DP World Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DP World Bundle

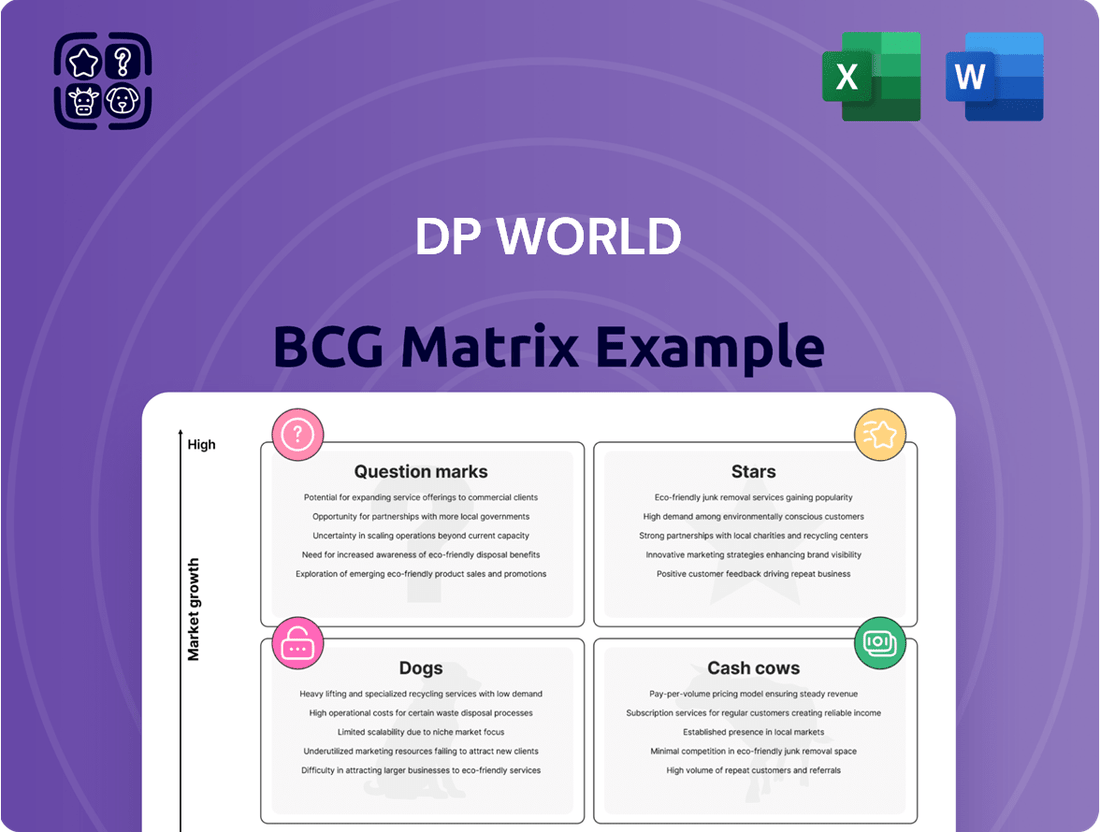

Uncover the strategic positioning of DP World's diverse portfolio with our insightful BCG Matrix preview. See where their ventures fall as Stars, Cash Cows, Dogs, or Question Marks, and understand the implications for future growth. Purchase the full BCG Matrix report for a comprehensive breakdown, data-driven recommendations, and a clear roadmap to optimize DP World's investment and product strategies.

Stars

DP World is actively expanding its portfolio beyond traditional port operations to encompass integrated supply chain solutions. This strategic shift includes offering services like advanced container handling, extensive warehousing, and efficient intermodal transportation. These integrated offerings are key growth drivers in the increasingly complex global logistics landscape.

The company's investment in these high-growth, high-margin areas, such as specialized cargo handling and digitalized logistics platforms, is designed to capture greater value. For instance, DP World's 2024 investments have heavily focused on expanding its logistics parks and digital infrastructure, aiming to streamline the entire movement of goods from origin to destination.

DP World is strategically channeling significant capital into key growth markets, with a projected $2.5 billion expenditure in 2025. This substantial investment underscores its commitment to expanding capacity and solidifying its global trade leadership.

These investments are targeted at high-potential regions, including major developments in India at Tuna Tekra, Senegal's Ndayane port, Jeddah in Saudi Arabia, and the UK's London Gateway. These projects are designed to capture growing trade volumes and enhance DP World's market share in these vital economic corridors.

The logistics sector is rapidly embracing automation and artificial intelligence. The global AI in logistics market was valued at approximately $3.5 billion in 2023 and is expected to grow significantly, reaching an estimated $25.4 billion by 2030, with a compound annual growth rate of over 32%. DP World is at the forefront of this digital transformation, investing heavily in AI, predictive analytics, and advanced digital platforms to streamline operations and boost supply chain resilience.

DP World's strategic investments in technologies like AI and predictive analytics are designed to enhance operational efficiency and provide greater visibility across its global network. For instance, their use of AI in port operations can optimize container placement and reduce vessel turnaround times, directly impacting cost savings and service speed. This focus on digitalization allows DP World to offer more agile and responsive logistics solutions in a market that demands constant innovation.

Expansion of Global Port Capacity

DP World's strategic investments in expanding its global port capacity firmly place it in the 'Star' category of the BCG matrix. In 2024, the company's container handling capacity surpassed 100 million TEU, a testament to its aggressive growth strategy.

Further bolstering this position, DP World is set to add approximately 5.4 million TEUs of capacity in 2025, projecting a total of 107.6 million TEUs. This continuous infrastructure development signals a dominant market share within the expanding global port operations sector.

- Global Port Capacity Growth: DP World's container handling capacity reached over 100 million TEU in 2024.

- Future Expansion: Plans include an additional 5.4 million TEU capacity in 2025, reaching an estimated 107.6 million TEU.

- Market Position: This expansion signifies a high market share in a growing port operations market.

- Performance: DP World's gross container volumes outperform the market, reinforcing its 'Star' status.

Focus on Sustainability and Green Logistics

DP World's strategic focus on sustainability and green logistics is a key driver for its future growth, aligning with global environmental imperatives. The company's commitment is evident through actions like issuing a $100 million blue bond, a significant financial instrument dedicated to environmental projects. Furthermore, DP World has had its emissions reduction targets validated by the Science Based Targets initiative (SBTi), underscoring a credible approach to decarbonization.

The 'Our World, Our Future' strategy actively embeds eco-friendly practices across operations. This includes the adoption of electric vehicles within its fleet and the continuous optimization of logistics routes to minimize fuel consumption and emissions. These initiatives are not just about environmental responsibility but are increasingly becoming a competitive advantage in the logistics sector.

This dedication to sustainability is attracting a growing segment of environmentally conscious clients, positioning DP World as a frontrunner in the burgeoning green logistics market. By integrating sustainability into its core business model, DP World is enhancing its brand reputation and securing long-term viability in an industry where environmental performance is paramount.

- $100 million: Amount of blue bond issued to fund environmental projects.

- SBTi Validation: Emissions targets confirmed by the Science Based Targets initiative.

- 'Our World, Our Future': DP World's strategy to integrate eco-friendly practices.

- Electric Vehicles & Route Optimization: Key operational initiatives for greener logistics.

DP World's substantial investments in expanding its global port capacity, exceeding 100 million TEU in 2024 and projected to reach 107.6 million TEU in 2025, firmly place it in the 'Star' category of the BCG matrix. This aggressive growth strategy, coupled with outperforming gross container volumes, signals a dominant market share in a rapidly expanding port operations sector.

| Metric | 2024 (Actual) | 2025 (Projected) | Growth Indicator |

|---|---|---|---|

| Container Handling Capacity (Million TEU) | 100+ | 107.6 | Expansion |

| New Capacity Addition (Million TEU) | N/A | 5.4 | Investment |

| Market Share in Port Operations | Dominant | Increasing | Strategic Focus |

What is included in the product

This DP World BCG Matrix analysis offers tailored insights for its product portfolio, highlighting which units to invest in, hold, or divest.

A clear BCG Matrix visualizes DP World's portfolio, easing the pain of strategic resource allocation.

Cash Cows

DP World's established global port terminal operations are firmly positioned as Cash Cows within the BCG Matrix. This segment benefits from DP World's extensive worldwide network, where the company commands a substantial market share in a mature industry.

These operations consistently deliver robust financial results, with container handling capacity surpassing 100 million TEU. This significant volume translates directly into substantial and reliable revenue streams and adjusted EBITDA for the company.

The Ports and Terminals segment showcased a strong performance trajectory throughout 2024, playing a pivotal role in DP World achieving record overall revenue. This segment's consistent profitability underpins the company's financial stability.

Jebel Ali Port and Freezone (Jafza) stands as DP World's premier asset, a mature and exceptionally well-performing operation. Its consistent revenue generation solidifies its position as a vital hub within DP World's extensive global network, underscoring its enduring significance and reliable cash flow.

In 2023, DP World reported a substantial 7.4% increase in revenue to $12.4 billion, with its terminals handling a record 89.5 million TEU (twenty-foot equivalent units). Jebel Ali Port, as the flagship, significantly contributed to this growth, demonstrating its continued strength.

Jafza's contribution to non-oil trade is considerable, highlighting a proven and mature business model that consistently generates substantial revenue for DP World, further solidifying its cash cow status.

DP World's freight forwarding network, boasting over 240 offices globally, functions as a robust cash cow. This extensive infrastructure ensures consistent revenue by efficiently managing ocean and air freight, customs clearance, and warehousing for a wide range of cargo owners.

The network's stability is further bolstered by DP World's strong position in the broader logistics market. While some areas are still expanding, the established presence in key trade routes generates reliable cash flow, supporting the company's overall financial health.

Warehousing and Logistics Parks

DP World's warehousing and logistics parks function as significant cash cows within its portfolio. These established assets across the globe, such as the Sokhna Logistics Park, consistently generate stable revenue from storage, distribution, and specialized logistics services. The ongoing need for efficient global trade infrastructure solidifies their role as reliable income generators.

These parks are crucial for DP World's integrated supply chain approach, offering essential services that support its core port operations. For instance, DP World London Gateway's warehousing facilities are integral to its multimodal offering, enhancing cargo flow and customer value. The company's strategic investments in expanding these logistics hubs underscore their importance as mature, revenue-generating assets.

- Stable Revenue Streams: DP World's logistics parks provide predictable income through long-term contracts for warehousing and distribution services.

- Global Network: The presence of these parks across key trade routes supports DP World's integrated supply chain solutions.

- Value-Added Services: Beyond mere storage, these facilities offer services like freight forwarding and customs clearance, boosting revenue per square foot.

- Market Demand: The increasing complexity and volume of global trade ensure a consistent demand for efficient and well-located warehousing.

Marine Services

DP World's marine services, encompassing essential offerings like drydocks and maritime support, function as a classic Cash Cow within its portfolio. These operations are characterized by their stability and critical importance to global port functionality, generating predictable and substantial revenue. While the market growth for these foundational services might be modest, DP World's significant market share, bolstered by its extensive infrastructure and established reputation, ensures consistent profitability.

The company's ongoing commitment to these segments is evident in strategic investments, such as the expansion and modernization of Drydocks World. This focus on maintaining and enhancing its marine service capabilities underscores their role as reliable profit generators, contributing significantly to DP World's overall financial strength. For instance, in 2023, DP World reported robust performance across its terminals, with marine services playing a vital role in supporting these operations.

- Stable Revenue Streams: Marine services provide consistent income due to their essential nature in port operations.

- High Market Share: DP World benefits from a dominant position in critical maritime support services.

- Strategic Investment: Continued investment in facilities like Drydocks World reinforces their Cash Cow status.

- Profitability Driver: These services are key contributors to DP World's overall financial performance.

DP World's established global port terminal operations are firmly positioned as Cash Cows within the BCG Matrix. These operations benefit from the company's extensive worldwide network, where DP World commands a substantial market share in a mature industry.

These operations consistently deliver robust financial results, with container handling capacity surpassing 100 million TEU. This significant volume translates directly into substantial and reliable revenue streams and adjusted EBITDA for the company.

The Ports and Terminals segment showcased a strong performance trajectory throughout 2024, playing a pivotal role in DP World achieving record overall revenue. This segment's consistent profitability underpins the company's financial stability.

Jebel Ali Port and Freezone (Jafza) stands as DP World's premier asset, a mature and exceptionally well-performing operation. Its consistent revenue generation solidifies its position as a vital hub within DP World's extensive global network, underscoring its enduring significance and reliable cash flow.

| Segment | BCG Category | Key Metrics (2023/2024 Data) | Strategic Importance |

|---|---|---|---|

| Ports & Terminals | Cash Cow | 100M+ TEU handled; Record revenue in 2024; Jebel Ali Port flagship | Core business, stable cash generation, global network backbone |

| Freight Forwarding | Cash Cow | 240+ global offices; Consistent revenue from ocean/air freight, customs | Supports integrated supply chain, reliable income |

| Warehousing & Logistics Parks | Cash Cow | Global presence (e.g., Sokhna, London Gateway); Stable revenue from storage/distribution | Enhances integrated supply chain, crucial for cargo flow |

| Marine Services | Cash Cow | Drydocks World expansion; Vital for port functionality; Robust performance in 2023 | Essential port support, consistent profitability, stable revenue |

Delivered as Shown

DP World BCG Matrix

The DP World BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive immediately after purchase. This comprehensive analysis, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional and actionable report ready for immediate use in your business planning.

Dogs

Within DP World's extensive network, certain smaller terminals may find themselves in markets experiencing sluggish growth. These locations, perhaps due to their strategic positioning or the competitive landscape, might struggle to capture substantial market share, leading to performance that barely breaks even or even consumes capital.

These underperforming assets are a natural consequence of managing a diverse global portfolio. While DP World's overall financial health is robust, with reported revenue growth of 10% year-on-year to $1.6 billion in the first half of 2024, these specific terminals represent a drag on overall profitability.

The challenge with these terminals lies in their limited potential for significant expansion or market dominance. Consequently, they may be candidates for divestment if strategies to improve their performance, such as operational efficiencies or targeted investment, do not yield positive results.

Some of DP World's older port infrastructure might fall into this category, characterized by significant challenges in upgrading to meet current efficiency and environmental demands. These assets often struggle in competitive, tech-driven logistics sectors, and the cost of modernization may outweigh the potential returns.

For instance, while specific port-by-port modernization costs are proprietary, the general trend in the industry highlights that retrofitting older facilities to accommodate larger vessels or implement advanced automation can run into hundreds of millions of dollars per terminal. DP World's strategic investments in advanced terminals, like those in Rotterdam or Jeddah, demonstrate a clear preference for newer, more adaptable assets, signaling a potential divestment or reduced focus on these legacy operations.

Certain niche logistics or port services within DP World's extensive portfolio might be experiencing declining demand. This could be due to evolving global trade routes, such as the redirection of shipping away from certain traditional hubs, or the rise of highly specialized, agile competitors who can offer more tailored solutions at lower costs. For instance, if DP World offers a very specific type of cargo handling that is becoming obsolete, or faces fierce price wars in a particular segment, these services could fall into this category.

Divested or Non-Core Assets

DP World might divest assets that are not central to its strategy of integrated supply chain solutions. These divested units, often characterized by low market share and limited growth potential within the company's overall structure, would typically be classified as Dogs in the BCG matrix. While specific divestitures from 2024-2025 aren't detailed in readily available public information, the strategic rationale for such actions remains consistent with portfolio optimization.

The decision to divest typically stems from a reassessment of an asset's contribution to DP World's long-term goals. If an operation is not generating sufficient returns or does not fit the vision for future growth, it may be considered for sale. This approach helps DP World concentrate resources on its more promising business segments.

- Strategic Realignment: Divestments occur when assets no longer align with DP World's core focus on integrated logistics and supply chain services.

- Performance Thresholds: Operations that fail to meet specific performance targets or profitability benchmarks are candidates for divestiture.

- Portfolio Optimization: Exiting low-growth, low-market-share segments frees up capital and management attention for more strategic investments.

- Market Dynamics: Changing industry landscapes or competitive pressures can also trigger the re-evaluation and potential divestment of certain business units.

Geographically Isolated or Politically Unstable Operations

Operations in geographically isolated or politically unstable regions present unique hurdles for DP World. These conditions can severely limit market share and growth potential, potentially placing such ventures in the Dogs quadrant of the BCG matrix. For instance, a terminal in a conflict-ridden area might struggle with consistent cargo volumes and face disruptions, resulting in low growth and a small market share.

DP World's diversified global footprint helps buffer against localized instability, but specific operations consistently impacted by these factors warrant close scrutiny. Such businesses may require significant restructuring or could be candidates for divestment if the risks outweigh the potential rewards. For example, a port facility in a nation experiencing prolonged civil unrest might see its revenue decline significantly, impacting its overall contribution to DP World's portfolio.

- Geopolitical Risk Impact: Operations in areas like the Horn of Africa, while strategically important, can be subject to regional instability, affecting throughput and profitability.

- Isolation Challenges: Terminals in remote locations with limited hinterland connectivity or underdeveloped infrastructure may experience slower growth compared to major hubs.

- Mitigation Strategies: DP World often employs robust security measures and diversified sourcing strategies to counter the effects of instability in certain operating regions.

- Strategic Review: Businesses facing persistent operational challenges due to isolation or political risk are periodically evaluated for their long-term viability and strategic fit within DP World's global network.

DP World's "Dogs" represent business units with low market share in low-growth industries. These might include older, less efficient terminals or niche logistics services facing declining demand. For instance, a terminal in a region with political instability or limited connectivity could struggle to grow and maintain a significant market share.

These underperforming assets, while not necessarily losing significant money, consume capital and management attention without offering substantial returns. DP World's strategy involves identifying these units for potential divestment or restructuring to optimize its global portfolio. This aligns with a broader industry trend of shedding non-core or underperforming assets to focus on high-growth areas.

DP World's overall revenue growth in the first half of 2024 was 10% to $1.6 billion, highlighting the strength of its core businesses. However, the presence of "Dogs" can dilute overall profitability. For example, while specific divestments in 2024 are not publicly detailed, the company's consistent focus on modernizing and expanding key hubs like Rotterdam indicates a strategic shift away from legacy operations that may no longer fit the growth profile.

The decision to divest is often driven by a lack of competitive advantage or a low potential for future expansion, especially when modernization costs are substantial. Industry benchmarks suggest retrofitting older ports can cost hundreds of millions, making divestment a logical step if returns are not projected to justify the investment.

Question Marks

DP World's strategic investments in new deep-sea ports, such as Banana in the Democratic Republic of Congo and Ndayane in Senegal, position these ventures as potential stars within the BCG matrix. These projects are situated in high-growth potential markets, aiming to tap into emerging trade corridors and stimulate significant economic development.

Despite the promising outlook, these new developments are currently in their nascent stages, characterized by low market share and substantial upfront capital requirements. This places them in the question mark category, demanding careful resource allocation and management to navigate the inherent uncertainties and achieve future market leadership.

Early-stage digital and AI-powered logistics platforms represent potential Stars or Question Marks within DP World's portfolio, depending on their current market penetration and future growth prospects. These innovative solutions, while promising high growth in the logistics tech sector, often start with a smaller market share until their scalability and widespread adoption are proven. DP World's strategic focus on digital transformation and AI integration means they are actively exploring and investing in such nascent technologies.

DP World's strategic expansion into new niche logistics verticals, such as automotive and technology supply chains, aligns with the characteristics of a question mark in the BCG matrix. These areas represent high-growth potential but currently have a low market share for DP World.

The acquisition of Syncreon in 2021 for $1.2 billion was a significant move into these specialized sectors, requiring substantial investment to build market presence and capture growth. This strategy aims to diversify DP World's revenue streams beyond traditional port operations.

Initiatives in Emerging Trade Corridors

DP World is strategically investing in emerging trade corridors, recognizing their high growth potential despite initial low market share. These ventures are designed to tap into developing economic regions and new trade routes, aligning with the company's objective to diversify and capture faster-growing markets.

These initiatives are characteristic of a question mark in the BCG matrix, signifying high market growth but currently low market share. DP World's commitment to these corridors demonstrates a forward-looking approach to global logistics, aiming to establish a strong foothold before competitors.

- Strategic Investments: DP World's expansion into nascent trade routes, such as those in Africa or Southeast Asia, exemplifies this strategy. For instance, their investments in ports like Berbera, Somaliland, aim to unlock significant regional trade potential.

- High Growth Potential: These corridors often serve rapidly developing economies, promising substantial volume increases as trade infrastructure and economic activity mature.

- Risk and Reward: While offering the chance to be an early mover, these corridors also present higher risks due to political instability, regulatory uncertainties, and undeveloped infrastructure.

- Portfolio Diversification: By focusing on these areas, DP World enhances its portfolio's resilience and growth prospects, moving beyond traditional, more saturated trade lanes.

Blue Economy and Ocean Conservation Initiatives

DP World's Ocean Strategy 2024-2030 and its $100 million blue bond issuance underscore a significant commitment to sustainable maritime operations and ocean protection. This strategic move positions DP World as a leader in the burgeoning blue economy, aiming to foster long-term environmental stewardship alongside its core business.

While these initiatives represent a forward-thinking approach to sustainability and brand enhancement, their immediate financial returns within the developing blue economy sector are projected to be modest. However, the long-term growth potential is substantial, driven by increasing environmental regulations and heightened consumer and investor awareness regarding marine conservation.

- DP World's Ocean Strategy 2024-2030: Focuses on reducing emissions, promoting circular economy principles, and investing in marine ecosystem restoration.

- $100 Million Blue Bond Issuance: The proceeds are earmarked for eligible blue economy projects, including sustainable marine and coastal infrastructure.

- Market Position in Blue Economy: Currently a nascent sector, DP World's early investment signifies a strategic bet on future growth and regulatory tailwinds.

- Financial Outlook: Short-term returns are likely low, but the initiatives are expected to enhance brand reputation and attract ESG-focused investment, leading to long-term value creation.

DP World's investments in new, developing trade corridors and niche logistics sectors, such as automotive and technology supply chains, are prime examples of question marks in the BCG matrix. These ventures are characterized by high growth potential within their respective markets but currently hold a low market share for DP World.

The company's strategic acquisition of Syncreon in 2021 for $1.2 billion highlights this approach, aiming to build a stronger presence in these specialized areas and diversify revenue beyond traditional port operations. These initiatives are crucial for capturing future growth in an evolving global logistics landscape.

DP World's commitment to these emerging areas, like the Banana port in the Democratic Republic of Congo and Ndayane in Senegal, signifies a deliberate strategy to establish early leadership in potentially lucrative, high-growth markets. These projects, while demanding significant upfront capital and facing inherent uncertainties, are positioned to become future stars if successful.

DP World's strategic focus on digital transformation, including early-stage AI-powered logistics platforms, also fits the question mark profile. While these technologies promise significant disruption and growth in the logistics tech sector, their current market penetration is often limited, requiring substantial investment to prove scalability and widespread adoption.

| Initiative | BCG Category | Market Growth | Market Share | Strategic Rationale |

|---|---|---|---|---|

| New Deep-Sea Ports (e.g., Banana, DRC; Ndayane, Senegal) | Question Mark | High | Low | Tap into emerging trade corridors, drive economic development, potential future stars. |

| Niche Logistics Verticals (Automotive, Tech Supply Chains) | Question Mark | High | Low | Diversify revenue, build presence in specialized sectors, leverage acquisitions like Syncreon. |

| Digital/AI Logistics Platforms | Question Mark (potential Star) | High | Low to Medium | Drive innovation, improve efficiency, capture growth in logistics technology. |

| Emerging Trade Corridors | Question Mark | High | Low | Diversify portfolio, capture growth in developing regions, establish early mover advantage. |

BCG Matrix Data Sources

Our DP World BCG Matrix is built on comprehensive market data, integrating internal financial reports, global trade statistics, and expert industry analysis to provide strategic clarity.