Drax Group plc Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Drax Group plc Bundle

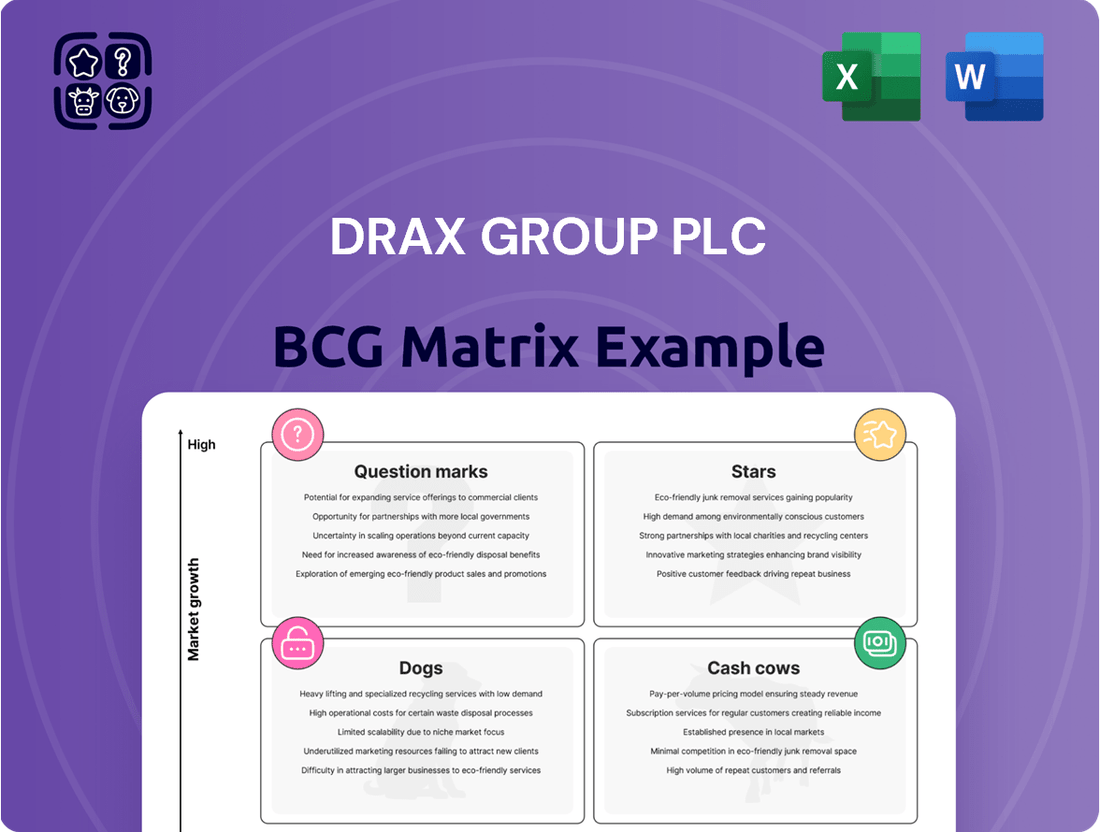

Curious about Drax Group plc's strategic positioning? Our BCG Matrix preview highlights key product categories, but to truly understand their market dynamics – identifying Stars, Cash Cows, Dogs, and Question Marks – you need the full picture.

Unlock a complete breakdown of Drax's portfolio, complete with data-driven insights and actionable recommendations. Purchase the full BCG Matrix report to gain a strategic advantage and make informed decisions about resource allocation and future investments.

Stars

Drax's ambitious Bioenergy with Carbon Capture and Storage (BECCS) project at its North Yorkshire facility is positioned as a potential Star in the BCG Matrix. This groundbreaking initiative has secured development consent and is slated to be the globe's largest single-site carbon removal operation, targeting the capture of millions of tonnes of CO2 annually.

The project's significance lies in its ability to drive carbon negativity, a crucial element in global decarbonization efforts. While awaiting final government subsidies, the anticipated high growth trajectory within the burgeoning carbon removals market, coupled with its substantial environmental impact, strongly suggests a Star classification.

Drax's pumped storage and hydro assets are key players in the UK's energy system, offering reliable power when the wind doesn't blow or the sun doesn't shine. These facilities are essential for grid stability, providing vital system support services that are becoming more important as the UK moves towards cleaner energy.

In 2023, Drax's pumped storage and hydro generation contributed significantly to their operational performance, highlighting their role in balancing the grid. The group's commitment to upgrading assets like the Cruachan pumped hydro storage scheme, which can generate 440 MW, underscores their strategic focus on these flexible generation capabilities.

Drax Group plc is a major player in North American biomass pellet production, operating 18 facilities and boasting access to four deepwater ports. This segment is experiencing robust growth, evidenced by record pellet production in the first half of 2025 and a corresponding rise in EBITDA.

The increasing global demand for sustainable biomass, particularly for emerging uses like sustainable aviation fuel (SAF) and bioenergy with carbon capture and storage (BECCS), strongly supports the positioning of this segment as a high-growth, high-market-share product within Drax's portfolio.

Elimini (International Carbon Removals Business)

Elimini, Drax's international carbon removals venture, is positioned as a potential Star in the BCG Matrix. Its mission is to establish carbon removal facilities worldwide, addressing the critical global demand for effective decarbonization solutions. The market for carbon removals is experiencing rapid expansion, and Drax's strategic focus on becoming a leader in this sector highlights Elimini's promising growth trajectory.

- Global Carbon Removal Market Growth: The voluntary carbon market, which includes carbon removals, saw significant activity in 2023, with projections indicating continued strong growth through 2030, driven by corporate net-zero commitments.

- Drax's Strategic Ambition: Drax aims to be a leading provider of bioenergy with carbon capture and storage (BECCS) and other carbon removal technologies, with Elimini serving as the vehicle for this global deployment.

- Investment and Development: While specific financial figures for Elimini are nascent, Drax has committed substantial investment to its carbon capture and BECCS projects, signaling confidence in the future of carbon removal technologies.

Strategic Partnerships for New Markets (e.g., SAF)

Drax is strategically positioning itself for future growth by forging partnerships to access new markets for its sustainable biomass. A key example is their agreement with Pathway Energy, which could see over 1 million tonnes of biomass pellets supplied annually for the burgeoning sustainable aviation fuel (SAF) sector.

- Diversification into SAF: This partnership signals Drax's intent to capitalize on the high-growth SAF market, a critical area for decarbonizing aviation.

- Leveraging existing strengths: By utilizing its established biomass production capabilities, Drax can efficiently enter these new markets.

- Future-proofing revenue: Exploring agreements like this is crucial for long-term revenue streams as the demand for sustainable fuels increases.

- Market expansion: This move represents a significant opportunity to expand Drax's market reach beyond its current operations.

Drax's BECCS project, aiming for millions of tonnes of CO2 capture annually, is a prime candidate for the Star quadrant due to its high growth potential in the expanding carbon removal market and its significant environmental impact. Similarly, Elimini, Drax's global carbon removal venture, is poised for Star status, capitalizing on the urgent worldwide need for decarbonization solutions. The biomass pellet production segment, with its robust growth and increasing demand from sectors like SAF and BECCS, also firmly lands in the Star category.

| Business Unit | BCG Category | Rationale | Key Data Points (2023/H1 2025) |

|---|---|---|---|

| BECCS Project (North Yorkshire) | Star | High growth potential in carbon removal market, significant environmental impact. | Global's largest single-site carbon removal operation, targets millions of tonnes CO2 capture annually. |

| Pumped Storage & Hydro | Cash Cow | Essential for grid stability, provides vital system support services. | Crucial for grid balancing; Cruachan facility generates 440 MW. |

| North American Biomass Pellets | Star | Robust growth driven by increasing global demand for sustainable biomass. | Operates 18 facilities; record pellet production and EBITDA rise in H1 2025. |

| Elimini (International Carbon Removals) | Star | Rapidly expanding market for carbon removals, strategic focus on global leadership. | Addresses critical global demand for decarbonization; voluntary carbon market growth projected through 2030. |

| SAF Partnerships (e.g., Pathway Energy) | Star | Accessing high-growth sustainable aviation fuel market. | Potential to supply over 1 million tonnes of biomass pellets annually for SAF. |

What is included in the product

The Drax Group BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis highlights which units to invest in, hold, or divest based on their market share and growth potential.

The Drax Group plc BCG Matrix offers a clear, one-page overview, relieving the pain of deciphering complex portfolio performance.

Cash Cows

Drax Power Station, now a leader in sustainable biomass, stands as the UK's largest single source of renewable power. In the first half of 2025, it supplied roughly 5% of the nation's electricity and 11% of its renewable energy generation.

Operating within a well-established market, Drax benefits from a significant market share, largely due to its reliable, dispatchable power and crucial system support services.

Despite a recent downturn in profits attributed to lower wholesale power prices, Drax is poised for future stability. The company anticipates securing a new low-carbon Contract for Difference (CfD) with the UK government, which should guarantee ongoing subsidies and predictable cash flow well past 2027.

Drax's existing operations benefit substantially from government subsidies like Contracts for Difference (CfD) and the Renewables Obligation (RO). These schemes offer a predictable revenue stream, underpinning strong profit margins in the established power generation sector.

For instance, Drax's biomass operations have historically been a significant beneficiary of these support mechanisms. The company's 2023 financial results showed continued reliance on these subsidies for its renewable generation activities.

The anticipation of a new CfD agreement for its generation assets, expected to commence between 2027 and 2031, reinforces its position as a reliable cash generator. This forward-looking support ensures continued financial stability for these mature business segments.

Drax's biomass supply chain, especially its North American operations, acts as a significant Cash Cow. This established network provides a reliable and cost-efficient fuel source, underpinning the company's power generation. In 2024, Drax utilized 9 million tonnes of fiber sourced from 13 distinct regions, highlighting the sheer scale and operational maturity of this segment.

The integrated nature of this biomass operation, spanning from pellet production right through to power generation, is key. This allows Drax to effectively manage costs and ensure a dependable supply, which in turn contributes substantially to the group's overall cash flow and financial stability.

Hydroelectric Power Schemes (Galloway)

Drax Group plc's Galloway Hydroelectric power scheme is a prime example of a Cash Cow within their business portfolio. These established assets consistently generate revenue with minimal need for increased investment in marketing or market development, reflecting their mature and stable position in the energy market.

- Established Revenue Stream: The Galloway scheme, operational for decades, provides a predictable and substantial income for Drax.

- Low Investment Needs: As a mature asset, it requires relatively low capital expenditure for maintenance and operation compared to newer technologies.

- Market Dominance: Hydroelectric power holds a stable, essential role in the UK's renewable energy mix, ensuring consistent demand.

- Contribution to Portfolio: It bolsters Drax's flexible generation capacity, crucial for grid stability, especially with the intermittency of other renewables.

Energy Solutions for Industrial & Commercial Customers

Drax's energy solutions for industrial and commercial (I&C) customers represent a significant Cash Cow for the company. This segment benefits from a mature market, providing a reliable and stable revenue stream. These offerings are part of Drax's broader FlexGen & Energy Solutions portfolio, showcasing their commitment to diverse energy services.

The core strength of this segment lies in its ability to generate consistent cash flow. Drax capitalizes on its established expertise in energy management and supply, delivering customized solutions to its I&C clients. This approach minimizes the need for substantial investments in market growth, allowing for efficient cash generation.

In 2024, Drax reported that its customers, including industrial and commercial entities, continued to rely on its diverse energy solutions. The company’s focus on providing stable and predictable energy supply, coupled with energy efficiency services, underpins the Cash Cow status of this business unit. For example, Drax's commitment to supporting businesses with their energy needs, including flexible generation and supply, contributes to its consistent performance.

- Stable Revenue Stream: The I&C energy solutions segment provides a predictable and consistent income for Drax.

- Mature Market Leverage: Drax effectively utilizes its expertise in a well-established market.

- Low Investment Requirement: This segment generates cash without demanding significant capital for expansion.

- Contribution to FlexGen & Energy Solutions: It forms a key part of Drax's wider energy services offering.

Drax's biomass supply chain, particularly its North American operations, functions as a robust Cash Cow. This segment benefits from an established, mature market with consistent demand for its fuel, requiring minimal new investment for growth. In 2024, Drax sourced 9 million tonnes of biomass from 13 regions, underscoring the operational scale and stability of this mature business.

The Galloway Hydroelectric power scheme exemplifies a Cash Cow due to its long-established revenue generation and minimal need for further capital expenditure. Its consistent contribution to the UK's renewable energy mix ensures a stable income stream with low operational risk.

Drax's energy solutions for industrial and commercial customers also represent a Cash Cow. This segment leverages Drax's existing expertise in a stable market to provide reliable energy services, generating consistent cash flow with limited investment requirements.

Delivered as Shown

Drax Group plc BCG Matrix

The BCG Matrix report for Drax Group plc that you are previewing is the complete, final document you will receive upon purchase. This means you are seeing the exact analysis, formatting, and strategic insights that will be yours to use immediately, without any watermarks or demo content. The preview accurately represents the professionally crafted report, ready for your strategic decision-making and business planning.

Dogs

Drax's legacy coal-fired units, with the last two ceasing commercial operation in Q1 2021, represent a strategic divestiture from a declining market. These assets are now considered Dogs within the BCG framework, having been phased out as planned by 2025.

Drax Group plc's older, less efficient ancillary operations, such as legacy IT systems or outdated maintenance practices, could be classified as Dogs in the BCG Matrix. These operations often represent high costs with minimal contribution to the company's strategic focus on renewable energy and carbon capture. For instance, in 2024, Drax continued its investment in biomass and carbon capture technologies, signaling a deliberate shift away from less productive assets.

Underperforming or Non-Strategic Smaller Investments, within Drax Group plc's BCG Matrix, would represent projects or ventures that haven't shown promising growth or market acceptance. These are often small-scale initiatives or pilot programs that, while perhaps innovative, do not align with Drax's core strategic direction.

These types of investments typically exhibit a low market share within their respective niches, which are often characterized by sluggish growth. Consequently, they might demand a significant portion of capital for minimal returns, making them inefficient uses of resources. For instance, if a new biomass pellet technology pilot project in 2024 showed only a 1% market penetration and required £10 million in ongoing R&D with no clear path to commercialization, it would fit this category.

Certain Contractual Obligations Nearing Expiry Without Renewal

Certain contractual obligations nearing expiry without renewal could place Drax Group plc in a 'Dog' category within the BCG Matrix. These might include short-term power purchase agreements (PPAs) or fuel supply contracts that are not being replaced with new, more advantageous terms. Such expiring contracts could lead to diminishing returns and inefficient resource allocation, as they no longer contribute significantly to the company's growth or profitability.

For instance, if Drax had a significant PPA for a specific generation asset that was set to expire in late 2024 without a clear path to renewal or a replacement contract, this asset could be considered a 'Dog'. This scenario would be particularly concerning if the asset requires ongoing maintenance or operational costs but is unlikely to generate substantial revenue post-expiry.

Drax's strategic focus on securing new long-term Contracts for Difference (CfDs) is a key mitigating factor against this risk. CfDs provide a stable revenue stream, insulating the company from short-term market volatility and ensuring the viability of its generation assets. For example, Drax secured a CfD for its pellet biomass operations, which underpins its future revenue from this segment.

- Expiring PPAs: Any short-term power purchase agreements without renewal prospects could become a 'Dog' if they tie up resources without contributing to future growth.

- Diminishing Returns: Contracts nearing expiry without new agreements may offer reduced financial benefits, impacting overall profitability.

- Resource Allocation: Assets linked to these expiring contracts might require continued investment for maintenance, yet provide little to no future revenue.

- Mitigation through CfDs: Drax's strategy to secure long-term CfDs for its biomass operations, like the one secured for its pellet biomass generation, aims to de-risk this 'Dog' scenario by ensuring stable, long-term revenue streams.

Highly Criticized or Environmentally Controversial Operations (if not addressed)

Drax Group plc’s operations, particularly its reliance on biomass, have faced significant criticism regarding sourcing and environmental impact. These concerns, if not proactively managed, represent a substantial reputational risk and could invite increased regulatory scrutiny. For instance, in 2023, while Drax continued its transition, reports from organizations like ClientEarth continued to highlight debates around the sustainability of biomass sourcing, potentially impacting public perception and investor confidence.

The potential for negative public perception and regulatory pressure can directly affect market share and the company's ability to secure future operational support. Failure to adequately address these environmental controversies could lead to a decrease in customer loyalty and a more challenging operating environment. Drax's commitment to its updated Biomass Sourcing Policy and Climate Transition Plan, however, are designed to counter these issues, aiming to build trust and demonstrate a clear path towards more sustainable energy generation.

- Reputational Risk: Past criticisms regarding biomass sourcing could damage public trust and brand image.

- Regulatory Pressure: Environmental concerns may lead to stricter regulations and compliance costs.

- Market Share Impact: Negative perception can deter customers and investors, potentially reducing market share.

- Mitigation Efforts: Drax's updated policies aim to address these environmental controversies and build stakeholder confidence.

Drax's legacy coal-fired power stations, with the last two ceasing commercial operation in Q1 2021 and fully phased out by 2025, are prime examples of 'Dogs' in the BCG Matrix. These assets, once significant revenue generators, now represent declining market share in a segment Drax is actively exiting. The company's strategic focus has shifted entirely to renewable energy sources, particularly biomass.

Older, less efficient ancillary operations, such as outdated IT infrastructure or legacy maintenance processes, also fall into the 'Dog' category. These require ongoing investment but offer minimal strategic value or return compared to Drax's core biomass and carbon capture initiatives. In 2024, Drax continued to invest heavily in its biomass supply chain and carbon capture technologies, underscoring its divestment from less productive areas.

Underperforming smaller investments or pilot projects that fail to gain market traction or align with Drax's strategic direction are also classified as 'Dogs'. These are typically characterized by low market share in slow-growing niches and may consume capital without yielding significant returns. For instance, a 2024 pilot for a new pellet technology showing only a 1% market penetration and requiring substantial ongoing R&D without a clear commercialization path would fit this description.

Question Marks

Drax's Bioenergy with Carbon Capture and Storage (BECCS) project is positioned as a future Star within the BCG matrix. While it has development consent, its commercial-scale deployment is a massive undertaking with substantial growth potential, though its current market share in actual captured emissions is minimal.

The critical factor for BECCS's success lies in securing definitive government subsidies and building out the essential infrastructure for CO2 transportation and storage. This venture demands significant capital investment, offering the prospect of high returns but also carrying considerable inherent risks.

Drax Group is investing in new Open Cycle Gas Turbines (OCGTs) to bolster its flexible generation capabilities. This move positions them within a burgeoning market for power that can quickly respond to demand fluctuations, a crucial element for integrating intermittent renewable energy sources. In 2024, the UK's capacity market, which OCGTs are designed to serve, saw significant auctions, with prices for capacity in the 2027/28 delivery year reaching £20.5/kW per year. This highlights the growing demand for such flexible assets.

While OCGTs operate in an expanding market, Drax's current market share in this segment is relatively small compared to its established biomass operations. The success of these OCGT investments hinges on continued market demand for rapid power provision and supportive regulatory policies that incentivize flexibility. The UK government's commitment to net-zero targets, while driving renewable growth, also necessitates reliable backup power, creating a favorable environment for OCGTs.

The proposed 600MW Cruachan II pumped hydro expansion by Drax Group plc represents a significant opportunity in the burgeoning long-duration energy storage sector, crucial for grid stability. This project aligns with the increasing demand for reliable energy solutions to support renewable energy integration.

Despite its high growth potential, the Cruachan II project's future development is uncertain, classifying it as a Question Mark within Drax's BCG Matrix. Drax recently opted not to submit the project into a particular UK government subsidy scheme, highlighting the project's dependence on a favorable investment framework.

Data Centre Development at Drax Power Station Site

Drax Group is venturing into the high-growth data centre market with plans for a 1 GW facility at its North Yorkshire power station site. This strategic move aims to capitalize on the surging demand for power-intensive AI infrastructure, a sector experiencing rapid expansion.

As a new entrant, Drax's data centre project is positioned as a 'Question Mark' in the BCG matrix. While the market offers significant potential, Drax currently holds no established market share, necessitating substantial investment to gain traction.

- Market Growth: The global data centre market is projected to grow significantly, driven by AI, cloud computing, and big data analytics. For instance, the AI hardware market alone was estimated to reach over $200 billion by 2027.

- Drax's Position: This 1 GW project represents a substantial initial investment for Drax in a new sector, requiring careful management to transition from exploration to market leadership.

- Key Dependencies: Success hinges on factors like continued robust demand for AI infrastructure, the timely development of necessary power and network infrastructure, and securing supportive regulatory frameworks to facilitate operations and growth.

International Carbon Removal Projects (beyond UK BECCS)

Drax's ambition to be a global leader in carbon removals, particularly through its Elimini business and exploring BECCS opportunities in North America, clearly places these international projects in the Question Mark category of the BCG matrix. This segment is characterized by high growth potential within the emerging carbon removal market, yet currently holds a low market share for Drax.

These ventures are situated in nascent markets that demand substantial capital investment and depend heavily on the development of supportive regulatory frameworks across various international geographies. The success of these initiatives is uncertain, representing a classic Question Mark scenario, but they also offer significant long-term upside potential for Drax.

- Market Growth: The global carbon removal market is projected to grow significantly, with some estimates suggesting it could reach hundreds of billions of dollars annually by 2050.

- Investment Needs: Developing BECCS infrastructure, especially internationally, requires substantial upfront capital, potentially running into billions of dollars for large-scale projects.

- Regulatory Dependence: The viability of these projects hinges on the establishment of clear carbon pricing mechanisms, tax credits, and supportive policies in target regions like North America.

- Elimini's Role: Elimini, Drax's carbon removal brand, aims to develop and deliver high-quality carbon dioxide removal (CDR) projects, positioning Drax to capture a share of this growing market.

Drax's proposed Cruachan II pumped hydro expansion and its new data centre venture are both classified as Question Marks in the BCG matrix. These projects are in high-growth sectors but represent new territory for Drax, meaning they have low current market share and require significant investment to establish themselves.

The success of Cruachan II hinges on securing favorable government support, as evidenced by Drax's decision not to enter a specific subsidy scheme recently. Similarly, the 1 GW data centre project, while tapping into the booming AI infrastructure market, requires Drax to build its presence from the ground up, facing substantial investment needs and regulatory dependencies.

The company's international carbon removal ambitions, including BECCS in North America and its Elimini brand, also fall into the Question Mark category. These are high-potential but nascent markets, demanding considerable capital and reliant on evolving international regulations to gain traction.

| Project | BCG Category | Market Growth Potential | Drax's Current Market Share | Key Dependencies/Considerations |

|---|---|---|---|---|

| Cruachan II Pumped Hydro | Question Mark | High (Energy Storage for Renewables) | Low (New Venture) | Government subsidies, grid integration, regulatory framework |

| 1 GW Data Centre (North Yorkshire) | Question Mark | Very High (AI & Cloud Demand) | None (New Entrant) | Infrastructure development, power supply, market competition |

| International BECCS & Carbon Removals (e.g., North America) | Question Mark | High (Emerging Carbon Market) | Low (Early Stage) | International regulations, carbon pricing, significant capital investment |

BCG Matrix Data Sources

Our BCG Matrix is informed by Drax Group's annual reports, market share data, and industry growth projections. This blend of internal and external information ensures a comprehensive view of each business unit's position.