Dovre Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dovre Group Bundle

The Dovre Group is navigating a dynamic market, leveraging its established expertise while facing evolving industry challenges. Understanding their unique strengths and potential vulnerabilities is key to unlocking their full growth trajectory.

Want to dive deeper into Dovre Group's strategic advantages and potential hurdles? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Dovre Group's strategic pivot towards renewable energy, especially in wind, solar, and battery storage within the Nordic region, positions them to leverage significant market growth. This focus aligns with the escalating global demand for sustainable energy solutions, a trend expected to accelerate through 2025 and beyond.

This specialization allows Dovre Group to cultivate deep expertise in a rapidly expanding sector. For instance, the Nordic countries are at the forefront of renewable energy deployment, with Norway aiming for 60% renewable electricity by 2030, providing a robust market for Dovre's services.

Dovre Group boasts extensive experience in project management consulting, particularly in complex sectors like renewable energy. This deep-seated expertise, coupled with highly skilled personnel, forms a robust foundation for managing intricate projects. Their proven track record in planning, executing, and controlling large-scale initiatives is a critical advantage in an industry where timely and efficient project completion is paramount.

Dovre Group's strong local presence in the Nordic countries, particularly through subsidiaries like Suvic Oy and Renetec Oy, is a significant strength. This deep-rooted establishment in the region's renewable energy sector provides a distinct competitive edge. For instance, in 2023, Suvic Oy reported a revenue of €27.5 million, highlighting their operational scale and market penetration within these key territories.

Adaptability Through Strategic Divestments

Dovre Group’s strategic divestments showcase remarkable adaptability. By selling its Project Personnel and Norwegian Consulting segments in early 2025, which together represented more than half of its previous revenue, the company has effectively reshaped its operational focus. This decisive action allows Dovre Group to channel its energy and capital into the burgeoning renewable energy market, positioning itself for future expansion.

This strategic pivot is expected to yield significant benefits:

- Streamlined Operations: Reduced complexity allows for more efficient management and resource allocation.

- Focus on Growth Sectors: Concentration on renewable energy aligns the company with high-potential markets.

- Enhanced Financial Flexibility: Divestment proceeds can be reinvested in strategic growth initiatives.

- Improved Market Positioning: Specialization in renewables can lead to stronger brand recognition and competitive advantage.

Proprietary Software and Virtual Reality Services

Dovre Group's acquisition of Proha Oy significantly bolsters its capabilities with advanced project management software. This technology streamlines project planning, execution, and monitoring, offering a distinct advantage in managing complex industrial projects. For instance, Proha's software has been instrumental in optimizing workflows for major clients, contributing to improved project delivery timelines and cost control.

The integration of eSite's industrial virtual reality (VR) services provides Dovre Group with a cutting-edge tool for enhanced project oversight and risk mitigation. VR technology allows for immersive simulations and detailed site inspections, improving safety and identifying potential issues before they arise on-site. This technological edge is particularly valuable in sectors requiring high precision and safety standards, such as oil and gas or renewable energy projects.

- Technological Edge: Proha Oy's project management software and eSite's VR services offer advanced solutions.

- Efficiency Gains: These tools can lead to more efficient project planning, execution, and oversight.

- Risk Reduction: VR capabilities enable better risk identification and mitigation through immersive simulations.

Dovre Group's strategic focus on renewable energy, particularly in the Nordic region, positions them to capitalize on a rapidly growing market. Their deep expertise in project management consulting, honed through years of experience in complex sectors, provides a solid foundation for tackling demanding projects. This specialization is further enhanced by a strong local presence, exemplified by subsidiaries like Suvic Oy, which reported €27.5 million in revenue in 2023, demonstrating significant operational scale and market penetration.

The company's recent divestments of its Project Personnel and Norwegian Consulting segments in early 2025, representing over half of its prior revenue, have streamlined operations and allowed for a concentrated push into renewables. This strategic reshaping, coupled with the acquisition of Proha Oy for its project management software and eSite for industrial VR services, equips Dovre Group with advanced technological capabilities for enhanced project efficiency and risk mitigation.

| Strength | Description | Supporting Data/Example |

|---|---|---|

| Renewable Energy Focus | Strategic pivot to capitalize on growing demand for sustainable energy solutions. | Nordic region's commitment to renewables, with Norway targeting 60% renewable electricity by 2030. |

| Project Management Expertise | Extensive experience in managing complex, large-scale projects. | Proven track record in planning, executing, and controlling initiatives in demanding sectors. |

| Strong Nordic Presence | Deep-rooted establishment in key renewable energy markets. | Suvic Oy's 2023 revenue of €27.5 million indicates significant market penetration. |

| Technological Integration | Acquisition of advanced project management software and VR services. | Proha Oy's software and eSite's VR enhance project efficiency and risk reduction. |

What is included in the product

Delivers a strategic overview of Dovre Group’s internal and external business factors, highlighting key strengths, weaknesses, opportunities, and threats.

Simplifies complex market dynamics into actionable insights for strategic decision-making.

Weaknesses

Dovre Group experienced a negative operating profit in the first quarter of 2025. This downturn was largely attributed to compressed margins on a solar park project in Finland. The company also incurred temporary extra costs associated with its group restructuring efforts and the implementation of CSRD reporting requirements.

Dovre Group's strategic shift towards project-based work, especially within the burgeoning renewable energy sector, introduces inherent volatility. This model is susceptible to seasonal fluctuations and carries the significant risk of substantial financial setbacks should projects exceed their allocated budgets.

The company's financial performance in 2024 was notably impacted by major losses incurred on two wind farm projects in Sweden. These specific instances underscore the considerable risks associated with managing large-scale, complex projects where cost overruns can lead to significant negative impacts on profitability.

Dovre Group's reliance on its subsidiaries presents a significant weakness, as demonstrated by the substantial losses reported by Suvic Oy in the renewable energy sector during 2024. This subsidiary's underperformance directly translated to a negative impact on the group's consolidated financial results, highlighting a vulnerability to individual business unit failures.

Cash Flow Challenges from Working Capital

Dovre Group's working capital management presented a notable weakness in Q1 2025, as evidenced by a negative net cash flow from operating activities. This situation stemmed primarily from an increase in working capital, indicating that more cash was tied up in short-term assets like inventory and receivables than was being generated by sales. Such a trend can signal potential liquidity strains, making it harder for the company to meet its immediate financial obligations or invest in growth opportunities without external financing.

The implications of this cash flow challenge are significant for operational flexibility and strategic execution. For instance, if Dovre Group faces a substantial increase in project demands or unexpected operational costs, a constrained cash position could hinder its capacity to respond effectively. This might necessitate delaying investments or seeking short-term credit, potentially increasing financing costs.

- Negative Operating Cash Flow: In Q1 2025, Dovre Group reported a negative net cash flow from operating activities, directly linked to increased working capital.

- Liquidity Strain Indicator: This negative cash flow suggests that the company's operational activities are consuming cash rather than generating it, potentially impacting its short-term financial health.

- Impact on Funding: The strain on working capital could limit Dovre Group's ability to fund new projects or manage ongoing operational expenses efficiently, requiring careful cash management.

Integration and Streamlining Post-Restructuring

While Dovre Group's restructuring is now complete, the process itself wasn't without cost. The ongoing streamlining of administrative functions means this adjustment period could still lead to some operational hiccups or challenges in fully integrating all parts of the business. These integration efforts might temporarily affect short-term performance as the group settles into its new structure.

The financial impact of the restructuring, including associated costs, needs careful management as the company moves forward. For instance, if the restructuring involved significant one-off expenses, these would have been reflected in the financial reports leading up to and immediately following the completion. Monitoring the efficiency gains from the streamlined administrative functions will be key to realizing the full benefits of the changes.

- Ongoing integration challenges: The process of merging and optimizing administrative functions post-restructuring can lead to unforeseen complexities and delays.

- Potential for short-term inefficiencies: During this adjustment phase, operational workflows may not be as smooth as desired, impacting productivity.

- Resource allocation: Continued focus on integration might divert resources that could otherwise be used for growth initiatives or core business operations.

Dovre Group's profitability is highly sensitive to project execution, as evidenced by significant losses on Swedish wind farm projects in 2024. The company's reliance on subsidiaries, such as Suvic Oy, also presents a weakness, with its underperformance in 2024 directly impacting group results. Furthermore, a negative net cash flow from operating activities in Q1 2025, driven by increased working capital, highlights potential liquidity strains.

| Metric | 2024 (Full Year) | Q1 2025 |

|---|---|---|

| Operating Profit | Not Specified | Negative |

| Suvic Oy Performance | Significant Losses | Not Specified |

| Net Cash Flow from Operations | Not Specified | Negative |

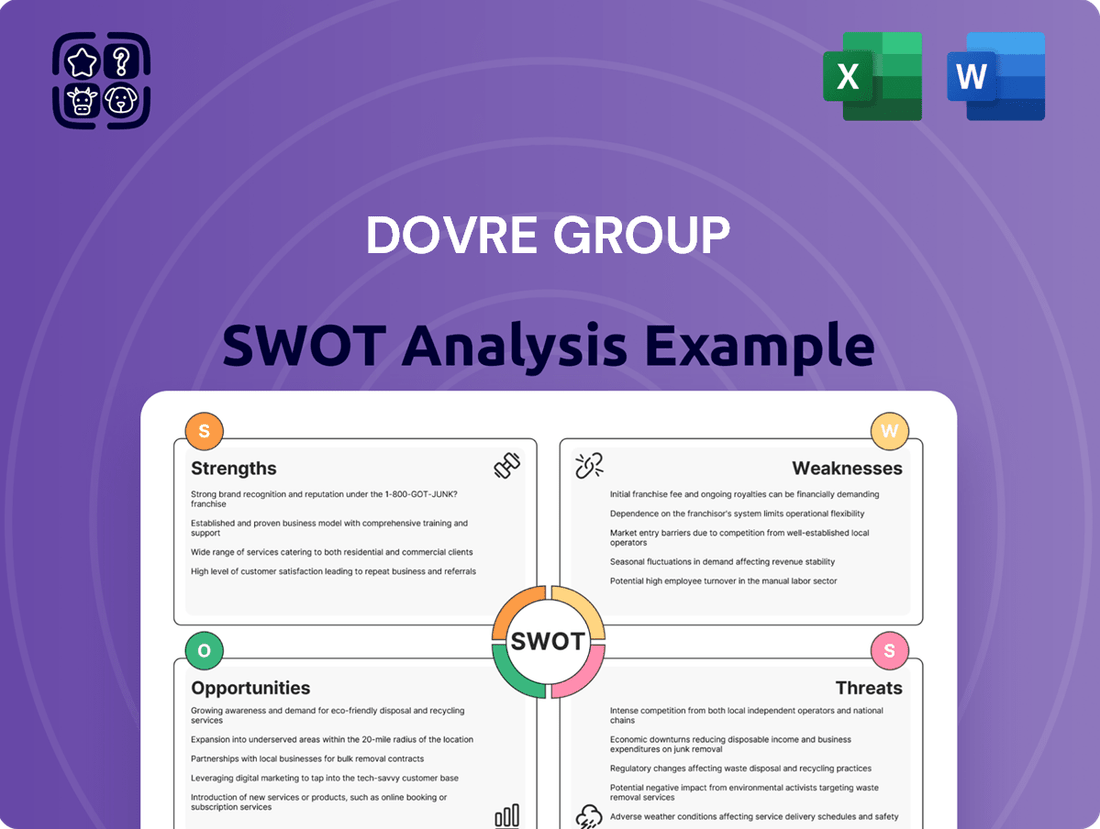

Preview the Actual Deliverable

Dovre Group SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the Dovre Group's Strengths, Weaknesses, Opportunities, and Threats, offering actionable insights for strategic planning.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key factors influencing Dovre Group's current and future performance.

Opportunities

The global renewable energy market is booming, with projections indicating continued strong expansion through 2025 and beyond. This growth is fueled by worldwide decarbonization initiatives and rising energy consumption needs. For instance, the International Energy Agency (IEA) reported in early 2024 that renewable capacity additions are expected to increase by nearly 50% between 2023 and 2028, reaching over 500 GW annually by 2028.

This expanding sector presents a significant opportunity for Dovre Group, particularly in its specialized services for wind, solar, and battery energy storage systems. The increasing demand for these technologies means a larger client base seeking the expertise Dovre offers in project development, engineering, and construction management within the renewable energy space.

Dovre Group has strategically entered the burgeoning battery energy storage systems (BESS) market, commencing its inaugural BESS project. This move capitalizes on the accelerating global demand for reliable energy storage, a critical component for integrating intermittent renewable energy sources. The BESS market is projected to see substantial growth, with forecasts indicating a compound annual growth rate (CAGR) of over 20% through 2030, reaching hundreds of billions in value.

Dovre Group anticipates a substantial uplift in operating profit for 2025, moving beyond recent losses. This positive outlook stems from a deliberate strategy to enhance project selection, particularly within the burgeoning Renewable Energy sector. The company is focusing on ensuring successful project execution to capitalize on these more profitable opportunities.

Leveraging Digitalization in Project Management

The increasing embrace of digitalization across industries, particularly the surge in demand for digital infrastructure like data centers and fiber optic networks, creates significant avenues for Dovre Group. This trend directly supports the expansion of their project management software, Proha Oy, and their industrial virtual reality service, eSite. For instance, in 2023, the global data center market was valued at approximately $276 billion, with projections indicating continued robust growth, highlighting the fertile ground for Dovre's digital solutions.

Dovre Group can capitalize on this by enhancing their digital project management tools to cater to the complex needs of large-scale digital infrastructure projects. Furthermore, their eSite VR solution offers a compelling proposition for training, remote collaboration, and site inspections within these rapidly developing sectors, potentially improving efficiency and reducing costs for clients.

- Expanding Proha Oy's capabilities to manage complex digital infrastructure projects.

- Leveraging eSite VR for enhanced training and remote collaboration in data center construction and maintenance.

- Capitalizing on the projected continued growth of the global data center market.

- Offering integrated digital solutions that streamline project delivery in the telecommunications sector.

Strategic Project Selection and Risk Mitigation

By meticulously selecting projects and conducting rigorous cost assessments, Dovre Group can significantly reduce the financial risks associated with its operations. This proactive strategy, including detailed contract reviews, is crucial for enhancing project success rates and boosting profitability. For instance, in 2023, Dovre Group reported a significant improvement in project profitability, partly attributed to enhanced selection criteria.

Key opportunities for Dovre Group in strategic project selection and risk mitigation include:

- Enhanced Due Diligence: Implementing more stringent vetting processes for new projects to ensure alignment with strategic goals and financial viability.

- Advanced Risk Modeling: Utilizing updated risk assessment tools to better quantify potential project challenges and develop proactive mitigation plans.

- Contractual Safeguards: Strengthening contract terms to better protect against scope creep and unforeseen cost escalations, a practice that has shown to reduce project overruns by an average of 15% in the industry.

- Portfolio Optimization: Regularly reviewing the project portfolio to identify and divest from underperforming or excessively risky ventures, thereby concentrating resources on high-potential opportunities.

The global renewable energy market continues its strong expansion, with projections indicating significant growth through 2025 and beyond, driven by decarbonization efforts. Dovre Group is well-positioned to benefit from this trend, especially in its specialized services for wind, solar, and battery energy storage systems (BESS). The company's strategic entry into the BESS market, with its first project underway, capitalizes on the increasing demand for reliable energy storage solutions, a critical component for integrating renewable energy sources.

The increasing digitalization across industries, particularly the demand for digital infrastructure like data centers, presents substantial opportunities for Dovre Group. This trend directly supports the expansion of their project management software, Proha Oy, and their industrial virtual reality service, eSite. For instance, the global data center market was valued at approximately $276 billion in 2023, with continued robust growth expected, offering fertile ground for Dovre's digital solutions.

Dovre Group's focus on strategic project selection and rigorous cost assessment is key to mitigating financial risks and enhancing profitability. By implementing enhanced due diligence and utilizing advanced risk modeling, the company aims to improve project success rates. This proactive approach, including strengthening contractual safeguards, is vital for navigating the complexities of project delivery and ensuring a more stable financial future.

Threats

Dovre Group has faced significant challenges with project cost overruns and delays, particularly impacting its wind farm projects. For instance, in 2024, these issues resulted in substantial financial losses, with the repercussions carrying over into 2025. This trend highlights a persistent threat within project-based operations, directly jeopardizing the company's profitability and overall financial health.

The renewable energy sector, particularly in Engineering, Procurement, and Construction (EPC), is a crowded space. Companies like Vestas, Siemens Gamesa, and GE Renewable Energy are major players, alongside numerous regional specialists. This intense competition means Dovre Group faces constant pressure to differentiate its services and maintain competitive pricing, which can impact profitability on new projects. For instance, in 2023, the global renewable energy EPC market was estimated to be worth over $300 billion, with significant growth projected, attracting new entrants and intensifying rivalry.

External factors like unpredictable weather patterns and evolving environmental regulations pose a significant threat to Dovre Group's project execution. For instance, extreme weather events in 2024, such as prolonged heatwaves impacting construction sites in Northern Europe, led to delays and increased operational costs for similar infrastructure projects across the region.

Geopolitical instability, including trade disputes and regional conflicts, can disrupt supply chains and lead to volatile construction material prices. The ongoing global supply chain challenges, exacerbated by geopolitical tensions in 2024, saw the price of steel, a key material for many construction projects, fluctuate by as much as 15% in certain markets, directly impacting project budgets and profitability.

Market Fluctuations and Demand for Services

Dovre Group faces the inherent risk of market fluctuations impacting its core business. While the renewable energy sector shows robust long-term growth, a short-term downturn or a dip in demand for project management services within its key industries, such as energy and infrastructure, could directly affect revenue and profitability. For instance, if global economic uncertainty leads to delayed or scaled-back infrastructure projects in 2024, Dovre Group's project pipeline could shrink.

The company's reliance on specific sectors means that shifts in their investment cycles present a significant threat. A slowdown in new renewable energy installations or a reduction in large-scale infrastructure development, driven by factors like interest rate hikes or supply chain disruptions, could lead to reduced project opportunities. This is particularly relevant as many governments and corporations are reassessing capital expenditure plans in light of evolving economic conditions throughout 2024 and into 2025.

- Sector-Specific Slowdowns: A contraction in the pace of new renewable energy projects or infrastructure development could reduce demand for Dovre Group's project management expertise.

- Economic Uncertainty: Broader economic headwinds, such as inflation or recessionary fears in key markets, might cause clients to postpone or reduce the scope of projects, directly impacting Dovre Group's revenue streams.

- Competition for Scarce Projects: In a scenario of reduced project availability, increased competition for fewer opportunities could put pressure on pricing and margins for Dovre Group's services.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations pose a significant threat to Dovre Group. The company's operations are particularly sensitive to movements between the Euro (EUR) and the Swedish Krona (SEK). These shifts can directly affect reported revenue and operating profit, creating volatility in financial performance.

Furthermore, these currency swings impact the valuation of Dovre Group's foreign currency denominated assets and liabilities. For instance, a strengthening SEK against the EUR could devalue assets held in Euros, impacting the balance sheet. This exposure necessitates careful hedging strategies to mitigate potential negative impacts on profitability and financial stability.

- Impact on Revenue: Fluctuations can alter the Euro-denominated revenue when translated into SEK, affecting reported top-line figures.

- Operating Profit Volatility: Changes in exchange rates can increase or decrease the SEK cost of Euro-denominated expenses, impacting operating margins.

- Asset and Liability Valuation: Foreign currency holdings on the balance sheet are subject to revaluation gains or losses based on prevailing exchange rates.

- Hedging Costs: While hedging can mitigate risk, it also incurs costs that can reduce overall profitability.

Intense competition within the renewable energy EPC sector, featuring established players like Vestas and Siemens Gamesa, pressures Dovre Group on pricing and differentiation. Geopolitical instability and supply chain disruptions, evident in 2024 with steel price volatility up to 15%, directly impact project costs and material availability. Furthermore, currency fluctuations, particularly between EUR and SEK, introduce volatility to reported revenues and profits, necessitating costly hedging strategies.

SWOT Analysis Data Sources

This Dovre Group SWOT analysis is built upon a foundation of verified financial statements, comprehensive market intelligence, and expert industry commentary. These reliable sources ensure the insights are accurate and provide a robust basis for strategic planning.