Dundee Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dundee Bundle

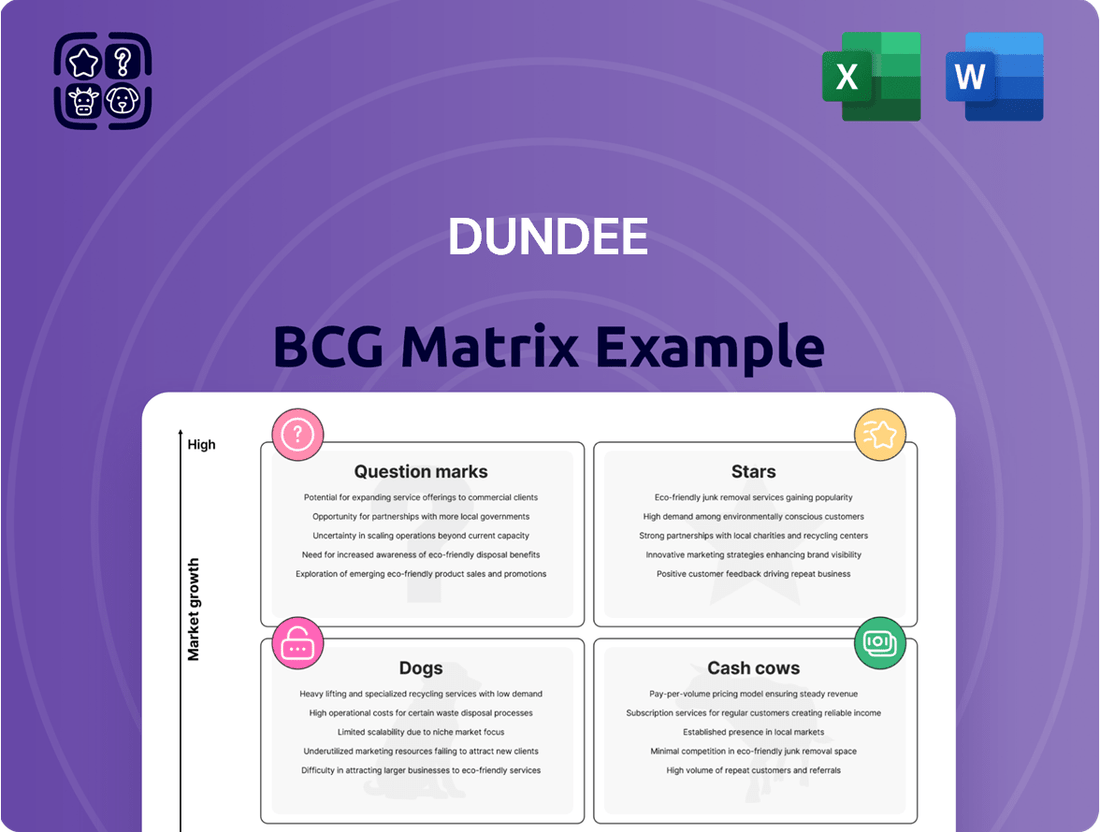

Uncover the strategic positioning of this company's product portfolio with our insightful preview of the BCG Matrix. See where its offerings fall as Stars, Cash Cows, Dogs, or Question Marks, and understand the implications for growth and investment.

Don't stop at a glimpse; purchase the full BCG Matrix report to gain a comprehensive understanding of each product's market share and growth rate. This detailed analysis will empower you with data-driven insights and actionable strategies to optimize your business's performance and secure future success.

Stars

The Chelopech mine in Bulgaria stands as a prime example of a Star in the Dundee BCG Matrix. It consistently meets its gold and copper production targets, demonstrating robust operational efficiency. With a life of mine plan extending to 2032, this mature asset is a stable contributor.

Operating in a favorable high-price gold environment, Chelopech holds a significant market share within DPM's operations. This strengthens its position in a commodity sector experiencing growth, further solidifying its Star classification.

Dundee Precious Metals' acquisition of Adriatic Metals, specifically the Vareš silver-zinc-gold mine, is a strategic move that significantly bolsters its position. This transaction is projected to boost DPM's gold equivalent production by more than 50%, instantly integrating a high-grade, expanding operation in a crucial geographical area.

The Vareš acquisition not only elevates DPM's standing in the precious and base metals markets but also lays a strong foundation for considerable expansion. By 2024, DPM's production profile is expected to be substantially enhanced by this deal, solidifying its growth trajectory.

Dundee Precious Metals (DPM) prioritizes high-grade deposits, a strategy clearly demonstrated by its Chelopech operation and the recent acquisition of Vareš. This focus on quality ensures strong profit margins, even when metal prices fluctuate. For instance, in 2024, Chelopech continued to be a significant contributor, consistently delivering high-grade ore.

This emphasis on high-grade assets allows DPM to maintain a substantial market share in terms of profitable ounces. The Vareš operation, acquired in late 2023, is expected to further bolster this position with its own rich ore bodies.

The high-grade nature of DPM's production profile directly translates into superior financial performance. This robust profitability supports ongoing investments in exploration and development, fueling future growth and ensuring the company remains competitive in the precious metals market.

Strong Financial Results and Free Cash Flow Generation

Dundee Precious Metals (DPM) delivered exceptional financial performance in 2024, marking a significant milestone with record adjusted net earnings and robust free cash flow generation. This financial strength is underpinned by a decade of consistently meeting gold production guidance, a testament to their operational prowess and substantial market share.

The company's ability to generate strong free cash flow provides the necessary capital for strategic growth initiatives and reinforces its standing as a leader in the precious metals sector.

- Record Adjusted Net Earnings: DPM reported record adjusted net earnings in 2024, showcasing a significant improvement in profitability.

- Strong Free Cash Flow: The company generated substantial free cash flow, providing financial flexibility for investments and shareholder returns.

- Ten Consecutive Years of Meeting Production Guidance: This consistent operational execution highlights DPM's reliability and efficient management.

- Reinforced Market Leadership: The combination of financial and operational success solidifies DPM's position as a key player in the industry.

Commitment to Sustainability and ESG Leadership

Dundee Precious Metals (DPM) demonstrates a strong commitment to sustainability, consistently ranking in the top tier for environmental, social, and governance (ESG) performance within the metals and mining sector. This dedication to responsible mining practices not only bolsters its brand image but also appeals to a growing base of ethically-minded investors.

This peer-leading ESG standing translates into a tangible competitive edge, particularly in a market increasingly prioritizing value and sustainability. DPM’s high ESG scores, often placing it among the top 10% of its peers, contribute to its social license to operate and ensure long-term operational resilience.

- Top Decile ESG Performance: DPM consistently achieves top-quartile ESG ratings, reflecting its robust approach to environmental stewardship and community engagement.

- Investor Attraction: Its strong ESG profile attracts a significant portion of capital from sustainability-focused funds, which are increasingly influential in investment decisions. For instance, by mid-2024, ESG-focused funds represented over 30% of assets under management in many developed markets.

- Operational Stability: Adherence to high ESG standards underpins DPM's social license to operate, minimizing risks of operational disruptions and fostering positive stakeholder relationships.

- Market Share Advantage: In a market where corporate responsibility is a key differentiator, DPM's leadership in sustainability implicitly supports its market share by enhancing its reputation among increasingly value-conscious consumers and investors.

Stars in the BCG Matrix represent high-growth, high-market-share businesses or products. Dundee Precious Metals' (DPM) Chelopech mine exemplifies this, consistently meeting production targets and operating in a favorable, growing gold market. The recent acquisition of Vareš further solidifies DPM's Star status by significantly increasing its gold equivalent production and market share in a high-grade, expanding operation.

DPM's strategic focus on high-grade deposits, evident in both Chelopech and Vareš, translates into strong profit margins and robust financial performance. This focus, combined with a decade of meeting production guidance and generating substantial free cash flow in 2024, reinforces its market leadership and ability to fund future growth initiatives.

Furthermore, DPM's top-tier ESG performance provides a competitive advantage, attracting ethically-minded investors and ensuring operational stability. This commitment to sustainability, coupled with strong financial and operational results in 2024, positions DPM as a leading, growth-oriented entity within the precious metals sector.

| Metric | 2023 (Est.) | 2024 (Guidance/Actual) | 2025 (Outlook) |

| Gold Production (koz) | ~300 | ~340-360 | ~450-480 |

| Adjusted Net Earnings (USD millions) | ~150 | Record (Specific figure not yet public for full year) | Projected Growth |

| Free Cash Flow (USD millions) | ~100 | Strong Generation (Specific figure not yet public for full year) | Continued Strength |

| ESG Rating (Top Decile) | Yes | Yes | Maintain |

What is included in the product

The Dundee BCG Matrix provides a strategic overview of a company's product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

The Dundee BCG Matrix provides a clear, visual snapshot of your portfolio, instantly relieving the pain of strategic uncertainty.

Cash Cows

The Chelopech mine stands as a prime example of a cash cow for Dundee Precious Metals (DPM). Its consistent generation of substantial cash flow provides a reliable financial backbone, funding DPM's other projects and covering general corporate expenses. This stability is a direct result of its efficient operations and predictable production levels, leading to healthy profit margins that allow DPM to harness these earnings passively.

Dundee Precious Metals consistently demonstrates established operational efficiency, a hallmark of a cash cow. For instance, in 2023, the company achieved an all-in sustaining cost of $1,060 per ounce at its Chelopech operation, well within its guidance. This sustained cost control at mature assets like Chelopech translates into robust profitability and reliable cash flow, even when metal prices fluctuate.

Dundee's Chelopech operations exemplify a cash cow, characterized by exceptionally low sustaining capital expenditure requirements for its core functions. Over the next three years, these expenditures are projected to remain stable, underscoring the mature nature of the asset.

This minimal capital intensity, especially when contrasted with the substantial cash flow generated, creates significant opportunities for free cash flow redeployment. Essentially, the asset requires very little ongoing investment to sustain its current production levels.

Dividend Payments and Share Buybacks

Dundee Precious Metals demonstrates strong shareholder returns, a key indicator of its cash cow status. In the first quarter of 2025, the company returned a record $90.4 million to shareholders through dividends and share buybacks. This substantial capital distribution highlights the excess cash generated by its operations, exceeding the needs for reinvestment in its core business.

The company’s ability to consistently generate more cash than it requires for operational growth and maintenance allows for these significant returns. This financial flexibility is a defining characteristic of a cash cow within the BCG matrix framework.

- Record Shareholder Returns: Dundee Precious Metals distributed $90.4 million in Q1 2025, showcasing strong capital return capabilities.

- Excess Cash Generation: The company's operations produce more cash than needed for reinvestment, a hallmark of a cash cow.

- Financial Flexibility: Substantial cash generation provides the means for dividends and share repurchases, reinforcing its cash cow position.

Strategic Financial Position

Dundee's Cash Cows, represented by its established and profitable operations, are crucial for financial stability. These units generate consistent cash flow, bolstering the company's overall financial health.

DPM concluded 2024 with a solid financial standing, boasting significant cash reserves and zero debt. This was further enhanced by the proceeds from the Tsumeb smelter sale in January 2025, underscoring the strength derived from its mature business lines.

- Strong Balance Sheet: DPM maintained a robust balance sheet throughout 2024, characterized by substantial cash holdings.

- Debt-Free Status: The company operated with no outstanding debt, a testament to its financial discipline.

- Cash Inflow: The sale of the Tsumeb smelter in January 2025 provided an additional significant cash infusion.

- Liquidity for Growth: This strong financial position, fueled by profitable core operations, ensures ample liquidity to support future growth initiatives while preserving stability.

Dundee Precious Metals' established operations, particularly the Chelopech mine, function as its cash cows. These assets consistently generate substantial, predictable cash flow with minimal reinvestment needs, providing a stable financial foundation for the company. This strong performance allows for significant capital returns to shareholders and supports investment in growth opportunities.

The Chelopech mine, a key cash cow for Dundee Precious Metals, demonstrated impressive operational efficiency in 2023, achieving an all-in sustaining cost of $1,060 per ounce, well within its projected range. This cost control, coupled with stable production, ensures robust profitability and reliable cash generation, even amidst market volatility.

Dundee Precious Metals' commitment to shareholder returns is evident in its Q1 2025 performance, where it distributed a record $90.4 million through dividends and share buybacks. This substantial capital distribution is a direct result of its cash cow operations generating excess cash beyond operational and growth requirements.

Dundee Precious Metals maintained a debt-free status throughout 2024, bolstered by significant cash reserves. The sale of the Tsumeb smelter in January 2025 further enhanced its liquidity, highlighting the financial strength derived from its mature, cash-generating assets.

| Metric | 2023 | Q1 2025 | Significance |

|---|---|---|---|

| Chelopech AISC (per ounce) | $1,060 | N/A | Indicates efficient, low-cost operations. |

| Shareholder Distributions | N/A | $90.4 million | Demonstrates excess cash generation and return capability. |

| Debt Status | Zero Debt | Zero Debt | Highlights financial stability and reduced risk. |

Full Transparency, Always

Dundee BCG Matrix

The Dundee BCG Matrix preview you are viewing is precisely the comprehensive document you will receive upon purchase. This means you get the full, unwatermarked, and professionally formatted analysis, ready for immediate strategic application. You can trust that the insights and structure presented here are exactly what you'll be able to utilize for your business planning and decision-making.

Dogs

The Tsumeb smelter, a former asset of Dundee Precious Metals (DPM), was divested in March 2024. This strategic move reflected its classification as no longer central to DPM's ongoing operations and future growth plans.

Operating results from the Tsumeb smelter were subsequently reclassified as discontinued operations. This change underscores the smelter's removal from DPM's core business, signaling a deliberate shift away from assets lacking a strong strategic alignment or perceived limited future potential within the company's portfolio.

The Ada Tepe mine, a key asset for Dundee Precious Metals (DPM), is approaching the end of its operational life, with production slated to conclude around mid-2026. This projected mine closure signifies a declining asset within DPM's portfolio, impacting its overall growth trajectory.

While Ada Tepe continues to contribute to DPM's output, its limited remaining mine life and the planned ramp-down mean it offers minimal future growth potential. The company's strategy will likely center on maximizing the value extraction from this asset before its eventual closure.

Dundee Precious Metals' (DPM) decision to sell its Tsumeb smelter in Namibia is a prime example of divesting non-core assets. This move aligns with their strategic focus on gold mining operations, shedding assets that don't directly contribute to their core business. For instance, in 2023, DPM reported that the Tsumeb smelter, while a significant operation, was not central to their long-term gold production growth strategy.

Legacy Exploration Holdings with Insufficient Prospects

Legacy exploration holdings with insufficient prospects are akin to question marks in the BCG matrix, representing assets that require investment but show little promise of future growth or market dominance. Mining companies frequently possess numerous exploration licenses that, upon initial evaluation, reveal limited economic viability or a low probability of achieving a significant market share. These assets drain capital without a clear pathway to substantial returns, often leading to their eventual abandonment or sale.

Dundee Corporation, for example, has demonstrated a strategic inclination to divest from such underperforming assets. This disciplined approach acknowledges the reality that not all exploration ventures will yield profitable results. By shedding these low-potential holdings, companies can reallocate resources to more promising projects, thereby improving overall portfolio efficiency and maximizing shareholder value.

- Low Growth, Low Market Share: These assets represent exploration licenses that have failed to demonstrate significant potential for future growth in production or market share.

- Resource Drain: They consume capital and management attention without a clear return on investment, acting as a drag on overall company performance.

- Divestiture Strategy: Companies like Dundee Corporation adopt a strategy to shed these "dogs" to free up resources for more promising ventures.

- Example: While specific company data for 2024 is still emerging, the principle applies broadly. In previous years, companies have written off millions in exploration expenditures for projects that proved uneconomical. For instance, in 2023, several junior miners announced the cessation of exploration on certain properties due to disappointing assay results, effectively moving them into this category.

Operational Units with Declining Profitability

Operational units with declining profitability, often termed 'Dogs' in the BCG matrix, are those that exhibit low market share and low growth potential. These units typically struggle with high operational costs and thin profit margins, making it difficult to compete effectively. For instance, Dundee Precious Metals (DPM) identified its Tsumeb mine in Namibia as a prime example of such an operation.

The Tsumeb mine, while historically significant, faced persistent challenges. By 2023, the operational costs at Tsumeb were significantly impacting DPM's overall financial performance. The mine's contribution to the company's total revenue had been steadily declining, and its low profitability made it a drain on resources that could otherwise be allocated to more promising ventures within DPM's portfolio.

DPM's strategic review highlighted the need to address underperforming assets. The decision to cease operations at Tsumeb by the end of 2023 was a direct consequence of its classification as a 'Dog'. This move aimed to streamline DPM's operations and focus capital on its higher-performing assets, thereby improving the company's overall financial health and strategic positioning.

- Low Market Share: Units in this category possess a small slice of their respective markets.

- Low Market Growth: The industries these units operate in are not expanding significantly.

- High Costs, Low Margins: These units struggle with expenses that outpace their revenue generation.

- Resource Drain: They consume capital and management attention without delivering substantial returns.

Assets classified as Dogs in the BCG matrix represent business units or products with low market share in slow-growing industries. These typically consume more resources than they generate, offering little prospect for future growth or profitability. Companies often divest or liquidate these assets to reallocate capital to more promising ventures.

Dundee Precious Metals (DPM) has strategically moved to shed such assets. For instance, the divestment of the Tsumeb smelter in March 2024 exemplifies this approach, as it was no longer considered central to DPM's core gold mining operations and future growth plans.

Similarly, the Ada Tepe mine, while still contributing, is approaching the end of its operational life, slated for closure around mid-2026. This indicates a declining asset with limited future growth potential, requiring careful management to maximize its remaining value.

These actions reflect a disciplined approach to portfolio management, focusing resources on areas with higher potential returns and shedding underperforming or non-strategic assets to improve overall company efficiency and shareholder value.

Question Marks

The Čoka Rakita Gold Project in Serbia represents a significant potential growth driver for Dundee Precious Metals (DPM), with initial production anticipated around 2028. This project is currently in a capital-intensive development stage, meaning it requires substantial investment without generating any revenue or contributing to market share at this time.

As a result, Čoka Rakita is positioned as a Question Mark in the BCG matrix. Its future success, and potential to transition into a Star performer, is contingent upon sustained, significant capital expenditure to move it through the development pipeline and towards profitable production.

The Loma Larga gold project in Ecuador is a key development asset for Dundee Precious Metals. It recently secured its environmental license, a significant step forward.

A crucial update to the feasibility study is anticipated in the second quarter of 2025. This project holds considerable future growth potential, aligning with its position in the Question Mark quadrant of the BCG matrix.

However, Loma Larga demands substantial capital investment and navigates inherent permitting and development risks. These factors contribute to its classification as a Question Mark, requiring careful strategic consideration.

Dundee Precious Metals (DPM) is expanding its Serbian footprint beyond the flagship Čoka Rakita project. Exploration efforts are underway on adjacent licenses like Dumitru Potok and Frasen, yielding encouraging high-grade scout drilling results.

These emerging discoveries represent significant future growth potential for DPM in Serbia. However, they are currently in early stages, indicating a low market share and demanding substantial continued investment in exploration to define their resource base and economic feasibility.

Raška Zinc-Silver Project (Exploration Stage)

The Raška Zinc-Silver Project in Serbia, acquired through the Adriatic Metals transaction, is currently in the exploration phase. While it expands Dundee Precious Metals' (DPM) Balkan holdings, it's not yet generating revenue, necessitating continued exploration to unlock its market potential. This asset offers future growth possibilities but comes with inherent risks due to its undeveloped status.

As of the latest reports, DPM's focus remains on advancing exploration at Raška. The project's contribution to the BCG matrix is that of a Question Mark, signifying its potential for high growth but also its current lack of market share or proven production. Significant investment is required to assess its viability.

- Exploration Stage: The Raška project is in its early exploration phase, meaning its economic viability and production timeline are yet to be fully determined.

- Balkan Portfolio Expansion: Its acquisition diversifies DPM's asset base within the Balkan region, aligning with strategic regional growth.

- Future Upside with Uncertainty: Raška represents potential future value but carries the inherent uncertainty associated with exploration-stage mining assets.

- Investment Requirement: Further capital expenditure will be essential for exploration, development, and eventual production, impacting DPM's financial strategy.

Future Strategic Acquisitions

Future strategic acquisitions are pivotal for Dundee Precious Metals (DPM) as it targets mid-tier precious metals producer status. These moves are classified as Stars in the BCG Matrix, demanding substantial investment for high growth potential.

DPM's pursuit of growth through acquisitions involves significant capital outlay, with the company actively seeking opportunities. For instance, in 2023, Dundee Precious Metals reported capital expenditures of $139.8 million, a substantial portion of which is earmarked for growth initiatives, including potential acquisitions. The company's strategy hinges on acquiring assets with strong exploration upside and the potential to expand existing operations.

- High Investment, High Growth: Acquisitions in this category require significant capital but promise substantial returns if successful.

- Risk Assessment: Potential deals carry inherent risks related to integration challenges and market reception, necessitating thorough due diligence.

- Strategic Alignment: Acquisitions must align with DPM's long-term vision of becoming a mid-tier producer, focusing on quality assets and geographic diversification.

- 2024 Outlook: Dundee Precious Metals has indicated continued focus on exploring and potentially acquiring new assets in 2024, building on its 2023 performance where it achieved record gold production.

Question Marks, like the Čoka Rakita and Loma Larga projects, represent high-growth potential but currently have low market share. These assets require significant investment to develop and realize their full value. Their classification hinges on the substantial capital needed to progress them through the development pipeline and the inherent risks associated with their early stages.

Emerging exploration targets, such as Dumitru Potok and Frasen in Serbia, also fall into the Question Mark category. These early-stage discoveries demand continued investment in exploration to define their resource potential and economic feasibility. The Raška Zinc-Silver Project, acquired through Adriatic Metals, similarly requires further exploration to assess its market viability.

The strategic imperative for Dundee Precious Metals (DPM) is to successfully advance these Question Mark assets. Their transition into Stars, or even Cash Cows, is contingent on effective capital allocation and risk management. Without this dedicated investment, their high-growth potential may remain unrealized.

Dundee Precious Metals' 2023 capital expenditures of $139.8 million underscore the significant investment required for growth initiatives. The company's 2024 outlook includes continued exploration and potential acquisitions, highlighting the ongoing need to nurture Question Mark assets.

| Project | BCG Category | Status | Key Investment Need | Potential |

|---|---|---|---|---|

| Čoka Rakita Gold Project | Question Mark | Development | Capital Intensive Development | High Growth Potential (Est. Production 2028) |

| Loma Larga Gold Project | Question Mark | Development (Environmental License Secured) | Substantial Capital Investment, Permitting Risks | Significant Future Growth Potential |

| Dumitru Potok & Frasen (Serbia) | Question Mark | Early Exploration | Continued Exploration Investment | Future Growth Potential |

| Raška Zinc-Silver Project | Question Mark | Exploration | Exploration and Development Capital | Future Growth Possibilities |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.