Ehrmann AG SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ehrmann AG Bundle

Ehrmann AG's SWOT analysis reveals a strong brand reputation and established market presence, but also highlights potential challenges in adapting to evolving consumer preferences and increasing competition. Understanding these dynamics is crucial for navigating the dairy market.

Want the full story behind Ehrmann AG's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Ehrmann SE boasts a rich heritage spanning over a century as a family-owned German dairy. This extensive history has cemented its reputation for quality and tradition, fostering significant consumer trust and brand loyalty, particularly in its established European markets.

The company's well-recognized brands, including 'Almighurt' and 'Obstgarten,' are market leaders in their categories. For instance, in 2023, Ehrmann's yogurt products held a significant market share in Germany, demonstrating the enduring appeal of its heritage brands.

Ehrmann AG boasts a wide array of dairy products, encompassing yogurts, quark, desserts, and milk-based drinks, effectively catering to a broad spectrum of consumer preferences. This diversity ensures the company can meet varied tastes and dietary needs within the market.

The company demonstrates a strong commitment to product innovation, exemplified by its successful 'High Protein' range and 'Foodie' drinkable meals. These offerings directly address current consumer demands for health-conscious and convenient food options, reflecting Ehrmann's adaptability to evolving market trends.

This expansive and forward-thinking product portfolio is a key strength, enabling Ehrmann to effectively capture diverse market segments and remain responsive to shifting consumer tastes and preferences. For instance, in 2023, the high-protein dairy segment saw continued growth, with brands like Ehrmann's High Protein yogurt reporting strong sales performance.

Ehrmann SE boasts an impressive global reach, with its dairy products available in over 70 countries. This extensive distribution network is supported by six international production facilities and nine sales offices, underscoring its strong supply chain and market access.

Commitment to Quality Ingredients and Rigorous Control

Ehrmann AG’s commitment to quality is a significant strength, rooted in its daily sourcing of fresh milk from family-run farms in Germany's Allgäu region, a prime area for traditional dairy farming. This dedication ensures a high-quality raw material, forming the foundation of their product excellence.

The company’s rigorous quality control is evident in its extensive daily laboratory analyses, with approximately 2,300 tests conducted each day. This meticulous approach guarantees product safety and consistency, building strong consumer trust.

This unwavering focus on quality ingredients and stringent control processes serves as a key differentiator for Ehrmann in the highly competitive dairy market.

- Daily Milk Sourcing: Fresh milk collected daily from Allgäu family farms.

- Rigorous Quality Control: Approximately 2,300 laboratory analyses performed daily.

- Consumer Confidence: High standards build trust and brand loyalty.

- Market Differentiation: Quality focus sets Ehrmann apart from competitors.

Proactive Stance on Sustainability

Ehrmann AG actively champions sustainability, integrating social and ecological responsibility into its core operations. This commitment is exemplified by its alignment with global frameworks like the Science Based Targets initiative (SBTi), aiming to significantly reduce its carbon footprint. For instance, in 2024, the company continued its investment in renewable energy sources for its production facilities, aiming for a 15% reduction in Scope 1 and 2 emissions by 2027 compared to a 2022 baseline.

This forward-thinking approach to environmental stewardship and ethical business practices appeals to a growing segment of consumers who prioritize eco-friendly and socially responsible brands. Market research from 2024 indicates that over 60% of German consumers are willing to pay a premium for sustainably produced food products, a trend Ehrmann is well-positioned to capitalize on.

- Commitment to SBTi: Ehrmann is actively working towards science-based targets for carbon reduction.

- Consumer Appeal: Proactive sustainability efforts resonate with eco-conscious consumers.

- Market Advantage: Positions Ehrmann favorably in a market increasingly valuing environmental responsibility.

- Investment in Renewables: Continued investment in renewable energy for production facilities in 2024.

Ehrmann SE benefits from a strong brand portfolio, including market-leading yogurts like Almighurt and Obstgarten, which consistently demonstrate significant market share in Germany. This brand recognition, built over decades, translates into substantial consumer loyalty and trust, a critical asset in the competitive dairy sector.

The company's commitment to product innovation is a notable strength, evident in its successful launches of high-protein dairy and convenient drinkable meals. These products align with current consumer trends favoring health and convenience, as seen in the continued growth of the high-protein dairy segment in 2023, where Ehrmann's offerings performed well.

Ehrmann's extensive global distribution network, reaching over 70 countries and supported by international production and sales offices, provides a significant competitive advantage. This broad market access ensures consistent product availability and allows the company to leverage economies of scale.

The company's dedication to quality, from sourcing fresh milk daily from German family farms to conducting approximately 2,300 daily laboratory analyses, underpins its reputation. This rigorous quality control is a key differentiator, fostering consumer confidence and brand preference.

What is included in the product

Analyzes Ehrmann AG’s competitive position through key internal and external factors.

Highlights key strategic advantages and potential threats for Ehrmann AG, enabling proactive risk mitigation and opportunity capitalization.

Weaknesses

Ehrmann AG's significant reliance on traditional dairy products presents a notable weakness. Despite ongoing innovation, the company's core revenue streams are tied to a market segment experiencing a downward trend in per capita consumption in crucial regions, such as Germany. For instance, German per capita milk consumption has been on a gradual decline, falling from approximately 89.3 kg in 2010 to around 83.7 kg by 2022, a trend that could impact Ehrmann's sales volume for its traditional offerings.

This deep-rooted dependency on conventional dairy exposes Ehrmann to substantial risk if the consumer shift towards plant-based alternatives gains further momentum. Should the pace of this diversification outstrip Ehrmann's own strategic moves into these growing markets, the company could face significant headwinds. The broader European agricultural landscape also adds complexity, with structural challenges impacting raw milk availability, particularly within Germany, which could affect production costs and supply chain stability for its foundational dairy products.

Ehrmann AG faces formidable competition in the dairy sector, a market characterized by significant consolidation and the presence of global giants like Lactalis Group and Arla Foods. This intense rivalry, further amplified by emerging plant-based alternatives, puts considerable strain on Ehrmann's pricing strategies and profit margins. For instance, the global dairy market, valued at over $900 billion in 2023, sees significant market share held by these large players, demanding substantial R&D and marketing expenditures from companies like Ehrmann to remain competitive.

Ehrmann AG, as a global dairy producer, faces significant risks from supply chain disruptions. Events like geopolitical tensions or extreme weather patterns can limit the availability of key inputs, driving up costs. For instance, the ongoing geopolitical instability in Eastern Europe has impacted global commodity markets, including dairy and feed, leading to price surges for European dairy farmers in 2024.

The company's profitability is also susceptible to cost volatility. Fluctuations in raw milk prices, which are a primary input, can directly affect production expenses. In 2024, European milk prices saw considerable swings, influenced by feed costs and farmer sentiment, presenting a constant challenge for cost management at Ehrmann.

Adaptation to Rapidly Evolving Consumer Preferences

Ehrmann AG faces a significant hurdle in keeping pace with the swift shifts in what consumers want, especially the growing desire for plant-based, low-sugar, and minimally processed foods. This requires constant agility in developing new products and refining marketing approaches to effectively tap into these expanding market niches.

The company must be prepared to quickly pivot its product portfolio and communication strategies. For instance, the plant-based sector, while growing, also sees consumers expressing concern over ultra-processed options, demanding cleaner ingredient lists.

- Market Shift: Consumer demand for plant-based alternatives surged, with the global plant-based food market projected to reach $162 billion by 2030, up from $29.7 billion in 2020, according to Bloomberg Intelligence.

- Health Focus: A 2024 survey by NielsenIQ indicated that 45% of consumers are actively reducing their sugar intake, highlighting the pressure on traditional dairy products.

- Innovation Lag: Failure to quickly introduce appealing, less processed alternatives could lead to market share erosion as competitors capitalize on these evolving preferences.

Limited Public Disclosure of Specific Emissions Data

While Ehrmann AG expresses a commitment to sustainability and aligns with the Science Based Targets initiative (SBTi), the current public unavailability of specific, absolute carbon emissions data presents a potential transparency gap. This absence might make it challenging for investors and stakeholders to benchmark Ehrmann's environmental performance against competitors who offer more granular reporting.

This lack of detailed disclosure could impede the company's ability to fully demonstrate its environmental progress and could be a point of concern for financially-literate decision-makers and environmentally-focused stakeholders who value quantifiable data. For instance, in 2023, many food and beverage companies increased their ESG reporting, with some detailing Scope 1, 2, and 3 emissions, which Ehrmann currently does not publicly provide in absolute terms.

- Limited Benchmarking: The absence of specific absolute emissions data hinders direct comparison with industry peers who disclose such figures.

- Perceived Transparency Gap: Stakeholders seeking detailed environmental metrics may view this as a lack of complete transparency.

- Hindered Progress Showcase: The company may not be fully capitalizing on opportunities to highlight its environmental achievements through detailed data.

Ehrmann AG's reliance on traditional dairy products is a significant weakness, especially as per capita milk consumption declines in key markets like Germany. This trend, with German milk consumption falling from approximately 89.3 kg in 2010 to about 83.7 kg by 2022, directly impacts sales of core offerings. The company's vulnerability to the growing plant-based alternative market is amplified by this dependency, potentially leading to market share erosion if diversification efforts lag behind consumer shifts.

What You See Is What You Get

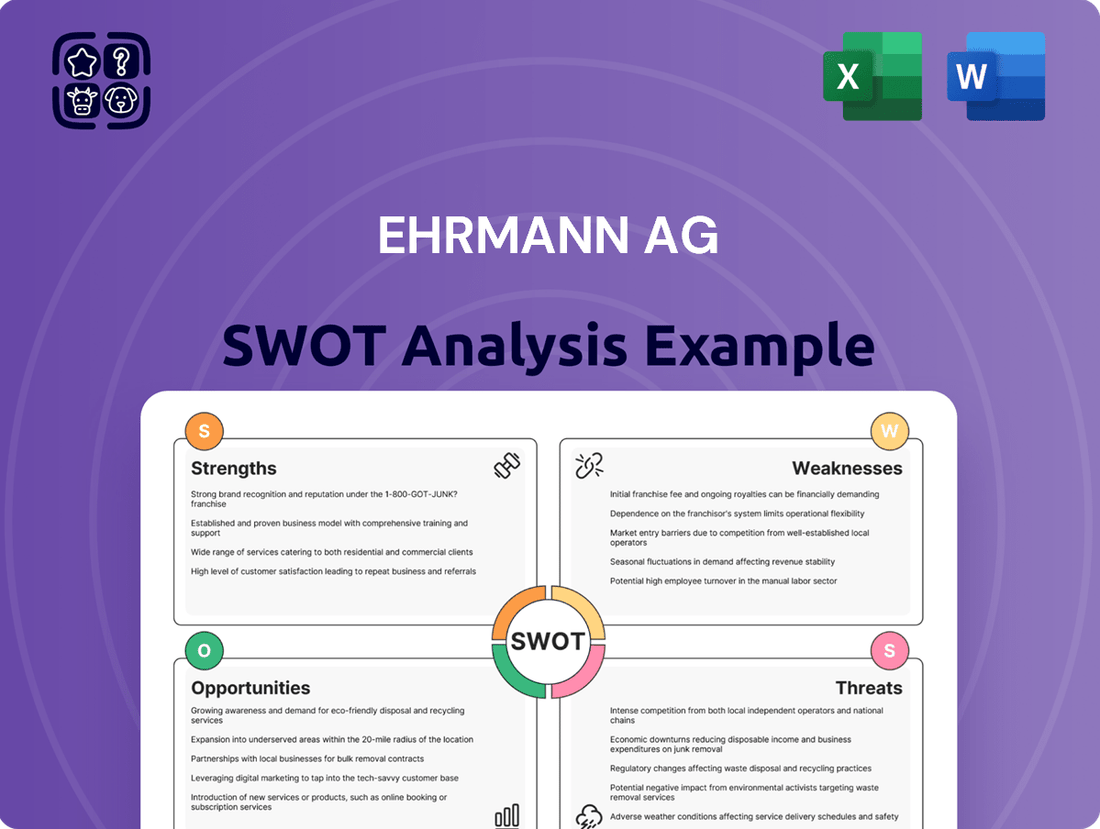

Ehrmann AG SWOT Analysis

This is the actual Ehrmann AG SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and actionable insights.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, revealing all strategic components.

This is a real excerpt from the complete Ehrmann AG SWOT analysis. Once purchased, you’ll receive the full, editable version ready for your strategic planning.

Opportunities

Ehrmann AG can leverage the booming plant-based dairy market, which is expected to hit around $114 billion by 2035. This growth is fueled by consumers seeking healthier, eco-friendly, and ethically produced food options.

The company has a prime opportunity to broaden its current plant-based product lines and introduce novel items. Focusing on areas like plant-based cheese and yogurt, Ehrmann can cater to consumer desires for superior taste, texture, and nutritional value.

Ehrmann AG has a significant opportunity to expand its product line into functional foods, tapping into the growing consumer demand for health-conscious options. For instance, the global functional foods market was valued at approximately $277 billion in 2023 and is projected to reach over $450 billion by 2030, indicating substantial growth potential. Developing products with added probiotics for digestive health or higher protein content aligns with these consumer trends.

Furthermore, there's a clear avenue for developing more convenient, on-the-go, and snacking-focused dairy and dairy alternative products. This caters to increasingly busy lifestyles and the desire for quick, healthy options. The convenience food market in Europe alone is expected to see robust growth, with dairy-based snacks being a key segment.

Ehrmann AG's existing global footprint, reaching over 70 countries, presents a significant opportunity for strategic geographic market expansion. The company can capitalize on growing demand for dairy and dairy alternatives in emerging economies, particularly in regions experiencing rising disposable incomes and increased health consciousness.

For instance, by analyzing market reports from 2024 and early 2025, Ehrmann could pinpoint specific high-growth markets in Southeast Asia or Africa where dairy product consumption is projected to increase by an estimated 5-7% annually. This expansion could involve setting up new production facilities to cater to local tastes and regulations, or bolstering existing distribution channels to ensure wider product availability.

Enhance Brand Value Through Sustainability Leadership

Ehrmann can significantly boost its brand image by making sustainability a core part of its identity. As consumer demand for eco-friendly products rises, particularly among younger demographics, showcasing genuine progress in areas like reduced packaging waste and ethical sourcing can attract and retain customers. For instance, a 2024 survey indicated that 68% of consumers are more likely to purchase from brands with strong environmental commitments.

By actively leading in sustainable practices, Ehrmann can differentiate itself in a competitive market. This leadership could involve investing in renewable energy for its production facilities or pioneering biodegradable packaging solutions. Such initiatives not only appeal to environmentally conscious consumers but can also lead to operational efficiencies and cost savings over time, potentially allowing for premium pricing on products that highlight their sustainable attributes.

Key opportunities for Ehrmann to enhance brand value through sustainability leadership include:

- Transparently communicating progress on sustainability targets: Sharing data on carbon footprint reduction and waste management improvements can build trust.

- Investing in sustainable packaging innovation: Developing and adopting more eco-friendly packaging materials can resonate with consumers.

- Highlighting ethical and sustainable sourcing practices: Emphasizing fair labor and environmentally sound agricultural methods for ingredients can strengthen brand appeal.

- Achieving recognized sustainability certifications: Obtaining certifications like B Corp or specific environmental labels can validate claims and enhance credibility.

Pursue Strategic Mergers, Acquisitions, and Partnerships

Ehrmann AG can significantly boost its growth and market reach by pursuing strategic mergers, acquisitions, and partnerships. This approach has already proven effective, as seen in their acquisition of Trewithen Dairy in the UK, which expanded their presence in a key European market.

Such strategic alliances offer several key advantages:

- Market Expansion: Gaining immediate access to new geographic regions or customer segments.

- Product Portfolio Enhancement: Integrating new product lines or complementary offerings to diversify revenue streams.

- Technological Advancement: Acquiring innovative technologies or intellectual property to stay ahead of competitors.

- Capacity Building: Increasing production capabilities or operational efficiencies through shared resources or expanded facilities.

Ehrmann AG can capitalize on the growing demand for plant-based products, a market projected to reach $114 billion by 2035, by expanding its current offerings and introducing new items like plant-based cheese and yogurt. The company also has a strong opportunity in functional foods, a sector valued at $277 billion in 2023 and expected to grow significantly, by developing products with added health benefits.

Leveraging its global presence in over 70 countries, Ehrmann can target emerging economies with rising incomes and health consciousness, potentially increasing sales by an estimated 5-7% annually in regions like Southeast Asia. Furthermore, emphasizing sustainability, which influences 68% of consumer purchasing decisions according to a 2024 survey, can enhance brand loyalty and market differentiation through initiatives like eco-friendly packaging and ethical sourcing.

Threats

A significant threat for Ehrmann AG is the continuing drop in how much traditional milk and certain dairy items people consume, particularly in established markets such as Germany. This trend, alongside an anticipated decrease in milk output across the EU, could dampen demand for Ehrmann's main products.

For instance, per capita fluid milk consumption in the EU has been on a downward trend, with some reports indicating a decline of over 1% annually in recent years. This necessitates a proactive business model adjustment for Ehrmann to maintain profitability amidst evolving consumer preferences.

The plant-based dairy alternative market is experiencing explosive growth, with new, innovative products constantly entering the fray. This intensified competition directly challenges Ehrmann AG's established market share, as these alternatives become increasingly sophisticated in mimicking traditional dairy products. For instance, the global plant-based milk market was valued at approximately USD 15.8 billion in 2023 and is projected to reach USD 38.7 billion by 2030, growing at a CAGR of 13.7% during the forecast period (2024-2030), according to industry reports.

Consumers are increasingly drawn to plant-based options due to growing concerns about health, sustainability, and animal welfare. This shift in consumer preference could significantly erode Ehrmann's traditional dairy customer base, forcing the company to adapt its product offerings and marketing strategies to remain competitive in this evolving landscape.

Ehrmann AG is significantly exposed to the threat of fluctuating raw material prices, with milk being a primary concern. For instance, European milk prices saw considerable volatility in 2023, with some regions experiencing increases of over 15% year-on-year due to factors like feed costs and farmer sentiment, directly impacting Ehrmann's cost of goods sold.

Supply chain disruptions, exacerbated by geopolitical tensions and extreme weather events, pose another substantial threat. The ongoing conflicts in Eastern Europe and climate-related events like droughts in key agricultural regions in 2024 continue to strain global logistics and the availability of essential inputs, potentially leading to production delays and increased transportation expenses for Ehrmann.

Increasing Regulatory Scrutiny and Environmental Compliance Costs

The dairy sector faces growing regulatory pressure, with potential for stricter rules on animal welfare, emissions, and waste. For Ehrmann AG, this could translate into higher operational expenses and necessary investments in new technologies or processes to meet these evolving environmental standards.

Compliance costs are a significant concern. For instance, the European Union's Farm to Fork strategy, aiming for more sustainable food systems, could introduce new requirements impacting dairy production. In 2024, the German agricultural sector, where Ehrmann operates, is already seeing discussions around stricter manure management regulations, which could add substantial costs for dairy farmers and, by extension, processors like Ehrmann.

These increased compliance burdens may affect Ehrmann's profitability if they cannot be fully passed on to consumers or offset by efficiency gains.

- Evolving Environmental Regulations: Dairy industry facing stricter rules on emissions, waste, and animal welfare.

- Increased Operational Costs: Compliance may necessitate higher spending on technology and process improvements.

- Potential Impact on Profitability: Difficulty in passing on costs could affect Ehrmann's financial performance.

Economic Downturns and Inflationary Pressures

Global economic slowdowns and persistent inflation pose a significant threat to Ehrmann AG. These conditions can erode consumer spending power, prompting a move towards less expensive private label goods or budget-friendly alternatives. For instance, in early 2024, inflation rates in key European markets remained elevated, impacting household budgets.

This shift in consumer behavior could directly affect Ehrmann's sales volume, particularly for its premium product lines, as economic uncertainty encourages a focus on value. A prolonged period of reduced disposable income could lead to a noticeable decline in overall revenue for the company, as brand preference takes a backseat to affordability.

- Reduced Consumer Spending: Higher inflation directly curtails discretionary income, making premium dairy products less accessible.

- Shift to Private Labels: Retailers' own-brand offerings often present a lower-cost alternative, directly competing with Ehrmann's market share.

- Impact on Premium Pricing: Ehrmann's ability to maintain premium pricing may be challenged if consumers are unwilling or unable to pay more.

- Revenue Decline: A sustained economic downturn could lead to a tangible decrease in Ehrmann's top-line financial performance.

The increasing popularity of plant-based dairy alternatives presents a substantial threat, as this market is projected to grow significantly. For example, the global plant-based milk market was valued at approximately USD 15.8 billion in 2023 and is expected to reach USD 38.7 billion by 2030, indicating a robust CAGR of 13.7% for the period 2024-2030. This surge is driven by consumer interest in health, sustainability, and animal welfare, directly challenging Ehrmann's traditional dairy offerings and potentially eroding its customer base.

Ehrmann AG also faces threats from fluctuating raw material prices, particularly for milk, which saw considerable volatility in 2023 with some European regions experiencing increases over 15% year-on-year. Furthermore, evolving environmental regulations, such as those stemming from the EU's Farm to Fork strategy and discussions around stricter manure management in Germany for 2024, could lead to increased operational costs and necessitate significant investments in new technologies or processes to ensure compliance.

Global economic slowdowns and persistent inflation, as seen with elevated inflation rates in key European markets in early 2024, directly impact consumer spending power. This economic pressure can lead consumers to opt for less expensive private label goods or budget-friendly alternatives, potentially reducing sales volume for Ehrmann's premium product lines and impacting overall revenue.

SWOT Analysis Data Sources

Ehrmann AG's SWOT analysis is built upon a robust foundation of financial statements, comprehensive market research, and expert industry commentary. This ensures a data-driven approach, incorporating real-time performance metrics and forward-looking market trends for accurate strategic insights.