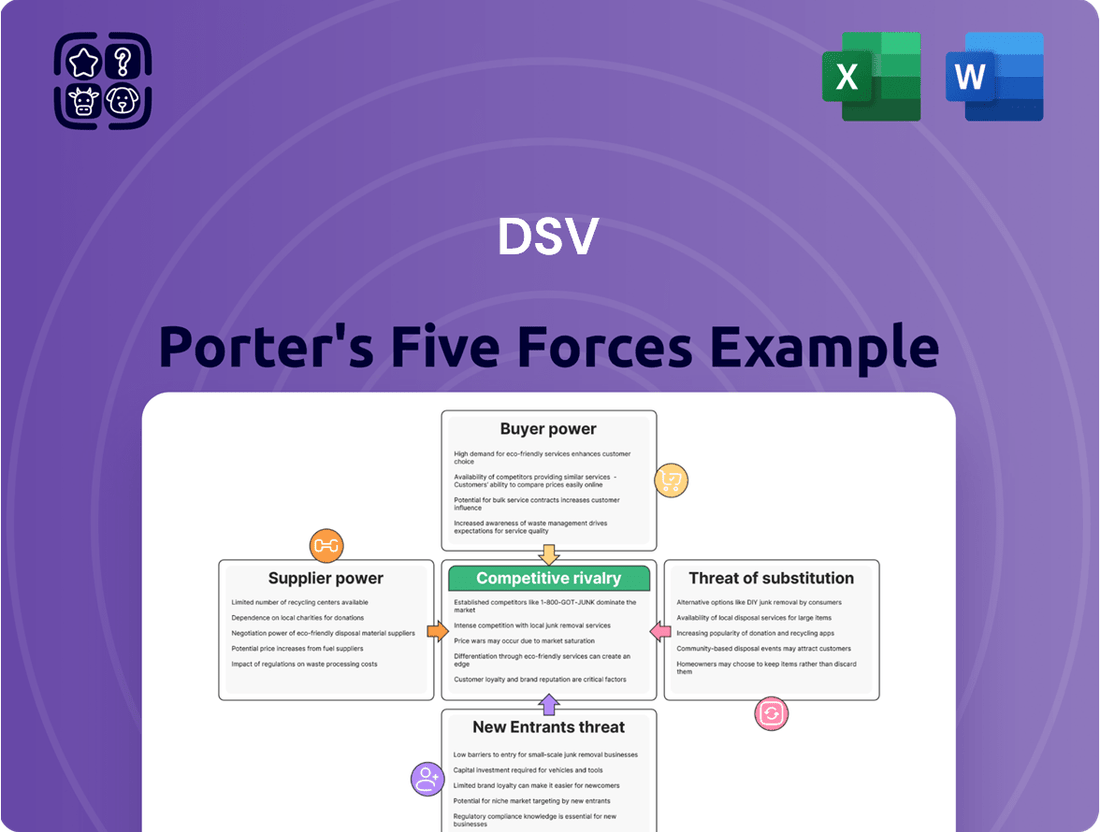

DSV Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DSV Bundle

DSV navigates a complex logistics landscape where buyer power can be substantial, especially from large shippers, while the threat of new entrants is moderate due to high capital requirements. The intensity of rivalry among established players like DSV is significant, driving constant innovation and efficiency gains.

The threat of substitute services, such as in-house logistics or alternative transportation modes, also presents a challenge, necessitating DSV to continuously demonstrate its value proposition. Furthermore, supplier bargaining power can fluctuate, impacting DSV's operational costs and service delivery.

Understanding these intricate dynamics is crucial for any stakeholder looking to grasp DSV's strategic positioning and future growth potential.

The complete report reveals the real forces shaping DSV’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

DSV, with its asset-light strategy, is significantly exposed to the bargaining power of concentrated essential service providers like ocean shipping lines and airlines. These dominant carriers can wield considerable influence, particularly when global demand for freight capacity surges or when capacity is limited, as seen during the disruptions of 2021 and 2022. For instance, in 2023, the Freightos Baltic Index indicated substantial volatility in container shipping rates, with spot rates on major East-West lanes fluctuating significantly, directly affecting DSV's cost of goods and margins.

The bargaining power of suppliers is significantly influenced by the volatile nature of fuel prices. For a logistics giant like DSV, fuel constitutes a major operational cost, granting fuel providers considerable leverage. This means that fluctuations in oil markets directly impact DSV's profitability, as they can be pressured to accept higher fuel surcharges.

Compounding this is the ongoing labor shortage, especially for skilled truck drivers across Europe. This scarcity naturally drives up wages and increases recruitment costs for DSV's road transport operations. The increased wage demands from drivers, coupled with potential inefficiencies caused by understaffing, directly translate to higher operating expenses for the company.

In 2024, the European Union experienced a notable deficit in qualified truck drivers, estimated to be over 400,000. This shortage has been a persistent issue, enabling drivers and trucking companies to negotiate for better compensation and working conditions, thereby strengthening their bargaining position against logistics providers like DSV.

The increasing integration of technology in the logistics sector significantly bolsters the bargaining power of technology providers. As companies like DSV lean on advanced logistics software, artificial intelligence, and integrated digital platforms to streamline operations and enhance efficiency, these suppliers become critical partners. This reliance allows them to influence service quality and dictate cost structures within the supply chain.

For instance, the global logistics technology market was valued at approximately $20.5 billion in 2023 and is projected to grow substantially. DSV's investment in digital transformation initiatives, including its ongoing efforts to enhance its global IT infrastructure and adopt AI-driven solutions for route optimization and warehouse management, underscores its dependence on these specialized providers. This dependence grants suppliers leverage in negotiations, potentially impacting DSV's operational costs and competitive edge.

High switching costs for specialized assets

Even though DSV operates an asset-light model, certain specialized equipment and advanced IT systems are crucial for its operations. The significant upfront investment required for these specialized assets, coupled with the intricate integration processes, can create substantial switching costs. For instance, acquiring and implementing new fleet management software or specialized handling machinery can run into millions of euros, making it economically challenging for DSV to abruptly change suppliers.

These high switching costs empower suppliers of specialized assets. If DSV relies on a particular type of temperature-controlled container or a proprietary tracking technology, the supplier of that asset holds considerable leverage. DSV might face penalties or substantial retraining costs if they switch to a different provider whose systems are not easily compatible.

In 2024, the global logistics technology market saw continued investment, with companies like DSV likely upgrading their IT infrastructure. The cost of integrating new enterprise resource planning (ERP) systems or advanced route optimization software can easily exceed €10 million for a company of DSV's scale. This financial commitment acts as a barrier to switching, giving established IT suppliers more bargaining power.

- High initial capital outlay for specialized logistics technology.

- Complex integration and compatibility issues with existing DSV systems.

- Significant costs associated with retraining staff on new specialized equipment or software.

- Potential for contract penalties or revenue disruption during a supplier transition.

Supplier ability to forward integrate

The potential for suppliers to integrate forward into DSV's core business, such as freight forwarding, represents a significant bargaining power. Major shipping lines, for instance, possess the infrastructure and customer base to offer similar services, directly challenging DSV's market position. While this threat might be less pronounced for DSV's largest transport providers due to DSV's own scale, the underlying possibility influences ongoing contract negotiations. DSV must cultivate robust supplier relationships to mitigate this risk, ensuring competitive pricing and service continuity.

Consider the implications for DSV:

- Suppliers could leverage their existing assets and expertise to offer competing forwarding services.

- This integration would transform suppliers into direct rivals, intensifying market competition.

- DSV's ability to secure favorable terms is directly impacted by this potential competitive threat.

- Maintaining strong supplier partnerships is crucial for safeguarding DSV's competitive edge.

Suppliers of essential logistics services, such as ocean carriers and technology providers, hold significant sway over DSV due to market concentration and the critical nature of their offerings. For instance, in 2023, container shipping rates showed considerable volatility, impacting DSV's costs. Furthermore, the ongoing shortage of skilled truck drivers in Europe, exceeding 400,000 in 2024, empowers these labor suppliers to negotiate for better terms.

| Supplier Type | Key Leverage Points | 2023/2024 Impact Examples | DSV's Exposure |

| Ocean Shipping Lines | Limited capacity, high demand, market concentration | Freightos Baltic Index volatility in container rates | High, due to asset-light reliance on external carriers |

| Technology Providers (Logistics Software, AI) | Criticality of advanced systems, integration complexity | Global logistics tech market valued at $20.5B in 2023; high IT integration costs (e.g., €10M+ for ERP) | High, driven by digital transformation needs |

| Fuel Providers | Volatility of oil markets | Direct impact on operating costs via fuel surcharges | High, as fuel is a major operational expense |

| Skilled Labor (e.g., Truck Drivers) | Labor shortages, specialized skills | Over 400,000 driver deficit in EU in 2024; wage increase pressures | High in road transport segments |

What is included in the product

This DSV Porter's Five Forces analysis dissects the competitive environment, examining supplier and buyer power, threat of new entrants and substitutes, and existing rivalry to inform strategic decision-making.

Easily identify and quantify competitive threats with a visual, interactive dashboard, eliminating the guesswork in strategic planning.

Customers Bargaining Power

Many customers perceive freight forwarding as a standardized service, making price a significant factor in their decision-making, particularly for common shipping lanes and consistent volumes. This perception fuels strong price competition within the industry.

This customer price sensitivity directly translates into their ability to negotiate for lower freight rates. For a company like DSV, this can put downward pressure on profit margins, especially if the services offered are not clearly differentiated from competitors.

In 2023, the global freight forwarding market was valued at approximately $1.4 trillion, indicating a substantial market where price is a key driver for many participants. This large market size amplifies the impact of customer price sensitivity.

DSV's ability to command higher prices relies heavily on its capacity to offer value beyond basic transportation, such as advanced tracking technology, integrated supply chain solutions, or specialized handling capabilities, thereby reducing the commoditization effect.

The freight forwarding sector, though seeing some consolidation, still offers customers a broad selection of service providers. This means businesses can readily compare offerings from major players like DHL, Kuehne+Nagel, and DSV itself, alongside many smaller specialized firms.

Having numerous alternatives empowers customers significantly. They can leverage this choice to negotiate more favorable pricing, better service level agreements, or more flexible shipping terms. For instance, in 2023, the global freight forwarding market was valued at approximately $247 billion, indicating a substantial competitive landscape where customer choice is a key factor.

Large volume B2B customers significantly influence DSV's bargaining power dynamics. These clients, often multinational corporations, manage substantial shipping volumes, giving them considerable leverage. In 2024, DSV's top-tier clients likely represent a large portion of its revenue, enabling them to negotiate for lower rates and specialized services, directly impacting DSV's profitability.

The complexity of these customers' supply chains further amplifies their power. They demand highly customized logistics solutions, requiring DSV to invest resources in tailoring its offerings. This need for bespoke services means these large buyers can switch providers if their specific requirements aren't met, thereby increasing their ability to dictate terms.

Low customer switching costs for basic services

For basic freight forwarding services, customers can often switch providers with minimal disruption and expense, particularly when contractual obligations are short-term or easily ended. This low switching cost is a significant factor that amplifies the bargaining power of customers, compelling companies like DSV to remain highly competitive in both pricing and service delivery to retain their business.

This dynamic means customers can readily explore alternative options if they perceive better value elsewhere, putting pressure on DSV to continuously innovate and optimize its offerings. For instance, a shipper needing standard container transport might find it straightforward to move their business to another forwarder if they can secure a 5% lower rate, as seen in many general commodity movements.

- Low Switching Costs: For basic freight services, changing providers typically involves minimal financial penalties or operational hurdles for the customer.

- Price Sensitivity: This ease of switching makes customers more sensitive to price differences, forcing providers like DSV to maintain competitive rates.

- Service Level Pressure: Customers can leverage their ability to switch to demand higher service standards and reliability.

- Market Competition: The prevalence of numerous freight forwarders offering similar core services intensifies this customer bargaining power.

Demand for value-added services without premium pricing

Customers are pushing for more sophisticated services such as real-time shipment tracking and improved supply chain visibility. They also expect greener logistics solutions, reflecting a growing emphasis on sustainability.

Despite these increased demands, many clients are hesitant to accept higher prices for these enhanced offerings. This creates a challenge for logistics providers like DSV, requiring them to invest in new technologies and service improvements while keeping their pricing competitive.

This dynamic puts significant pressure on DSV's margins. For instance, while the global logistics market saw substantial growth, the ability to pass on the costs of advanced features remains limited in many segments.

- Increased Demand: Customers expect real-time tracking and supply chain visibility.

- Sustainability Focus: Growing preference for environmentally friendly logistics.

- Price Sensitivity: Reluctance to pay a premium for value-added services.

- Margin Pressure: DSV must balance innovation with competitive pricing.

Customers in the freight forwarding market often view services as interchangeable, making price a primary decision factor, especially for consistent, high-volume shipments. This perception significantly empowers buyers, as they can readily compare rates across numerous providers. In 2024, DSV faces this pressure, needing to offer competitive pricing to retain clients who can easily switch to a competitor offering similar basic services.

Large, frequent shippers hold substantial leverage due to their volume. These clients can negotiate for preferential rates and tailored service agreements, directly impacting DSV's profitability. The ease with which these customers can switch providers, often with minimal cost or disruption, further amplifies their bargaining power, compelling DSV to continuously demonstrate value beyond price.

| Customer Power Factor | Impact on DSV | 2024 Data/Trend |

|---|---|---|

| Price Sensitivity | Downward pressure on freight rates and profit margins | Global freight forwarding market remains highly competitive, with price a key differentiator for many shippers. |

| Availability of Alternatives | Weakens DSV's pricing power, encourages service differentiation | Numerous global and regional freight forwarders compete, offering customers a wide selection of providers. |

| Switching Costs | Low switching costs empower customers to change providers easily | For standard services, switching often involves minimal financial or operational barriers for the customer. |

| Volume of Purchases | Large clients can negotiate significant discounts and favorable terms | Major multinational corporations, DSV's key accounts, represent substantial shipping volumes, granting them considerable leverage. |

Full Version Awaits

DSV Porter's Five Forces Analysis

This preview showcases the complete DSV Porter's Five Forces Analysis, offering a comprehensive examination of the competitive landscape within the logistics and transportation industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, providing actionable insights into DSV's strategic positioning. You can trust that this detailed analysis, covering threats of new entrants, bargaining power of buyers and suppliers, threat of substitutes, and rivalry among existing competitors, is precisely what you will download. No alterations or missing sections will occur; the preview accurately reflects the final deliverable, ready for your immediate use and strategic planning.

Rivalry Among Competitors

The global freight forwarding sector, despite some consolidation, remains incredibly fragmented. Thousands of companies, from giants to smaller regional players, vie for business. This means DSV faces a constant barrage of competition, making it tough to significantly grow market share without either undercutting rivals on price or finding unique ways to stand out.

In 2024, the industry's competitive intensity is palpable. DSV, as a major global player, directly contends with numerous other large international logistics companies like Kuehne+Nagel, DHL Supply Chain, and DB Schenker. These competitors also possess extensive networks and resources, intensifying the rivalry for contracts and customers across all modes of transport.

The sheer number of participants, estimated in the tens of thousands globally, fuels aggressive pricing strategies. Companies often engage in price wars to secure volumes, which can compress profit margins for everyone involved. This environment necessitates continuous efforts in operational efficiency and service innovation for DSV to maintain its competitive edge.

DSV faces fierce competition from established global logistics powerhouses like DHL, Kuehne+Nagel, Maersk, and DB Schenker, a company DSV is in the process of acquiring. This intense rivalry is a defining characteristic of the industry, pushing all players to constantly innovate and optimize their operations to secure lucrative contracts and maintain market dominance.

The competitive landscape is shaped by aggressive strategies, including significant investments in global network expansion and cutting-edge technology. For instance, in 2023, major logistics firms continued to pour billions into digital transformation and sustainability initiatives to enhance efficiency and attract environmentally conscious clients.

Strategic acquisitions are a common tactic, as demonstrated by DSV's pending acquisition of DB Schenker, which is valued at approximately €14 billion as of early 2024. This move alone will significantly alter the competitive balance, consolidating market share and potentially intensifying the fight for global contract business.

The logistics sector is witnessing a wave of consolidation, with prominent companies like DSV strategically acquiring rivals to bolster their market presence and operational efficiency. For instance, DSV's pursuit of DB Schenker, a deal potentially valued in the tens of billions of euros, exemplifies this trend. While such mergers diminish the overall number of direct competitors, the remaining large entities engage in fiercer competition.

Price competition driven by oversupply and economic uncertainty

The maritime shipping industry, a core area for DSV, faces intense price competition fueled by oversupply in vessel capacity. This oversupply, coupled with broader economic uncertainties, puts significant downward pressure on freight rates, making it a challenging environment for logistics providers. For instance, in early 2024, the Baltic Dry Index, a key indicator of shipping costs, experienced volatility reflecting these market pressures.

DSV must actively manage these conditions to sustain profitability. Focusing on operational efficiency, such as optimizing route planning and consolidating shipments, is crucial. Additionally, differentiating its services by offering value-added solutions beyond basic transportation, like advanced tracking or specialized handling, can help mitigate the impact of pure price competition.

- Oversupply Impact: Excess shipping capacity directly translates to lower freight rates, intensifying competition.

- Economic Uncertainty: Broader economic slowdowns can reduce cargo volumes, further pressuring prices.

- DSV's Strategy: Operational efficiency and value-added services are key to maintaining margins.

- 2024 Context: Market data from early 2024 indicated ongoing price sensitivity within the sector.

Differentiation through technology and value-added services

Competitive rivalry in the logistics sector is intensifying, moving beyond simple price wars. Companies are increasingly differentiating themselves through cutting-edge technology and value-added services. This shift means that simply offering transportation is no longer enough; a deep understanding of digitalization and integrated supply chain solutions is paramount.

DSV's success hinges on its capacity to provide these sophisticated, tech-driven offerings. For instance, by the end of 2023, DSV had invested significantly in digital platforms to enhance customer visibility and operational efficiency, aiming to meet the growing demand for transparency. This focus on innovation allows DSV to stand out against competitors who may still rely on more traditional models.

The evolving customer expectations for sustainability and end-to-end supply chain management further fuel this competitive dynamic. DSV's strategic investments in areas like green logistics and advanced tracking systems directly address these needs. In 2024, DSV continued to expand its digital capabilities, aiming to provide seamless, data-rich experiences for its clients, thus solidifying its competitive edge.

- Technology as a Differentiator: Logistics firms are increasingly competing on the sophistication of their digital platforms and integrated solutions, moving beyond pure price competition.

- DSV's Strategic Focus: DSV is leveraging advanced technology and digitalization to offer comprehensive supply chain solutions, enhancing customer value and operational efficiency.

- Customer Demand for Transparency: Evolving client needs for real-time visibility and data-driven insights are shaping competitive strategies in the sector.

- Sustainability as a Key Factor: The growing importance of environmental, social, and governance (ESG) factors means that sustainable logistics practices are becoming a critical element of differentiation.

The competitive rivalry within the global freight forwarding sector is exceptionally high, characterized by a vast number of participants ranging from multinational giants to smaller, specialized firms. DSV, as a leading player, faces intense competition from peers like Kuehne+Nagel, DHL Supply Chain, and Maersk, all of whom possess extensive global networks and significant resources. This rivalry is further amplified by aggressive pricing strategies, often driven by overcapacity in certain transport modes, particularly maritime shipping, which can compress profit margins across the industry. For instance, early 2024 market data showed continued price sensitivity among customers, underscoring the need for efficiency and differentiation.

Companies are increasingly distinguishing themselves through technological innovation and value-added services, moving beyond basic transportation. DSV's strategic investments in digital platforms and sustainability initiatives, like its ongoing pursuit of DB Schenker for approximately €14 billion in early 2024, are examples of this trend. These moves aim to enhance customer visibility, operational efficiency, and meet growing demands for transparent and environmentally conscious logistics solutions, thereby solidifying competitive advantage in an evolving market.

| Competitor | Global Network Strength | Key Differentiators | 2023/2024 Focus Areas |

|---|---|---|---|

| DSV | Extensive global presence | Digitalization, integrated supply chain solutions, pending DB Schenker acquisition | Technology investment, sustainability initiatives |

| Kuehne+Nagel | Strong global footprint | Sea & Air logistics expertise, digital solutions | Network expansion, digital transformation |

| DHL Supply Chain | Vast global network | Contract logistics, e-commerce solutions, innovation | Automation, data analytics |

| Maersk | Global shipping and logistics leader | Integrated container logistics, digitalization, sustainability | Ocean-to-door solutions, decarbonization |

SSubstitutes Threaten

Large clients, particularly multinational corporations and major retailers, possess the financial and operational capacity to bring logistics functions in-house. This trend is amplified by advancements in logistics technology and software, making internal management a more attractive and feasible substitute for third-party providers like DSV. For instance, the increasing availability of sophisticated Warehouse Management Systems (WMS) and Transportation Management Systems (TMS) empowers companies to gain greater control over their supply chains. In 2024, many large enterprises reported significant investments in their internal logistics infrastructure, aiming for cost savings and enhanced operational efficiency. This capability directly challenges the value proposition of outsourced logistics services by offering an alternative that can be tailored precisely to a company's unique needs.

The rise of direct shipping by manufacturers and e-commerce platforms presents a significant threat of substitution for DSV. As online retail continues its rapid expansion, many companies are investing heavily in their own logistics networks to handle last-mile and regional deliveries, effectively cutting out traditional intermediaries like DSV. This is particularly evident in the business-to-consumer (B2C) sector, where companies like Amazon have set high expectations for speed and cost-effectiveness.

For instance, by 2024, numerous large e-commerce players are expected to further bolster their in-house delivery capabilities, aiming to control more of the customer experience and reduce reliance on third-party logistics providers. This direct-to-consumer shipping model often allows manufacturers to offer competitive pricing and faster delivery times, directly eroding DSV's market share, especially for smaller shipments or less complex routes.

Customers increasingly evaluate transportation choices based on cost, speed, and environmental impact, leading to a potential substitution of services. For example, a growing preference for sea freight over air freight for non-urgent shipments, or a surge in domestic rail usage for long-distance hauling, directly affects DSV's revenue streams across its various divisions. In 2024, the global logistics market saw fluctuating fuel prices, making modal shifts a constant consideration for shippers seeking cost efficiencies.

Emergence of digital freight platforms and brokers

The rise of digital freight platforms and online brokers presents a significant threat of substitution for traditional logistics providers like DSV. These platforms often streamline the booking process and offer greater price transparency, appealing to shippers who might find traditional methods cumbersome. For instance, by mid-2024, it's estimated that digital freight marketplaces are capturing a growing share of the spot market, particularly for less-than-truckload (LTL) and less complex full truckload (FTL) shipments.

These tech-savvy alternatives can disrupt established customer relationships by offering a more agile and accessible service, especially for smaller businesses or those with less intricate supply chain needs. Consider the growing adoption rates; many smaller and medium-sized enterprises (SMEs) are finding these digital solutions more cost-effective and efficient. This trend is expected to accelerate as more advanced features, like real-time tracking and automated documentation, become standard on these platforms.

The threat is amplified by their ability to disintermediate traditional forwarders, potentially bypassing established networks and direct sales channels. This can lead to price erosion in certain market segments. For example, in 2023, studies indicated that digital brokers were able to operate with significantly lower overheads compared to traditional forwarders, allowing them to offer competitive rates.

- Digital platforms simplify freight booking and pricing transparency, attracting shippers.

- Tech-driven substitutes can disrupt traditional forwarder relationships, especially for smaller shipments.

- SMEs are increasingly adopting digital freight solutions due to efficiency and cost-effectiveness.

- The disintermediation potential of digital brokers can lead to price competition.

Alternative supply chain models

Customers increasingly explore alternative supply chain models, such as nearshoring and reshoring, which directly impacts the demand for traditional freight forwarding services. These shifts can significantly reduce reliance on extensive international logistics, thereby posing a threat to established global providers like DSV. For instance, a growing number of companies are re-evaluating their global footprints in response to geopolitical instability and rising shipping costs, a trend that gained momentum in 2023 and is projected to continue. This strategic move away from long, complex supply chains directly substitutes the need for a substantial portion of the services offered by international logistics companies.

The adoption of these alternative models can lead to a substantial decrease in the volume of goods requiring international transportation. For example, the World Trade Organization (WTO) noted in its 2024 outlook that while global trade growth is expected, regional trade blocs are strengthening, potentially diverting cargo from traditional long-haul routes. This means that fewer containers might need to traverse oceans, directly impacting freight forwarders who specialize in these routes. This strategic realignment by businesses aims to build more resilient and agile supply chains, effectively substituting the comprehensive international logistics solutions that companies like DSV currently provide.

- Nearshoring and Reshoring Trends: Companies are increasingly bringing manufacturing closer to home to mitigate risks and reduce lead times, directly lessening the need for international freight forwarding.

- Impact on Global Logistics Demand: This strategic shift can diminish the overall demand for global logistics providers by reducing the volume of cross-border shipments.

- Resilience and Agility: The drive for more resilient and agile supply chains is a key motivator behind adopting these alternative models.

- Market Shifts: Regional trade growth and geopolitical factors are contributing to a potential reallocation of global shipping volumes.

The increasing ability of large clients, particularly multinational corporations, to manage logistics in-house presents a significant substitute threat. Advancements in technology, such as sophisticated Warehouse Management Systems (WMS) and Transportation Management Systems (TMS), empower these companies to gain greater control and efficiency, making internal operations more feasible and attractive. In 2024, many large enterprises continued to invest heavily in their internal logistics infrastructure, seeking cost savings and enhanced operational control, which directly challenges the value proposition of outsourced providers like DSV.

The expansion of direct shipping by manufacturers and e-commerce platforms also poses a considerable substitution threat. As online retail grows, many companies are building their own logistics networks for last-mile and regional deliveries, bypassing traditional intermediaries. By mid-2024, a notable trend saw major e-commerce players bolstering their in-house delivery capabilities to better control customer experience and reduce reliance on third-party logistics, impacting DSV, especially for smaller shipments.

Digital freight platforms and online brokers offer streamlined booking and greater price transparency, acting as substitutes for traditional logistics services. These tech-driven alternatives are particularly appealing to shippers seeking agility and cost-effectiveness, with many SMEs adopting them by 2024. These platforms can disintermediate traditional forwarders, leading to price competition, as evidenced by their lower overheads reported in 2023.

The trend of nearshoring and reshoring, driven by geopolitical instability and rising costs, reduces the reliance on extensive international logistics. This strategic shift can significantly diminish the demand for global freight forwarding services. The World Trade Organization's 2024 outlook suggested strengthening regional trade blocs, potentially diverting cargo from long-haul routes and impacting providers like DSV.

| Threat Type | Description | Impact on DSV | Trend Example (2024) | Data Point |

|---|---|---|---|---|

| In-house Logistics | Clients managing logistics internally. | Reduced outsourced volume. | Increased investment in internal logistics tech. | Many large enterprises boosted internal infrastructure spending. |

| Direct Shipping | Manufacturers/e-commerce handling own deliveries. | Loss of last-mile and regional business. | E-commerce players expanding in-house delivery networks. | Specific data on market share shift not publicly disclosed but trend significant. |

| Digital Freight Platforms | Online brokers simplifying freight booking. | Price pressure and disintermediation. | Growing adoption by SMEs. | Digital brokers' lower overheads cited in 2023 studies. |

| Nearshoring/Reshoring | Bringing production closer to home. | Decreased demand for international transport. | Focus on regional trade bloc growth. | WTO noted strengthening regional trade in 2024 outlook. |

Entrants Threaten

Establishing a global transport and logistics network, akin to DSV's extensive reach, demands an enormous initial capital outlay. This includes significant investments in physical assets like warehouses, fleets of vehicles, and advanced tracking technology, along with the financial resources to build and maintain operations in multiple international markets.

For instance, acquiring and maintaining a modern fleet of trucks and aircraft alone can run into billions of dollars. In 2024, the global logistics market was valued at over $10 trillion, with a substantial portion of this value tied up in the physical infrastructure and technological backbone required to operate efficiently on such a scale. These high upfront costs act as a formidable barrier, deterring many potential competitors from entering the market at a significant level.

The global logistics sector is burdened by a complex web of international trade regulations, customs laws, and environmental standards that vary significantly by country. For instance, in 2024, the average time to clear customs for imports globally remained a considerable hurdle, with some regions experiencing delays of over a week, impacting delivery timelines and operational costs.

New companies entering the logistics market must invest heavily in understanding and adhering to these diverse legal frameworks. This includes obtaining necessary licenses, permits, and certifications, which can be both time-consuming and expensive, creating a substantial barrier to entry for smaller or less capitalized firms.

Building the in-house expertise to manage compliance across multiple jurisdictions is another significant challenge. Failure to comply can result in hefty fines, shipment seizures, and severe reputational damage, making regulatory navigation a critical and costly component of establishing a logistics operation.

The need for established global networks and relationships presents a significant barrier for new entrants into the logistics sector, much like for DSV. DSV has spent decades cultivating an extensive global web of agents, partners, and crucial connections with carriers and customs authorities. Building and maintaining such a comprehensive and reliable infrastructure is incredibly time-consuming and requires substantial investment and the slow build-up of trust.

Brand recognition and customer loyalty

Existing industry leaders like DSV benefit from significant brand recognition and deeply entrenched customer loyalty. This makes it difficult for new entrants to lure away established clients who trust DSV's proven track record and extensive service history. For instance, DSV's consistent performance and global network contribute to this loyalty, creating substantial switching barriers.

Newcomers face the challenge of building trust and demonstrating reliability without years of successful operations and a strong reputation. Potential customers are often hesitant to switch to an unknown entity for critical logistics needs, preferring the security and predictability offered by established players. This established trust is a significant deterrent to new market entrants.

- Brand Recognition: DSV's long-standing presence in the logistics sector has fostered strong brand recall among businesses.

- Customer Loyalty: Existing relationships and satisfaction levels create inertia against switching to new providers.

- Switching Barriers: The cost and effort for customers to change logistics partners, coupled with trust concerns, favor incumbents.

- Trust Deficit: New entrants must overcome a lack of proven performance and a history of reliability to gain market traction.

Opportunities for niche or tech-driven entrants

While building a global logistics network like DSV's is a substantial undertaking, the threat of new entrants isn't entirely absent. Niche players and tech-focused startups can carve out market share by concentrating on specific segments, such as specialized last-mile delivery solutions or advanced digital freight forwarding platforms.

These agile newcomers often bypass traditional capital-intensive barriers by leveraging innovative technology and focusing on unmet customer needs. For example, by 2024, the rise of AI-powered route optimization and real-time tracking has lowered the operational complexity for smaller, specialized logistics providers, enabling them to compete effectively in localized or service-specific markets.

- Niche Focus: New entrants can target underserved segments like cold chain logistics or e-commerce fulfillment.

- Technological Leverage: Startups are utilizing AI, blockchain, and IoT to create more efficient and transparent supply chains.

- Agility Advantage: Smaller, tech-driven companies can adapt quickly to changing market demands and customer preferences.

- Lower Capital Requirements: Digital platforms reduce the need for extensive physical infrastructure in certain logistics niches.

The threat of new entrants for a global logistics giant like DSV is generally considered moderate due to significant barriers. These include immense capital requirements for infrastructure, complex regulatory landscapes across various countries, and the need for established global networks and relationships. Furthermore, strong brand recognition and customer loyalty enjoyed by incumbents like DSV create substantial switching barriers for potential new competitors.

However, the threat is not negligible. Niche players and technology-focused startups can emerge by targeting specific market segments or leveraging innovative solutions. These newcomers often bypass traditional capital hurdles through digital platforms and specialized services, as seen with the increasing adoption of AI in route optimization by smaller firms in 2024, which lowered operational complexity.

| Barrier to Entry | Impact on New Entrants | 2024 Context/Example |

|---|---|---|

| Capital Intensity | High; requires massive investment in fleets, warehouses, and technology. | Global logistics market valued over $10 trillion in 2024, much tied to infrastructure. |

| Regulatory Complexity | Significant; navigating diverse international trade laws and customs. | Customs clearance times in 2024 varied, impacting operational costs and timelines. |

| Established Networks | Challenging; building global agent and partner relationships takes time and trust. | Decades of cultivation by incumbents like DSV create a strong incumbency advantage. |

| Brand & Loyalty | Difficult; overcoming customer trust in established players is a major hurdle. | New entrants face a trust deficit without proven track records. |

| Technological Innovation | Moderate threat; niche players use tech to bypass some barriers. | AI-powered logistics solutions emerged as competitive tools for smaller firms in 2024. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of credible data, including industry-specific market research reports, company financial statements, and relevant trade publications. This comprehensive approach ensures a robust understanding of competitive pressures.