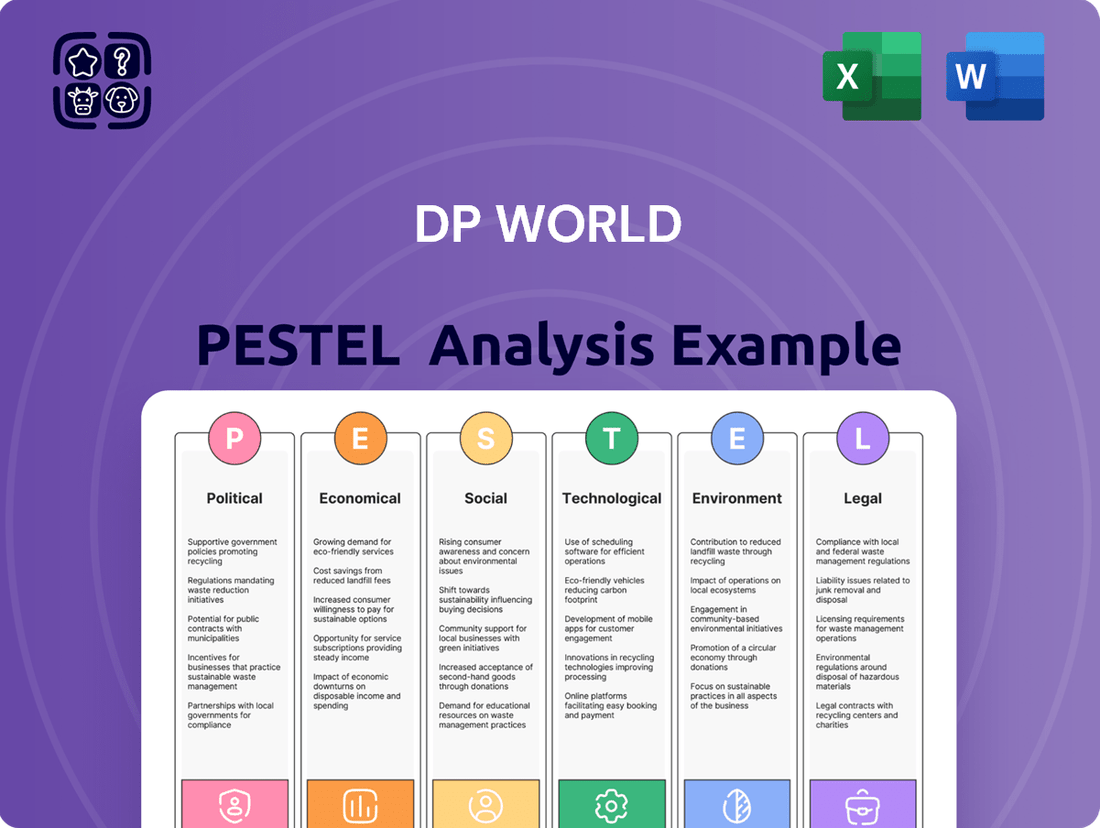

DP World PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DP World Bundle

Unlock the critical external factors shaping DP World's trajectory. Our PESTLE analysis dives deep into political stability, economic shifts, technological advancements, environmental regulations, and social dynamics impacting the logistics giant. Gain an unparalleled understanding of the forces at play and how they influence DP World's strategic decisions. Download the full PESTLE analysis now to equip yourself with actionable intelligence for informed decision-making and a competitive edge.

Political factors

DP World's vast global operations are significantly influenced by geopolitical stability. For instance, ongoing conflicts or regional instability, such as those impacting the Red Sea in late 2023 and early 2024, directly disrupt shipping routes, increasing transit times and operational costs for DP World's terminals. This instability can lead to rerouting of cargo, impacting throughput volumes at affected ports.

Shifts in international trade relations, including the imposition of tariffs or the formation of new trade blocs, directly affect the volume of goods handled. For example, trade disputes between major economies could reduce overall global trade volumes, which in turn would lessen the demand for DP World's services. The company's ability to adapt to these changing trade dynamics is paramount for sustained growth.

Maintaining robust relationships with governments in the 50+ countries where DP World operates is critical for securing and renewing concessions, which are essential for long-term operational continuity. Favorable government policies and stable regulatory environments are key to DP World's ability to invest in and expand its port and logistics infrastructure, ensuring smooth operations and attracting further investment.

Government policies on trade tariffs and customs procedures directly impact DP World's global operations, influencing the cost of goods and the volume of cargo handled. For instance, the World Trade Organization's (WTO) forecast for global trade growth in 2024 is around 3.3%, a figure that can be significantly shaped by protectionist policies in major economies. Favorable government investments in port infrastructure, such as the $1.5 billion expansion project at DP World's Jebel Ali Port in Dubai, are crucial for enhancing capacity and efficiency.

Regulatory frameworks governing port operations, shipping, and logistics are paramount for DP World's strategic planning and compliance. Changes in environmental regulations, for example, can necessitate significant capital expenditure for cleaner technologies. In 2024, many nations are focusing on digitizing customs procedures to streamline trade, a trend DP World actively supports through its technology investments, aiming to reduce transit times and improve supply chain visibility.

DP World's operations are inherently exposed to regions facing political instability and security risks, such as the Horn of Africa and the Middle East. These areas can experience piracy, civil unrest, or interstate conflicts, directly threatening DP World's port infrastructure, vessels, and staff. For example, the Red Sea, a critical artery for DP World's trade, has seen increased security concerns in recent years, impacting shipping schedules and insurance premiums for carriers utilizing these routes.

Trade Agreements and Blocs

The shifting landscape of international trade agreements and economic blocs significantly influences global trade volumes, directly impacting DP World's operations. For instance, the European Union, a major economic bloc, facilitates seamless trade among its member states, benefiting port operators like DP World that handle intra-EU cargo. In 2024, the EU reported a substantial increase in intra-bloc trade, underscoring the positive effect of such agreements.

Preferential trade agreements can unlock new opportunities by boosting cargo traffic between signatory nations. The African Continental Free Trade Area (AfCFTA), which officially began in 2021 and saw significant progress in 2024 with more countries ratifying protocols, aims to create a single market for goods and services across Africa. This expansion is projected to increase intra-African trade by over 80% by 2035, presenting a substantial growth avenue for DP World’s logistics and port services in the region.

Conversely, the dissolution or renegotiation of trade agreements can introduce considerable operational challenges and reduce trade flows. The ongoing trade tensions and the potential for new tariffs, as seen in various bilateral disputes throughout 2024, can disrupt established shipping routes and negatively affect DP World's throughput volumes. Such uncertainties necessitate adaptive strategies and a close monitoring of geopolitical developments.

- EU Intra-bloc Trade Growth: The European Union's continued economic integration in 2024 sustained robust intra-bloc trade, benefiting DP World's European port operations.

- AfCFTA Potential: The African Continental Free Trade Area's expansion in 2024 is expected to boost intra-African trade by over 80% by 2035, creating significant opportunities for DP World.

- Trade Dispute Impact: Geopolitical trade disputes and tariff impositions in 2024 highlight the risks associated with trade agreement instability for global logistics providers.

Political Stability of Host Nations

DP World's operations are significantly impacted by the political stability of the nations where it has a presence. Unstable political environments, marked by frequent government changes or civil unrest, can disrupt operations and deter crucial long-term investments. For instance, as of early 2024, several regions where DP World operates, particularly in parts of Africa and the Middle East, have experienced varying degrees of political volatility, influencing investor confidence and project timelines.

The predictability of government policies and regulations is paramount for DP World's strategic planning. Unforeseen policy shifts, such as changes in trade agreements, taxation, or nationalization risks, can directly affect profitability and operational efficiency. The company's extensive global footprint means it must continuously monitor and adapt to diverse political landscapes, with a focus on countries demonstrating consistent governance and a pro-business regulatory framework.

- Geopolitical Risk Assessment: DP World actively assesses geopolitical risks, with reports in late 2023 highlighting heightened concerns in emerging markets due to internal political fragilities.

- Foreign Direct Investment (FDI) Trends: Countries with stable political systems tend to attract higher FDI, a trend DP World leverages by prioritizing investments in such environments. For example, stable economies in the UAE and Saudi Arabia continue to be key hubs.

- Regulatory Consistency: DP World’s long-term capital expenditure plans, often spanning decades, necessitate a high degree of confidence in the consistency of regulatory frameworks across its terminal operations.

- Impact of Elections: Upcoming elections in several key operational countries in 2024 and 2025 are being closely monitored for potential policy shifts that could affect trade infrastructure investments.

Political stability is a cornerstone for DP World's extensive global operations, directly influencing investment decisions and operational continuity. Regions with consistent governance and predictable policy environments, such as the UAE, remain critical hubs for the company's growth and strategic planning. Conversely, political volatility in other operating regions, as observed in parts of Africa and the Middle East in early 2024, can create significant operational challenges and impact investor sentiment.

Government policies, including trade agreements and customs regulations, profoundly shape DP World's business. The African Continental Free Trade Area (AfCFTA), with its aim to boost intra-African trade by over 80% by 2035, presents a significant growth opportunity, as more nations ratified protocols in 2024. However, trade disputes and potential tariffs in 2024 also underscore the risks associated with unstable trade pacts, necessitating agile strategic responses.

DP World's ability to secure and renew concessions hinges on strong governmental relationships and favorable regulatory frameworks. The company's long-term capital expenditure plans, often spanning decades, require a high degree of confidence in regulatory consistency, making political stability a key factor in project viability. Upcoming elections in several key operating countries in 2024 and 2025 are closely watched for potential policy shifts impacting trade infrastructure.

| Key Political Factors | Impact on DP World | Supporting Data/Examples (2024/2025 Focus) |

| Geopolitical Stability | Disrupts shipping routes, increases costs, impacts throughput. | Red Sea instability (late 2023-early 2024) led to rerouting. |

| Trade Agreements & Blocs | Influences global trade volumes and cargo handling. | AfCFTA progress (2024) to boost intra-African trade by 80% by 2035. EU intra-bloc trade growth supports European operations. |

| Government Policies & Regulations | Affects profitability, operational efficiency, and investment. | Focus on digitizing customs (2024) streamlines trade. Jebel Ali Port expansion ($1.5B) highlights favorable government investment. |

| Political Volatility | Threatens infrastructure, staff, and investor confidence. | Political fragilities in emerging markets noted in late 2023 reports. |

What is included in the product

This DP World PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

A concise DP World PESTLE analysis provides a readily digestible overview of external factors, alleviating the pain of sifting through extensive data for strategic decision-making.

Economic factors

DP World's performance is directly tied to global economic health and trade volumes. Strong economic growth, like the projected 3.2% global GDP growth for 2024 according to the IMF, generally fuels demand for logistics and shipping, increasing DP World's cargo throughput.

Conversely, economic downturns present challenges. For instance, while global trade volume saw a slight rebound in late 2023 and early 2024 after a contraction in 2023, geopolitical tensions and persistent inflation could still dampen trade activity, impacting DP World's revenue streams.

Rising inflation presents a significant hurdle for DP World, directly impacting its operational expenses. Costs for essential inputs like fuel, labor, and equipment maintenance have seen substantial increases. For instance, global inflation rates remained elevated through much of 2023 and into early 2024, with many economies experiencing consumer price index (CPI) figures well above central bank targets.

Effectively managing these escalating input costs while simultaneously offering competitive service pricing is a persistent challenge for DP World. The company must navigate the delicate balance of absorbing some of these cost hikes to retain market share versus passing them on to customers.

Without robust productivity improvements or strategic pricing adjustments, inflationary pressures can directly erode DP World's profit margins. For example, if operating costs rise by 5% and revenue only increases by 2%, the profit margin will naturally shrink, highlighting the critical need for cost control and revenue optimization strategies.

DP World's global operations mean it's constantly navigating the ups and downs of currency exchange rates. When a local currency where DP World spends a lot of money, like the UAE Dirham or the Australian Dollar, strengthens against its reporting currency (often the US Dollar), it makes those local expenses more costly when converted. For instance, if the Dirham strengthens significantly against the USD, DP World's costs in Dubai would effectively rise in dollar terms.

These fluctuations directly impact DP World's financial health, affecting everything from how much revenue it brings in to the value of its assets in different regions. For example, if DP World has significant assets in a country whose currency depreciates, the reported value of those assets in US Dollars will decrease, even if their local currency value remains stable. This volatility necessitates careful financial management.

To counter this, DP World likely employs hedging strategies. These financial tools, such as forward contracts or currency options, are used to lock in exchange rates for future transactions, thereby reducing the uncertainty and potential negative impact of currency movements. This is a common practice for multinational corporations to stabilize earnings and protect against adverse market shifts.

Interest Rates and Investment Climate

Changes in global interest rates directly impact DP World's financial strategy. For instance, if major central banks like the US Federal Reserve maintain higher interest rates through 2024 and into 2025, DP World's cost of borrowing for significant infrastructure projects, such as expanding its Jebel Ali port or acquiring new logistics assets, will likely increase. This can make capital-intensive developments more expensive, potentially leading to a more cautious approach to expansion.

The prevailing investment climate, closely tied to interest rate levels and broader economic stability, also shapes DP World's access to and cost of capital. A robust investment climate, characterized by investor confidence and readily available funding, would facilitate DP World's growth initiatives. Conversely, a more uncertain or risk-averse environment could lead to higher capital costs and a reduced appetite for new investments.

- Global Interest Rate Environment: As of mid-2024, many developed economies are still navigating inflation, with central banks signaling a cautious approach to rate cuts. For example, the US Federal Reserve kept its benchmark interest rate steady in its June 2024 meeting, indicating that borrowing costs are likely to remain elevated for some time.

- Impact on Capital Projects: Higher interest rates translate to increased financing costs for DP World's capital expenditures, which are crucial for port expansion and technological upgrades. This could affect the financial viability of new projects or necessitate a re-evaluation of investment timelines.

- Investment Climate and Capital Availability: The overall sentiment among investors towards infrastructure and logistics sectors will influence DP World's ability to raise funds. Strong investor demand, even in a higher rate environment, can still support growth if projects demonstrate clear returns.

- DP World's Debt Structure: DP World's existing debt levels and its reliance on debt financing for growth mean that interest rate fluctuations have a material impact on its profitability and cash flow.

Supply Chain Resilience and Demand Shocks

The economic repercussions of supply chain disruptions, amplified by events like the COVID-19 pandemic and geopolitical tensions, significantly impact DP World's operations. While temporary backlogs and elevated freight rates can emerge, prolonged instability directly curtails manufacturing output and dampens overall global trade demand.

DP World's capacity to provide robust and flexible logistics solutions is a critical differentiator in this environment. For instance, DP World's investment in technology and infrastructure aims to mitigate these shocks. In 2023, the company continued to expand its terminal capacity and digital offerings to enhance efficiency and responsiveness.

- Supply Chain Vulnerability: Global supply chains faced significant strain in 2024 due to ongoing geopolitical conflicts and climate-related events, leading to increased transportation costs and delivery delays.

- Demand Fluctuations: Consumer and industrial demand experienced volatility throughout 2024, influenced by inflation rates and shifts in economic growth forecasts across major trading blocs.

- Resilience as a Competitive Edge: DP World's focus on diversified routes and advanced tracking systems positions it to better manage demand shocks and supply chain interruptions, a key advantage in the current economic climate.

Global economic growth directly influences DP World's cargo volumes. The IMF projected global GDP growth at 3.2% for 2024, a figure that generally supports increased trade activity and, consequently, higher throughput for DP World's terminals.

However, persistent inflation remains a key challenge, driving up operational costs for fuel, labor, and equipment. Many economies saw inflation rates significantly above central bank targets through early 2024, impacting DP World's margins if these costs cannot be passed on to customers through competitive pricing.

Currency exchange rate volatility also affects DP World's financial reporting and operational costs. A strengthening reporting currency, like the US Dollar, against currencies where DP World incurs significant expenses can increase its cost base in dollar terms, necessitating careful financial management and hedging strategies.

| Economic Factor | 2024/2025 Outlook | Impact on DP World |

|---|---|---|

| Global GDP Growth | Projected 3.2% for 2024 (IMF) | Supports increased trade volumes and cargo throughput. |

| Inflation Rates | Elevated in many economies through early 2024 | Increases operational expenses (fuel, labor), potentially eroding profit margins. |

| Interest Rates | Cautious approach to cuts by major central banks | Raises financing costs for capital projects, potentially impacting expansion plans. |

| Supply Chain Stability | Continued vulnerability due to geopolitical and climate events | Can lead to demand fluctuations and increased transportation costs, requiring resilient logistics solutions. |

Preview the Actual Deliverable

DP World PESTLE Analysis

The preview shown here is the exact DP World PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, offering a comprehensive look at the political, economic, social, technological, legal, and environmental factors impacting DP World.

The content and structure shown in the preview is the same DP World PESTLE Analysis document you’ll download after payment, providing actionable insights for strategic planning.

Sociological factors

DP World's success hinges on effective labor relations and workforce management, especially with its vast global workforce operating in varied cultural settings. Disruptions from strikes or labor shortages can significantly impact port operations and overall productivity. For instance, in 2024, several global logistics hubs experienced labor disputes, highlighting the ongoing sensitivity of these issues.

Attracting and retaining skilled talent remains a significant hurdle in the competitive global market. DP World's commitment to training and development is crucial, as the industry increasingly demands specialized expertise. The company reported investing heavily in upskilling programs in 2024 to address evolving technological needs and maintain a competitive edge in workforce capabilities.

DP World's extensive global operations mean its ports and logistics centers are deeply intertwined with local communities. For instance, in 2024, DP World continued its focus on community development projects, investing in education and infrastructure near its Jebel Ali Free Zone in Dubai, a key hub. Positive community engagement, including local hiring and supporting small businesses, is crucial for securing and maintaining what's often called a 'social license to operate,' allowing for smoother, uninterrupted operations.

Consumers increasingly demand ethically sourced goods, pushing logistics companies like DP World to ensure transparency. This shift means greater scrutiny of labor practices and environmental impact throughout the supply chain.

In 2024, for example, surveys indicated that over 60% of consumers consider sustainability a key factor in their purchasing decisions, directly impacting how goods are moved and managed.

This trend necessitates significant investment in technologies that can track products from origin to destination, verifying claims of ethical sourcing and sustainability for DP World and its partners.

Demographic Shifts and Urbanization

Global demographic shifts, including a projected population increase to 9.7 billion by 2050, directly shape consumer markets and the demand for goods and services. This growth, coupled with increasing urbanization, means more people are concentrated in cities, creating new logistical challenges and opportunities.

The trend towards urban living, with over 56% of the world's population residing in cities in 2023, necessitates more efficient 'last-mile' delivery solutions. DP World's strategic investments in logistics parks near major urban hubs, such as its Jebel Ali hub in Dubai, directly address this growing demand for integrated supply chain services.

- Global population projected to reach 9.7 billion by 2050.

- Over 56% of the world's population lived in urban areas in 2023.

- Urbanization drives demand for advanced 'last-mile' logistics.

- DP World invests in logistics parks near key metropolitan areas.

Health and Safety Standards

Maintaining rigorous health and safety standards is critical for DP World, influencing operational continuity and public trust. Non-compliance can result in substantial fines and operational disruptions. For instance, in 2023, the International Labour Organization reported that workplace accidents and diseases cost the global economy an estimated $3.7 trillion annually, underscoring the financial implications of safety lapses.

DP World's commitment to safety directly impacts its ability to operate without interruption and maintain a positive brand image. Incidents can lead to costly investigations, temporary closures, and a decline in stakeholder confidence. The company's proactive approach involves ongoing investment in safety training and advanced equipment to mitigate these risks.

- Employee Well-being: Ensuring a safe working environment protects DP World's most valuable asset – its people.

- Regulatory Compliance: Adherence to international and local health and safety regulations is non-negotiable, avoiding legal penalties.

- Reputational Management: A strong safety record enhances DP World's reputation as a responsible global operator.

- Operational Efficiency: Preventing accidents minimizes downtime and associated financial losses, contributing to smoother operations.

DP World's workforce is a critical asset, and managing labor relations effectively across diverse cultural landscapes is paramount. Strikes or labor shortages, as seen in various global logistics hubs during 2024, can significantly disrupt operations and productivity. The company's investment in upskilling programs in 2024 highlights the need to attract and retain specialized talent in a competitive market.

Community engagement is vital for DP World's social license to operate. Projects in 2024 near its Jebel Ali hub, focusing on education and local business support, demonstrate this commitment. Positive community relations ensure smoother, uninterrupted operations by fostering goodwill and local support.

Consumer demand for ethical sourcing, with over 60% of consumers prioritizing sustainability in 2024 purchasing decisions, pushes logistics firms like DP World towards greater supply chain transparency. This necessitates investments in tracking technologies to verify ethical labor practices and environmental impact.

Demographic shifts, including a projected global population of 9.7 billion by 2050 and over 56% of the world's population living in urban areas in 2023, create both challenges and opportunities for DP World. The increasing urbanization drives demand for efficient 'last-mile' delivery solutions, which DP World addresses through strategic logistics park investments near major cities.

| Sociological Factor | Impact on DP World | 2023/2024 Data/Trend |

|---|---|---|

| Labor Relations & Workforce Management | Operational continuity, productivity, talent acquisition | Global logistics hubs experienced labor disputes in 2024; DP World invested in upskilling programs. |

| Community Engagement | Social license to operate, operational smoothness | DP World focused on community development projects near Jebel Ali in 2024. |

| Consumer Ethics & Transparency | Supply chain scrutiny, demand for ethical practices | Over 60% of consumers considered sustainability in 2024 purchasing; need for product tracking tech. |

| Demographics & Urbanization | Demand for logistics services, 'last-mile' solutions | Global population to reach 9.7 billion by 2050; over 56% urbanized in 2023. |

Technological factors

DP World is heavily investing in automation and robotics, with projects like the Jebel Ali Port's Terminal 4 showcasing automated stacking cranes and automated guided vehicles (AGVs). This adoption is projected to boost efficiency by up to 30% and reduce labor costs significantly. These advancements are critical for faster vessel turnaround times, aiming to improve overall throughput by an estimated 15% in the coming years.

DP World is heavily invested in digitalizing its supply chain and logistics operations. This includes the widespread implementation of Port Community Systems (PCS) and electronic data interchange (EDI) across its global terminals. For instance, by the end of 2024, DP World aims to have its PCS operational in over 70% of its major ports, facilitating smoother data flow.

These digital initiatives are crucial for enhancing operational efficiency and customer experience. Cloud-based platforms are now integral to DP World's strategy, enabling real-time cargo tracking and providing unprecedented visibility throughout the logistics chain. This improved transparency allows for better operational planning and a more responsive service offering to clients.

The impact of this digitalization is significant, with DP World reporting a 15% reduction in cargo dwell times in terminals where advanced digital systems are fully integrated. This efficiency gain translates directly into cost savings and improved turnaround times, a critical competitive advantage in the global shipping industry.

As DP World's operations become more digitized, cybersecurity stands out as a crucial technological factor. Protecting sensitive cargo data, operational systems, and financial information from cyber threats is essential for maintaining business continuity and trust. A significant cyberattack in 2024 could lead to substantial financial losses, operational disruptions, and severe reputational damage, underscoring the need for advanced cybersecurity infrastructure and stringent protocols.

Artificial Intelligence (AI) and Machine Learning (ML)

Artificial Intelligence and Machine Learning are revolutionizing DP World's operations. These technologies are being implemented to enhance efficiency across the board, from maintaining critical port equipment to meticulously planning vessel arrivals and departures, ensuring a smoother flow of cargo. For instance, DP World has been investing in AI for predictive maintenance, aiming to reduce downtime on their vast fleets of cranes and other machinery. In 2024, the company reported significant improvements in operational uptime following the integration of AI-powered diagnostics.

AI-driven analytics are proving invaluable for identifying inefficiencies within the complex logistics network. By analyzing vast datasets, DP World can pinpoint bottlenecks in real-time, forecast future cargo demand with greater accuracy, and optimize the allocation of resources like labor and equipment. This data-driven approach directly translates to substantial cost savings and a more responsive supply chain. DP World's strategic focus on digital transformation, heavily reliant on AI and ML, is expected to yield further operational enhancements throughout 2025.

- Predictive Maintenance: AI algorithms analyze sensor data from port equipment to anticipate failures, reducing unexpected downtime.

- Vessel Scheduling Optimization: ML models forecast arrival times and optimize berth allocation, minimizing waiting periods for ships.

- Cargo Flow Analysis: AI identifies choke points in container handling and suggests improvements for faster throughput.

- Demand Forecasting: Machine learning predicts cargo volumes, enabling better resource planning and inventory management.

Blockchain for Supply Chain Traceability

Blockchain technology is increasingly recognized for its ability to bolster transparency, security, and traceability across intricate global supply chains. By establishing unalterable records of goods and transactions, it can significantly curb fraud, streamline customs procedures, and offer comprehensive visibility to all parties involved. For DP World, embracing these advancements positions them as a more reliable and efficient logistics partner.

The adoption of blockchain in supply chain management is gaining momentum. For instance, a 2024 report indicated that over 60% of supply chain professionals believe blockchain will revolutionize the sector by 2027, citing enhanced data integrity and reduced operational costs as key benefits. DP World's strategic investments in blockchain pilot programs, such as those explored in 2023 and early 2024 for container tracking, directly address these industry trends.

- Enhanced Data Security: Blockchain's distributed ledger technology ensures that supply chain data is tamper-proof, reducing the risk of unauthorized alterations.

- Improved Efficiency: Automating verification processes through smart contracts can accelerate customs clearance and reduce administrative overhead.

- Increased Transparency: Real-time tracking of goods provides all stakeholders with accurate, up-to-the-minute information, fostering trust.

- Fraud Reduction: Immutable transaction records make it significantly harder to introduce counterfeit goods or engage in fraudulent activities within the supply chain.

DP World's technological advancements are centered on automation and digitalization. Investments in automated cranes and guided vehicles at Jebel Ali Port aim for a 30% efficiency boost and significant labor cost reductions. Digitalization initiatives, including Port Community Systems, are projected to be in over 70% of its major ports by the end of 2024, improving data flow and reducing cargo dwell times by 15%.

AI and Machine Learning are key to optimizing operations, from predictive maintenance of port equipment to enhanced cargo flow analysis and demand forecasting. These technologies are expected to yield further operational enhancements throughout 2025, contributing to greater efficiency and cost savings.

Blockchain technology is being explored for enhanced supply chain transparency, security, and fraud reduction. Pilot programs for container tracking in early 2024 demonstrate DP World's commitment to leveraging this technology, with industry reports suggesting blockchain could revolutionize the sector by 2027.

| Technological Factor | DP World Initiative | Projected Impact/Status |

| Automation & Robotics | Automated stacking cranes, AGVs at Jebel Ali Port | Up to 30% efficiency boost, reduced labor costs |

| Digitalization | Port Community Systems (PCS), EDI | 70%+ major ports by end of 2024; 15% reduction in cargo dwell times |

| AI & Machine Learning | Predictive maintenance, demand forecasting | Improved operational uptime, enhanced efficiency |

| Blockchain | Container tracking pilot programs | Enhanced transparency, security, and fraud reduction |

Legal factors

DP World navigates a complex landscape of international trade laws and customs regulations, essential for its global operations. For instance, the World Trade Organization (WTO) agreements, which came into effect in 1995, provide a foundational framework for global trade, impacting DP World's port services and logistics. Adherence to these rules is paramount to avoid significant financial penalties and operational disruptions, as seen in past instances of customs non-compliance by various global logistics firms.

Changes in customs duties, import/export restrictions, and trade agreements, such as those impacting trade between the European Union and the UK post-Brexit, directly affect DP World's cost structures and efficiency. In 2023, global trade faced ongoing adjustments due to geopolitical shifts, underscoring the need for DP World to maintain robust legal and compliance teams to adapt to evolving legal requirements and ensure smooth cross-border cargo movement.

DP World, operating globally, must navigate a complex web of antitrust and competition laws designed to prevent monopolistic practices and foster fair market competition. These regulations are crucial for maintaining a level playing field in the logistics and port operations sector.

Any proposed mergers, acquisitions, or strategic alliances undertaken by DP World undergo rigorous scrutiny to ensure adherence to these competition frameworks. For instance, the European Commission’s Directorate-General for Competition actively monitors such activities to safeguard market fairness.

Failure to comply with these stringent regulations can result in severe penalties, including significant financial fines and mandatory divestiture of assets. In 2023, the European Union imposed billions in fines across various sectors for antitrust violations, underscoring the gravity of these laws.

DP World navigates a complex web of global labor and employment laws, impacting everything from minimum wages and working hours to employee benefits and union recognition. For instance, in the UAE, Federal Decree-Law No. 33 of 2021 on the Regulation of Labour Relations sets stringent standards for employment contracts and worker rights. Failure to comply with these diverse regulations across its many operating countries, such as those governing collective bargaining in Australia or occupational health and safety in the UK, can lead to significant legal penalties, financial penalties, and severe reputational harm.

Maintaining consistent global standards while adapting to the nuances of local labor regulations presents an ongoing operational challenge for DP World. The company must ensure its employment practices align with varying legal frameworks, such as the EU's General Data Protection Regulation (GDPR) which impacts employee data handling, or specific national laws on worker representation. This requires robust compliance mechanisms and continuous monitoring to avoid legal disputes and maintain a positive employer brand worldwide.

Environmental Regulations and Compliance

DP World operates within a landscape of increasingly stringent environmental regulations. These rules, covering emissions, waste management, water pollution, and biodiversity, directly affect port operations and shipping activities. For instance, the International Maritime Organization's (IMO) 2020 sulfur cap, which limited sulfur content in fuel oil to 0.5%, significantly impacted shipping costs and operational adjustments for companies like DP World.

Compliance necessitates substantial investment in eco-friendly technologies and sustainable practices. This includes adhering to regulations on ballast water management to prevent the spread of invasive species, reducing sulfur oxide (SOx) emissions from vessels calling at its ports, and responsible land-use planning to minimize environmental impact. Failure to comply can result in hefty fines and reputational damage.

- Ballast Water Management: International Convention for the Control and Management of Ships' Ballast Water and Sediments (BWM Convention) requires ships to manage their ballast water to prevent the introduction of invasive alien species.

- Emissions Control Areas (ECAs): DP World's ports are increasingly located in or near ECAs, requiring vessels to use fuels with a lower sulfur content, such as the 0.5% limit mandated by the IMO.

- Waste Management: Regulations on port waste reception facilities and the handling of hazardous materials from vessels are becoming more rigorous, impacting operational costs and infrastructure requirements.

- Biodiversity Protection: Coastal development and port expansion projects must increasingly consider biodiversity impacts, often requiring environmental impact assessments and mitigation strategies.

Data Privacy and Security Laws

DP World's operations are heavily influenced by data privacy and security laws, especially as the logistics sector becomes increasingly digital. The company manages substantial volumes of sensitive customer and operational data, necessitating strict adherence to global regulations like the General Data Protection Regulation (GDPR) and various local data protection acts. In 2023, the global cost of data breaches reached an average of $4.45 million, highlighting the significant financial and reputational risks associated with non-compliance.

Maintaining robust data protection measures is paramount for DP World to safeguard against breaches and ensure lawful data handling. This commitment is vital for preserving customer trust and avoiding substantial legal penalties and operational disruptions. For instance, fines under GDPR can reach up to 4% of global annual turnover or €20 million, whichever is higher, underscoring the critical importance of compliance.

- Global Data Breach Costs: Average cost of a data breach in 2023 was $4.45 million.

- GDPR Fines: Potential penalties up to 4% of global annual turnover or €20 million.

- Data Handling: Essential for maintaining customer trust and operational integrity.

- Digitalization Impact: Increased data volumes necessitate stronger legal frameworks.

DP World's global operations are significantly shaped by international trade laws and customs regulations, impacting everything from port efficiency to cost structures. Adherence to frameworks like World Trade Organization (WTO) agreements is crucial, as non-compliance can lead to substantial financial penalties. Evolving trade policies, such as those following Brexit, necessitate continuous legal vigilance to manage cross-border cargo smoothly.

Environmental factors

Climate change presents substantial physical risks to DP World's vital port infrastructure, particularly due to rising sea levels and more frequent extreme weather. These environmental shifts can lead to increased flooding, damaging storm surges, and coastal erosion, directly threatening operational continuity.

To mitigate these threats, DP World is strategically investing in climate-resilient designs and adaptation measures. For instance, the company is enhancing quay walls and exploring elevated infrastructure solutions at key locations, such as its Jebel Ali Port, to better withstand inundation and storm impacts. This proactive approach is crucial for safeguarding assets and ensuring uninterrupted global trade flow.

The maritime and logistics sectors are facing significant pressure to curb carbon emissions. DP World, as a major global operator, is increasingly subject to regulatory demands and stakeholder expectations for decarbonization across its port equipment, vessel movements, and landside logistics. For instance, the International Maritime Organization (IMO) has set ambitious greenhouse gas reduction targets, aiming for at least a 20% reduction by 2030 compared to 2008 levels, pushing companies like DP World to adapt.

This imperative translates into substantial investments in cleaner technologies. DP World is actively exploring and implementing solutions such as the adoption of alternative fuels, the deployment of electric vehicles for port operations, and the integration of renewable energy sources, like solar power, within its terminal infrastructure. These initiatives are crucial for meeting environmental goals and maintaining operational competitiveness in a rapidly evolving regulatory landscape.

DP World faces significant environmental responsibilities, particularly in waste management and pollution control. Effectively managing waste from both vessels and its terminals is crucial. This includes handling everything from general refuse to hazardous materials, ensuring proper disposal and recycling to meet stringent environmental standards.

Preventing pollution, especially oil spills, is paramount for port operations. DP World's commitment to environmental stewardship necessitates robust spill prevention and response plans. In 2023, the maritime industry saw continued efforts to reduce emissions, with the International Maritime Organization (IMO) aiming for net-zero GHG emissions by or around 2050, impacting vessel operations and port infrastructure.

Controlling air and noise pollution also remains a key focus. Emissions from ships, cargo handling equipment, and nearby industrial activities can impact local air quality and community well-being. DP World must adhere to international regulations like MARPOL Annex VI for air pollution and local noise ordinances, ensuring compliance to avoid fines and maintain its social license to operate.

Biodiversity and Ecosystem Protection

Port expansions and ongoing operations by DP World can significantly affect marine and terrestrial biodiversity, as well as delicate ecosystems. For instance, dredging for new channels or berths can disrupt seabed habitats. DP World's commitment to sustainability, as highlighted in their 2023 sustainability report, emphasizes the importance of conducting thorough environmental impact assessments before commencing new projects.

To address these environmental concerns, DP World is mandated to implement robust mitigation strategies to safeguard local flora and fauna. This involves careful management of dredging activities to minimize sediment plumes and protect sensitive marine life. Furthermore, preserving and restoring habitats surrounding their port facilities is a key component of their environmental stewardship. In 2024, DP World announced a partnership with a marine conservation group to monitor and enhance biodiversity around its Jebel Ali Port, aiming to increase fish populations by 15% by 2026.

- Environmental Impact Assessments: DP World conducts detailed EIAs for all new port developments to identify and assess potential impacts on biodiversity.

- Mitigation Strategies: Implementing measures such as responsible dredging, habitat restoration, and pollution control to minimize operational footprint.

- Biodiversity Monitoring: Ongoing programs to track the health of local ecosystems and the effectiveness of conservation efforts, with a focus on key indicator species.

- Sustainable Practices: Integrating eco-friendly technologies and operational procedures to reduce environmental impact and promote ecosystem resilience.

Resource Scarcity and Sustainable Resource Use

Resource scarcity, particularly concerning water and energy, presents a significant environmental consideration for DP World's global operations. The company is increasingly motivated to implement sustainable resource management, directly impacting its bottom line through reduced operational expenses. For instance, investing in water recycling technologies and energy efficiency upgrades can yield substantial cost savings. By 2024, global water stress is projected to affect over 5 billion people, highlighting the urgency for companies like DP World to adopt efficient water usage strategies across its port facilities.

DP World's commitment to environmental stewardship is further demonstrated through its exploration and adoption of renewable energy sources. This strategic shift not only mitigates the environmental impact of its energy consumption but also aligns with growing investor and regulatory demands for sustainable business practices. As of early 2025, renewable energy sources are becoming more cost-competitive, making investments in solar and wind power for DP World's facilities a financially sound decision. The company has set targets to reduce its carbon footprint, with energy efficiency and renewable energy integration being key pillars.

- DP World's investments in water recycling and energy efficiency aim to lower operational costs and enhance its environmental profile.

- The global increase in water stress by 2024 underscores the critical need for efficient water management in port operations.

- Adoption of renewable energy sources, such as solar and wind power, is a strategic move to reduce carbon emissions and align with sustainability goals.

- DP World's proactive approach to resource management positions it favorably amidst increasing environmental regulations and investor expectations for ESG performance.

Environmental factors pose significant risks and opportunities for DP World. Climate change, with rising sea levels and extreme weather, threatens port infrastructure, necessitating investments in resilient designs. The push for decarbonization in maritime logistics, driven by regulations like IMO's GHG reduction targets, compels DP World to adopt cleaner fuels and electric equipment.

DP World must also manage waste and pollution, including oil spills, to meet environmental standards and maintain its social license. Biodiversity impacts from port expansions require careful mitigation and habitat restoration, as seen in their 2024 partnership to enhance marine life around Jebel Ali Port. Resource scarcity, particularly water and energy, drives the adoption of efficient technologies and renewable energy sources, like solar power, which became more cost-competitive by early 2025.

| Environmental Factor | Impact on DP World | DP World's Response/Action | Relevant Data/Target |

|---|---|---|---|

| Climate Change (Sea Level Rise, Extreme Weather) | Risk to port infrastructure, operational disruption | Investing in climate-resilient designs (e.g., enhanced quay walls) | Jebel Ali Port infrastructure upgrades |

| Decarbonization Pressure | Need to reduce emissions from operations | Adopting alternative fuels, electric port equipment, renewable energy | IMO GHG reduction targets (20% by 2030 vs 2008) |

| Waste Management & Pollution Control | Compliance with environmental standards, risk of spills | Robust waste handling, spill prevention and response plans | MARPOL Annex VI for air pollution; IMO net-zero GHG target by 2050 |

| Biodiversity Impact | Potential disruption to marine and terrestrial ecosystems | Environmental Impact Assessments, habitat restoration, biodiversity monitoring | Partnership to enhance biodiversity around Jebel Ali Port (target: 15% increase in fish populations by 2026) |

| Resource Scarcity (Water, Energy) | Operational cost implications, need for efficiency | Water recycling, energy efficiency upgrades, adoption of renewable energy | Global water stress affecting over 5 billion people by 2024; increased cost-competitiveness of renewables by early 2025 |

PESTLE Analysis Data Sources

DP World's PESTLE Analysis is informed by a robust blend of data sources, including official government publications, international trade agreements, and reports from leading economic and logistics research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing global trade and port operations.