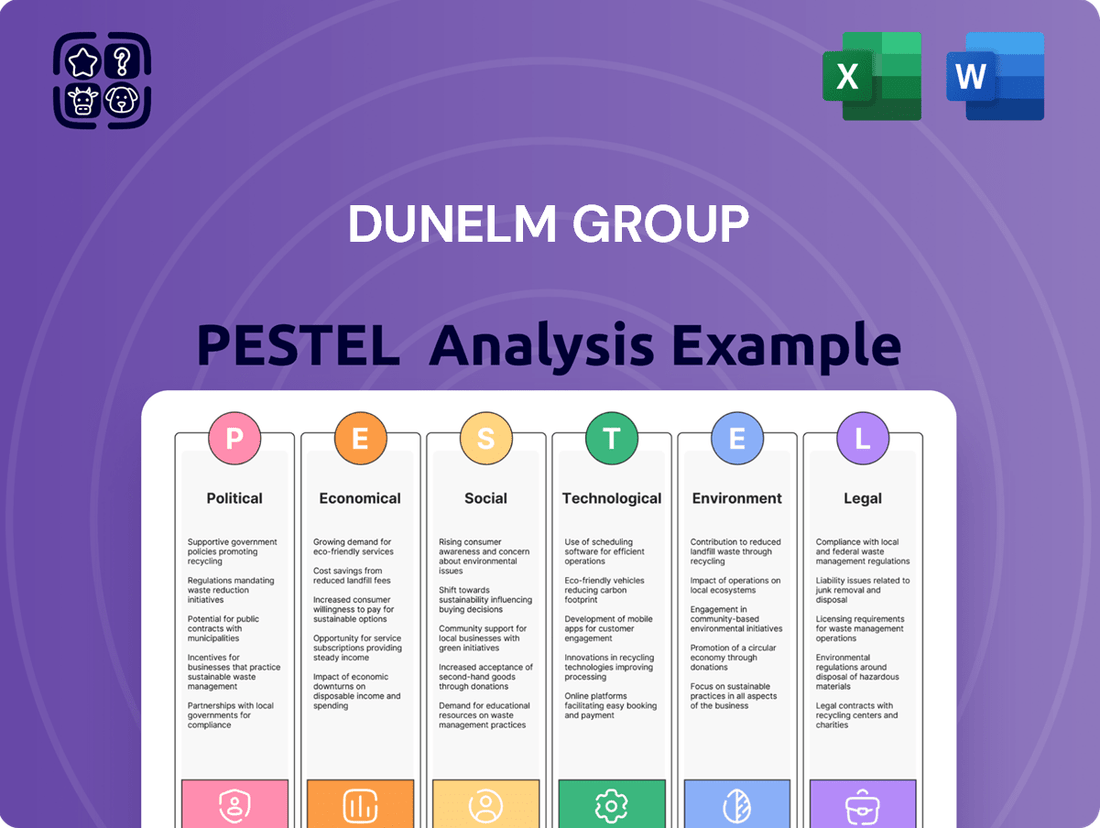

Dunelm Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dunelm Group Bundle

Dunelm Group operates within a dynamic external environment, influenced by evolving political landscapes, economic fluctuations, and shifting consumer social trends. Understanding these forces is crucial for strategic planning and identifying potential opportunities and threats. Our comprehensive PESTLE analysis dives deep into these factors, offering actionable insights to navigate the market effectively.

Gain a competitive edge by leveraging our meticulously researched PESTLE analysis of Dunelm Group. Uncover how political stability, economic growth, technological advancements, environmental concerns, and legal frameworks are shaping the company's trajectory. Download the full report to arm yourself with the intelligence needed to make informed decisions and secure your market position.

Political factors

As a major UK retailer, Dunelm Group is significantly shaped by government policies. Changes in areas like taxation, import/export regulations, and business rates directly affect its operational expenses and how it prices its products.

The upcoming Digital Markets, Competition and Consumers Act 2024, with key provisions effective from April 2025, will introduce stricter consumer protection laws. This legislation grants the Competition and Markets Authority (CMA) enhanced powers, including the ability to levy substantial fines of up to 10% of a company's global annual turnover for non-compliance, potentially impacting Dunelm's financial performance.

The UK's consumer protection landscape is set for a significant overhaul with the Digital Markets, Competition and Consumers Act 2024, coming into effect in April 2025. This legislation introduces stricter rules, including outright bans on deceptive practices like 'drip pricing' and the use of fake online reviews. The Competition and Markets Authority (CMA) will possess enhanced direct enforcement powers, enabling them to levy substantial fines on non-compliant businesses.

For Dunelm, this means an immediate need to scrutinise and adapt its marketing strategies, pricing structures, and online review moderation processes. Ensuring full compliance with these new regulations is crucial to prevent potential financial penalties and safeguard the company's reputation in the eyes of consumers.

The UK's evolving trade landscape, particularly after Brexit, presents significant considerations for Dunelm. New trade agreements or changes to existing ones can directly influence the cost and ease of sourcing home furnishings from international suppliers. For instance, shifts in tariffs or customs procedures with the EU, a key trading partner, could increase Dunelm's import expenses.

Dunelm, like many retailers, must navigate these complexities to maintain competitive pricing and product availability. The ongoing adjustments to trade relationships mean that supply chain resilience is paramount. Fluctuations in costs associated with imported goods, such as textiles and furniture components, can impact Dunelm's profit margins and necessitate strategic sourcing decisions.

For example, if tariffs on goods from certain regions increase, Dunelm might explore alternative sourcing locations or adjust its product mix. The Office for National Statistics reported in early 2024 that UK trade in goods with the EU saw notable shifts following the implementation of new customs checks, highlighting the real-world impact on businesses.

Employment Law and Minimum Wage

Changes in UK employment laws, particularly concerning the National Living Wage and National Insurance contributions, directly affect Dunelm's operational expenses. As of April 2024, the National Living Wage increased to £11.44 per hour for those aged 21 and over, impacting a significant portion of Dunelm's workforce. This rise in labour costs can exert pressure on the company's profit margins.

Dunelm, as a substantial employer with a widespread retail presence, must adapt to these increasing wage demands. The company may need to focus on enhancing staff productivity and maintaining stringent control over its operational expenditures to mitigate the impact of higher labour costs.

- National Living Wage Increase: The National Living Wage rose to £11.44 per hour in April 2024 for workers aged 21 and over.

- Impact on Labour Costs: This legislative change directly increases Dunelm's overall expenditure on its staff.

- Profit Margin Pressure: Higher wage bills can potentially reduce the company's profitability if not offset by efficiency gains.

- Strategic Response: Dunelm is likely to implement productivity improvements and cost management strategies to navigate these changes.

Political Stability and Consumer Confidence

The overall political stability within the United Kingdom significantly impacts consumer confidence, a crucial driver for discretionary spending categories such as home furnishings, which Dunelm Group operates within. A stable political landscape typically cultivates greater consumer optimism, directly influencing purchasing decisions and potentially leading to increased sales for retailers like Dunelm.

Conversely, periods of political uncertainty or instability can foster cautious consumer behavior, leading individuals to delay or reduce spending on non-essential items. This hesitancy directly affects Dunelm's revenue streams, as consumers prioritize essential goods during uncertain times.

- Consumer Confidence Index: In early 2024, the GfK Consumer Confidence Index showed a gradual improvement, reaching -19 in February 2024, up from -38 in February 2023, indicating a potential shift towards more positive consumer sentiment.

- Retail Sales Volume: While overall retail sales volumes saw a slight increase of 0.1% in January 2024 compared to December 2023, the sector remains sensitive to economic and political shifts.

- Government Policy Impact: Changes in government fiscal policy, such as alterations to taxation or interest rates, can directly influence household disposable income and, consequently, consumer spending on home goods.

New consumer protection laws, such as the Digital Markets, Competition and Consumers Act 2024, effective April 2025, will impose stricter rules on retailers like Dunelm, with potential fines up to 10% of global turnover for non-compliance.

Changes in UK trade policy post-Brexit can impact sourcing costs and supply chain efficiency, as seen in early 2024 shifts in UK-EU trade following new customs checks.

Rising labour costs, driven by the National Living Wage increase to £11.44 per hour in April 2024 for those 21 and over, directly affect Dunelm's operational expenses and profit margins.

Political stability influences consumer confidence, with early 2024 data showing a slight improvement in the GfK Consumer Confidence Index to -19, impacting discretionary spending on home furnishings.

| Legislation/Policy | Effective Date | Impact on Dunelm | Relevant Data/Example |

| Digital Markets, Competition and Consumers Act 2024 | April 2025 | Stricter consumer protection, potential fines up to 10% global turnover | Bans drip pricing, fake reviews; CMA enhanced enforcement powers |

| Post-Brexit Trade Adjustments | Ongoing | Sourcing costs, supply chain resilience | Office for National Statistics: Noted shifts in UK-EU trade in early 2024 |

| National Living Wage Increase | April 2024 | Increased labour costs, potential profit margin pressure | £11.44 per hour for workers aged 21+ |

| Political Stability & Consumer Confidence | Ongoing | Impacts discretionary spending | GfK Consumer Confidence Index at -19 in Feb 2024 (up from -38 in Feb 2023) |

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors influencing the Dunelm Group, covering Political, Economic, Social, Technological, Environmental, and Legal aspects.

It provides actionable insights for strategic decision-making, highlighting potential threats and opportunities within Dunelm's operating landscape.

A concise Dunelm Group PESTLE analysis summary, formatted for easy integration into presentations and strategy documents, alleviates the pain of time-consuming data compilation.

Economic factors

The persistent high inflation and the UK's cost-of-living crisis significantly squeeze household budgets, directly affecting consumer spending on discretionary items such as home furnishings. Dunelm, like many retailers in this sector, faces the challenge of consumers prioritizing essential spending over non-essential home upgrades.

While some indicators like a narrowing trade deficit and moderating inflation provided a slight uplift towards the close of 2024, the economic outlook for 2025 suggests continued challenges. For instance, the Office for Budget Responsibility projected inflation to remain above the Bank of England's 2% target for much of 2025, impacting real wage growth.

This economic environment compels consumers to re-evaluate their purchasing decisions, often leading them to postpone significant home décor investments. Instead, they might opt for smaller, more affordable purchases or shift spending towards experiences and services that offer immediate perceived value.

UK consumer spending on home improvements and furniture saw a slowdown in 2024, with reports indicating declines as households focused more on essential goods and sought out better value. This trend saw a shift away from significant discretionary home purchases.

While big-ticket items are less favored, consumers still show interest in decorating projects, often driven by the positive emotional impact. This segment remains a resilient area for spending, even amidst broader economic caution.

Dunelm, however, managed to achieve sales growth in this challenging market during its fiscal year ending June 2024. This was largely attributed to an increase in sales volume and consistent pricing strategies, with its digital channels notably outperforming.

Fluctuations in interest rates significantly impact the demand for home furnishings. Higher rates can deter new homeowners and reduce discretionary spending on items like furniture and decor. For instance, the Bank of England's base rate, which stood at 5.25% in early 2024, influences mortgage affordability and, consequently, housing market activity.

The health of the UK housing market is a key driver for Dunelm. A recovering market, potentially boosted by initiatives like stamp duty reforms, can stimulate spending from new homeowners eager to furnish their properties. This demographic is a prime target for home decor retailers.

Despite economic headwinds, the UK home decor market is showing resilience, with projections indicating growth. Furniture remains the largest segment within this market, underscoring its importance to retailers like Dunelm. The market was valued at approximately £17 billion in 2023, with furniture sales accounting for a substantial portion.

Supply Chain Costs and Disruptions

Dunelm's reliance on intricate global supply chains means that any hiccups, like shipping delays or escalating freight expenses, can directly affect how much product is on shelves and at what price. For instance, the ongoing volatility in shipping rates, which saw significant increases in 2023 and continued into early 2024, presents a persistent challenge.

In response to these pressures and the broader economic climate, retailers like Dunelm are actively reviewing and reconfiguring their supply chains. The goal is to create more streamlined and resilient operations, especially as potential new costs, such as packaging levies, loom. This strategic reassessment is crucial for navigating the current economic landscape.

A primary objective for Dunelm is to safeguard its gross margin despite these mounting supply chain costs and potential disruptions. For the fiscal year ending June 2024, Dunelm reported a gross margin of 50.1%, demonstrating a strong focus on cost management and pricing strategies to absorb inflationary pressures.

- Global Supply Chain Vulnerability: Dunelm's extensive reliance on international sourcing exposes it to risks from geopolitical events, natural disasters, and transportation bottlenecks.

- Rising Logistics Costs: Increased fuel prices and container shipping rates, which remained elevated in 2024 compared to pre-pandemic levels, directly impact Dunelm's cost of goods sold.

- Strategic Supply Chain Realignment: Retailers are exploring near-shoring or diversifying suppliers to mitigate risks and improve delivery times, potentially impacting inventory management and costs.

- Margin Protection: Dunelm's ability to maintain healthy gross margins, such as the 50.1% reported for FY24, is critical for its profitability in the face of rising operational expenses.

Competition and Market Share

The UK home furnishings sector is highly competitive, and Dunelm is actively working to grow its market share. Currently standing at 7.7%, the company has set a medium-term objective to reach 10%.

The market is seeing increased demand for budget-friendly products that allow consumers to refresh their homes. Online sales are projected to be the fastest-growing segment within this market.

Dunelm's strategic approach involves broadening its product offerings and ensuring its pricing remains competitive to capture a larger share of this expanding market.

- Market Share Goal: Dunelm aims to increase its UK home furnishings market share from 7.7% to 10%.

- Market Trend: Growth in affordable options for home updates is a key driver.

- Channel Growth: Online sales are expected to experience the fastest growth.

- Dunelm's Strategy: Expanding product range and maintaining competitive pricing are central to their plan.

The UK economy faces persistent inflation, impacting household budgets and discretionary spending on items like home furnishings. While inflation showed signs of moderating towards the end of 2024, the Office for Budget Responsibility projected it to remain above the Bank of England's 2% target throughout much of 2025, affecting real wage growth.

Interest rates, with the Bank of England's base rate at 5.25% in early 2024, continue to influence housing market activity and consumer confidence, potentially dampening demand for larger home purchases.

Despite these economic challenges, the UK home furnishings market, valued at approximately £17 billion in 2023, shows resilience, with furniture being the largest segment.

Dunelm reported sales growth in its fiscal year ending June 2024, achieving a gross margin of 50.1%, and aims to increase its market share from 7.7% to 10% by expanding its product range and maintaining competitive pricing.

| Economic Factor | 2024/2025 Outlook | Impact on Dunelm |

| Inflation | Moderating but above target | Squeezes household budgets, affecting discretionary spending |

| Interest Rates | High (e.g., 5.25% BoE base rate) | Impacts housing market and consumer confidence |

| Consumer Spending | Prioritizing essentials, cautious on discretionary items | Reduced demand for big-ticket home furnishings |

| Market Size | Resilient, £17bn (2023) | Opportunities for market share growth |

| Dunelm Performance | Sales growth FY24, 50.1% gross margin | Strategies focus on volume and pricing |

Same Document Delivered

Dunelm Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Dunelm Group delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting their operations. Gain actionable insights into the strategic landscape for this leading home furnishings retailer.

Sociological factors

Modern consumers are placing a greater emphasis on their living spaces, with a growing desire for personalized and aesthetically pleasing home environments. This shift fuels demand for home styling products, as individuals invest more in making their homes comfortable and attractive. For instance, Dunelm reported a strong performance in its home furnishings category, reflecting this trend.

The persistent trend of remote and hybrid working continues to shape consumer needs, particularly regarding home offices. There's a noticeable demand for furniture that is not only functional and ergonomic but also stylish, seamlessly integrating into home decor. This dual requirement for practicality and design means consumers are actively seeking items that enhance both their work-from-home setup and their overall living experience.

Consumers are increasingly prioritizing sustainability and ethical sourcing, with many willing to spend more on eco-friendly products, even when facing economic pressures. For instance, a 2024 report indicated that over 60% of consumers consider sustainability when making purchasing decisions.

Dunelm is actively responding to this by integrating its 'Good & Circular' sustainability strategy, which includes ambitious targets for reducing its carbon footprint, aiming for a 50% reduction in absolute Scope 1 and 2 CO2e emissions by 2030 against a 2019 baseline. The company is also focused on growing its 'Conscious Choice' product range, emphasizing materials like recycled polyester and organic cotton.

This growing consumer consciousness directly impacts purchasing behavior and fosters stronger brand loyalty among those companies that demonstrate genuine commitment to environmental and social responsibility.

Demographic shifts, particularly the ongoing trend of urbanization, are significantly shaping the demand for home furnishings. As more people move into cities, the need for functional and aesthetically pleasing home decor that maximizes limited living spaces grows. This trend is further amplified by rising middle-class incomes, which provide consumers with greater disposable income to invest in their homes.

The growing urban population directly impacts housing preferences, with a noticeable increase in demand for versatile and space-saving furniture and decor solutions. Dunelm is actively responding to these evolving consumer needs by strategically expanding its physical presence. A key move in this direction was the opening of its first inner London store, aiming to capture a larger share of the urban market and cater to the specific demands of city dwellers.

Influence of Digital and Social Media

Digital and social media platforms are powerful conduits for interior design trends, directly shaping consumer preferences. Platforms like Instagram, Pinterest, and TikTok are now primary sources for inspiration, product discovery, and even DIY project guidance, fostering a surge in social commerce. This trend highlights the critical need for retailers like Dunelm to cultivate a robust online presence and consistently produce engaging digital content to connect with and influence their target audience.

In 2024, the influence of social media on purchasing decisions continues to grow, with a significant portion of consumers reporting that they discover new brands and products through these channels. For instance, a substantial percentage of Gen Z and Millennial shoppers actively seek out home decor ideas on platforms like TikTok, often leading to impulse purchases. Retailers are increasingly investing in influencer marketing and shoppable content to capitalize on this shift.

- Trend Diffusion: Social media accelerates the spread of interior design trends, making them accessible to a wider audience.

- Consumer Inspiration: Platforms like Pinterest and Instagram are key for users seeking home decor ideas and product recommendations.

- Social Commerce Growth: The integration of shopping features on social media facilitates direct purchases, blurring the lines between inspiration and transaction.

- Retailer Adaptation: Businesses must prioritize digital engagement and visually appealing content to remain competitive in this evolving landscape.

Value-Driven Shopping and Affordability

In today's economic landscape, consumers are prioritizing value and affordability when refreshing their living spaces, leading them to seek out budget-friendly options. Dunelm's core strategy of offering stylish yet accessible home goods perfectly caters to this growing consumer sentiment, positioning it favorably within the market.

The demand for high-quality products at lower price points is driving significant expansion in the mid-range home decor sector. This trend is evident as consumers actively seek out retailers that can deliver both aesthetic appeal and economic sensibility.

- Value Focus: Shoppers are increasingly scrutinizing prices and seeking the best possible deals, making value a primary purchasing driver.

- Affordability Demand: The desire for home updates without significant financial strain is boosting sales for retailers offering cost-effective solutions.

- Mid-Market Growth: The home furnishings market is seeing a surge in the mid-range segment, as consumers look for a balance of quality and price.

- Dunelm's Alignment: Dunelm's established reputation for providing affordable home essentials aligns directly with these evolving consumer priorities.

Societal attitudes towards home living have shifted significantly, with a pronounced focus on creating comfortable and personalized spaces. This trend is amplified by the ongoing prevalence of remote and hybrid work, which necessitates functional yet stylish home office setups. Consumers are also increasingly prioritizing sustainability and ethical sourcing, demonstrating a willingness to invest in eco-friendly products, even amidst economic uncertainties.

Demographic changes, notably urbanization, are reshaping demand for home furnishings, particularly for space-saving and versatile solutions. The influence of digital and social media platforms on interior design trends continues to grow, acting as key drivers for product discovery and purchasing decisions. This digital-native approach to inspiration and commerce requires retailers to maintain a strong online presence and engaging content strategies.

Dunelm's strategy aligns well with these sociological shifts. For instance, in their 2024 financial year, Dunelm reported a 5.7% increase in total sales to £9.3 billion, demonstrating their ability to cater to evolving consumer preferences for value and style. The company's commitment to sustainability is also evident, with their 'Good & Circular' initiative aiming for significant carbon footprint reductions.

| Trend | Impact on Dunelm | Supporting Data (2024/2025) |

|---|---|---|

| Emphasis on Home Comfort & Personalization | Increased demand for home styling products | Strong performance in home furnishings category |

| Remote/Hybrid Work | Demand for functional and stylish home office furniture | Continued growth in furniture and storage solutions |

| Sustainability & Ethical Sourcing | Consumer preference for eco-friendly options | Growth in 'Conscious Choice' product range; 60%+ consumers consider sustainability in purchases |

| Urbanization | Demand for space-saving and versatile decor | Expansion into urban markets, e.g., first inner London store |

| Digital & Social Media Influence | Importance of online presence and engaging content | Increased social commerce, influencer marketing adoption |

Technological factors

Dunelm's e-commerce platform is a crucial technological factor, complementing its extensive network of physical stores. Digital sales now represent a substantial and expanding segment of the company's overall revenue, demonstrating the increasing importance of online channels.

The company is actively investing in its digital capabilities, aiming to refine its online offering and strengthen its multi-channel approach. This includes enhancing services like Click & Collect, which bridges the gap between online browsing and in-store purchasing, ensuring a smooth and convenient customer experience.

For the fiscal year ending June 30, 2024, Dunelm reported a significant uplift in digital sales, contributing to its overall growth trajectory. This focus on seamless integration between online and offline touchpoints is vital for meeting evolving consumer preferences.

Dunelm is actively integrating AI into its online platform, notably using Google Cloud's generative AI for its search and recommendation engines. This technological advancement is designed to make finding products on their website smoother and more personalized for shoppers.

By reducing the effort needed to discover items, Dunelm aims to boost its online sales and improve the overall customer experience. This focus on AI-driven personalization is a key technological strategy for the company's digital growth trajectory.

Augmented reality (AR) and virtual reality (VR) are becoming increasingly relevant in the furniture e-commerce space, offering customers a novel way to visualize products within their own homes before making a purchase. This technology has the potential to significantly enhance the online shopping experience by bridging the gap between digital browsing and the tangible reality of a product. By allowing customers to virtually place furniture items in their living rooms, for instance, AR/VR can boost confidence in purchasing decisions and potentially lead to a reduction in product returns.

Data Analytics and Customer Insights

Dunelm is increasingly leveraging data analytics to understand its customers better, aiming to refine marketing and personalize product selections. This focus on data-driven insights is central to their strategy for enhancing online experiences and connecting products directly to consumer needs.

In the fiscal year ending June 30, 2024, Dunelm reported a 5.4% increase in total revenue to £9.0 billion, partly fueled by improved online engagement and targeted marketing driven by customer data. The company's investment in its digital platform and data capabilities is a key component of its growth strategy.

- Enhanced Customer Understanding: Data analytics allows Dunelm to segment its customer base more effectively, identifying purchasing patterns and preferences.

- Optimized Marketing Spend: By analyzing campaign performance and customer response, Dunelm can allocate its marketing budget more efficiently.

- Personalized Shopping Experience: Insights from data enable Dunelm to offer tailored product recommendations and promotions, boosting customer loyalty and sales.

- Informed Product Development: Understanding what data suggests about consumer demand helps Dunelm make better decisions regarding its product assortment and inventory management.

Operational Technology and Efficiency

Dunelm is actively investing in technology to boost its operational efficiency. This includes deploying machine learning and automating routine tasks, which is projected to free up employee time for more value-added activities. The company's strategy is to leverage these technological advancements to streamline its supply chain and in-store operations, ultimately leading to better productivity and cost savings.

These technological upgrades are crucial for Dunelm's competitive edge. By reducing manual effort in areas like inventory management and order processing, the group aims to enhance its speed and accuracy. This focus on operational technology is a key part of their broader digital transformation strategy, supporting growth and customer service improvements.

- Machine Learning Implementation: Enhancing forecasting and personalization.

- Automation of Low-Value Tasks: Improving employee focus and reducing errors.

- Supply Chain Optimization: Leveraging technology for faster, more efficient logistics.

- Data Analytics: Driving informed decision-making across operations.

Dunelm's technological advancements are central to its growth, with a significant emphasis on its e-commerce platform and digital capabilities. For the fiscal year ending June 30, 2024, the company reported a 5.4% increase in total revenue to £9.0 billion, with digital sales playing an increasingly vital role.

The company is actively integrating AI, such as Google Cloud's generative AI, into its online search and recommendation engines to personalize the customer experience and drive online sales. Furthermore, Dunelm leverages data analytics to enhance customer understanding, optimize marketing, and personalize offerings, contributing to improved customer engagement.

Investments in operational technology, including machine learning and automation, are streamlining processes like inventory management and supply chain logistics. This focus aims to boost efficiency, reduce errors, and allow employees to concentrate on more value-added tasks, supporting overall productivity and cost savings.

| Technology Area | Impact on Dunelm | Key Initiatives | Fiscal Year 2024 Data/Projections |

|---|---|---|---|

| E-commerce & Digital Platform | Increased online sales and customer engagement | Platform enhancements, Click & Collect, AI integration | Digital sales a substantial and expanding segment of revenue |

| Artificial Intelligence (AI) | Personalized customer experience, improved product discovery | Generative AI for search and recommendations | Aimed at boosting online sales and customer satisfaction |

| Data Analytics | Enhanced customer understanding, targeted marketing | Customer segmentation, purchase pattern analysis | Contributed to improved online engagement and targeted marketing |

| Operational Technology | Streamlined operations, increased efficiency | Machine learning, automation of routine tasks | Projected to free up employee time for value-added activities |

Legal factors

The Digital Markets, Competition and Consumers Act 2024 (DMCCA), set to be fully implemented by April 2025, will introduce significant changes to consumer protection in the UK. This act empowers the Competition and Markets Authority (CMA) with direct enforcement capabilities, including the ability to levy fines up to 10% of a company's global turnover for violations such as drip pricing, misleading environmental claims, and fabricated customer reviews.

For Dunelm, adherence to these stringent new regulations is paramount. Failure to comply could result in substantial financial penalties and considerable damage to the company's reputation, impacting consumer trust and market standing.

Dunelm Group operates under stringent data protection laws, notably the UK's Data Protection Act 2018, which came into full effect in May 2018, aligning with the EU's GDPR. This legislation mandates how personal data is collected, processed, and stored, impacting Dunelm's customer relationship management and marketing efforts.

The company prioritizes the secure and ethical handling of both customer and colleague personal information, recognizing that breaches can lead to significant reputational damage and financial penalties. In 2023, the UK Information Commissioner's Office (ICO) issued fines totaling over £1.5 million for data protection contraventions, highlighting the regulatory environment Dunelm navigates.

Compliance extends to all third parties who may access Dunelm's data, requiring robust contractual agreements and oversight to ensure consistent adherence to privacy standards. This commitment is crucial for maintaining customer trust in an era of increasing data-driven commerce.

New consumer protection laws, effective from 2024, are tightening regulations around advertising and marketing. These rules specifically target misleading practices such as falsely advertising price discounts and the increasingly scrutinized area of 'greenwashing,' which involves making unsubstantiated environmental claims. For Dunelm, this means their marketing content, especially any statements about sustainability or product benefits, must be demonstrably true and clearly communicated to avoid penalties.

Supply Chain Compliance and Ethical Sourcing

Dunelm Group places a strong emphasis on legal compliance and ethical conduct within its supply chain, maintaining a zero-tolerance policy for issues like modern slavery, bribery, and fraud. This commitment is crucial for building trust and ensuring long-term sustainability in its operations.

The company actively implements robust controls designed to identify and eliminate exploitation throughout its supply network. This includes ensuring that all individuals involved in producing Dunelm's products benefit from safe and legal working environments, which is increasingly becoming a standard expectation for responsible businesses.

- Modern Slavery Act Compliance: Dunelm's commitment to eradicating modern slavery is a key legal and ethical imperative, with ongoing efforts to ensure transparency and accountability in its supply chain.

- Bribery and Fraud Prevention: Strict policies are in place to prevent bribery and fraud, safeguarding the company's reputation and adhering to global anti-corruption legislation.

- Ethical Sourcing Standards: The group requires suppliers to meet high standards for working conditions, promoting fair treatment and safety for all workers involved in its product manufacturing.

- Supply Chain Due Diligence: Dunelm undertakes due diligence to identify and mitigate risks related to ethical sourcing, ensuring its partners align with its core values and legal obligations.

Product Safety and Standards

Dunelm, as a prominent UK home furnishings retailer, navigates a complex legal landscape concerning product safety. Compliance with stringent regulations, such as the Furniture and Furnishings (Fire) (Safety) Regulations 1988, is paramount for all upholstered items and textiles sold. Failure to meet these standards can result in significant fines and reputational damage.

Beyond fire safety, Dunelm must also adhere to legislation like the General Product Safety Regulations 2005, which mandates that products placed on the market must be safe. This includes managing chemical restrictions under frameworks like REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals), ensuring no harmful substances exceed permitted levels in products like paints, adhesives, or materials used in furnishings.

- Fire Safety Compliance: Adherence to UK fire safety standards for furniture and textiles is a non-negotiable legal requirement.

- Chemical Restrictions: Dunelm must ensure products meet chemical safety regulations, such as those under REACH, to protect consumers.

- General Product Safety: The company is legally obligated to ensure all products sold are safe for consumer use, preventing potential liabilities.

- Consumer Protection Laws: Broader consumer rights legislation also dictates product quality and safety, impacting Dunelm's operations.

The Digital Markets, Competition and Consumers Act 2024 (DMCCA), fully implemented by April 2025, will significantly bolster consumer protection in the UK. This act grants the Competition and Markets Authority (CMA) direct enforcement powers, including the ability to impose fines up to 10% of a company's global turnover for violations like drip pricing and misleading environmental claims.

Dunelm must navigate evolving advertising standards, particularly concerning 'greenwashing' and price discount claims, as new consumer protection laws effective from 2024 tighten regulations. Demonstrably true marketing content is crucial to avoid penalties, impacting how the company communicates sustainability efforts and product benefits.

The company operates under the UK's Data Protection Act 2018, mirroring GDPR, which governs personal data handling and impacts customer relationship management. In 2023, the ICO issued over £1.5 million in fines for data protection breaches, underscoring the financial risks of non-compliance.

Dunelm's commitment to eradicating modern slavery, preventing bribery and fraud, and upholding ethical sourcing standards are critical legal and operational imperatives. Robust supply chain due diligence is essential to ensure partners align with these core values and legal obligations.

| Legal Area | Key Legislation/Regulation | Impact on Dunelm | Potential Financial Risk (Example) |

|---|---|---|---|

| Consumer Protection | DMCCA 2024 (fully implemented April 2025) | Stricter rules on advertising, drip pricing, fake reviews. Fines up to 10% global turnover. | Potential fines for misleading marketing claims. |

| Data Protection | UK Data Protection Act 2018 (GDPR aligned) | Mandates secure and ethical handling of customer/colleague data. | ICO fines in 2023 exceeded £1.5 million for contraventions. |

| Supply Chain Ethics | Modern Slavery Act, Bribery Act | Zero-tolerance for exploitation, fraud, and bribery in supply chains. | Reputational damage and legal action for supply chain non-compliance. |

| Product Safety | Furniture and Furnishings (Fire) (Safety) Regulations 1988, General Product Safety Regulations 2005, REACH | Ensuring fire safety, general product safety, and chemical compliance for all products. | Fines and product recalls for non-compliant items. |

Environmental factors

Dunelm is actively addressing climate change, setting a goal to slash its Scope 1, 2, and 3 carbon emissions by half by 2030. This ambitious target, validated by the Science Based Targets initiative (SBTi), underscores a deep commitment to reducing its environmental impact throughout its business and supply chain.

The company aims to achieve net zero emissions by 2040, showcasing a long-term strategy for environmental stewardship. This proactive approach to carbon footprint reduction is becoming increasingly crucial for businesses navigating the evolving regulatory landscape and consumer expectations around sustainability.

Dunelm is focusing on sustainable sourcing and materials to meet rising consumer expectations for eco-friendly options. The company is investing in capabilities and new technologies to create more environmentally conscious products.

A significant portion of Dunelm's own-brand offerings, around 26%, falls into its 'Conscious Choice' category. These products are manufactured using at least 50% materials that are considered more responsibly sourced, reflecting a strategic response to market trends.

Dunelm's commitment to sustainability, framed as 'Good & Circular', directly addresses waste reduction and the promotion of a circular economy. This strategic focus guides their efforts to minimize environmental impact throughout the product lifecycle.

A practical example of this is their partnership with 'Too Good To Go', which allows them to offer surplus food from their cafes as surprise bags. This initiative not only combats food waste but also engages customers in a tangible way with their sustainability goals.

While specific figures for Dunelm's waste reduction in 2024/2025 are not yet widely published, the company's ongoing efforts in this area are a key component of its broader environmental strategy, aiming to create a more resource-efficient business model.

Packaging and Extended Producer Responsibility (EPR)

The UK's full implementation of Extended Producer Responsibility (EPR) for packaging in 2025 will significantly impact retailers like Dunelm. This regulation shifts the financial and operational burden of managing packaging waste onto producers, meaning Dunelm will likely face increased costs and responsibilities for its product packaging throughout its lifecycle.

This will necessitate a strategic review of Dunelm's packaging choices, potentially driving a move towards more sustainable and recyclable materials. The company may also need to invest in improved waste management systems or collaborate with waste management partners to comply with EPR obligations.

- Increased Costs: Dunelm could see higher operational expenses due to EPR fees, which are calculated based on the amount and type of packaging placed on the market.

- Material Innovation: The regulation may spur investment in research and development for eco-friendly packaging alternatives, reducing waste and improving recyclability.

- Supply Chain Adjustments: Dunelm might need to work closely with its suppliers to ensure compliance, potentially leading to changes in sourcing and packaging design upstream.

- Consumer Perception: Proactive management of packaging EPR can enhance Dunelm's brand image, appealing to environmentally conscious consumers.

Compliance with Environmental Regulations

Dunelm Group faces increasing scrutiny regarding its environmental impact, necessitating strict adherence to evolving regulations. For instance, the upcoming European Union Deforestation Regulation (EUDR), effective January 1, 2025, will require rigorous due diligence to ensure products are deforestation-free. Dunelm is actively preparing for this by offering training to both its suppliers and internal teams, focusing on the new processes and data management systems needed for compliance.

These proactive measures demonstrate a commitment to navigating complex environmental legislation. The company's investment in supplier training highlights the interconnectedness of its supply chain with regulatory obligations. This focus on compliance is crucial for maintaining market access and brand reputation in an environmentally conscious market.

- EUDR Implementation: The EU Deforestation Regulation takes effect January 1, 2025, impacting supply chains globally.

- Supplier Training: Dunelm is equipping its suppliers with the knowledge and tools for EUDR compliance.

- Data Management: New systems are being put in place to manage the data required for due diligence under the EUDR.

- Proactive Compliance: Dunelm's efforts showcase a forward-thinking approach to environmental regulatory challenges.

Dunelm is making significant strides in environmental responsibility, aiming to cut its carbon emissions by half by 2030 and achieve net zero by 2040, with targets validated by the Science Based Targets initiative (SBTi).

The company is also focusing on sustainable sourcing, with 26% of its own-brand products now falling into the 'Conscious Choice' category, using at least 50% more responsibly sourced materials.

Upcoming regulations like the UK's Extended Producer Responsibility for packaging in 2025 and the EU Deforestation Regulation (EUDR) from January 1, 2025, will necessitate further adjustments in packaging and supply chain due diligence.

PESTLE Analysis Data Sources

Our Dunelm Group PESTLE Analysis is built on a foundation of comprehensive data, drawing from official UK government publications, reputable economic forecasting agencies, and leading industry market research reports. This ensures each factor, from political stability to technological advancements, is grounded in current and credible insights.