Ehrmann AG Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ehrmann AG Bundle

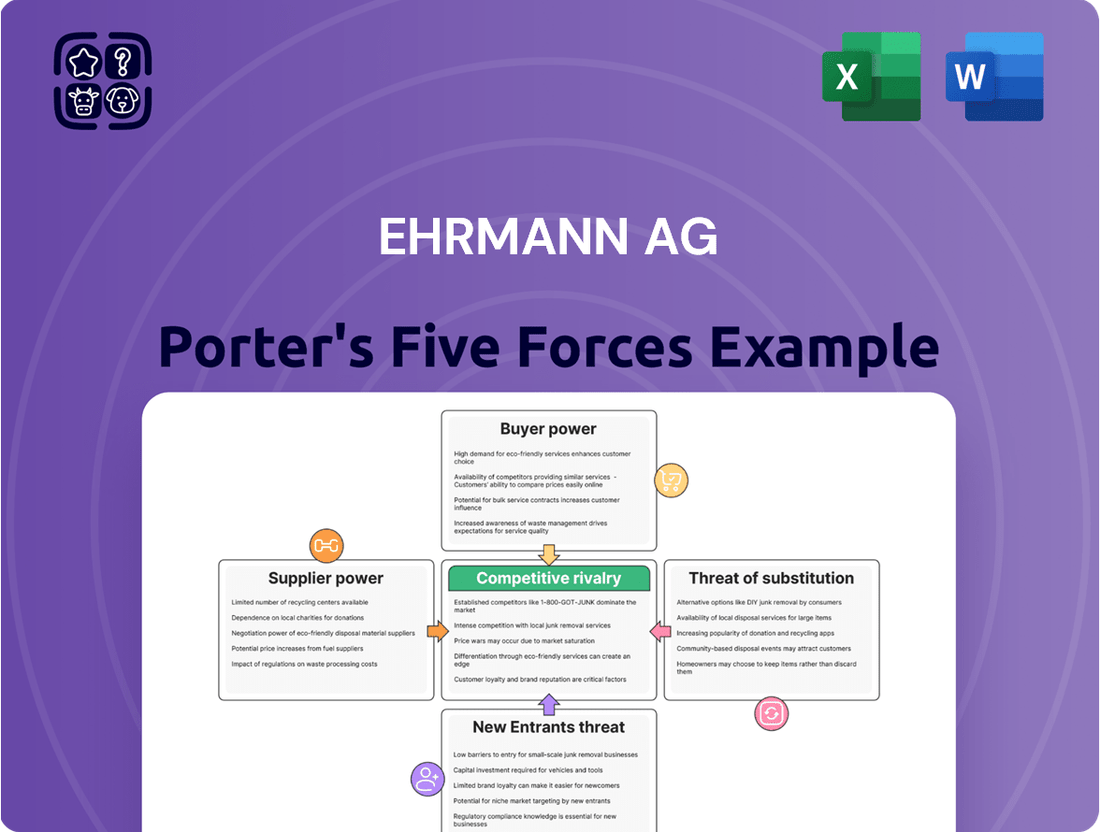

Ehrmann AG navigates a dairy market characterized by moderate buyer power and intense rivalry among established players. Understanding the threat of substitutes, like plant-based alternatives, is crucial for their long-term strategy.

The complete report reveals the real forces shaping Ehrmann AG’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Ehrmann AG's reliance on raw milk is substantial, as it forms the core input for its dairy products. This dependence grants significant leverage to milk suppliers, particularly in regions with limited dairy farm options or where agricultural policies create price volatility. For instance, in 2024, European milk prices saw fluctuations due to factors like feed costs and environmental regulations, directly impacting dairy processors like Ehrmann.

The bargaining power of these suppliers is amplified by stringent quality standards demanded by consumers and retailers for dairy products. Milk farmers who consistently meet these high-quality benchmarks can command better prices. Ehrmann's strategy to foster long-term partnerships with dairy cooperatives and explore direct sourcing initiatives aims to stabilize supply and potentially negotiate more favorable terms, thereby mitigating the suppliers' inherent power.

Ehrmann AG faces potential leverage from a select group of specialized ingredient suppliers, particularly for unique components like proprietary bacterial cultures or distinctive fruit preparations. For instance, in 2024, the global market for specialized dairy cultures saw consolidation, with a few key players controlling a significant share of innovative strains. This limited availability can empower these suppliers to command higher prices, especially when their ingredients are critical to Ehrmann's product differentiation, such as in their premium yogurt lines.

The cost and availability of essential packaging materials like plastics, cartons, and foils significantly impact Ehrmann AG's operational expenses and product delivery. Suppliers of these materials hold considerable bargaining power, particularly when faced with fluctuating raw material prices, such as the impact of oil price changes on plastic production, or during periods of global supply chain disruption. For instance, the global plastics market experienced price increases in early 2024 due to energy costs and geopolitical factors, directly affecting packaging material expenses for companies like Ehrmann.

Labor Market Dynamics for Skilled Workforce

The availability of skilled labor in dairy processing, such as technicians and quality control specialists, directly impacts supplier power in the labor market. A scarcity of these specialized roles, or a generally tight labor market, can drive up wage expectations and complicate hiring for companies like Ehrmann AG.

In 2024, reports indicated a persistent shortage of skilled manufacturing labor across various sectors in Germany, including food production, with some regions experiencing unemployment rates for skilled workers below 2%. This environment grants considerable leverage to available talent.

- Skilled Labor Shortage: Persistent demand for dairy processing technicians and logistics personnel in 2024.

- Wage Pressures: Tight labor markets can lead to increased wage demands from skilled workers.

- Recruitment Challenges: Specialized skill requirements can make it difficult and costly to find qualified candidates.

- Ehrmann's Strategy: Investment in training and retention programs is crucial for securing essential human capital.

Logistics and Transportation Providers

The bargaining power of logistics and transportation providers is a significant factor for Ehrmann AG, particularly given the perishable nature of dairy products. Efficient and timely delivery is paramount to maintaining product quality and meeting consumer demand. In 2024, the global logistics market experienced continued pressure from fluctuating fuel prices, with diesel costs impacting transportation expenses. For instance, average diesel prices in Europe saw an upward trend throughout the year, directly affecting shipping rates.

This increased cost for logistics services can directly impact Ehrmann's operational expenses. Factors such as a persistent driver shortage in key European markets and limitations in infrastructure, especially in rural distribution areas, further empower these providers. These conditions can lead to higher freight charges and potentially impact delivery schedules, creating a challenge for Ehrmann’s supply chain efficiency.

- Rising Fuel Costs: In 2024, the average price of diesel fuel in Germany, a key market for Ehrmann, saw an increase of approximately 8-10% compared to 2023, directly impacting transportation costs.

- Driver Shortages: The European Union continued to face a deficit of qualified truck drivers in 2024, estimated to be around 400,000, giving existing drivers and logistics companies more leverage.

- Infrastructure Limitations: Certain regions Ehrmann serves may have less developed road networks, increasing transit times and fuel consumption, thereby strengthening the bargaining position of providers with the necessary specialized equipment or routes.

Ehrmann AG's reliance on raw milk, a primary input, grants considerable power to its suppliers. In 2024, European milk prices experienced volatility due to feed costs and regulations, directly affecting dairy processors. Suppliers meeting stringent quality standards can command higher prices, and Ehrmann's efforts to build partnerships and source directly aim to mitigate this supplier leverage.

Specialized ingredient suppliers, particularly for unique cultures or fruit preparations, can also exert significant influence. The 2024 consolidation in the specialized dairy cultures market, with a few key players dominating, empowers these suppliers to charge premium prices for critical, differentiating ingredients.

The bargaining power of packaging material suppliers is substantial, influenced by raw material costs and supply chain disruptions. For instance, global plastic prices rose in early 2024 due to energy costs and geopolitical events, increasing expenses for companies like Ehrmann.

Logistics providers hold sway due to the perishable nature of dairy products and market pressures. In 2024, fluctuating fuel prices, particularly diesel, increased transportation expenses, with driver shortages in Europe further empowering logistics companies.

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Ehrmann AG's position in the dairy industry.

Visualize competitive intensity across all five forces with a dynamic, interactive dashboard for immediate strategic insight.

Customers Bargaining Power

Major supermarket chains and discounters are a substantial part of Ehrmann AG's customer landscape. These dominant retailers wield significant leverage through their sheer purchasing volume, their control over prime shelf placement, and their straightforward ability to shift between dairy producers.

In 2024, the concentration of retail power in Germany, Ehrmann's primary market, means a few large players dictate terms. For instance, the top five German supermarket chains accounted for over 80% of grocery sales in the first half of 2024, giving them immense clout.

These powerful customers frequently insist on aggressive pricing, demand promotional funding, and specify particular product ranges, which in turn can squeeze Ehrmann's profitability. This dynamic forces dairy producers like Ehrmann to constantly optimize their cost structures and product offerings to remain competitive.

Consumer price sensitivity in the dairy market presents a significant factor for Ehrmann AG. While Ehrmann focuses on quality, many consumers, particularly for everyday dairy items, will compare prices. For instance, in 2024, the average price of milk in Germany saw fluctuations, impacting purchasing decisions for price-conscious shoppers.

However, Ehrmann's strategy of emphasizing premium quality and innovation aims to cultivate brand loyalty. A strong brand reputation can mitigate the impact of price sensitivity, as consumers may be willing to pay a premium for perceived value and trust. This loyalty reduces their inclination to switch to competitors based solely on lower prices.

Ehrmann's broad product range, from yogurts to specialty dairy, allows it to appeal to various consumer needs and price points. This diversification helps buffer the bargaining power of customers who might be highly sensitive to price for certain staple products but less so for premium or niche offerings.

The growing presence of private label dairy products from major retailers like Lidl and Aldi directly impacts Ehrmann AG by increasing customer bargaining power. These store brands, often priced lower than national brands, provide consumers with readily available, cost-effective alternatives, forcing Ehrmann to sharpen its competitive edge.

In 2024, the private label share in the European dairy market continued its upward trend, with some categories exceeding 30% in key markets. This puts pressure on manufacturers like Ehrmann to innovate and emphasize superior quality, unique selling propositions, or brand loyalty to justify their pricing and maintain market share against these powerful retail-backed competitors.

Information Access and Product Comparison

Customers today have unprecedented access to information about products and services, including pricing and reviews, thanks to digital platforms. This transparency significantly boosts their bargaining power. For instance, in 2024, a significant portion of consumers actively researched products online before making a purchase, with studies indicating over 80% of shoppers using their smartphones to check prices or product details while in a store.

This ease of comparison means customers can readily evaluate Ehrmann AG's dairy products against those of competitors, putting pressure on the company to offer competitive pricing and superior value. If Ehrmann's offerings don't meet these expectations, customers can easily switch to alternatives. This highlights the critical need for Ehrmann to maintain a strong and informative online presence that clearly articulates its unique selling propositions and brand benefits.

- Increased Online Research: In 2024, online product research by consumers reached new heights, empowering them to make more informed purchasing decisions.

- Price Transparency: Digital channels have made pricing information readily available, allowing customers to easily compare Ehrmann's products with competitors.

- Demand for Value: Enhanced information access translates into higher customer expectations for value, potentially impacting Ehrmann's pricing strategies.

- Competitive Switching: Customers are more willing and able to switch brands if they perceive better value or quality elsewhere, increasing competitive pressure on Ehrmann.

Demand for Customization and Innovation

Customers, especially major retailers, are increasingly vocal about their needs for customized product formulations, eco-friendly packaging solutions, and novel flavor profiles to cater to shifting consumer tastes. For instance, in 2024, the demand for plant-based dairy alternatives saw a significant surge, with market reports indicating a global growth rate of over 10% year-on-year, pushing dairy producers like Ehrmann to innovate rapidly.

Ehrmann's commitment to ongoing product development is a key strength, but it also necessitates responsiveness to these evolving customer demands. This can translate into higher research and development expenditures and the need for agile manufacturing processes that can accommodate a wider variety of product specifications.

- Retailer Demand: Retailers often leverage their purchasing power to request exclusive product lines or specific packaging formats, influencing production runs and inventory management.

- Consumer Trends: The rapid pace of consumer trend adoption, such as the growing preference for low-sugar or probiotic-enhanced yogurts, forces manufacturers to continually adapt their offerings.

- Innovation Costs: Meeting these customization and innovation demands can increase operational costs, impacting profit margins if not managed efficiently through economies of scale or premium pricing strategies.

The bargaining power of customers for Ehrmann AG is significantly influenced by the concentration of major retailers and the increasing price sensitivity of consumers. In 2024, the dominance of a few large supermarket chains in Germany, Ehrmann's core market, grants them substantial leverage through purchasing volume and control over shelf space. This allows them to dictate terms, demand promotional funding, and push for aggressive pricing, directly impacting Ehrmann's profitability.

Furthermore, the rising popularity of private label dairy products, which often undercut national brands on price, intensifies this pressure. By 2024, private label dairy items were capturing a significant market share in Europe, exceeding 30% in some categories. This forces Ehrmann to continuously innovate and highlight its unique selling propositions to justify its pricing against these lower-cost alternatives.

The digital age has also empowered customers, with widespread online research and price transparency becoming the norm. In 2024, it was common for over 80% of shoppers to use their smartphones for price checks while in-store, enabling easy comparison of Ehrmann's offerings with competitors. This heightened awareness necessitates that Ehrmann maintains a strong value proposition and brand loyalty to counter the readily available alternatives.

| Customer Segment | Bargaining Power Factors | Impact on Ehrmann AG | 2024 Data/Trend |

|---|---|---|---|

| Major Retailers (Supermarkets, Discounters) | High purchasing volume, control over shelf space, ability to switch suppliers | Pressure on pricing, demand for promotional support, potential margin squeeze | Top 5 German supermarket chains accounted for >80% of grocery sales (H1 2024) |

| Price-Sensitive Consumers | Focus on everyday dairy items, comparison shopping | Need for competitive pricing on staple products, impact on sales volume | Fluctuations in average milk prices in Germany influenced purchasing decisions (2024) |

| Private Label Advocates | Preference for lower-cost store brands | Increased competition from retailer-owned brands, need for differentiation | Private label share in European dairy market continued upward trend (>30% in some categories, 2024) |

| Informed Online Shoppers | Access to product information, reviews, and price comparisons | Demand for transparency, value, and clear unique selling propositions | >80% of shoppers used smartphones for price/product checks in-store (2024) |

Same Document Delivered

Ehrmann AG Porter's Five Forces Analysis

This preview showcases the complete Ehrmann AG Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the dairy industry. You're viewing the exact, professionally formatted document that will be delivered instantly upon purchase, ensuring you receive a ready-to-use strategic tool without any discrepancies.

Rivalry Among Competitors

The European dairy sector is crowded with formidable players. Giants like Danone and Lactalis, alongside numerous strong domestic cooperatives and brands, fiercely compete for consumer attention. This intense rivalry forces companies like Ehrmann AG to constantly innovate and manage costs effectively to maintain their market position.

Ehrmann AG navigates intense competitive rivalry, particularly in product differentiation and innovation. While basic dairy products face commoditization, Ehrmann counters with a focus on quality ingredients and a steady stream of new offerings, such as its expanded yogurt and quark dessert lines. For instance, in 2023, the dairy sector saw significant new product launches, with companies investing heavily in R&D to capture consumer attention.

However, this drive for differentiation is a shared strategy. Competitors also pour resources into research and development, alongside robust marketing campaigns, to carve out distinct market positions. This constant innovation cycle means maintaining a unique selling proposition for any extended period is a considerable challenge, emphasizing the need for agility.

The critical factor for success in this environment is the speed and effectiveness with which companies can introduce novel and appealing products to the market. For example, in the first half of 2024, key players in the European dairy market reported increased R&D spending, directly correlating with the introduction of over 50 new product variations across yogurt and dairy-based snacks.

Competitors in the dairy sector, including those vying with Ehrmann AG, pour considerable resources into marketing and advertising. These campaigns are crucial for building brand recognition, fostering customer loyalty, and introducing new dairy products to the market. For instance, in 2024, major dairy players often allocate between 5% to 15% of their revenue to marketing, a figure that can escalate for new product launches or during peak promotional periods.

To remain competitive and capture consumer attention against these often well-funded rivals, Ehrmann AG must also commit substantial financial resources to its own marketing initiatives. This intense marketing battle significantly raises the overall cost of competing within the dairy industry, as companies continuously invest to stand out and secure market share.

Industry Growth Rate and Capacity Utilization

The traditional dairy market in mature economies often experiences a slower growth rate, intensifying rivalry as companies vie for existing market share. This can be exacerbated by industry overcapacity, potentially triggering price wars as firms aim to maximize production facility utilization. For instance, in 2023, the European dairy market saw modest volume growth, with some sub-sectors facing oversupply challenges.

Ehrmann AG navigates this by focusing on international expansion and emphasizing higher-value product segments, which can help to buffer against the pressures of slow domestic growth and capacity utilization issues. This strategic approach allows the company to tap into new markets and differentiate itself beyond price competition.

- Slow Market Growth: Mature dairy markets in regions like Western Europe experienced growth rates around 1-2% in 2023, increasing competitive intensity.

- Capacity Utilization Pressure: Overcapacity in certain dairy product categories can lead to price reductions to ensure production lines remain active.

- Ehrmann's Mitigation Strategy: International expansion and a focus on premium or specialized dairy products help Ehrmann AG reduce reliance on price-sensitive, mature markets.

- Diversification Benefits: By moving into segments like plant-based alternatives or specialized yogurts, Ehrmann can sidestep some of the direct competition in traditional, high-capacity dairy sectors.

Strategic Alliances and Acquisitions

Strategic alliances and acquisitions significantly reshape the dairy sector. For instance, in 2023, Lactalis continued its global expansion through strategic acquisitions, bolstering its market presence. This consolidation trend means larger entities gain greater bargaining power, potentially impacting suppliers and distributors, and forcing companies like Ehrmann to continually assess their competitive standing and explore collaborative opportunities to maintain market share.

These industry-wide consolidation activities can lead to a more concentrated market. Companies that successfully integrate acquisitions often benefit from economies of scale, enhanced distribution networks, and broader product portfolios. Ehrmann AG must therefore remain agile, actively monitoring these moves and considering strategic partnerships or acquisitions to counter the growing influence of larger consolidated players.

- Consolidation Impact: Dairy industry consolidation, driven by M&A, creates larger, more powerful competitors.

- Market Dynamics Shift: Acquisitions alter market dynamics, increasing the market power of some players.

- Ehrmann's Response: Ehrmann AG needs to constantly evaluate its strategic positioning and potential partnerships.

- Competitive Pressure: Larger, consolidated entities can exert greater pressure on pricing and market access.

The European dairy market is characterized by intense competition among numerous established brands and cooperatives. Ehrmann AG faces significant rivalry, particularly in product innovation and marketing, as competitors also invest heavily to differentiate themselves. This necessitates continuous R&D and substantial marketing budgets to maintain market share and consumer appeal.

The drive for differentiation is a shared strategy, with competitors also pouring resources into research and development and robust marketing campaigns. This constant innovation cycle makes maintaining a unique selling proposition challenging, emphasizing the need for agility. For example, in the first half of 2024, key players reported increased R&D spending, correlating with over 50 new product variations in yogurt and dairy-based snacks.

Marketing expenditures are substantial, with major dairy players often allocating 5% to 15% of revenue to marketing in 2024, a figure that can rise for new product launches. This intense marketing battle escalates the cost of competing, as companies invest to stand out and secure market share.

Mature dairy markets often experience slower growth, intensifying rivalry as companies vie for existing share, sometimes leading to price wars due to overcapacity. In 2023, the European dairy market saw modest volume growth, with some sub-sectors facing oversupply. Ehrmann mitigates this through international expansion and focusing on higher-value products.

| Competitor Action | Impact on Ehrmann AG | Example Data (2023-2024) |

|---|---|---|

| New Product Launches | Necessitates rapid innovation and R&D investment | Over 50 new yogurt/snack variations launched in H1 2024 |

| Aggressive Marketing Campaigns | Requires increased marketing spend to maintain brand visibility | 5-15% of revenue allocated to marketing by major players in 2024 |

| Industry Consolidation (M&A) | Increases market power of larger competitors, potentially impacting pricing | Lactalis' continued global expansion via acquisitions in 2023 |

| Price Competition (due to overcapacity) | Threatens profit margins in mature markets | Modest volume growth in Europe in 2023, with some oversupply |

SSubstitutes Threaten

The most significant threat of substitution for Ehrmann AG stems from the booming plant-based dairy alternative market. Products like oat milk, almond milk, soy yogurt, and coconut-based desserts are directly challenging Ehrmann's traditional dairy portfolio.

Consumer preferences are shifting towards these alternatives, driven by perceived health benefits, dietary needs such as lactose intolerance, ethical considerations, and growing environmental awareness. This trend directly impacts the demand for conventional dairy products.

In 2024, the global plant-based milk market alone was valued at over $20 billion, with projections indicating continued robust growth. For instance, oat milk, a key competitor, saw its market share expand significantly, demonstrating a clear substitution effect impacting established players like Ehrmann.

Ehrmann AG's yogurt and dairy products face significant competition from a broad spectrum of alternative breakfast and snack categories. Consumers are increasingly opting for options like cereals, fresh fruit, protein bars, and smoothies, which offer convenience and perceived health benefits. This diverse competitive landscape means that a shift in consumer dietary trends, for instance, a growing preference for plant-based alternatives or low-carb diets, could easily divert demand away from traditional dairy offerings.

Ehrmann AG's milk-based drinks encounter significant competition from a wide array of alternative beverage options. These include juices, carbonated soft drinks, bottled water, and a growing market of functional beverages, all vying for consumer attention and spending. For instance, the global bottled water market was valued at approximately $350 billion in 2023 and is projected to grow, indicating a strong consumer preference for non-dairy hydration choices.

Changing Consumer Dietary Trends

Evolving consumer dietary trends, such as a growing preference for low-sugar, high-protein, or whole-food options, directly impact the demand for traditional dairy products. If Ehrmann AG's product range doesn't adapt to these shifts, consumers might seek alternatives in other food categories.

For instance, the plant-based milk market, a significant substitute, saw global sales reach an estimated $17.1 billion in 2023, projected to grow further. This demonstrates a clear consumer movement away from dairy for various dietary and ethical reasons.

- Shifting Demand: Consumers increasingly favor dairy alternatives or products with specific health attributes, potentially reducing reliance on conventional dairy items.

- Market Adaptability: Ehrmann AG's ability to innovate and offer products aligned with these trends, like fortified yogurts or reduced-lactose options, is crucial to mitigating this threat.

- Competitive Landscape: The rise of plant-based and health-focused food companies presents a direct challenge, offering consumers a wider array of choices that can substitute for dairy.

Homemade and Unprocessed Alternatives

While Ehrmann AG primarily focuses on processed dairy products, a minor threat of substitution exists from consumers choosing homemade alternatives or less processed whole-food options, particularly for basic milk and simple yogurt. For instance, the demand for artisanal cheeses made at home or locally sourced, unprocessed milk presents a niche alternative. In 2024, the global market for DIY food and beverage kits saw continued growth, indicating a consumer interest in creating products from scratch.

This trend is more pronounced for less complex dairy items where the perceived value of freshness and natural ingredients outweighs the convenience of processed goods. Consumers might opt for making their own yogurt or ricotta, bypassing commercially produced versions. Data from 2023 showed a 5% increase in home baking and dairy preparation trends in key European markets.

- Homemade Dairy Production: Consumers may opt to create their own yogurt, cheese, or butter, reducing reliance on commercially processed products.

- Whole-Food Alternatives: A shift towards less processed options like raw milk (where legal and available) or simply consuming fruits and nuts as snacks instead of yogurt cups is a substitute behavior.

- Health and Ingredient Focus: Concerns about additives, sugar content, or a desire for natural ingredients drive some consumers towards homemade or minimally processed dairy.

The threat of substitutes for Ehrmann AG is significant, primarily driven by the expanding plant-based dairy alternative market and evolving consumer preferences for healthier, non-dairy options. These substitutes directly compete with Ehrmann's core dairy products, impacting sales volumes and market share.

In 2024, the global plant-based milk market alone was valued at over $20 billion, showcasing a strong consumer shift. This trend is further amplified by the growing availability and acceptance of alternatives like oat milk, almond milk, and soy-based yogurts, which cater to dietary needs and ethical concerns.

| Product Category | Key Substitutes | 2023/2024 Market Data/Trend |

|---|---|---|

| Dairy Milk | Plant-based milks (oat, almond, soy), juices, functional beverages | Global plant-based milk market: ~$17.1 billion (2023), projected growth. Bottled water market: ~$350 billion (2023). |

| Yogurt & Desserts | Plant-based yogurts, fruit-based snacks, protein bars, smoothies | Increasing demand for plant-based yogurts. Growth in protein bars and healthy snack categories. |

| Processed Dairy | Homemade dairy products, whole foods (fruits, nuts), DIY food kits | Growth in DIY food kits. Niche demand for artisanal or locally sourced dairy. |

Entrants Threaten

The dairy processing sector, including operations like Ehrmann AG, demands considerable upfront capital. Setting up modern processing plants, acquiring specialized machinery, and establishing robust cold chain logistics represent significant financial outlays. For instance, a new, large-scale dairy processing facility can easily cost tens of millions of euros to construct and equip.

These substantial capital requirements act as a significant deterrent for potential new competitors. The sheer scale of investment needed to build a competitive production and distribution network discourages many from entering the market, thereby lowering the threat of new entrants for established players like Ehrmann.

Securing prime shelf space in major supermarket chains presents a formidable barrier for newcomers. Ehrmann AG benefits from deeply entrenched relationships with retailers, built over years of consistent supply and collaboration. These established ties, coupled with a robust and efficient supply chain, make it exceedingly challenging for new entrants to gain comparable market visibility and penetration without significant upfront capital and considerable time investment.

Ehrmann AG benefits from significant brand loyalty built over decades, making it challenging for new entrants. Consumers often stick with familiar brands they trust for quality and taste, a significant barrier to entry in the dairy sector.

For instance, in 2024, brand loyalty remains a cornerstone of consumer purchasing decisions in the German food market, with established brands like Ehrmann often commanding a premium due to perceived reliability and consistent product experience.

New competitors would need substantial investment in marketing and potentially price reductions to even begin challenging Ehrmann's established consumer base, a costly endeavor that dampens the threat of new entrants.

Regulatory Hurdles and Food Safety Standards

The dairy sector faces significant regulatory barriers. For instance, in the EU, the European Food Safety Authority (EFSA) sets rigorous standards for milk production and processing. New entrants must invest heavily in compliance, including obtaining certifications like HACCP (Hazard Analysis and Critical Control Points), which can cost tens of thousands of Euros and take months to secure. Ehrmann AG, with its long-standing presence, has already established these robust systems, creating a substantial hurdle for potential competitors.

These stringent food safety regulations and quality standards, including detailed labeling requirements, act as a powerful deterrent. Navigating these complex frameworks, securing necessary certifications, and implementing comprehensive quality control systems demands considerable time and financial resources. For example, the cost of establishing a fully compliant dairy processing facility can easily run into millions of Euros, a capital outlay that new entrants must be prepared for.

- Regulatory Compliance Costs: New dairy businesses can face upfront costs exceeding €100,000 for initial certifications and system implementation.

- Time to Market: Obtaining all necessary permits and approvals in major markets like Germany can take 12-18 months.

- Quality Control Investment: Establishing advanced laboratory testing and traceability systems requires significant ongoing investment, potentially 3-5% of annual revenue.

- Ehrmann's Advantage: As an established player, Ehrmann AG has amortized these costs and benefits from optimized, compliant operations.

Economies of Scale and Experience Curve

Ehrmann AG, like many established players in the dairy industry, benefits significantly from economies of scale. This means that as production volume increases, the cost per unit of product decreases due to more efficient use of resources in production, purchasing, and distribution. For example, in 2023, large-scale dairy processors often achieved significantly lower raw material acquisition costs compared to smaller operations, a trend that continued into early 2024.

Furthermore, Ehrmann's long operational history has cultivated an experience curve advantage. This curve reflects how production costs tend to fall as cumulative experience in producing a product grows. Through years of refining processes, optimizing supply chains, and developing specialized knowledge, Ehrmann can operate more efficiently, making it difficult for new entrants to match their cost structure and operational effectiveness.

- Economies of Scale: Lower per-unit costs in production, purchasing, and distribution for incumbent firms.

- Experience Curve: Increased efficiency and effectiveness gained through years of operational practice.

- Cost Barrier: Newcomers struggle to compete on cost due to scale and experience advantages of established companies.

- Market Entry: These factors create a substantial barrier to entry for potential new competitors in the dairy sector.

The threat of new entrants for Ehrmann AG is relatively low, primarily due to high capital requirements and established brand loyalty. Building a dairy processing plant and distribution network demands millions of Euros, a significant hurdle for newcomers. Furthermore, consumer trust in established brands like Ehrmann, reinforced by consistent quality and marketing efforts, makes it difficult for new players to gain market share. In 2024, these factors continue to protect incumbent dairy processors.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Ehrmann AG is built upon a robust foundation of data, drawing from Ehrmann AG's annual reports, investor presentations, and official company press releases. This is supplemented by industry-specific market research reports from reputable firms and analyses of competitor activities and public statements.