Dril-Quip PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dril-Quip Bundle

Uncover the critical political, economic, social, technological, environmental, and legal forces shaping Dril-Quip's future. Our comprehensive PESTLE analysis provides actionable intelligence to navigate market complexities and identify strategic opportunities. Download the full version now to gain a competitive edge.

Political factors

Government energy policies are a major driver for Dril-Quip. Policies that encourage or discourage fossil fuel exploration, especially in challenging deepwater and harsh environments where Dril-Quip specializes, directly shape its potential customer base. For instance, the Biden administration's initial pause on new oil and gas leases in 2021, though later modified, highlighted how policy shifts can impact the market.

The ongoing global transition towards renewable energy sources versus continued support for traditional oil and gas significantly alters the investment landscape for Dril-Quip's clients. As of early 2024, while renewable investments are growing, global oil and gas demand remains robust, supporting the need for specialized offshore equipment.

Furthermore, government incentives like subsidies and tax credits for energy projects, or conversely, the implementation of carbon taxes, directly affect the operational costs and economic feasibility of oil and gas ventures. These financial levers critically influence client decisions on capital expenditure, which in turn impacts Dril-Quip's order book.

The stability of key oil-producing regions, particularly the Middle East and parts of Africa, directly influences the global oil and gas supply, impacting demand for Dril-Quip's specialized equipment. For instance, ongoing tensions in Eastern Europe and the Middle East in early 2024 continue to create volatility in energy markets, affecting investment decisions in exploration and production.

Geopolitical conflicts and trade disputes can significantly disrupt supply chains and increase operational risks for companies like Dril-Quip. The imposition of international sanctions, as seen in various regions, can limit market access and alter competitive landscapes, potentially reducing the demand for new drilling and completion technologies.

The regulatory landscape for offshore drilling is a complex web, with rules varying significantly from one country to another. This means Dril-Quip needs to ensure its equipment, like subsea wellheads and casings, adheres to a multitude of international standards, from the stringent requirements of the North Sea to the evolving regulations in the Gulf of Mexico. For instance, in 2024, the U.S. Bureau of Safety and Environmental Enforcement (BSEE) continued its focus on enhancing safety and environmental protection, impacting equipment design and operational protocols.

These differing regulations, including permitting timelines and environmental compliance measures, can introduce substantial costs and lead times for projects. However, this complexity also presents opportunities for Dril-Quip. Companies that can reliably supply equipment meeting these diverse and often tightening global standards, such as those mandated by Norway's Petroleum Safety Authority, are well-positioned. Strict oversight, like the increased scrutiny following incidents in recent years, often drives demand for more advanced, safer, and environmentally sound drilling equipment.

International Trade Policies

International trade policies significantly influence Dril-Quip's operational landscape. Tariffs and protectionist measures enacted by nations can directly increase the cost of importing essential raw materials for manufacturing or exporting finished goods. For instance, changes in trade agreements, such as those impacting steel or specialized equipment, can alter Dril-Quip's cost of goods sold and affect its pricing strategies in different regions.

Fluctuations in these policies create supply chain volatility and impact Dril-Quip's global competitiveness. As of early 2025, ongoing trade discussions and potential adjustments to existing agreements, like those involving major oil-producing nations, highlight the dynamic nature of this factor. Open trade policies, conversely, tend to streamline market access and reduce logistical expenses for companies like Dril-Quip.

- Tariffs: Increased tariffs on imported steel or components could raise Dril-Quip's manufacturing costs by an estimated 5-10% in affected markets.

- Trade Agreements: The renegotiation of trade pacts could impact market access for Dril-Quip's equipment in key regions, potentially affecting export volumes.

- Protectionism: Local content requirements in some countries may necessitate adjustments to Dril-Quip's supply chain and manufacturing footprint.

- Supply Chain Costs: Disruptions due to trade disputes could lead to a 3-7% increase in logistics and transportation expenses for Dril-Quip's global operations.

Government Investment in Infrastructure

Governmental investment in energy infrastructure, such as pipelines and processing facilities, directly influences the demand for upstream drilling and production equipment, a key market for Dril-Quip. For instance, the U.S. government's commitment to modernizing its energy grid, as seen in initiatives supporting natural gas infrastructure expansion, can indirectly boost sales for companies like Dril-Quip.

Specific investments in deepwater port capabilities or specialized logistics infrastructure are crucial for facilitating Dril-Quip's offshore operations and those of its global clientele. Without adequate port upgrades, the efficiency and cost-effectiveness of transporting large, specialized equipment can be significantly hampered.

- U.S. Infrastructure Investment: The Infrastructure Investment and Jobs Act of 2021 allocated significant funds towards energy infrastructure, potentially creating opportunities for equipment suppliers.

- Global Trends: Many nations are prioritizing energy security, leading to increased investment in LNG terminals and pipeline networks, which require specialized drilling and production equipment.

- Impact on Operations: Enhanced port facilities can reduce lead times and logistical costs for Dril-Quip's complex offshore equipment.

Governmental support for the energy sector, whether through subsidies or direct investment in infrastructure, significantly impacts Dril-Quip's market. For example, the Infrastructure Investment and Jobs Act of 2021 in the U.S. has provided substantial funding for energy projects, potentially boosting demand for specialized drilling equipment.

Conversely, policies that favor renewable energy over fossil fuels can present challenges, though global energy demand in early 2025 still supports the need for offshore exploration. Geopolitical stability in key oil-producing regions also plays a crucial role, with ongoing tensions in early 2024 impacting energy market volatility and investment decisions.

International trade policies, including tariffs and trade agreements, directly affect Dril-Quip's manufacturing costs and market access, with potential tariff increases on steel impacting production expenses. Regulatory frameworks, varying by country, necessitate adherence to diverse safety and environmental standards, such as those enforced by the U.S. BSEE in 2024, which can drive demand for advanced equipment.

| Policy Area | Impact on Dril-Quip | Data/Example (2024-2025) |

|---|---|---|

| Energy Subsidies/Incentives | Increases project feasibility, boosting demand for equipment. | U.S. Infrastructure Investment and Jobs Act (2021) funding energy projects. |

| Renewable Energy Transition | Potential reduction in fossil fuel exploration investment. | Global renewable investment growth alongside continued oil/gas demand in early 2025. |

| Geopolitical Stability | Affects oil price volatility and investment in exploration. | Tensions in Eastern Europe and Middle East impacting energy markets in early 2024. |

| Trade Tariffs | Increases manufacturing costs for raw materials and components. | Estimated 5-10% cost increase on imported steel in affected markets. |

| Regulatory Standards | Drives demand for advanced, compliant equipment. | U.S. BSEE's continued focus on safety and environmental protection in 2024. |

What is included in the product

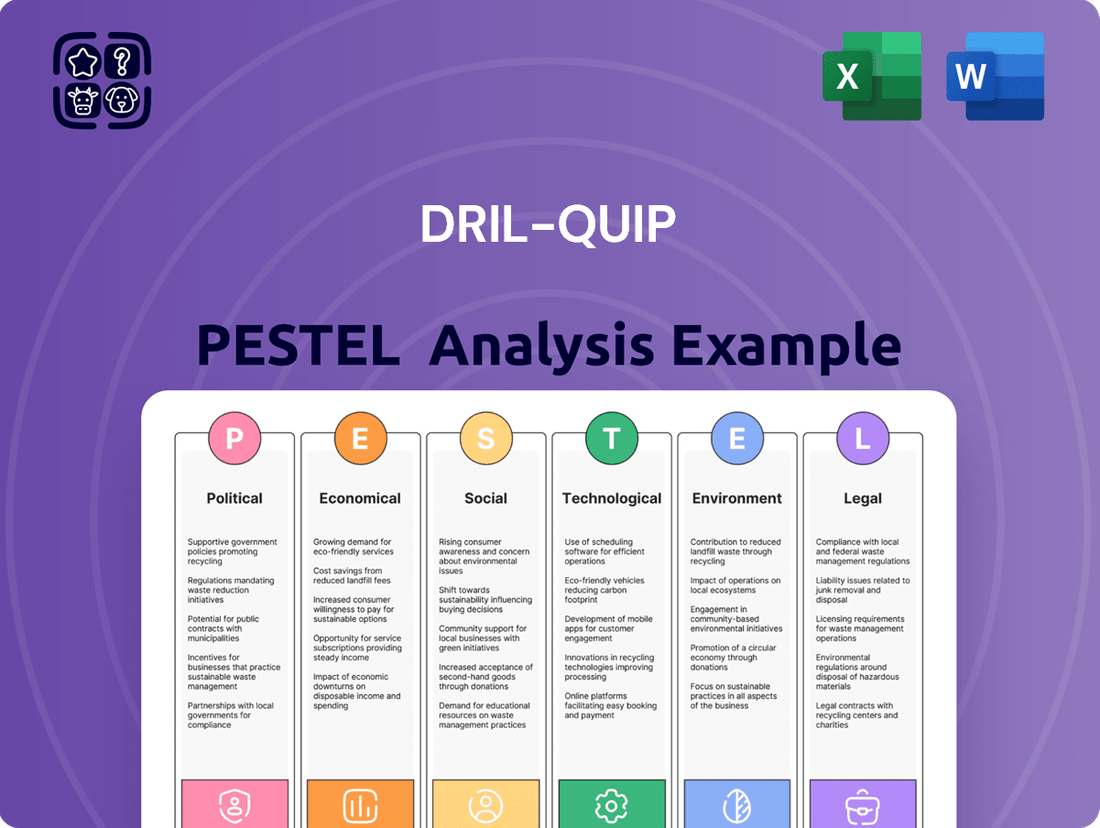

The Dril-Quip PESTLE Analysis dissects the company's operating environment by examining Political, Economic, Social, Technological, Environmental, and Legal forces, providing a comprehensive view of external influences.

The Dril-Quip PESTLE analysis offers a structured framework to identify and address potential external challenges, acting as a proactive pain point reliever by preparing the company for future market shifts and regulatory changes.

Economic factors

Global oil prices have shown volatility, with Brent crude averaging around $83 per barrel in early 2024, a figure that influences exploration and production (E&P) spending. Higher energy prices directly correlate with increased capital expenditures by E&P companies, which in turn boosts demand for Dril-Quip's specialized drilling and production equipment. For instance, a sustained period of prices above $70 per barrel often signals a more robust investment environment for the sector.

Conversely, a downturn in oil and gas prices, such as the dips seen in late 2023 where WTI crude briefly traded below $70, can significantly curb E&P investment. This reduction in spending leads to project deferrals and a subsequent decrease in demand for the capital-intensive equipment Dril-Quip provides. The International Energy Agency (IEA) projected a modest increase in global oil demand for 2024, suggesting a potentially supportive, albeit not explosive, pricing environment for the industry.

Dril-Quip's financial performance is intrinsically linked to the capital expenditure (CapEx) budgets of exploration and production (E&P) companies. In 2024, global oil and gas upstream CapEx is projected to reach approximately $560 billion, a notable increase from the prior year, driven by higher commodity prices and a focus on energy security. This spending directly impacts demand for Dril-Quip's specialized drilling and production equipment, particularly in deepwater and harsh environments.

The willingness of major integrated oil companies, independent producers, and foreign national oil companies to commit capital is a key determinant of Dril-Quip's revenue streams. For instance, a significant portion of Dril-Quip's backlog is tied to deepwater projects, where upfront investment is substantial. Economic forecasts, including projected oil and gas prices and global GDP growth, significantly influence these investment decisions, as they shape the perceived profitability and risk of new projects.

Company-specific financial health also plays a crucial role. E&P companies with strong balance sheets and healthy cash flows are more likely to approve and fund large-scale projects requiring advanced equipment. Conversely, companies facing financial constraints may delay or scale back their CapEx plans, directly affecting Dril-Quip's order book. For example, in early 2024, many energy companies reported robust earnings, leading to increased capital allocation towards exploration and production activities.

Global economic growth is a primary driver for industrial activity, transportation, and overall energy consumption, directly influencing the demand for oil and gas. A strong global economy typically translates to increased energy needs, which in turn stimulates more investment in exploration and production. For instance, the International Monetary Fund (IMF) projected global growth to be around 3.2% in 2024, a slight acceleration from 2023, indicating a supportive environment for energy demand.

Conversely, economic downturns can significantly dampen energy demand. This reduced consumption often leads to lower energy prices and a subsequent decrease in capital expenditure within the oil and gas sector, impacting companies like Dril-Quip that supply equipment for these operations. The World Bank noted in early 2024 that while global growth was stabilizing, risks remained, suggesting potential volatility in energy markets.

Interest Rates and Access to Capital

Prevailing interest rates directly influence the cost of capital for Dril-Quip's clients in the oil and gas sector. As of mid-2024, benchmark rates like the Federal Funds Rate have remained elevated, impacting the borrowing capacity for energy companies. This makes it more expensive for them to finance the substantial upfront investments required for complex projects, such as those in deepwater exploration and production.

The ease of access to capital is therefore a critical economic factor for Dril-Quip. When financial markets are tight or borrowing costs are high, companies may postpone or scale back their capital expenditure plans. For instance, a significant increase in the cost of debt could lead an operator to delay a multi-billion dollar deepwater development, directly affecting Dril-Quip's order book.

- Interest Rate Impact: Higher borrowing costs due to elevated interest rates can directly reduce the profitability of new oil and gas projects, potentially leading to project deferrals.

- Capital Expenditure Sensitivity: Dril-Quip's clients, particularly those undertaking capital-intensive deepwater projects, are highly sensitive to the availability and cost of financing.

- Market Conditions: Favorable financial conditions, characterized by lower interest rates and readily available credit, are essential for driving demand for Dril-Quip's specialized equipment and services.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations significantly impact Dril-Quip as a global entity. Its financial results are directly tied to the strength and weakness of various currencies involved in its international sales and sourcing activities.

Favorable exchange rates can boost Dril-Quip's international competitiveness and lower the cost of its imported materials. For instance, if the US dollar weakens against other major currencies, Dril-Quip's products become cheaper for international buyers, potentially increasing sales volume. Conversely, a stronger dollar can make its exports more expensive.

Unfavorable currency movements can negatively affect profitability. If Dril-Quip has significant costs denominated in a strengthening currency while its revenues are in a weaker one, its profit margins can shrink. For example, if Dril-Quip sources a substantial portion of its components from Europe and the Euro strengthens against the dollar, its procurement costs will rise.

- Impact on Revenue: A stronger US dollar relative to currencies in key markets like Europe or Asia can decrease the reported revenue from those regions.

- Impact on Costs: Conversely, if Dril-Quip procures materials or components from countries with weakening currencies, it can lead to lower production costs.

- Hedging Strategies: Companies like Dril-Quip often employ hedging strategies, such as forward contracts, to mitigate the risks associated with currency volatility.

- 2024/2025 Outlook: Analysts predict continued volatility in major currency pairs in 2024 and 2025, driven by differing monetary policies and geopolitical events, necessitating ongoing vigilance from Dril-Quip's finance department.

Global economic growth directly influences energy demand, with the IMF projecting 3.2% global growth for 2024, a supportive signal for the oil and gas sector. However, economic downturns can reduce energy consumption and investment in exploration, impacting Dril-Quip's equipment sales. The World Bank noted in early 2024 that while global growth was stabilizing, risks remained, suggesting potential market volatility.

Elevated interest rates, with benchmark rates remaining high in mid-2024, increase the cost of capital for Dril-Quip's clients, potentially delaying large projects. This sensitivity to financing costs means favorable financial conditions are crucial for driving demand for Dril-Quip's specialized equipment.

Currency fluctuations pose a significant risk, as a stronger US dollar can decrease international revenue and make exports more expensive. Conversely, favorable rates can boost competitiveness, though hedging strategies are often employed to mitigate volatility, which analysts expect to continue through 2024 and 2025.

| Economic Factor | 2024 Projection/Status | Impact on Dril-Quip | Data Source |

|---|---|---|---|

| Global GDP Growth | ~3.2% (IMF) | Supports energy demand and E&P investment | International Monetary Fund (IMF) |

| Interest Rates | Elevated benchmark rates (mid-2024) | Increases cost of capital for clients, potentially delaying projects | Federal Reserve / Central Banks |

| Currency Exchange Rates | Continued volatility predicted | Affects international revenue and costs; requires hedging | Financial Analysts / Market Forecasters |

Full Version Awaits

Dril-Quip PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Dril-Quip PESTLE analysis provides an in-depth look at the Political, Economic, Social, Technological, Legal, and Environmental factors influencing the company's operations and market position.

Sociological factors

Public perception of fossil fuels is increasingly negative, driven by growing awareness of climate change. This trend puts pressure on companies like Dril-Quip, which supports oil and gas extraction, to adapt. For instance, a 2023 Pew Research Center survey found that 62% of Americans believe the government is not doing enough to address climate change, indicating a strong public demand for cleaner energy solutions.

The oil and gas sector, especially areas like deepwater drilling, is struggling to find and keep skilled workers. This is a significant sociological factor affecting companies like Dril-Quip. An aging workforce, coupled with concerns about long-term career prospects in the industry, contributes to a talent shortage. This directly impacts Dril-Quip's capacity for innovation, manufacturing, and servicing its intricate drilling equipment.

This skills gap means Dril-Quip must prioritize investing in robust training and development programs. For instance, as of early 2024, industry reports indicated a projected deficit of over 100,000 skilled workers in the global energy sector by 2025, highlighting the urgency for companies to build their internal talent pipelines.

Societal expectations for robust health and safety protocols are increasingly influencing industrial operations, particularly in sectors like offshore drilling. The potential for severe reputational harm, heightened regulatory scrutiny, and significant legal liabilities following any incident means companies must prioritize safety. Dril-Quip's focus on embedding safety into its product development and service delivery directly addresses these societal demands, fostering client confidence and ensuring uninterrupted operations.

Community Relations and Local Impact

A company's social license to operate, particularly in the oil and gas sector, hinges on fostering strong community relations. Positive engagement in operational areas is crucial for project acceptance. Dril-Quip, as a key supplier, finds its business indirectly influenced by the public perception and social acceptance of its clients' upstream activities.

Public sentiment regarding environmental stewardship, the creation of local employment, and the distribution of economic benefits significantly shapes support or opposition to oil and gas projects. For instance, in 2024, several major offshore projects faced delays due to local community concerns over potential environmental disruptions and the equitable distribution of job opportunities, impacting the demand for specialized equipment like that provided by Dril-Quip.

- Community Acceptance: Positive community relations are vital for the smooth operation of oil and gas projects, directly affecting demand for suppliers.

- Environmental and Economic Impact: Public scrutiny over environmental effects and local economic benefits can lead to project delays or cancellations.

- Indirect Influence on Dril-Quip: Dril-Quip's business is indirectly tied to the social license and public perception of its oil and gas clients' operations.

Demand for Sustainable Energy Solutions

The increasing global demand for sustainable energy solutions, driven by climate change concerns and government policies, is reshaping investment landscapes. This societal shift is directing significant capital towards renewable energy sources like solar and wind, potentially impacting funding for traditional fossil fuel projects. For instance, in 2024, global investment in the energy transition reached an estimated $2 trillion, a substantial increase from previous years, according to the International Energy Agency (IEA).

This transition poses a challenge for companies like Dril-Quip, which specializes in equipment for oil and gas extraction, particularly in deepwater environments. As investment flows away from fossil fuels, the development of new, capital-intensive deepwater projects could slow down. This necessitates a strategic re-evaluation of Dril-Quip's business model and its potential role in supporting the evolving energy sector.

- Societal pressure for decarbonization is accelerating the energy transition.

- Investment in renewables is surging, with projections indicating continued growth through 2025.

- Dril-Quip's traditional market may face headwinds due to shifting investment priorities.

- Exploring diversification into green energy infrastructure or sustainable oil and gas technologies is becoming crucial.

Societal expectations for ethical business practices and corporate social responsibility are increasingly influencing the oil and gas industry. Consumers and investors alike are scrutinizing companies for their environmental impact and labor practices, putting pressure on firms like Dril-Quip to demonstrate strong ESG (Environmental, Social, and Governance) performance. A 2024 Deloitte survey indicated that 70% of investors consider ESG factors material to their investment decisions, underscoring the importance of these considerations for Dril-Quip's stakeholders.

Technological factors

Continuous advancements in drilling techniques, automation, and digitalization are fundamentally reshaping the oil and gas sector, directly influencing Dril-Quip's product development and market standing. The industry's push for greater efficiency and safety necessitates the design and manufacturing of increasingly sophisticated subsea wellheads, trees, and riser systems.

For Dril-Quip, this means a constant drive to integrate new materials and smart technologies into their offerings. These innovations are key to enhancing product performance, particularly in the challenging deepwater and harsh environments where many of their clients operate. For instance, the adoption of advanced materials like high-strength alloys can improve the durability and lifespan of subsea equipment, reducing maintenance costs and downtime for operators.

The increasing reliance on digitalization and automation in offshore operations also presents opportunities for Dril-Quip to develop smart, connected equipment. This could include systems with integrated sensors for real-time monitoring and predictive maintenance, further boosting operational efficiency and safety. In 2024, investments in digital oilfield technologies are projected to continue their upward trend, creating a fertile ground for companies like Dril-Quip that can deliver technologically superior solutions.

The relentless pursuit of energy in challenging offshore locations, such as ultra-deepwater and Arctic regions, necessitates drilling equipment capable of enduring extreme pressures, fluctuating temperatures, and corrosive saltwater environments. This demand directly fuels the need for advanced materials that can offer superior strength and resilience.

Dril-Quip's product development hinges on ongoing research into novel alloys and composite materials. Innovations in material science, leading to lighter yet stronger and more durable components, directly enhance the performance and lifespan of Dril-Quip's drilling and production systems, impacting their competitive edge.

For instance, the increasing adoption of high-strength low-alloy (HSLA) steels and advanced polymer composites in subsea applications, driven by their corrosion resistance and reduced weight, allows for more efficient installation and operation. These material advancements are crucial for Dril-Quip to offer reliable solutions in demanding offshore projects, where equipment failure can be catastrophic.

Technological advancements are significantly reshaping subsea equipment. We're seeing a strong push towards miniaturization, modularity, and enhanced reliability. This means equipment is becoming smaller, easier to assemble, and more dependable in harsh offshore environments.

These more compact and efficient designs directly benefit clients by lowering installation costs and reducing the physical footprint required for operations. Furthermore, improved reliability translates to fewer maintenance needs, which is a critical factor in the high-cost world of subsea exploration and production.

Dril-Quip's capacity to incorporate these cutting-edge design improvements into its product offerings is a key differentiator. For instance, the company's focus on developing advanced wellhead systems, which are core to subsea operations, directly leverages these technological trends, allowing them to offer more cost-effective and robust solutions compared to competitors.

Data Analytics and AI for Predictive Maintenance

The oil and gas industry is increasingly leveraging data analytics and AI for predictive maintenance, a shift that could significantly benefit Dril-Quip. This technology allows for the anticipation of equipment failures before they occur, optimizing operational uptime. For instance, a report from 2024 indicated that companies using predictive maintenance saw an average reduction in unplanned downtime by 20-30%.

Dril-Quip can integrate advanced sensors and data analytics capabilities directly into its drilling equipment. This not only enhances the performance of its own products but also offers clients valuable insights into asset health, transforming maintenance from a reactive cost center to proactive asset management. This integration can lead to substantial savings for operators by minimizing costly disruptions.

- Enhanced Equipment Uptime: Predictive maintenance, powered by AI, can reduce unplanned downtime by an estimated 20-30% in the oil and gas sector as of 2024.

- Value-Added Services: Dril-Quip can offer data-driven insights and performance optimization as a service to its clients.

- Proactive Asset Management: The shift from reactive repairs to predictive interventions ensures greater reliability and efficiency for drilling and production assets.

Carbon Capture and Storage (CCS) Technologies

While Dril-Quip doesn't directly produce Carbon Capture and Storage (CCS) equipment, the increasing integration of CCS in the oil and gas sector could impact its business. As CCS becomes more common, Dril-Quip's deepwater drilling and production equipment may need to be designed for compatibility with these new systems.

This potential need for integration could create opportunities for Dril-Quip to develop specialized components or services supporting CCS infrastructure. For instance, the company might adapt its wellhead systems or subsea connectors to interface with CO2 injection pipelines.

The global CCS market is projected for significant growth. Estimates suggest the market could reach tens of billions of dollars by the early 2030s, driven by climate targets and industrial decarbonization efforts. This expansion underscores the potential for CCS to influence upstream equipment requirements.

Key considerations for Dril-Quip include:

- Technological Adaptation: Ensuring existing and future equipment can accommodate CCS integration points.

- Market Demand Shift: Monitoring the pace of CCS adoption to anticipate demand for compatible subsea components.

- New Service Opportunities: Exploring specialized installation or maintenance services related to CCS integration on offshore platforms.

Technological advancements are rapidly transforming the oil and gas industry, pushing Dril-Quip to innovate in areas like automation, digitalization, and advanced materials. The drive for efficiency and safety in deepwater operations demands increasingly sophisticated subsea equipment, influencing Dril-Quip's product development and market competitiveness.

The integration of smart technologies, such as sensors for real-time monitoring and AI for predictive maintenance, offers significant opportunities. As of 2024, predictive maintenance is estimated to reduce unplanned downtime by 20-30%, a key benefit Dril-Quip can leverage by embedding these capabilities into its offerings.

Furthermore, the growing focus on Carbon Capture and Storage (CCS) may necessitate adaptations in Dril-Quip's equipment for compatibility with new infrastructure, potentially opening new market avenues as the CCS market is projected for substantial growth in the coming decade.

Legal factors

Dril-Quip navigates a complex web of environmental regulations, especially in its deepwater and offshore segments. Compliance with rules governing emissions, waste management, water quality, and biodiversity is paramount, with significant penalties for non-adherence.

The company must invest heavily to meet these standards, as evidenced by the increasing focus on Scope 1, 2, and 3 emissions reporting across the energy sector. For instance, the International Energy Agency (IEA) reported in 2024 that offshore oil and gas operations face stringent oversight concerning methane emissions and produced water discharge.

While stricter environmental laws can increase operational costs, they also create opportunities. Dril-Quip's expertise in designing robust and efficient equipment for challenging environments positions it to benefit from the growing demand for technologies that minimize environmental impact, such as advanced subsea systems designed for reduced operational footprint.

Dril-Quip must navigate a complex web of international and national safety standards for its drilling and production equipment. These regulations, including those from the American Petroleum Institute (API) and the International Organization for Standardization (ISO), are not merely guidelines but mandatory requirements for operation.

Failure to comply with these stringent safety standards, such as maintaining specific pressure ratings or material integrity, can result in significant financial penalties and operational disruptions. For instance, a major incident due to non-compliance could lead to costly equipment recalls or even temporary cessation of operations, impacting revenue streams and market confidence.

Robust safety protocols are therefore a cornerstone of Dril-Quip's operational strategy. In 2024, the industry saw continued emphasis on predictive maintenance and digitalization to enhance safety, with companies investing heavily in technologies that monitor equipment health in real-time to prevent failures and ensure worker well-being.

Dril-Quip, as a key supplier to offshore energy projects, navigates a complex web of international maritime laws. These regulations govern everything from vessel movements and operations within territorial waters to stringent environmental protection standards at sea. Compliance with frameworks like MARPOL (International Convention for the Prevention of Pollution from Ships) and SOLAS (International Convention for the Safety of Life at Sea) is paramount for maintaining operational licenses and avoiding significant penalties, impacting equipment design and deployment strategies.

Contractual Laws and Intellectual Property Rights

Dril-Quip's global operations are underpinned by a complex web of contractual agreements covering sales, service, and strategic alliances. Navigating the varying contractual laws across different jurisdictions is paramount for ensuring smooth business transactions and mitigating legal risks. The company's reliance on specialized technology means that strong contractual enforcement is key to its revenue streams.

Protecting its intellectual property (IP) is a cornerstone of Dril-Quip's competitive strategy. This includes patents for its innovative drilling equipment designs and proprietary technologies. As of its latest filings, Dril-Quip actively manages a portfolio of patents, with a significant portion focused on downhole tools and well construction technologies, crucial for maintaining its market position.

- Contractual Compliance: Dril-Quip must adhere to international contract laws, impacting everything from equipment sales to service agreements in over 60 countries.

- Intellectual Property Portfolio: The company holds numerous patents and trademarks, essential for safeguarding its technological advancements and preventing infringement in the competitive oil and gas equipment sector.

- IP Enforcement: Robust legal frameworks are necessary to enforce IP rights, particularly in regions with differing levels of IP protection, ensuring Dril-Quip's innovations remain commercially viable.

Antitrust and Competition Laws

As a specialized equipment provider in the oil and gas sector, Dril-Quip operates under a complex web of antitrust and competition laws across its global markets. These regulations, designed to foster fair play and prevent market dominance, directly shape how Dril-Quip approaches market expansion, potential partnerships, and pricing strategies. For instance, the U.S. Department of Justice's Antitrust Division actively scrutinizes mergers and acquisitions to ensure they don't unduly harm competition, a factor Dril-Quip must consider in any strategic consolidation. Compliance is crucial for maintaining market access and avoiding costly legal battles that could disrupt operations and profitability.

Navigating these legal frameworks is paramount for Dril-Quip's sustained success. Failure to adhere to competition laws can result in significant fines and reputational damage. For example, in 2023, the European Commission imposed substantial fines on companies for anticompetitive practices in various industries, underscoring the strict enforcement environment. Dril-Quip must therefore ensure its business practices, from product development to sales agreements, align with these global standards to safeguard its market position and operational integrity.

- Global Enforcement: Antitrust authorities worldwide, including the U.S. FTC and the European Commission, actively monitor and enforce competition laws.

- Merger Scrutiny: Potential acquisitions or mergers by Dril-Quip would undergo rigorous review to assess their impact on market competition.

- Pricing Practices: Laws prohibit price-fixing and other collusive behaviors, requiring Dril-Quip to maintain independent and fair pricing.

- Market Access: Adherence to these laws is essential for Dril-Quip to operate freely and compete effectively in its specialized market segments.

Dril-Quip's legal landscape is shaped by stringent safety and environmental regulations, demanding significant investment in compliance and robust operational protocols. The company must also navigate complex international maritime laws, contractual agreements across diverse jurisdictions, and robust intellectual property protection to safeguard its innovations. Furthermore, adherence to global antitrust and competition laws is critical for maintaining market access and avoiding penalties, influencing strategic decisions on market expansion and pricing.

Environmental factors

The intensifying global commitment to combating climate change, with many nations setting net-zero emission targets for 2050, directly impacts the oil and gas sector. This translates into increased scrutiny and pressure on companies like Dril-Quip's clients to adopt more sustainable practices and reduce their carbon footprint. For instance, in 2024, the International Energy Agency reported that investments in clean energy technologies are projected to surpass fossil fuel investments for the first time, signaling a significant shift in capital allocation.

This environmental shift influences decisions regarding new deepwater exploration and production projects. Clients are increasingly seeking solutions that minimize greenhouse gas emissions throughout the project lifecycle, pushing for the adoption of more carbon-efficient technologies and potentially steering investment away from traditional fossil fuel extraction altogether. Dril-Quip, therefore, faces an indirect but substantial challenge to innovate and offer equipment and services that align with their clients' decarbonization goals and evolving energy strategies.

Deepwater drilling, a core area for Dril-Quip, carries significant risks of oil spills and environmental incidents. These events can lead to severe ecological damage and substantial economic fallout, impacting the entire offshore energy sector. For instance, the 2010 Deepwater Horizon spill resulted in billions of dollars in cleanup costs and fines, highlighting the immense liability involved.

Consequently, the industry faces heightened regulatory scrutiny and public pressure, directly affecting companies like Dril-Quip. This scrutiny translates into a growing demand for equipment engineered with advanced spill prevention and containment technologies. Manufacturers are thus incentivized to innovate in areas like subsea well control systems and advanced sealing solutions to mitigate these risks.

Dril-Quip's deepwater operations necessitate robust biodiversity protection measures. Increasingly stringent regulations, particularly concerning seismic surveys and drilling waste, directly impact operational planning and equipment design. For instance, the International Seabed Authority continues to develop regulations for deep-sea mining, which could influence offshore drilling practices in shared or adjacent areas, emphasizing the need for adaptive environmental strategies.

Resource Depletion and Energy Transition

The increasing scarcity of readily available oil and gas reserves is pushing the industry towards more complex extraction methods like deepwater drilling, a key market for Dril-Quip. This trend is somewhat counterbalanced by the global energy transition, which raises questions about the long-term demand for fossil fuel extraction equipment.

The International Energy Agency (IEA) projected in its 2024 outlook that while oil and gas demand will likely peak in the coming years, it will remain substantial for decades, particularly in developing economies. This suggests a continued, albeit potentially moderating, need for advanced drilling technologies. However, the accelerating pace of renewable energy adoption, with global investment in clean energy expected to surpass $2 trillion in 2024, presents a significant long-term challenge to fossil fuel infrastructure demand.

- Deepwater and Unconventional Resource Growth: Investments in these areas are expected to rise due to declining conventional reserves, directly benefiting companies like Dril-Quip that specialize in the necessary equipment.

- Energy Transition Impact: The shift towards renewables could reduce overall demand for oil and gas drilling services and equipment over the long term.

- Fossil Fuel Demand Uncertainty: While demand remains, its future trajectory is increasingly uncertain, creating a dynamic market environment.

- Technological Adaptation: Companies must adapt to potentially shifting demand, possibly by diversifying into equipment for geothermal or other energy sectors.

Waste Management and Emissions Reduction Targets

The oil and gas sector faces mounting pressure to curb waste and slash greenhouse gas emissions. For Dril-Quip, this translates to scrutinizing the environmental impact of its manufacturing operations and the lifecycle of its equipment.

Meeting these targets often involves adopting cleaner production methods and designing products with sustainability in mind. For instance, the International Energy Agency (IEA) reported in 2024 that global energy-related CO2 emissions saw a slight decrease in 2023, signaling a trend towards emission reduction efforts that companies like Dril-Quip must align with.

- Manufacturing Footprint: Dril-Quip must assess and reduce waste generated during the production of its drilling and production equipment.

- Product Lifecycle: Consideration of how its products contribute to waste or emission reduction for its clients is crucial.

- Client Demand: Increasingly, oil and gas companies are selecting equipment that aids them in achieving their own environmental, social, and governance (ESG) objectives, impacting Dril-Quip's sales pipeline.

- Regulatory Compliance: Adherence to evolving environmental regulations regarding waste disposal and emissions standards is a non-negotiable operational requirement.

The global push for sustainability and emissions reduction directly influences Dril-Quip's market, as clients prioritize environmentally friendly solutions. The International Energy Agency's 2024 outlook highlights that clean energy investments are projected to exceed fossil fuel investments, a trend that necessitates Dril-Quip's adaptation towards supporting decarbonization efforts.

The inherent risks of deepwater drilling, such as potential oil spills, bring intense regulatory scrutiny and a demand for advanced safety technologies. This is underscored by the significant liabilities associated with past incidents, like the Deepwater Horizon spill, which emphasizes the need for robust spill prevention equipment.

Biodiversity protection measures and evolving regulations for offshore activities, including waste management and seismic surveys, directly impact operational planning and equipment design. For instance, the International Seabed Authority's ongoing development of deep-sea mining regulations could indirectly shape offshore drilling practices.

While deepwater exploration is driven by declining conventional reserves, the broader energy transition presents a long-term challenge to fossil fuel infrastructure. Global investment in clean energy is expected to surpass $2 trillion in 2024, signaling a significant shift that could moderate future demand for oil and gas extraction equipment.

| Environmental Factor | Impact on Dril-Quip | Supporting Data/Trend (2024/2025) |

|---|---|---|

| Climate Change & Emissions Reduction | Increased demand for low-carbon solutions; pressure to reduce operational footprint. | Clean energy investments projected to exceed fossil fuel investments globally. |

| Risk of Environmental Incidents (e.g., Oil Spills) | Heightened regulatory oversight; demand for advanced spill prevention and containment technologies. | Continued focus on stringent safety standards and liability management in offshore operations. |

| Biodiversity Protection & Waste Management | Need for compliance with stricter regulations on drilling waste and operational impacts. | Evolving international regulations for offshore activities and resource extraction. |

| Energy Transition & Demand Shift | Long-term uncertainty in fossil fuel demand; potential need for diversification. | Accelerating adoption of renewables, with global clean energy investment exceeding $2 trillion in 2024. |

PESTLE Analysis Data Sources

Our Dril-Quip PESTLE Analysis is meticulously constructed using data from official government publications, reputable financial institutions, and leading industry analysis firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the oil and gas equipment sector.