DSV Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DSV Bundle

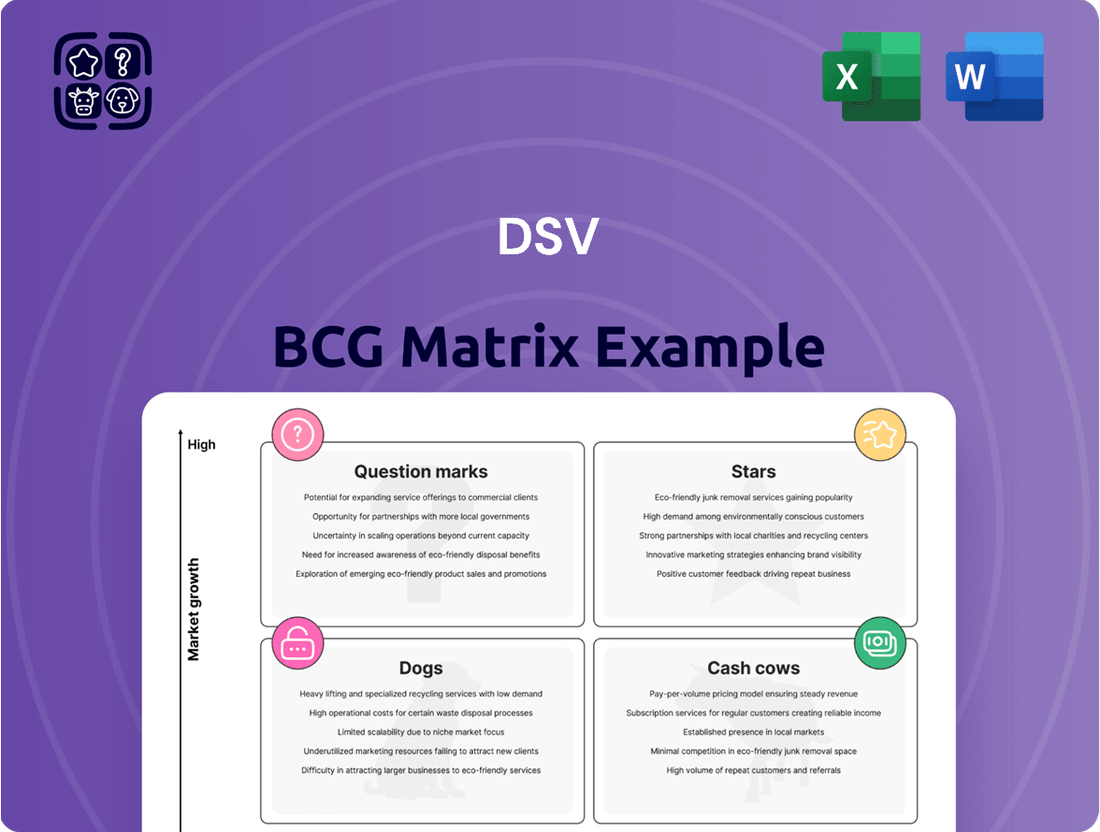

Uncover the strategic heartbeat of a business with the DSV BCG Matrix. This powerful tool visually categorizes a company's products or business units into four quadrants: Stars, Cash Cows, Dogs, and Question Marks, based on market growth and relative market share. Understanding these placements is crucial for effective resource allocation and strategic planning.

This preview offers a glimpse into how these categories illuminate a company's portfolio. Are you curious to see which products are poised for future growth, which are generating consistent revenue, which are underperforming, and which require careful consideration?

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

DSV's e-commerce logistics solutions are a clear Star in the BCG matrix, fueled by the booming online retail sector. This segment is experiencing robust growth, and DSV is strategically investing and expanding its capabilities to meet this demand. For instance, the global e-commerce market was valued at approximately $5.7 trillion in 2023 and is anticipated to reach over $8 trillion by 2027, presenting a massive opportunity. DSV's focus on streamlining and optimizing supply chains for online businesses positions them to capture a significant portion of this expanding market.

DSV's specialized logistics services for the technology and healthcare sectors position them as a Star within the BCG matrix. These industries demand intricate handling, temperature control, and rapid delivery, often involving high-value goods. For instance, in 2024, the global healthcare logistics market was projected to reach over $300 billion, with technology logistics experiencing similar robust growth.

The complexity and critical nature of tech and healthcare supply chains mean DSV can command premium pricing for its tailored solutions. This leads to higher profit margins and a strong competitive advantage. DSV's investment in specialized infrastructure, such as cold chain capabilities and secure facilities, further solidifies their position in these lucrative segments.

DSV's acquisition of DB Schenker, a monumental deal valued at €14.3 billion as of mid-2024, represents a significant 'Star' in its BCG Matrix. This strategic integration is poised to dramatically expand DSV's global footprint and solidify its position as a top-tier logistics provider. The move is projected to double DSV's revenue and workforce, creating a powerhouse with enhanced capabilities across various transport and logistics segments.

The primary objective behind such large-scale integrations is the swift realization of significant synergies, estimated to contribute substantially to DSV's profitability post-acquisition. By combining networks and optimizing operations, DSV aims to unlock operational efficiencies and cost savings, further strengthening its competitive advantage. This aggressive expansion strategy underscores DSV's ambition to lead the global transport and logistics market.

Green Logistics and Sustainable Solutions

DSV is making significant strides in green logistics, investing in electric truck fleets and alternative fuels like HVO. This proactive stance positions them favorably as demand for sustainable supply chains intensifies. By offering comprehensive CO2 reporting and decarbonization strategies, DSV is not just meeting but anticipating customer and regulatory needs. In 2024, DSV announced plans to expand its fleet of electric vehicles, aiming for a substantial increase in their sustainable transport capacity by the end of the year.

- Investment in electric trucks: DSV is actively expanding its electric vehicle fleet, a key component of its green logistics strategy.

- Alternative fuels adoption: The company is exploring and implementing alternative fuels such as Hydrotreated Vegetable Oil (HVO) to reduce its carbon footprint.

- Customer demand for sustainability: Growing customer preference for environmentally friendly supply chains is a significant driver for DSV's green initiatives.

- Regulatory pressures: Stricter environmental regulations globally are pushing logistics providers like DSV to adopt more sustainable practices.

Digital Transformation and Advanced Visibility Tools

DSV's commitment to digital transformation is evident in its advanced visibility tools, which are crucial for its position in the BCG matrix. These solutions, including real-time end-to-end visibility and track and trace capabilities, directly contribute to operational efficiency and client satisfaction.

The company's investment in technologies like Purchase Order Management Systems (POMS) enhances supply chain optimization by providing critical data for decision-making. For example, DSV reported a significant increase in the adoption of its digital booking platforms, facilitating smoother transactions and better data flow.

DSV's ongoing investment in automation, predictive analytics, and AI is a key differentiator in the logistics sector. This proactive approach ensures they remain competitive in a rapidly digitizing industry.

- Enhanced Supply Chain Efficiency: DSV's digital tools streamline operations, reducing transit times and improving on-time delivery rates.

- Data-Driven Optimization: Real-time visibility and POMS provide actionable insights for better inventory management and cost control.

- Future-Proofing Logistics: Continuous investment in AI and predictive analytics positions DSV to adapt to evolving market demands and technological advancements.

- Client Value Proposition: These advanced digital solutions offer clients unparalleled transparency and control over their supply chains.

DSV's strategic focus on e-commerce logistics, tech and healthcare specialized services, the acquisition of DB Schenker, and its commitment to green and digital transformation all highlight its Star position. These areas represent high growth markets where DSV is actively investing and expanding its capabilities, leading to increased market share and profitability.

The e-commerce sector, projected to exceed $8 trillion by 2027, and the healthcare logistics market, already over $300 billion in 2024, demonstrate the significant growth potential. The DB Schenker acquisition alone is expected to double DSV's revenue, further solidifying its Star status.

DSV's investments in electric fleets and sustainable fuels address growing environmental demands, while its digital transformation enhances efficiency and client value. These initiatives collectively position DSV for continued leadership and strong performance in the logistics industry.

| Segment | Growth Rate | Market Share | DSV's Position |

| E-commerce Logistics | High | Growing | Star |

| Tech & Healthcare Logistics | High | Strong | Star |

| Green Logistics | Increasing | Developing | Star |

| Digital Transformation | Rapid | Expanding | Star |

| DB Schenker Integration | Transformative | Dominant | Star |

What is included in the product

Strategic analysis of business units based on market share and growth rate.

Guides investment decisions by categorizing products into Stars, Cash Cows, Question Marks, and Dogs.

A clear DSV BCG Matrix visualizes business unit performance, easing the pain of understanding portfolio health.

Cash Cows

DSV's traditional air freight forwarding, a cornerstone of its operations, functions as a strong Cash Cow within the company's portfolio. This segment, particularly its activity on key global trade routes, consistently delivers robust gross profit, even amidst market fluctuations and rate volatility. In 2024, DSV reported significant contributions from its freight forwarding division, underscoring the enduring strength of its air cargo services, which leverage an extensive global infrastructure and deep-rooted client partnerships.

DSV's established sea freight forwarding routes, particularly the high-volume Trans-Pacific and Asia-Europe lanes, are prime examples of its Cash Cows. These mature segments, despite potential freight rate volatility, provide a steady stream of income due to DSV's significant market share and robust capacity. For instance, DSV reported total revenue of DKK 151.4 billion in 2023, with a substantial portion likely derived from these core shipping operations.

The efficiency with which DSV manages these large volumes in a well-established market is key to its strong cash-generating ability. This operational expertise allows them to maintain profitability even when market conditions are challenging. Their ability to secure competitive rates and optimize logistics across these key trade lanes directly contributes to their status as a reliable source of cash for the company.

DSV's Solutions division, which handles large-scale contract logistics like warehousing and distribution for major industrial clients, operates as a Cash Cow within the company's portfolio. This segment is characterized by its stable revenue streams, largely due to the long-term nature of its customer contracts.

The division benefits from a high market share and a strong reputation for operational efficiency, which translates into reliable and consistent cash flow generation for DSV. Even with potential short-term dips in profitability during the initial phases of new warehouse expansions, the underlying strength of this business unit ensures its continued role as a significant cash generator.

European Road Freight Network

DSV's European Road Freight network, particularly its groupage operations, functions as a robust Cash Cow. This segment benefits from a substantial market share, underpinned by its extensive infrastructure and broad geographical reach across Europe. Even with prevailing economic headwinds and rising operational costs, the network's established presence ensures consistent revenue generation.

The division's ability to maintain its high market share is a testament to its comprehensive coverage and well-developed logistics capabilities. This stability makes it a dependable source of predictable, albeit moderate, income for DSV. For instance, DSV reported strong performance in its Road division throughout 2024, with revenues contributing significantly to the group's overall profitability.

- Market Share Dominance: DSV holds a leading position in European road freight, leveraging its vast network.

- Stable Revenue Streams: The groupage services provide consistent, predictable income despite lower growth expectations.

- Resilience to Economic Factors: The network demonstrates resilience against regional economic slowdowns and cost inflation.

- 2024 Performance Indicator: DSV's Road division consistently delivered strong results in 2024, highlighting its Cash Cow status.

Customs Services and Compliance Solutions

DSV's Customs Services and Compliance Solutions represent a robust Cash Cow within its portfolio, acting as a critical enabler for global trade. These services are indispensable for navigating the complexities of international shipments, generating a reliable and consistent revenue stream. Once the necessary infrastructure and specialized expertise are established, the ongoing investment required to maintain these operations is relatively modest.

The persistent high demand for regulatory adherence and expert navigation in customs procedures guarantees a steady influx of business for DSV. This stability is a hallmark of a Cash Cow, providing predictable earnings that can support other, more growth-oriented ventures within the company. For instance, in 2024, DSV's global customs brokerage operations continued to be a significant contributor to overall revenue, bolstered by increasing trade volumes and stricter compliance requirements worldwide.

- Essential for Global Trade: DSV's customs services are fundamental to the movement of goods across borders, ensuring compliance and efficiency.

- Stable Revenue Stream: The consistent demand for these services provides a predictable and reliable source of income for DSV.

- Low Investment Needs: Post-establishment, the infrastructure and expertise required for customs solutions demand relatively low ongoing capital investment.

- High Demand for Compliance: Businesses globally rely on expert guidance to meet evolving customs regulations, driving continuous demand for DSV's offerings.

DSV's established air and sea freight forwarding networks function as its primary Cash Cows, characterized by high market share and consistent revenue generation. These mature segments, while perhaps not experiencing rapid growth, provide a stable and predictable stream of income that fuels other company initiatives. Their operational efficiency and extensive infrastructure solidify their position as dependable cash generators for DSV.

| DSV Business Segment | BCG Matrix Category | Key Characteristics | 2024 Performance Insight |

|---|---|---|---|

| Air Freight Forwarding | Cash Cow | High market share, robust gross profit, extensive global infrastructure | Significant contributions to overall revenue, demonstrating enduring strength. |

| Sea Freight Forwarding | Cash Cow | Dominant on key trade lanes (Trans-Pacific, Asia-Europe), steady income | Substantial portion of total revenue, leveraging significant capacity. |

| Solutions (Contract Logistics) | Cash Cow | Stable revenue from long-term contracts, high operational efficiency | Reliable and consistent cash flow generation, underpinning overall profitability. |

| European Road Freight (Groupage) | Cash Cow | Extensive infrastructure, broad geographical reach, consistent revenue | Strong performance throughout 2024, contributing significantly to group profitability. |

| Customs Services & Compliance | Cash Cow | Indispensable for global trade, low ongoing investment needs | Significant revenue contributor in 2024, driven by increasing trade volumes and compliance needs. |

What You’re Viewing Is Included

DSV BCG Matrix

The DSV BCG Matrix document you are previewing is the exact, fully functional report you will receive upon purchase. This comprehensive analysis tool, designed for strategic decision-making, will be delivered to you without any watermarks or introductory content, ensuring immediate usability for your business planning needs.

Dogs

DSV's older or less strategically positioned warehousing facilities, especially those in mature markets, might be experiencing low utilization. These underperforming assets can be a drain, incurring ongoing costs without contributing significantly to revenue or market presence.

The company's stated objective to boost warehouse utilization rates implies that certain facilities are not operating at their full potential. For instance, if DSV aims for 90% utilization across its network and currently sits at 70%, those underutilized sites would be prime candidates for evaluation within a BCG-like matrix.

These facilities, while potentially carrying significant book value, might represent a drag on profitability if their operational expenses outweigh their generated income. The challenge lies in assessing whether these legacy sites can be revitalized or if they should be divested.

Niche, low-volume road transport lanes, especially those with intense competition and stagnant growth in areas with weak economic activity, often land in the Dog category of the BCG matrix. These routes can find it difficult to become profitable because of a small market share and operational expenses that are too high for the amount of freight moved. For instance, a specific route within a declining industrial region in Europe might see freight volumes drop by 5% year-over-year, with multiple carriers vying for the limited business, leading to downward pressure on rates.

Outdated IT systems in newly acquired entities can be considered Dogs within the DSV BCG Matrix. These legacy systems, often from smaller companies integrated into DSV's operations, present significant integration challenges with the company's standardized platform.

These systems typically demand substantial maintenance and lack the scalability necessary for DSV's growth, thereby acting as a drain on resources. For instance, if an acquired firm maintained its 2015-era enterprise resource planning (ERP) system, its inability to seamlessly connect with DSV's modern cloud-based logistics software would create operational friction.

The inefficiency stemming from these disparate IT infrastructures can hinder overall productivity and delay synergistic benefits from acquisitions. DSV's 2023 annual report highlighted that integration costs for acquisitions can be substantial, and outdated IT is a primary driver of these expenses, impacting projected cost savings.

Such systems consume valuable financial and human capital that could otherwise be allocated to more promising growth initiatives. The ongoing cost of maintaining these legacy systems, potentially running into millions of dollars annually across multiple acquisitions, further solidifies their classification as Dogs.

Highly Specialized, Low-Demand Project Cargo Routes

Certain highly specialized project cargo routes, often characterized by infrequent demand and significant operational complexities, can be viewed as potential question marks or even dogs within a strategic framework like the DSV BCG Matrix. These segments, while potentially lucrative on an individual shipment basis, may struggle to generate consistent revenue or market share due to their niche nature. For instance, transporting oversized components for a remote, one-off renewable energy project in a challenging geographical location might fit this description.

While DSV generally demonstrates strong capabilities in project transport, specific niche routes with limited repeat business and high associated overheads might not contribute positively to overall market share or growth. Consider the logistics of moving specialized scientific equipment for a singular research expedition to Antarctica. The immense planning, specialized equipment, and regulatory hurdles involved for a single, infrequent movement can strain resources without a corresponding long-term market presence.

In 2024, the global project cargo market, while robust, saw regional variations. For example, while infrastructure development in Asia Pacific drove significant project cargo volumes, certain specialized routes in less developed regions experienced lower activity. DSV's own 2024 reports highlighted that while their overall project logistics revenue grew, specific segments focused on highly specialized, low-demand routes saw slower growth, indicating potential "dog" status in those micro-markets.

- Niche Operations: Segments requiring unique, heavy-lift equipment or specialized handling for infrequent, large-scale projects.

- Low Repeat Business: Routes where customer engagement is sporadic, making it difficult to build consistent revenue streams.

- High Overhead Costs: Operations with significant fixed costs (e.g., specialized assets, dedicated personnel) that are not offset by regular volume.

- Limited Growth Potential: Market segments with inherently small customer bases or infrequent project cycles, hindering expansion.

Small, Non-Core Regional Freight Operations

Small, non-core regional freight operations, particularly those in fragmented or declining local markets where DSV has a minimal market share, would likely be categorized as Dogs in the BCG Matrix. These segments often face challenges in achieving necessary economies of scale, which can hinder profitability and make it difficult to compete effectively. For instance, in 2024, DSV continued its strategic focus on integrating acquisitions and optimizing its network, meaning smaller, underperforming regional units might not receive the investment needed to improve their market position.

Such operations typically exhibit low market share and low growth potential. They may not contribute significantly to DSV's overall revenue or profit and could even drain resources without a clear path to improvement. The company's emphasis on digital transformation and sustainable logistics solutions in 2024 also means that operations not aligned with these forward-looking strategies might be considered candidates for divestment or restructuring.

Key characteristics of these Dog segments include:

- Low Market Share: Minimal presence in their respective regional markets.

- Low Growth Prospects: Operating in stagnant or contracting local freight sectors.

- Limited Strategic Fit: Not aligning with DSV's core competencies or growth ambitions.

- Potential for Divestment: May be considered for sale or closure to reallocate capital.

Dogs in DSV's BCG matrix represent business units or services with low market share and low growth prospects. These often include underutilized warehousing facilities in mature markets or niche road transport lanes with declining volumes and high competition. For example, DSV's 2023 integration of Panalpina might have resulted in some regional offices or specialized services that did not achieve significant market penetration or growth, thus becoming candidates for the Dog category.

These segments, like outdated IT systems in acquired companies, consume resources without delivering substantial returns. DSV's strategic focus in 2024 on optimizing its global network and investing in digital solutions means that operations not aligning with these priorities are under scrutiny.

The key challenge with Dogs is to decide whether to divest them, restructure them, or invest minimally to maintain them if they serve a supporting role. In 2024, DSV's divestment of non-core assets, a strategy common for managing Dogs, aimed to streamline operations and focus capital on more promising ventures.

Table: Illustrative DSV Dog Segments (2024 Estimates)

| Segment Type | Market Share (Est.) | Growth Rate (Est.) | Strategic Consideration |

|---|---|---|---|

| Underutilized Warehouses (Mature Markets) | Low | Stagnant | Divestment or Repurposing |

| Niche Road Freight Lanes (Declining Regions) | Low | Negative | Exit or Consolidation |

| Legacy IT Systems (Acquired Entities) | N/A (Internal) | N/A (Internal) | Integration or Replacement |

Question Marks

DSV's aggressive expansion into emerging markets positions them as potential 'Question Marks' within their portfolio. These regions, like Southeast Asia and parts of Africa, present substantial growth opportunities, but DSV's current market share is likely nascent, necessitating significant upfront investment. For instance, DSV's strategic acquisitions, such as those in 2024 aimed at bolstering their presence in these developing economies, underscore this commitment to high-potential, albeit uncertain, ventures.

These emerging markets require substantial capital for infrastructure development, technology adoption, and building strong local partnerships to navigate unique regulatory and operational landscapes. The success of these investments hinges on DSV's ability to effectively scale operations and capture market share against established local players and other global competitors.

The outcome for these emerging market logistics operations is inherently uncertain; they could evolve into strong 'Stars' if DSV successfully capitalizes on the growth, or they might remain 'Question Marks' if market penetration proves more challenging than anticipated. By 2024, many emerging economies reported double-digit growth in e-commerce, a key driver for logistics demand, signaling the potential upside for DSV's strategic focus.

Pilot programs for autonomous vehicles and drone delivery in last-mile logistics are actively being explored by major logistics players. These represent a high-growth frontier with the potential to fundamentally reshape delivery networks. For DSV, these nascent technologies likely mean a low current market share, demanding substantial investment in research and development. The immediate return on these investments is not guaranteed, positioning these initiatives within the question mark category of a BCG matrix.

Developing and deploying advanced, proprietary AI-driven supply chain optimization software for external clients positions DSV as a potential Question Mark in the BCG matrix. This segment offers significant growth prospects within the burgeoning digital logistics sector, a market projected to reach over $30 billion globally by 2028.

However, DSV would be venturing into a highly competitive technology landscape, where established players already hold substantial market share. Significant upfront investment would be crucial to establish credibility and demonstrate the unique value proposition of their AI solutions in a market characterized by rapid innovation and evolving client needs.

Hyper-Specialized, Niche Industry Solutions

DSV's strategic focus on hyper-specialized logistics for emerging niche industries, such as advanced biotech materials and components for next-generation renewable energy technologies, positions them for significant future growth.

These sectors, while currently representing lower volumes, offer substantial upside potential. For instance, the global biopharmaceutical logistics market was projected to reach approximately $30.6 billion by 2024, with specialized cold chain solutions being a key driver. Similarly, the market for specialized components in emerging renewable energy, like advanced battery materials, is experiencing rapid expansion, with some segments seeing annual growth rates exceeding 20%.

This strategy requires substantial upfront investment in infrastructure, technology, and specialized talent. However, by building deep expertise and a strong market presence in these high-growth areas, DSV can command premium pricing and establish defensible competitive advantages.

- High Growth Potential: Targeting rapidly expanding niche markets.

- Expertise Required: Demands specialized knowledge and operational capabilities.

- Investment Needs: Significant upfront capital for specialized infrastructure and talent.

- Market Leadership: Opportunity to become a dominant player in emerging sectors.

Carbon Capture and Offset Logistics Services

Developing comprehensive carbon capture and offset logistics services positions DSV as a Question Mark within the BCG matrix. While the global carbon capture market is projected to reach USD 41.37 billion by 2030, growing at a CAGR of 17.7%, the specialized logistics for these nascent technologies are still maturing. DSV's investment in this area reflects a bet on future growth, but its current market share in advanced, integrated carbon solutions is likely modest, necessitating significant market cultivation.

- Market Evolution: The demand for integrated carbon logistics is rising, driven by stricter environmental regulations and corporate sustainability goals.

- Investment Needs: Significant capital expenditure is required to build specialized infrastructure and expertise for handling captured CO2 and verified offset credits.

- Competitive Landscape: While the overall logistics market is competitive, the niche of carbon logistics is less saturated, offering potential for early movers.

- DSV's Position: DSV's established global logistics network provides a strong foundation, but developing specialized capabilities for this segment is key to capturing market share.

DSV's exploration into providing specialized logistics for circular economy initiatives, such as reverse logistics for electronics or advanced materials recycling, places them in the Question Mark category. These markets offer substantial long-term growth potential as sustainability becomes a core business imperative.

The global circular economy market is projected to grow significantly, with estimates suggesting it could reach trillions of dollars in value by 2030. However, DSV's current market share in these highly specific reverse logistics and recycling streams is likely minimal, requiring considerable investment in infrastructure, technology, and partnerships to establish a foothold.

Success in this area hinges on DSV's ability to build efficient, cost-effective reverse supply chains and develop expertise in handling diverse waste streams. The potential upside is significant, as companies increasingly seek partners to manage their environmental footprint and comply with evolving regulations, making these ventures strategic bets on future market demands.

| Initiative | Market Potential | DSV's Current Share | Investment Needs | BCG Category |

|---|---|---|---|---|

| Emerging Markets Logistics | High (e.g., double-digit e-commerce growth in 2024) | Nascent | Substantial (infrastructure, tech, partnerships) | Question Mark |

| Autonomous/Drone Delivery Tech | High (reshaping networks) | Low | Significant (R&D) | Question Mark |

| Niche Industry Logistics (Biotech, Renewables) | High (e.g., Biopharma logistics ~$30.6B by 2024) | Developing | Significant (specialized infrastructure, talent) | Question Mark |

| Carbon Capture & Offset Logistics | High (USD 41.37B by 2030 for Carbon Capture) | Modest | Significant (specialized infrastructure, expertise) | Question Mark |

| Circular Economy Logistics | High (trillions by 2030) | Minimal | Considerable (infrastructure, tech, partnerships) | Question Mark |

| AI-Driven Supply Chain Software | High (>$30B globally by 2028 for digital logistics) | Low | Crucial (credibility, value proposition) | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages robust data from public company filings, industry association reports, and market research firms to provide a comprehensive view of business units.