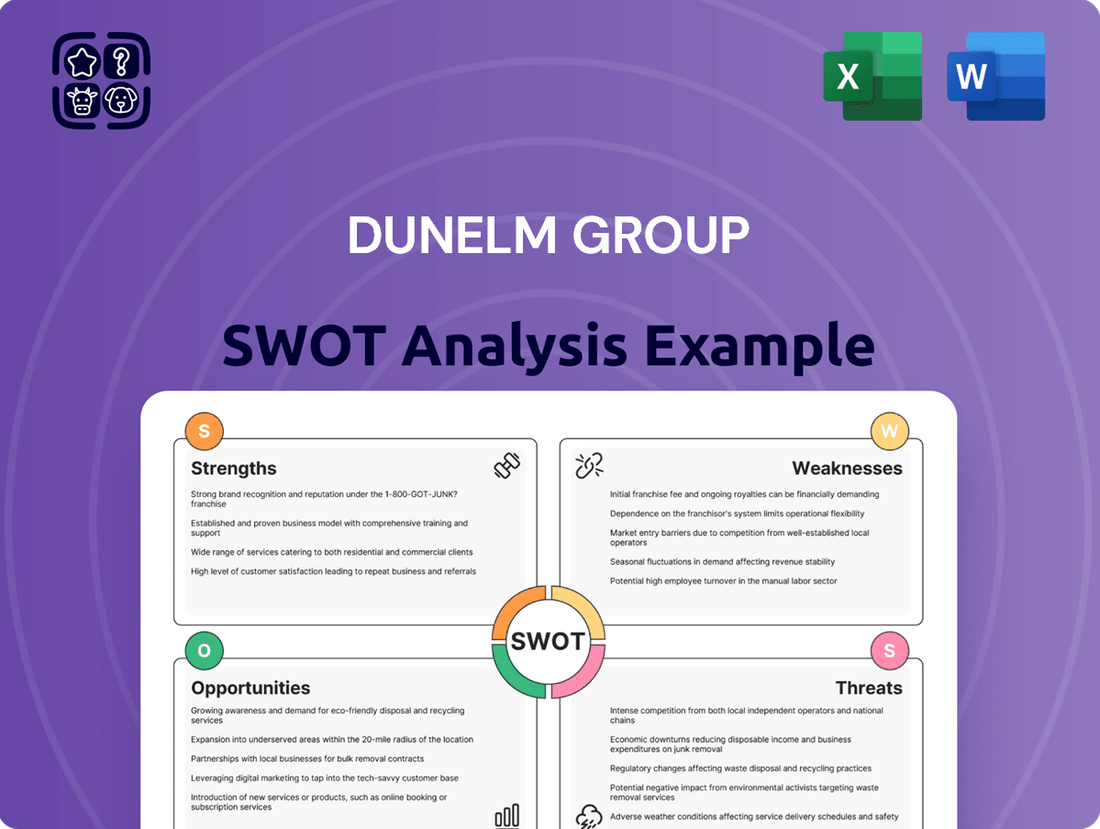

Dunelm Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dunelm Group Bundle

Dunelm Group's impressive brand recognition and extensive product range are significant strengths in the competitive homeware market. However, understanding their vulnerabilities to economic downturns and the opportunities presented by evolving consumer trends is crucial for strategic planning.

Want the full story behind Dunelm's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Dunelm Group plc stands as the undisputed leader in the UK home furnishings sector, commanding a substantial portion of the market. This dominance is evidenced by its consistent growth, having secured 7.8% of the UK homewares market by December 2024, with ambitious plans to reach 10% in the near future. Its unique and specialized offering has cultivated strong brand recognition among British shoppers.

Dunelm's strength lies in its robust multi-channel business model, effectively blending a significant physical store presence with a rapidly expanding online platform. This integrated approach offers customers flexibility and convenience, catering to diverse shopping preferences.

The company's digital capabilities are a key asset, with online sales demonstrating impressive growth. For the first half of fiscal year 2025, digital sales comprised 39% of total revenue, a figure that climbed to 42% by the fourth quarter of FY25, highlighting the increasing importance of e-commerce to Dunelm's overall performance.

Dunelm Group has shown impressive financial resilience, achieving a 2.4% increase in sales for the first half of fiscal year 2025 and a 4.2% rise in the fourth quarter of fiscal year 2025, even when the market faced difficulties. This consistent growth highlights the company's ability to navigate economic headwinds effectively.

A key factor in this performance is Dunelm's robust gross margin, which stood at 52.8% in H1 FY25 and 52.4% for the full FY25. This strong margin is a direct result of the company's adept management of input costs and a disciplined approach to promotions, ensuring profitability remains high.

This financial stability not only underpins Dunelm's consistent profitability but also provides a solid foundation for delivering reliable shareholder returns, demonstrating a healthy and well-managed business.

Broad Product Offer and Value Proposition

Dunelm's strength lies in its extensive and varied product selection, covering everything from furniture to bedding and kitchenware. This broad offering appeals to a wide customer base, ensuring there’s something for almost everyone, regardless of their style preferences or budget.

The company’s pricing strategy is a key differentiator. Dunelm effectively utilizes a wide price architecture, allowing customers to choose products that fit their specific financial circumstances, whether they are looking for budget-friendly options or are willing to spend more for premium items. This flexibility is particularly valuable in the current economic climate.

Dunelm's commitment to providing value and quality has been a significant factor in its success, enabling it to maintain customer loyalty even when consumers are facing economic challenges. This focus on delivering good products at accessible prices underpins its broad appeal.

Key aspects of Dunelm's product offer and value proposition include:

- Diverse Product Range: Comprehensive selection of stylish and affordable homeware.

- Broad Price Architecture: Caters to various budgets, allowing for customer flexibility.

- Value and Quality Focus: Resonates with consumers, even during economic downturns.

- Wide Customer Appeal: Attracts a large and varied customer base due to its accessible offerings.

Strategic Growth Initiatives and Operational Capabilities

Dunelm is actively pursuing strategic growth initiatives, including expanding its store footprint with new superstores and smaller format sites, and entering new markets like inner London and Ireland. This expansion is a key driver for increasing market share and customer accessibility.

The company continuously invests in enhancing its digital proposition, incorporating features such as AI-driven search and recommendations to improve the online customer experience. For instance, their investment in digital capabilities aims to capture a larger share of the growing online home furnishings market.

Dunelm focuses on harnessing its operational capabilities through new technology and productivity initiatives to drive efficiency. This includes optimizing supply chains and in-store operations, which is crucial for maintaining competitive pricing and improving margins.

- Store Expansion: Plans include new superstores and smaller format sites, alongside entry into new markets like Ireland.

- Digital Enhancement: Investment in AI-driven search and recommendations to boost online customer experience.

- Operational Efficiency: Focus on new technology and productivity initiatives to streamline operations and reduce costs.

Dunelm's extensive product range, spanning furniture, bedding, and kitchenware, ensures broad customer appeal across diverse tastes and budgets. Its carefully managed pricing strategy, offering a wide price architecture, allows consumers to find options that suit their financial circumstances, a critical advantage in the current economic climate. This commitment to delivering value and quality has fostered strong customer loyalty, even during challenging economic periods, solidifying its market position.

What is included in the product

Delivers a strategic overview of Dunelm Group’s internal and external business factors, highlighting its strong brand, extensive product range, and customer loyalty, while also identifying potential threats from online competition and economic downturns.

Offers a clear breakdown of Dunelm's strategic landscape, simplifying complex competitive pressures and operational challenges.

Weaknesses

Dunelm's significant reliance on the UK market presents a key weakness. The company's operations are almost exclusively within the United Kingdom, leaving it highly exposed to the economic health, regulatory environment, and consumer spending patterns specific to this single nation. For instance, while the UK economy showed some resilience in early 2024, ongoing inflation and interest rate concerns continue to pose risks to discretionary spending, directly impacting Dunelm's sales.

Dunelm operates in a sector heavily influenced by consumer sentiment, which can be quite unpredictable. Even with strong past performance, the company faces challenges from fluctuating economic conditions and a general sense of caution among shoppers.

Spending on non-essential items, such as home furnishings which is Dunelm's core business, is particularly vulnerable. Factors like inflation and the general cost of living directly impact how much disposable income consumers have for these types of purchases.

If consumers remain hesitant to spend due to economic worries, Dunelm could experience a slowdown in sales and a dampening of its growth trajectory. For instance, in early 2024, consumer confidence indices showed continued pressure, impacting discretionary spending across retail.

Dunelm, like other retailers, faces risks from disruptions in its supply chain and rising costs. Inflationary pressures and increasing labor expenses directly impact its operational expenses. For instance, the UK inflation rate remained elevated in early 2024, impacting consumer spending power and business costs.

While Dunelm has shown resilience through operational efficiency and productivity improvements, prolonged or severe cost increases, particularly in areas like shipping and raw materials, could still squeeze profit margins. The company's ability to manage its extensive global supply chain effectively remains a critical factor in mitigating these vulnerabilities.

Intense Competition in a Mature Market

Dunelm operates in a saturated UK home furnishings sector, facing formidable rivals such as IKEA, DFS, and a growing number of online-only brands. This intense competition necessitates constant innovation and clear differentiation to preserve market share.

The pressure from competitors can significantly impact pricing strategies, potentially leading to reduced margins, and often requires increased investment in marketing and promotional activities to stand out.

- Market Saturation: The UK home furnishings market is characterized by a high density of established and new players.

- Established Competitors: Key rivals include IKEA, DFS, and numerous other brick-and-mortar and online retailers.

- Pricing Pressure: Intense competition can force Dunelm to adopt more aggressive pricing, potentially squeezing profitability.

- Marketing Costs: To maintain visibility and attract customers, Dunelm may need to allocate substantial resources to marketing efforts.

Potential for Rapid Shifts in Consumer Trends

Dunelm operates in the home furnishings sector, which is highly susceptible to swift changes in consumer tastes and design aesthetics. A key weakness is the potential for rapid shifts in these trends, which can quickly render existing product lines less appealing. For instance, a sudden surge in demand for minimalist decor over maximalist styles, or a preference for sustainable materials over synthetics, could significantly impact Dunelm's sales if the company is slow to pivot its product development and sourcing strategies.

This market dynamism necessitates a constant vigilance and responsiveness. Failing to quickly identify and adapt to significant shifts in style, material preferences, or purchasing habits, such as a move towards online-only purchasing for certain categories, could lead to a decline in product relevance and demand. Dunelm’s ability to maintain its market position hinges on its capacity to anticipate and react to these evolving consumer behaviors.

- Market Volatility: The home decor market is notoriously fickle, with trends changing rapidly.

- Adaptation Lag: Delays in recognizing and responding to new design preferences can erode market share.

- Innovation Imperative: Continuous investment in product innovation and market research is crucial for staying ahead of consumer trend shifts.

Dunelm's heavy reliance on the UK market makes it vulnerable to domestic economic downturns and specific consumer spending habits. For example, while the UK economy showed some signs of stabilization in early 2024, persistent inflation continued to pressure household budgets, directly affecting discretionary spending on home furnishings.

The home furnishings sector is highly competitive, with Dunelm facing strong rivals like IKEA and numerous online retailers. This saturation can lead to price wars and increased marketing expenses, potentially impacting profit margins. For instance, the ongoing need to differentiate in a crowded market requires significant investment in brand building and product innovation.

Changes in consumer tastes and design trends can quickly impact demand for Dunelm's product lines. A failure to adapt swiftly to emerging styles or material preferences, such as a growing demand for sustainable products, could lead to decreased sales and a decline in product relevance. Staying ahead of these shifts is crucial for maintaining market share.

| Weakness | Description | Impact Example (Early 2024) |

|---|---|---|

| Geographic Concentration | Over-reliance on the UK market. | Exposure to UK-specific economic pressures like inflation impacting consumer spending. |

| Intense Competition | Saturated market with strong rivals. | Potential for price reductions and higher marketing costs to maintain market position. |

| Trend Sensitivity | Vulnerability to rapid shifts in consumer tastes. | Risk of product lines becoming outdated if product development and sourcing strategies are not agile. |

What You See Is What You Get

Dunelm Group SWOT Analysis

You’re previewing the actual Dunelm Group SWOT analysis document. The complete, in-depth report will be available immediately after purchase, offering a comprehensive understanding of their strategic position.

Opportunities

The persistent expansion of e-commerce offers Dunelm a prime chance to bolster its online sales, building on the significant contribution they already make to overall revenue. In the fiscal year ending June 2023, Dunelm reported that its digital channels accounted for 20% of its total sales, a figure expected to climb.

Further investment in digital advancements, including AI-powered search functionalities and tailored product suggestions, will be crucial for deepening customer connections and fueling continued online expansion. This strategic focus mirrors the wider trend of increasing online adoption within the home furnishings market.

Dunelm has a clear ambition to grow its market share, aiming for 10% in the medium term. This builds upon its already solid standing in the homewares sector.

The current economic climate presents a fertile ground for expansion. As smaller or struggling retailers face increasing difficulties, Dunelm, as a market leader, is well-positioned to capture their customer base and increase its overall market presence.

By consistently delivering on its value proposition and maintaining a wide selection of products, Dunelm can attract a larger segment of consumers. This strategy is key to solidifying its leadership position and achieving its market share objectives.

Dunelm's strategic store portfolio expansion presents a significant opportunity, with plans to launch 5-10 new superstores annually. This physical growth is further bolstered by their entry into new markets, including 13 acquired stores in Ireland, and a targeted push into inner London.

The exploration of smaller format stores is another key avenue for growth. This allows Dunelm to tap into high-footfall urban areas and connect with customer segments that may have been less accessible through their traditional larger out-of-town locations. This move is expected to boost brand visibility and overall accessibility.

Increasing Demand for Sustainable and Ethical Products

Consumers are increasingly prioritizing home furnishings that are both sustainable and ethically produced, presenting a significant opportunity for Dunelm. The company has been actively pursuing sustainability, evidenced by its commitment to science-based carbon reduction targets and a focus on responsibly sourced materials.

This growing consumer demand can be leveraged by highlighting Dunelm's 'Good & Circular' initiatives and its range of consciously chosen products. For instance, by the end of fiscal year 2023, Dunelm reported that 70% of its cotton products were sourced from more sustainable sources, a tangible step that resonates with environmentally aware shoppers.

This trend allows Dunelm to attract a broader customer base, particularly younger demographics who are more vocal about environmental concerns. By effectively communicating its sustainability efforts, Dunelm can foster stronger brand loyalty and differentiate itself in a competitive market.

- Growing Consumer Preference: A significant portion of consumers, especially millennials and Gen Z, actively seek out brands with strong environmental and ethical credentials.

- Dunelm's Sustainability Initiatives: Dunelm's commitment to science-based targets and responsibly sourced materials, including its progress in sustainable cotton sourcing (70% by FY23), directly addresses this demand.

- Brand Loyalty and Market Share: Promoting its 'Good & Circular' approach and conscious choice products can attract new customers and deepen loyalty among existing ones.

- Competitive Advantage: Proactive engagement with sustainability trends can provide Dunelm with a competitive edge over rivals who are slower to adapt to these evolving consumer values.

Leveraging Home Improvement and Renovation Trends

The UK's home improvement and renovation sector is experiencing significant growth, fueled by an aging housing stock and a growing consumer desire for personalized living spaces. This trend directly benefits Dunelm, as homeowners increasingly invest in enhancing their environments. For instance, the home improvement market in the UK was valued at approximately £58 billion in 2023, with projections indicating continued expansion through 2025.

Dunelm is well-positioned to capitalize on this by offering a broad product range that meets the evolving needs of renovators. This includes stylish, functional, and budget-friendly furniture, home textiles, and decor items. The company's ability to provide affordable yet aspirational solutions aligns perfectly with consumer spending patterns in this segment.

- Growing Market Demand: The UK home improvement market is a substantial and expanding sector, offering a consistent demand for Dunelm's core product categories.

- Consumer Desire for Personalization: Homeowners are actively seeking products that allow them to express their individual style, a need Dunelm can fulfill with its diverse offerings.

- Affordability Advantage: Dunelm's reputation for providing value for money is a key differentiator in a market where consumers are conscious of renovation costs.

Dunelm's expanding digital presence, which contributed 20% of sales in FY23, presents a significant growth avenue. Further investment in AI and personalized recommendations can enhance customer engagement and online sales, aligning with the broader market shift towards e-commerce in home furnishings.

The company's strategic physical expansion, including 5-10 new superstores annually and entry into new markets like Ireland, alongside exploring smaller format stores, offers substantial reach. This dual approach to physical retail strengthens brand visibility and accessibility across diverse consumer segments.

Growing consumer demand for sustainable and ethical products aligns perfectly with Dunelm's 'Good & Circular' initiatives and its 70% sustainable cotton sourcing by FY23. Effectively communicating these efforts can attract environmentally conscious consumers and foster brand loyalty.

The robust UK home improvement market, valued at £58 billion in 2023, provides a strong backdrop for Dunelm's offerings. Its ability to supply affordable, stylish, and functional home goods caters directly to consumers undertaking renovations and personalizing their living spaces.

Threats

A significant economic downturn in the UK, exacerbated by persistent inflation and elevated interest rates, poses a substantial threat to Dunelm. This environment is likely to curb consumer discretionary spending, particularly on non-essential items such as home furnishings. For instance, the Office for Budget Responsibility (OBR) forecast for UK GDP growth in 2024 was revised down to 0.8% in November 2023, signaling continued economic headwinds.

This subdued consumer confidence and the resulting volatile trading environment directly impact Dunelm's sales volumes and revenue growth potential. Companies like Dunelm, which sell discretionary goods, are particularly vulnerable when household budgets tighten. The Bank of England’s Monetary Policy Committee has maintained a base rate of 5.25% as of early 2024, contributing to higher borrowing costs for consumers, which further dampens spending.

The UK home furnishings sector is a crowded space, with Dunelm facing a multitude of competitors ranging from major high street brands and agile online-only retailers to smaller, independent shops. This fragmentation means constant pressure to innovate and maintain price competitiveness.

Intensifying competition can directly impact Dunelm's profitability through price wars and increased marketing expenditure needed to stand out. For instance, the rise of direct-to-consumer online brands in 2024 and 2025 has put further pressure on traditional retailers to adapt their strategies and pricing.

Should rivals introduce disruptive business models or adopt aggressive pricing, Dunelm risks losing market share if its unique selling propositions, like its broad product range and in-store experience, are not sufficiently compelling or if its pricing becomes uncompetitive.

Dunelm is grappling with escalating operational expenses, notably wage inflation, which has been a persistent concern throughout 2024. These rising costs extend across its entire supply chain and operational framework.

Despite Dunelm's ongoing efforts to boost productivity, the persistence of these inflationary pressures, which saw consumer price inflation averaging around 2.3% in the UK for much of 2024, poses a significant threat to profit margins. The ability to pass these increased costs onto customers remains a critical factor for maintaining profitability.

Disruption from New Technologies and Business Models

Dunelm faces a significant threat from disruptive technologies and evolving business models in the retail sector. Competitors are increasingly leveraging advanced technologies like augmented reality (AR) for virtual furniture placement, offering customers a more immersive and convenient shopping experience. For instance, IKEA Place app, launched in 2017, allows users to visualize furniture in their homes using AR, a capability Dunelm is also developing but must accelerate to remain competitive.

Furthermore, the rise of agile, direct-to-consumer (DTC) brands with streamlined operations and specialized product offerings can quickly capture market share. These new entrants often focus on niche markets or specific product categories, challenging established players like Dunelm. The ongoing digital transformation across the retail landscape means that failure to adapt quickly to these technological and business model shifts could lead to a loss of competitive edge.

Dunelm's own digital investments, including its app and website enhancements, are crucial, but the pace of innovation by others is a constant challenge. For example, the broader retail industry saw a significant shift towards online sales, with UK online retail sales accounting for approximately 27.7% of total retail sales in early 2024, underscoring the need for robust digital capabilities.

- Technological Disruption: Competitors adopting AR for product visualization and AI for personalized shopping experiences pose a threat.

- Agile Business Models: New, nimble DTC brands can quickly gain traction by focusing on specific customer needs.

- Pace of Innovation: Dunelm must continuously invest in and adapt to rapidly evolving retail technologies to maintain market relevance.

Growth of the Second-Hand and Circular Economy Market

The burgeoning second-hand and circular economy presents a significant challenge. Consumers are increasingly drawn to pre-owned homewares, motivated by both environmental consciousness and the pursuit of better value. This trend could directly siphon demand away from new products offered by retailers like Dunelm.

Online platforms dedicated to the resale of furniture and home decor are gaining traction. Their growing influence may diminish the market for new items, potentially disrupting traditional retail models. Dunelm, like other established players, needs to consider integrating circular economy principles to mitigate this long-term threat.

- Market Growth: The global second-hand market is projected to reach $350 billion by 2027, with home goods being a significant contributor.

- Consumer Shift: A 2024 survey indicated that over 60% of consumers are considering second-hand options for home furnishings due to cost savings and sustainability.

- Platform Impact: Resale platforms saw a 25% year-over-year increase in home decor listings in late 2024.

The UK's economic climate, marked by persistent inflation and high interest rates, significantly curtails consumer discretionary spending on items like home furnishings. For instance, the OBR's November 2023 forecast revised UK GDP growth down to 0.8% for 2024, highlighting ongoing economic challenges and impacting Dunelm's sales potential.

Intensifying competition from agile online retailers and direct-to-consumer brands puts pressure on Dunelm's pricing and market share. The retail sector's digital transformation, with online sales comprising around 27.7% of UK retail in early 2024, necessitates continuous adaptation to evolving technologies and business models to maintain relevance.

Escalating operational costs, including wage inflation and supply chain expenses, threaten Dunelm's profit margins, especially with consumer price inflation averaging 2.3% in the UK through much of 2024. The growing circular economy and second-hand market also divert demand from new products, as evidenced by a projected $350 billion global second-hand market by 2027.

SWOT Analysis Data Sources

This analysis is built upon a foundation of reliable data, including Dunelm's official financial reports, comprehensive market research, and expert commentary from industry analysts, ensuring a robust and informed assessment.