Drax Group plc Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Drax Group plc Bundle

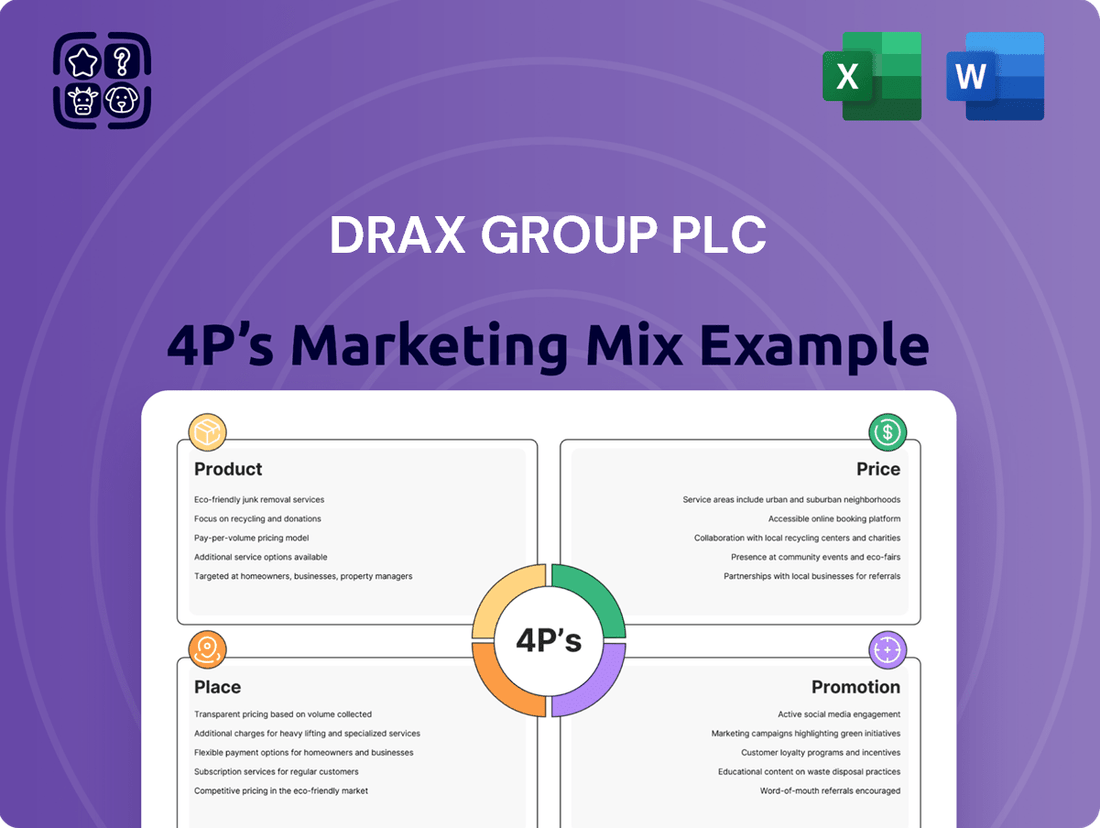

Drax Group plc's marketing mix is a complex interplay of sustainable biomass power generation (Product), competitive energy pricing (Price), strategic plant locations and supply chains (Place), and robust stakeholder communication (Promotion). Understanding how these elements synergize is crucial for grasping their market position.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Drax Group plc's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into the energy sector.

Product

Drax Group plc's core offering is the generation of electricity, with a strong emphasis on sustainable biomass. This positions them as a vital player in the UK's renewable energy landscape. In 2024, Drax Power Station stood out as the largest single contributor of renewable power across the nation, underscoring its importance for the UK's energy security.

The company's renewable power assets are designed for flexibility and dispatchability. This means Drax can reliably supply electricity when needed, providing essential support to the grid, particularly during periods when variable sources like wind and solar power are less productive. This capability ensures a consistent power supply for millions of homes and businesses.

Drax's sustainable biomass pellets are a core product, fueling its own power generation and sold externally. In 2024, the company produced 4 million metric tons of these pellets, marking a 5% rise from the previous year, bolstered by the expansion of its Aliceville facility.

The company's commitment to sustainability is evident in its strict due diligence for biomass sourcing, adhering to legislation and certifications like the Sustainable Biomass Program (SBP).

Bioenergy with Carbon Capture and Storage (BECCS) is a cornerstone of Drax's future strategy, targeting carbon-negative operations. Drax aims to capture over 20 million tonnes of CO2 annually through its BECCS developments in the UK and abroad.

The UK BECCS project at Drax Power Station is positioned as a leading global carbon dioxide removal effort. Specifically, plans are in place to capture up to 4 million tonnes of CO2 per year from each of the converted units at the station.

Carbon Removal Credits (CDR)

Drax Group plc's Carbon Removal Credits (CDR) represent a forward-thinking product within its marketing mix, leveraging its pioneering role in Bioenergy with Carbon Capture and Storage (BECCS). These credits signify the verified, permanent removal of CO2 from the atmosphere, positioning Drax as a key player in the burgeoning voluntary carbon market. The company has already demonstrated market traction, notably securing agreements with major corporations such as Microsoft, indicating a strong demand for its CDR offerings.

The strategic establishment of Elimini, Drax's US-based subsidiary, underscores the group's commitment to scaling its carbon removal capabilities and marketing these credits globally. Elimini is designed to spearhead efforts in delivering megaton-scale carbon removals, a crucial step in meeting the ambitious climate targets set by various industries and governments. This focus on scale and market presence highlights the product's potential for significant revenue generation and environmental impact.

- Product: Carbon Removal Credits (CDR) generated through BECCS technology.

- Market: Voluntary carbon market, targeting corporations seeking to offset emissions.

- Key Partnerships: Secured deals with major entities like Microsoft.

- Strategic Expansion: US subsidiary Elimini to drive global megaton-scale carbon removals and credit marketing.

Emerging Bioenergy Solutions

Drax Group is actively diversifying its sustainable biomass applications beyond traditional electricity generation, focusing on emerging bioenergy solutions like Sustainable Aviation Fuel (SAF) and biochar. This strategic pivot aims to unlock new revenue streams and capitalize on the growing demand for decarbonization technologies.

A significant development is the agreement for heads of terms to potentially supply 1 million tonnes per year of sustainable biomass for SAF production, commencing in 2029. This multi-year deal underscores Drax's commitment to these high-value, environmentally focused markets.

- Product Diversification: Expanding biomass use into SAF and biochar.

- Market Opportunity: Targeting high-value, decarbonization-focused products.

- SAF Agreement: Heads of terms for 1 million tonnes/year from 2029.

- Strategic Growth: Positioning for future demand in sustainable fuels and materials.

Drax's product portfolio centers on renewable electricity generation, primarily from biomass. A key development in 2024 was the company's position as the UK's largest single contributor of renewable power, highlighting its critical role in national energy security. This dispatchable renewable power ensures grid stability, especially when intermittent sources are less productive.

The company also produces and sells sustainable biomass pellets, a crucial input for its power stations. In 2024, Drax's pellet production reached 4 million metric tons, a 5% increase year-on-year, partly due to the expansion of its Aliceville facility. This demonstrates a growing capacity to meet internal and external demand for its core product.

Drax is also pioneering Bioenergy with Carbon Capture and Storage (BECCS), aiming for carbon-negative operations. The UK BECCS project at Drax Power Station is designed to capture up to 4 million tonnes of CO2 annually per converted unit, positioning it as a significant global carbon dioxide removal initiative.

Furthermore, Drax is diversifying its product offerings into areas like Sustainable Aviation Fuel (SAF) and biochar. The company has secured heads of terms for a potential supply of 1 million tonnes of sustainable biomass per year for SAF production starting in 2029, signaling a strategic move into high-value, decarbonization-focused markets.

| Product Segment | Key Metric/Development | Year | Status/Outlook |

|---|---|---|---|

| Renewable Electricity | Largest single contributor of renewable power in the UK | 2024 | Key to UK energy security |

| Sustainable Biomass Pellets | 4 million metric tons produced | 2024 | 5% increase YoY, Aliceville expansion |

| BECCS (Carbon Removal) | Targeting 4 million tonnes CO2 capture/year per unit | Ongoing | Pioneering global carbon dioxide removal |

| SAF & Biochar | Heads of terms for 1 million tonnes/year biomass for SAF | Commencing 2029 | Strategic diversification into new markets |

What is included in the product

This analysis provides a comprehensive overview of Drax Group plc's marketing mix, detailing their Product offerings, Pricing strategies, Place (distribution) channels, and Promotion activities.

It's designed for professionals seeking a clear understanding of Drax's market positioning and marketing efforts.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of understanding Drax Group plc's market position.

Provides a clear, concise overview of Drax Group plc's 4Ps, resolving the challenge of communicating intricate marketing plans to diverse audiences.

Place

The UK National Grid serves as Drax Group's primary distribution channel, enabling the company to deliver electricity generated from its diverse power stations. This vital connection ensures Drax's output reaches consumers across the nation, playing a crucial role in the UK's energy infrastructure.

Drax's flagship facility, the Drax Power Station in North Yorkshire, is a cornerstone of this distribution. Its successful conversion to sustainable biomass provides dispatchable renewable power, a critical component for grid stability and decarbonization efforts. This strategic shift highlights Drax's commitment to a cleaner energy future.

In 2024, Drax's contribution to the UK's energy landscape was significant. The company supplied approximately 10% of the nation's renewable power and over 5% of its total electricity, underscoring its importance in meeting both environmental targets and energy demand.

Drax's North American pellet production facilities in the United States and Canada are crucial for its biomass power generation strategy. These sites are vital for supplying the high-quality wood pellets needed for its UK operations. The company achieved a significant milestone, reporting record pellet production in the first half of 2025, a 5% increase over the same period in 2024.

Drax manages a vast global biomass supply chain, focusing on sustainable woody biomass sourced from forestry residues and by-products. This complex network is crucial for its operations, ensuring the efficient transport of pellets, notably from North America to the UK. In 2023, Drax reported sourcing approximately 7.7 million tonnes of biomass, with a significant portion originating from North America, underscoring the scale and logistical demands of their supply chain.

The company places a strong emphasis on sustainability, implementing rigorous due diligence processes with its suppliers. This commitment ensures that the biomass procured meets stringent environmental standards, a critical factor for Drax's renewable energy generation. Their efforts in supply chain optimization are vital for maintaining a consistent and responsible flow of fuel, directly impacting operational efficiency and environmental credentials.

International BECCS Project Sites

Drax Group is strategically expanding its global footprint for Bioenergy with Carbon Capture and Storage (BECCS) operations, moving beyond its UK base. The company is particularly focused on developing project sites in the US South, recognizing the region's potential for biomass supply and established infrastructure.

This international expansion represents a significant evolution of Drax's 'Place' strategy within its marketing mix. Preliminary studies for its inaugural international BECCS project commenced in 2022, signaling a proactive approach to global market penetration.

- US South Focus: Drax is prioritizing the US South for its initial international BECCS developments.

- Construction Timeline: Construction for its first international BECCS project is slated to begin in 2025.

- Operational Target: Commercial operations for this international venture are targeted to commence in 2028.

Direct Sales to Industrial & Commercial Customers

Drax Group plc's direct sales to Industrial & Commercial (I&C) customers represent a key component of its marketing mix, focusing on providing tailored energy solutions and supporting decarbonization efforts. While Drax divested its Opus SME customer base in late 2024, it continues to directly engage with larger industrial and commercial clients.

This direct channel allows Drax to offer a more specialized approach, addressing the unique energy requirements and sustainability goals of these businesses. The strategy prioritizes building strong relationships and delivering value beyond simple energy supply, aiming to be a partner in their transition to lower-carbon operations.

- Focused I&C Strategy: Post-Opus divestment, Drax concentrates its direct sales efforts on the I&C sector.

- Decarbonization Support: The direct sales model emphasizes assisting I&C customers with their decarbonization objectives.

- Tailored Energy Solutions: Drax provides customized energy offerings to meet the specific needs of industrial and commercial clients.

Drax's 'Place' strategy encompasses its UK distribution via National Grid and its global biomass supply chain, primarily from North America to the UK. The company is strategically expanding its Bioenergy with Carbon Capture and Storage (BECCS) operations, with a focus on the US South for new project developments. This international push signifies a broadening of its operational footprint and market reach.

| Location | Key Activity | 2024/2025 Data Point |

|---|---|---|

| UK | Electricity Distribution | Supplied ~10% of UK renewable power |

| North America (US/Canada) | Biomass Pellet Production | Record pellet production in H1 2025, up 5% vs H1 2024 |

| US South | BECCS Project Development | Construction for first international BECCS project slated for 2025 |

Same Document Delivered

Drax Group plc 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Drax Group plc 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion in detail. You're viewing the exact version of the analysis you'll receive—fully complete, ready to use.

Promotion

Drax Group plc champions its sustainability leadership, striving to be climate, nature, and people positive. This commitment is underscored by an ambitious goal to reach net-zero emissions across its entire value chain by 2040, a significant target in the energy sector's transition.

In March 2025, Drax unveiled a robust new sustainability framework, a product of collaboration with scientific experts, academics, and non-governmental organizations. This framework outlines 26 specific, time-bound targets, solidifying Drax's proactive stance and leadership in driving the energy transition forward.

Drax Group plc's advocacy for UK energy security is a cornerstone of its marketing, emphasizing its role in providing reliable, dispatchable renewable power. This is particularly crucial during peak demand or when intermittent sources like wind and solar are less productive. For instance, in 2023, Drax's biomass generation provided significant capacity, contributing to grid stability.

The company's strong push for Bioenergy with Carbon Capture and Storage (BECCS) technology is framed as essential for the UK's net-zero targets. Drax actively engages with the UK government, advocating for supportive policy frameworks and subsidy agreements to enable BECCS deployment. This strategic positioning highlights Drax's national importance in the decarbonization agenda.

Drax Group plc prioritizes investor communications and transparency, a key element in its marketing mix. The company provides regular financial reports, webcast presentations, and investor updates to its audience of financially-literate decision-makers. This commitment ensures stakeholders are well-informed about Drax's operational and financial standing.

Dissemination of annual and half-year results, alongside announcements regarding dividends and share buybacks, is a core practice. For instance, Drax's 2023 full-year results reported a revenue of £2.7 billion, demonstrating its robust financial performance. These communications are strategically crafted to foster investor confidence and facilitate capital attraction.

Community Engagement and Green Skills Development

Drax Group plc actively cultivates community engagement and fosters green skills development, highlighting its commitment to social impact. The company supports these areas through the Drax Foundation and its Community Fund, with a particular focus on STEM education and training for green jobs. This strategic approach aims to build positive relationships within communities, attract a future workforce skilled in sustainability, and solidify its reputation for corporate social responsibility.

In 2024 alone, the Drax Foundation demonstrated its commitment by providing £3.6 million in charitable giving. These funds were directed towards initiatives that align with climate action, nature conservation, and positive societal impact.

- Community Investment: Drax Foundation contributed £3.6 million in 2024 to climate, nature, and people-positive projects.

- Talent Pipeline: Investments in STEM and green skills training aim to attract and develop future employees.

- Social Responsibility: These initiatives underscore Drax's dedication to being a responsible corporate citizen.

Strategic Partnerships and Market Development

Drax Group plc actively cultivates future growth and innovation by announcing strategic partnerships. For instance, a memorandum of understanding with Respira aims to secure carbon removal credits, while heads of terms with Pathway Energy focus on securing sustainable aviation fuel (SAF) biomass supply. These collaborations underscore Drax's forward-thinking strategy and its commitment to developing new markets for its biomass and carbon removal offerings.

These strategic alliances are crucial for Drax's market development, particularly in the burgeoning carbon capture and SAF sectors. By securing key supply chains and potential off-takers, Drax is positioning itself to capitalize on the increasing demand for low-carbon solutions. For example, the global carbon capture, utilization, and storage (CCUS) market is projected to grow significantly, with estimates suggesting it could reach hundreds of billions of dollars by the end of the decade, highlighting the potential of these partnerships.

- Strategic Partnerships: Memorandum of Understanding with Respira for carbon removal credits.

- Market Development: Heads of Terms with Pathway Energy for SAF biomass supply.

- Future Growth: Focus on innovation in biomass products and carbon removal services.

- Industry Trends: Alignment with the expanding global demand for low-carbon solutions.

Drax's promotional efforts center on its sustainability leadership and role in UK energy security, highlighting its commitment to being climate, nature, and people positive. The company actively advocates for policies supporting Bioenergy with Carbon Capture and Storage (BECCS), positioning it as vital for the UK's net-zero goals.

Investor relations are a key promotional channel, with regular financial reporting and presentations designed to build confidence and attract capital. For instance, the company reported £2.7 billion in revenue for 2023, demonstrating financial strength.

Community engagement and talent development are promoted through the Drax Foundation, which provided £3.6 million in charitable giving in 2024. These initiatives underscore Drax's dedication to social responsibility and building a skilled workforce for the future.

Strategic partnerships, such as those with Respira for carbon removal credits and Pathway Energy for SAF biomass, are promoted to showcase innovation and market development in low-carbon solutions.

| Promotional Focus | Key Initiatives | Supporting Data/Examples |

|---|---|---|

| Sustainability Leadership | Net-zero by 2040, new sustainability framework (March 2025) | 26 specific, time-bound targets in framework |

| UK Energy Security | Advocacy for dispatchable renewable power, BECCS | Biomass generation contributed to grid stability in 2023 |

| Investor Relations | Financial reports, webcast presentations | £2.7 billion revenue (2023 full-year results) |

| Community & Talent | Drax Foundation, STEM education | £3.6 million charitable giving (2024) |

| Innovation & Growth | Strategic partnerships (Respira, Pathway Energy) | Focus on carbon removal credits and SAF biomass supply |

Price

Drax's revenue and profitability are heavily tied to UK Government Contracts for Difference (CfD) agreements, which secure prices for its renewable energy output. These agreements are a cornerstone of their pricing strategy.

In early 2025, Drax secured a heads of terms agreement for a new low-carbon dispatchable CfD. This deal is set to support operations at Drax Power Station from April 2027 to March 2031, underscoring the government's role in their pricing structure.

This crucial CfD agreement is vital for Drax's long-term financial stability. It provides the certainty needed for continued investment, particularly in their Bioenergy with Carbon Capture and Storage (BECCS) projects, directly impacting their future revenue streams.

Drax's financial results are closely tied to the fluctuations in UK wholesale electricity prices, a key driver of its revenue. For instance, the company reported a profit drop in the first half of 2025 compared to the same period in 2024, with lower wholesale energy prices identified as a contributing factor.

Looking ahead, market analysts are projecting a continued downward trend in wholesale prices throughout 2025. This forecast directly influences Drax's revenue expectations and strategic planning for the upcoming fiscal year.

The Electricity Generator Levy (EGL), a UK government measure active from January 2023 to March 2028, directly affects Drax's financial performance, specifically its adjusted EBITDA. This levy targets revenue from certain biomass and run-of-river hydro facilities.

For Drax, the EGL represented a significant financial impact, totaling £205 million in 2023. This figure decreased to £161 million in 2024, indicating a reduction in the levy's burden on the company's earnings for that period.

Capital Allocation and Shareholder Returns

Drax Group plc maintains a strategic approach to capital allocation, carefully balancing investments aimed at future growth with direct returns to its shareholders. This commitment is evident through its consistent dividend payouts and active share buyback initiatives.

The company's dedication to shareholder returns is underscored by its 2024 financial performance. Drax proposed a final dividend of 15.6 pence per share, bringing the total dividend for the full year to 26.0 pence per share. This reflects a tangible commitment to rewarding investors.

Further demonstrating this commitment, a £300 million share buyback program was initiated in August 2024. By July 2025, approximately £272 million of this program had been completed, actively reducing the number of outstanding shares and thereby enhancing shareholder value.

- Disciplined Capital Allocation: Balancing growth investments with shareholder returns.

- 2024 Dividend: Proposed final dividend of 15.6 pence per share, reaching 26.0 pence for the full year.

- Share Buyback Program: £300 million initiated in August 2024, with £272 million completed by July 2025.

Valuation of Carbon Removal Credits

The potential to generate and sell carbon dioxide removal (CDR) credits from Drax's Bioenergy with Carbon Capture and Storage (BECCS) projects offers a substantial new revenue avenue, directly impacting its long-term pricing strategies for electricity generated from these facilities. This emerging market for verified carbon removals is gaining traction, with Drax having already secured agreements to supply CDR credits, demonstrating a clear market appetite and willingness to pay for genuine carbon removal. The economic viability of future BECCS investments by Drax hinges significantly on the valuation and sustained market demand for these credits.

The pricing of these CDR credits is still evolving, but initial market indications provide a benchmark. For instance, in the voluntary carbon market, prices for high-quality CDR can range significantly. By mid-2024, some forward contracts for durable carbon removals were reportedly being discussed in the range of $100-$200 per tonne of CO2, though actual realized prices for Drax's specific CDR credits will depend on verification standards, contract terms, and buyer demand.

- Revenue Stream: CDR credits from BECCS represent a novel and potentially significant income source for Drax, influencing its overall revenue generation and pricing models.

- Market Validation: Secured deals for CDR credits confirm market interest and a willingness to compensate for verified carbon removal, validating the business case for BECCS.

- Investment Driver: The valuation and demand for CDR credits are critical factors that will shape Drax's decisions regarding future investments in and expansion of its BECCS capacity.

- Pricing Dynamics: As of mid-2024, forward prices for durable carbon removals in the voluntary market suggest a potential range that informs the economic feasibility of Drax's CDR credit sales.

Drax's pricing strategy is heavily influenced by government support mechanisms like Contracts for Difference (CfDs), which guarantee prices for its renewable energy. The company's financial performance is also directly impacted by fluctuations in UK wholesale electricity prices, with lower prices in the first half of 2025 affecting profitability compared to 2024.

The Electricity Generator Levy (EGL) has also played a role, costing Drax £205 million in 2023 and £161 million in 2024. Furthermore, the emerging market for carbon dioxide removal (CDR) credits from its BECCS projects presents a new pricing opportunity, with mid-2024 estimates for durable carbon removals in the voluntary market ranging from $100-$200 per tonne of CO2.

| Pricing Factor | Impact on Drax | Relevant Period/Data |

| Contracts for Difference (CfDs) | Secures prices for renewable energy output | Heads of terms for new low-carbon dispatchable CfD secured early 2025 for April 2027-March 2031 |

| Wholesale Electricity Prices | Directly drives revenue; lower prices impacted H1 2025 profit | Forecasted downward trend in wholesale prices throughout 2025 |

| Electricity Generator Levy (EGL) | Reduces adjusted EBITDA | £205 million in 2023, £161 million in 2024 |

| Carbon Dioxide Removal (CDR) Credits | Potential new revenue stream from BECCS | Mid-2024 estimates for voluntary market: $100-$200 per tonne of CO2 |

4P's Marketing Mix Analysis Data Sources

Our Drax Group plc 4P's analysis is grounded in a comprehensive review of public company disclosures, including annual reports and investor presentations. We also incorporate data from industry publications and competitor analysis to ensure a thorough understanding of their market position and strategies.