DP World Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DP World Bundle

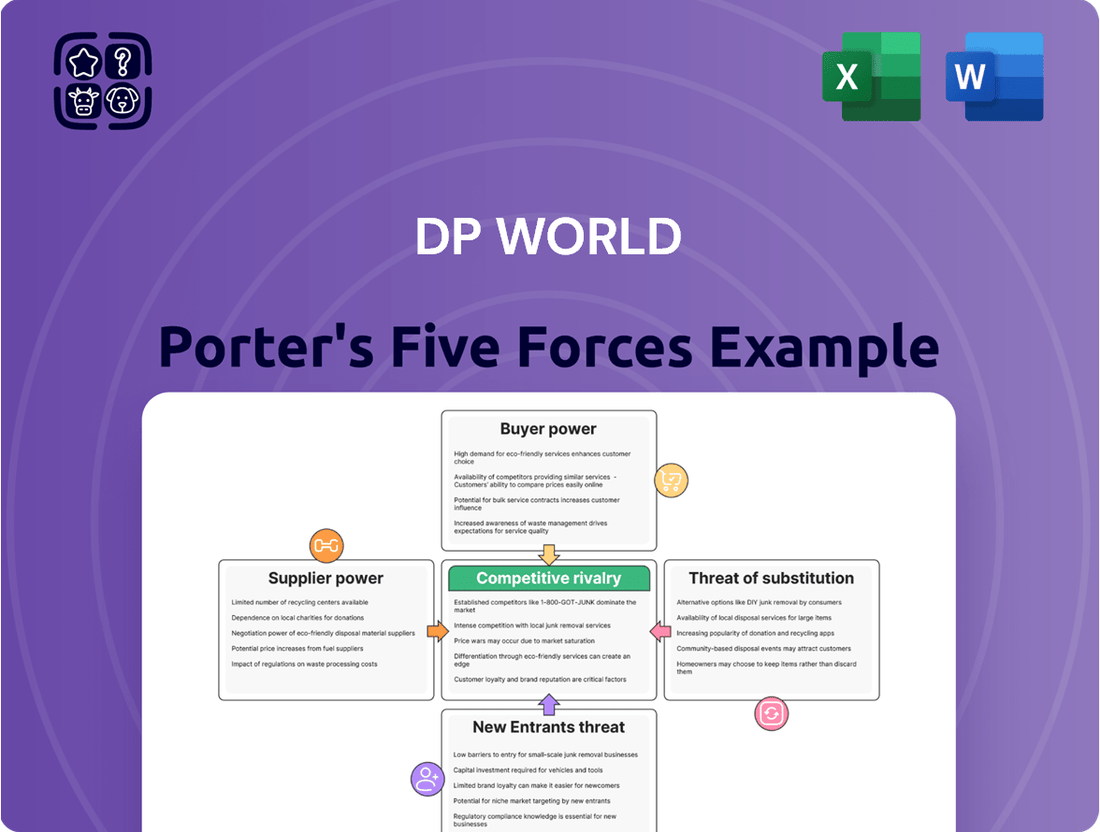

DP World operates within a complex global logistics landscape, facing significant pressure from powerful buyers and intense rivalry among established players. Understanding the nuances of supplier bargaining power and the threat of substitutes is crucial for navigating this dynamic market.

The complete report reveals the real forces shaping DP World’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

DP World depends on specialized suppliers for critical port machinery like quay cranes and yard cranes, as well as advanced logistics software. A high concentration among these suppliers, meaning only a few companies dominate the market for these essential inputs, grants them considerable leverage. For instance, in 2024, the market for large-scale port automation systems is largely controlled by a handful of global technology firms, potentially allowing them to dictate terms and pricing to DP World.

The uniqueness of inputs significantly impacts supplier power for DP World. Highly specialized port machinery, advanced IT systems for global supply chain management, and crucial land or concession rights can give suppliers considerable leverage. If DP World struggles to find readily available alternatives for these critical inputs, suppliers can dictate terms more effectively.

For example, proprietary software essential for managing DP World's extensive global network or unique, custom-designed port infrastructure can create strong dependencies on specific vendors. This lack of substitutability means suppliers of these specialized components or systems are in a stronger bargaining position, potentially leading to higher costs or less favorable contract terms for DP World.

Switching costs for DP World, particularly concerning long-term infrastructure and integrated technology systems, can be significant. These costs encompass contractual penalties, the expense of retraining personnel on new systems, and the potential for operational disruptions during a transition. For instance, replacing a proprietary terminal operating system could involve millions in licensing, integration, and downtime costs.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into port operations or logistics services significantly boosts their bargaining power against DP World. This potential for suppliers to become direct competitors introduces a new dynamic, as they could capture a larger share of the value chain.

However, DP World's extensive global footprint and the substantial capital investment required for port infrastructure and operations present a formidable barrier to entry for most suppliers contemplating forward integration. For instance, establishing a new container terminal often involves billions of dollars in upfront costs and extensive regulatory approvals, making it an economically unfeasible proposition for the vast majority of DP World's suppliers.

- High Capital Requirements: Building and operating a modern port facility demands immense capital, often in the billions of dollars, deterring most suppliers.

- Geographic Dispersion: DP World operates in numerous countries, requiring suppliers to replicate complex operations globally to effectively compete.

- Regulatory Hurdles: Port operations are heavily regulated, adding layers of complexity and cost for any potential new entrant.

- DP World's Scale: The sheer scale and established network of DP World create significant competitive advantages that are difficult for suppliers to overcome through integration.

Importance of DP World to Suppliers

The significance of DP World as a customer heavily influences its bargaining power with suppliers. If DP World constitutes a large percentage of a supplier's overall sales, that supplier is likely more amenable to favorable pricing and contract terms. For instance, in 2024, DP World's substantial procurement volumes across its global port operations mean that many equipment manufacturers and service providers rely significantly on these contracts for revenue stability.

Conversely, if DP World is a minor client for a large-scale supplier, its individual leverage diminishes. Suppliers serving a broad customer base, including other major port operators, may be less inclined to offer concessions to DP World alone. This dynamic is critical when considering the cost of specialized equipment or essential services required for port operations, where supplier concentration can be high.

- DP World's substantial procurement volumes in 2024 give it considerable leverage with suppliers who depend on its business.

- Suppliers with a diversified customer base may exhibit less price sensitivity to DP World's demands.

- The reliance of specific equipment manufacturers on DP World contracts can significantly impact negotiation outcomes.

DP World faces moderate bargaining power from its suppliers due to the specialized nature of port equipment and technology. While a few dominant firms supply critical machinery like quay cranes, DP World's scale and global presence can mitigate some supplier leverage. For instance, in 2024, DP World’s significant order volumes for automated terminal systems from a limited number of providers mean these suppliers are incentivized to maintain competitive pricing to secure these large contracts.

The bargaining power of suppliers is amplified by the high switching costs associated with integrated port technology and infrastructure. Replacing proprietary operating systems or specialized machinery involves substantial financial outlays and operational risks for DP World. This dependency makes suppliers of unique, custom-designed solutions, such as advanced terminal operating systems, particularly influential in contract negotiations.

DP World's substantial procurement volumes in 2024 provide considerable leverage over suppliers who rely heavily on its business. However, suppliers with a diversified customer base, including other major port operators, may exhibit less price sensitivity to DP World's demands, thus balancing this power dynamic.

| Supplier Characteristic | Impact on DP World | 2024 Context/Example |

|---|---|---|

| Supplier Concentration | High concentration grants suppliers more power. | Market for automated port systems dominated by a few key players. |

| Uniqueness of Input | Lack of substitutes increases supplier leverage. | Proprietary software for global supply chain management. |

| Switching Costs | High costs for DP World empower suppliers. | Millions in costs to replace integrated terminal operating systems. |

| Forward Integration Threat | Suppliers becoming competitors enhances their power. | Limited by DP World's high capital requirements and regulatory hurdles. |

| DP World's Customer Significance | DP World's large share of supplier sales increases its leverage. | Substantial procurement volumes ensure supplier reliance on DP World contracts. |

What is included in the product

This analysis dissects the competitive forces impacting DP World, evaluating the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the global port and logistics sector.

Easily identify and quantify the impact of each Porter's Five Forces on DP World's operations, providing clear insights into competitive pressures.

Customers Bargaining Power

DP World caters to a wide array of clients, from global shipping giants to individual cargo owners and businesses needing comprehensive logistics. The concentration of these customers is a key factor in their bargaining power. If a small number of very large customers generate a substantial percentage of DP World's income, they can leverage this position to negotiate lower service fees or demand more advantageous contract conditions.

Switching port operators or logistics providers can be a costly endeavor for customers. These costs can include the expense of reconfiguring entire supply chains, the administrative burden of negotiating new contracts, and the operational adjustments required to work with a different provider. For instance, a company might face significant upfront fees or the need for extensive training to adopt new systems.

Consequently, these high switching costs significantly diminish the bargaining power of customers. When it's difficult or expensive to change providers, customers are less inclined to seek alternative options, even if DP World implements minor price increases or offers slightly less favorable terms. This inertia benefits DP World by allowing them to maintain pricing and service levels.

Customer price sensitivity is a significant factor for DP World, particularly in the global trade and logistics sector. Many of its clients operate in highly competitive industries where even small cost savings can impact their bottom line. This sensitivity intensifies when economic conditions worsen or when there's an oversupply of shipping capacity, as seen in various periods of global trade fluctuations.

For instance, during 2023, the global shipping industry experienced a notable slowdown in freight rates compared to the peak of 2021 and early 2022. This decline in rates directly translates to customers having more leverage to negotiate terms and prices with terminal operators like DP World. Companies are actively seeking cost efficiencies, making price a primary consideration in their choice of logistics partners.

Threat of Backward Integration by Customers

The threat of backward integration by customers, particularly large shipping lines and major cargo owners, significantly impacts DP World's bargaining power. If these entities were to invest in and operate their own port terminals or logistics facilities, they would gain greater control over their supply chains, thereby increasing their leverage over DP World.

This is not merely a theoretical concern. Several major shipping lines already hold stakes in terminal operations, demonstrating that backward integration is a tangible and actively pursued strategy within the industry. For instance, by 2023, companies like Maersk were actively expanding their integrated logistics offerings, which could naturally extend to terminal ownership.

- Customer Integration Potential: Large shipping conglomerates possess the financial resources and operational expertise to develop or acquire their own port infrastructure.

- Industry Precedent: Existing investments by shipping lines in terminal operations serve as a clear indicator of this trend's viability.

- Increased Bargaining Power: Successful backward integration by customers directly reduces their reliance on DP World, enhancing their negotiation position.

Availability of Alternative Services

The bargaining power of DP World's customers is significantly influenced by the availability of alternative services. When customers have numerous choices for port operations, logistics, or shipping routes, their ability to negotiate better terms with DP World intensifies.

For instance, if a shipper can easily find comparable services from other major port operators or a network of independent logistics providers, they are less reliant on DP World. This is particularly relevant in 2024, where disruptions in global supply chains have sometimes led to increased demand for alternative routes and providers. DP World's strategy to counter this involves building a vast global network and offering integrated, end-to-end solutions. This aims to create a unique value proposition, making it harder for customers to find a direct, equally comprehensive alternative, thereby moderating their bargaining power.

- Availability of Alternatives: Customers can switch to other ports or logistics providers if DP World's pricing or service levels are unfavorable.

- Customer Reliance: DP World's integrated solutions and global reach aim to reduce customer reliance on alternatives.

- Market Dynamics: In 2024, the evolving logistics landscape, including new port developments and digital freight platforms, can either increase or decrease the availability of viable alternatives for DP World's clients.

DP World's customers, especially large shipping lines, hold significant bargaining power due to their substantial business volume and the potential for backward integration. High switching costs for customers, however, tend to mitigate this power. In 2023, the global shipping slowdown meant customers were more price-sensitive, giving them more leverage to negotiate with terminal operators.

The availability of alternative port operators and logistics providers also influences customer power. DP World's extensive global network and integrated services aim to reduce customer reliance on these alternatives, thereby strengthening its negotiating position. The industry has seen major players like Maersk expanding integrated logistics in 2023, hinting at potential terminal ownership by customers.

| Factor | Impact on DP World | 2023/2024 Relevance |

|---|---|---|

| Customer Concentration | High concentration of large clients increases their bargaining power. | Major shipping lines represent a significant portion of global trade volumes. |

| Switching Costs | High switching costs reduce customer bargaining power. | Reconfiguring supply chains and adopting new systems remain costly for clients. |

| Price Sensitivity | Increased price sensitivity empowers customers to negotiate better terms. | Global trade slowdown in 2023 led to lower freight rates, increasing customer leverage. |

| Backward Integration Threat | Potential for customers to operate their own terminals enhances their power. | Shipping lines are increasingly involved in end-to-end logistics solutions. |

| Availability of Alternatives | More alternatives increase customer bargaining power. | New port developments and digital platforms in 2024 could offer more choices. |

Full Version Awaits

DP World Porter's Five Forces Analysis

This preview showcases the complete DP World Porter's Five Forces Analysis, offering an in-depth examination of the competitive landscape. The document you see here is precisely the same professionally formatted analysis you will receive immediately after purchase, ensuring no surprises. You can confidently expect to download this comprehensive report, ready for immediate use and strategic application.

Rivalry Among Competitors

The global port and logistics arena is quite crowded, featuring several major companies that compete directly with DP World. Think of players like PSA International, China Merchants Ports, APM Terminals, and MSC Group. These aren't small operations; they are significant global entities.

What's really telling is that the top seven port operators worldwide collectively manage more than 40% of all cargo passing through ports globally. This statistic highlights a notable level of market concentration, meaning a few large companies hold a substantial share of the business.

The global logistics and port operations industry is experiencing a moderate growth trajectory. Projections indicate that global container throughput is expected to see continued expansion, with estimates suggesting a compound annual growth rate (CAGR) in the low single digits for the coming years. However, if this growth rate were to slow down significantly, it would likely fuel more aggressive competition among established players like DP World as they fight to capture market share in a less expanding environment.

DP World actively differentiates its services beyond basic port operations. This includes offering specialized cargo handling for complex goods and providing integrated, end-to-end supply chain solutions that streamline logistics for clients. For instance, DP World's 2023 revenue reached $11.6 billion, reflecting its success in offering value-added services.

The company's significant investments in advanced technology, such as automation and artificial intelligence, further set it apart. These technological advancements aim to improve efficiency, reduce costs, and enhance the overall customer experience, thereby mitigating direct price competition. By focusing on these differentiators, DP World aims to build stronger customer loyalty and command premium pricing.

Exit Barriers

DP World faces significant competitive rivalry due to high exit barriers in the port and logistics sector. The immense capital investment required for ports, terminals, and specialized infrastructure creates a substantial financial commitment. For instance, developing a new deep-water port can easily run into billions of dollars, making it incredibly difficult for companies to divest or exit unprofitable operations without incurring massive losses.

Long-term concession agreements further lock companies into specific markets, even if those markets become less attractive. These agreements often span decades, obligating operators to maintain facilities and services. This means that even if a particular terminal is underperforming, DP World and its competitors are compelled to continue operations, intensifying the fight for market share and profitability among existing players.

The specialized nature of port infrastructure also contributes to high exit barriers. Assets like gantry cranes, specialized berths, and sophisticated cargo handling systems have limited alternative uses outside the maritime industry. This lack of fungibility means that selling these assets upon exit is challenging and often results in significant write-downs, reinforcing the tendency for companies to remain in the market despite adverse conditions, thereby fueling competitive pressure.

- High Capital Investment: Building a modern container terminal can cost upwards of $1 billion, creating a significant barrier to exit.

- Long-Term Concessions: Concession agreements often range from 30 to 50 years, obligating operators to long-term commitments.

- Specialized Assets: Port infrastructure, such as specialized cranes and deep-water berths, has very limited resale value outside the industry.

Cost Structure of Competitors

Competitors in the port and logistics sector often exhibit significant fixed costs, primarily due to massive infrastructure investments in terminals, cranes, and IT systems. For instance, major players like Maersk's APM Terminals or Hutchison Ports require substantial upfront capital, leading to high fixed cost bases. This can pressure operators to maintain high utilization rates, potentially leading to more aggressive pricing to fill capacity, especially during economic downturns.

The interplay between fixed and variable costs shapes competitive dynamics. Companies with a higher proportion of fixed costs may be more sensitive to volume fluctuations, potentially engaging in price wars to secure business and cover their overheads. Conversely, a more flexible, variable cost structure might allow for greater pricing agility without compromising profitability on underutilized assets.

Geopolitical shifts and escalating operational expenses, such as fuel, labor, and regulatory compliance, further complicate cost structures. For example, supply chain disruptions in 2024 have led to increased energy costs and labor shortages, impacting the variable cost components for many operators. These rising costs can either force price increases across the board or create opportunities for more cost-efficient competitors to gain an advantage.

- High Fixed Costs: Port operators face substantial fixed costs from infrastructure development and maintenance, impacting their need for high utilization.

- Pricing Strategy Influence: Operators with high fixed costs may lower prices to ensure capacity utilization, intensifying price competition.

- Variable Cost Sensitivity: Rising operational expenses like fuel and labor in 2024 affect variable costs, influencing competitive positioning.

- Geopolitical Impact: Geopolitical factors can disrupt supply chains and increase operational costs, further influencing competitor cost structures and pricing.

DP World operates in a highly competitive landscape with major global players like PSA International and China Merchants Ports. The top seven port operators manage over 40% of global cargo, indicating significant concentration and intense rivalry. While the industry sees moderate growth, any slowdown could intensify competition as firms fight for market share.

High exit barriers, including massive capital investments exceeding $1 billion for new terminals and long-term concession agreements (often 30-50 years), keep companies locked in. Specialized assets also have limited resale value, forcing operators to compete vigorously within the existing market rather than exit easily.

High fixed costs associated with infrastructure and technology compel operators to maintain high utilization rates. This can lead to aggressive pricing strategies, especially when demand softens or operational expenses like fuel and labor, which saw increases in 2024, rise. Companies with more variable cost structures may have an advantage in pricing flexibility.

| Competitor | Global Market Share (Approx.) | Key Differentiators/Strategies |

|---|---|---|

| PSA International | Significant global presence, focus on efficiency and strategic partnerships. | Strong foothold in Asia, particularly Singapore. |

| China Merchants Ports | Extensive port network, particularly in China and along the Belt and Road Initiative. | Government backing, integrated logistics solutions. |

| APM Terminals (Maersk) | Global terminal network, integrated with Maersk's shipping lines. | Leveraging synergies with parent company, focus on digitalization. |

| Hutchison Ports | Wide geographical spread, diverse port operations. | Strategic acquisitions and investments in emerging markets. |

SSubstitutes Threaten

While ocean shipping is the backbone of global trade, alternative transport modes like air cargo, rail, and trucking present viable substitutes for specific needs. For instance, air freight, though significantly more expensive, offers speed for time-sensitive or high-value items, a segment where ocean shipping is less competitive. In 2024, the global air cargo market saw continued demand, with volumes expected to grow, demonstrating its role as a substitute for certain high-margin goods traditionally moved by sea.

Large multinational corporations increasingly possess the resources and expertise to develop sophisticated in-house logistics and supply chain management capabilities. This trend of backward integration by customers directly challenges third-party providers like DP World, as these giants can internalize services previously outsourced. For instance, a major automotive manufacturer might invest in its own fleet of trucks and warehousing facilities, reducing its reliance on external port operators for certain segments of its supply chain.

This strategic move by customers to build internal logistics operations can significantly diminish the demand for external port and terminal services. Companies like Amazon have famously expanded their logistics networks, operating their own fulfillment centers and delivery systems, thereby capturing a larger share of the value chain and reducing their dependence on traditional logistics partners.

Emerging technologies like drone delivery for last-mile logistics and sophisticated digital platforms enabling direct shipping present a growing threat. These innovations could offer viable alternatives to traditional port and cargo handling, particularly for niche or smaller shipments. For instance, the global drone delivery market is projected to reach over $30 billion by 2026, indicating significant potential for disruption.

Shifts in Global Supply Chains

Shifts in global supply chains represent a significant threat of substitutes for DP World. As companies increasingly explore reshoring or nearshoring manufacturing, the reliance on extensive international shipping and traditional port services diminishes. This trend favors more localized supply chains and alternative logistics models, potentially bypassing major hub ports.

For instance, the ongoing restructuring of global supply chains, accelerated by geopolitical events and a desire for greater resilience, could see a rise in regional distribution centers. This might reduce the volume of goods passing through large, consolidated ports. In 2024, many companies continued to re-evaluate their sourcing strategies, with a notable increase in investments in domestic manufacturing capabilities in North America and Europe.

- Reshoring Initiatives: Governments in developed economies are actively promoting domestic manufacturing, reducing the need for long-haul shipping.

- Nearshoring Trends: Companies are moving production closer to end markets, shortening supply chains and potentially using smaller, regional ports.

- Digitalization of Logistics: Advanced digital platforms can facilitate more direct and efficient movement of goods, potentially reducing reliance on traditional intermediaries.

- Alternative Transportation: Growth in air cargo for high-value goods or increased use of rail and road for regional movements can substitute for ocean freight services.

Direct Manufacturer-to-Consumer Models

The proliferation of direct-to-consumer (D2C) models, significantly boosted by advancements in e-commerce platforms, presents a notable threat of substitution for traditional logistics providers like DP World. These D2C approaches allow manufacturers to bypass intermediaries, including bulk shipping and extensive warehousing networks, thereby potentially diminishing the demand for services heavily reliant on large-scale port infrastructure.

This shift can lead to an increased demand for specialized logistics, such as last-mile parcel delivery, which operates on different models and infrastructure requirements than containerized freight. For instance, by 2024, the global e-commerce market is projected to reach over $6.3 trillion, with a substantial portion of this growth driven by D2C sales, indicating a tangible shift in consumer purchasing habits and the associated logistical needs.

- D2C Growth: E-commerce enabling manufacturers to sell directly to consumers bypasses traditional supply chains.

- Logistics Shift: This reduces reliance on bulk shipping and large warehousing, favoring parcel delivery services.

- Market Impact: By 2024, global e-commerce is expected to surpass $6.3 trillion, with D2C playing a significant role.

The threat of substitutes for DP World is multifaceted, encompassing alternative transportation modes, customer backward integration, and evolving supply chain structures. Air cargo, though pricier, offers speed for high-value goods, a segment where ocean shipping is less competitive. In 2024, air cargo volumes continued to grow, highlighting its role as a substitute for certain time-sensitive shipments.

Large corporations increasingly manage their logistics in-house, reducing reliance on third-party providers like DP World. Amazon's expansion into its own delivery networks exemplifies this trend, capturing more of the value chain. Emerging technologies like drone delivery also pose a future threat, particularly for niche shipments.

Shifts in global supply chains, such as reshoring and nearshoring, diminish the need for extensive international shipping and traditional port services. In 2024, many companies re-evaluated sourcing, investing in domestic manufacturing, which favors regional distribution centers over large hub ports.

The rise of direct-to-consumer (D2C) models, fueled by e-commerce, bypasses traditional logistics. This shift favors specialized parcel delivery over bulk shipping and large warehousing. By 2024, global e-commerce was projected to exceed $6.3 trillion, with D2C sales a significant driver.

| Substitute Mode | Key Characteristic | 2024 Relevance/Projection |

|---|---|---|

| Air Cargo | Speed for high-value/time-sensitive goods | Continued demand growth, substituting for specific ocean freight needs |

| In-house Logistics (Customer Integration) | Control over supply chain, cost efficiency | Increasing trend among large corporations, reducing outsourcing |

| Drone Delivery | Last-mile efficiency, niche applications | Market projected to reach over $30 billion by 2026 |

| Reshoring/Nearshoring | Reduced reliance on long-haul shipping | Accelerated by geopolitical events, favoring regional logistics |

| Direct-to-Consumer (D2C) | Bypassing intermediaries, specialized delivery | E-commerce market over $6.3 trillion by 2024, significant D2C component |

Entrants Threaten

The global port and logistics industry demands staggering upfront capital. Building a new, state-of-the-art container terminal can easily cost billions of dollars, encompassing land acquisition, dredging, quay construction, and advanced cargo-handling equipment. For instance, DP World's Jebel Ali Port expansion projects have seen investments in the hundreds of millions, highlighting the scale involved.

These substantial capital requirements create a formidable barrier to entry for potential new competitors. Companies must secure massive financing, often through complex debt structures or equity raises, just to establish a basic operational footprint. This financial hurdle significantly limits the pool of viable new entrants capable of challenging established players like DP World.

Established giants like DP World enjoy substantial economies of scale, which translates into lower operational costs per container handled. For instance, in 2023, DP World reported a revenue of $12.4 billion, reflecting its massive operational footprint and the cost advantages that come with it.

Newcomers would find it incredibly challenging to match these cost efficiencies without first securing a significant market share. This barrier means that a new entrant would likely face higher per-unit costs, making it difficult to compete on price against an incumbent with established scale.

New players face significant hurdles in securing prime port locations and obtaining long-term government concessions, which are essential for operations. These prime spots are often already occupied by established entities. For instance, in 2024, the global port infrastructure market continues to see substantial investment, but the majority of high-traffic, strategically located ports are operated under decades-long concessions by major players like DP World, Maersk, and COSCO Shipping Ports, making it difficult for newcomers to find suitable, available sites.

Brand Loyalty and Reputation

DP World's established brand loyalty and robust reputation present a significant barrier to new entrants. Building comparable trust and recognition in the global supply chain sector requires immense investment and time, often spanning decades. For instance, DP World's consistent performance and strategic partnerships have solidified its market position, making it difficult for newcomers to quickly gain traction.

New companies face the daunting task of replicating DP World's decades-long commitment to service excellence and reliability. This deep-seated customer loyalty means that existing clients are unlikely to switch to an unproven entity without substantial incentives. In 2023, DP World reported a significant increase in gross profit, underscoring its operational efficiency and the value customers place on its services.

- Brand Recognition: DP World is a globally recognized name, synonymous with efficient port operations and supply chain management.

- Customer Loyalty: Long-standing relationships with major shipping lines and cargo owners create a sticky customer base.

- Reputational Capital: DP World's history of successful project execution and innovation builds significant trust.

- Market Inertia: The cost and effort for a new entrant to displace DP World's established reputation are substantial.

Regulatory and Government Policies

The port and logistics sector is a heavily regulated environment, demanding numerous permits, licenses, and strict adherence to compliance standards. These extensive requirements act as a significant barrier, making it challenging and costly for potential new entrants to establish operations and compete effectively.

Government policies play a crucial role in shaping the industry landscape. For instance, environmental regulations, such as emissions standards for vessels and port facilities, can necessitate substantial capital investment in new technologies or upgrades, deterring smaller or less capitalized new players. Similarly, evolving trade agreements can alter the flow of goods and introduce new operational complexities, requiring established players and potential entrants alike to adapt their strategies and infrastructure.

- High Capital Requirements: Securing necessary permits and licenses, alongside investing in compliant infrastructure and technology, demands significant upfront capital, often in the hundreds of millions of dollars for major port operations.

- Complex Compliance Frameworks: Navigating international maritime regulations, customs procedures, and national security requirements involves specialized expertise and ongoing investment in compliance management systems.

- Government Support for Incumbents: In some regions, governments may offer incentives or preferential treatment to existing port operators, further solidifying their market position and creating an uneven playing field for new entrants.

The threat of new entrants into the global port and logistics sector, particularly for a major player like DP World, is generally considered low. This is primarily due to the immense capital investment required, which can run into billions for establishing a modern container terminal. For instance, DP World's ongoing expansion projects consistently involve hundreds of millions in investment, setting a high bar for any newcomer. This financial barrier, coupled with the difficulty of securing prime, concessioned port locations—which are typically already held by established operators—significantly limits the number of viable new competitors.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Building new port infrastructure costs billions, including land, dredging, and equipment. | Very High - Deters most potential entrants. |

| Access to Distribution Channels/Locations | Prime port locations are scarce and often secured by long-term concessions. | High - Difficult to find suitable, available sites. |

| Brand Reputation & Customer Loyalty | Decades of service excellence build strong client relationships. | High - New entrants struggle to gain trust and displace incumbents. |

| Government Policy & Regulation | Extensive permits, licenses, and compliance requirements are costly and complex. | High - Adds significant operational and financial burdens. |

Porter's Five Forces Analysis Data Sources

Our DP World Porter's Five Forces analysis is built upon a foundation of diverse and credible data sources. These include DP World's official annual reports and investor presentations, alongside industry-specific market research reports from reputable firms like Drewry and IHS Markit. We also incorporate data from financial news outlets and trade publications to capture real-time market dynamics and competitive intelligence.