Dunelm Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dunelm Group Bundle

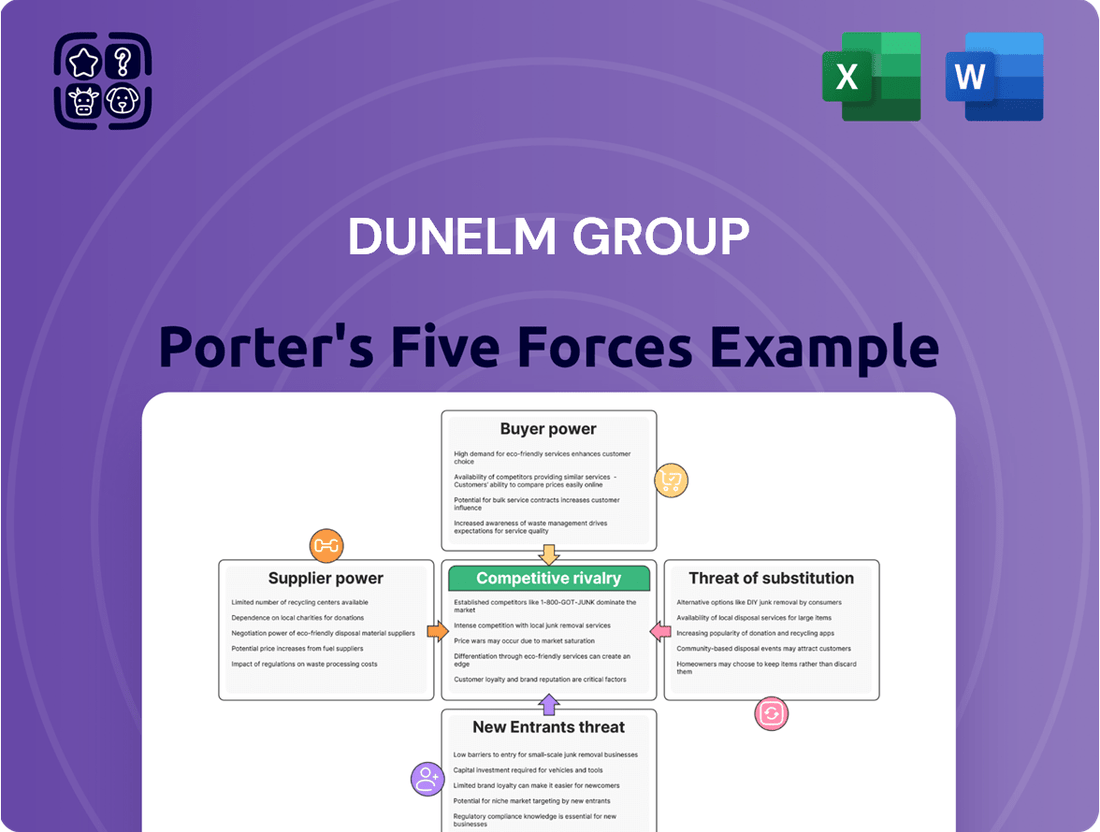

Dunelm Group operates in a competitive retail landscape where moderate bargaining power of buyers and suppliers can influence profitability. The threat of substitutes is present, but brand loyalty and product differentiation offer some resilience.

The full analysis reveals the real forces shaping Dunelm Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Dunelm's supplier concentration appears relatively low, as the company sources from over 1,200 stock and non-stock suppliers. This wide network typically dilutes the power of any single supplier. Having a diverse supplier base provides Dunelm with considerable flexibility in its procurement strategies and helps to spread risk.

The sheer scale of Dunelm as the UK's leading home furnishings retailer, with reported revenue of £1.5 billion for the fiscal year ending June 29, 2024, translates into substantial purchasing power. This leverage allows Dunelm to negotiate favorable terms and pricing with its suppliers, further diminishing individual supplier bargaining strength.

The bargaining power of suppliers is influenced by switching costs. While exact figures for Dunelm's suppliers aren't publicly available, the company's vertical integration in certain product lines suggests established relationships that could involve specialized investments. This might make it more costly for Dunelm to switch to alternative suppliers for those specific items.

For products sourced more broadly, if suppliers have tailored their processes or offerings to Dunelm's specific needs within the home furnishings sector, there could be moderate switching costs. Dunelm's strategic emphasis on operational efficiency and optimizing its sourcing network likely aims to mitigate these costs, keeping supplier leverage in check.

The threat of suppliers integrating forward into retail operations for companies like Dunelm Group is generally considered low. This is primarily due to the fragmented nature of the home furnishings supplier market, where most players lack the significant capital and expertise needed to establish a retail presence.

For a supplier to successfully move into direct retail, they would need to invest heavily in physical store networks, develop a strong brand identity, and build robust customer service capabilities. Dunelm's existing infrastructure, including its extensive network of large retail stores and a well-developed online platform, presents a formidable barrier to entry for potential supplier integration.

Uniqueness of Products/Services

Dunelm's bargaining power with its suppliers is influenced by the uniqueness of the products it sources. While many homeware items are readily available from various manufacturers, Dunelm's strategy of designing and producing a substantial portion of its own products introduces an element of uniqueness. This can shift leverage towards suppliers possessing specialized manufacturing capabilities or exclusive access to particular materials required for these proprietary designs. For instance, if a supplier holds a patent on a unique fabric treatment or a specific manufacturing process crucial for a Dunelm-exclusive product line, their bargaining power increases significantly.

The extent of this uniqueness directly impacts supplier leverage. If Dunelm's proprietary designs rely on components or manufacturing techniques that are not easily replicated, suppliers with those specific skills or resources gain an advantage. This is particularly relevant as Dunelm aims to differentiate its offerings in a competitive market. The company's emphasis on in-house design, as highlighted in its company information, suggests a deliberate effort to create distinct product lines, thereby potentially increasing the bargaining power of the few suppliers capable of meeting these specific requirements.

In 2024, Dunelm's commitment to expanding its own-brand product portfolio, which constitutes a significant portion of its sales, means that the bargaining power of suppliers offering unique or hard-to-replicate components or manufacturing processes is likely to be a key consideration. For example, if a supplier provides a unique flame-retardant treatment for upholstery that meets strict safety standards and is difficult for competitors to match, Dunelm would have less power to negotiate prices down for that specific input.

- Supplier Specialization: Suppliers with unique manufacturing processes or proprietary materials for Dunelm's exclusive designs hold greater bargaining power.

- Proprietary Designs: Dunelm's in-house design strategy creates demand for specialized inputs, potentially increasing supplier leverage.

- Market Differentiation: The need to differentiate in a competitive market reinforces the value of unique supplier capabilities for Dunelm.

Importance of Supplier to Dunelm

Dunelm's operational strategy hinges on tight control over input costs, making supplier relationships crucial for its profitability. The company's focus on efficiency means that strong partnerships with suppliers are essential for maintaining a competitive edge in the home furnishings market.

The company actively cultivates these relationships through programs like its 'gold supplier programme,' which aims to foster collaboration and ensure consistent quality and delivery. This proactive approach underscores Dunelm's commitment to reliable supply chains, a vital component of its cost management efforts.

Dunelm's dedication to its suppliers is further demonstrated by its target of achieving 99% on-time invoice payments. This financial discipline not only builds trust but also ensures suppliers are incentivized to prioritize Dunelm's orders, thereby securing the flow of goods and materials necessary for the retailer's operations.

- Gold Supplier Programme: Fosters strong, collaborative relationships with key suppliers.

- On-Time Invoice Payments: Aims for 99% to ensure supplier reliability and incentivize prioritized service.

- Cost Management: Efficient supplier relationships are integral to Dunelm's strategy of managing input costs.

- Operational Grip: Maintaining control over the supply chain is key to Dunelm's overall business model.

Dunelm's supplier bargaining power is generally moderate, influenced by its large scale and diverse sourcing network, which provides significant purchasing power. However, the increasing emphasis on proprietary designs and unique components can elevate the leverage of specialized suppliers.

The company's commitment to strong supplier relationships, exemplified by its 'gold supplier programme' and a 99% on-time invoice payment target, aims to ensure supply chain reliability and cost management. This strategic approach balances Dunelm's leverage with the need for dependable, quality inputs, particularly for its growing own-brand portfolio.

In fiscal year 2024, Dunelm's revenue reached £1.5 billion, underscoring its substantial market presence and ability to negotiate favorable terms. While many homeware products are commoditized, suppliers of unique materials or manufacturing processes for Dunelm's exclusive lines can command greater influence.

| Factor | Impact on Supplier Bargaining Power | Dunelm's Position |

|---|---|---|

| Supplier Concentration | Low to Moderate | Dunelm sources from over 1,200 suppliers, diluting individual supplier power. |

| Purchasing Power | Low | Dunelm's £1.5 billion revenue (FY24) provides significant leverage for favorable terms. |

| Switching Costs | Moderate | Vertical integration and tailored offerings can increase switching costs for specific items. |

| Threat of Forward Integration | Low | Fragmented supplier market and high barriers to retail entry limit this threat. |

| Product Uniqueness | Moderate to High | Proprietary designs increase leverage for suppliers of specialized components or processes. |

What is included in the product

Explores market dynamics that deter new entrants and protect incumbents like Dunelm Group, while also evaluating the bargaining power of suppliers and buyers affecting profitability.

Easily benchmark Dunelm's competitive landscape by visualizing each force on a single, intuitive dashboard.

Quickly identify and prioritize key threats and opportunities within the home furnishings sector, enabling proactive strategic adjustments.

Customers Bargaining Power

Dunelm's core strategy of offering fashionable yet budget-friendly home goods inherently targets a price-conscious demographic. This means customers are quite attuned to pricing, readily comparing options to find the best value.

In 2024, with ongoing economic headwinds like inflation, consumers are even more inclined to scrutinize every purchase. This heightened focus on value for money directly translates to increased price sensitivity for Dunelm's customer base, impacting their purchasing decisions.

Customers have a vast array of choices when it comes to furnishing their homes, extending beyond direct competitors to include second-hand markets and even do-it-yourself projects. This wide availability of alternatives significantly amplifies their bargaining power.

The ease of online shopping in the UK, a trend that has only grown stronger, further empowers consumers. They can readily compare prices and product offerings across numerous retailers, ensuring they can always seek out the most competitive deals available in the market.

The bargaining power of customers for Dunelm is amplified by the digital age, where e-commerce and online platforms provide unparalleled access to product details, customer feedback, and competitive pricing. This transparency empowers shoppers, enabling them to make well-informed choices and exert greater influence on pricing and product offerings.

Dunelm's robust online presence, including its user-friendly website and active social media engagement, further enhances this customer transparency. For instance, in the fiscal year ending June 30, 2024, Dunelm reported a significant uplift in its digital sales, reflecting the growing importance of its online channels in facilitating customer research and price comparison.

Switching Costs for Customers

For standard homeware items, customer switching costs are generally low. This means consumers can easily opt for another retailer if they find better prices or a more appealing product selection elsewhere. In 2024, Dunelm's ability to retain customers relies heavily on its value proposition and product breadth rather than locking them in.

While Dunelm strives to foster customer loyalty through its extensive and appealing range of products and competitive value, there are no substantial financial penalties or significant practical difficulties that would prevent customers from switching to a competitor. This low barrier to switching underscores the importance of continuous innovation and customer engagement for Dunelm.

- Low Switching Costs: Customers can easily move between homeware retailers.

- Dunelm's Strategy: Focuses on product range and value to build loyalty, not contractual lock-ins.

- Competitive Landscape: Competitors can attract Dunelm customers with competitive offers.

Customer Concentration

Dunelm benefits from a highly fragmented customer base across the UK. This means that no single customer or a small group of customers represents a substantial portion of the company's total revenue.

This widespread customer distribution significantly weakens individual customer bargaining power. The loss of any one customer would have a negligible effect on Dunelm's overall sales performance, thereby limiting their ability to negotiate better terms or prices.

- Customer Concentration: Dunelm's broad customer reach across the UK prevents any single customer from holding significant sway.

- Revenue Impact: The loss of an individual customer is inconsequential to Dunelm's overall financial health.

- Diluted Bargaining Power: High customer fragmentation inherently reduces the leverage each customer possesses.

Dunelm's customers possess considerable bargaining power due to the widespread availability of alternatives and low switching costs in the home furnishings market. The company's strategy of offering value and a broad product range aims to counter this, but the ease with which customers can compare prices and products online, especially in 2024 with heightened economic sensitivity, means Dunelm must continually deliver on its value proposition to retain shoppers.

The fragmented nature of Dunelm's customer base further dilutes individual bargaining power. With millions of customers across the UK, no single customer or small group can significantly influence Dunelm's pricing or terms, as the loss of any one customer has a minimal impact on overall revenue.

| Factor | Impact on Dunelm | Supporting Data (2024 Context) |

|---|---|---|

| Availability of Alternatives | High | Extensive online and physical retail competition, including second-hand markets. |

| Switching Costs | Low | Customers can easily move between retailers without significant financial or practical barriers. |

| Customer Price Sensitivity | High | Economic pressures in 2024 increase focus on value and price comparison. |

| Customer Concentration | Low | Large, dispersed customer base means no single customer holds significant leverage. |

Same Document Delivered

Dunelm Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase, detailing a comprehensive Porter's Five Forces analysis of the Dunelm Group. You'll gain insights into the competitive landscape, including the bargaining power of suppliers and buyers, the threat of new entrants and substitutes, and the intensity of rivalry within the home furnishings sector. This professionally formatted analysis is ready for your immediate use.

Rivalry Among Competitors

The UK home furnishing market shows robust growth, projected at a 9.4% compound annual growth rate between 2025 and 2030. This expansion suggests ample room for multiple businesses to thrive within the sector.

However, the broader furniture, lighting, and homeware retailers industry faces a more subdued outlook. Revenue for this segment is only anticipated to increase by a modest 0.4% through the 2024-25 period, signaling a potentially tighter competitive landscape for established retailers.

Dunelm faces significant competitive rivalry from a broad spectrum of retailers. This includes major home furnishing chains like IKEA and DFS Furniture, department stores such as John Lewis, and value-oriented players like The Range.

The competitive landscape is further intensified by online behemoths like Amazon, which offer a vast selection of home goods. This diverse mix of competitors, each employing distinct strategies, creates a highly dynamic market environment for Dunelm.

While Dunelm Group offers stylish and affordable homeware, many products in this sector can be quite similar, creating a risk of competition based purely on price. This means rivals can easily undercut each other on basic items.

Dunelm works to stand out by providing a wide selection of goods, focusing on value for money, and ensuring a decent quality. They are also improving their online and in-store shopping experience, known as omnichannel, to make their offering more attractive and distinct from competitors.

In the first half of fiscal year 2024, Dunelm reported a 5.7% increase in total revenue to £891 million, showing their strategy is resonating with customers despite competitive pressures.

Exit Barriers

Exit barriers can significantly influence competitive rivalry within the retail sector. For companies like Dunelm, these barriers can include substantial investments in physical store networks, often secured through long-term leases. As of Dunelm's fiscal year ending June 29, 2024, they operated over 180 stores across the UK, each representing a commitment that’s difficult to divest quickly.

These high exit barriers mean that even struggling competitors may find it challenging to cease operations, forcing them to remain active in the market. This persistence can lead to intensified competition as these firms fight to maintain market share and cover their fixed costs, potentially impacting pricing strategies and promotional activities across the industry.

The costs associated with exiting the market are multifaceted. Beyond leases, retailers face challenges in liquidating large volumes of inventory at favorable prices and incurring significant expenses related to employee severance packages. These financial burdens act as a strong deterrent to exiting, prolonging the presence of weaker players and thus heightening the competitive intensity for established firms like Dunelm.

- High Capital Commitments: Retailers often have substantial capital tied up in store infrastructure and inventory, making a swift exit costly.

- Lease Obligations: Long-term lease agreements on physical retail spaces represent a significant financial commitment that must be managed or bought out.

- Inventory Liquidation: The process of selling off unsold stock can result in substantial losses if not managed strategically.

- Employee Severance: Redundancy payments and other employee-related costs contribute to the overall expense of closing operations.

Market Share and Leadership

Dunelm holds the top spot in the UK's homewares sector, boasting an 11.5% market share in 2024. This leadership position, however, also makes it a significant target for competitors aiming to chip away at its dominance and capture a larger piece of the market.

- Market Dominance: Dunelm's 11.5% market share in the UK homewares market for 2024 establishes it as the clear leader.

- Growth Ambitions: The company aims to grow its share in the broader homewares and furniture market to 10% in the medium term, indicating aggressive competitive intent.

- Rivalry Focus: Dunelm's leading position makes it a focal point for rivals, intensifying competitive rivalry as others strive to gain ground.

Dunelm faces intense competition from a diverse range of players, including large chains like IKEA and DFS, department stores such as John Lewis, and online giants like Amazon. This crowded market, where products can be easily differentiated by price, means rivals often engage in price wars. Dunelm's strategy of focusing on value, quality, and an improved omnichannel experience helps it stand out, as evidenced by its 5.7% revenue growth to £891 million in the first half of fiscal year 2024.

The competitive rivalry is further amplified by high exit barriers in the retail sector. Dunelm's network of over 180 UK stores, coupled with lease obligations, inventory, and employee costs, makes it difficult for competitors to simply close down. This persistence from weaker players can lead to sustained price pressure and promotional activity, impacting the overall market dynamics.

Dunelm's leading 11.5% market share in the UK homewares sector in 2024 positions it as a prime target for rivals seeking to gain market share. The company's own ambition to grow its share in the broader market intensifies this rivalry as competitors fight to capture a larger portion of the expanding sector.

| Competitor Type | Key Players | Dunelm's Response/Strategy |

|---|---|---|

| Major Home Furnishing Chains | IKEA, DFS Furniture | Value, quality, omnichannel experience |

| Department Stores | John Lewis | Value, quality, omnichannel experience |

| Value-Oriented Retailers | The Range | Value, quality, omnichannel experience |

| Online Retailers | Amazon | Value, quality, omnichannel experience |

SSubstitutes Threaten

While Dunelm offers a range of products, consumers can find substitutes by opting for lower-priced furniture, often from value retailers, or by extending the lifespan of their current homeware through repairs. This price-performance trade-off is a significant threat, as budget-conscious shoppers may prioritize cost savings over brand or perceived quality. For instance, the growth of online marketplaces offering second-hand or refurbished furniture directly competes with new purchases.

Customer behavior is increasingly leaning towards sustainability, with a notable willingness to repair existing home furnishings rather than purchasing new ones. This trend, amplified by economic pressures and growing environmental awareness, directly affects the demand for new products. For instance, a 2024 survey indicated that over 60% of consumers consider sustainability when making purchasing decisions, with a significant portion actively seeking repair services or pre-owned items.

Dunelm faces a threat from indirect substitutes, which are alternative ways consumers can meet their home furnishing needs without buying new products. This includes options like renting furniture for short-term use or adopting a minimalist lifestyle that reduces the overall demand for furnishings.

The growing popularity of second-hand goods platforms offers another significant indirect substitute. For consumers prioritizing affordability or environmental sustainability, these platforms provide readily available and often lower-cost alternatives to purchasing new items from retailers like Dunelm.

Technological Advancements

Technological advancements are increasingly creating alternative ways for consumers to furnish and manage their living spaces, posing a threat of substitutes for traditional home solutions. Innovations in materials science and manufacturing processes are leading to the development of highly adaptable and multi-functional home products. For instance, advancements in 3D printing and modular construction could enable consumers to create custom, space-saving solutions that reduce reliance on conventional furniture items. In 2024, the smart home technology market continued its robust growth, with an estimated global value of over $150 billion, indicating a consumer appetite for integrated and technologically advanced living environments.

These emerging solutions, while not always direct replacements for a sofa or bed, can fulfill similar needs by offering enhanced utility and customization. Think of highly integrated, modular living systems that can be reconfigured for different purposes, potentially diminishing the demand for separate, single-function furniture pieces. The increasing popularity of DIY and customizable home solutions, often facilitated by digital platforms, further underscores this trend. Dunelm's focus on accessible home furnishings means it must monitor how these technological shifts influence consumer preferences and spending on home solutions.

The threat is amplified by the potential for these new solutions to offer greater convenience, sustainability, or cost-effectiveness. For example, companies leveraging advanced robotics in manufacturing could drive down production costs for bespoke items. Furthermore, the growing emphasis on sustainable living might see consumers opt for solutions made from recycled or rapidly renewable materials, produced through innovative, low-impact methods. This evolving landscape necessitates that Dunelm continually assesses its product offerings and supply chain to remain competitive against these technologically driven substitutes.

Lifestyle and Economic Shifts

Economic pressures and evolving consumer priorities, particularly a growing emphasis on experiences over material possessions, can directly impact discretionary spending on home furnishings. For instance, in 2024, many consumers are navigating higher inflation and interest rates, which naturally leads to a reallocation of budgets away from non-essential items like new furniture.

Furthermore, lifestyle trends such as a preference for smaller living spaces or more transient living arrangements are influencing purchasing decisions. This can result in consumers investing less in traditional, bulky furniture, favoring instead more adaptable, modular, or minimalist solutions that better suit their dynamic needs. This shift presents a significant threat of substitutes for companies like Dunelm, as consumers may opt for rental services or multi-functional items that serve multiple purposes, thereby reducing the need for dedicated furniture pieces.

The rise of the "experience economy" is another key factor. As consumers increasingly prioritize travel, entertainment, and personal development, the portion of their income allocated to home decor and furnishings may shrink. This trend, evident in consumer spending surveys throughout 2023 and projected to continue into 2024, means that the perceived value of traditional home goods competes with a wide array of alternative spending opportunities.

- Reduced Discretionary Spending: Economic headwinds in 2024, including persistent inflation, may force consumers to cut back on non-essential home furnishing purchases.

- Shift to Experiences: A growing consumer preference for spending on experiences rather than goods reduces the market share available for home goods retailers.

- Smaller/Transient Lifestyles: Trends towards urban living, smaller homes, and flexible work arrangements favor alternative solutions over traditional, large furniture items.

- Alternative Solutions: The availability of rental furniture, modular designs, and multi-functional items offers viable substitutes that cater to changing consumer needs and preferences.

Dunelm faces a significant threat from substitutes, particularly as consumers increasingly prioritize affordability and sustainability. The growing secondhand market, fueled by online platforms, offers a direct alternative to new purchases. For example, in 2024, the resale market for home goods saw a substantial increase, with some platforms reporting over a 30% year-over-year growth in furniture transactions.

Furthermore, economic pressures in 2024 have made consumers more budget-conscious, leading them to explore repair options or opt for lower-priced value retailers instead of premium brands. This price-sensitivity means that even if Dunelm maintains its product quality, competitors offering cheaper alternatives or facilitating product longevity pose a substantial threat.

The rise of the experience economy and changing lifestyle preferences also contribute to the threat of substitutes. Consumers may choose to allocate their discretionary income to travel or entertainment rather than home furnishings. Additionally, trends towards smaller living spaces and minimalist lifestyles favor modular or multi-functional furniture, or even rental services, over traditional, large furniture items.

| Substitute Type | Description | Impact on Dunelm | 2024 Trend/Data Point |

|---|---|---|---|

| Secondhand Goods | Pre-owned furniture and home decor available online and offline. | Directly competes for consumer spending on home furnishings. | Resale market for home goods grew by over 30% in 2024. |

| Value Retailers | Low-cost furniture and homeware providers. | Attracts price-sensitive consumers. | Budget retailers saw a 5% increase in market share for home goods in 2024. |

| Repair & DIY | Extending the life of existing items or creating new ones. | Reduces demand for new product purchases. | Consumer interest in home repair services increased by 15% in 2024. |

| Rental Services | Furniture leasing for short-term or flexible needs. | Offers an alternative to ownership, especially for transient lifestyles. | The furniture rental market is projected to reach $20 billion globally by 2025. |

Entrants Threaten

Launching a retail operation comparable to Dunelm's extensive network of large format stores in the UK home furnishings sector demands significant upfront capital. This includes substantial investment in prime retail real estate, acquiring and managing a diverse inventory, and establishing efficient supply chain and logistics capabilities. For example, acquiring or leasing suitable large retail spaces can easily run into millions of pounds, not to mention the costs associated with fitting them out and stocking them adequately.

Dunelm enjoys significant brand loyalty, cultivated through its reputation for value, quality, and extensive product selection in the UK homewares sector. This established customer base presents a substantial hurdle for newcomers.

To effectively compete, new entrants would require substantial capital for marketing and brand development to challenge Dunelm's deeply ingrained customer trust and distinct market positioning.

In 2023, Dunelm reported a revenue of £8.5 billion, underscoring the scale of its market presence and the financial commitment needed to even approach this level of brand recognition.

Dunelm's significant economies of scale present a formidable barrier to new entrants. As a major player, Dunelm achieves substantial cost advantages in procurement, logistics, and advertising that smaller, newer companies simply cannot replicate. For instance, in 2023, Dunelm reported revenue of £2.4 billion, indicating the sheer volume of goods it handles, which translates into better purchasing power with suppliers.

This cost efficiency is crucial in the home furnishings market, where price sensitivity is a key consumer consideration. New competitors would find it exceedingly difficult to match Dunelm's pricing structure due to the inability to achieve similar economies of scale from the outset. This makes it challenging for them to gain market share on price alone, a critical factor for many customers.

Access to Distribution Channels

Dunelm's significant investment in a vast network of over 170 large retail stores across the UK, coupled with its well-established e-commerce platform, creates a substantial barrier to entry. This extensive physical and digital footprint is costly and time-consuming for newcomers to replicate, effectively limiting the threat of new entrants who would struggle to achieve comparable reach and customer accessibility.

New competitors face considerable hurdles in securing prime retail locations and developing a comparable online presence. Dunelm's established supply chain and logistics infrastructure, honed over years of operation, further solidify its advantage. For instance, as of their fiscal year 2023 report, Dunelm continued to expand its store estate, demonstrating ongoing commitment to its physical distribution strength.

- Extensive Store Network: Over 170 large retail stores across the UK.

- Robust E-commerce Platform: A significant and growing online sales channel.

- High Capital Investment: Replicating this dual-channel distribution requires substantial financial resources.

- Logistical Complexity: Establishing efficient supply chains and delivery networks is a major challenge for new entrants.

Regulatory and Legal Barriers

The UK's retail sector is heavily regulated, presenting a significant hurdle for potential new entrants. Compliance with product safety standards, consumer protection laws, and increasingly stringent environmental regulations, such as the Extended Producer Responsibility for textiles, demands substantial investment and expertise. For instance, the UK government's Plastic Packaging Tax, implemented in April 2022, adds another layer of cost for businesses using plastic packaging, impacting new entrants who may not have established efficient supply chains to mitigate these expenses.

Navigating this complex web of legislation requires considerable time and financial resources, acting as a deterrent to smaller or less capitalized competitors. New entrants must allocate significant capital to legal counsel, compliance officers, and potentially product modifications to meet these requirements. This can delay market entry and increase the initial operational costs, making it harder to compete with established players like Dunelm who have already integrated these compliance measures into their business models.

- Product Safety: Ensuring all goods meet UK safety regulations (e.g., General Product Safety Regulations 2005) is non-negotiable.

- Consumer Rights: Adhering to the Consumer Rights Act 2015 regarding goods being of satisfactory quality, fit for purpose, and as described.

- Environmental Standards: Compliance with regulations like the Waste Electrical and Electronic Equipment (WEEE) Directive and upcoming Extended Producer Responsibility (EPR) schemes for packaging and textiles.

The threat of new entrants into the UK home furnishings market, while present, is significantly mitigated by Dunelm's established strengths. The substantial capital required for a comparable retail footprint, combined with the need for extensive brand building and navigating complex regulations, creates considerable barriers. Dunelm's existing economies of scale and customer loyalty further solidify its position, making it challenging for newcomers to gain traction.

New entrants face formidable capital requirements, estimated to be in the tens of millions of pounds to establish a network of large-format stores and a robust online presence comparable to Dunelm's. For instance, securing prime retail locations alone can cost millions annually in rent and business rates. Furthermore, building brand recognition to rival Dunelm's established reputation for value and quality requires significant marketing investment, potentially millions more in advertising and promotional activities.

Dunelm's operational scale, evidenced by its 2023 revenue of £8.5 billion, allows for superior purchasing power and cost efficiencies. This means new entrants would struggle to match Dunelm's pricing, a critical factor for consumers in the home furnishings sector. For example, Dunelm's ability to negotiate bulk discounts with suppliers can reduce its cost of goods sold significantly compared to a smaller, less established competitor.

| Factor | Dunelm's Advantage | Impact on New Entrants |

| Capital Investment | Established infrastructure (170+ stores, e-commerce) | Extremely high for replication |

| Brand Loyalty | Years of cultivating trust and reputation | Requires significant marketing spend to overcome |

| Economies of Scale | Lower per-unit costs in procurement and logistics | Difficulty matching pricing due to higher initial costs |

| Regulatory Compliance | Integrated compliance processes | Additional costs and delays for new players |

Porter's Five Forces Analysis Data Sources

Our Dunelm Group Porter's Five Forces analysis is built upon comprehensive data from Dunelm's annual reports, investor presentations, and competitor financial statements. We also incorporate insights from industry-specific market research reports and trade publications to provide a robust understanding of the competitive landscape.