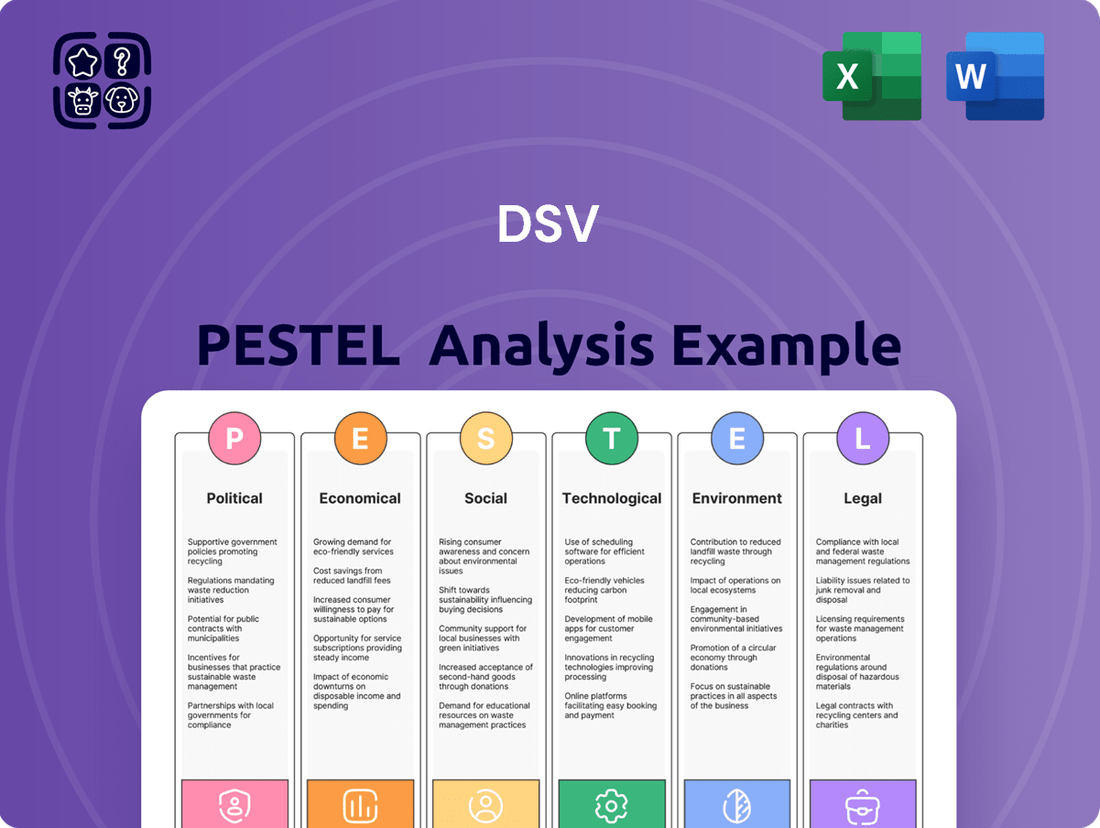

DSV PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DSV Bundle

Unlock the strategic levers impacting DSV by dissecting the political, economic, social, technological, environmental, and legal forces at play. Understand how global shifts in trade policy, economic downturns, and evolving consumer behavior directly influence DSV's operational landscape and future growth. This comprehensive PESTLE analysis provides the critical external context needed to anticipate challenges and capitalize on emerging opportunities. Don't navigate the complexities of the logistics industry blindfolded; download the full PESTLE analysis for DSV and gain the foresight to make informed, impactful decisions.

Political factors

Geopolitical instability, like the ongoing disruptions in the Red Sea, directly impacts DSV’s operations by forcing costly rerouting and increasing transit times. These events create significant uncertainty, requiring DSV to remain agile in adapting its global supply chain strategies.

Trade wars and tariffs also pose a substantial risk, potentially altering trade flows and increasing the cost of moving goods across borders. DSV’s Q1 2025 report highlighted that macroeconomic uncertainties and trade tariffs were key factors influencing market conditions, suggesting a tangible impact on their business environment.

Changes in international trade agreements and the imposition of new tariffs directly influence the volume and flow of goods, significantly impacting DSV's freight forwarding operations. For instance, the ongoing trade tensions between major economic blocs can create uncertainty, making it harder for DSV to forecast demand and manage its global logistics networks efficiently.

Increased tariffs can reduce global trade volumes, potentially leading to lower demand for DSV's services. Conversely, new trade agreements, such as the potential expansion or renegotiation of existing pacts, could open up new markets and create fresh opportunities for DSV to expand its service offerings and reach.

DSV has expressed concerns that potential trade tariffs could slightly dampen demand, potentially reducing the company's profits in the current fiscal year. For example, a hypothetical 5% increase in tariffs on key trade routes could directly impact DSV's revenue streams by making cross-border shipments less attractive for clients.

Governments globally enforce a wide array of regulations impacting transport and logistics, covering everything from operator licensing and safety protocols to infrastructure investment. DSV, operating across numerous countries, must navigate this complex web of national and international rules. For instance, the European Union's ongoing efforts to harmonize road transport regulations, including driver working hours and emissions standards, directly affect DSV's European operations. These regulations, while adding compliance costs, are crucial for maintaining a level playing field and ensuring operational safety.

The dynamic nature of these governmental policies necessitates constant vigilance and strategic adaptation from DSV. For example, in 2024, several nations are intensifying scrutiny on carbon emissions from freight transport, potentially leading to new taxes or operational restrictions. DSV's ability to anticipate and respond to these regulatory shifts, such as investing in greener fleets or optimizing routes to meet new emission targets, is critical for sustained growth and competitive advantage. The company's financial performance is directly linked to its capacity to manage these evolving compliance demands efficiently.

Customs Policies and Border Controls

Evolving customs policies and increasingly stringent border controls are critical political factors influencing DSV's global logistics operations. These changes can directly affect transit times and operational costs. For instance, in 2024, many countries are implementing more rigorous checks and digitalization requirements for shipments, adding complexity to cross-border movements.

The bureaucratic procedures associated with customs can create significant delays. These delays can impact DSV's ability to meet delivery schedules, potentially affecting customer satisfaction and DSV's competitive positioning in the market. The sheer volume of international trade processed by DSV means navigating a vast and often shifting landscape of these regulations.

DSV's strategic move to acquire Schenker in 2023 significantly expanded its global footprint, meaning it now manages an even more extensive and intricate web of international customs regulations. This integration requires substantial investment in compliance and expertise to ensure smooth operations across all new territories.

- Increased Compliance Costs: Stricter customs regulations often necessitate greater investment in technology and personnel to ensure adherence, directly impacting operational expenses.

- Transit Time Variability: Changes in border control efficiency and customs processing times can lead to unpredictable delivery schedules, a key concern for clients.

- Trade Agreement Impact: Political shifts influencing trade agreements can alter customs duties and quotas, requiring agile adaptation by DSV's policy teams.

Political Relations and Regional Blocs

DSV's global operations are significantly shaped by the political relationships between major trading blocs and individual nations. These relationships directly impact market access and the ease with which DSV can conduct its business, from cross-border logistics to establishing new service hubs.

For instance, favorable trade agreements and stable political alliances can open doors for DSV’s expansion and streamline its supply chain networks. Conversely, geopolitical tensions or trade disputes can result in operational disruptions, tariffs, or even force a withdrawal from certain markets. DSV's 2024 annual report specifically highlighted that the ongoing challenging macroeconomic and geopolitical landscape continued to be a key influence on market dynamics and, by extension, DSV's strategic planning.

- Trade Agreements: The existence and nature of bilateral and multilateral trade agreements directly affect DSV's ability to move goods efficiently across borders, influencing costs and delivery times.

- Geopolitical Stability: Regions experiencing political instability or conflict pose significant risks to DSV’s operations, potentially leading to service interruptions and increased security costs.

- Regulatory Environment: Changes in government policies and regulations, such as customs procedures or environmental standards, can impact DSV's operational flexibility and compliance requirements.

- International Relations: The overall state of international relations, including diplomatic ties and potential sanctions between countries, can create barriers or opportunities for DSV’s global logistics network.

Political factors significantly influence DSV's global operations. Geopolitical instability, trade wars, and shifting international relations create uncertainty, impacting trade flows and requiring strategic adaptation. For example, DSV's 2024 annual report noted the challenging geopolitical landscape as a key influence on market dynamics.

Evolving government regulations, from customs procedures to environmental standards, directly affect DSV's compliance costs and operational flexibility. Stricter border controls and customs policies can lead to transit time variability, a critical factor for client satisfaction. The company's 2023 acquisition of Schenker further amplified the complexity of navigating diverse international regulations.

Changes in trade agreements can alter customs duties and quotas, impacting the cost and efficiency of cross-border shipments. DSV's Q1 2025 report highlighted market uncertainties and trade tariffs as key influences, underscoring the tangible impact of these political shifts on their business environment.

Increased tariffs could potentially dampen demand, as DSV has expressed concerns about a reduction in profits. For instance, a hypothetical 5% tariff increase on key trade routes could directly impact revenue by making shipments less attractive for clients. Conversely, new trade agreements could create new market opportunities for DSV.

What is included in the product

This DSV PESTLE analysis delves into the external macro-environmental factors impacting DSV across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing actionable insights for strategic decision-making.

Provides a concise and actionable summary of the PESTLE analysis, enabling faster decision-making and reducing the burden of sifting through extensive data.

Economic factors

DSV's performance is intrinsically linked to the ebb and flow of global economic activity. A slowdown in worldwide growth, a significant concern heading into 2025, directly translates to reduced trade volumes and a dampened demand for the logistics and transport services DSV provides. Conversely, periods of strong economic expansion typically fuel increased international commerce, driving up the need for sophisticated supply chain management.

DSV's Q1 2025 financial report highlights this sensitivity. While the company achieved positive earnings growth, signaling resilience, this was primarily bolstered by an increase in gross profit within its Air & Sea division. However, the Road segment experienced a notable impact from prevailing weaker market conditions, underscoring the varied effects of economic headwinds across DSV's operational units.

Fluctuations in global fuel prices and energy costs are a significant factor for DSV, directly impacting its operational expenses across road, sea, and air freight. Higher energy costs can squeeze profit margins if DSV can't fully pass these increases onto customers through freight rates. For instance, DSV's February 2025 market update noted a rise in diesel prices, presenting a financial challenge for transport operators.

High inflation in 2024 and early 2025 has directly impacted DSV's operational expenses. For instance, the cost of labor, fuel, and materials has seen significant increases, directly affecting DSV's cost of goods sold and operating margins. This inflationary environment necessitates proactive cost management strategies to mitigate the impact on profitability.

Rising interest rates, a consequence of central banks' efforts to combat inflation, also present a challenge for DSV. Higher borrowing costs can make it more expensive for DSV to finance its capital expenditures, such as expanding its logistics network through acquisitions or building new facilities. This increased cost of capital can constrain DSV's investment capacity and potentially slow down growth initiatives.

DSV's financial performance is therefore sensitive to these macroeconomic shifts. The company's Q1 2025 results highlighted this, with a reported decrease in EBIT for the Solutions segment. This was partly attributed to increased depreciation costs stemming from investments in new, state-of-the-art warehouses, a direct consequence of the company's ongoing expansion and modernization efforts amid these economic pressures.

Careful financial management is crucial for DSV to navigate these economic headwinds. The company must balance the need for continued investment in its infrastructure and services with the rising costs associated with inflation and higher interest rates. Strategies like optimizing operational efficiency, hedging against currency fluctuations, and maintaining a strong balance sheet are key to preserving profitability and ensuring continued investment capacity.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant economic factor for DSV, a global logistics powerhouse. As DSV operates across numerous countries, its financial results are translated into its reporting currency, the Danish Krone (DKK). This translation process means that changes in exchange rates, particularly against major currencies like the US dollar, can materially impact reported revenues, costs, and ultimately, profitability. If the DKK strengthens against other currencies where DSV earns revenue, those earnings will translate into fewer DKK, potentially masking strong operational performance. This is a critical consideration for investors and analysts monitoring DSV's financial health.

For instance, DSV's 2025 outlook assumes a stable currency environment, specifically that exchange rates, with the US dollar against the DKK, will remain at current levels. This assumption is crucial because adverse currency movements could significantly diminish reported profits, even if the company's underlying business operations are performing well. For example, if the USD weakens considerably against the DKK, revenue earned in USD would be worth less when converted back to DKK, impacting DSV's consolidated financial statements.

- Impact on Revenue: A stronger DKK can reduce the DKK value of revenues earned in foreign currencies.

- Impact on Costs: Conversely, a weaker DKK can increase the DKK cost of imported goods or services.

- Profitability Erosion: Unfavorable exchange rate shifts can directly erode net profits, independent of operational efficiency.

- DSV's 2025 Outlook: The company's financial projections are based on the assumption of stable USD/DKK exchange rates.

Consumer Spending and Demand for Goods

Consumer spending is a major driver for DSV, directly impacting the volume of goods needing transportation and warehousing. When consumers are buying more, DSV's business naturally picks up, especially in areas like retail and e-commerce fulfillment.

A strong consumer market translates to increased demand across DSV's services. For instance, a robust economy encouraging higher spending means more products need to move through supply chains, benefiting DSV's freight forwarding and logistics operations. Conversely, a slowdown in consumer purchases can lead to reduced shipment volumes and less demand for warehousing space.

DSV's air freight business, in particular, saw a positive correlation with consumer spending trends. In 2024, an uptick in consumer spending, notably within the United States, directly contributed to higher volumes of air freight handled by DSV.

- Consumer spending influences DSV's shipment volumes, especially in retail and e-commerce.

- Robust consumer markets boost demand for DSV's transportation and warehousing services.

- Declines in consumer demand can lead to reduced activity for DSV.

- DSV's air freight volumes in 2024 benefited from increased consumer spending, particularly in the US.

Global economic conditions significantly shape DSV's performance, with growth slowdowns in 2025 impacting trade volumes and demand for logistics services. While DSV's Q1 2025 results showed resilience, the Road segment felt the pinch of weaker markets, contrasting with growth in Air & Sea.

Inflationary pressures in 2024 and early 2025 increased operational costs for DSV, affecting labor, fuel, and materials, which in turn impacted operating margins. Rising interest rates also pose a challenge, potentially increasing borrowing costs for capital expenditures and acquisitions, as seen in the Q1 2025 EBIT decrease in the Solutions segment due to depreciation from new warehouse investments.

| Economic Factor | Impact on DSV | 2024/2025 Data/Observation |

|---|---|---|

| Global Economic Growth | Reduced trade volumes, dampened demand for logistics services. | Slowdown in worldwide growth is a significant concern heading into 2025. |

| Inflation | Increased operational costs (labor, fuel, materials), impacting profit margins. | High inflation observed in 2024 and early 2025. |

| Interest Rates | Higher borrowing costs for capital expenditures and acquisitions. | Rising interest rates implemented by central banks to combat inflation. |

| Currency Exchange Rates | Fluctuations impact reported revenues and profitability, especially USD/DKK. | DSV's 2025 outlook assumes stable USD/DKK exchange rates. |

| Consumer Spending | Drives shipment volumes, particularly in retail and e-commerce. | Uptick in consumer spending in the US contributed to higher DSV air freight volumes in 2024. |

Same Document Delivered

DSV PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This DSV PESTLE analysis provides a comprehensive overview of the external factors impacting the company. You'll find detailed insights into Political, Economic, Social, Technological, Legal, and Environmental influences. This ready-to-use document empowers you to make informed strategic decisions.

Sociological factors

Consumers today expect their purchases to arrive swiftly, with clear visibility into the shipping process and the ability to choose convenient delivery times or locations. This shift, heavily influenced by the booming e-commerce sector, means businesses like DSV need to offer more than just basic transport.

The relentless growth of online shopping, which saw global e-commerce sales reach an estimated $6.3 trillion in 2023 and projected to hit $7.4 trillion by 2025, underscores this demand. DSV's ability to provide efficient last-mile solutions and robust real-time tracking is crucial for retaining customers and staying competitive in this dynamic market.

The logistics sector, including companies like DSV, continues to grapple with a significant lack of available workers and a shortage of skilled individuals, especially for critical roles such as truck drivers and warehouse staff. This scarcity directly translates into higher labor costs, reduced operational efficiency, and challenges in expanding business capacity, ultimately hindering DSV's responsiveness to market demand.

DSV's own February 2025 market outlook highlights a worsening situation for driver shortages across Europe. Projections indicate this deficit will become more acute in 2025, largely driven by an aging demographic of existing drivers and a declining interest from younger generations in pursuing a career in transportation.

Demographic shifts significantly impact DSV's talent acquisition and retention. For instance, many developed nations are experiencing an aging workforce, which could lead to a shrinking pool of available labor, while other regions boast a younger, growing population, presenting a different set of challenges and opportunities. In 2024, the global population reached over 8 billion, with a notable portion in the working-age bracket, but the distribution varies greatly by country.

DSV's commitment to diversity and inclusion is crucial for navigating these demographic changes. By fostering an inclusive environment, the company can attract a broader range of talent, tapping into diverse skill sets and perspectives essential for a global logistics leader. This approach is particularly important as many countries, including those where DSV operates, are seeing increased ethnic and cultural diversity in their populations.

Embracing diversity means creating a workplace where all employees, regardless of background, feel valued and can contribute their best. DSV's initiatives aim to ensure that everyone has the opportunity to grow and succeed, reflecting the increasingly diverse nature of the global workforce. This focus on inclusion helps DSV adapt to changing societal expectations and maintain a competitive edge in talent management.

Emphasis on Ethical Supply Chains

Societal expectations are increasingly pushing companies like DSV to prioritize ethical supply chains. Consumers and stakeholders are demanding greater transparency regarding fair labor practices and responsible sourcing of materials. This growing awareness puts direct pressure on logistics providers to demonstrate accountability throughout their complex networks. Companies are expected not only to comply with regulations but also to proactively uphold human rights and ethical conduct across all operations and with their business partners.

Reports like EiQ's 'Supply Chain Sustainability: Top Trends for 2025' underscore this shift, pointing to escalating human rights and environmental risks. This highlights the critical need for businesses to embed ethical conduct deeply into their operational frameworks. For DSV, this translates to rigorous due diligence and robust management systems to ensure that every link in its supply chain adheres to ethical standards.

- Growing Consumer Demand: Surveys indicate a significant increase in consumer willingness to pay more for products from ethically sourced supply chains.

- Regulatory Scrutiny: Governments worldwide are enacting stricter legislation concerning supply chain transparency and labor rights, impacting global logistics operations.

- Investor Focus: Environmental, Social, and Governance (ESG) investing continues to gain momentum, with investors increasingly scrutinizing companies' supply chain ethics.

- Reputational Risk: Negative publicity stemming from unethical practices within a supply chain can severely damage a logistics provider's brand and customer trust.

Urbanization and Last-Mile Delivery Challenges

Increasing urbanization is a significant trend influencing DSV's operations. As more people move into cities, the demand for efficient logistics and last-mile delivery solutions escalates, creating a substantial market opportunity. However, this growth is met with considerable challenges, particularly traffic congestion and environmental concerns within densely populated urban areas.

To effectively navigate these complex urban environments, DSV must prioritize investment in innovative solutions and robust infrastructure. This includes exploring greener delivery methods and optimizing route planning to mitigate the impact of congestion. The company's ability to adapt to these urban dynamics will be crucial for its continued success and sustainability in the logistics sector.

The last-mile delivery segment, a critical component of urban logistics, is poised for substantial growth. Projections indicate a significant expansion driven by advancements such as micro-fulfillment centers, the deployment of drones for rapid delivery, and the eventual integration of autonomous vehicles. These technologies are expected to reshape how goods reach consumers in urban settings.

Key aspects of this evolving landscape for DSV include:

- Urban population growth: Cities are expanding, increasing the density of delivery points and the complexity of urban logistics networks.

- Congestion and emissions: Densely populated areas often suffer from severe traffic, leading to delays and higher operational costs due to fuel consumption and emissions.

- Technological adoption: Innovations like electric delivery vehicles, cargo bikes, and smart routing software are essential for efficient and sustainable urban deliveries.

- E-commerce surge: The continued rise of online shopping directly fuels the demand for last-mile delivery services, particularly in metropolitan areas.

Societal shifts are fundamentally reshaping consumer expectations for logistics. Customers now demand swift deliveries, transparent tracking, and flexible delivery options, driven by the e-commerce boom which saw global sales reach approximately $6.3 trillion in 2023, with expectations to climb to $7.4 trillion by 2025. This necessitates advanced last-mile solutions and real-time visibility from companies like DSV.

The increasing emphasis on ethical supply chains is a major societal factor. Consumers and investors are scrutinizing labor practices and sourcing, with ESG investing showing strong growth. Reports like EiQ's 'Supply Chain Sustainability: Top Trends for 2025' highlight escalating human rights risks, pushing logistics providers to ensure rigorous due diligence and ethical conduct across their entire networks.

Urbanization presents both opportunities and challenges for DSV. Growing city populations increase demand for efficient delivery but also lead to congestion and environmental concerns. Adapting through greener delivery methods and smart routing is key, especially as last-mile delivery is set to expand significantly with technologies like drones and autonomous vehicles.

| Societal Factor | Impact on DSV | Relevant Data/Trends (2024-2025) |

|---|---|---|

| Consumer Delivery Expectations | Increased demand for speed, transparency, and flexibility. | Global e-commerce sales projected to reach $7.4 trillion by 2025. |

| Ethical Supply Chain Scrutiny | Pressure for transparency, fair labor, and responsible sourcing. | ESG investing momentum; EiQ report highlights rising human rights risks. |

| Urbanization | Growth in demand for last-mile delivery coupled with congestion challenges. | Continued migration to cities, driving need for efficient urban logistics solutions. |

Technological factors

DSV's strategic embrace of automation and robotics within its warehousing and sorting operations is a significant technological driver. This adoption is directly linked to achieving greater efficiency, curbing labor expenses, and accelerating overall operational throughput. Technologies such as autonomous mobile robots (AMRs) and collaborative robots, often referred to as cobots, are instrumental in optimizing core functions like order picking, efficient packing, and rapid sorting.

The impact of these advanced technologies is substantial, with industry projections indicating that as much as 25% of typical warehouse tasks could be automated by the close of 2025. This trend underscores a broader industry shift towards intelligent automation, aiming to create more agile and cost-effective supply chains.

Digitalization, particularly through blockchain and Internet of Things (IoT) devices, is fundamentally reshaping supply chain visibility and transparency for companies like DSV. This technological shift enables real-time data capture on crucial elements such as location and temperature, leading to more precise tracking, smarter decision-making, and stronger defenses against fraud. The global investment in IoT and blockchain solutions within supply chains is projected to see a significant annual growth rate of 20% up to 2025, indicating a strong market trend towards these advanced operational capabilities.

The accelerating expansion of e-commerce is fundamentally reshaping logistics, demanding advanced capabilities in warehousing, inventory management, and swift last-mile delivery. DSV needs to consistently upgrade its digital systems and physical networks to manage the escalating volumes and speed expectations inherent in online retail operations.

The global e-commerce market is projected to hit $6.3 trillion in 2024, a significant driver for enhanced cross-border shipping services that prioritize speed and dependability. This trend requires substantial investment in technology and infrastructure to ensure seamless international transit for online purchases.

Data Analytics and Artificial Intelligence (AI)

Data analytics and AI are becoming indispensable tools for optimizing operations in the logistics sector. DSV can leverage these technologies to refine its route planning, predict customer demand more accurately, and streamline overall efficiency throughout its vast network. For instance, AI-powered systems can pinpoint the most economical and time-saving routes, taking into account real-time traffic and weather conditions. This level of optimization directly impacts fuel consumption and delivery times.

Machine learning algorithms play a crucial role in forecasting demand, allowing DSV to better manage inventory levels and anticipate shipping volumes. This proactive approach helps avoid stockouts or overstocking, leading to significant cost savings and improved customer satisfaction. The industry trend is clear: by 2025, it's projected that 80% of logistics companies will have integrated AI into their operations for enhanced real-time visibility and more intelligent decision-making processes.

- Route Optimization: AI can analyze millions of data points to find the most efficient delivery paths, reducing transit times and fuel costs.

- Demand Forecasting: Machine learning models predict shipment volumes and customer needs, enabling better resource allocation and inventory management.

- Operational Efficiency: AI implementation is expected to drive significant improvements in overall logistics network performance.

- Industry Adoption: An estimated 80% of logistics firms will be using AI solutions by 2025 for real-time data insights and automated decision support.

Emerging Transport Technologies

The logistics sector is seeing significant investment in and adoption of emerging transport technologies, directly impacting DSV's competitive edge and sustainability. Autonomous vehicles, including self-driving trucks and delivery drones, along with alternative fuel vehicles, are central to these advancements. These innovations offer potential benefits like cost reductions through optimized operations, extended operational hours, improved safety metrics, and a decreased environmental footprint. By 2025, many logistics players are actively piloting and integrating autonomous trucks into their existing fleets, signaling a tangible shift in industry practices.

The drive towards more sustainable and efficient logistics is accelerating technological integration. For DSV, embracing these changes is not just about staying current but about unlocking new operational efficiencies and meeting evolving environmental standards. The development of electric and hydrogen-powered trucks, for instance, is gaining momentum, with companies aiming to decarbonize their road freight operations. Furthermore, advancements in drone technology are poised to revolutionize last-mile delivery, offering faster and more agile solutions for certain types of shipments.

Key technological factors influencing DSV's strategy include:

- Autonomous Driving: Continued development and regulatory approval for self-driving trucks are expected to transform long-haul freight, potentially enabling 24/7 operations and reducing labor costs. Major trials are already underway globally.

- Alternative Fuels: The transition to electric, hydrogen, and other low-emission powertrains for heavy-duty vehicles is a significant trend, driven by both environmental regulations and corporate sustainability targets.

- Drones and Urban Logistics: The use of drones for last-mile delivery is expanding, particularly in urban environments, offering speed and efficiency for smaller packages.

- Data Analytics and AI: The integration of artificial intelligence and advanced data analytics is crucial for optimizing routing, fleet management, and predictive maintenance, enhancing overall operational performance.

Technological advancements are rapidly transforming the logistics landscape, and DSV must adapt to remain competitive. Automation in warehouses, with robots handling tasks like picking and sorting, is projected to automate up to 25% of typical warehouse jobs by the end of 2025, boosting efficiency and cutting labor costs.

Digitalization through IoT and blockchain enhances supply chain transparency, enabling real-time tracking of goods. Global investment in these areas for supply chains is expected to grow at a 20% annual rate through 2025, highlighting a strong market push toward smarter operations.

AI and data analytics are becoming critical for optimizing routes, predicting demand, and improving overall network efficiency. By 2025, approximately 80% of logistics companies are anticipated to integrate AI for real-time insights and automated decision-making.

Emerging transport technologies, such as autonomous vehicles and alternative fuel trucks, are also key. These innovations promise cost reductions, extended operational hours, and a smaller environmental footprint, with many companies actively piloting autonomous trucks globally.

Legal factors

DSV navigates a multifaceted landscape of international transport laws and conventions crucial for its global operations. These include regulations for air freight like the Montreal Convention, maritime transport governed by the UN Convention on the Law of the Sea, and road transport agreements such as the ADR for dangerous goods. Adherence to these varied legal structures is non-negotiable and dictates operational procedures from securing cargo to managing potential liabilities and insurance needs.

The sheer scale of DSV's presence, spanning over 80 countries, amplifies the legal complexity. Ensuring consistent compliance with these diverse international frameworks across its vast network represents a substantial legal and administrative challenge, requiring constant vigilance and adaptation to evolving global regulations.

DSV faces stringent data privacy demands, particularly with regulations like the EU's General Data Protection Regulation (GDPR). Failure to comply, especially concerning sensitive customer and shipment information, can result in substantial fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher. Robust cybersecurity measures are therefore paramount for DSV to safeguard its operations and maintain client confidence in 2025.

Cybersecurity breaches not only carry financial penalties but also inflict significant reputational damage, eroding customer trust which is vital in the logistics sector. As supply chains become increasingly digitized, ensuring the integrity of data flow is critical. DSV's investment in advanced cybersecurity solutions in 2024 and 2025 directly impacts its ability to guarantee secure and reliable logistics services.

DSV navigates a complex web of labor and employment laws across the many countries where it operates. These regulations cover critical areas like maximum working hours, minimum wage requirements, and the rights of employees regarding unionization. Ensuring compliance with these diverse legal frameworks is a significant undertaking for any global company.

Following its acquisition of Schenker, DSV's global workforce expanded significantly, reaching approximately 160,000 employees as of late 2023. This substantial increase necessitates continuous attention to maintaining adherence to each country's specific labor statutes and upholding equitable employment practices worldwide.

DSV's commitment extends to fostering an environment where all its employees can flourish and reach their full potential. This involves creating a workplace that is not only compliant with legal mandates but also champions diversity and inclusion, recognizing the value of a broad range of perspectives and backgrounds.

Competition Law and Anti-Trust Regulations

DSV, as a prominent global logistics provider, operates under stringent competition and anti-trust laws across numerous countries. These regulations are crucial for preventing market monopolization and ensuring a level playing field, especially as DSV pursues strategic growth through acquisitions, such as its significant investment in DB Schenker. The company must navigate these legal frameworks meticulously to ensure compliance, particularly concerning market share and potential impacts on competition. For instance, the proposed acquisition of DB Schenker, valued at approximately €14.3 billion in late 2023, was subject to extensive review by competition authorities in key markets, underscoring the critical role of these laws in shaping the industry landscape.

The acquisition of Schenker, a move that would significantly bolster DSV's global presence, necessitates thorough scrutiny from regulatory bodies. These authorities assess whether such a merger would unduly restrict competition or lead to unfair market advantages. DSV's proactive engagement with these legal requirements is vital for the successful integration of new assets and continued market access. Failure to comply can result in substantial fines and operational disruptions, making adherence to anti-trust guidelines a cornerstone of DSV's global strategy.

Key considerations for DSV under competition law include:

- Merger Control: Ensuring acquisitions, like the Schenker deal, receive necessary approvals from competition authorities by demonstrating they do not harm market competition.

- Market Conduct: Adhering to regulations that prohibit anti-competitive practices, such as price-fixing or abuse of dominant market positions.

- Regulatory Scrutiny: Proactively managing relationships with regulators and providing transparent data to facilitate approval processes.

- Global Compliance: Maintaining awareness and adherence to varying competition laws in all operating jurisdictions, from the EU to the US and beyond.

Customs and Trade Compliance Laws

DSV operates within a complex web of customs and trade compliance laws, a critical aspect of its global logistics business. These regulations encompass import and export controls, sanctions, and trade embargoes, which differ greatly depending on the countries involved and the specific goods being transported. Staying compliant is paramount, as violations can lead to significant financial penalties, operational disruptions, and damage to DSV's reputation.

The company's commitment to robust compliance systems is therefore non-negotiable for its worldwide operations. For instance, DSV's first quarter 2025 financial results were notably affected by the ongoing uncertainties surrounding various international trade tariffs. This highlights the direct financial impact of navigating these dynamic legal landscapes.

- Navigating diverse import/export controls: Each nation has unique requirements for goods entering or leaving its borders, impacting documentation and clearance processes.

- Adherence to sanctions and embargoes: DSV must meticulously track and comply with international sanctions and trade embargoes, which can restrict business with certain countries or entities.

- Financial impact of non-compliance: Fines for customs violations can be substantial, potentially running into millions of dollars, alongside the cost of seized goods.

- Q1 2025 tariff impact: DSV's Q1 2025 performance underscored the sensitivity of logistics operations to trade policy shifts, with tariff uncertainties contributing to financial headwinds.

DSV operates under extensive international transport laws, from the Montreal Convention for air freight to maritime and road transport regulations. Compliance with these varied legal structures is essential for cargo handling, liability management, and insurance, impacting daily operations across its global network.

The company must also adhere to stringent data privacy laws, such as the EU's GDPR, which carries penalties up to 4% of global annual revenue or €20 million. Robust cybersecurity is paramount in 2024 and 2025 to protect sensitive data and maintain client trust in increasingly digitized supply chains.

DSV's global workforce, numbering around 160,000 post-Schenker acquisition in late 2023, requires strict adherence to diverse labor and employment laws worldwide, covering working hours, wages, and employee rights.

Furthermore, DSV faces significant competition and anti-trust scrutiny, particularly with its €14.3 billion investment in DB Schenker in late 2023. Navigating merger control and market conduct regulations is critical to avoid penalties and ensure market access.

Environmental factors

DSV navigates a landscape shaped by evolving climate change regulations and increasingly stringent emission standards. Initiatives like the International Maritime Organization's 2020 regulations for sulfur oxides and the European Union's ambitious Green Deal are compelling the logistics sector towards decarbonization. These policies directly impact DSV's operational costs and strategic planning, requiring significant capital allocation for greener technologies.

Meeting these regulatory demands means substantial investments in modernizing fleets with more fuel-efficient vessels and exploring alternative fuels such as biofuels or even hydrogen. Furthermore, DSV must enhance operational efficiency through route optimization and intermodal shifts to lower its overall carbon footprint. These adjustments are critical for maintaining compliance and competitive positioning in the global market.

DSV has publicly committed to ambitious sustainability goals, aiming for net-zero emissions by 2050. This commitment is underpinned by Science Based Targets initiative (SBTi) validated near-term carbon reduction targets for 2030, demonstrating a clear roadmap for emissions reduction. For instance, in 2023, DSV reported a 15% reduction in scope 1 and 2 emissions intensity compared to their 2022 baseline, showcasing progress towards these long-term objectives.

Customers and investors are increasingly prioritizing sustainability, directly impacting logistics providers like DSV. This translates into a strong demand for eco-friendly transport options and clear reporting on environmental impact. For instance, a significant 57% of logistics companies are targeting net-zero emissions by 2050, a trend DSV must align with to maintain competitiveness and attract capital.

Growing concerns about resource scarcity and the increasing demand for effective waste management significantly shape DSV's strategic approach to logistics and supply chain operations. These environmental pressures directly impact how DSV handles warehousing, packaging, and transportation, pushing for more sustainable solutions.

DSV is actively working to reduce its environmental footprint by minimizing waste generation and implementing robust recycling programs across its facilities. For instance, in 2023, DSV reported a 10% increase in the use of recycled materials in its packaging solutions across its European operations, demonstrating a tangible commitment to this goal.

The company is championing a circular economy mindset, aiming to keep resources in use for as long as possible, extract maximum value from them whilst in use, then recover and regenerate products and materials at the end of each service life. This involves redesigning processes to reduce reliance on virgin materials and exploring innovative waste-to-resource pathways.

Impact of Extreme Weather Events

The increasing frequency and intensity of extreme weather events, a direct consequence of climate change, pose significant risks to DSV's global supply chains. These events can lead to disruptions in transportation networks, damage to critical infrastructure like ports and warehouses, and delays in goods movement, impacting DSV's operational efficiency and profitability. For instance, the severe flooding in parts of Europe in mid-2024 caused widespread transportation disruptions, highlighting the vulnerability of logistics operations. Building resilience and adaptability into DSV's infrastructure and operational planning is paramount to ensure continuity and minimize financial repercussions from these climate-induced challenges.

In 2025, the interconnectedness of political shifts, escalating climate impacts, and persistent geopolitical instability are fundamentally reshaping the global supply chain environment. DSV, as a major logistics player, must navigate these volatile conditions. The World Meteorological Organization has reported a significant rise in the number of weather and climate-related disasters in recent years, with 2023 being one of the warmest years on record. This trend directly influences operational costs, insurance premiums, and the need for more robust contingency planning.

- Increased Frequency of Extreme Weather: Events like hurricanes, floods, and heatwaves are becoming more common and severe, impacting transit times and infrastructure integrity.

- Supply Chain Disruptions: Extreme weather can halt or delay critical shipping routes and overland transport, leading to inventory shortages and increased costs for DSV and its clients.

- Infrastructure Damage: Ports, roads, and rail lines vital for logistics can suffer damage, requiring costly repairs and rerouting of shipments.

- Financial Impact: Unforeseen disruptions and damage can result in significant financial losses through delayed deliveries, increased operational expenses, and potential cargo damage.

Development of Green Logistics Solutions

DSV is heavily invested in developing and deploying green logistics solutions. This includes integrating electric vehicles into their fleet and exploring alternative fuels like Hydrotreated Vegetable Oil (HVO). Route optimization software is also a key component in their strategy to slash emissions.

These sustainability efforts are not just about environmental responsibility; they also drive operational efficiency and align with growing customer demand for eco-friendly services. In 2023, DSV reported a 15% reduction in CO2 emissions intensity from its transport operations compared to 2022.

DSV is actively trialling various decarbonisation initiatives across the logistics sector. For example, they are piloting hydrogen-powered trucks on specific routes to assess their viability. Their commitment is underscored by a target to reduce Scope 1 and 2 emissions by 40% by 2030.

- Electric Vehicle Adoption: DSV is expanding its fleet of electric vans and trucks, with a goal to have 25% of its European light commercial vehicle fleet be electric by 2025.

- Alternative Fuels: Increased use of HVO in existing diesel engines, offering a significant reduction in lifecycle greenhouse gas emissions.

- Route Optimization: Advanced software solutions are implemented to minimize mileage, reduce idling time, and thereby cut fuel consumption and emissions.

- Decarbonisation Trials: Active participation in pilot programs for hydrogen fuel cell technology and sustainable aviation fuel (SAF) for air freight.

Environmental factors are increasingly influential, pushing DSV towards greener operations. Stricter regulations on emissions, like those from the EU Green Deal, necessitate investments in sustainable technologies and efficient logistics. For instance, DSV aims to have 25% of its European light commercial vehicle fleet be electric by 2025, demonstrating a proactive approach to compliance and environmental responsibility.

The growing concern over climate change and its impact on supply chains, evidenced by more frequent extreme weather events, requires DSV to build resilience. These events, such as the mid-2024 European floods, disrupt transport networks and infrastructure. DSV's commitment to net-zero by 2050, supported by SBTi-validated targets, is crucial for mitigating these risks and maintaining operational continuity.

DSV's sustainability drive is also influenced by market demand, with customers and investors prioritizing eco-friendly services. This trend is reflected in the logistics sector, where 57% of companies target net-zero emissions by 2050. DSV's reported 15% reduction in scope 1 and 2 emissions intensity in 2023 highlights its progress in aligning with these expectations.

Resource scarcity and waste management are also key environmental considerations for DSV. The company is focused on reducing waste and increasing the use of recycled materials, with a 10% rise in recycled packaging materials in European operations in 2023. This aligns with a circular economy approach, minimizing reliance on virgin resources.

| Environmental Factor | DSV's Action/Response | Key Data/Target |

|---|---|---|

| Climate Change Regulations | Investing in greener technologies, optimizing routes | Net-zero emissions by 2050; 15% reduction in scope 1 & 2 emissions intensity (2023 vs 2022) |

| Extreme Weather Events | Building supply chain resilience, contingency planning | Mid-2024 European floods caused widespread transport disruptions |

| Customer/Investor Demand for Sustainability | Offering eco-friendly transport, transparent reporting | 57% of logistics companies targeting net-zero by 2050 |

| Resource Scarcity & Waste Management | Minimizing waste, increasing recycled material use | 10% increase in recycled packaging materials (Europe, 2023) |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously constructed using a combination of official government publications, reports from reputable international organizations, and specialized industry research. This ensures that each aspect, from political stability to technological advancements, is supported by credible and current information.