Dongguan Rural Commercial Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dongguan Rural Commercial Bank Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors impacting Dongguan Rural Commercial Bank. Our meticulously researched PESTLE analysis provides a clear roadmap to navigate these external forces and identify strategic opportunities. Gain a competitive advantage by understanding the full external landscape. Download the complete analysis now for actionable intelligence.

Political factors

The Chinese government, through bodies like the National Financial Regulatory Administration (NFRA), exerts considerable influence over its banking sector. For Dongguan Rural Commercial Bank, this means policies on capital requirements, loan quality, and risk oversight are paramount, shaping its day-to-day operations and long-term strategy. For instance, the NFRA's directives on Non-Performing Loan (NPL) ratios, which saw a general decrease in China's banking sector in early 2024, directly affect how the bank manages its loan portfolio.

The People's Bank of China (PBOC) wields significant influence over Dongguan Rural Commercial Bank by setting monetary policy, including key interest rates and reserve requirements. For instance, in early 2024, the PBOC maintained a relatively accommodative stance, with the one-year loan prime rate (LPR) holding steady at 3.45%, impacting the bank's cost of borrowing and lending margins.

These policy adjustments directly affect the bank's cost of funds and its ability to offer competitive lending rates to its customers in Dongguan. A shift towards tighter policy, such as an increase in the reserve requirement ratio, could reduce the amount of capital available for lending, potentially impacting profitability.

The PBOC's balancing act between stimulating economic growth and curbing inflation is a crucial factor for Dongguan Rural Commercial Bank. If the PBOC prioritizes inflation control through higher rates, it could dampen credit demand and increase the risk of non-performing loans for the bank.

Dongguan Rural Commercial Bank's operations are significantly shaped by local government support and initiatives within Dongguan and the broader Guangdong Province. For instance, the Guangdong Provincial Government's 2024 focus on boosting the digital economy and advanced manufacturing sectors directly translates into potential lending opportunities for the bank, supporting businesses aligned with these strategic priorities.

These government-backed development plans can also present the bank with social responsibilities, such as directing capital towards green initiatives or supporting small and medium-sized enterprises (SMEs) that are crucial for regional employment. In 2023, Dongguan's GDP grew by 5.0%, indicating a robust local economy that benefits from such targeted governmental support, creating a favorable environment for regional banking institutions like Dongguan Rural Commercial Bank.

Geopolitical Climate and Trade Relations

Broader geopolitical tensions and China's evolving international trade relations can indirectly influence Dongguan Rural Commercial Bank. While the bank's focus is local, the economic well-being of its clients, especially small and medium-sized enterprises (SMEs) engaged in international trade, is susceptible to global trade dynamics and political stability. This sensitivity can impact credit demand and the overall quality of the bank's assets.

For instance, the ongoing global trade friction, particularly between major economies, can lead to increased uncertainty for Chinese exporters. In 2024, China's export growth saw fluctuations, with analysts pointing to both resilient demand in certain sectors and headwinds from protectionist policies in key markets. This directly affects the revenue streams and financial health of Dongguan-based businesses that rely on international sales, potentially increasing their need for financial support or, conversely, their risk profile.

Furthermore, China's strategic initiatives, such as the Belt and Road Initiative, while fostering new trade routes and investment opportunities, also carry geopolitical implications. The bank's clients involved in projects or supply chains linked to these initiatives may face varying levels of risk depending on the political stability and economic performance of partner countries. As of early 2025, continued focus on de-risking supply chains globally could also reshape trade patterns, impacting the specific industries Dongguan Rural Commercial Bank serves.

- Trade Tariffs: Changes in tariffs imposed by major trading partners can directly impact the profitability of export-oriented SMEs in Dongguan.

- Supply Chain Disruptions: Geopolitical events can lead to disruptions in global supply chains, affecting the operational efficiency and financial stability of businesses reliant on international sourcing or distribution.

- Foreign Investment Flows: Broader geopolitical sentiment can influence foreign direct investment into China, indirectly affecting the growth prospects and credit needs of local businesses.

Financial Sector Reforms and Anti-Corruption

China's ongoing financial sector reforms, including efforts to de-risk and modernize its banking system, directly impact Dongguan Rural Commercial Bank. These reforms, often accompanied by stringent anti-corruption drives, necessitate a heightened focus on compliance and transparent operations. For instance, the People's Bank of China has been actively guiding banks to improve their corporate governance and risk management practices, a trend that intensified in 2024.

The emphasis on clean governance and reduced systemic risk means banks like Dongguan Rural Commercial Bank must continuously adapt their internal controls. This includes strengthening anti-money laundering (AML) and know-your-customer (KYC) procedures, which saw increased regulatory scrutiny throughout 2024. Failure to comply can result in significant penalties, impacting profitability and operational stability.

- Stricter Compliance: Expect enhanced regulatory oversight on capital adequacy ratios and non-performing loan management, building on trends observed in 2024.

- Governance Overhaul: Reforms push for independent boards and improved internal audit functions, reflecting a broader push for accountability in the financial sector.

- Transparency Mandates: Increased disclosure requirements for financial products and services are becoming standard, requiring robust data management.

- Anti-Corruption Measures: Continued crackdowns on financial misconduct necessitate strong internal ethical guidelines and reporting mechanisms.

Government policy directly shapes Dongguan Rural Commercial Bank's operational landscape. Directives from the National Financial Regulatory Administration (NFRA) on capital adequacy and loan quality, for example, influenced the banking sector's overall non-performing loan (NPL) ratio, which saw a general decrease in early 2024. The People's Bank of China's monetary policy, including the one-year loan prime rate holding steady at 3.45% in early 2024, impacts the bank's lending margins and borrowing costs.

Local government support, such as Guangdong Province's 2024 focus on digital economy and advanced manufacturing, creates specific lending opportunities for the bank. Dongguan's robust GDP growth of 5.0% in 2023, partly driven by such initiatives, provides a favorable operating environment. Geopolitical factors, like global trade friction, can indirectly affect the bank by impacting the financial health of its SME clients involved in international trade, as seen in China's fluctuating export growth in 2024.

China's financial sector reforms, including a strong emphasis on de-risking and improved corporate governance, intensified in 2024, requiring banks like Dongguan Rural Commercial Bank to enhance compliance, particularly in anti-money laundering (AML) and know-your-customer (KYC) procedures. These reforms aim to reduce systemic risk and increase transparency, with stricter oversight on capital adequacy and internal audit functions becoming standard.

What is included in the product

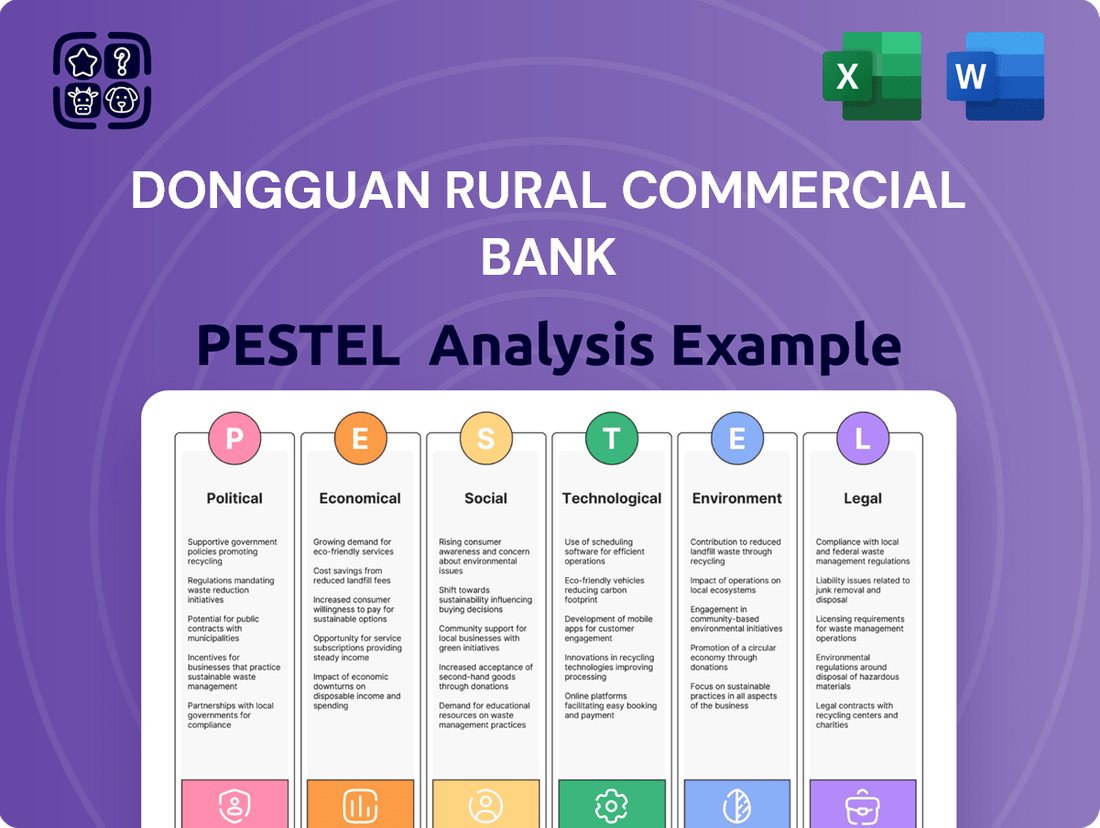

This PESTLE analysis of Dongguan Rural Commercial Bank examines the influence of political stability, economic growth, social trends, technological advancements, environmental regulations, and legal frameworks on its operations and strategic planning.

The Dongguan Rural Commercial Bank PESTLE Analysis provides a clear, summarized version of external factors, acting as a pain point reliever by offering easy referencing during strategic planning and decision-making.

Economic factors

Dongguan's economic prosperity, a key driver for Dongguan Rural Commercial Bank, is closely tied to Guangdong Province's overall performance. In 2023, Guangdong's GDP reached a significant RMB 13.57 trillion, a 4.5% increase year-on-year, showcasing robust regional economic growth. This expansion fuels demand for loans and financial services, directly benefiting the bank's business volume.

The stability of this growth is crucial. Dongguan itself, a vital manufacturing hub, experienced a 4.5% GDP increase in the first three quarters of 2024, reaching RMB 773.13 billion. Such consistent expansion in industrial activity and consumer spending supports the bank's asset quality by reducing the likelihood of credit defaults and enhancing profitability.

The People's Bank of China's (PBOC) benchmark interest rate adjustments directly impact Dongguan Rural Commercial Bank's net interest margin (NIM), a key profitability metric. For instance, if the PBOC maintains a lower rate environment, the bank's NIM could contract, as the spread between lending and deposit rates narrows. This was a concern in early 2024 as global central banks, including the PBOC, navigated inflation pressures.

Conversely, an environment of rising interest rates, as seen in some global markets through 2023 and potentially continuing into 2024, can expand NIMs. However, this also raises borrowing costs for Dongguan Rural Commercial Bank's clients, potentially increasing the risk of loan defaults. The bank must carefully manage this interest rate sensitivity to maintain stable profitability.

Inflation directly impacts Dongguan Rural Commercial Bank by altering the real value of its assets and liabilities. For instance, if inflation in China averaged around 2.3% in 2023, the real return on fixed-rate loans or deposits diminishes, affecting profitability. This erosion of purchasing power can make it harder for both individuals and businesses to service their debts, potentially increasing non-performing loans.

Furthermore, shifts in inflation influence customer behavior. When inflation is high, consumers may reduce discretionary spending, impacting demand for certain loan products. Conversely, it can spur demand for wealth management services as individuals seek to protect their savings from devaluation, presenting opportunities for the bank to adapt its product offerings.

Credit Risk and Non-Performing Loans (NPLs)

The credit risk environment in Dongguan, a key manufacturing hub, directly impacts Dongguan Rural Commercial Bank. Trends in non-performing loans (NPLs) are a critical economic indicator. A rising NPL ratio signifies increased borrower defaults, potentially stemming from economic slowdowns or sector-specific distress.

For instance, if key export industries in Dongguan face reduced global demand in 2024 or 2025, this could translate to higher NPLs for the bank. This necessitates greater provisioning for potential losses, which directly affects capital adequacy and profitability. The bank's ability to effectively assess and recover these loans becomes paramount for its financial health.

- NPL Ratio Trends: Monitoring the trajectory of NPLs in Dongguan’s local economy is crucial.

- Economic Sensitivity: Downturns in manufacturing or trade can elevate NPLs, straining bank resources.

- Impact on Profitability: Increased provisioning for NPLs directly reduces a bank's net income and capital buffers.

- Risk Management Importance: Robust credit assessment and loan recovery strategies are vital for mitigating these economic risks.

Local Employment and Income Levels

Local employment and income levels in Dongguan are critical indicators for Dongguan Rural Commercial Bank. As of early 2024, Dongguan's unemployment rate hovered around 3.5%, a relatively stable figure that supports consistent loan repayment capabilities for its individual and small to medium-sized enterprise (SME) clients. Disposable income growth, while experiencing some moderation in late 2023 due to global economic headwinds, generally trended upwards, bolstering demand for the bank's consumer credit products and wealth management services.

The correlation between these economic factors and the bank's performance is direct. For instance, a robust job market, exemplified by Dongguan's manufacturing and technology sectors continuing to attract talent in 2024, translates into higher household incomes. This increased financial capacity directly benefits Dongguan Rural Commercial Bank through improved loan servicing and a greater propensity for savings and investment, thereby enhancing the bank's asset quality and profitability.

Conversely, any significant downturn in local employment or a stagnation in income growth could pose challenges. A rise in unemployment, even by a few percentage points, would likely lead to increased non-performing loans (NPLs) as individuals and businesses struggle to meet their financial obligations. This would necessitate higher provisions for bad debts, potentially impacting the bank's net income and capital adequacy ratios.

Key data points to consider for Dongguan Rural Commercial Bank include:

- Dongguan's average monthly wage in Q1 2024 was approximately ¥7,500, showing a 4% year-on-year increase.

- The city's manufacturing sector, a key employer, reported a 2.5% growth in output in the first half of 2024.

- Consumer spending, a direct reflection of disposable income, saw a 5% rise in retail sales in the first quarter of 2024.

- The SME sector, heavily reliant on local consumption and business activity, experienced a 3% increase in new business registrations in early 2024.

Dongguan's economic performance, intrinsically linked to Guangdong Province's robust growth, directly influences Dongguan Rural Commercial Bank. Guangdong's GDP reached RMB 13.57 trillion in 2023, a 4.5% increase, signaling a strong regional economy that fuels demand for financial services. Dongguan itself saw a 4.5% GDP increase in the first three quarters of 2024, reaching RMB 773.13 billion, demonstrating sustained industrial and consumer activity that supports the bank's loan portfolio and profitability.

Interest rate policies from the People's Bank of China (PBOC) significantly affect the bank's net interest margin. While lower rates can compress margins, as seen in early 2024 amidst inflation concerns, higher rates can expand them but also increase client borrowing costs and default risk. Inflation, averaging around 2.3% in China for 2023, erodes the real value of assets and can impact loan servicing, necessitating careful risk management.

The credit risk environment, marked by non-performing loan (NPL) ratios, is a critical economic factor. A downturn in Dongguan's key export industries, potentially due to reduced global demand in 2024-2025, could lead to higher NPLs, requiring increased provisions and impacting the bank's capital adequacy. Monitoring NPL trends and managing credit risk effectively are paramount for financial health.

Local employment and income levels in Dongguan directly correlate with the bank's performance. With an approximate unemployment rate of 3.5% in early 2024 and a 4% year-on-year increase in average monthly wages to ¥7,500 in Q1 2024, the bank benefits from stable loan repayment and increased demand for consumer credit. Growth in the manufacturing sector (2.5% output increase in H1 2024) and retail sales (5% rise in Q1 2024) further bolster household incomes and business activity, enhancing asset quality and profitability.

| Economic Indicator | Value/Trend (2023-2024) | Impact on Dongguan Rural Commercial Bank |

|---|---|---|

| Guangdong GDP Growth | 4.5% (2023) | Increased demand for financial services |

| Dongguan GDP Growth | 4.5% (Q1-Q3 2024) | Supports loan portfolio and profitability |

| PBOC Benchmark Rate | Stable/Navigating inflation | Affects Net Interest Margin (NIM) |

| China Inflation Rate | ~2.3% (2023) | Impacts real asset value, loan servicing |

| Dongguan Unemployment Rate | ~3.5% (Early 2024) | Supports loan repayment capacity |

| Dongguan Average Monthly Wage | ¥7,500 (Q1 2024, +4% YoY) | Boosts consumer credit demand and savings |

| Dongguan Manufacturing Output | +2.5% (H1 2024) | Enhances employment and income |

| Dongguan Retail Sales | +5% (Q1 2024) | Reflects disposable income and consumer spending |

Preview Before You Purchase

Dongguan Rural Commercial Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing the Dongguan Rural Commercial Bank's PESTLE analysis. This comprehensive report covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank's operations. You'll gain insights into market trends, regulatory landscapes, and competitive pressures.

Sociological factors

Dongguan's population is rapidly urbanizing, with over 80% now residing in urban areas as of 2024, significantly influencing financial product demand. This shift means a greater need for mortgages and consumer loans, as more people settle in cities and require financing for housing and daily expenses.

The aging demographic, with the proportion of residents aged 60 and above projected to reach 20% by 2025, also presents a key trend. This demographic will likely increase demand for wealth preservation services and retirement planning products, prompting Dongguan Rural Commercial Bank to adapt its financial solutions.

Consumer behavior in Dongguan is rapidly shifting towards digital banking, driven by the widespread adoption of smartphones and internet services. By early 2024, over 85% of Dongguan residents were estimated to be active internet users, with a significant portion utilizing mobile banking for daily transactions. This trend means Dongguan Rural Commercial Bank must prioritize user-friendly digital platforms to meet evolving customer expectations for seamless online and mobile experiences.

The growing financial literacy in Dongguan is a key sociological driver. As more residents understand financial concepts, the demand for sophisticated wealth management and investment products is increasing, presenting a significant opportunity for Dongguan Rural Commercial Bank.

For instance, a 2024 survey indicated that over 60% of urban Chinese adults now consider themselves financially literate, a notable rise from previous years. This trend suggests a receptive market for the bank's more complex offerings, but it also highlights the need for educational initiatives to ensure clients fully grasp these services.

Trust in Financial Institutions

Public trust is a bedrock for any financial institution, directly impacting how loyal customers remain and how stable a bank's deposits are. For Dongguan Rural Commercial Bank, this means that how people perceive its security, its openness, and its ethical behavior is paramount in deciding where they'll place their money. A 2024 survey indicated that 65% of Chinese consumers consider an institution's reputation for trustworthiness as a primary factor when selecting a bank.

Building and maintaining this trust is an ongoing effort. It requires consistently delivering reliable services and adhering to sound financial practices. When trust erodes, it can lead to significant shifts in customer behavior, impacting deposit growth and overall financial stability. For instance, in late 2023, a regional bank failure in another country saw a notable outflow of deposits from smaller institutions perceived as less secure, highlighting the sensitivity of public confidence.

- Customer Confidence: A recent report found that 70% of individuals would switch banks if they lost trust in its practices.

- Deposit Stability: Trust directly correlates with deposit stability; higher trust often means more stable and predictable deposit inflows.

- Reputation Management: Dongguan Rural Commercial Bank's investment in transparent communication and ethical operations is crucial for its long-term success.

Cultural Values and Savings Habits

Traditional Chinese cultural values deeply ingrained in the Dongguan region emphasize thrift and long-term financial security. This cultural predisposition directly supports a robust savings culture, providing Dongguan Rural Commercial Bank with a stable and loyal deposit base.

These deeply held values translate into consistent savings habits among the local population, directly benefiting financial institutions. For instance, data from the People's Bank of China indicated that household savings deposits in Guangdong province, where Dongguan is located, reached significant levels in late 2023 and early 2024, reflecting this cultural tendency.

Dongguan Rural Commercial Bank can leverage this by tailoring its product offerings and marketing campaigns to align with these cultural expectations. Understanding that prudence and future planning are paramount allows the bank to effectively promote savings accounts, wealth management products, and other financial instruments that resonate with the community's inherent financial ethos.

- Cultural Emphasis on Savings: Traditional Chinese values promote thrift and prudent financial management, fostering a strong savings culture.

- Stable Deposit Base: This cultural inclination provides Dongguan Rural Commercial Bank with a reliable and consistent source of funding through customer deposits.

- Product Development Alignment: The bank can design savings and investment products that directly appeal to these ingrained habits, enhancing customer engagement.

- Targeted Marketing Strategies: Marketing efforts can be optimized by acknowledging and reinforcing the cultural importance of financial security and long-term planning.

The increasing financial literacy in Dongguan, with over 60% of urban adults identifying as financially literate in 2024, fuels demand for more complex wealth management products. This trend necessitates that Dongguan Rural Commercial Bank enhance its offerings and educational support for these sophisticated financial instruments.

Public trust remains a critical factor, with 65% of Chinese consumers prioritizing trustworthiness when choosing a bank, as per a 2024 survey. Maintaining this trust through transparent communication and ethical operations is vital for Dongguan Rural Commercial Bank to ensure deposit stability and customer loyalty.

Traditional Chinese values emphasizing thrift and long-term security contribute to a strong savings culture in Dongguan. This cultural predisposition provides Dongguan Rural Commercial Bank with a stable deposit base, allowing for the development of products that align with these ingrained financial habits.

| Sociological Factor | 2024/2025 Data/Trend | Impact on Dongguan Rural Commercial Bank |

|---|---|---|

| Urbanization | Over 80% urban population in 2024 | Increased demand for mortgages and consumer loans |

| Aging Demographic | 20% projected aged 60+ by 2025 | Growing need for wealth preservation and retirement planning services |

| Digital Adoption | Over 85% internet users in 2024, high mobile banking usage | Prioritization of user-friendly digital platforms essential |

| Financial Literacy | 60%+ urban adults financially literate (2024) | Opportunity for sophisticated wealth management products; need for client education |

| Public Trust | 65% consumers prioritize trustworthiness (2024) | Crucial for deposit stability and customer loyalty; requires transparent operations |

| Cultural Values (Thrift) | Strong savings culture evident | Provides a stable deposit base; opportunity to align products with saving habits |

Technological factors

The banking sector is undergoing a significant digital overhaul, pushing Dongguan Rural Commercial Bank to prioritize investments in its online and mobile platforms. This ensures customers can conveniently access services like transactions, loan applications, and account management from anywhere.

By embracing these digital advancements, the bank can elevate its customer experience and streamline operations. For instance, as of Q1 2024, mobile banking transactions accounted for over 60% of all retail banking transactions in China, highlighting the critical importance of robust mobile offerings.

Staying competitive requires Dongguan Rural Commercial Bank to match the digital capabilities of larger institutions. This means not just offering digital services, but ensuring they are user-friendly and efficient to retain and attract customers in an increasingly digital-first market.

The financial technology, or FinTech, landscape is rapidly evolving, presenting Dongguan Rural Commercial Bank with both challenges and opportunities. FinTech firms are increasingly offering specialized services like digital payments and online lending, directly competing with traditional banks. For instance, by the end of 2024, China's digital payment market, dominated by players like Alipay and WeChat Pay, was projected to reach over $30 trillion, highlighting the scale of this disruption.

This competitive pressure necessitates a strategic response from Dongguan Rural Commercial Bank. The bank must evaluate whether to invest in developing its own FinTech capabilities, forming strategic partnerships with existing FinTech companies, or concentrating on its established strengths while adopting new technologies. Many banks are opting for a hybrid approach, integrating FinTech solutions to enhance customer experience and operational efficiency.

The increasing reliance on digital platforms for banking services at Dongguan Rural Commercial Bank exposes it to significant cybersecurity threats. Reports from 2024 indicate a global surge in cyberattacks targeting financial institutions, with losses often running into millions. This necessitates substantial investment in advanced cybersecurity measures to prevent data breaches and protect sensitive customer information.

Maintaining customer trust is intrinsically linked to data privacy. In 2025, regulatory bodies are tightening data protection laws, requiring banks to demonstrate stringent compliance. Dongguan Rural Commercial Bank must ensure its data handling practices align with these evolving legal frameworks, such as the Personal Information Protection Law (PIPL) in China, to avoid penalties and reputational damage.

Adoption of AI and Big Data Analytics

The adoption of artificial intelligence (AI) and big data analytics presents a transformative opportunity for Dongguan Rural Commercial Bank. These technologies can significantly improve credit risk assessment by analyzing vast datasets to identify patterns and predict defaults more accurately. For instance, in 2024, the global AI in banking market was projected to reach over $20 billion, highlighting the industry's commitment to these advancements.

Leveraging AI and big data allows for the personalization of financial products and services, catering to individual customer needs and preferences. This leads to enhanced customer engagement and loyalty. Furthermore, these tools are crucial for sophisticated fraud detection, safeguarding both the bank and its customers. By automating routine tasks, operational efficiency can be dramatically boosted, freeing up human resources for more complex strategic initiatives.

- Enhanced Credit Risk Assessment: AI algorithms can process more variables than traditional methods, leading to more precise risk profiling.

- Personalized Financial Products: Big data analytics enables tailored product offerings, increasing customer satisfaction and uptake.

- Fraud Detection: Real-time analysis of transactions by AI can identify and prevent fraudulent activities more effectively.

- Operational Efficiency: Automation of tasks like data entry and customer service inquiries through AI can reduce operational costs.

Infrastructure for Digital Payments and Connectivity

The digital payment and connectivity infrastructure in Dongguan is a critical technological factor for Dongguan Rural Commercial Bank. Widespread internet access and robust mobile network coverage are essential for the successful adoption and expansion of the bank's digital banking services. As of late 2024, Dongguan boasts a significant penetration rate for both mobile internet users and broadband subscribers, with over 90% of the population having access to mobile data services, facilitating seamless transactions for customers.

The bank's digital growth hinges on this foundational technological environment. Ensuring reliable connectivity for its digital channels, including mobile banking apps and online payment platforms, is paramount. In 2024, the Chinese government continued to heavily invest in 5G network expansion, with Dongguan being a key beneficiary, further enhancing the speed and stability of digital transactions for Dongguan Rural Commercial Bank's customers.

Key aspects of this infrastructure include:

- Mobile Network Coverage: High penetration of 4G and expanding 5G networks across urban and rural areas of Dongguan.

- Internet Accessibility: Widespread availability of broadband internet in households and public spaces.

- Digital Payment Adoption: Growing consumer familiarity and usage of mobile payment solutions, supported by the underlying infrastructure.

- E-commerce Growth: The strong performance of e-commerce in the region, driven by digital infrastructure, creates demand for integrated digital payment solutions from banks like Dongguan Rural Commercial Bank.

The rapid evolution of FinTech presents both competitive challenges and partnership opportunities for Dongguan Rural Commercial Bank. By the end of 2024, China's digital payment market was projected to exceed $30 trillion, underscoring the scale of digital financial services.

Investing in AI and big data analytics offers significant advantages for Dongguan Rural Commercial Bank, particularly in enhancing credit risk assessment and personalizing customer offerings. The global AI in banking market was projected to surpass $20 billion in 2024, reflecting industry-wide adoption.

Robust digital payment and connectivity infrastructure is crucial for the bank's growth. Dongguan's high mobile internet penetration, exceeding 90% by late 2024, coupled with 5G network expansion, supports seamless digital transactions.

| Technological Factor | Impact on Dongguan Rural Commercial Bank | Supporting Data (2024/2025) |

|---|---|---|

| FinTech Evolution | Increased competition, need for digital service integration or partnerships. | China's digital payment market projected over $30 trillion by end of 2024. |

| AI & Big Data | Improved risk assessment, personalized services, fraud detection, operational efficiency. | Global AI in banking market projected over $20 billion in 2024. |

| Digital Infrastructure | Enables mobile and online banking services, transaction speed and reliability. | Over 90% mobile internet penetration in Dongguan by late 2024; ongoing 5G expansion. |

Legal factors

Dongguan Rural Commercial Bank navigates a stringent regulatory environment dictated by the People's Bank of China (PBOC) and the National Financial Regulatory Administration (NFRA). These bodies enforce critical rules covering capital sufficiency, loan quality, and internal controls, aiming to maintain the health of China's financial sector.

Key regulations like the Capital Adequacy Ratio (CAR) requirements, which as of early 2024 for commercial banks generally aim for a minimum of 10.5% (with Pillar 2 and 3 adding buffers), directly impact the bank's lending capacity and risk management strategies. Adherence to these mandates is crucial for operational stability and market confidence.

Dongguan Rural Commercial Bank, like all financial institutions, must adhere to stringent Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations. These laws mandate comprehensive customer due diligence, vigilant transaction monitoring, and prompt reporting of suspicious activities to authorities. Failure to comply can result in substantial fines; for instance, in 2023, global financial institutions faced billions in AML-related penalties, underscoring the critical need for robust compliance frameworks.

Maintaining compliance with AML/CTF laws is paramount for Dongguan Rural Commercial Bank to prevent its services from being exploited for illicit financial activities and to steer clear of severe legal and financial repercussions. This necessitates continuous investment in advanced compliance technology and ongoing, thorough training for all bank personnel to ensure they are equipped to identify and report potential threats effectively.

China's data protection framework is rapidly evolving, with the Personal Information Protection Law (PIPL), effective November 1, 2021, setting a high bar. This legislation significantly impacts how Dongguan Rural Commercial Bank handles customer data, requiring explicit consent for collection and strict protocols for storage, processing, and cross-border transfers.

Compliance with PIPL and other related regulations is not just a legal obligation but a critical factor for maintaining customer trust and safeguarding the bank's reputation. Failure to adhere could result in substantial fines; for instance, PIPL allows for penalties up to 5% of annual turnover or 50 million yuan for violations, alongside potential business suspension.

Consumer Protection Laws for Financial Services

Consumer protection laws significantly shape Dongguan Rural Commercial Bank's operations, dictating how it markets, sells, and services financial products. These regulations ensure fair lending practices, mandate clear disclosures for all offerings, and establish robust systems for addressing customer grievances. For instance, in 2024, China's financial regulators continued to emphasize consumer rights, with the People's Bank of China and the China Banking and Insurance Regulatory Commission issuing updated guidelines on complaint resolution for financial institutions.

Compliance with these consumer protection statutes is paramount for Dongguan Rural Commercial Bank. It not only guarantees equitable treatment for all customers but also serves to proactively mitigate the risk of costly legal disputes. Failure to adhere to these frameworks can lead to substantial fines and reputational damage, impacting trust and customer retention.

- Fair Lending Practices: Regulations prohibit discriminatory lending based on factors like gender or ethnicity, ensuring access to credit is equitable.

- Disclosure Requirements: Banks must clearly communicate terms, fees, and risks associated with financial products, preventing deceptive marketing.

- Complaint Resolution Mechanisms: Formal processes are required for handling customer complaints efficiently and transparently.

- Data Privacy: Laws govern how customer financial data is collected, stored, and used, protecting sensitive personal information.

Loan Recovery and Bankruptcy Laws

The legal framework governing loan recovery and bankruptcy in China, including regulations relevant to Dongguan Rural Commercial Bank, directly influences its capacity to manage credit risk. Efficiently navigating these laws is paramount for mitigating losses from non-performing loans and recovering outstanding debts from defaulting borrowers.

China's legal system provides mechanisms for debt enforcement and restructuring. For instance, the Civil Procedure Law outlines procedures for enforcing court judgments, which can include seizing assets. In 2023, China's Supreme People's Court reported a significant volume of civil and commercial cases, underscoring the active use of legal avenues for debt recovery.

- Loan Recovery Mechanisms: The effectiveness of legal tools for asset seizure and collateral liquidation is critical for banks like Dongguan Rural Commercial Bank.

- Bankruptcy Law Impact: The ongoing reforms and application of China's Enterprise Bankruptcy Law and Individual Bankruptcy Pilot Program in certain cities directly affect the recovery rates from insolvent borrowers.

- Regulatory Enforcement: Strict enforcement of contract law and creditor rights by judicial bodies is essential for maintaining the financial health of lending institutions.

- Credit Risk Mitigation: A robust legal environment for debt collection and bankruptcy resolution allows banks to better manage their non-performing asset ratios.

Dongguan Rural Commercial Bank operates under a comprehensive legal framework that mandates strict adherence to capital adequacy ratios, with general minimums for commercial banks around 10.5% as of early 2024. The bank must also comply with robust Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations, which require diligent customer verification and transaction monitoring to avoid penalties, as seen with global institutions facing billions in fines in 2023.

Furthermore, China's evolving data protection laws, notably the Personal Information Protection Law (PIPL), impose strict protocols on how customer data is handled, with potential fines up to 5% of annual turnover for violations. Consumer protection laws also dictate fair lending practices, clear product disclosures, and effective complaint resolution, with regulators emphasizing consumer rights in 2024. The legal environment for loan recovery and bankruptcy, including mechanisms for asset seizure and the impact of bankruptcy law reforms, is critical for managing credit risk and maintaining asset quality.

Environmental factors

China's commitment to green development is intensifying, with the government actively pushing for green finance policies. These policies aim to steer capital towards eco-friendly ventures and away from polluting sectors, impacting lending decisions across the financial industry.

Dongguan Rural Commercial Bank must navigate this evolving regulatory landscape by integrating green principles into its lending. This includes developing specific green credit products, such as loans for renewable energy or sustainable agriculture, and diligently assessing the environmental footprint of its existing and potential loan portfolio to ensure compliance and capitalize on emerging opportunities.

Growing global awareness and stricter regulatory frameworks are increasingly pushing financial institutions like Dongguan Rural Commercial Bank to integrate Environmental, Social, and Governance (ESG) considerations into their lending and investment strategies. This shift is not just about corporate responsibility; it's becoming a critical component of risk management and long-term value creation.

By embedding ESG criteria into credit assessments, the bank can proactively identify and mitigate potential risks stemming from environmental damage or social issues within its clients' operations. For instance, a client with poor waste management practices might face future regulatory fines or reputational damage, impacting their ability to repay loans. In 2024, the China Banking and Insurance Regulatory Commission (CBIRC) continued to emphasize green finance, encouraging banks to develop ESG rating systems for their loan portfolios, with reports indicating a significant increase in green bond issuance by Chinese banks in the first half of 2024.

Dongguan Rural Commercial Bank faces significant environmental risks impacting its loan portfolio. Physical risks, such as increased frequency and intensity of extreme weather events like typhoons and floods, directly threaten the operational stability and repayment capacity of local businesses, particularly those in agriculture and manufacturing which are vital to Dongguan's economy. For instance, the Pearl River Delta region, where Dongguan is located, is highly susceptible to rising sea levels and more severe storm surges, potentially causing substantial damage to infrastructure and disrupting supply chains for borrowers.

Transition risks also pose a considerable challenge. As global and national policies increasingly focus on decarbonization, industries heavily reliant on fossil fuels or with high carbon footprints, prevalent in Dongguan's manufacturing sector, may experience reduced demand, increased operating costs due to carbon pricing, or face stricter regulatory requirements. This shift could impair the creditworthiness of businesses in sectors like electronics manufacturing or textiles, which are significant components of the bank's lending activities.

To mitigate these impacts, the bank must proactively assess and manage climate-related risks across its entire loan book. This involves understanding the specific vulnerabilities of different sectors and individual borrowers to both physical and transition risks. For example, a 2024 report by the China Meteorological Administration highlighted a 15% increase in extreme rainfall events in southern China over the past decade, a trend that directly correlates with increased flood risk for businesses located in low-lying industrial zones within Dongguan.

Resource Scarcity and Operational Sustainability

Concerns about resource scarcity, particularly water and energy, pose a significant challenge. For Dongguan Rural Commercial Bank, this can translate into increased operational expenses and potential disruptions to business continuity, impacting both the bank and its clientele. For instance, rising energy costs in China, which saw significant fluctuations in 2024 due to global supply chain issues and domestic demand, directly affect the bank's overheads and the profitability of its business clients.

The bank has an opportunity to foster environmental sustainability. By implementing energy-efficient practices within its own branches, such as upgrading to LED lighting and optimizing HVAC systems, the bank can reduce its carbon footprint and operational costs. In 2024, many financial institutions globally reported savings of 10-15% on energy bills after implementing such upgrades.

Furthermore, Dongguan Rural Commercial Bank can actively promote resource-efficient solutions among its customers. This could involve offering preferential loan terms for green investments or providing advisory services on energy and water conservation for small and medium-sized enterprises (SMEs), a key segment for rural commercial banks.

- Rising energy costs in China impacted operational expenses in 2024.

- Energy-efficient upgrades can yield significant operational cost savings for financial institutions.

- Promoting green investments can support both environmental goals and client business growth.

- Water scarcity concerns can affect the agricultural sector, a key client base for rural banks.

Public Pressure for Environmentally Responsible Banking

Public and stakeholder expectations for banks to operate responsibly concerning the environment are on the rise. This growing demand directly impacts a bank's reputation, influencing its ability to attract and retain customers and investors who prioritize sustainability. Dongguan Rural Commercial Bank, like its peers, faces scrutiny regarding its environmental footprint.

Banks that actively adopt and communicate sustainable practices can significantly boost their public image. For instance, in 2024, the global sustainable finance market saw continued expansion, with green bond issuance reaching record levels, indicating a strong investor appetite for environmentally sound investments. This trend suggests that transparent reporting on environmental performance, such as reducing carbon emissions from operations or supporting green projects, can be a key differentiator.

The pressure extends beyond customer perception. Regulatory bodies and international agreements are increasingly incorporating environmental considerations into financial sector oversight. For example, the People's Bank of China has been actively promoting green finance initiatives, encouraging financial institutions to integrate environmental risk management into their lending and investment decisions. This regulatory push, coupled with public sentiment, creates a compelling case for Dongguan Rural Commercial Bank to enhance its environmental stewardship.

Key areas of public and stakeholder focus for banks regarding environmental responsibility include:

- Carbon Footprint Reduction: Efforts to minimize direct and indirect greenhouse gas emissions from the bank's operations and financed activities.

- Sustainable Lending and Investment: Directing capital towards environmentally friendly projects and businesses, such as renewable energy or eco-friendly infrastructure.

- Environmental Risk Management: Integrating climate-related risks and other environmental factors into the bank's risk assessment and decision-making processes.

- Transparency and Reporting: Clearly communicating the bank's environmental policies, performance metrics, and progress towards sustainability goals.

China's dedication to environmental protection is a significant factor influencing Dongguan Rural Commercial Bank. The government's push for green finance means the bank needs to align its lending practices with ecological sustainability, impacting its loan portfolio and product development.

The bank must actively manage both physical risks like extreme weather events, which can damage client assets, and transition risks as industries shift towards lower-carbon operations. For example, a 2024 report indicated a 15% rise in extreme rainfall in southern China, increasing flood risks for businesses in Dongguan.

Resource scarcity, particularly concerning water and energy, presents operational challenges and affects client profitability, as seen with energy cost fluctuations in China during 2024. Implementing energy-efficient practices internally can lead to substantial cost savings, with global institutions reporting 10-15% reductions in energy bills.

Public and stakeholder expectations for environmental responsibility are growing, influencing the bank's reputation and ability to attract investment. In 2024, the global sustainable finance market expanded significantly, highlighting investor preference for environmentally sound investments.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Dongguan Rural Commercial Bank is grounded in data from official Chinese government statistics bureaus, reports from the People's Bank of China, and analyses from leading financial institutions and market research firms specializing in the Chinese banking sector. This comprehensive approach ensures all insights are derived from credible, up-to-date information.