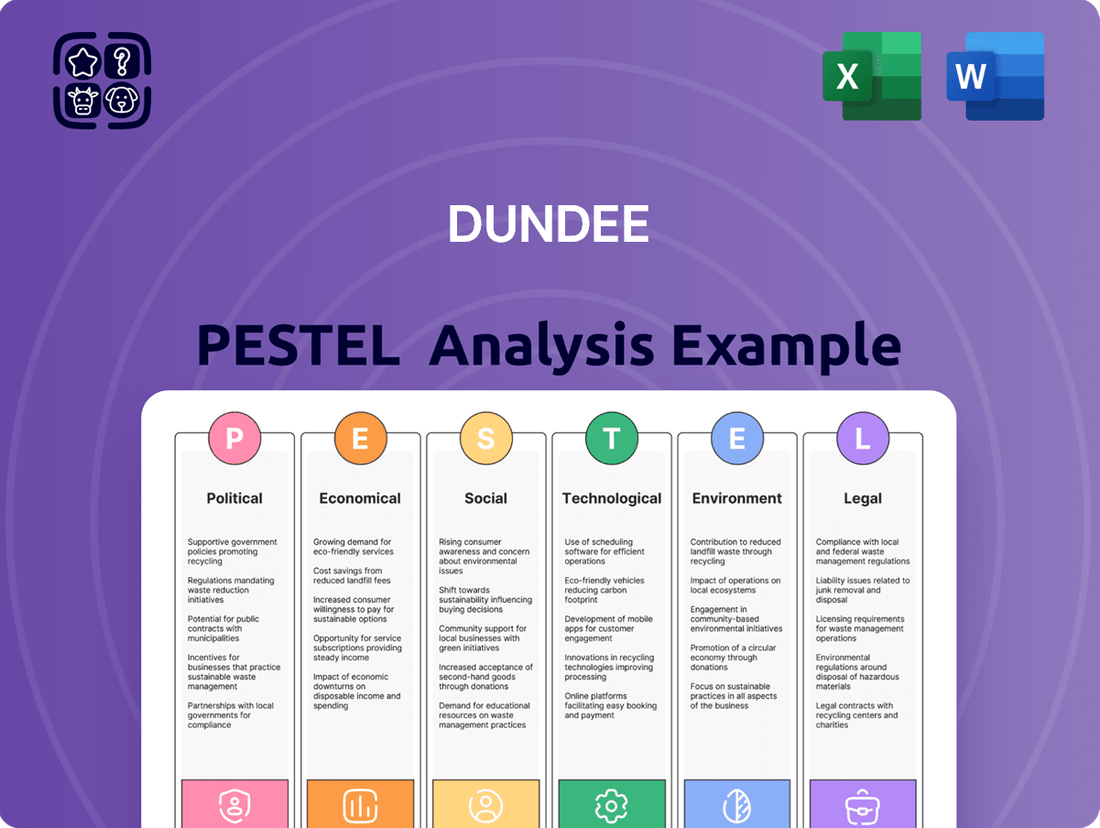

Dundee PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dundee Bundle

Unlock the forces shaping Dundee's future with our comprehensive PESTLE analysis. From political shifts to technological advancements, understand the external landscape impacting its operations and strategic decisions. Gain a competitive edge by leveraging these critical insights. Download the full report now for actionable intelligence to inform your own business strategy.

Political factors

The political landscape in countries where Dundee Precious Metals operates, such as Bulgaria, Namibia, and Serbia, is a key factor. For instance, Serbia's commitment to attracting foreign investment, as evidenced by its consistent efforts to improve its business environment, generally supports mining operations. However, any shifts in government stability or policy direction could introduce uncertainty.

Changes in mining legislation or fiscal regimes can have a direct impact on Dundee's bottom line. For example, a revision to royalty rates or environmental compliance standards in Bulgaria could alter the cost structure of its operations there. Monitoring these policy shifts is essential for risk management and strategic planning.

Government attitudes towards foreign direct investment in the mining sector are critical. In 2023, Serbia, for example, continued to signal its openness to international mining companies, aiming to leverage its mineral resources. Dundee's ability to navigate and adapt to evolving regulatory frameworks in all its operating jurisdictions will be paramount to its sustained success.

Governments in countries where Dundee Precious Metals operates, such as Bulgaria, Namibia, and Serbia, are increasingly adopting resource nationalism. This often translates into policies like higher royalties or mandatory local content requirements. For instance, Namibia has been a proponent of local beneficiation, aiming to increase value addition within the country for its mineral resources.

These measures can directly impact Dundee's operational flexibility and cost structures. The company might face pressure to prioritize local employment, source materials from domestic suppliers, and engage in partnerships with local entities. For example, in 2023, Serbia continued to review its mining regulations, with potential implications for foreign investment and operational agreements.

Geopolitical risks significantly impact Dundee Precious Metals' operations. For instance, ongoing tensions in regions like Eastern Europe, which have seen increased military activity and sanctions throughout 2024, can disrupt global supply chains for mining equipment and consumables. This instability also affects international relations, potentially leading to trade disputes that could hinder Dundee's ability to export its gold and concentrate products from its Bulgarian operations.

Corruption and Governance

Dundee Precious Metals' operations in countries like Bulgaria, Namibia, and Serbia are susceptible to the impact of corruption and the quality of governance. High levels of corruption can translate into increased operational expenses, such as unexpected fees or bribes, and can significantly delay crucial permitting processes. This creates an environment of unpredictability, hindering efficient project development and expansion.

Conversely, jurisdictions with robust anti-corruption frameworks and transparent governance structures offer a more stable and predictable business landscape. For instance, Transparency International's 2023 Corruption Perception Index ranked Bulgaria at 71, Namibia at 50, and Serbia at 36 out of 180 countries, indicating varying degrees of perceived corruption. These rankings highlight the importance for Dundee to navigate these diverse governance environments carefully.

- Increased Costs: Corruption can lead to higher operational expenditures due to demands for illicit payments.

- Permitting Delays: Poor governance can slow down or complicate the acquisition of necessary permits and licenses.

- Unfair Competition: Corrupt practices can create an uneven playing field, disadvantaging companies with strong ethical standards.

- Regulatory Uncertainty: Weak governance can result in unpredictable regulatory changes, impacting long-term planning.

Trade Policies and Agreements

Dundee Precious Metals navigates a complex global trade landscape where international policies and agreements significantly influence its operations. Changes in tariffs or the establishment of new trade barriers can directly affect the cost of importing essential materials and equipment, as well as the competitiveness of its exported precious metals. For instance, in 2024, ongoing discussions around potential revisions to trade agreements impacting key markets could introduce new cost pressures or market access challenges.

The company's ability to thrive is closely tied to the stability and predictability of international trade. Shifts in global trade alliances or the imposition of new regulations can create uncertainty, impacting Dundee's supply chain and its access to diverse international markets for its gold and silver products. The World Trade Organization’s (WTO) Trade Facilitation Agreement, implemented in 2017 and continuing to evolve, aims to streamline customs procedures, but its effectiveness varies across jurisdictions, presenting both opportunities and potential hurdles for Dundee's cross-border transactions.

- Impact of Tariffs: Potential increases in import duties on mining equipment could raise capital expenditure for Dundee's projects.

- Market Access: Trade agreements, or their absence, dictate the ease with which Dundee can sell its refined metals in various international markets.

- Supply Chain Resilience: Geopolitical shifts influencing trade routes and policies can affect the timely and cost-effective delivery of supplies and the shipment of finished products.

Political stability and government policies in Bulgaria, Namibia, and Serbia directly influence Dundee Precious Metals' operations. For example, Serbia's ongoing efforts to improve its business climate in 2023 and 2024 signal support for foreign investment, while Namibia's focus on local beneficiation in 2023 presents both opportunities and compliance considerations.

Changes in mining regulations, fiscal regimes, and attitudes towards foreign direct investment are critical. Dundee must adapt to evolving legal frameworks, such as those potentially impacting royalty rates or environmental standards in Bulgaria, to manage risks and plan strategically. Geopolitical tensions in Eastern Europe in 2024 also pose supply chain and export challenges.

Governance quality and corruption levels present varying operational landscapes. Transparency International's 2023 Corruption Perception Index highlights differences, with Serbia at 36, Namibia at 50, and Bulgaria at 71, underscoring the need for careful navigation of diverse governance environments to avoid increased costs and permitting delays.

International trade policies and agreements significantly impact Dundee's costs and market access. Potential tariff changes or trade barriers in 2024 could affect the import of equipment and the export of precious metals, necessitating robust supply chain resilience and market access strategies.

What is included in the product

This Dundee PESTLE analysis provides a comprehensive examination of external macro-environmental factors, including Political, Economic, Social, Technological, Environmental, and Legal influences, to identify strategic opportunities and potential challenges for businesses operating in or considering the region.

The Dundee PESTLE Analysis provides a clean, summarized version of the full analysis, acting as a pain point reliever by enabling easy referencing during meetings or presentations.

Economic factors

Global gold prices are a crucial factor for Dundee Precious Metals, directly influencing its revenue and profitability. Economic uncertainties and inflation fears have driven gold prices upwards, with forecasts suggesting continued strength into 2024 and 2025. For instance, gold prices averaged around $2,300 per ounce in early 2024, a significant increase from previous years.

This upward trend in gold prices, driven by factors like central bank buying and geopolitical tensions, is expected to benefit Dundee. Higher gold prices translate to increased earnings for the company, assuming production levels remain stable. The sustained strength observed in the market through mid-2025 is a positive indicator for Dundee's financial outlook.

Dundee Precious Metals is facing significant operating cost pressures due to global inflation. Rising energy prices, particularly for electricity and fuel, directly impact mining operations in Bulgaria, Namibia, and Serbia. For instance, the average price of Brent crude oil, a key indicator for energy costs, saw a notable increase in late 2023 and early 2024, affecting transportation and equipment expenses.

Labor costs are also on the rise across the regions where Dundee operates. Increased demand for skilled mining personnel, coupled with general wage inflation, contributes to higher payroll expenses. Furthermore, the cost of essential raw materials and consumables, such as explosives and processing chemicals, has seen an upward trend, squeezing profit margins if not managed proactively.

Effectively managing these escalating operating costs is paramount for Dundee Precious Metals to sustain profitability. The company's ability to control expenditures on energy, labor, and materials will be a key determinant of its financial performance in the current economic environment, which has seen inflation rates remain elevated in many developed and developing economies throughout 2024.

Dundee Precious Metals' ability to secure funding for its various projects, from initial exploration to expanding existing operations, is a critical determinant of its success. The company's growth hinges on its capacity to tap into global financial markets.

Investor confidence in the mining industry, particularly for gold and copper, directly impacts the cost and availability of both debt and equity financing. For instance, as of early 2025, the average cost of capital for junior mining companies seeking equity financing has seen an uptick due to increased global economic uncertainty, making access more challenging.

Furthermore, the availability of credit lines and the terms offered by financial institutions will significantly shape Dundee's strategic investment decisions and its overall expansion plans throughout 2024 and into 2025.

Currency Exchange Rates

Fluctuations in currency exchange rates significantly influence Dundee's financial performance, given its reporting currency is the US dollar and its operations span Bulgaria, Namibia, and Serbia. A strengthening US dollar against the Bulgarian Lev (BGN), Namibian Dollar (NAD), and Serbian Dinar (RSD) can make Dundee's foreign earnings worth less when converted back. For instance, if the average exchange rate in 2024 for USD/BGN shifts from 0.55 to 0.50, it means more BGN are needed to equal one USD, potentially reducing reported revenue from Bulgaria.

Conversely, favorable exchange rate movements can boost profitability. If the US dollar weakens, the value of revenues generated in Bulgaria, Namibia, and Serbia increases when translated into dollars. For example, a hypothetical scenario where the USD/NAD rate moves from 18.00 to 17.00 in 2025 would mean that the same amount of Namibian Dollars earned translates into more US Dollars, positively impacting Dundee's top and bottom lines.

These currency shifts directly affect both revenue and cost structures. Imported raw materials or components priced in USD for operations in these countries become more expensive if the local currency weakens. This can squeeze profit margins. Dundee must actively manage its currency exposure through hedging strategies to mitigate the impact of adverse exchange rate volatility.

- Impact on Revenue: A stronger USD reduces the US dollar value of earnings from Bulgaria, Namibia, and Serbia.

- Impact on Costs: A weaker local currency increases the cost of USD-denominated inputs for operations in these countries.

- 2024/2025 Exchange Rate Trends: Monitoring the USD/BGN, USD/NAD, and USD/RSD trends is crucial for forecasting and financial planning.

- Strategic Hedging: Implementing currency hedging strategies can protect against unfavorable exchange rate movements and stabilize profitability.

Economic Growth in Operating Countries

The economic growth trajectories in Bulgaria, Namibia, and Serbia directly influence Dundee's operational landscape. A healthy economy in these regions typically translates to stronger local demand for goods and services, which can support ancillary businesses related to mining operations. Furthermore, robust economic conditions often correlate with increased infrastructure development, potentially easing logistical challenges for Dundee. For instance, Bulgaria's GDP grew by an estimated 1.9% in 2023, and Serbia projected a 2.5% growth for the same year, indicating a generally positive, albeit varied, economic climate. Namibia's economic performance, while subject to commodity price fluctuations, also plays a crucial role in its operational environment.

The availability of skilled labor is another critical factor tied to economic health. As economies expand, so does the pool of qualified workers, which can be beneficial for Dundee in sourcing talent for its mining activities. Conversely, economic downturns might lead to labor shortages or increased competition for skilled personnel. Dundee's success will be partly contingent on the ability to leverage the human capital available within these growing or stable economies.

A stable and growing economic environment fosters a more predictable operating framework. This stability is vital for long-term investment decisions and the efficient execution of mining projects. Dundee's strategic planning will need to account for the specific economic growth forecasts and potential volatility within Bulgaria, Namibia, and Serbia to mitigate risks and capitalize on opportunities.

- Bulgaria's economic growth: Projected to be around 2.0% for 2024, reflecting a moderate but steady expansion.

- Namibia's economic outlook: Expected to see growth driven by mining and tourism, with forecasts around 3.5% for 2024.

- Serbia's economic performance: Anticipated to maintain growth around 3.0% in 2024, supported by foreign investment and domestic demand.

- Impact on demand: Stronger economic growth in these countries generally boosts local demand for resources and services related to mining operations.

Global economic growth directly impacts Dundee Precious Metals' operational environment and market demand. Stronger economic expansion in Bulgaria, Namibia, and Serbia generally supports higher demand for resources and services supporting mining activities. For instance, Bulgaria's GDP growth was estimated at 1.9% in 2023, with projections around 2.0% for 2024, indicating a stable economic climate.

Namibia's economy, heavily influenced by commodity prices, was expected to grow by approximately 3.5% in 2024. Serbia anticipated a growth rate of around 3.0% for 2024, bolstered by foreign investment. These growth figures suggest a generally positive, though varied, economic landscape across Dundee's operational regions, impacting labor availability and infrastructure development.

| Country | 2023 GDP Growth (Est.) | 2024 GDP Growth (Proj.) |

|---|---|---|

| Bulgaria | 1.9% | 2.0% |

| Namibia | (Varies with commodity prices) | 3.5% |

| Serbia | (Varies) | 3.0% |

Preview the Actual Deliverable

Dundee PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive Dundee PESTLE analysis offers a deep dive into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the city. It's designed to provide actionable insights for strategic planning.

What you’re previewing here is the actual file—fully formatted and professionally structured, ensuring you have all the necessary information at your fingertips.

Sociological factors

Dundee Precious Metals' commitment to sustainable and responsible mining practices is paramount for its social license to operate. In 2023, the company reported investing over $15 million in community development initiatives across its operating regions, demonstrating a tangible effort to foster positive relationships and ensure shared value.

Building and nurturing trusted stakeholder relationships is crucial for Dundee. For instance, their community engagement programs in Bulgaria, which focus on education and local economic development, have been instrumental in securing community support, as evidenced by the lack of significant operational disruptions due to social unrest in recent years.

Ensuring lasting benefits beyond mine life is a key component of Dundee's strategy. Their focus on legacy projects and environmental stewardship aims to leave a positive and enduring impact, a commitment reflected in their ongoing rehabilitation efforts at closed mine sites, which are designed to create new ecological and economic opportunities.

Dundee Precious Metals' operational success heavily relies on the availability of a skilled workforce and harmonious labor relations. For instance, in 2023, the mining sector globally faced a shortage of skilled tradespeople, a trend likely impacting recruitment efforts in regions like Bulgaria where Dundee operates its Chelopech mine. Positive labor relations are crucial for maintaining productivity; a significant strike in the mining industry can halt operations for extended periods, directly affecting output and revenue.

Dundee Precious Metals places a high priority on the health and safety of its workforce and the communities where it operates. This commitment is central to its operational philosophy, aiming to foster a secure environment for all stakeholders.

The company's adherence to rigorous safety protocols is paramount for mitigating operational risks and ensuring business continuity. In 2023, Dundee reported a Total Recordable Injury Frequency Rate (TRIFR) of 0.98, a significant improvement from 1.34 in 2022, showcasing their dedication to enhanced safety performance.

Maintaining a strong safety record is not only a moral imperative but also a key factor in preserving Dundee's positive reputation and preventing costly operational disruptions. This focus directly impacts their ability to maintain social license to operate and attract and retain talent.

Indigenous Rights and Cultural Heritage

Dundee Precious Metals, operating in diverse regions, faces critical considerations regarding indigenous rights and the preservation of cultural heritage. Proactive engagement with local communities is paramount, ensuring adherence to international standards for land rights and cultural safeguarding. For instance, in Bulgaria, where Dundee has significant operations, the company has emphasized its commitment to community development and environmental stewardship, which implicitly includes respecting local traditions and heritage. In 2023, Dundee reported ongoing community engagement initiatives across its operating sites, underscoring the importance of these relationships for sustainable mining practices.

The company's approach to indigenous rights and cultural heritage is crucial for maintaining its social license to operate. Failure to adequately address these factors can lead to project delays, reputational damage, and increased operational risks. Dundee's sustainability reports consistently highlight efforts to consult with local stakeholders and implement culturally sensitive practices, reflecting an understanding of these sociological imperatives. The company's commitment to responsible mining practices in 2024 and beyond will likely continue to be shaped by these evolving societal expectations and regulatory frameworks.

- Community Engagement: Dundee actively consults with local communities to understand and respect their rights and cultural heritage.

- International Standards: Adherence to global best practices for land rights and cultural preservation is a key operational principle.

- Risk Mitigation: Proactive engagement helps mitigate risks associated with social opposition and reputational damage.

- Sustainability Reporting: The company's sustainability reports detail initiatives aimed at fostering positive relationships with indigenous and local populations.

Public Perception of Mining Industry

Public sentiment toward the mining sector, especially regarding its environmental and social footprint, significantly shapes regulations, investor confidence, and local community buy-in. Negative perceptions can lead to stricter oversight and reduced investment opportunities.

Dundee Precious Metals actively addresses these concerns. For instance, in 2023, the company reported a 20% reduction in water intensity at its Chelopech operation compared to 2022, demonstrating a tangible commitment to environmental stewardship. This proactive approach to Environmental, Social, and Governance (ESG) principles is crucial for building trust and maintaining its social license to operate.

- Environmental Concerns: Public scrutiny over mining's impact on ecosystems, water resources, and biodiversity remains high.

- Social License to Operate: Community relations and local benefit sharing are paramount for project approval and ongoing operations.

- Investor Sentiment: ESG performance is increasingly a key factor for institutional investors, influencing capital allocation.

- Transparency and Reporting: Companies like Dundee Precious Metals use detailed ESG reports, such as their 2023 Sustainability Report, to showcase their efforts and mitigate negative public perception.

Sociological factors are critical for Dundee Precious Metals' operations, influencing its social license to operate and overall business sustainability. The company's significant investment in community development, exceeding $15 million in 2023, underscores its commitment to building strong stakeholder relationships. Positive community engagement, as seen in Bulgaria, directly correlates with operational stability, minimizing social unrest and ensuring uninterrupted production.

Dundee's focus on leaving a positive legacy beyond mine life, through rehabilitation and economic development projects, is vital for long-term community acceptance. Furthermore, the company's dedication to workforce health and safety, evidenced by a reduced Total Recordable Injury Frequency Rate (TRIFR) to 0.98 in 2023, is essential for attracting and retaining skilled labor and maintaining a positive reputation.

Respect for indigenous rights and cultural heritage is a cornerstone of Dundee's approach, with ongoing community consultations in 2023 highlighting this commitment. Public sentiment towards mining, particularly concerning environmental and social impacts, directly affects regulatory landscapes and investor confidence. Dundee's proactive ESG efforts, including a 20% reduction in water intensity at Chelopech in 2023, are key to mitigating negative perceptions and securing continued support.

Technological factors

Technological advancements in mining automation and digitalization are significantly reshaping the sector. Dundee Precious Metals (DPM) can harness these innovations, including AI-powered predictive maintenance and autonomous drilling systems, to boost operational efficiency and worker safety. For instance, the mining industry saw a significant increase in the adoption of autonomous vehicles, with some reports indicating a 20% year-over-year growth in deployment across major mining operations leading into 2024.

The integration of AI and machine learning offers DPM opportunities to optimize exploration, improve ore grade prediction, and streamline processing. This digital transformation can lead to substantial cost reductions, with studies suggesting that advanced automation can lower operating expenses by up to 15% in certain mining contexts. Furthermore, remote monitoring and control systems enhance safety by reducing human exposure to hazardous environments, a critical factor in the mining industry's ongoing commitment to sustainability and responsible operations.

Innovative exploration technologies, such as advanced geological modeling and satellite-based systems, are significantly enhancing the precision and speed of identifying new ore bodies. These tools allow companies to pinpoint potential resources more effectively, thereby reducing the time and cost associated with traditional exploration methods.

Dundee Precious Metals is actively leveraging these technological advancements, notably in its exploration efforts at the Čoka Rakita project in Serbia. In 2023, the company reported significant progress at Čoka Rakita, with drilling results indicating a substantial increase in the estimated mineral resource, underscoring the value of these sophisticated exploration techniques.

Technological advancements in gold processing and extraction are significantly boosting recovery rates and minimizing environmental footprints. For instance, innovations like advanced flotation techniques and bio-leaching are becoming more prevalent, allowing companies to extract more gold from lower-grade ores. Dundee Precious Metals, by adopting these cutting-edge methods, can see improved operational efficiency and a stronger competitive edge in the market.

Data Analytics and Predictive Maintenance

Data analytics and predictive maintenance, increasingly driven by AI and IoT, are transforming operational efficiency for companies like Dundee Precious Metals. These technologies enable real-time monitoring of machinery and operational environments, allowing for proactive identification of potential issues. For instance, in 2024, the mining sector saw increased investment in AI-powered predictive maintenance solutions, with some companies reporting a reduction in unplanned downtime by up to 30%.

By leveraging these advancements, Dundee can anticipate equipment failures before they occur, thereby minimizing costly disruptions and optimizing maintenance schedules. This proactive approach not only preserves asset integrity but also contributes to more predictable production cycles and potentially lower operational expenditures. For example, a recent industry report highlighted that predictive maintenance strategies can lead to savings of 10-40% on maintenance costs compared to traditional reactive methods.

- Real-time equipment monitoring using IoT sensors provides immediate insights into operational status.

- AI-driven analytics identify subtle patterns indicative of impending equipment failure.

- Optimized maintenance schedules reduce unnecessary interventions and prevent catastrophic breakdowns.

- Reduced downtime directly translates to increased production output and cost savings, with industry estimates suggesting potential savings of 10-40% on maintenance costs.

Renewable Energy Integration in Mining

The mining industry is increasingly adopting renewable energy sources to power operations, a trend that aligns with global sustainability objectives and offers potential cost savings. Dundee Precious Metals is actively exploring these integrations, which could significantly enhance its environmental stewardship and build greater long-term operational resilience against fluctuating traditional energy prices.

For instance, in 2023, the global mining sector saw a notable increase in renewable energy procurement, with many companies setting ambitious targets for decarbonization. Dundee's strategic move towards renewables, potentially including solar and wind power at its sites, could position it favorably in a market where environmental, social, and governance (ESG) performance is paramount for investors and stakeholders.

- Renewable energy adoption in mining is projected to grow substantially, driven by cost efficiency and ESG mandates.

- Dundee Precious Metals' exploration of renewables supports its commitment to reducing its carbon footprint.

- The integration of renewables can lead to more stable and predictable energy costs for mining operations.

Technological advancements are rapidly transforming mining operations, with AI and automation driving efficiency and safety. Dundee Precious Metals (DPM) can leverage these innovations, like autonomous drilling and AI-powered predictive maintenance, to reduce costs and enhance production. The mining industry saw a 20% year-over-year growth in autonomous vehicle deployment leading into 2024.

Legal factors

Dundee Precious Metals navigates a complex web of mining laws and regulations across its operational jurisdictions: Bulgaria, Namibia, and Serbia. Adherence to these frameworks, covering everything from initial exploration permits to ongoing extraction practices and concession fee structures, is critical. For instance, in 2023, Dundee reported paying approximately $16.5 million in royalties and taxes across its operations, demonstrating a direct financial impact of these regulatory environments.

Dundee Precious Metals operates under stringent environmental regulations, necessitating thorough environmental impact assessments and the acquisition of various permits for its mining operations. This includes navigating complex approval processes and adapting to evolving standards concerning air emissions, water discharge, and the responsible management of mining waste. For instance, in 2023, the company reported significant investments in environmental initiatives, including $10.5 million allocated to water management and tailings facility upgrades across its operations, demonstrating a commitment to compliance.

Dundee Precious Metals must navigate a complex web of national labor laws, encompassing minimum wage regulations, safe working conditions, and the rights afforded to trade unions. For instance, in Bulgaria, where Dundee operates the Chelopech mine, the national minimum wage was set at BGN 933 per month as of January 1, 2024, impacting labor costs and compliance strategies.

Maintaining fair employment practices is not merely a legal obligation but a strategic imperative for Dundee. Adherence to these standards fosters positive labor relations, which is crucial for operational stability and can significantly reduce the risk of costly legal disputes and associated reputational damage.

Corporate Governance and Reporting Standards

Dundee Precious Metals operates under stringent corporate governance and reporting requirements in Canada, where it is headquartered, and in its mining jurisdictions. These regulations ensure accountability and transparency in its operations and financial dealings. For example, as of early 2024, Canadian public companies are continuously assessed against evolving governance best practices, impacting board composition and executive compensation structures.

Adherence to recognized reporting frameworks is paramount for Dundee. This includes frameworks like the Global Reporting Initiative (GRI) for sustainability, the Sustainability Accounting Standards Board (SASB) for industry-specific disclosures, and the Task Force on Climate-related Financial Disclosures (TCFD) for climate risk reporting. In 2023, for instance, the Canadian Securities Administrators continued to emphasize the importance of climate-related disclosures, pushing companies like Dundee to provide more detailed information on their environmental impact and mitigation strategies.

- Canadian Securities Administrators (CSA) guidance on ESG disclosures: Ongoing focus on enhancing the quality and comparability of environmental, social, and governance reporting.

- GRI Standards adoption: Dundee's commitment to comprehensive sustainability reporting, covering economic, environmental, and social impacts.

- SASB Materiality Map: Utilizing SASB standards to identify and report on financially material sustainability issues specific to the mining industry.

- TCFD implementation: Disclosing climate-related risks and opportunities, a critical area for investor confidence in the mining sector.

International Treaties and Agreements

International treaties and agreements significantly shape the operational landscape for companies like Dundee Precious Metals. These global frameworks, covering areas such as mining regulations, environmental protection standards, and human rights, can directly or indirectly influence national laws and corporate accountability. For instance, adherence to the Extractive Industries Transparency Initiative (EITI) standards, which many countries are adopting, could affect reporting requirements and stakeholder engagement. Dundee's operations must remain attuned to these evolving international norms, ensuring compliance and adapting strategies to mitigate potential risks or capitalize on emerging opportunities presented by global accords.

The impact of these international agreements is not always direct but can create a ripple effect. For example, the Paris Agreement on climate change, while not directly regulating mining, drives national policy shifts towards decarbonization. This could lead to increased scrutiny of energy consumption in mining operations and potential mandates for renewable energy adoption, impacting operational costs and investment decisions for Dundee. Similarly, international human rights covenants can foster greater expectations for responsible sourcing and community engagement, pushing companies to implement robust due diligence processes throughout their supply chains.

Key international frameworks influencing the mining sector include:

- The UN Guiding Principles on Business and Human Rights: These principles provide a global standard for protecting human rights in business, impacting how companies like Dundee engage with local communities and manage their social license to operate.

- International Labour Organization (ILO) Conventions: Conventions concerning occupational safety and health, freedom of association, and child labor set benchmarks for labor practices that can influence operational standards and employee relations.

- Multilateral Environmental Agreements: Treaties such as the Convention on Biological Diversity or agreements on transboundary pollution can impose obligations or influence national regulations related to environmental impact assessments and mitigation strategies for mining activities.

Legal factors significantly influence Dundee Precious Metals' operations, encompassing mining-specific legislation, environmental compliance, and labor laws across Bulgaria, Namibia, and Serbia. Adherence to these regulations, including concession fees and royalty payments, is paramount, as evidenced by the approximately $16.5 million in royalties and taxes paid in 2023. Furthermore, international agreements and corporate governance standards, particularly in Canada, dictate reporting practices and ethical operations, with a growing emphasis on ESG disclosures as seen in Canadian Securities Administrators' guidance.

Environmental factors

Dundee Precious Metals acknowledges the significant environmental risks associated with mining, such as land disruption and water consumption. In 2023, the company reported a 10% reduction in freshwater withdrawal intensity compared to 2022, demonstrating progress in water management.

To address these challenges, Dundee implements comprehensive environmental impact assessments and mitigation strategies. Their Chelopech operation in Bulgaria, for instance, utilizes advanced water recycling systems, achieving a recycling rate of over 80% for process water in 2023, thereby minimizing reliance on external water sources.

Responsible waste management is also a key focus, with ongoing efforts to ensure safe and secure deposition of tailings. Dundee’s Kapan mine in Armenia has invested in new tailings management facilities designed to meet stringent international environmental standards, aiming for zero discharge of process water by 2025.

The mining sector is under significant pressure to tackle climate change and curb greenhouse gas (GHG) emissions. Dundee Precious Metals is actively responding to this, having established specific goals for reducing its Scope 1 and 2 GHG emissions.

Dundee Precious Metals has committed to achieving Net Zero by 2050, a target that demonstrates its alignment with broader international efforts to combat climate change. This commitment reflects a growing industry trend toward sustainability and environmental responsibility.

Water management is a significant environmental consideration for mining operations like Dundee Precious Metals, particularly in areas where water is scarce. Dundee's approach includes innovative water recycling techniques, showcasing a dedication to sustainable water use, which is increasingly important for operational continuity and social license to operate.

Biodiversity Protection and Land Reclamation

Dundee Precious Metals (DPM) faces significant environmental considerations, especially concerning biodiversity protection and land reclamation. Mining operations inherently disrupt ecosystems, impacting local flora and fauna. DPM's commitment to responsible mining includes strategies to mitigate these effects.

In Bulgaria, DPM's operations are situated near or within Natura 2000 sites, a network of protected areas across the European Union. This proximity necessitates stringent measures for biodiversity preservation. For instance, in 2023, DPM reported spending $5.4 million on environmental management and rehabilitation activities across its global operations, with a focus on minimizing ecological footprints.

- Biodiversity Impact: Mining can lead to habitat fragmentation and loss, affecting species diversity.

- Natura 2000 Compliance: Operations near protected areas require adherence to strict EU environmental regulations.

- Land Reclamation Investment: DPM allocated $5.4 million in 2023 for environmental management and rehabilitation, demonstrating a financial commitment to restoring mined lands.

- Ongoing Monitoring: Continuous monitoring of biodiversity and the effectiveness of reclamation efforts is crucial for long-term sustainability.

Waste Management and Tailings Storage

Effective management of mine waste and tailings is a critical environmental consideration for Dundee Precious Metals and the broader mining sector. Failure to properly handle these materials can lead to significant ecological damage and long-term liabilities. In 2023, the mining industry globally continued to face increased scrutiny regarding its environmental footprint, with regulators and investors demanding more robust waste management strategies.

Dundee Precious Metals is actively implementing innovative approaches to waste deposition, aiming to enhance circularity within its operations and reduce potential environmental risks. For instance, their approach at the Chelopech operation in Bulgaria focuses on paste backfilling and dry stacking, which significantly reduces water usage and the footprint of tailings storage facilities. This strategy is vital for minimizing the long-term environmental impact and ensuring compliance with evolving environmental standards expected to tighten further through 2025.

- Reduced Water Consumption: Paste backfilling methods, as utilized by Dundee, can decrease water requirements in tailings management by up to 70% compared to conventional slurry disposal.

- Lower Footprint: Dry stacking of tailings, another Dundee initiative, can reduce the surface area required for storage by as much as 50%, leading to less land disturbance.

- Circularity Focus: By repurposing tailings as backfill, Dundee contributes to a more circular economy within mining, minimizing the need for virgin materials and reducing waste volume.

- Risk Mitigation: These advanced methods significantly lower the risk of tailings dam failures, a major environmental concern that has led to costly remediation efforts in the past for other mining companies.

Dundee Precious Metals is actively managing its environmental impact, with a focus on water conservation and emissions reduction. The company reported a 10% reduction in freshwater withdrawal intensity in 2023, showcasing improved water management practices. Furthermore, Dundee is committed to Net Zero by 2050, aligning with global climate action goals.

Biodiversity protection and land reclamation are key environmental considerations, particularly for operations near protected areas like Bulgaria's Natura 2000 sites. In 2023, Dundee invested $5.4 million in environmental management and rehabilitation, underscoring its dedication to minimizing ecological footprints and restoring mined lands.

Dundee Precious Metals is implementing advanced waste management techniques, such as paste backfilling and dry stacking, to reduce water usage and the physical footprint of tailings storage. These methods enhance operational efficiency and significantly lower the risk of environmental damage associated with tailings management, a critical concern for the mining industry.

| Environmental Metric | 2023 Performance | Target/Context |

| Freshwater Withdrawal Intensity | 10% Reduction vs. 2022 | Demonstrates improved water stewardship |

| Water Recycling Rate (Chelopech) | Over 80% | Minimizes reliance on external water sources |

| GHG Emissions | Specific reduction goals set | Aligned with Net Zero by 2050 commitment |

| Environmental Management & Rehabilitation Spend | $5.4 million | Investment in minimizing ecological footprints and land restoration |

PESTLE Analysis Data Sources

Our Dundee PESTLE Analysis draws on a robust blend of official government statistics, local council reports, and regional economic indicators. We meticulously gather data on political stability, economic performance, social trends, technological advancements, environmental regulations, and legal frameworks specific to Dundee.