Ehrmann AG PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ehrmann AG Bundle

Navigate the complex external forces shaping Ehrmann AG's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors impacting the dairy giant. Gain a strategic advantage by foreseeing challenges and identifying opportunities within the industry. Download the full PESTLE analysis now to unlock actionable intelligence and refine your market strategy.

Political factors

The EU's Common Agricultural Policy (CAP) for 2023-2027 and the ambitious EU Green Deal are fundamentally reshaping the European dairy landscape, directly impacting companies like Ehrmann AG. These directives, while championing sustainable farming, introduce new compliance requirements that can increase operational costs for dairy producers throughout the Union.

These policy shifts place additional financial burdens on farmers, potentially affecting milk supply volumes and overall profitability within the EU dairy sector. For instance, the push for reduced pesticide use and enhanced biodiversity under the Green Deal can necessitate investments in new farming techniques or equipment.

Furthermore, the European Commission's recent pivot from the 'Farm to Fork' strategy to a 'Vision for Agriculture and Food' signals a recalibration. This new vision places a greater emphasis on the economic viability of farming enterprises, aiming to balance environmental aspirations with the practical need for profitable agricultural operations.

The German government actively supports its dairy sector, a cornerstone of the nation's agricultural output. In 2023, Germany remained the largest milk producer in the European Union, processing approximately 31.5 million tonnes of milk. This strong governmental backing often translates into subsidies and programs designed to enhance farmer competitiveness and facilitate adaptation to evolving environmental and quality standards, thereby fostering a more stable operational landscape for companies like Ehrmann AG.

Ehrmann AG's export success is significantly influenced by international trade policies, particularly EU Free Trade Agreements. These agreements, like the one with Canada, reduce barriers for dairy products, opening up new markets. For instance, the EU's trade deal with Mercosur, though facing ongoing discussions, could further reshape the competitive landscape for European food producers by potentially lowering tariffs on agricultural imports.

Changes in trade relationships, such as potential US tariffs on European goods, pose a risk. A hypothetical 10% tariff on dairy exports to the US, for example, could increase Ehrmann's costs and reduce its competitiveness. Conversely, the EU's proactive trade strategy aims to secure favorable terms for its agricultural sector, balancing opportunities for dairy exports against the influx of competing products from countries with different trade regulations.

Geopolitical Instabilities

Geopolitical instabilities significantly shape the operating environment for companies like Ehrmann AG. Ongoing conflicts and escalating trade tensions, such as those observed in Eastern Europe and between major economic blocs in 2024, contribute to a volatile global economic outlook. This uncertainty directly impacts the food industry by disrupting supply chains and increasing energy costs.

For Ehrmann, these external pressures translate into tangible challenges. Price volatility for key raw materials, including dairy and agricultural inputs, is a direct consequence of these geopolitical shifts. Furthermore, logistical risks, such as port congestion or trade route disruptions, can impede the efficient movement of goods, necessitating a proactive approach to supply chain resilience.

- Supply Chain Disruptions: The ongoing conflict in Ukraine, for instance, has continued to affect global grain and fertilizer prices in 2024, with ripple effects on feed costs for dairy cows.

- Energy Cost Volatility: Geopolitical tensions often lead to fluctuations in oil and gas prices, directly impacting transportation and production energy expenses for food manufacturers.

- Trade Policy Uncertainty: Shifting trade agreements and tariffs between major economies can alter market access and the cost of imported ingredients or exported finished goods.

- Increased Risk Premiums: Financial institutions may demand higher risk premiums for investments in regions perceived as unstable, potentially affecting capital access for expansion or operational upgrades.

Consumer Protection and Food Safety Oversight

Political factors significantly influence Ehrmann AG, particularly concerning consumer protection and food safety. Governmental bodies like Germany's Federal Office of Consumer Protection and Food Safety (BVL) play a crucial role by continuously updating food safety regulations and conducting targeted checks to ensure consumer health protection. These regulations, often harmonized with broader EU law, dictate standards for hygiene, permissible residues, and additives.

Ehrmann AG must maintain rigorous adherence to these evolving standards to safeguard consumer trust and ensure continued market access. For instance, in 2024, the BVL continued its focus on pesticide residue monitoring, with reports indicating a high compliance rate among dairy producers, though specific data for Ehrmann's product lines would require direct disclosure. Failure to comply can lead to significant fines and reputational damage, impacting sales and brand loyalty.

- Regulatory Compliance: Ehrmann AG must align with Germany's BVL and EU food safety directives, covering hygiene, residues, and additives.

- Consumer Trust: Adherence to stringent food safety standards is paramount for maintaining consumer confidence and brand reputation.

- Market Access: Compliance with national and EU regulations is a prerequisite for selling products within these key markets.

Governmental support for the German dairy sector remains robust, with Germany continuing its position as the EU's largest milk producer. In 2023, approximately 31.5 million tonnes of milk were processed in Germany, underscoring the sector's economic importance and the likelihood of continued policy support. This governmental backing, often in the form of subsidies and programs, helps companies like Ehrmann AG navigate evolving environmental and quality standards, fostering a more stable operational environment.

What is included in the product

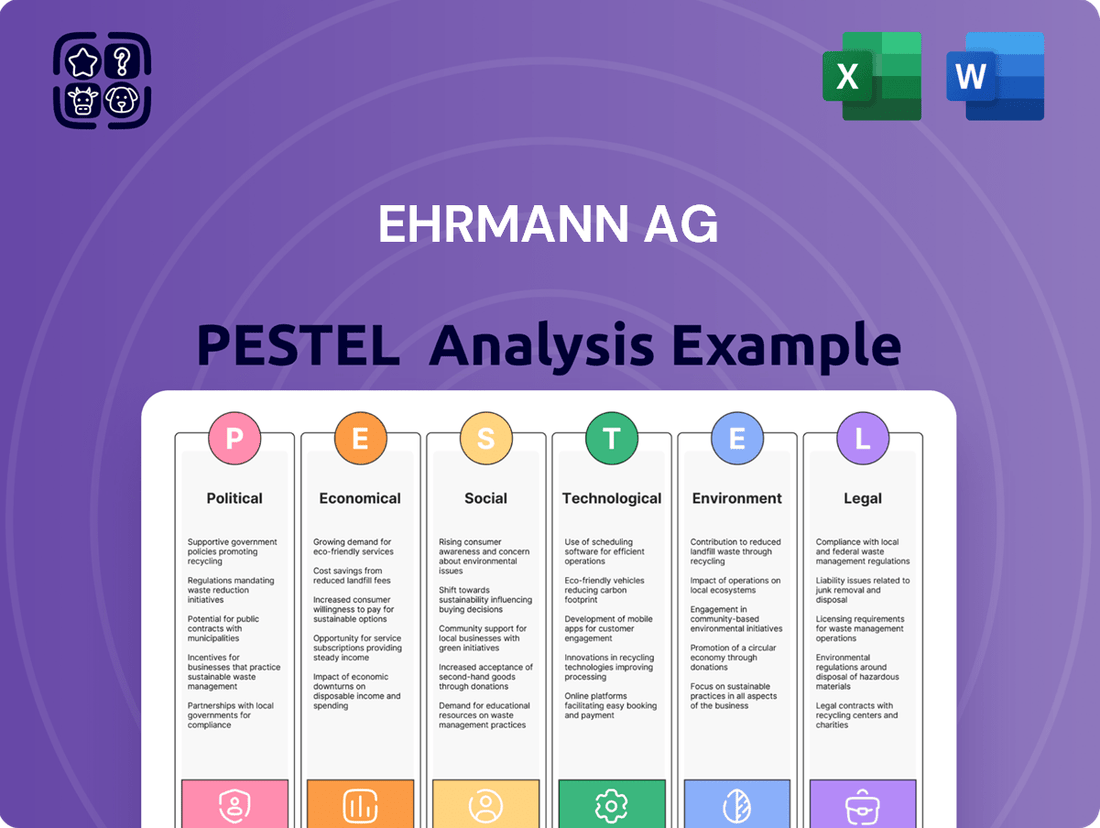

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Ehrmann AG, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version of the Ehrmann AG PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, streamlining strategic discussions.

Economic factors

High inflation across Europe, especially in food, is making consumers more careful with their money and focus on value. For example, in early 2024, Eurozone inflation hovered around 2.4%, with food prices seeing significant increases throughout 2023.

Even as overall food inflation starts to cool, the costs for making food and drinks stay high. Manufacturers often pass these higher costs onto shoppers, meaning prices for many items, including dairy, remain elevated.

This economic pressure impacts demand for premium dairy products from companies like Ehrmann AG. Consumers might shift towards cheaper alternatives or store-brand options to manage their budgets, affecting sales volumes for higher-priced goods.

Dairy processors such as Ehrmann AG are significantly impacted by the fluctuating costs of essential inputs. Raw milk prices, a primary component, along with feed for livestock, represent substantial and often volatile expenses. This volatility directly affects the company's cost of goods sold and overall profitability.

Energy costs have seen a notable upward trend since early 2024, a factor that permeates the entire European food industry. For Ehrmann, this translates to higher expenses not only in manufacturing processes but also in the crucial areas of refrigeration and transportation, adding pressure to operational budgets.

Effectively managing these unpredictable input costs is paramount for Ehrmann to sustain healthy profit margins. This challenge is amplified by the forecast of a decline in milk production within the European Union, potentially tightening supply and further increasing raw material prices.

The German dairy market, a substantial USD 26.67 billion industry in 2024, is experiencing a dual evolution. While demand for traditional dairy, particularly high-protein and functional options, continues to rise, the plant-based dairy alternatives sector is also booming. This burgeoning plant-based market in Germany is forecast to hit USD 3,779.5 million by 2030, presenting a clear challenge and opportunity for companies like Ehrmann AG.

Decline in EU Milk Production

EU milk production is projected for a slight decrease in 2025. This downturn is attributed to fewer dairy cows, squeezed profit margins for farmers, stricter environmental rules, and the impact of animal diseases. For instance, the European Commission's short-term outlook for EU agricultural markets in 2025 anticipates a 0.5% reduction in milk deliveries compared to 2024.

This tightening of raw milk supply, especially in key dairy nations like Germany, creates a challenge for processors. It forces companies such as Ehrmann AG to focus on producing higher-margin items like cheese, potentially diverting milk away from other product lines.

The declining availability of raw milk can significantly affect Ehrmann's ability to secure sufficient inputs for its diverse product portfolio. This trend necessitates a strategic review of sourcing practices and production priorities to navigate the evolving dairy landscape.

- Forecasted EU Milk Production Decline: A marginal decrease of 0.5% is anticipated for 2025.

- Key Drivers: Reduced cow numbers, tight farmer margins, environmental regulations, and disease outbreaks.

- Impact on Processors: Pressure to prioritize high-value products like cheese due to reduced raw material availability.

- Strategic Implications for Ehrmann: Potential challenges in raw material sourcing and the need to adapt production strategies.

Growth of Private Label and Discounters

As inflation continues to impact consumer spending power, private label brands are experiencing significant growth, particularly within the dairy and broader food sectors. This trend is directly linked to consumers actively seeking more affordable alternatives, leading to a noticeable shift in market share away from established brands.

Discounters are also benefiting from this economic climate, attracting a larger customer base that prioritizes value. For companies like Ehrmann AG, this means facing intensified competition from these private label offerings and the aggressive pricing strategies of discounters.

To navigate this challenging landscape, Ehrmann AG must strategically position its branded products. This involves highlighting unique selling propositions beyond price, such as quality, innovation, or brand loyalty, to retain its market share in an increasingly cost-conscious consumer environment.

For instance, during 2024, reports indicated that private label market share in the UK grocery sector reached a new high, exceeding 50% in some categories. This demonstrates the tangible impact of economic pressures on consumer behavior and the growing dominance of store brands.

The economic environment in 2024 and 2025 presents a complex picture for dairy companies like Ehrmann AG. High inflation, particularly in food items, is making consumers more budget-conscious, leading them to seek value and potentially opt for private label brands or discount retailers. This economic pressure also impacts the cost of production, with rising energy and input costs for farmers squeezing profit margins.

The German dairy market, valued at approximately USD 26.67 billion in 2024, is also seeing a rise in plant-based alternatives, which is projected to reach USD 3,779.5 million by 2030. This dual trend of cost sensitivity and evolving consumer preferences creates a challenging landscape for traditional dairy producers.

Furthermore, a slight decline in EU milk production is anticipated for 2025, with a projected 0.5% reduction. This is driven by factors such as fewer dairy cows, reduced farmer profitability, and stricter environmental regulations, which could further impact raw material availability and costs for companies like Ehrmann AG.

| Economic Factor | Data Point / Trend | Impact on Ehrmann AG |

|---|---|---|

| Inflation | Eurozone inflation around 2.4% (early 2024); food prices significantly up in 2023. | Reduced consumer spending on premium products; increased price sensitivity. |

| Input Costs | Rising energy costs; volatile raw milk and feed prices. | Higher production costs; pressure on profit margins. |

| Market Dynamics | Growth in private label brands (e.g., >50% share in some UK categories in 2024); discounters gaining market share. | Intensified competition; need to emphasize brand value beyond price. |

| EU Milk Production | Projected 0.5% decrease in 2025 due to farmer margins, regulations, and disease. | Potential tightening of raw milk supply; focus on higher-margin products. |

| Plant-Based Alternatives | German market forecast to reach USD 3,779.5 million by 2030. | Need to compete with or integrate plant-based offerings. |

Preview Before You Purchase

Ehrmann AG PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Ehrmann AG PESTLE analysis provides a deep dive into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to a detailed breakdown of Ehrmann AG's strategic landscape, enabling informed decision-making.

The content and structure shown in the preview is the same document you’ll download after payment. This Ehrmann AG PESTLE analysis is meticulously researched and presented for your professional use.

Sociological factors

Following the COVID-19 pandemic, there's a noticeable surge in consumer focus on health and wellness. This shift is directly fueling demand for dairy products that offer enhanced nutritional value, such as those rich in protein, containing beneficial probiotics, or formulated with lower fat content. For instance, in Germany, a significant market for Ehrmann AG, consumers are actively seeking out fortified yogurts, milk with added protein, and dairy options that support gut health.

Ehrmann AG's existing product lines, which include a variety of yogurts and quark, are well-positioned to capitalize on this escalating consumer preference for healthier dairy alternatives. The company's offerings align directly with the growing market for functional foods designed to promote well-being. In 2024, the German dairy market saw continued growth in the health and wellness segment, with sales of high-protein dairy products increasing by an estimated 7% year-over-year.

The market for plant-based dairy alternatives is experiencing robust growth, with consumers increasingly opting for vegan, lactose-free, or environmentally conscious choices. This trend encompasses plant-based milks, yogurts, and cheeses, as well as innovative hybrid products that blend dairy with plant-based ingredients.

Globally, the plant-based food market was valued at approximately $29.4 billion in 2023 and is projected to reach $161.9 billion by 2030, demonstrating a compound annual growth rate of 27.4%. Within this, the plant-based dairy segment is a significant contributor, driven by health and sustainability concerns. For instance, sales of plant-based milk in the US alone surpassed $2.5 billion in 2023.

Ehrmann AG must strategically address this evolving consumer preference. This could involve enhancing their traditional dairy offerings or exploring diversification into the burgeoning plant-based dairy and hybrid product sectors to maintain market relevance and capture new growth opportunities.

Consumers, particularly millennials and Gen Z, are increasingly vocal about their demand for sustainable and ethically produced goods. In 2024, surveys indicated that over 60% of consumers are willing to pay a premium for products from environmentally conscious brands. This trend directly impacts the dairy industry, with a growing preference for organic and responsibly sourced milk. Ehrmann AG's commitment to quality ingredients and sustainable farming practices aligns with these evolving consumer expectations, positioning them favorably in a market that values transparency and ethical sourcing.

Demand for Convenience and On-the-Go Formats

Modern life moves fast, and consumers are increasingly looking for products that fit their busy schedules. This means a growing demand for ready-to-eat, single-serving, and easily portable dairy options, like mini-packs and portion-controlled desserts. These convenient formats not only simplify consumption but also help consumers manage portion sizes and reduce food waste, aligning with sustainability concerns.

Ehrmann AG can strategically leverage this societal shift by expanding its portfolio of convenient packaging solutions. For instance, offering a wider array of yogurts and desserts in compact, resealable, or easily disposable single-serving containers directly addresses the needs of consumers who are often eating away from home. This focus on portability and ease of use is crucial for capturing market share in the current consumer landscape.

- Growing Demand: The global market for convenient foods, including dairy, has seen significant growth. In 2023, the on-the-go food market was valued at over $140 billion and is projected to continue expanding.

- Consumer Preference: Research indicates that over 60% of consumers prioritize convenience when making food purchasing decisions, especially for snacks and breakfast items.

- Waste Reduction: Single-serving packs can contribute to reduced food waste, a factor that resonates with an increasing number of environmentally conscious consumers.

- Product Innovation: Companies like Ehrmann can innovate with packaging that is not only convenient but also sustainable, further appealing to this demographic.

Aging Population and Specific Nutritional Needs

Germany's demographic landscape is notably characterized by an aging population, with the proportion of individuals aged 65 and over steadily increasing. As of 2023, this age group represented over 22% of the German population, a figure projected to continue its upward trend. This demographic shift directly influences consumer behavior, fostering a heightened demand for dairy products that support healthy aging. Consumers are increasingly seeking options that contribute to muscle health, provide essential nutrients, and bolster immune function.

Ehrmann AG has a significant opportunity to cater to these evolving needs. Innovations in product development can focus on dairy items fortified with ingredients like whey protein, known for its role in muscle synthesis, or lactoferrin, which supports immune responses. For instance, a 2024 market analysis indicated a 15% year-over-year growth in the functional foods segment targeting seniors. This presents a clear pathway for Ehrmann to expand its product portfolio by offering specialized dairy solutions.

- Demographic Trend: Germany's population aged 65+ is over 22% as of 2023, a growing segment.

- Consumer Demand: Increased interest in dairy products supporting muscle health, nutrition, and immunity.

- Market Growth: The functional foods market for seniors saw a 15% growth in 2024.

- Innovation Opportunity: Fortifying products with whey protein or lactoferrin to meet specific nutritional needs.

Societal shifts are profoundly impacting consumer preferences in the dairy sector, with a growing emphasis on health and wellness. This translates into increased demand for products fortified with protein, probiotics, or lower fat content, reflecting a proactive approach to personal well-being. For Ehrmann AG, this presents a clear opportunity to align its product development with these evolving consumer priorities.

The increasing demand for convenience is another significant sociological factor, driving the popularity of single-serving and portable dairy options. Consumers, especially those with busy lifestyles, are seeking products that are easy to consume on-the-go, such as mini-packs and portion-controlled desserts. This trend allows companies like Ehrmann to innovate with packaging that enhances portability and user experience.

Ethical consumption and sustainability are also becoming paramount, with consumers, particularly younger generations, prioritizing brands that demonstrate environmental responsibility and transparent sourcing. In 2024, a substantial majority of consumers expressed a willingness to pay more for products from eco-conscious companies. Ehrmann's commitment to quality and sustainable practices positions it favorably to meet these expectations.

Germany's aging population, representing over 22% of the populace in 2023, is also shaping market demand, leading to a greater need for dairy products that support healthy aging, such as those aiding muscle health and immunity. This demographic trend offers Ehrmann a strategic avenue to develop specialized, functional dairy offerings.

| Sociological Factor | Impact on Dairy Consumption | Ehrmann AG Opportunity |

|---|---|---|

| Health & Wellness Focus | Increased demand for fortified, low-fat, and probiotic-rich dairy products. | Expand product lines with enhanced nutritional profiles. |

| Demand for Convenience | Growth in single-serving, portable, and ready-to-eat dairy items. | Develop and promote convenient packaging and portion sizes. |

| Ethical & Sustainable Consumption | Preference for organic, responsibly sourced, and transparently produced dairy. | Highlight sustainable practices and ingredient sourcing. |

| Aging Population | Rising demand for dairy supporting muscle health, immunity, and overall well-being in seniors. | Innovate with functional ingredients targeting age-related nutritional needs. |

Technological factors

Automation is significantly transforming the dairy industry, boosting efficiency and consistency while lowering labor expenses on production lines. For instance, by 2024, the global dairy automation market was projected to reach over $3.5 billion, indicating a strong trend towards integrating advanced technologies.

Robotic systems are becoming commonplace in milking, processing, and packaging, which helps reduce human error and meet the growing demand for high-quality dairy products manufactured at scale. This adoption is crucial for companies like Ehrmann AG to maintain competitiveness.

Ehrmann AG can capitalize on these technological advancements to streamline its manufacturing operations and enhance overall efficiency. By investing in robotic milking systems, for example, Ehrmann could see a reduction in labor costs by up to 15-20% per farm, as reported in industry analyses from early 2025.

Advanced data analytics and AI are revolutionizing how companies like Ehrmann AG operate. Digital tools, including AI and the Internet of Things (IoT), allow for real-time monitoring of production lines. This continuous stream of data provides invaluable insights, helping to pinpoint inefficiencies and streamline operations. For instance, in 2024, many food manufacturers reported significant improvements in waste reduction, with some seeing a decrease of up to 15% through AI-driven process optimization.

Furthermore, artificial intelligence is proving indispensable for achieving more accurate demand forecasting. By sifting through vast datasets, including historical sales, market trends, and even weather patterns, AI can predict consumer demand with greater precision. This capability is crucial for a company like Ehrmann, enabling them to better manage inventory and reduce the risk of overstocking or stockouts. In 2025, AI-powered forecasting is expected to improve accuracy by an average of 10-20% compared to traditional methods.

The implementation of these technologies allows Ehrmann to fine-tune critical aspects of its business. This includes optimizing production schedules to match predicted demand, refining distribution networks for faster delivery, and ensuring inventory levels are perfectly balanced. Such precision not only cuts costs but also enhances customer satisfaction by ensuring product availability. Companies adopting these advanced analytics in 2024 often saw a boost in operational efficiency, with some reporting a 5-8% increase in overall productivity.

Sophisticated sensor technology is revolutionizing dairy operations for companies like Ehrmann AG. Real-time monitoring of raw milk quality, including temperature and acidity, is becoming standard across the supply chain, ensuring product integrity. For instance, advancements in biosensors can detect somatic cell counts, a key indicator of udder health, with greater accuracy and speed than traditional methods.

Wearable sensors for livestock are also gaining traction, offering significant benefits for animal welfare and farm efficiency. These devices can track vital signs and activity levels in calves and cattle, allowing for early detection of illness and reducing mortality rates. In 2024, studies indicated that smart monitoring systems could decrease calf mortality by up to 15%, directly impacting operational costs and herd health.

Innovation in Product Formulation and Packaging

Technological advancements are driving significant innovation in dairy product formulation, enabling Ehrmann AG to develop enhanced beverages. For instance, the incorporation of live cultures, vitamins, and minerals can create dairy drinks with improved nutritional profiles and extended shelf-life, even at ambient temperatures. This trend is supported by a growing consumer demand for functional foods, with the global functional beverage market projected to reach $214.3 billion by 2028, according to Grand View Research.

Packaging innovation is equally critical for Ehrmann's technological strategy. The focus is shifting towards recyclable, biodegradable, and sustainable materials to address environmental concerns and meet consumer expectations. For example, the European Union's Plastic Strategy aims to ensure all plastic packaging is reusable or recyclable by 2030, a regulatory push that aligns with companies prioritizing eco-friendly packaging solutions. Ehrmann can leverage these advancements to not only reduce its environmental footprint but also to enhance product appeal and marketability.

- Enhanced Shelf-Life: Innovations in formulation, such as UHT processing and advanced preservation techniques, allow dairy products to maintain quality for longer periods without refrigeration, potentially reducing spoilage and logistics costs.

- Nutritional Fortification: The integration of probiotics, prebiotics, vitamins, and minerals into dairy beverages caters to the rising demand for health-conscious products. The global probiotics market, for instance, was valued at $52.5 billion in 2023 and is expected to grow.

- Sustainable Packaging Materials: Adoption of materials like recycled PET (rPET), plant-based plastics, or compostable films can significantly lower environmental impact, aligning with corporate sustainability goals and consumer preferences.

- Smart Packaging Solutions: Emerging technologies in smart packaging, such as those indicating product freshness or providing traceability, can further differentiate Ehrmann’s offerings and build consumer trust.

Precision Fermentation for Alternative Dairy

Precision fermentation is a game-changer for the dairy industry, enabling the production of animal-free milk proteins like casein and whey using microorganisms. This technology offers a sustainable path to creating products that closely replicate the taste and nutritional profile of traditional dairy.

For a company like Ehrmann AG, which has a strong foundation in conventional dairy, understanding and potentially investing in precision fermentation presents a forward-looking strategic avenue. The global alternative dairy market is projected to reach $61.4 billion by 2030, highlighting the significant growth potential of these innovative technologies.

- Market Growth: The alternative dairy market is expanding rapidly, with precision fermentation poised to capture a significant share.

- Sustainability Focus: This technology offers a more environmentally friendly approach to dairy production compared to traditional methods.

- Consumer Demand: Growing consumer interest in plant-based and animal-free products drives the adoption of precision fermentation.

- Technological Advancement: Continued innovation in microbial strains and bioprocessing is enhancing the efficiency and scalability of precision fermentation.

Technological advancements are fundamentally reshaping dairy operations for companies like Ehrmann AG, driving efficiency and product innovation. Automation, including robotic milking and advanced processing, is becoming standard, with the global dairy automation market expected to exceed $3.5 billion by 2024. This adoption is crucial for maintaining competitiveness and meeting demand for scaled, high-quality products.

AI and data analytics are revolutionizing production, enabling real-time monitoring and optimized forecasting, with AI-driven process optimization potentially reducing waste by up to 15% in 2024. Furthermore, precision fermentation offers a sustainable route to animal-free dairy proteins, tapping into a rapidly growing alternative dairy market projected to reach $61.4 billion by 2030.

| Technology Area | Key Advancement | Impact on Ehrmann AG | Market Data/Projection |

| Automation | Robotic milking, automated processing | Increased efficiency, reduced labor costs (15-20% potential reduction) | Global dairy automation market > $3.5 billion (2024) |

| Data Analytics & AI | Real-time monitoring, AI forecasting | Waste reduction (up to 15%), improved demand accuracy (10-20% improvement) | AI adoption leading to 5-8% productivity increase |

| Precision Fermentation | Animal-free protein production | Sustainable product development, market diversification | Alternative dairy market $61.4 billion by 2030 |

Legal factors

Ehrmann AG operates under strict food safety and hygiene regulations established by German and European Union legislation. These laws govern every step of the supply chain, from sourcing raw materials to delivering finished products, guaranteeing consumer safety. For instance, the EU's General Food Law (Regulation (EC) No 178/2002) sets out foundational principles and requirements for food businesses, including traceability and hazard analysis.

Staying compliant means Ehrmann must constantly adapt to evolving standards. In 2024, the German Federal Office of Consumer Protection and Food Safety (BVL) continues to enforce these rules, with potential updates to hygiene protocols or allergen labeling requirements. Failure to comply can result in significant fines, product recalls, and damage to Ehrmann's brand reputation, impacting sales which in 2023 saw the German food industry facing increased scrutiny on sustainability and ethical sourcing practices.

The EU's Common Agricultural Policy (CAP) for 2023-2027 mandates specific environmental and sustainability targets for member states, directly impacting dairy farming operations. These regulations, which include requirements for biodiversity protection and reduced pesticide use, can necessitate investments in new equipment or altered farming techniques for dairy producers supplying Ehrmann AG. For instance, the CAP Strategic Plans require member states to allocate a significant portion of their CAP budget to eco-schemes, potentially increasing operational costs for farmers by an estimated 5-10% depending on the specific measures adopted.

The EU Green Deal's ambitious ecological targets translate into significant regulatory shifts for the dairy industry, impacting Ehrmann AG. New rules focus on methane reduction and improved nutrient management, directly affecting agricultural practices. These changes are designed to lessen the environmental impact of dairy farming.

Compliance with these evolving standards, such as those potentially increasing the cost of fertilizer use or requiring investments in manure management technologies, could lead to higher operational expenses for Ehrmann and its suppliers. For instance, the EU aims to cut greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, a broad target that trickles down to agricultural sectors.

Ehrmann must proactively ensure its entire supply chain, from farm to processing, adheres to these increasingly stringent environmental regulations. This includes supporting suppliers in adopting sustainable practices and potentially investing in technologies that mitigate environmental impact, ensuring long-term viability and market access within the EU.

Consumer Protection and Labeling Laws

Germany's robust consumer protection framework, largely harmonized with EU directives, mandates strict adherence to regulations concerning product information and fair commercial practices. These laws, found in acts like the German Civil Code (BGB) and the Act Against Unfair Competition (UWG), dictate everything from contract terms to advertising claims. For Ehrmann AG, this means meticulous attention to detail in product labeling and marketing to ensure full compliance. For instance, in 2023, Germany saw a significant number of consumer complaints related to misleading advertising, highlighting the critical nature of accurate product representation.

Ehrmann AG must navigate a complex web of legislation to safeguard consumer rights and maintain market trust. Key areas include ensuring transparency in pricing, clarity in ingredient lists, and truthful representation of product benefits. Failure to comply can result in substantial fines and reputational damage. The German Federal Office of Justice reported a steady increase in consumer protection cases over the past few years, underscoring the heightened regulatory scrutiny.

Specific legal requirements impacting Ehrmann AG's operations include:

- Accurate Labeling: Ensuring all ingredients, nutritional information, and origin details are clearly and correctly displayed on packaging, aligning with EU Regulation (EU) No 1169/2011 on the provision of food information to consumers.

- Fair Advertising Practices: Avoiding misleading claims about product health benefits, taste, or origin, in line with the UWG's prohibitions against unfair commercial practices. In 2024, the German Advertising Standards Council issued several reprimands for unsubstantiated health claims in the food sector.

- Contractual Transparency: Clearly outlining terms and conditions for any direct-to-consumer sales or subscription services, adhering to the BGB's provisions on consumer contracts.

- Product Safety: Guaranteeing that all products meet stringent German and EU safety standards, with regular monitoring and potential recalls if issues arise.

Animal Welfare Legislation

The European Union is actively developing new animal welfare legislation, signaling a significant shift towards higher ethical standards in farming. While the exact details of upcoming EU-wide regulations are still being finalized, the trajectory is clear: increased scrutiny and stricter requirements for livestock management.

Consumer demand for ethically produced goods is already a powerful force. For instance, in 2024, surveys indicated that over 70% of European consumers consider animal welfare a crucial factor when purchasing dairy products. This sentiment translates into market pressure, compelling companies like Ehrmann AG to proactively adapt their sourcing and operational practices.

Ehrmann must ensure its supply chain adheres to, and ideally surpasses, these evolving welfare standards. This involves not only compliance with current regulations but also anticipating future legislative changes and consumer expectations regarding the treatment of dairy cows. Proactive engagement with animal welfare best practices can mitigate risks and enhance brand reputation.

- Legislative Roadmaps: EU is progressing on new animal welfare directives, impacting dairy farming.

- Consumer Sentiment: Over 70% of European consumers prioritize animal welfare in dairy purchases (2024 data).

- Industry Pressure: Dairy producers face growing pressure to adopt higher welfare standards.

- Ehrmann's Mandate: Aligning sourcing with or exceeding these evolving welfare expectations is critical.

Ehrmann AG operates within a robust legal framework, heavily influenced by German and EU regulations, particularly concerning food safety, consumer protection, and environmental sustainability. Compliance with directives like the EU's General Food Law (Regulation (EC) No 178/2002) and German acts such as the Act Against Unfair Competition (UWG) is paramount. For instance, the German Advertising Standards Council issued several reprimands in 2024 for unsubstantiated health claims in the food sector, underscoring the need for accurate marketing.

The EU's Common Agricultural Policy (CAP) for 2023-2027 and the EU Green Deal impose stringent environmental and animal welfare standards that impact dairy farming, a core part of Ehrmann's supply chain. These regulations may necessitate increased operational costs for suppliers, potentially affecting raw material prices. Surveys in 2024 indicated that over 70% of European consumers consider animal welfare a crucial factor in dairy purchases, adding market pressure for ethical sourcing.

| Legal Area | Key Regulations/Acts | Impact on Ehrmann AG | 2024/2025 Relevance |

|---|---|---|---|

| Food Safety & Hygiene | EU General Food Law (Reg. (EC) No 178/2002) | Mandates traceability, hazard analysis, and strict hygiene protocols across the supply chain. | Continued enforcement by BVL; potential updates to allergen labeling. |

| Consumer Protection | German Civil Code (BGB), Act Against Unfair Competition (UWG) | Requires transparent pricing, accurate labeling, and truthful advertising to avoid misleading consumers. | Heightened scrutiny on marketing claims; 2023 saw increased consumer complaints regarding misleading advertising in Germany. |

| Environmental Sustainability | EU Common Agricultural Policy (CAP 2023-2027), EU Green Deal | Influences dairy farming practices with targets for biodiversity, reduced pesticide use, and methane reduction. | Potential for increased supplier costs due to eco-scheme requirements; EU aims to cut greenhouse gas emissions by 55% by 2030. |

| Animal Welfare | Emerging EU Animal Welfare Legislation | Increasingly strict requirements for livestock management and ethical treatment of dairy cows. | Consumer demand for ethical products is high (over 70% in 2024 surveys); proactive adaptation is critical for brand reputation. |

Environmental factors

The dairy industry, including companies like Ehrmann AG, is under intense scrutiny to curb its greenhouse gas emissions, primarily methane from livestock and nitrous oxide from fertilizers. These emissions are a major focus for environmental regulations and increasingly, consumer demand for sustainable products. For instance, global dairy sector emissions were estimated to be around 3.5% of total anthropogenic greenhouse gas emissions in recent years, highlighting the scale of the challenge.

To address this, dairy producers are exploring solutions like integrating renewable energy sources on farms, such as solar or biogas, and implementing circular economy principles to minimize waste. These efforts aim to reduce the sector's overall environmental impact and meet evolving market expectations for responsible production.

Ehrmann AG's participation in the Science Based Targets initiative (SBTi) demonstrates a commitment to setting ambitious, science-aligned goals for emission reduction. While specific, publicly disclosed emission reduction figures for Ehrmann AG's dairy operations in 2024 or projections for 2025 are still being finalized as part of their SBTi commitment, the company's engagement signals a strategic focus on decarbonization pathways within its value chain.

Dairy farming, the core of Ehrmann AG's operations, is inherently water-intensive. In 2024, agricultural water use globally accounted for approximately 70% of freshwater withdrawals, highlighting the sector's significant demand. Inefficient water management or excessive consumption by Ehrmann's supply chain could place considerable strain on water resources, particularly in regions already facing water stress.

Furthermore, the potential for water pollution from livestock operations and manure storage is a critical concern. Runoff containing nutrients like nitrogen and phosphorus can degrade water quality, impacting ecosystems and human health. By 2025, Ehrmann AG and its partners must implement robust waste management strategies and explore precision irrigation techniques to minimize nutrient runoff and conserve water resources.

Packaging for dairy products significantly impacts the environment, driving a move towards sustainable materials. Ehrmann AG, like its peers, is increasingly pressured by regulations and consumer demand to adopt biodegradable, recyclable, and innovative packaging. For instance, the EU's Circular Economy Action Plan aims to increase recycling rates for packaging, with specific targets for plastic packaging set to rise. By rethinking its packaging strategy, Ehrmann can mitigate environmental risks and capitalize on the growing market for eco-conscious products, potentially aligning with the 2025 targets for plastic packaging recycling.

Food Waste Reduction Strategies

Minimizing food waste is a major focus for companies like Ehrmann AG, impacting both the environment and their bottom line. In 2024, the European Union continued to push for ambitious food waste reduction targets, with many member states aiming to cut food waste by 50% by 2030. This regulatory pressure highlights the need for robust strategies across the entire supply chain.

Effective inventory management and optimized supply chain logistics are crucial for Ehrmann to tackle food waste. Implementing advanced planning systems can help forecast demand more accurately, reducing overstocking and subsequent spoilage. For instance, by leveraging real-time sales data and predictive analytics, Ehrmann can fine-tune its production and distribution schedules, minimizing the risk of products expiring before reaching consumers.

- Supply Chain Optimization: Ehrmann can invest in technologies that improve cold chain management and track product shelf life, reducing spoilage from farm to fork.

- Inventory Management: Utilizing AI-powered inventory systems to match production with actual demand can significantly cut down on waste.

- Consumer Engagement: Educating consumers on proper storage and usage of dairy products can also play a role in reducing household food waste.

- Circular Economy Initiatives: Exploring partnerships for repurposing unavoidable food by-products into animal feed or biogas can create value from waste streams.

Impact of Climate Change on Raw Material Supply

Climate change and its associated extreme weather events pose a significant threat to Ehrmann AG's raw material supply, particularly milk. These events can cause substantial seasonal fluctuations in milk availability and lead to increased price volatility. For instance, droughts can stress pastures, reducing feed quality and quantity, while floods can damage infrastructure and disrupt transportation.

Herd health is also directly impacted. Outbreaks of diseases, sometimes exacerbated by changing climate conditions, can significantly reduce milk yields. The spread of bluetongue virus in Europe, for example, has previously affected cattle populations, highlighting the vulnerability of dairy herds to environmental shifts.

To counter these environmental risks and ensure a stable supply of milk, Ehrmann AG must implement resilient supply chain management strategies. This includes diversifying sourcing regions and investing in technologies that can help monitor and predict weather-related impacts on dairy farming.

- Milk Price Volatility: Global dairy commodity prices have experienced significant swings, with factors like weather impacting supply. For example, during periods of drought in major dairy-producing regions in 2023, milk prices saw upward pressure.

- Impact on Herd Health: Extreme heat can reduce cow comfort and milk production by up to 10-25% in affected periods, and increase susceptibility to diseases.

- Supply Chain Resilience: Ehrmann AG's reliance on dairy as a primary input means that disruptions due to climate events, such as those experienced in 2024 with unseasonably heavy rainfall in parts of Europe impacting fodder availability, directly affect production continuity.

Ehrmann AG faces significant environmental pressures, particularly concerning greenhouse gas emissions from its dairy operations. Global dairy emissions contribute to climate change, driving a need for sustainable practices. Companies like Ehrmann are actively pursuing emission reductions, with initiatives like the Science Based Targets initiative (SBTi) guiding their strategy towards a more sustainable future by 2025.

Water usage and pollution are also critical environmental factors. The dairy sector's high water demand, with agriculture accounting for about 70% of global freshwater withdrawals in 2024, necessitates efficient water management. Preventing water pollution from livestock operations is paramount to protect ecosystems and public health, requiring robust waste management by 2025.

Packaging sustainability is another key area. Ehrmann AG, like its competitors, is responding to regulatory demands and consumer preferences for eco-friendly packaging. The EU's commitment to increasing recycling rates, with specific targets for plastic packaging by 2025, pushes companies to innovate in this space.

Food waste reduction is a major operational and environmental challenge. With the EU aiming to halve food waste by 2030, Ehrmann AG must implement advanced inventory and supply chain management systems. Leveraging data analytics to accurately forecast demand and optimize distribution is crucial to minimize spoilage and meet these ambitious targets.

| Environmental Factor | Impact on Ehrmann AG | Key Data/Targets |

|---|---|---|

| Greenhouse Gas Emissions | Methane and nitrous oxide from dairy farming contribute to climate change. | Global dairy sector emissions ~3.5% of total anthropogenic GHGs. SBTi commitment for reduction targets. |

| Water Management | High water consumption and potential for pollution from livestock. | Agriculture accounts for ~70% of global freshwater withdrawals (2024). Need for efficient practices by 2025. |

| Packaging | Consumer and regulatory pressure for sustainable materials. | EU aims to increase packaging recycling rates, with plastic packaging targets by 2025. |

| Food Waste | Environmental and economic impact of spoilage across the supply chain. | EU target to reduce food waste by 50% by 2030. Requires optimized inventory and logistics. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Ehrmann AG is built upon a robust foundation of data from official government publications, reputable market research firms, and respected international organizations. We meticulously gather insights on political stability, economic indicators, technological advancements, environmental regulations, and socio-cultural trends to ensure comprehensive and accurate analysis.