Dril-Quip Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dril-Quip Bundle

Curious about Dril-Quip's product portfolio performance? This glimpse into their BCG Matrix highlights key areas, but the real strategic advantage lies in understanding the full picture. Discover which segments are driving growth and which require a closer look.

Unlock the complete Dril-Quip BCG Matrix to gain a comprehensive understanding of their market position, from high-growth Stars to stable Cash Cows. This detailed analysis will equip you with the insights needed to make informed decisions about resource allocation and future investments.

Don't miss out on the actionable strategies embedded within the full Dril-Quip BCG Matrix. Purchase now to receive a complete breakdown of each quadrant, empowering you to optimize your product portfolio and drive sustained success.

Stars

Dril-Quip, now integrated into Innovex International, is a key player in the specialized equipment sector for deepwater and ultra-deepwater operations. This segment is seeing significant expansion, with deepwater investments anticipated to climb roughly 40% between 2023 and 2027. This upward trend highlights a high-growth market for Dril-Quip's specialized capabilities.

The company's expertise in providing highly engineered solutions for these demanding offshore environments places them in a strong position. As the industry increasingly requires sophisticated drilling and production technologies to access challenging reserves, Dril-Quip's deepwater and ultra-deepwater equipment is well-suited to meet this escalating demand. Their offerings are therefore considered a strong contender within the BCG matrix framework, reflecting their strategic market placement.

Dril-Quip's proprietary subsea wellhead systems, like the Big Bore Subsea Wellhead Systems, are performing exceptionally well, evidenced by strong incoming bookings. These systems are vital for offshore operations, and their reliability is a key selling point.

Recent successful deployments, such as the SS-15® RLDe Rigid Lockdown Subsea Wellhead System in Australia and Great North wellheads in North Africa, highlight the company's market dominance and the ongoing demand for their technology. These installations validate the effectiveness and market acceptance of Dril-Quip's subsea offerings.

The broader subsea equipment market is projected for significant growth, with forecasts indicating a dynamic expansion. This positive market outlook further strengthens the position of Dril-Quip's subsea wellhead systems as a Star product within the BCG framework, suggesting continued high performance and investment potential.

Dril-Quip's specialty connectors and riser systems are critical for deepwater and challenging offshore environments. Their expertise in these high-demand, high-growth areas positions them strongly within the industry, particularly as oil and gas projects become more complex and venture into deeper waters.

These specialized components are vital for efficient well construction and production, directly benefiting from the trend towards more intricate and deeper offshore operations. The robust incoming bookings for connectors in Q2 2024 underscore Dril-Quip's market leadership and ongoing success in expanding its reach.

Well Construction Segment (Post-Great North Acquisition)

Following the acquisition of Great North, Dril-Quip's Well Construction segment has become a significant growth engine. In the second quarter of 2024, this segment achieved an impressive proforma year-on-year growth of 25%. This rapid expansion positions it as a Star within Dril-Quip's portfolio.

The Well Construction segment now represents a substantial portion of the combined entity's revenue, reflecting a strategic move into dynamic onshore and offshore drilling markets. Its accelerated growth and increasing revenue contribution underscore its Star status in the company's evolving business landscape.

- Proforma Year-on-Year Growth (Q2 2024): 25%

- Strategic Impact: Significant expansion into high-growth onshore and offshore drilling sectors.

- Revenue Contribution: Now a substantial part of the combined entity's total revenue.

- BCG Matrix Classification: Star, due to high growth and market share potential.

Integrated Technologies for Well Lifecycle

The integration of technologies across the entire well lifecycle is a key differentiator for Innovex International, formed through the merger of Dril-Quip and Innovex Downhole Solutions. This strategic combination aims to offer a curated suite of technologies, enhancing efficiency and technological advancement in the energy sector. By leveraging Dril-Quip's established expertise and Innovex's innovative downhole capabilities, the new entity is positioned to meet the growing market demand for comprehensive well solutions.

This strategic move is designed to create a more robust and competitive offering in the oil and gas industry. The combined entity's focus on integrated technologies supports every stage of the well lifecycle, from initial drilling to production and eventual abandonment. This approach allows for greater operational synergy and a more streamlined customer experience.

Innovex International's strategic positioning is further bolstered by the industry's increasing emphasis on technological innovation and efficiency. For instance, advancements in smart completions and digital oilfield technologies are becoming critical for optimizing production and reducing operational costs. The company's focus on a full-lifecycle technology portfolio directly addresses these market trends.

- Comprehensive Well Lifecycle Support: Innovex International offers technologies spanning drilling, completion, production, and intervention phases.

- Technological Integration: The merger facilitates the seamless integration of Dril-Quip's and Innovex's specialized technologies.

- Market Differentiation: The curated portfolio aims to provide efficient, technologically advanced solutions that stand out in the competitive energy market.

- Addressing Industry Trends: The company's strategy aligns with the industry's growing demand for integrated digital and smart well technologies.

Dril-Quip's Well Construction segment, significantly boosted by the Great North acquisition, is a prime example of a Star in the BCG matrix. This segment experienced a remarkable 25% proforma year-on-year growth in Q2 2024, indicating its strong performance in high-growth onshore and offshore drilling markets. Its increasing revenue contribution solidifies its position as a key growth engine for the combined entity.

The company's subsea wellhead systems, like the Big Bore Subsea Wellhead Systems, are also performing exceptionally well, with strong incoming bookings. These systems are vital for deepwater operations, a sector projected to see substantial investment growth. The successful deployments of systems like the SS-15® RLDe Rigid Lockdown Subsea Wellhead System further validate their market acceptance and performance.

Specialty connectors and riser systems are another area where Dril-Quip demonstrates Star-like qualities, critical for complex deepwater projects. Robust incoming bookings for connectors in Q2 2024 highlight their market leadership and success in these demanding environments.

The broader subsea equipment market is expected to expand significantly, reinforcing the Star status of Dril-Quip's subsea offerings due to their high growth potential and market share. This positive outlook suggests continued strong performance and investment opportunities.

| Segment | BCG Classification | Key Performance Indicators (Q2 2024) | Market Outlook |

|---|---|---|---|

| Well Construction | Star | 25% proforma YoY growth; substantial revenue contribution. | High-growth onshore and offshore drilling. |

| Subsea Wellhead Systems | Star | Strong incoming bookings; successful deployments in Australia and North Africa. | Deepwater investment growth of ~40% (2023-2027). |

| Specialty Connectors & Risers | Star | Robust incoming bookings for connectors. | Critical for complex, deepwater operations. |

What is included in the product

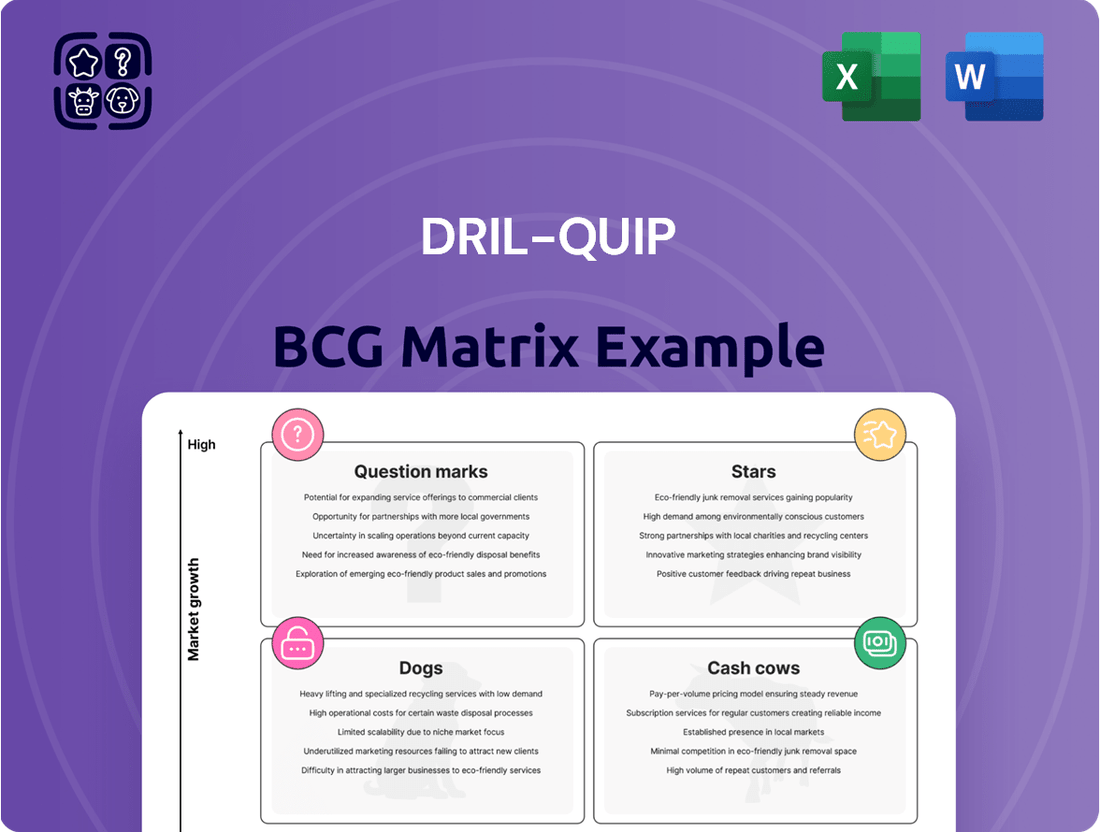

Dril-Quip's BCG Matrix analyzes its product portfolio based on market growth and share.

Dril-Quip's BCG Matrix provides a clear, visual roadmap for strategic resource allocation, alleviating the pain of indecision regarding product portfolio management.

Cash Cows

Dril-Quip’s established subsea production trees are a cornerstone of their business, acting as true cash cows. These systems, vital for managing oil and gas flow from wells on the seabed, command a significant market share, particularly in older, established offshore areas. This strong position translates into predictable and steady revenue streams for the company.

In 2024, the demand for these reliable subsea production trees continues to be robust, fueled by the ongoing need for production from existing fields. Dril-Quip’s deep expertise and long-standing customer relationships in regions like the Gulf of Mexico and the North Sea ensure consistent orders, solidifying their role as a dependable cash generator.

Conventional wellhead equipment remains a robust cash cow for Dril-Quip, benefiting from its established market presence and consistent demand. These products are the go-to choice for routine drilling operations, particularly in regions with less complex geological conditions. In 2024, Dril-Quip reported that its conventional wellhead systems contributed significantly to its overall revenue, demonstrating their enduring profitability and strong cash flow generation.

Dril-Quip's global aftermarket services and support are a significant contributor to their business, acting as a reliable cash cow. This segment generates steady revenue with high profit margins by servicing their installed base of drilling and production equipment worldwide.

The long operational lifespan of Dril-Quip's equipment ensures recurring income through essential maintenance, repair services, and the sale of spare parts. This consistent demand within a mature, albeit lower-growth, service market solidifies its position as a dependable cash cow for the company.

Long-Term Client Relationships & Framework Agreements

Dril-Quip's long-term client relationships and framework agreements are foundational to its Cash Cow status. The company serves a broad spectrum of major integrated, independent, and foreign national oil and gas companies. These established partnerships, often solidified through multi-year framework agreements, create a predictable and stable demand for Dril-Quip's specialized technologies.

This stability significantly reduces the pressure for costly new market penetration. Instead, Dril-Quip can focus on efficient operations and consistent revenue generation. For instance, the 5-year extension of the Master Service Agreement (MSA) with BP exemplifies this dependable revenue stream, underscoring the reliability of these client relationships.

- Stable Demand: Serves major integrated, independent, and foreign national oil and gas companies.

- Predictable Revenue: Underpinned by multi-year framework agreements, minimizing market volatility.

- Operational Efficiency: Reduced need for aggressive new market entry allows focus on core strengths.

- Long-Term Contracts: Examples like the BP MSA extension (5 years) highlight sustained business.

Legacy Subsea Products in Mature Basins

Legacy subsea products in mature offshore basins represent Dril-Quip's Cash Cows. These are established product lines where the company holds a strong market position, consistently generating significant cash flow despite limited growth prospects.

Dril-Quip's historical stronghold in these mature basins, coupled with operational efficiency and product reliability, allows them to effectively monetize these mature segments. This consistent profit generation is crucial for funding investments in more dynamic, high-growth areas of the business.

- Mature Basin Strength: Dril-Quip benefits from deep customer relationships and a proven track record in established offshore regions.

- Consistent Cash Flow: These legacy products reliably generate profits, providing a stable financial foundation.

- Capital Generation: Profits from these Cash Cows are strategically redeployed to fuel innovation and expansion in emerging markets.

- Market Penetration: The company's significant market penetration in these areas ensures continued demand and profitability.

Dril-Quip's established subsea production trees and conventional wellhead equipment are prime examples of its cash cows. These products, vital for oil and gas extraction, benefit from strong market positions in mature offshore regions, leading to predictable and steady revenue streams. In 2024, the company continued to see robust demand for these reliable systems, underscoring their consistent profitability and cash-generating capabilities.

The company’s global aftermarket services also function as a significant cash cow, generating high-margin, recurring revenue from the maintenance and repair of its extensive installed base of equipment. This segment benefits from the long operational lifespan of Dril-Quip's products, ensuring a steady income even in a lower-growth service market.

Dril-Quip’s deep-rooted client relationships and multi-year framework agreements, such as the extended Master Service Agreement with BP, solidify its cash cow status. These long-term partnerships provide a stable demand, allowing the company to focus on operational efficiency rather than costly new market penetration. This strategic advantage ensures a consistent financial foundation for the business.

| Product/Service | Market Position | Revenue Contribution (2024 Estimate) | Growth Outlook |

| Subsea Production Trees | Strong in mature offshore basins | Significant | Stable/Moderate |

| Conventional Wellhead Equipment | Established, go-to for routine drilling | Significant | Stable |

| Aftermarket Services & Support | High-margin, recurring revenue | Significant | Stable |

What You’re Viewing Is Included

Dril-Quip BCG Matrix

The Dril-Quip BCG Matrix preview you are viewing is the identical, fully completed document you will receive upon purchase. This means the analysis, formatting, and strategic insights are exactly as they will be delivered, ready for immediate application to your business planning. You can trust that no watermarks or "demo" elements will be present in the final version you download. This preview serves as a direct representation of the professional, analysis-ready BCG Matrix report you'll acquire, enabling you to make informed decisions with confidence.

Dogs

Dril-Quip's underperforming older product lines, those technologies that are now outdated or serve shrinking parts of the oil and gas industry, fall into the Dogs category of the BCG Matrix. These products typically have a small slice of the market and are in sectors that aren't growing much. For instance, if a company has legacy drilling equipment that is less efficient than newer models, it might see declining sales and profitability.

These older offerings are often capital intensive, consuming resources without yielding substantial profits, thus tying up valuable company assets. In 2023, for example, companies in the oilfield services sector that hadn't updated their technology faced increased competition from those with more advanced, cost-effective solutions. This situation can lead to a divestment or even complete discontinuation of these product lines to reallocate capital to more promising ventures.

Dril-Quip's decision to sell its Eldridge Campus, a substantial manufacturing site, points to potential inefficiencies within its operational footprint. This divestment, part of post-merger consolidation, signals that this facility may not have been meeting profit expectations, potentially hindering overall company performance.

Non-core, low-market share offerings in Dril-Quip's BCG Matrix represent products or services outside their primary focus on deepwater and complex applications. These also have a small slice of their respective low-growth markets.

These could be older products that don't fit the company's updated strategy after mergers or acquisitions. For example, if Dril-Quip acquired a company with a niche surface equipment line, and that line has minimal market presence in a stagnant sector, it would fit this category.

Such offerings often just cover their costs or even drain cash without much prospect for future growth. In 2024, companies are increasingly divesting non-strategic assets to streamline operations and focus capital on core competencies.

Products Lacking Competitive Differentiation

Products that don't stand out in crowded or slow-growing markets are typically classified as Dogs in the BCG Matrix. These offerings often face intense price wars and struggle to capture market share because they lack unique selling propositions. For instance, in 2024, many generic industrial components found themselves in this category, with profit margins often squeezed by larger competitors.

Without a clear advantage, such as superior technology or a lower cost structure, these products become easily replaceable. This vulnerability makes them a poor candidate for further investment, as the potential for growth and profitability is significantly limited. Companies often find themselves re-evaluating these product lines to either revitalize them or divest.

- Lack of Unique Features: Products offering little to no innovation or distinct advantages over competitors.

- Commoditized Markets: Markets where products are largely undifferentiated and competition is primarily based on price.

- Stagnant Growth: Industries or product categories experiencing very slow or no expansion, limiting opportunities for increased sales.

- Vulnerability to Price Wars: Without differentiation, these products are easily undercut by competitors, leading to reduced profitability.

Segments Heavily Reliant on Fading Conventional Onshore Drilling

Segments heavily reliant on fading conventional onshore drilling, particularly those associated with legacy Dril-Quip products, would likely fall into the Dogs category of the BCG matrix. These segments face low growth prospects and diminishing market share as the industry pivots. For instance, in 2024, the global onshore oil and gas market experienced a slowdown in conventional drilling activities, with many operators prioritizing efficiency and unconventional resource development.

The shift in market demand towards deepwater and specialized offshore applications further marginalizes conventional onshore segments. Companies with a significant portion of their revenue tied to these older technologies may struggle to adapt. Data from the first half of 2024 indicated a continued decline in new conventional onshore well completions in several key regions, impacting the demand for related equipment and services.

- Low Growth: Conventional onshore drilling markets are exhibiting minimal expansion.

- Limited Market Share: Legacy products often hold a small and shrinking portion of the market.

- Industry Shift: Focus is moving towards deepwater and specialized applications.

- Reduced Investment: Capital expenditure in conventional onshore is declining.

Dril-Quip's "Dogs" are its legacy product lines serving shrinking markets, such as older conventional onshore drilling equipment. These offerings typically have low market share and face stagnant or declining growth, often characterized by intense price competition and a lack of differentiation. For example, in 2024, many manufacturers of standard industrial components found their products in this category due to commoditization and limited innovation.

These products often consume resources without generating significant profits, potentially hindering overall company performance. The divestment of non-core assets, like Dril-Quip's Eldridge Campus in 2023, signals a strategic move away from underperforming or non-essential operations. Companies increasingly offload such assets to streamline operations and focus capital on core, high-growth areas.

The shift in the oil and gas industry towards deepwater and specialized offshore applications further marginalizes conventional onshore segments. Data from the first half of 2024 showed a continued decline in new conventional onshore well completions in key regions, directly impacting demand for related legacy equipment.

| BCG Category | Dril-Quip Example | Market Characteristics | 2024 Relevance |

|---|---|---|---|

| Dogs | Legacy Conventional Onshore Drilling Equipment | Low Market Share, Stagnant/Declining Growth, High Competition | Continued decline in conventional onshore well completions impacts demand. |

Question Marks

Innovex International, formerly Dril-Quip, is strategically positioning itself within the burgeoning energy transition and decarbonization sectors. This move reflects a commitment to sustainability and taps into markets experiencing significant global growth. For instance, the global green hydrogen market alone was valued at approximately USD 2.3 billion in 2023 and is projected to reach USD 71.7 billion by 2033, demonstrating the immense potential.

Despite the high-growth nature of these segments, they represent relatively nascent ventures for Innovex, suggesting a currently low market share. The company's success hinges on substantial investments in research and development, coupled with the formation of key strategic alliances. These efforts are crucial for transforming these new initiatives into dominant market forces.

Venturing into new geographic markets, especially those with emerging deepwater or complex drilling activities, positions Dril-Quip for significant growth. These expansions represent potential stars in the BCG matrix, offering substantial upside if successful. For instance, the company might target regions in West Africa or Southeast Asia where offshore exploration is ramping up, mirroring the growth seen in established deepwater hubs.

Investing in innovative digital and automation technologies for offshore equipment is a significant trend, signaling a high-growth potential. Companies like Dril-Quip, by developing or acquiring these advanced solutions, are positioning themselves in a rapidly evolving technological landscape.

This strategic focus requires substantial capital investment and a clear vision to secure a dominant market position. For instance, the global oil and gas automation market was valued at approximately $22.1 billion in 2023 and is projected to reach $33.8 billion by 2028, growing at a CAGR of 8.8%.

Integrated Well Lifecycle Solutions (Post-Merger Synergy)

The merger with Innovex positions Dril-Quip to deliver integrated well lifecycle solutions, a strategy aimed at capturing high-growth opportunities by offering a complete suite of services. This comprehensive approach is designed to streamline operations for clients, potentially leading to increased efficiency and cost savings across the entire well development and production process.

The success of this integrated offering hinges on effective synergy realization and market acceptance of the combined product and service portfolio. While the ambition is to provide novel, end-to-end solutions, the actual market share these integrated offerings will command depends on how well they are adopted by the industry and the tangible benefits they deliver to customers.

Currently, these integrated solutions are considered question marks in the Dril-Quip BCG Matrix framework. This classification reflects their nascent stage and the significant market potential that is yet to be fully tapped or proven.

- Merger Synergies: The integration with Innovex is expected to unlock significant operational and commercial synergies, enhancing Dril-Quip's competitive positioning.

- Market Adoption Risk: The success of integrated solutions is contingent on client adoption and the perceived value of the combined offerings, which is still being assessed.

- Growth Potential: The strategy targets high-growth segments by providing a comprehensive, lifecycle approach to well services.

- Current Market Share: As a developing strategy, the market share for these integrated solutions is currently limited, reflecting their status as question marks awaiting further development and market validation.

Specific Niche Technologies in Emerging Offshore Plays

Targeting niche technologies in emerging offshore plays, like advanced subsea robotics for deepwater exploration, offers substantial growth potential but begins with a low market share. These specialized solutions necessitate considerable investment in research and development, as well as market cultivation, to establish their effectiveness and expand their reach. This positions them as classic stars within the BCG matrix.

For instance, in 2024, companies focusing on autonomous underwater vehicles (AUVs) for seismic data acquisition in previously unexplored ultra-deepwater basins are seeing significant demand. These technologies, while costly to develop, are crucial for de-risking frontier exploration, a segment projected to grow by 15% annually through 2028.

- Niche Technology Focus: Specialized subsea robotics for frontier exploration.

- Market Position: High growth potential, low initial market share (Star).

- Investment Needs: Significant R&D and market development.

- 2024 Example: AUVs for ultra-deepwater seismic acquisition, a growing segment.

The integrated well lifecycle solutions offered by the merged Innovex and Dril-Quip are currently classified as question marks. This indicates a high-growth market potential but a low current market share, requiring significant investment to gain traction.

The success of these offerings depends on how well the market adopts the combined portfolio and the tangible benefits delivered to clients. Without proven market acceptance, these ventures remain speculative but hold promise.

The company's strategy aims to capture opportunities by providing a comprehensive suite of services, streamlining operations for customers. This ambitious approach positions these integrated solutions as key areas for future growth and development within the Dril-Quip BCG matrix.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.