EL AL Isreal Airline PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EL AL Isreal Airline Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping EL AL Israel Airline's strategic landscape. From geopolitical shifts impacting travel demand to evolving environmental regulations, understanding these external forces is paramount for success. Gain a competitive advantage by leveraging these insights for your own market strategy.

Download the full PESTLE Analysis now and equip yourself with actionable intelligence to navigate the complexities of the aviation industry and strengthen your position in the market.

Political factors

The ongoing geopolitical instability in the Middle East, especially the Israel-Hamas war, profoundly affects El Al. This conflict has caused numerous foreign airlines to suspend flights, elevating El Al’s role as a vital air link for Israel. This situation has effectively granted El Al a monopoly on specific routes, consequently enhancing its financial results.

For instance, during the initial phase of the conflict in late 2023, El Al reported a significant surge in passenger numbers and revenue compared to the previous year, benefiting from the absence of competitors. However, these circumstances also bring about increased operational challenges and heightened safety considerations for the airline.

As Israel's national carrier, El Al benefits from substantial government backing, particularly in covering its considerable security expenses. This support is crucial for maintaining operations and competitive pricing in the global aviation market.

While the government's contribution to security costs is slated for a gradual reduction, El Al's capacity to absorb these increasing expenses is directly linked to state approval for dividend payouts. This dynamic underscores the intertwined financial and strategic relationship between the airline and the Israeli government, especially as El Al navigates its post-privatization era.

Israel's involvement in international aviation agreements, like the EU-Israel and US-Israel Open Skies Agreements, cultivates a competitive landscape built on mutual benefits. These agreements reduce barriers, potentially leading to increased route options and more competitive pricing for consumers, which directly impacts El Al's market positioning.

The European Aviation Safety Agency's (EASA) decision to lift flight warnings for Israel in July 2025 is a significant development. This move is anticipated to prompt a resurgence of services from various European carriers, intensifying the competitive pressure on El Al by offering travelers more choices and potentially lower fares.

Security Regulations and Measures

EL AL Israel Airlines operates under rigorous security regulations mandated by the Israeli government, significantly impacting its operational framework and financial outlays. These stringent measures, enforced across all Israeli international airports, are crucial for passenger safety but translate into substantial operational expenses. For instance, the ongoing security enhancements and personnel required at Ben Gurion Airport contribute directly to EL AL's cost structure.

Further elaborating on these security demands, recent developments in May 2024 introduced updated protocols for general aviation flights originating from the United States destined for Israel. These new rules necessitate specific, often costly, security procedures, adding another layer of compliance for airlines like EL AL. Such evolving security landscapes require continuous investment in training, technology, and personnel to maintain adherence and operational efficiency.

- Mandatory Security Compliance: EL AL must adhere to Israeli government-mandated security protocols at all its domestic operations.

- Increased Operational Costs: The implementation and maintenance of these advanced security measures directly inflate EL AL's operating expenses.

- Evolving Regulations: Recent updates in May 2024 introduced new security requirements for US-to-Israel general aviation flights, impacting broader aviation security frameworks.

Governmental Crisis Management

The Israeli government's approach to crisis management significantly impacts El Al. During heightened security situations, decisions like temporary airspace closures directly affect El Al's flight schedules and operational flexibility. For instance, the conflict in late 2023 and early 2024 led to significant disruptions, with El Al needing to reroute flights, impacting passenger capacity and increasing operational costs.

El Al maintains close coordination with governmental security authorities to navigate these challenges. This collaboration is crucial for adjusting its network and managing disruptions effectively.

- Security-driven airspace closures: Such events can ground flights for extended periods, as seen during periods of increased regional tension.

- Governmental directives on safety protocols: El Al must adhere to evolving security regulations mandated by the Israeli government, influencing operational procedures and potentially passenger experience.

- Coordination for rerouting: In response to airspace restrictions, El Al works with authorities to find alternative flight paths, a process that can add significant flight time and fuel costs. For example, during certain security alerts, flights to Europe might be rerouted to avoid sensitive areas, adding hours to travel time and increasing fuel consumption by up to 15%.

The Israeli government's direct involvement in El Al's operations, particularly its substantial contribution to the airline's significant security costs, remains a critical political factor. While these costs are expected to decrease, El Al's ability to manage them is tied to government approvals for dividends, highlighting a strong state-airline financial nexus.

International aviation agreements, such as the EU-Israel and US-Israel Open Skies Agreements, foster a competitive environment that can influence El Al's market position and pricing strategies. The anticipated lifting of flight warnings for Israel by EASA in July 2025 is poised to reintroduce competition from European carriers, potentially impacting El Al's market share.

El Al operates under strict, government-mandated security regulations, which significantly increase operational expenses. For example, in May 2024, new security protocols for US-to-Israel flights were introduced, adding compliance costs. These evolving security landscapes necessitate continuous investment in training and technology.

Government decisions regarding airspace closures during security crises directly affect El Al's flight schedules and operational flexibility. For instance, rerouting flights to avoid sensitive areas can add considerable flight time and increase fuel consumption by as much as 15%.

What is included in the product

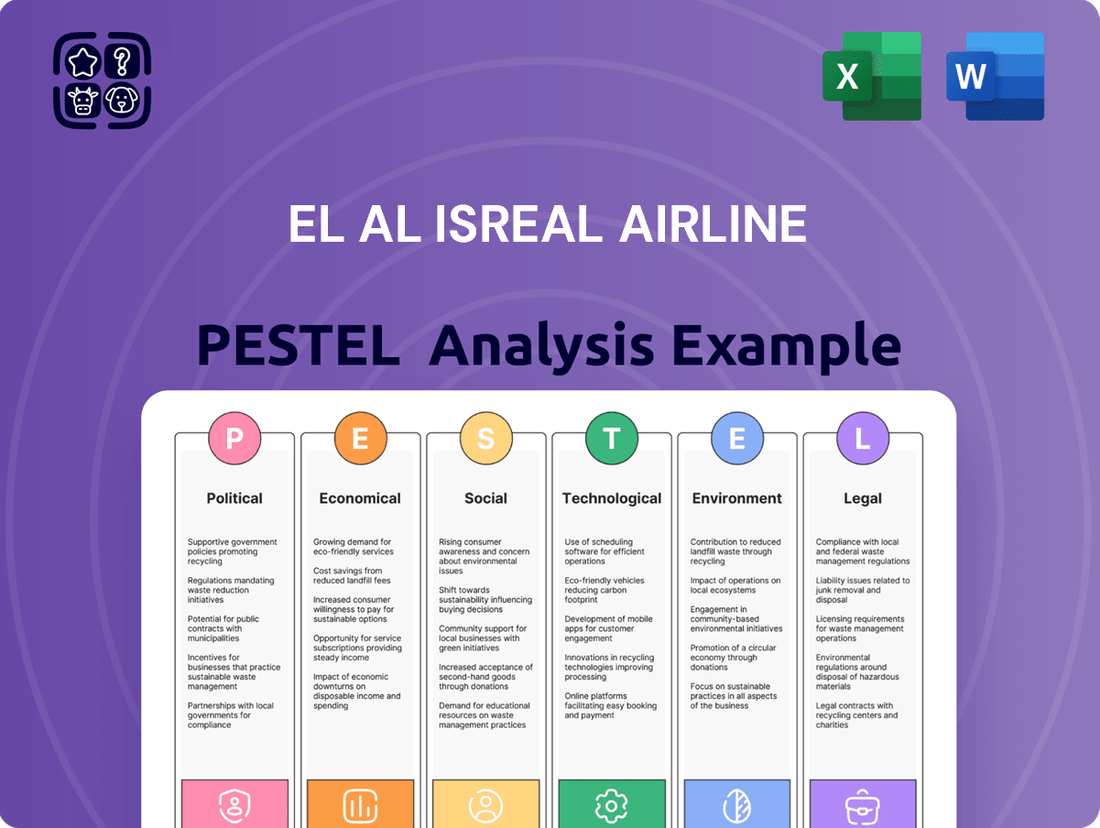

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting EL AL Israel Airlines, providing a comprehensive overview of the external forces shaping its operations and strategic decisions.

It offers actionable insights for stakeholders to navigate the complex landscape and identify key opportunities and challenges for the airline.

This PESTLE analysis for EL AL Israel Airlines provides a clear, summarized version of external factors, offering easy referencing during meetings and presentations to alleviate the pain of information overload.

Visually segmented by PESTEL categories, this analysis allows for quick interpretation at a glance, relieving the pain of deciphering complex market dynamics.

Economic factors

El Al Israel Airlines demonstrated exceptional financial performance in 2024, achieving record revenue of $3.4 billion, a significant 37% surge compared to 2023. The airline also reported a net profit of $545 million, an impressive nearly fivefold increase from the prior year.

This robust financial momentum carried into the first quarter of 2025. El Al saw its net profit climb by 19% and revenue grow by 5%, largely attributed to sustained high passenger demand.

The suspension of flights by numerous international carriers due to regional conflicts, particularly impacting routes to North America, significantly reduced seat supply at Ben Gurion Airport. This created a near-monopoly situation for El Al Israel Airlines on many key international routes.

This reduced competition allowed El Al to achieve high occupancy rates throughout 2024, with some reports indicating load factors exceeding 90% on popular long-haul flights. The airline's market share on these routes consequently saw a substantial increase.

Consequently, El Al experienced a notable boost in profitability during this period, directly benefiting from the limited competition and increased demand for its services. For instance, the airline reported a significant jump in operating income in the first half of 2024 compared to the same period in 2023.

El Al faced scrutiny over ticket pricing, with average fares climbing 14% in 2024 amid reduced foreign airline presence. This pricing strategy coincided with a significant market share increase at Ben Gurion Airport, reaching 47.5% during the same year.

However, as international carriers returned in early 2025, El Al's market share saw a slight dip to 44%. This shift underscores the dynamic interplay between pricing decisions and competitive pressures in the airline industry.

Fleet Modernization and Operational Efficiency

EL AL's strategic fleet modernization, particularly the acquisition of Boeing 737 MAX and 787 Dreamliner aircraft, is a significant driver for enhancing operational performance and fuel efficiency. This investment directly addresses rising fuel costs and environmental concerns, positioning the airline for greater competitiveness.

The introduction of the new 737 MAX jets is projected to yield substantial benefits, including an estimated 20% reduction in fuel consumption and emissions. This efficiency gain is crucial for lowering operating expenses over the long term and supporting EL AL's sustainability goals.

- Fleet Investment: EL AL is investing heavily in new aircraft, including the Boeing 737 MAX and 787 Dreamliner.

- Fuel Efficiency Gains: The 737 MAX is anticipated to cut fuel usage and emissions by approximately 20%.

- Cost Reduction: Improved fuel efficiency translates to lower operational costs, a key factor in airline profitability.

- Environmental Impact: Reduced emissions align with global efforts to curb the aviation industry's carbon footprint.

Employee Profit-Sharing and Incentives

EL AL Israel Airlines' employee profit-sharing and incentive programs are directly tied to its financial performance. In 2024, the airline reported strong financial results, which activated a profit-sharing agreement with its pilots. This resulted in significant bonus payouts, demonstrating a clear link between employee incentives and the company's success.

This approach fosters a culture where staff are directly invested in the company's financial well-being. For instance, the 2024 bonuses served as a tangible reward for the pilots' contributions to the airline's profitability.

- 2024 Financial Performance: EL AL's robust financial outcomes in 2024 were a key driver for profit-sharing activation.

- Pilot Bonuses: Pilots received substantial bonuses as a direct result of the profit-sharing agreement.

- Incentive Alignment: The program effectively aligns employee incentives with the overall financial success of EL AL.

Economic factors significantly influenced EL AL's performance in 2024 and early 2025. The airline achieved record revenues of $3.4 billion in 2024, a 37% increase from the previous year, and its net profit surged to $545 million. This strong financial showing continued into Q1 2025 with a 19% net profit climb and 5% revenue growth, driven by sustained passenger demand.

The temporary suspension of flights by international carriers, particularly on North American routes, created a favorable competitive landscape for EL AL at Ben Gurion Airport. This allowed the airline to secure high load factors, with some flights exceeding 90% occupancy in 2024, boosting its market share to 47.5% by year-end.

However, the return of international airlines in early 2025 led to a slight decrease in EL AL's market share to 44%, highlighting the sensitivity of its market position to competitive pressures. Average fares increased by 14% in 2024 due to reduced competition, a strategy that coincided with its market share gains.

| Metric | 2023 | 2024 | Q1 2025 |

|---|---|---|---|

| Revenue | $2.48 billion | $3.4 billion | (Not specified, but 5% growth from Q1 2024) |

| Net Profit | $110 million | $545 million | (19% increase from Q1 2024) |

| Market Share (Ben Gurion) | (Not specified) | 47.5% | 44% |

| Average Fare Increase | (Not specified) | 14% | (Not specified) |

Preview Before You Purchase

EL AL Isreal Airline PESTLE Analysis

The preview you see here is the exact, fully formatted EL AL Israel Airline PESTLE Analysis document you’ll receive after purchase. This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting EL AL. You'll gain immediate access to this professionally structured report, providing actionable insights into the airline's strategic landscape.

Sociological factors

EL AL plays a crucial role in connecting Israel and Jewish communities worldwide, facilitating travel for business, leisure, and family. The airline's commitment to these demographics is evident in its strategic route planning and service offerings.

In 2024, EL AL observed a significant uptick in demand for flights to North America, reflecting a growing need for direct and convenient travel options for Israeli expatriates and Jewish travelers. This surge in demand underscores the airline's importance as a cultural and economic connector.

The airline's expanded flight schedules, particularly to major North American hubs, directly address this demographic's travel patterns. For instance, increased frequencies to cities like New York and Toronto cater to a substantial Israeli and Jewish diaspora seeking reliable air travel.

During national crises, El Al's role extends beyond typical commercial operations, as seen in its significant repatriation efforts. For instance, in the initial stages of the COVID-19 pandemic, El Al operated numerous flights to bring back thousands of Israelis stranded abroad, solidifying its image as the national carrier. This commitment builds profound trust and a strong sense of national identity among the Israeli populace.

Customer perception of EL AL's pricing is a significant sociological factor. While the airline is often lauded for its role in national security, especially during times of conflict, it has also faced public backlash for perceived high ticket prices. This sentiment was particularly pronounced when EL AL operated as a de facto monopoly due to the grounding of foreign carriers, leading to criticism about affordability.

For instance, during the initial phases of the COVID-19 pandemic in early 2020, when many international airlines suspended flights to Israel, EL AL was one of the few operating repatriation flights. While essential, the cost of these flights drew considerable public commentary. Balancing the need to maintain profitability, especially after periods of reduced travel and increased operational costs, with public expectations for reasonable fares presents an ongoing challenge for EL AL's management.

Cultural and Religious Offerings

El Al Israel Airlines prominently features kosher meal services on all its flights, a direct response to the religious dietary needs of a substantial segment of its passenger base. This commitment is deeply ingrained in the airline's operational ethos, reflecting a core understanding of its primary customer demographic's cultural and religious values.

Beyond culinary offerings, El Al's stringent security measures are another critical element that resonates with its clientele. These protocols are not just operational necessities but are perceived as a reflection of the airline's respect for the safety concerns and cultural expectations of its passengers, particularly those traveling to and from Israel. In 2023, El Al reported carrying over 5.5 million passengers, with a significant portion of these travelers prioritizing these culturally aligned services.

- Kosher Meals: Standard on all El Al flights, catering to Jewish dietary laws.

- Security Standards: Perceived as exceptionally high, aligning with passenger expectations.

- Cultural Alignment: Services and operations are designed to meet the cultural and religious norms of its core customer base.

- Passenger Volume: Over 5.5 million passengers in 2023, highlighting the broad appeal of its culturally sensitive approach.

Support for National Causes and Initiatives

EL AL Israel Airlines demonstrates strong support for national causes, a key sociological factor influencing its operations and public perception. The airline actively participates in initiatives that resonate with national sentiment and societal needs.

A significant aspect of this support involves providing complimentary flights for families of hostages, a humanitarian effort that underscores the airline's commitment during times of national crisis. Furthermore, EL AL's assistance to Zionist organizations highlights its alignment with foundational national values and historical narratives.

These actions reflect EL AL's corporate social responsibility, positioning it not just as a commercial entity but as a contributor to the broader societal well-being of Israel. This engagement can foster goodwill and strengthen its brand image among the Israeli public.

- Humanitarian Aid: Provided complimentary flights for families of hostages, offering crucial support during national emergencies.

- National Alignment: Supports Zionist organizations, reinforcing its connection to Israel's core identity and history.

- Corporate Social Responsibility: Engages in initiatives that benefit society, enhancing its reputation beyond commercial success.

EL AL's deep connection to Israeli society is evident in its role as a cultural and religious service provider, offering kosher meals as standard and maintaining exceptionally high security protocols. This cultural alignment is crucial, as demonstrated by the over 5.5 million passengers it carried in 2023, many of whom prioritize these sensitive services. The airline also actively supports national causes, providing complimentary flights for families of hostages and assisting Zionist organizations, thereby reinforcing its image as a socially responsible entity integral to national identity.

| Sociological Factor | Description | Impact on EL AL | Supporting Data/Examples |

|---|---|---|---|

| Cultural & Religious Alignment | Providing services that cater to the specific cultural and religious needs of its primary customer base. | Enhances customer loyalty and brand perception, differentiating EL AL from competitors. | Kosher meals are standard on all flights. Over 5.5 million passengers in 2023, with a significant portion valuing these services. |

| National Identity & Support | Demonstrating commitment to national causes and societal well-being. | Builds goodwill, strengthens brand image, and fosters a sense of national pride among passengers. | Complimentary flights for families of hostages. Support for Zionist organizations. |

| Public Perception of Pricing | The balance between operational costs, national service roles, and passenger expectations for affordable fares. | Can lead to public criticism if perceived as exploitative, especially during periods of limited competition or national need. | Public commentary on repatriation flight costs during early COVID-19 pandemic. |

| Repatriation Efforts | Acting as a key facilitator for bringing Israeli citizens home during crises. | Solidifies EL AL's image as the national carrier, building trust and a strong sense of national connection. | Operated numerous repatriation flights during the COVID-19 pandemic, bringing back thousands of Israelis. |

Technological factors

EL AL is actively modernizing its fleet, a key technological factor impacting its operations. This includes a substantial order for up to 31 Boeing 737 MAX aircraft, set to replace aging narrow-body planes, with initial deliveries expected in 2028. This strategic move aims to improve fuel efficiency and passenger comfort.

Further enhancing its long-haul reach, EL AL is also expanding its wide-body capacity. The airline plans to introduce up to nine new Boeing 787-9 Dreamliners into its fleet. These advanced aircraft will bolster EL AL's ability to serve international routes more effectively and competitively.

EL AL is heavily investing in digital transformation for customer service, enhancing its online platforms like its website and app. This focus aims to streamline ticket sales and improve customer interactions. For instance, in 2024, the airline reported a significant increase in digital channel usage for bookings and inquiries.

Key digital features being rolled out include online flight cancellation and the ability to hold bookings, directly responding to changing consumer preferences. This move is crucial as a substantial percentage of EL AL's customer base now expects seamless self-service options, a trend projected to grow by 15% annually through 2025.

EL AL Israel Airlines is a leader in implementing advanced security systems, a critical technological factor for its operations. These systems are constantly evolving, reflecting significant investment in cutting-edge technology to maintain passenger and aircraft safety. While exact technological specifications are confidential, this commitment underscores EL AL's dedication to robust security protocols.

Fuel Efficiency and Environmental Performance

EL AL's technological advancements heavily focus on fuel efficiency and environmental performance, directly impacting operational costs and regulatory compliance. The airline's strategic acquisition of new-generation aircraft, such as the Boeing 737 MAX and 787 Dreamliner, is central to this effort.

These modern aircraft are engineered for significantly reduced fuel consumption, with the Boeing 787 Dreamliner, for instance, offering up to 20% better fuel efficiency compared to previous models. This translates to lower operating expenses and a smaller carbon footprint, aligning EL AL with increasingly stringent global environmental standards and passenger expectations for sustainable travel.

The technological benefits extend to reduced emissions, with the 737 MAX also demonstrating substantial improvements in fuel burn and emissions per seat. This proactive approach to fleet modernization is crucial for maintaining competitiveness and meeting the industry's evolving environmental targets.

- Fleet Modernization: Acquisition of Boeing 737 MAX and 787 Dreamliner aircraft.

- Fuel Efficiency Gains: Expected improvements of up to 20% in fuel consumption with the 787 Dreamliner.

- Environmental Alignment: Reduced carbon emissions per passenger, meeting global sustainability goals.

- Cost Reduction: Lower fuel expenses directly contribute to improved profitability.

Cabin Refurbishment and Passenger Experience

EL AL is actively upgrading its existing wide-body fleet, including Boeing 777-200ER aircraft, by investing in new cabin interiors. This strategic move is designed to significantly improve the passenger experience, offering a more comfortable and technologically advanced environment during flights. The airline aims to align its older aircraft with the modern standards set by its newer fleet acquisitions.

These cabin refurbishments are a key part of EL AL's broader strategy to remain competitive in the evolving aviation landscape. By enhancing the in-flight amenities and comfort, the airline seeks to attract and retain passengers who increasingly prioritize a premium travel experience. This focus on passenger satisfaction is crucial for building brand loyalty and driving revenue growth.

Technological integration within these refurbished cabins is a significant aspect. Passengers can expect improved entertainment systems, better connectivity options, and more intuitive cabin controls, reflecting the latest advancements in aviation technology. This commitment to modernization ensures EL AL's fleet remains appealing to a discerning customer base.

The investment in cabin upgrades is expected to yield tangible benefits. For instance, a more appealing cabin environment can lead to higher customer satisfaction scores, potentially translating into increased bookings and ancillary revenue. While specific financial figures for the 2024/2025 refurbishment program are not publicly detailed, similar industry investments in cabin modernization have shown positive impacts on passenger load factors and revenue per available seat mile (RASM).

Technological factors are pivotal for EL AL, driving fleet modernization, operational efficiency, and customer experience. The airline's commitment to acquiring new aircraft like the Boeing 737 MAX and 787 Dreamliner directly addresses fuel efficiency, with the 787 offering up to 20% better fuel economy. This strategic investment in advanced technology also includes significant upgrades to digital platforms, enhancing customer service and self-service options, with digital channel usage projected to continue its upward trend through 2025.

| Technology Area | Specific Initiative/Aircraft | Key Benefit | Projected Impact (2024-2025) |

|---|---|---|---|

| Fleet Modernization | Boeing 737 MAX (up to 31) | Improved fuel efficiency, reduced emissions | Lower operating costs, enhanced environmental profile |

| Fleet Modernization | Boeing 787 Dreamliner (up to 9) | Up to 20% better fuel efficiency | Significant reduction in fuel expenditure, increased long-haul competitiveness |

| Digital Transformation | Website & App Enhancements | Streamlined bookings, improved customer interaction | Increased digital channel usage, higher customer satisfaction scores |

| Cabin Refurbishment | Boeing 777-200ER interiors | Enhanced passenger comfort, modern amenities | Improved passenger experience, potential for higher load factors |

Legal factors

El Al Israel Airlines navigates a complex web of aviation laws and regulations, both domestically and internationally. In 2024, Israel's Civil Aviation Authority (CAA) continues to enforce stringent safety protocols, directly impacting El Al's operational procedures and aircraft maintenance standards. Failure to comply with these, alongside evolving international aviation standards from bodies like ICAO, could jeopardize its operating licenses and incur significant penalties.

Key legal considerations for El Al in 2024-2025 include adherence to noise abatement procedures, which vary by airport and can influence flight scheduling and route planning. Furthermore, the airline must maintain rigorous security measures, a critical aspect given its history and the geopolitical landscape, ensuring compliance with Israeli airport security directives and international best practices to safeguard passengers and operations.

Israel's commitment to Open Skies agreements, notably with the European Union and the United States, fundamentally shapes El Al's operating environment. These agreements foster increased competition by granting reciprocal operating rights, allowing foreign carriers greater access to the Israeli market. For instance, the EU-Israel Open Skies agreement, fully implemented in 2018, removed many restrictions on routes and capacity, leading to more competitive pricing and service offerings.

This global framework generally supports open market access for airlines, including El Al. However, the airline must remain agile, as geopolitical events can introduce temporary disruptions or shifts in competitive dynamics. For example, security concerns or regional conflicts can lead to flight route adjustments or temporary bans, impacting El Al's ability to fully leverage these agreements.

Starting January 1, 2025, Israel introduced the Electronic Travel Authorization (ETA-IL) for visitors from countries that typically don't require a visa. This new regulation means EL AL Israel Airlines, along with other carriers, must confirm a traveler's ETA-IL approval before they can board their flight.

This compliance requirement adds a new step to EL AL's passenger check-in process, potentially impacting boarding times and operational efficiency. Airlines will need robust systems to verify these authorizations, ensuring smooth passenger flow and adherence to Israeli immigration policies.

Data Protection and Privacy Regulations

The aviation industry, including EL AL, faces increasing scrutiny regarding data protection. With cyber threats on the rise, the upcoming August 2025 enforcement of Amendment 13 to Israel's Privacy Protection Law will significantly impact how passenger data is handled. This amendment mandates stricter security measures and greater transparency in data processing.

EL AL must adapt its operations to comply with these enhanced privacy standards. Failure to do so could result in substantial penalties and damage to its reputation. For instance, the General Data Protection Regulation (GDPR) in Europe, which came into full effect in 2018, has set a precedent for stringent data privacy laws, with fines reaching up to 4% of global annual turnover.

Key compliance areas for EL AL include:

- Data Minimization: Collecting only necessary passenger information.

- Consent Management: Obtaining explicit consent for data usage.

- Security Measures: Implementing robust cybersecurity protocols to prevent breaches.

- Data Breach Notification: Establishing clear procedures for reporting breaches to authorities and affected individuals.

Government Agreements on Security Costs and Dividends

El Al's capacity to distribute dividends is directly influenced by a recent accord with the Israeli government concerning the allocation of security expenses. This legal and financial framework enables the airline to retain a larger portion of its earnings.

Under this agreement, El Al's dividend distribution is permissible, but it is contingent upon a phased escalation of its own contribution towards security costs. This structure aims to balance the airline's financial health with national security responsibilities.

- Dividend Distribution: The government agreement permits El Al to pay dividends, a significant shift from previous constraints.

- Security Cost Sharing: The core of the agreement involves a structured sharing of security costs between El Al and the Israeli government.

- Phased Contribution: El Al's contribution to security expenses will gradually increase over time, impacting future profit retention.

- Financial Flexibility: This arrangement provides El Al with greater financial flexibility, potentially boosting investor confidence.

El Al operates under strict aviation regulations, with Israel's Civil Aviation Authority (CAA) enforcing safety standards in 2024. International agreements like Open Skies, such as the one with the EU, increase competition by allowing foreign carriers more access to Israel's market, impacting El Al's pricing strategies.

New regulations, like the Electronic Travel Authorization (ETA-IL) effective January 1, 2025, require El Al to verify passenger travel documents before boarding. Furthermore, Amendment 13 to Israel's Privacy Protection Law, with enforcement starting August 2025, mandates stricter data handling for passenger information, mirroring global trends like GDPR.

An accord with the Israeli government allows El Al to distribute dividends, contingent on its increasing contribution to security costs. This framework provides El Al with enhanced financial flexibility, a positive development for investor confidence.

Environmental factors

El Al Israel Airlines is actively pursuing environmental sustainability, a commitment recognized by its Platinum rating in Maala's 2024 ESG ranking. This high achievement underscores the company's dedication to responsible business practices.

Further solidifying its environmental focus, El Al has adopted the IATA Environmental Assessment (IEnvA) program. This program is built upon the robust ISO 14001 standard, providing a structured framework for managing and reducing the airline's environmental footprint.

El Al is committed to reducing its environmental impact, setting a target to achieve net-zero carbon emissions by 2050. This ambitious goal drives their participation in various carbon dioxide emission reduction schemes, aiming to mitigate the airline's contribution to climate change.

A key element of El Al's strategy involves enhancing fuel efficiency across its fleet. For instance, in 2023, the airline continued its fleet modernization efforts, which directly contribute to lower fuel consumption per passenger mile, a crucial metric for carbon footprint reduction.

EL AL Israel Airlines, like all major carriers, must navigate strict noise restrictions at airports worldwide. These regulations are designed to minimize the impact of aviation on communities living near airports. For instance, many European airports impose curfews or limits on the number of flights during nighttime hours, which can directly affect scheduling and operational flexibility.

Specifically, EL AL faces potential challenges with proposed flight regulations at Ben Gurion Airport concerning night hours. While specific details of these 2024/2025 proposals are still emerging, such measures often aim to reduce noise pollution during sensitive periods. Compliance requires careful fleet management and potentially adjusting flight schedules, impacting overall efficiency.

Managing noise emissions is an ongoing environmental consideration. Airlines invest in quieter aircraft technologies and operational procedures to meet increasingly stringent noise standards. The continuous evolution of these regulations means EL AL must remain adaptable, investing in fleet modernization and operational strategies to ensure ongoing compliance and minimize its environmental footprint.

Fuel Efficiency of Modern Aircraft

El Al's commitment to environmental sustainability is significantly bolstered by its ongoing fleet modernization. The introduction of newer aircraft, such as the Boeing 737 MAX and the 787 Dreamliner, is a cornerstone of this strategy. These advanced models are engineered for superior fuel efficiency compared to their predecessors.

The fuel efficiency of these modern aircraft directly translates into reduced carbon emissions per passenger mile. For instance, the Boeing 787 Dreamliner can offer up to 20% better fuel efficiency than the aircraft it replaces, leading to a substantial decrease in the airline's overall carbon footprint. This aligns with global efforts to mitigate climate change and promotes a more environmentally responsible approach to air travel.

- Fleet Modernization: El Al is integrating Boeing 737 MAX and 787 Dreamliner aircraft into its operations.

- Fuel Efficiency Gains: These new aircraft provide significant improvements in fuel consumption, with the 787 Dreamliner offering up to a 20% improvement.

- Emission Reduction: Enhanced fuel efficiency directly leads to lower greenhouse gas emissions per flight.

- Environmental Impact: This strategy supports El Al's environmental goals and contributes to a greener aviation sector.

Waste and Water Management

EL AL Israel Airlines actively addresses environmental risks, including potential land and water pollution, and the challenges of inefficient waste and sewage management. The airline's commitment to sustainability is demonstrated through concrete actions like wastewater treatment and general waste processing, reflecting a dedication to responsible operational practices.

In 2023, EL AL continued its efforts in waste reduction, with a focus on improving recycling rates across its operations. While specific 2024 figures are still being compiled, the airline aims to build upon its 2023 performance, which saw a notable increase in the diversion of waste from landfills through enhanced segregation and processing. These initiatives are crucial for minimizing the company's environmental footprint.

- Wastewater Treatment: EL AL implements systems to treat wastewater generated from aircraft and ground operations, ensuring compliance with environmental regulations.

- Waste Segregation and Recycling: The airline actively segregates different waste streams, including plastics, paper, and metals, to maximize recycling opportunities.

- Sustainable Procurement: Efforts are underway to incorporate environmentally friendly materials and reduce single-use plastics in onboard services.

Environmental regulations significantly shape airline operations, pushing for reduced emissions and noise pollution. El Al's commitment to sustainability is evident in its pursuit of net-zero carbon emissions by 2050, actively participating in carbon reduction schemes and modernizing its fleet for better fuel efficiency.

The airline's fleet modernization, including the introduction of Boeing 737 MAX and 787 Dreamliner aircraft, is a key environmental strategy. These newer models offer up to 20% better fuel efficiency than older aircraft, directly lowering the carbon footprint per passenger mile.

El Al also focuses on managing operational waste and wastewater, aiming to increase recycling rates and reduce landfill diversion. These efforts are crucial for minimizing the company's overall environmental impact.

| Environmental Factor | El Al's Action/Status | Impact/Goal |

|---|---|---|

| Carbon Emissions | Net-zero by 2050 target; participation in reduction schemes | Mitigate climate change contribution |

| Fuel Efficiency | Fleet modernization (737 MAX, 787 Dreamliner) | Reduce emissions per passenger mile (up to 20% improvement with 787) |

| Noise Pollution | Adherence to IEnvA, ISO 14001; managing airport restrictions | Minimize impact on communities, ensure operational compliance |

| Waste Management | Improving recycling rates, wastewater treatment | Reduce landfill diversion, responsible operational practices |

PESTLE Analysis Data Sources

Our EL AL Israel Airline PESTLE Analysis is built on data from official Israeli government publications, international aviation authorities, and reputable economic forecasting agencies. We incorporate reports on geopolitical stability, economic performance, and regulatory changes to provide a comprehensive view.