EL AL Isreal Airline Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EL AL Isreal Airline Bundle

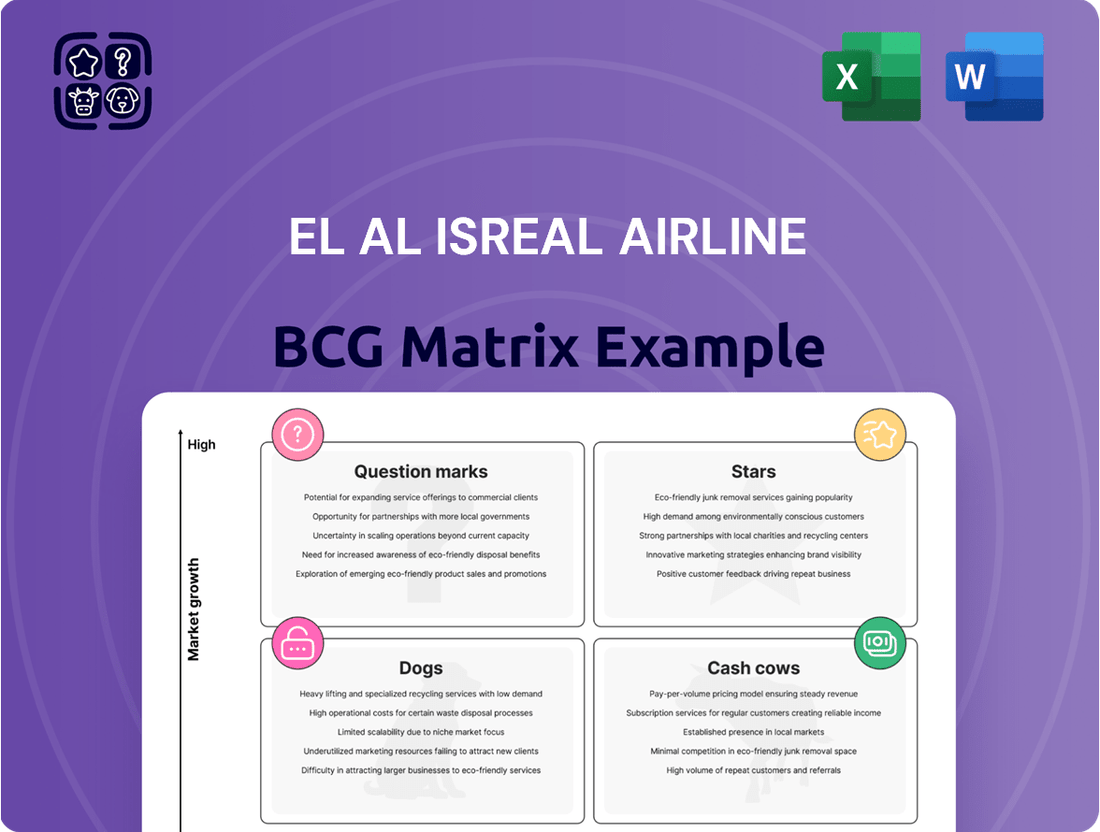

EL AL Israel Airline's BCG Matrix offers a strategic snapshot of its diverse operations, from established routes to emerging markets. Understanding where its services fall as Stars, Cash Cows, Dogs, or Question Marks is crucial for navigating the competitive aviation landscape.

This preview hints at the powerful insights contained within the full EL AL BCG Matrix. Purchase the complete report to gain a comprehensive understanding of their market position and unlock data-driven strategies for optimizing their portfolio.

Don't miss out on the opportunity to leverage this detailed analysis. Get the full BCG Matrix for EL AL Israel Airline and equip yourself with the knowledge to make informed decisions about resource allocation and future growth.

Stars

El Al's North American routes are a clear Star in its BCG Matrix. The airline enjoys a dominant position, often exceeding a 90% market share on these highly profitable corridors in 2024. This strength is underscored by consistently high load factors, reaching 96% in Q4 2024, demonstrating robust demand.

These routes are a major revenue driver, contributing a significant 43% of El Al's total passenger and cargo revenue in the first half of 2024 from its US operations alone. The airline is actively reinforcing this Star status by expanding its North American presence, with plans for up to 52 weekly flights to the US in the 2025 summer season.

EL AL's cargo operations have ascended to Star status within its BCG Matrix, especially during times of geopolitical tension. The airline has strategically shifted its focus to cargo, bolstering both belly cargo and dedicated freighter services to capitalize on demand when passenger travel is disrupted.

This strategic pivot is evident in the introduction of a converted Boeing 737-800 freighter and plans to convert a widebody aircraft for cargo use, with aspirations for its own widebody freighter by 2028. These efforts underscore a commitment to maximizing cargo's potential.

Cargo operations proved to be a significant profit driver, contributing roughly one-third of the airline's $147 million profit in the second quarter of 2024. This substantial contribution highlights the segment's robust performance and its critical role in EL AL's overall financial health.

EL AL Israel Airlines has achieved impressive load factors, hitting 94% in 2024 and an even higher 94.3% in the first quarter of 2025. This means almost every seat is filled, directly boosting the airline's financial performance.

The airline also saw a significant 24% jump in Revenue per Available Seat Kilometer (RASK) in 2024 compared to the previous year. This strong growth shows EL AL is effectively using its capacity and has the power to set competitive prices, especially when demand is high and there are fewer airlines flying.

Brand Reputation for Reliability and Security

El Al's brand reputation for reliability and security is a significant strength, particularly in the context of its operations during challenging geopolitical periods. This perceived dependability has cultivated a loyal customer base, especially among those with strong ties to Israel. For instance, during periods of heightened regional tension, El Al often remained one of the few international carriers consistently operating flights to Israel, a factor that significantly bolsters its image as a secure and reliable choice.

This unwavering commitment to operational continuity and stringent security measures has translated into tangible benefits. In 2023, El Al reported a significant increase in passenger numbers, reaching 6.3 million, a substantial rise from 5.7 million in 2022, underscoring the market's trust in the airline during uncertain times. This strong brand equity allows El Al to command a premium and maintain market share even as competitive pressures evolve.

- Brand Strength: El Al's reputation for reliability and security is a key differentiator, fostering customer loyalty.

- Operational Resilience: The airline's ability to maintain operations during challenging periods reinforces its dependable image.

- Market Impact: This strong brand perception enables El Al to sustain market share and pricing power against competitors.

Strategic Fleet Expansion and Modernization

EL AL's strategic fleet expansion and modernization efforts are central to its growth trajectory. The airline is reactivating its Boeing 777s, with plans to retrofit them to mirror the cabin layouts of their Boeing 787 Dreamliners. This initiative aims to boost seating capacity and standardize the long-haul experience.

The company is also set to receive more Boeing 787 Dreamliners, with deliveries scheduled between 2024 and 2026. This infusion of fuel-efficient aircraft is crucial for enhancing operational efficiency and driving growth on its important long-haul routes.

EL AL has ambitious fleet goals, targeting an increase to 61 aircraft by the year 2030. This expansion underscores a commitment to increasing market share and improving service capabilities.

- Fleet Modernization: Reactivating and retrofitting Boeing 777s to match Dreamliner interiors.

- Dreamliner Expansion: Receiving additional Boeing 787 Dreamliners between 2024 and 2026.

- Capacity Increase: Aiming to boost seating capacity through fleet upgrades and expansion.

- Long-Term Goal: Targeting a total of 61 aircraft in the fleet by 2030.

EL AL's North American routes are a prime example of a Star in the BCG Matrix, boasting high market share and strong demand. These routes are significant revenue generators for the airline, and EL AL is actively investing in their expansion.

Cargo operations have also emerged as a Star for EL AL, particularly in response to geopolitical events. The airline has strategically prioritized cargo services, leading to increased profitability in this segment and demonstrating its adaptability.

EL AL's overall operational performance, characterized by high load factors and increased RASK, solidifies its Star status. The airline's resilience and ability to command premium pricing reflect its strong market position.

| Route/Segment | Market Share (2024) | Load Factor (Q4 2024) | Revenue Contribution (H1 2024) | Strategic Focus |

|---|---|---|---|---|

| North America | >90% | 96% | 43% (US Operations) | Expansion, Increased Flights |

| Cargo Operations | N/A (Strategic Pivot) | High (Variable) | ~33% (Q2 2024 Profit) | Freighter Conversion, Belly Cargo |

What is included in the product

EL AL Israel Airline's BCG Matrix would analyze its different routes and services, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This framework would guide strategic decisions on investment, divestment, and resource allocation for EL AL's diverse offerings.

EL AL's BCG Matrix analysis provides a clear roadmap for resource allocation, relieving the pain of inefficient investment.

This visual tool helps EL AL identify and address underperforming segments, easing the burden of strategic uncertainty.

Cash Cows

El Al's commanding presence at Ben Gurion Airport, holding a 44% market share in Q1 2025 and peaking at 73% in January 2025, solidifies its position as a cash cow. This dominance, even with fluctuations from foreign carriers, indicates a mature market where El Al enjoys a strong, established customer base. The airline leverages this significant passenger traffic through Israel's primary international hub to generate substantial and reliable cash flow.

EL AL's established European routes represent significant cash cows. These routes, while perhaps not experiencing the explosive growth of some others, offer a reliable and consistent stream of revenue. The demand from both Israeli citizens traveling to Europe and international visitors heading to Israel remains robust, underpinning the profitability of these services.

The airline's strategic decisions reflect the importance of these routes. For instance, EL AL has bolstered its presence in key European hubs, increasing flight frequencies. As of recent reports, this includes up to eight weekly flights connecting Tel Aviv to major German and Austrian cities like Frankfurt, Munich, and Vienna, alongside 11 weekly frequencies to Berlin and Zurich. This increased capacity highlights their role as dependable profit centers.

EL AL's commitment to providing kosher food on all flights, coupled with its status as Israel's national carrier, cultivates a dedicated customer segment. This niche, prioritizing cultural and religious needs, ensures a consistent demand, differentiating EL AL from competitors on these specific service aspects.

This specialized service fosters customer loyalty, making passengers less inclined to switch to other airlines. For instance, in 2023, EL AL reported carrying over 5.5 million passengers, a significant portion of whom likely appreciate the readily available kosher meal options, contributing to a stable revenue stream.

Frequent Flyer Loyalty Program

The Matmid frequent flyer program is a significant Cash Cow for EL AL Israel Airlines. With around 4 million members as of early 2024, it represents a substantial and loyal customer base that drives consistent revenue.

This established program ensures a predictable stream of income because these members are less likely to be swayed by competitor pricing. Their loyalty translates directly into repeat bookings, making the program a reliable revenue generator for the airline.

Continued investment in the Matmid program is crucial for maintaining its Cash Cow status. By offering appealing benefits and ensuring member engagement, EL AL can solidify customer retention and guarantee ongoing recurring revenue streams.

- Approximately 4 million members

- Consistent repeat business

- Predictable revenue streams

- Reduced susceptibility to pricing competition

Domestic and Regional Feeder Routes

EL AL's domestic and regional feeder routes, while not typically high-growth markets themselves, play a crucial role in supporting the airline's more lucrative international operations. These shorter flights act as essential connectors, bringing passengers from various points into EL AL's main hubs for onward travel. This network ensures consistent passenger flow, contributing to the overall load factor on long-haul segments.

These feeder routes are likely categorized as Cash Cows within EL AL's BCG Matrix. They generate steady revenue and cash flow due to their established presence and consistent demand, even if market growth is modest. The stability they provide is vital for funding investments in other areas of the business.

- Contribution to Load Factor: Feeder routes help maximize the passenger capacity utilization on EL AL's international flights.

- Network Synergy: They create a comprehensive network, enhancing customer convenience and loyalty.

- Revenue Stability: These routes provide a predictable revenue stream, acting as a reliable cash generator for the airline.

- Operational Efficiency: By utilizing existing infrastructure and aircraft, these routes can be operated efficiently, further boosting their cash cow status.

EL AL's established European routes are significant cash cows, generating reliable revenue from consistent demand. The airline has increased flight frequencies to key hubs, with up to eight weekly flights to Frankfurt, Munich, and Vienna, and eleven to Berlin and Zurich, underscoring their profitability.

The Matmid frequent flyer program, boasting around 4 million members by early 2024, is a prime cash cow. This loyalty base ensures predictable income and repeat bookings, reducing susceptibility to competitor pricing and solidifying a stable revenue stream.

| Category | Key Characteristic | Revenue Contribution | Market Growth | EL AL Example |

|---|---|---|---|---|

| Established Routes | Mature, consistent demand | High and stable cash flow | Low to moderate | European city pairs |

| Loyalty Programs | High member engagement | Predictable repeat business | Moderate | Matmid Frequent Flyer Program |

What You See Is What You Get

EL AL Isreal Airline BCG Matrix

The EL AL Israel Airline BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic clarity, will be delivered to you without any watermarks or demo content, ready for immediate professional use.

What you see here is the definitive EL AL Israel Airline BCG Matrix report; the identical file will be yours after completing your purchase. This professionally crafted analysis is ready for immediate download and application in your strategic planning or presentations, ensuring no surprises and no need for further revisions.

This preview showcases the actual EL AL Israel Airline BCG Matrix file that you will acquire with your purchase. Once bought, you gain instant access to the complete, editable version, perfectly suited for integration into your business strategy, client reports, or internal discussions.

Dogs

Underperforming older aircraft within EL AL's fleet, especially those not yet retrofitted or slated for retirement, represent a challenge. These planes can carry significantly higher operational expenses, particularly in fuel consumption and maintenance, when contrasted with their newer, more fuel-efficient counterparts. This disparity directly impacts profit margins, making them less competitive.

EL AL is actively engaged in a fleet modernization program, a crucial step to address these inefficiencies. However, any older aircraft that remain in service, perhaps due to ongoing supply chain issues affecting the delivery of newer models, would be categorized here. For instance, if a significant portion of their older Boeing 737-800s are still operating without winglets or other efficiency upgrades, they would contribute to this underperforming segment.

Routes with high competition and low profitability for EL AL, often found in established European or North American corridors, are prime examples of potential cash traps. For instance, the Tel Aviv to London Heathrow route consistently sees intense competition from carriers like British Airways, Virgin Atlantic, and Ryanair, driving down average fares. In 2024, reports indicated that average yields on such high-volume routes were under pressure, with some estimates suggesting profit margins dipping below 5% due to intense price wars.

These routes, if also experiencing stagnant passenger growth or a decline in business travel demand, become particularly problematic. For example, a route that saw consistent 3% annual growth in the past might now be experiencing less than 1% growth, meaning increased capacity from competitors doesn't translate into higher overall demand for EL AL. This scenario requires continuous investment in marketing and fleet utilization just to hold onto existing market share, yielding minimal returns.

The potential re-entry or increased presence of foreign carriers, particularly low-cost carriers or those with aggressive expansion strategies, can quickly transform even moderately profitable routes into cash traps. If EL AL cannot differentiate its offering through service, loyalty programs, or operational efficiency, it risks losing valuable market share on these highly competitive, low-margin segments. This was a concern highlighted in early 2025 analyses of the Middle Eastern aviation market, where new entrants were aggressively targeting established routes.

EL AL's Dogs category encompasses routes that consistently show low passenger demand, often struggling to reach profitable load factors. These routes, even with adjustments to capacity or pricing, fail to generate significant revenue and can become a financial drain. For instance, during the first half of 2024, certain less popular international city pairs saw load factors dipping below 60%, a stark contrast to EL AL's overall average of over 80% for the same period.

Inefficient Operational Processes

EL AL's internal operational processes, if outdated or inefficient, could be classified as 'Dogs' within a BCG Matrix framework. These are not products but rather internal functions that drain resources. For instance, legacy IT systems can hinder real-time data processing, impacting everything from booking to baggage handling.

Cumbersome ground handling procedures at busy airports contribute to delays and increased labor costs. Inefficient resource allocation, such as suboptimal aircraft routing or crew scheduling, further exacerbates these issues. These internal 'dogs' consume valuable capital and human resources without generating a proportionate return.

For example, if EL AL's IT infrastructure requires significant manual intervention for tasks that could be automated, it directly impacts productivity. In 2023, the airline industry globally faced challenges with operational efficiency, with average flight delays costing billions. Specific figures for EL AL's internal process inefficiencies are not publicly disclosed, but industry benchmarks suggest that outdated systems can increase operational costs by 10-20%.

- Legacy IT Systems: Hindering real-time data and automation, leading to increased manual work and potential errors.

- Cumbersome Ground Handling: Slow turnaround times and inefficient baggage management contribute to delays and higher operational expenses.

- Inefficient Resource Allocation: Suboptimal aircraft utilization and crew scheduling can result in wasted capacity and increased costs.

Fort Lauderdale Route Suspension

EL AL's decision to suspend its Fort Lauderdale route starting April 2026, consolidating its Florida operations in Miami, suggests this route was likely a Stars or Cash Cows that has transitioned to a Dog.

This strategic shift indicates that the Fort Lauderdale service, despite potentially having initial high load factors, did not meet EL AL's long-term profitability or strategic objectives compared to focusing on Miami.

This move aligns with a BCG Matrix analysis where underperforming or less strategically vital routes are divested or consolidated.

- Route Suspension: EL AL will cease flights to Fort Lauderdale in April 2026.

- Consolidation Strategy: Florida operations will be consolidated at Miami International Airport.

- Potential Underperformance: The suspension implies the Fort Lauderdale route may not have met profitability or strategic goals.

- BCG Matrix Implication: This action suggests the route has likely moved into the Dog quadrant of the BCG Matrix.

EL AL's "Dogs" category encompasses underperforming assets that consume resources without significant returns. This includes older, less fuel-efficient aircraft that incur higher operational costs, and routes with low demand and intense competition, leading to poor load factors and thin profit margins. For instance, in early 2024, some less popular international routes saw load factors below 60%, significantly impacting profitability.

Inefficient internal processes, such as legacy IT systems or cumbersome ground handling, also fall into this category, draining capital and human resources. The airline's decision to suspend its Fort Lauderdale route in April 2026, consolidating operations in Miami, further illustrates this, suggesting the former route was not meeting strategic or profitability objectives.

| Category | Description | Example | 2024 Data/Observation |

| Aircraft | Older, inefficient planes | Boeing 737-800s without winglets | Higher fuel and maintenance costs compared to newer models |

| Routes | Low demand, high competition | Tel Aviv to London Heathrow | Average yields under pressure, profit margins potentially below 5% |

| Internal Processes | Outdated or inefficient operations | Legacy IT systems | Can increase operational costs by 10-20% (industry benchmark) |

Question Marks

El Al's expansion into new international markets, exemplified by the launch of five weekly flights between Tel Aviv and Boston in May 2024, positions these routes as Question Marks within the BCG Matrix. This strategic move aims to tap into existing demand from significant Israeli and Jewish populations in the Boston area, a demographic factor that could drive initial passenger numbers.

The success of these new routes hinges on their ability to convert initial interest into sustained profitability and market dominance. Given that these are relatively new ventures for El Al, their long-term market share and revenue generation potential are still uncertain, requiring substantial investment in marketing and operational efficiency to mature.

EL AL Israel Airlines' stated focus on increasing flights to the Far East signals a strategic move into potentially lucrative but competitive markets. This expansion into new destinations like Vietnam or the Philippines, for instance, would likely place these ventures in the 'Question Mark' category of the BCG Matrix.

These new routes represent high-growth potential markets, aligning with the 'Question Mark' profile. However, EL AL's current market share in these specific nascent Far East markets is presumed to be low. For example, in 2023, while EL AL saw a significant rebound in passenger numbers overall, its presence in less established Far East routes would require substantial investment to build brand recognition and capture market share against incumbent carriers.

El Al Israel Airlines has signaled a clear intent to diversify beyond its core aviation business, eyeing the credit and financial sectors. Their previous attempt to acquire Isracard underscores this strategic pivot towards non-aviation ventures, aiming to broaden their customer offerings.

Within a BCG Matrix framework, potential acquisitions in financial services for El Al would likely be classified as Stars or Question Marks. While the financial sector offers substantial growth potential, El Al’s current market share and expertise in this domain are nascent, necessitating strategic, calculated investments to navigate these high-growth, yet unproven, territories.

Post-Conflict Tourism Recovery Initiatives

As Israel's tourism sector rebounds post-conflict, El Al's efforts to recapture international visitors, especially as foreign airlines re-enter the market, are crucial. The airline faces the challenge of retaining its increased market share against resurgent competition. El Al's focus on marketing and competitive pricing will be key to converting this inbound tourism growth into sustained Star performance.

El Al's post-conflict recovery initiatives are designed to capitalize on returning confidence. For instance, in 2023, despite the challenges, Israel's tourism sector saw a significant uptick in arrivals compared to the immediate post-conflict period, with El Al playing a vital role in facilitating this recovery. The airline's investment in new routes and enhanced passenger experience aims to solidify its position.

- Marketing Investment: El Al has allocated significant funds to promotional campaigns in key international markets, emphasizing safety and Israel's unique attractions.

- Competitive Pricing: The airline is employing dynamic pricing strategies to attract price-sensitive travelers and counter offers from competing carriers.

- Route Expansion: El Al is selectively adding or increasing frequencies on routes showing strong recovery potential, aiming to capture a larger share of the returning tourist flow.

Integration of New Aircraft Types (e.g., Boeing 737 MAX)

EL AL's acquisition of twenty Boeing 737 MAX aircraft, with options for eleven more, positions these planes as potential Question Marks within its BCG Matrix. Their efficient design promises improved operating costs, but the actual profitability and market penetration of the 737 MAX on EL AL's short-to-medium haul routes will determine their future standing. Successful integration and route optimization are key to transforming this investment into a Star or Cash Cow.

The 737 MAX fleet represents a significant capital investment for EL AL. As of early 2024, the airline is in the process of receiving these new aircraft, which are designed for enhanced fuel efficiency and passenger capacity. The critical factor for their BCG classification is their performance in generating revenue and market share against competitors in their target segments.

- Fleet Modernization: EL AL's order for twenty 737 MAX aircraft signifies a strategic move to update its fleet with more fuel-efficient technology.

- Market Uncertainty: The success of the 737 MAX in achieving EL AL's profitability and market share goals on short-to-medium haul routes remains a key question.

- Operational Challenges: Integrating new aircraft types often involves complexities in training, maintenance, and route planning, impacting immediate performance.

- Competitive Landscape: The airline's ability to leverage the 737 MAX's capabilities to gain an edge in competitive markets is crucial for its future success.

New routes, like Tel Aviv to Boston launched in May 2024, are classified as Question Marks for El Al. These ventures require significant investment to build market share and achieve profitability in potentially high-growth areas.

The airline's expansion into new Far East markets also falls into the Question Mark category, given the low current market share and the need for substantial marketing to compete with established carriers.

The acquisition of 737 MAX aircraft represents another Question Mark, as their ultimate success in generating revenue and market share on specific routes is still to be determined.

| BCG Category | El Al Initiative | Rationale | Key Factors for Success |

| Question Mark | Tel Aviv - Boston Route (launched May 2024) | New market entry with potential demand from specific demographics. | Sustained passenger numbers, market dominance, marketing investment. |

| Question Mark | Expansion into new Far East markets | High-growth potential but low current market share. | Brand recognition, competitive pricing, capturing market share. |

| Question Mark | 737 MAX Fleet Acquisition | Modernization with uncertain revenue and market share impact. | Profitability, route optimization, operational integration. |

BCG Matrix Data Sources

Our EL AL BCG Matrix is informed by publicly available financial statements, industry growth forecasts, and route performance data. This blend ensures a comprehensive view of market share and industry attractiveness.