health and vitality.

These new product launches, while targeting a high-growth area, likely possess a low initial market share. Consequently, they require substantial investment to build brand awareness and capture a meaningful position within the competitive beauty landscape, fitting the profile of a .

Estée Lauder Companies (ELC) strategically launched established brands like Estée Lauder and Lab Series onto Amazon's U.S. Premium Beauty store in 2024, with a notable expansion in October 2024. This move positions them within a rapidly expanding e-commerce segment, aiming to capture a new customer base.

While the exact initial market share for these brands on Amazon's premium platform remains to be seen, their presence signifies a deliberate investment in a potentially high-growth area. This strategic placement aligns with the BCG matrix's Question Mark category, where significant investment is needed to determine future market leadership and potential for Stars.

Undisclosed brands from New Incubation Ventures (NIV)

Estée Lauder Companies' (ELC) New Incubation Ventures (NIV) program, which notably partnered with TikTok, is designed to foster and elevate emerging brands and storytellers within the beauty sector. Any new brands or concepts emerging from this initiative would likely be classified as Question Marks in a BCG matrix. These ventures operate in rapidly expanding markets, but their market share and long-term viability remain uncertain, requiring significant investment to determine their potential.

These nascent brands, by their very nature, represent potential future stars for ELC but also carry substantial risk. For instance, ELC invested in DECIEM, a brand that was initially a question mark, and it has since become a star performer. The NIV program, by focusing on digital-first engagement and emerging talent, aims to identify and nurture such potential successes early on. In 2023, ELC continued to explore strategic investments and partnerships, signaling a commitment to innovation and growth in the dynamic beauty landscape.

- High Growth Potential: Brands from NIV are positioned in fast-growing beauty segments.

- Uncertain Market Share: Their position in the market is not yet established.

- Significant Investment Required: Capital is needed to build brand awareness and market penetration.

- Strategic Importance: These ventures are crucial for ELC's future portfolio diversification and innovation pipeline.

Targeted expansion into new geographic emerging markets

Estee Lauder Companies (ELC) is strategically targeting expansion into new geographic emerging markets, aiming to accelerate net sales growth. These regions, while offering substantial growth potential, typically see ELC's brands and products starting with a low market share. This positions them as question marks within the BCG matrix, requiring significant investment and carefully crafted strategies to capture market share and achieve success.

For instance, ELC's focus on markets like Southeast Asia and parts of Africa exemplifies this strategy. In 2024, e-commerce penetration in many of these emerging markets continued to rise, presenting a key channel for ELC's expansion. The company is investing in localized marketing campaigns and adapting product assortments to resonate with local consumer preferences, a crucial step for question mark products.

- Targeted Investment: ELC is directing capital towards building brand awareness and distribution networks in these nascent markets.

- Market Share Development: Initial market share in these emerging economies is low, necessitating a long-term perspective for growth.

- Strategic Adaptation: Product offerings and marketing approaches are being tailored to meet the specific demands and cultural nuances of each new region.

- Growth Potential: The high growth trajectory of these emerging markets makes them critical for ELC's future revenue diversification and overall expansion.

Question Marks in Estée Lauder Companies' (ELC) BCG Matrix represent new ventures or brands in high-growth markets with low current market share. These require significant investment to determine their future success. BALMAIN Beauty and new product lines from the Skin Longevity platform are prime examples, needing strategic focus to evolve into Stars.

ELC's expansion into emerging markets and the incubation of new brands through programs like NIV also fall into this category. These initiatives, while carrying inherent risk, are crucial for ELC's innovation pipeline and future portfolio diversification, aiming to capture future market leadership.

The strategic placement of established brands like Estée Lauder and Lab Series on Amazon's U.S. Premium Beauty store in 2024 also positions them as potential Question Marks, leveraging a growing e-commerce channel.

These ventures are characterized by high growth potential but uncertain market share, necessitating targeted investment and strategic adaptation to achieve long-term viability.

BCG Matrix Data Sources

Our Estee Lauder BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.