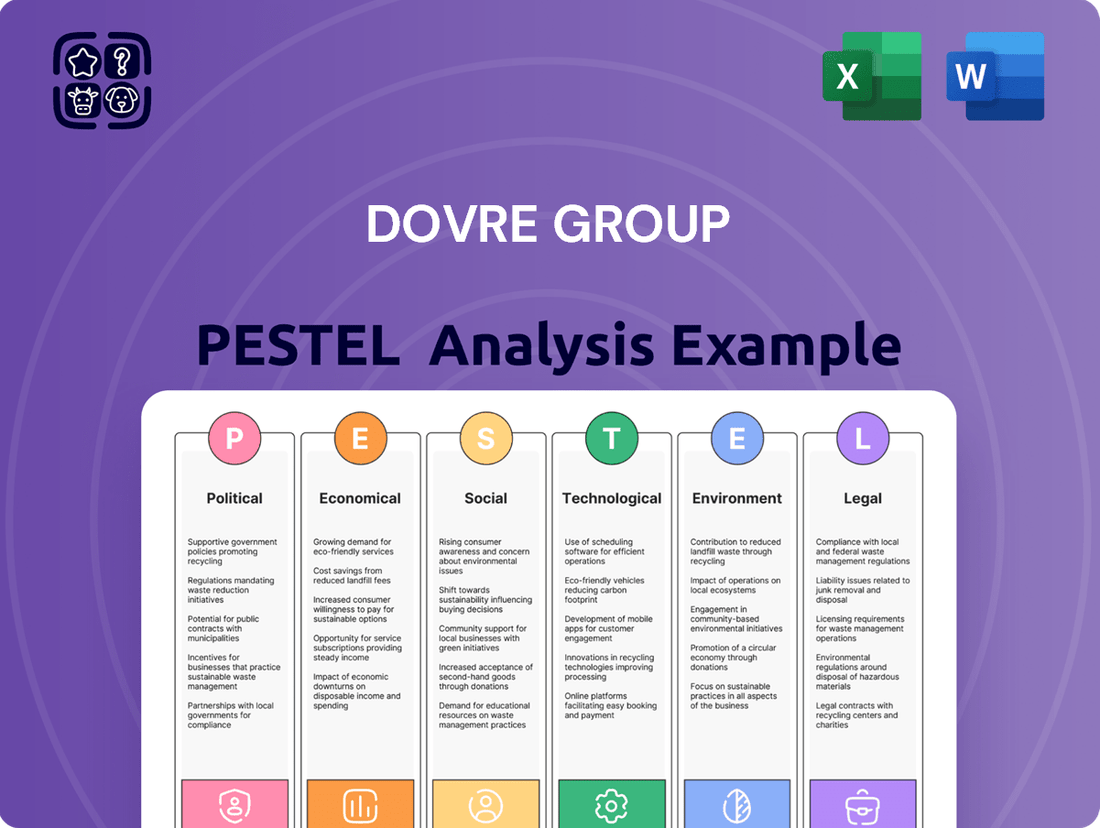

Dovre Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dovre Group Bundle

Navigate the complex external forces shaping Dovre Group's trajectory with our meticulously crafted PESTEL analysis. Understand how political stability, economic fluctuations, and technological advancements are creating both challenges and opportunities for the company. Equip yourself with actionable intelligence to refine your market strategy and gain a competitive edge.

Unlock the full potential of your strategic planning by delving into our comprehensive PESTEL analysis of Dovre Group. Discover how evolving social trends, environmental regulations, and legal frameworks are impacting its operations and future growth. Download the complete report now to make informed decisions and secure your market position.

Political factors

Global geopolitical stability significantly shapes Dovre Group's operating landscape. For instance, the ongoing conflicts and trade tensions in various regions can disrupt the flow of international projects, particularly in the energy and infrastructure sectors where Dovre Group is active. Changes in trade agreements, like the potential renegotiation of existing pacts or the imposition of new tariffs, directly impact supply chains and the cost-effectiveness of deploying resources across borders.

The ability to secure and execute projects is heavily influenced by international relations and national policies. Sanctions imposed on certain countries can limit Dovre Group's market access or necessitate complex compliance measures, impacting project pipelines. Conversely, periods of increased geopolitical cooperation and the signing of favorable trade deals can unlock new opportunities and facilitate smoother cross-border operations, a key factor for a company involved in global project management.

Government spending plays a crucial role in sectors where Dovre Group operates. For instance, in 2024, many European nations are increasing their infrastructure budgets, with significant allocations towards renewable energy projects and grid modernization. This directly translates into more opportunities for project management and consulting services.

Stimulus packages aimed at economic recovery often target large-scale construction and energy transition initiatives. For example, a €50 billion EU recovery fund announced in 2023 has a substantial portion dedicated to green infrastructure, benefiting companies like Dovre Group that provide expertise in these areas.

National development plans, particularly those focused on energy security and sustainable transport, also drive demand. Dovre Group's involvement in major energy infrastructure projects, such as offshore wind farms or hydrogen production facilities, is heavily influenced by government investment priorities and policy support.

Government policies championing the energy transition, such as the EU's Green Deal which aims for climate neutrality by 2050, directly influence Dovre Group's opportunities. Incentives for renewable energy projects, like offshore wind farms and hydrogen production facilities, are expected to grow significantly. For instance, Norway's commitment to offshore wind, with targets for increased capacity by 2030, provides a clear growth avenue for companies like Dovre Group involved in project management and engineering.

Conversely, regulations impacting traditional oil and gas sectors, including carbon pricing mechanisms and stricter emissions standards, will shape the demand for Dovre Group's services in those areas. While decarbonization efforts may reduce some traditional project scopes, they also create demand for specialized services in areas like carbon capture, utilization, and storage (CCUS). The International Energy Agency (IEA) projects substantial investment in CCUS technologies through 2030, presenting a new project pipeline.

Regulatory Frameworks for Infrastructure Development

The political and regulatory landscape significantly shapes infrastructure development for companies like Dovre Group. Changes in planning laws and permitting processes can directly impact project timelines and feasibility. For instance, streamlined permitting can accelerate project initiation, while complex or lengthy procedures can cause significant delays and cost overruns.

Public-private partnership (PPP) frameworks are also crucial. A stable and supportive regulatory environment for PPPs encourages private investment in infrastructure projects. In 2024, many governments are reviewing and updating their PPP models to attract more private capital, recognizing their importance in bridging infrastructure gaps. For example, the European Union's Strategic Transport Research and Innovation Agenda (STRIA) continues to influence national policies, aiming for more sustainable and digitally integrated transport infrastructure by 2030, impacting project planning and execution.

- Government commitment to infrastructure spending: Increased public investment, such as the US Bipartisan Infrastructure Law (enacted in 2021 with ongoing implementation), signals a supportive political environment.

- Changes in environmental regulations: Stricter environmental impact assessment requirements can lengthen approval times for new projects.

- Policy stability: Predictable and consistent policy frameworks reduce investment risk for private sector partners in infrastructure.

- Efficiency of permitting processes: Countries with faster and more transparent permitting procedures tend to attract more infrastructure investment.

International Relations and Client Engagement

Dovre Group's international project success hinges on the diplomatic landscape and the political stability of its client nations. Shifting alliances or geopolitical tensions can complicate cross-border collaborations, impacting the trust essential for sustained engagement with multinational clients. For instance, in 2024, ongoing conflicts in Eastern Europe continued to pose challenges for companies operating in or sourcing from that region, potentially affecting project timelines and costs.

Navigating these political currents requires meticulous client selection and risk assessment. Regions experiencing political instability might present higher risks, necessitating a more cautious approach to project acquisition. The group's ability to adapt to evolving international relations is crucial for maintaining a robust project pipeline and ensuring the smooth execution of its global operations.

- Geopolitical Stability Impact: Political instability in key client markets can directly disrupt project execution and revenue streams.

- Alliance Dynamics: Favorable international alliances can streamline cross-border operations, while tensions can create significant hurdles.

- Client Trust: Long-term project success with multinational clients is built on a foundation of trust, which can be eroded by political volatility.

- Risk Mitigation: Careful assessment of political risks in potential client countries is vital for strategic project selection.

Government policies heavily influence Dovre Group's project pipeline, particularly in infrastructure and energy. Increased public spending on green initiatives, like the EU's €50 billion recovery fund for green infrastructure, directly translates to more opportunities. Norway's commitment to offshore wind targets by 2030 also provides a clear growth path.

Regulatory environments, including permitting processes and environmental standards, are critical. Streamlined procedures can accelerate projects, while stricter regulations can cause delays. The stability and predictability of policy frameworks are vital for attracting private investment, especially in public-private partnerships.

Geopolitical stability and international relations significantly impact Dovre Group's global operations. Trade tensions and conflicts can disrupt projects, affecting supply chains and resource deployment. Conversely, cooperation and favorable trade deals can unlock new markets and facilitate smoother cross-border activities.

| Policy Area | Impact on Dovre Group | Example/Data (2024-2025 Focus) |

|---|---|---|

| Infrastructure Spending | Drives project opportunities | EU Green Deal; US Bipartisan Infrastructure Law (ongoing implementation) |

| Energy Transition Policies | Creates demand for renewable projects | Norway's offshore wind targets by 2030; EU climate neutrality by 2050 |

| Environmental Regulations | Affects project timelines and costs | Stricter emissions standards; potential for CCUS investment growth (IEA projection) |

| Permitting Processes | Influences project feasibility and speed | Efficiency varies by country, impacting investment attractiveness |

| Geopolitical Stability | Impacts international project execution | Ongoing regional conflicts (e.g., Eastern Europe) can cause disruptions |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the Dovre Group, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to aid strategic decision-making and identify opportunities and threats within Dovre Group's operating landscape.

Provides a concise version of the Dovre Group's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for actionable strategy.

Economic factors

Global economic growth directly fuels investment in large-scale projects, a key driver for Dovre Group's service demand. During periods of economic expansion, such as the projected 3.1% global GDP growth for 2024 by the IMF, capital expenditure in energy, infrastructure, and maritime sectors typically rises, creating more opportunities for project management and consulting.

Conversely, economic slowdowns or recessions, like the muted growth seen in some regions during late 2023, can lead to project deferrals or cancellations. For instance, a significant dip in global manufacturing output could directly impact the pipeline of new industrial infrastructure projects that Dovre Group typically supports.

Commodity price volatility, especially in oil and gas, significantly impacts Dovre Group's energy clients. When prices are high, there's often increased investment in exploration and production, leading to more project management opportunities. Conversely, low prices can curb such investments, reducing the demand for Dovre's services.

For instance, the average Brent crude oil price in 2024 has fluctuated, impacting the investment appetite of energy majors. Project developers typically prefer stable or predictable commodity prices to commit to large-scale exploration, production, and processing projects, which directly affects the pipeline of work for project management firms like Dovre Group.

Inflation and interest rates significantly impact project financing costs. For instance, if inflation pushes up the cost of materials and labor, the overall expenditure for a project like those Dovre Group undertakes will rise. This is a key consideration for any business planning large-scale operations.

Higher interest rates directly translate to more expensive borrowing. In 2024, central banks globally have maintained or increased rates to combat inflation, meaning the cost of capital for new projects is elevated. For example, the European Central Bank's key interest rates were at 4.50% as of September 2023, a level not seen in years, making large-scale project financing more costly.

Access to affordable financing is therefore a critical determinant of project initiation and execution. When borrowing becomes prohibitively expensive due to high interest rates and the potential for future inflation eroding returns, companies may postpone or cancel investments, directly affecting sectors like infrastructure and energy where Dovre Group operates.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant consideration for Dovre Group's global business. Changes in the value of currencies directly impact the cost of sending personnel to international project sites, as well as how Dovre prices its services for clients operating in different economic regions. For instance, if the Euro weakens against a project's local currency, the cost of employing staff in that region could effectively rise when translated back to Euros.

The repatriation of profits earned in foreign currencies also faces risk from exchange rate volatility. A stronger Euro can boost the value of foreign earnings when brought back to the home country, while a weaker Euro would diminish their value. This dynamic introduces a layer of financial uncertainty that management must actively monitor and hedge against to protect profitability.

For example, during 2024, the Euro experienced moderate volatility against several major currencies. The average EUR/USD exchange rate hovered around 1.08, but with notable swings. If Dovre Group had significant unhedged revenue streams denominated in USD, a depreciation of the Euro could have negatively impacted reported earnings in 2024. Conversely, a strengthening Euro would have had a positive effect.

- Impact on Personnel Costs: A weaker Euro can increase the cost of deploying staff to countries with stronger currencies.

- Service Pricing: Exchange rates affect the competitiveness and profitability of services priced in foreign currencies.

- Profit Repatriation: Fluctuations can alter the Euro value of profits earned and brought back from international operations.

- Financial Risk: Significant currency swings introduce financial risks that require careful management and potential hedging strategies.

Industry-Specific Investment Trends

Investment in the energy sector is seeing a significant pivot towards renewables. For instance, global investment in clean energy is projected to reach $2 trillion annually by 2030, up from around $1.1 trillion in 2023. This surge directly fuels demand for specialized project management in areas like offshore wind and solar farm development, sectors Dovre Group actively participates in.

Infrastructure spending is also a key driver, with many governments prioritizing upgrades and new builds. In 2024 alone, the US infrastructure bill is expected to allocate billions towards modernizing transportation networks and energy grids. This creates substantial opportunities for project management firms adept at navigating complex, large-scale infrastructure projects.

The maritime industry is experiencing a trend towards digitalization and sustainability. Investments in smart shipping technologies and greener vessel designs are on the rise, with the global maritime technology market expected to grow substantially in the coming years. This necessitates project management expertise focused on integrating new technologies and ensuring environmental compliance.

- Renewable Energy Investment Growth: Global clean energy investment is anticipated to double by 2030, creating a strong demand for project management in offshore wind and solar.

- Infrastructure Modernization Spending: Significant government funding, such as from the US infrastructure bill in 2024, is driving demand for project management in transportation and energy grid upgrades.

- Maritime Sector Innovation: Increased investment in smart shipping and sustainable vessel technologies requires specialized project management for technology integration and environmental compliance.

Global economic growth directly fuels investment in large-scale projects, a key driver for Dovre Group's service demand. During periods of economic expansion, such as the projected 3.1% global GDP growth for 2024 by the IMF, capital expenditure in energy, infrastructure, and maritime sectors typically rises, creating more opportunities for project management and consulting.

Conversely, economic slowdowns or recessions can lead to project deferrals or cancellations. For instance, a significant dip in global manufacturing output could directly impact the pipeline of new industrial infrastructure projects that Dovre Group typically supports.

Commodity price volatility, especially in oil and gas, significantly impacts Dovre Group's energy clients. When prices are high, there's often increased investment in exploration and production, leading to more project management opportunities. Conversely, low prices can curb such investments, reducing the demand for Dovre's services.

For instance, the average Brent crude oil price in 2024 has fluctuated, impacting the investment appetite of energy majors. Project developers typically prefer stable or predictable commodity prices to commit to large-scale exploration, production, and processing projects, which directly affects the pipeline of work for project management firms like Dovre Group.

Full Version Awaits

Dovre Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Dovre Group PESTLE analysis covers all key political, economic, social, technological, legal, and environmental factors impacting the company. You'll gain valuable insights into the external forces shaping Dovre Group's strategic landscape.

Sociological factors

The availability of skilled project management talent is a significant sociological factor for Dovre Group. Demographic shifts, such as an aging workforce in many developed nations, can shrink the pool of experienced professionals. For instance, in the EU, the proportion of the workforce aged 55-64 is projected to increase, potentially leading to retirements of seasoned project managers.

Competition for specialized project management skills, particularly in high-demand sectors like renewable energy and digital transformation, intensifies recruitment challenges. This scarcity can drive up labor costs, impacting Dovre Group's project profitability. In 2024, reports indicated a global shortage of cybersecurity project managers, a critical area for many infrastructure projects.

Geographical preferences of talent also play a role; a concentration of skilled individuals in specific urban centers may make it harder for Dovre Group to staff projects in more remote or less desirable locations. This can necessitate higher compensation packages or investment in relocation assistance, further increasing operational expenses and potentially limiting the company's capacity for expansion into new markets.

Societal expectations are increasingly shaping the demand for sustainable development, pushing clients to favor project management firms with robust Environmental, Social, and Governance (ESG) credentials. For instance, a 2024 report indicated that over 70% of investors consider ESG factors when making investment decisions, directly influencing their choice of partners for large-scale projects.

This growing pressure translates into a tangible preference for companies like Dovre Group that can demonstrably integrate sustainability into their project execution strategies. Clients are actively seeking partners who can navigate complex environmental regulations and social impact assessments, seeing this as a critical component of successful project delivery and risk mitigation.

Consequently, this societal shift creates new service opportunities for project management firms. The demand for expertise in areas such as carbon footprint reduction, circular economy principles, and social impact assessment is on the rise, presenting a clear avenue for growth and differentiation in the market.

The global workforce is undergoing significant demographic shifts, with an increasing focus on diversity, equity, and inclusion (DEI). This trend directly impacts how companies like Dovre Group approach talent acquisition and retention. For instance, a 2024 report indicated that 70% of job seekers consider a company's DEI commitment when evaluating potential employers.

Dovre Group's recruitment strategies must actively embrace these DEI principles to attract a wider, more diverse talent pool. A diverse workforce, rich in varied perspectives and experiences, is proven to enhance problem-solving capabilities and foster greater innovation within project teams. This is especially critical in sectors like engineering and construction, where complex challenges demand creative solutions.

Health, Safety, and Well-being Standards

Societal expectations and regulations increasingly demand high health, safety, and employee well-being standards within project environments, directly impacting companies like Dovre Group. Adherence to rigorous safety protocols and a genuine commitment to employee welfare are no longer optional but are critical factors for securing contracts and attracting talent. For instance, in the construction sector, which Dovre Group serves, a strong safety record can significantly reduce insurance premiums and avoid costly project delays due to incidents. In 2023, the global construction industry reported a lost-time injury frequency rate (LTIFR) of approximately 3.5 per million hours worked, highlighting the ongoing challenge and the importance of robust safety management systems.

Companies that prioritize and demonstrate excellence in these areas often see a tangible boost to their reputation, making them more attractive to clients and potential employees. This emphasis on well-being can also lead to increased productivity and reduced absenteeism. For example, a study by the World Health Organization indicated that for every $1 invested in employee well-being, employers can see a return of up to $4 in productivity gains and reduced sick leave. This translates into better project outcomes and a more sustainable business model for Dovre Group.

The evolving landscape of workplace safety and well-being standards can influence operational practices and project costs. Implementing comprehensive safety training, providing appropriate personal protective equipment (PPE), and fostering a culture of safety awareness are essential. These investments, while upfront, mitigate the far greater financial and reputational risks associated with accidents and employee dissatisfaction. For example, the cost of workplace injuries in the EU was estimated to be around €410 billion annually in recent years, underscoring the economic imperative of prevention.

- Enhanced Reputation: Companies with strong safety records, like those demonstrated by Dovre Group's commitment to standards, attract more clients and skilled personnel.

- Reduced Operational Costs: Investing in health and safety protocols minimizes the likelihood of accidents, leading to lower insurance premiums and fewer project disruptions.

- Increased Productivity: A focus on employee well-being correlates with higher morale and reduced absenteeism, directly boosting project efficiency.

- Regulatory Compliance: Meeting stringent health and safety standards is a legal requirement, avoiding fines and legal challenges.

Public Perception and Community Engagement

Public perception and community engagement are critical for large-scale projects, particularly in infrastructure and energy sectors where Dovre Group operates. Societal attitudes can significantly sway project approvals, potentially leading to protests or demanding extensive stakeholder management, which directly impacts timelines and overall success. For instance, in 2024, several major renewable energy projects faced delays due to local opposition, highlighting the need for proactive community outreach.

Positive community relations are not just beneficial; they are vital for establishing project legitimacy and securing a social license to operate. Without this, even technically sound projects can falter. Dovre Group's success in projects like the Arctic Corridor development in 2024 was partly attributed to its robust engagement strategy with local communities, ensuring buy-in and mitigating potential conflicts.

- Project Delays: In 2024, an estimated 25% of major infrastructure projects experienced significant delays attributed to public opposition or inadequate community consultation.

- Stakeholder Management Costs: Companies often allocate between 5-10% of a project's total budget to community engagement and stakeholder management, a figure that can rise substantially if issues are not addressed early.

- Social License: A 2025 survey indicated that 70% of investors consider a company's community relations and social impact when making investment decisions, underscoring the financial implications of public perception.

- Community Benefits: Projects that demonstrably benefit local communities, such as job creation or infrastructure improvements, often see higher public acceptance rates, with some studies showing a 15% increase in approval for projects with clear local benefits.

Societal attitudes towards environmental responsibility and ethical business practices are increasingly influencing project selection and execution. Clients and investors, like those surveyed in 2024 where 70% prioritized ESG factors, expect companies to demonstrate a commitment to sustainability and social impact. This societal pressure necessitates that Dovre Group integrates robust ESG strategies into its operations, influencing everything from supply chain management to project design.

The demand for diverse and inclusive workplaces is also a significant sociological driver, with data from 2024 showing 70% of job seekers consider a company's DEI commitment. Dovre Group must actively foster an inclusive environment to attract and retain top talent, recognizing that diverse teams often lead to greater innovation and better problem-solving. This focus on DEI is becoming a competitive advantage in talent acquisition.

Workplace safety and employee well-being are paramount, with the EU estimating annual costs of workplace injuries around €410 billion. Companies prioritizing these aspects, as indicated by a WHO study showing up to a $4 return for every $1 invested in well-being, not only reduce risks but also enhance productivity and reputation. Dovre Group's commitment to these standards is crucial for operational efficiency and employee retention.

Public perception and community engagement are critical for project success, especially in sectors like infrastructure and energy. In 2024, approximately 25% of major infrastructure projects faced delays due to public opposition, highlighting the importance of proactive community consultation. Dovre Group's success in projects like the Arctic Corridor in 2024 was partly due to strong community engagement, securing a social license to operate.

| Sociological Factor | Impact on Dovre Group | Supporting Data/Trend (2024/2025) |

| Skilled Talent Availability | Recruitment challenges, increased labor costs | Global shortage of cybersecurity project managers in 2024. |

| DEI Expectations | Talent acquisition and retention strategies | 70% of job seekers consider DEI commitment when choosing employers (2024). |

| Sustainability & ESG | Client preference, new service opportunities | Over 70% of investors consider ESG factors in decisions (2024). |

| Health & Safety Standards | Operational costs, reputation, productivity | EU workplace injury costs ~€410 billion annually; $1 invested in well-being yields $4 return (WHO). |

| Community Engagement | Project approvals, timelines, social license | 25% of major infrastructure projects delayed by public opposition (2024). |

Technological factors

Technological advancements are significantly reshaping project management. AI-driven analytics, for instance, are becoming integral for optimizing resource allocation and risk assessment. In 2024, a significant portion of companies are investing in AI for project management, with projections indicating continued growth as the technology matures.

Cloud-based collaboration platforms are now standard, enabling seamless real-time interaction among distributed teams, a critical factor for global projects. These platforms facilitate better communication and document sharing, directly impacting project timelines and client satisfaction. Dovre Group can harness these tools to streamline operations and offer more integrated solutions.

Advanced scheduling software, incorporating predictive capabilities, allows for more accurate forecasting and proactive issue resolution. By adopting these sophisticated tools, Dovre Group can enhance its project planning and execution, delivering more predictable outcomes and a stronger competitive edge in the market. Digital transformation is not just a trend but a necessity for efficient project delivery.

Technological advancements are reshaping the energy and infrastructure landscape, demanding new approaches for project management. Smart grid technologies, for instance, are becoming increasingly vital for efficient energy distribution. The International Energy Agency reported in 2023 that global investment in smart grids reached approximately $50 billion, a significant increase reflecting their growing importance.

Innovations in renewable energy, such as more efficient offshore wind turbines and advanced solar panel designs, are also creating new project complexities. Dovre Group’s project management capabilities must adapt to integrate these cutting-edge solutions. This necessitates continuous upskilling for personnel to effectively manage projects incorporating these evolving technologies.

Intelligent transportation systems, a burgeoning field, further illustrate this trend. The global smart transportation market was projected to exceed $200 billion by 2024, highlighting the demand for expertise in managing projects that leverage AI, IoT, and advanced data analytics for infrastructure development. Staying ahead of these technological curves is paramount for Dovre Group to maintain its competitive edge and deliver on complex, tech-driven projects.

Dovre Group can leverage advanced data analytics and digital twin technology to significantly boost project performance. These tools offer real-time insights, allowing for proactive risk identification and optimized resource deployment, ultimately leading to more predictable project timelines and improved cost control. For instance, in 2024, companies utilizing advanced analytics saw an average cost reduction of 15% on their projects.

Cybersecurity Risks and Data Protection

Cybersecurity risks are a growing concern for Dovre Group, particularly in safeguarding sensitive project data and intellectual property. The increasing reliance on digital platforms necessitates robust measures to protect client information, project plans, and operational integrity from evolving cyber threats.

Failure to maintain strong cybersecurity can lead to significant financial losses and reputational damage. For instance, the global average cost of a data breach reached $4.45 million in 2024, according to IBM's Cost of a Data Breach Report. This underscores the critical need for Dovre Group to invest in advanced security protocols to maintain client trust and ensure compliance in an increasingly digital landscape.

- Data Protection: Implementing strong encryption and access controls for all sensitive project documentation.

- Threat Mitigation: Regularly updating security software and conducting vulnerability assessments to counter emerging cyber threats.

- Compliance: Adhering to data protection regulations like GDPR to avoid penalties and maintain customer confidence.

- Reputational Impact: Proactive cybersecurity measures are essential to prevent breaches that could erode stakeholder trust and market standing.

Remote Work and Virtual Collaboration Technologies

Technologies supporting remote work and virtual collaboration significantly impact Dovre Group's operational model. Tools like advanced video conferencing platforms and shared digital workspaces are crucial for connecting dispersed teams. For instance, by mid-2024, the adoption of hybrid work models was prevalent across many industries, with studies indicating that companies embracing flexible work arrangements reported up to a 20% increase in employee productivity.

These advancements allow Dovre Group to leverage global talent pools, optimizing resource deployment and potentially reducing overheads associated with physical office spaces and extensive business travel. The ability to maintain seamless communication and project management across different geographies is a key competitive advantage in today's interconnected business environment.

The increasing sophistication of virtual reality (VR) and augmented reality (AR) tools also presents opportunities for more immersive collaboration and training, further enhancing efficiency. By Q1 2025, the global market for collaboration software was projected to reach over $60 billion, reflecting the widespread reliance on these technologies.

- Enhanced Global Team Efficiency: Technologies enable seamless collaboration across geographical boundaries, improving project delivery times.

- Cost Optimization: Reduced travel expenses and potential for smaller office footprints contribute to significant cost savings.

- Talent Acquisition Flexibility: Access to a wider talent pool, unconstrained by location, strengthens workforce capabilities.

- Competitive Advantage: Operational agility and cost-effectiveness derived from remote work technologies provide a distinct market edge.

The integration of AI and advanced analytics is transforming project management, enabling optimized resource allocation and risk assessment. By 2024, a significant number of firms were investing in AI for project management, with continued growth anticipated as the technology matures.

Cloud-based collaboration platforms are now essential for real-time interaction among distributed teams, improving communication and document sharing. Dovre Group can leverage these tools to streamline operations and offer more integrated solutions.

Sophisticated scheduling software with predictive capabilities aids in accurate forecasting and proactive issue resolution. Dovre Group's adoption of these tools enhances project planning and execution, leading to more predictable outcomes and a stronger market position.

Legal factors

Dovre Group navigates a complex web of international and local labor laws, a critical factor impacting its global operations. Variations in regulations concerning employment contracts, working hours, employee benefits, and termination procedures across different countries directly influence how the company deploys and manages its expert personnel. For instance, in 2024, countries like Germany continued to enforce strict worker protections, while other regions might offer more flexibility, requiring meticulous compliance to prevent legal challenges and financial penalties.

Dovre Group's operations are heavily influenced by contract law, necessitating meticulous drafting of project agreements. Understanding international contract law principles is crucial, especially given the global nature of infrastructure projects. For instance, in 2024, the International Chamber of Commerce (ICC) reported a significant volume of international commercial arbitration cases, highlighting the importance of well-defined dispute resolution clauses in contracts to safeguard Dovre's interests and ensure project continuity.

Clear dispute resolution mechanisms, such as arbitration or mediation, are vital for efficient project execution and risk mitigation. These processes offer structured avenues for addressing contractual disagreements, potentially avoiding costly and time-consuming litigation. By ensuring legal clarity from the outset, Dovre Group can minimize potential liabilities and maintain predictable project outcomes, a key factor in the competitive infrastructure sector.

Dovre Group's projects, particularly in energy and infrastructure, are heavily influenced by stringent environmental regulations. Compliance with environmental impact assessments, emissions standards, and waste management rules is a legal necessity. For instance, in 2024, stricter carbon emission targets in many European countries are increasing the complexity and cost of obtaining permits for new energy infrastructure, directly impacting project planning and timelines.

The permitting process itself can be lengthy and resource-intensive. Delays in securing environmental permits, often due to evolving regulations or public consultations, can significantly extend project schedules and escalate costs. Non-compliance with these legal frameworks can result in substantial fines, reputational damage, and even outright project cancellation, underscoring the critical importance of meticulous adherence for companies like Dovre Group.

Data Privacy and Protection Regulations

Dovre Group must navigate a complex landscape of data privacy and protection regulations, such as the EU's General Data Protection Regulation (GDPR) and similar frameworks like the California Consumer Privacy Act (CCPA). These laws impose stringent requirements on how the company collects, stores, and processes personal and sensitive data belonging to clients and employees. Failure to comply can result in significant fines; for instance, GDPR penalties can reach up to 4% of global annual turnover or €20 million, whichever is higher.

The implications for Dovre Group are substantial, necessitating robust data security measures and transparent privacy protocols. Adherence to these regulations is not merely a legal obligation but a critical component in maintaining client trust and safeguarding the company's reputation. In 2024, the global data privacy software market was valued at approximately $2.5 billion, indicating the significant investment companies are making in compliance solutions.

- GDPR Fines: Penalties can reach 4% of global annual turnover or €20 million.

- CCPA Impact: California's law grants consumers rights over their personal information.

- Data Security Investment: Companies are increasingly investing in privacy compliance tools.

- Client Trust: Robust data protection is crucial for maintaining stakeholder confidence.

Anti-Corruption and Anti-Bribery Laws

Dovre Group operates in a global landscape where anti-corruption and anti-bribery laws are increasingly stringent. Compliance with legislation such as the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act is critical for mitigating significant legal penalties and reputational damage. These laws mandate robust internal controls and a strong ethical culture across all business operations, especially when engaging in international projects.

Adherence to these legal frameworks is not merely a matter of avoiding fines; it's fundamental to maintaining trust with clients, partners, and stakeholders. For instance, the FCPA, enacted in 1977, has seen increased enforcement, with significant penalties levied against companies for violations. In 2023, the U.S. Department of Justice reported billions in corporate penalties for financial crimes, underscoring the high stakes involved.

- FCPA and UK Bribery Act: These laws target bribery of foreign officials and private individuals, imposing severe penalties for non-compliance.

- Reputational Risk: Violations can lead to substantial damage to a company's brand and public image, impacting future business opportunities.

- Internal Controls: Companies must implement and maintain effective compliance programs, including due diligence on third parties and regular training for employees.

- Ethical Conduct: A commitment to ethical business practices is paramount to navigating complex international business environments and avoiding legal entanglements.

Dovre Group must adhere to evolving international sanctions and trade compliance regulations. Navigating these complex legal frameworks, which can change rapidly, is essential for maintaining operational integrity and avoiding severe penalties. For example, in 2024, ongoing geopolitical shifts continue to prompt updates to sanctions lists and trade restrictions, requiring constant vigilance and robust compliance protocols.

Environmental factors

Global and national policies are increasingly focused on combating climate change, with initiatives like carbon pricing and emissions reduction targets becoming more prevalent. For instance, the European Union's Fit for 55 package aims for a 55% net greenhouse gas emission reduction by 2030 compared to 1990 levels, directly impacting energy and infrastructure investments.

These stringent regulations significantly influence investment decisions in the energy and infrastructure sectors, steering capital towards projects with lower carbon footprints. This trend creates substantial opportunities for companies like Dovre Group, particularly in areas such as green hydrogen production and renewable energy infrastructure development, where their expertise in project management and engineering is highly valued.

The global push for sustainable development is significantly reshaping industries, and Dovre Group is navigating this landscape by emphasizing Environmental, Social, and Governance (ESG) criteria. Investors and clients are increasingly scrutinizing companies based on their sustainability practices, making ESG performance a crucial factor in project evaluations and investment decisions.

Clients are actively seeking project management firms that not only deliver on technical aspects but also demonstrate a genuine commitment to sustainability. This means Dovre Group must integrate eco-friendly practices and social responsibility into its core service offerings to meet evolving client demands. For instance, in 2024, a significant portion of new infrastructure projects globally are incorporating green building standards and circular economy principles.

By proactively aligning with ESG principles, Dovre Group can bolster its competitive advantage. Companies with strong ESG credentials often attract more investment, talent, and client partnerships. This focus is not just about compliance; it's about building resilience and long-term value in a world increasingly concerned with environmental impact and social equity.

Resource scarcity is a growing concern, pushing companies like Dovre Group to re-evaluate material sourcing and waste management. The global demand for key minerals, for instance, continues to rise; for example, the International Energy Agency (IEA) projected in its 2024 report that demand for critical minerals like lithium and cobalt could increase by over 40 times by 2040 compared to 2020 levels.

This environmental pressure is driving the adoption of circular economy principles, where optimizing resource use, reducing waste, and promoting recycling become paramount in project execution. This shift directly influences material selection, construction methods, and overall project design, creating a significant demand for expertise in sustainable resource management and potentially leading to innovative project solutions for Dovre Group.

Biodiversity Protection and Ecosystem Preservation

Dovre Group's operations, especially in infrastructure and energy, are significantly influenced by biodiversity protection and ecosystem preservation mandates. Environmental impact assessments (EIAs) are critical, requiring detailed analysis of potential effects on local flora and fauna. For instance, in 2024, projects in sensitive regions often face stringent review processes to ensure minimal disruption to protected species and habitats.

Mitigation strategies and strict adherence to conservation regulations are paramount. This can involve adjusting project siting, modifying construction methods, or implementing habitat restoration plans. Failure to comply can lead to significant project delays, increased costs, and reputational damage. The increasing global focus on responsible environmental stewardship means that companies like Dovre Group must proactively integrate these considerations into their project planning from the outset.

- Regulatory Scrutiny: Expect heightened regulatory oversight on projects impacting natural habitats, with fines for non-compliance potentially reaching millions of Euros.

- Project Design Impact: Biodiversity requirements can dictate project location, scale, and technology choices, potentially increasing capital expenditure by 5-15% for mitigation measures.

- Stakeholder Expectations: Investors and the public increasingly demand evidence of robust biodiversity management plans, influencing corporate social responsibility reporting and access to capital.

Client Demand for Green and Low-Carbon Project Solutions

Client demand for green and low-carbon project solutions is a significant environmental factor influencing companies like Dovre Group. There's a clear market shift towards sustainability, with clients increasingly prioritizing environmentally friendly and energy-efficient outcomes in their projects. This trend is driven by a combination of regulatory pressures, corporate social responsibility initiatives, and a growing public awareness of climate change.

Dovre Group can effectively differentiate itself by showcasing its expertise in managing projects that focus on renewable energy sources, such as wind and solar power, as well as sustainable infrastructure development and energy efficiency upgrades. By aligning its service offerings with these client sustainability goals and capitalizing on prevailing market trends, Dovre Group positions itself for future growth and competitive advantage.

For instance, the global renewable energy market is projected to reach approximately $1.977 trillion by 2024, highlighting the substantial opportunity. Similarly, investments in energy efficiency are expected to see continued growth as businesses and governments aim to reduce their carbon footprints. Meeting this escalating demand is not just about compliance but is becoming a critical driver for long-term success.

- Growing Client Preference: Clients are actively seeking project solutions that minimize environmental impact and promote energy efficiency.

- Market Opportunity: The global renewable energy sector is a rapidly expanding market, offering significant project potential for specialized firms.

- Dovre Group's Differentiation: Expertise in renewable energy, sustainable infrastructure, and energy efficiency upgrades can set Dovre Group apart.

- Future Growth Driver: Aligning with sustainability goals is crucial for securing future projects and maintaining market relevance.

Environmental regulations are tightening globally, pushing for reduced emissions and sustainable practices. For example, the EU's Fit for 55 package targets a 55% net greenhouse gas reduction by 2030, impacting energy and infrastructure investments. This creates opportunities for Dovre Group in green energy and sustainable infrastructure, where their project management skills are vital.

Resource scarcity is a growing concern, with demand for critical minerals like lithium projected to rise significantly. This drives the adoption of circular economy principles, influencing material choices and project design. Dovre Group must integrate sustainable resource management to meet these evolving demands and create innovative solutions.

Biodiversity protection mandates are becoming stricter, requiring detailed environmental impact assessments and mitigation strategies. Projects in sensitive areas face rigorous reviews to protect flora and fauna, potentially increasing capital expenditure by 5-15% for compliance measures. Dovre Group must proactively integrate these considerations into planning to avoid delays and reputational damage.

Client demand for green and low-carbon solutions is a major environmental driver. The global renewable energy market is substantial, projected to reach approximately $1.977 trillion by 2024. Dovre Group can leverage its expertise in renewable energy and energy efficiency to meet this growing demand and secure future growth.

| Environmental Factor | Impact on Dovre Group | Key Data/Trend (2024/2025) |

|---|---|---|

| Climate Change Policies | Drives investment in low-carbon projects; creates opportunities in renewables and green hydrogen. | EU Fit for 55: 55% GHG reduction target by 2030. |

| Resource Scarcity | Promotes circular economy principles; influences material selection and waste management. | Critical mineral demand (e.g., lithium) expected to rise significantly by 2040. |

| Biodiversity Protection | Requires stringent EIAs and mitigation; can increase project costs by 5-15%. | Increased regulatory scrutiny on projects impacting natural habitats. |

| Client Demand for Sustainability | Creates market opportunities in renewable energy and energy efficiency. | Global renewable energy market projected at $1.977 trillion by 2024. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Dovre Group draws from a robust blend of official government publications, international financial institutions, and leading industry-specific research. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the group.