Dovre Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dovre Group Bundle

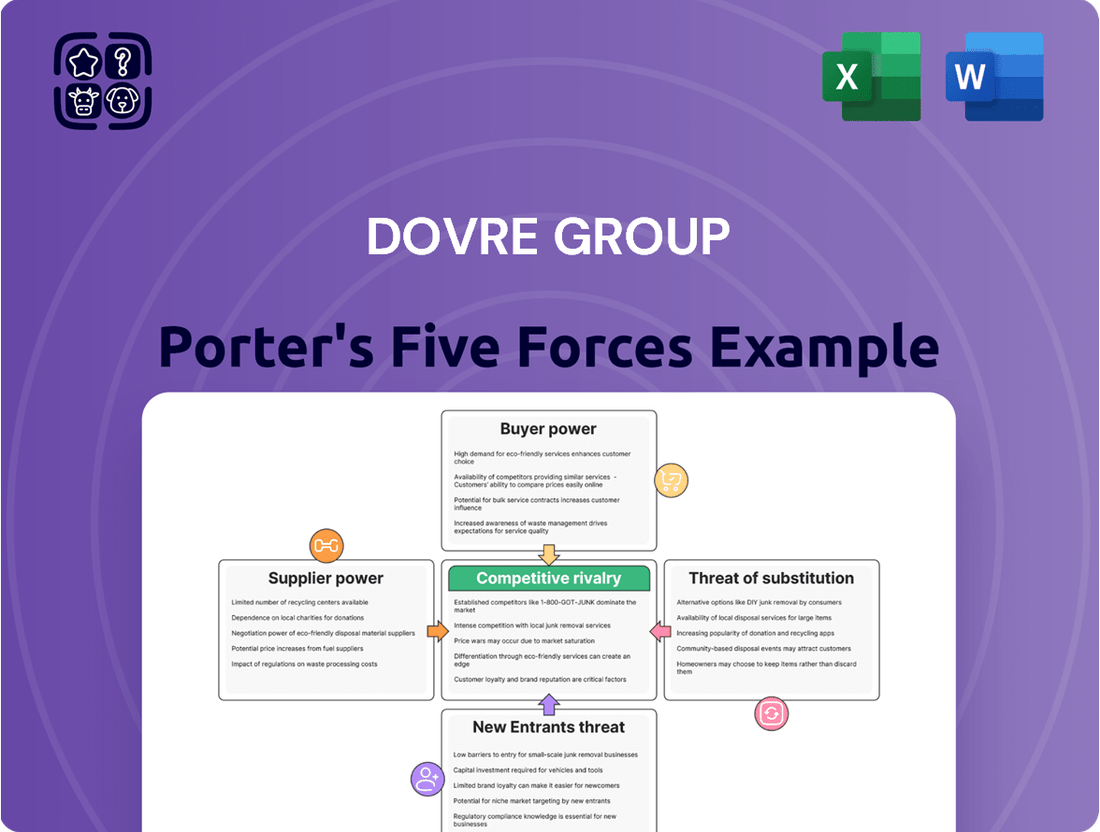

Dovre Group operates within a competitive landscape shaped by several key forces. Understanding the intensity of rivalry among existing competitors, the bargaining power of their suppliers, and the threat of new entrants is crucial for strategic planning. Furthermore, the presence of substitute products and the collective power of their buyers significantly influence Dovre Group's profitability and market position.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Dovre Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Dovre Group's reliance on specialized project management talent, especially in energy and infrastructure, highlights a key supplier bargaining power. The global demand for project management professionals is projected to reach 25 million new roles by 2030, indicating a substantial talent shortage.

Suppliers possessing unique or highly specialized skills, particularly in rapidly developing sectors such as renewable energy project development and industrial virtual reality, command a stronger position. Dovre Group's engagement in intricate, large-scale projects requires personnel with specific certifications, deep experience, and a demonstrated history of success, which inherently limits the ease of finding replacements.

Dovre Group faces substantial bargaining power from its suppliers due to high switching costs. Transitioning from one project management or recruitment supplier to another can be costly, involving expenses for onboarding new personnel, transferring critical project knowledge, and the inherent risk of project delays. This situation naturally fosters loyalty towards established, reliable suppliers.

This supplier leverage is amplified because finding and integrating new project management teams or specialized recruitment agencies requires significant time and resources. For instance, in 2024, the average time to fill highly specialized technical roles across industries often exceeded 60 days, highlighting the disruption and cost associated with supplier changeovers.

Consequently, existing suppliers are in a stronger position to negotiate terms and pricing with Dovre Group. They can command higher rates or less favorable contract conditions knowing that Dovre Group would incur substantial costs and potential operational disruptions if it were to switch providers.

Limited Number of Reputable Subcontractors

Dovre Group's reliance on a limited pool of specialized subcontractors for certain projects significantly enhances supplier bargaining power. When few reputable firms possess the necessary expertise, such as in niche engineering disciplines for major infrastructure developments, these suppliers can command higher prices and more favorable terms.

- Limited Subcontractor Availability: For highly specialized tasks within its project portfolio, Dovre Group may face a constrained market of qualified subcontractors.

- Increased Supplier Leverage: This scarcity empowers the few available subcontractors, allowing them to negotiate better pricing and contract conditions.

- Impact on Project Costs: The bargaining power of these limited suppliers can directly influence Dovre Group's project costs and profitability.

Strength of Professional Associations and Certifications

The strength of professional associations like the Project Management Institute (PMI) and its Project Management Professional (PMP) certification can significantly influence supplier power. These organizations establish rigorous standards for project management skills and knowledge, creating a benchmark for quality and expertise.

By formalizing and validating these competencies, these associations can indirectly limit the available pool of highly qualified project management professionals. This scarcity, driven by the demand for certified individuals, can empower suppliers who can provide such talent, potentially leading to higher service costs.

- Industry Standards: PMI's PMP certification is globally recognized, setting a high bar for project management professionals.

- Talent Pool Limitation: The rigorous requirements for PMP certification mean fewer individuals meet the criteria, potentially reducing the supply of qualified project managers.

- Compensation Expectations: Certified professionals often command higher salaries, reflecting their validated expertise and the value they bring to projects.

Dovre Group faces significant supplier bargaining power due to the scarcity of specialized project management talent, particularly in the energy and infrastructure sectors. The demand for these professionals is high, with projections indicating a need for millions of new roles globally by 2030, exacerbating talent shortages. This limited supply of highly skilled individuals empowers suppliers who can provide them, enabling them to negotiate more favorable terms and pricing with Dovre Group.

| Factor | Impact on Dovre Group | Supporting Data/Trend (as of 2024/2025) |

|---|---|---|

| Talent Scarcity | Increased supplier leverage, higher costs | Global project management roles projected to grow significantly by 2030; specialized roles often take over 60 days to fill. |

| High Switching Costs | Supplier loyalty, less negotiation flexibility | Costs include onboarding, knowledge transfer, and project delay risks. |

| Limited Specialized Subcontractors | Supplier pricing power, less favorable terms | Scarcity in niche engineering or specific project execution expertise. |

| Industry Certification Standards (e.g., PMP) | Higher compensation expectations for certified talent | PMP certification sets a high bar, limiting the pool of qualified professionals and increasing their value. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Dovre Group's position in the project management and consulting sector.

Effortlessly identify and quantify competitive pressures with a dynamic, interactive dashboard, transforming complex market analysis into actionable insights.

Customers Bargaining Power

Dovre Group's clientele frequently engages in massive, intricate projects within vital industries such as energy and infrastructure. These undertakings often come with substantial financial commitments, underscoring the significant bargaining power customers wield.

The sheer scale and strategic criticality of these projects naturally drive clients to seek the best possible outcomes. This inherent motivation translates into a strong desire to negotiate favorable terms, ensuring they secure high-quality services and optimal value for their significant investments.

The project management consulting market, while specialized, presents customers with numerous alternatives. Major global firms like McKinsey, Deloitte, and PwC, alongside many smaller, niche consultants, provide a competitive landscape. This broad availability empowers clients to shop around, compare services and pricing, and negotiate terms, directly impacting Dovre Group's pricing power.

Clients in the energy, infrastructure, and maritime sectors often have robust internal project management teams and deep industry expertise. This means they don't always need external help for standard project oversight, giving them more leverage.

With their own capabilities, these clients can push for more specialized, high-value services from consultants, or even bring certain tasks in-house. For example, major energy companies often have dedicated project management offices (PMOs) that handle significant portions of project execution, reducing their need for external project management support for routine functions.

Price Sensitivity of Customers

Customers' sensitivity to the price of project management consulting services significantly impacts Dovre Group. Given the substantial investment often required for these services, clients, especially those operating in cost-conscious sectors or facing intense market competition, are likely to scrutinize pricing closely. This necessitates Dovre Group to not only offer competitive rates but also to clearly articulate and prove the value proposition of its offerings to justify the expenditure.

For instance, in 2024, many industries experienced inflationary pressures, leading to tighter corporate budgets. Companies that might have previously absorbed higher consulting fees may now be more inclined to seek out providers who can demonstrate a clear return on investment or offer more flexible pricing structures. This heightened price sensitivity means Dovre Group must continuously benchmark its pricing against competitors and highlight the efficiency gains and cost savings its services can deliver.

- Price Sensitivity Drivers: Customers in sectors like construction or public infrastructure, where margins can be tight, are particularly attuned to project management costs.

- Value Demonstration: Dovre Group must quantify the benefits of its services, such as reduced project timelines or improved resource allocation, to justify its fees.

- Competitive Landscape: The presence of numerous consulting firms means customers have options, amplifying the importance of competitive pricing and superior service delivery.

- Budgetary Constraints: In 2024, many businesses reported increased operational costs, leading to a more rigorous evaluation of all discretionary spending, including consulting services.

Potential for In-house Project Management Teams

The bargaining power of customers is influenced by their potential to develop in-house project management teams. For larger corporations, building internal expertise offers a direct alternative to engaging external consultants like Dovre Group, thereby increasing their leverage.

This capability allows clients to manage projects internally, reducing reliance on external providers and potentially lowering costs. In 2024, many large enterprises continued to invest in upskilling their internal workforce, a trend that directly impacts the demand for external project management services.

- In-house capability development: Clients can build their own project management teams, reducing the need for external support.

- Cost reduction potential: Internal teams can be more cost-effective for ongoing or large-scale project needs.

- Strategic control: Managing projects internally offers greater control over execution and outcomes.

- Leverage in negotiations: The option to go in-house strengthens a customer's position when negotiating with consulting firms.

Customers in Dovre Group's core sectors, like energy and infrastructure, often possess significant financial clout and a strong need for optimal project outcomes. This naturally grants them considerable bargaining power, especially given the substantial investments involved in their large-scale projects.

The availability of numerous alternative project management consulting firms, coupled with clients' increasing in-house capabilities, further amplifies their negotiation leverage. In 2024, many companies focused on enhancing internal expertise, directly impacting the demand for external consultants and pushing firms like Dovre Group to offer competitive pricing and demonstrable value.

Clients are highly sensitive to the cost of project management services, particularly in 2024's economic climate with rising operational costs and tighter corporate budgets. Dovre Group must therefore clearly articulate the return on investment for its services to justify its fees and remain competitive in a market with many options.

| Factor | Impact on Dovre Group | 2024 Context |

|---|---|---|

| Client Size & Investment | High bargaining power due to large project values | Major infrastructure projects continue to demand significant capital expenditure. |

| Availability of Alternatives | Weakens Dovre's pricing power | Numerous global and niche consulting firms compete for projects. |

| In-house Capabilities | Reduces reliance on external consultants | Companies increasingly invest in internal project management teams for cost and control. |

| Price Sensitivity | Dovre must justify value and offer competitive rates | Inflationary pressures in 2024 led to more rigorous scrutiny of consulting spend. |

Preview Before You Purchase

Dovre Group Porter's Five Forces Analysis

This preview showcases the complete Dovre Group Porter's Five Forces Analysis, offering a thorough examination of competitive pressures within their industry. You're looking at the actual document, meaning the insights and strategic evaluations presented here are precisely what you'll receive. Once your purchase is complete, you'll gain instant access to this exact, professionally formatted analysis, ready for immediate application to your business strategies.

Rivalry Among Competitors

The project management consulting sector is highly fragmented, featuring a wide array of players from global giants like Deloitte and PwC to niche specialists and smaller, agile firms. This broad competitive base, especially in key operational regions for Dovre Group, fuels intense rivalry as companies battle for project wins and market presence.

Competitive rivalry within the project management consulting and expert personnel services sector is quite high. Many companies provide similar services, including project planning, execution, and control. This overlap in core offerings naturally fuels intense price competition, forcing businesses to find ways to stand out.

Differentiation often hinges on factors like a strong reputation, specialized expertise in particular industries or project types, or the ability to offer unique value-added services. For instance, companies that can demonstrate a proven track record of successful project delivery, perhaps backed by client testimonials or industry awards, gain a significant edge. The ability to offer niche skills, such as specialized knowledge in renewable energy project management or complex IT infrastructure rollouts, also allows firms to carve out distinct market positions.

The project management service market is booming, expected to hit USD 51.58 billion by 2033, growing at a healthy 9.02% compound annual growth rate from 2025. This robust expansion, especially within the energy, infrastructure, and manufacturing sectors, naturally draws in new competitors and motivates current companies to broaden their offerings. Consequently, the competitive rivalry within this space is intensifying as more players vie for market share.

Importance of Reputation and Track Record

In the competitive landscape of project management, a strong reputation and a proven track record are paramount for securing new contracts. Companies like Dovre Group, with a history of successful project execution, especially in demanding sectors such as energy and infrastructure, possess a significant competitive edge. This established credibility makes it considerably harder for emerging or less experienced firms to challenge their market position.

The advantage held by established players is directly linked to client trust and the perceived reduction of risk. Clients often prefer engaging with firms that have a documented history of delivering complex projects on time and within budget. For instance, in 2024, major infrastructure projects often involve stringent qualification processes where past performance is a key evaluation criterion.

- Reputation as a Barrier: A firm's established reputation acts as a significant barrier to entry for new competitors in the project management sector.

- Track Record in Complex Projects: Success in delivering large-scale, complex projects builds a strong track record, which is highly valued by clients in sectors like oil and gas or renewable energy.

- Client Trust and Risk Aversion: Clients often prioritize proven reliability, reducing their perceived risk by selecting companies with a history of successful project delivery.

- Competitive Advantage: Firms with decades of experience and a portfolio of successfully completed projects, like Dovre Group, inherently have an advantage over newer entrants.

Impact of Digitalization and AI on Service Delivery

The competitive landscape for Dovre Group is intensifying due to digitalization and AI. Competitors are actively integrating AI and automation into their project management services, enhancing efficiency and offering advanced predictive analytics. This technological shift compels Dovre Group to continually invest in and adopt new digital tools to maintain its competitive edge and deliver superior client value.

In 2024, the adoption of AI in project management is a significant trend. For instance, companies are using AI for risk assessment, resource allocation, and progress tracking, leading to an estimated 15-20% improvement in project delivery times. This forces Dovre Group to innovate its service delivery models.

- AI-driven efficiency gains: Competitors are achieving faster project completion and reduced operational costs through AI automation.

- Predictive analytics advantage: Advanced analytics offered by rivals help clients anticipate and mitigate project risks more effectively.

- Streamlined workflows: Digital platforms are simplifying complex project management processes, setting a new standard for service delivery.

- Dovre Group's imperative: Continuous innovation and investment in technology are crucial for Dovre Group to match or exceed competitor offerings in service delivery.

The project management consulting sector is highly competitive, with numerous firms offering similar services, leading to price pressures and a constant need for differentiation. Dovre Group faces rivals ranging from large global consultancies to specialized niche players, all vying for market share in a rapidly expanding industry. Success hinges on reputation, specialized expertise, and the ability to leverage technology.

In 2024, the project management market's growth, projected to reach USD 51.58 billion by 2033 with a 9.02% CAGR, attracts new entrants and intensifies competition. Established firms like Dovre Group benefit from strong track records and client trust, particularly in complex sectors like energy and infrastructure, where proven reliability is paramount. This established credibility creates a significant barrier for newer competitors.

The integration of AI and automation by competitors is a key driver of escalating rivalry, pushing firms to enhance efficiency and offer advanced analytics. For example, AI adoption in project management in 2024 is estimated to improve project delivery times by 15-20%. Dovre Group must continually invest in digital tools to maintain its competitive standing and deliver enhanced client value.

SSubstitutes Threaten

Clients, particularly large corporations with robust Project Management Offices (PMOs), increasingly opt for internal execution of projects, diminishing the need for external support from firms like Dovre Group. This trend is fueled by a strategic focus on building in-house project management capabilities.

The growing availability of skilled project management professionals and the emphasis on developing internal expertise directly challenge the necessity of outsourcing. For instance, in 2024, many large enterprises reported increased investment in training and development for their internal teams, aiming to reduce reliance on external consultants for project delivery.

The rise of advanced, user-friendly project management software, including AI-driven solutions for scheduling, resource planning, and risk assessment, presents a significant threat of substitution for certain consulting services. For instance, the global project management software market was valued at approximately $5.9 billion in 2023 and is projected to reach over $12.5 billion by 2030, indicating strong growth and increasing adoption.

Clients, especially those with less intricate project needs, may choose to leverage these tools to manage their projects internally, thereby reducing their reliance on external consulting expertise. This trend is amplified by the increasing sophistication and accessibility of these off-the-shelf solutions, making them a viable alternative for many businesses.

The burgeoning gig economy presents a significant threat of substitutes for traditional project management services. Platforms like Upwork and Toptal directly connect businesses with freelance project managers, offering a flexible and often more cost-effective alternative to engaging a full-service consulting firm. In 2024, the global freelance platform market was valued at approximately $3.7 trillion, indicating a substantial shift in how businesses access specialized talent.

While Dovre Group offers comprehensive project management expertise, clients can bypass these integrated services by directly hiring individual freelance project managers for specific tasks or shorter-term engagements. This direct sourcing model allows businesses to potentially reduce overhead and tailor their project management resources precisely to their immediate needs, impacting demand for bundled consulting packages.

General Business Consulting Firms Expanding into Project Management

Large general business consulting firms are increasingly offering project management as part of their broader service portfolios. These firms, which might not specialize solely in project management, can still serve as substitutes by providing comprehensive solutions that encompass project execution alongside strategic advice. For instance, major consulting players like Accenture and Deloitte have dedicated project and program management practices that compete directly with specialized firms.

The threat from these generalists is amplified by their ability to offer integrated solutions, leveraging their existing client relationships and broader expertise. This means clients can potentially source project management capabilities from a single, trusted advisor rather than engaging a separate, specialized firm. In 2024, the global management consulting market was valued at approximately $330 billion, with project management services representing a significant and growing segment within this larger industry.

- Broad Service Offerings: General consulting firms can bundle project management with strategic planning, digital transformation, and change management services.

- Integrated Solutions: Clients may prefer a single vendor for both strategic guidance and project execution, reducing complexity.

- Established Client Base: These firms often have deep-rooted relationships with large corporations, making them a convenient choice for project management needs.

- Market Penetration: The significant market share of major consulting players indicates their capacity to absorb project management work.

DIY Approach with Training and Templates

For less complex or smaller initiatives, clients might opt for a DIY strategy. This involves upskilling their internal teams through project management training and leveraging accessible templates and established methodologies. This approach directly diminishes the reliance on external consulting expertise.

This DIY trend is gaining traction as more organizations recognize the potential cost savings. For instance, in 2024, the global e-learning market, which often provides project management certifications and courses, was projected to reach over $400 billion, indicating a strong demand for self-directed skill development.

- Cost Savings: Clients can significantly reduce project costs by avoiding external consultant fees.

- Internal Capability Building: Investing in training enhances long-term internal project management skills.

- Template Availability: Numerous free and low-cost project management templates are readily accessible online.

- Reduced Dependence: Organizations become less reliant on external providers for project execution.

The threat of substitutes for Dovre Group's project management services is multifaceted, stemming from both technological advancements and evolving client strategies. Clients are increasingly bringing project management in-house, fueled by investments in internal training and development, as seen in 2024 enterprise spending. Furthermore, the proliferation of sophisticated project management software, with the market projected to exceed $12.5 billion by 2030, offers a viable alternative for managing projects internally.

The rise of the gig economy, evidenced by the $3.7 trillion global freelance platform market in 2024, allows businesses to directly source specialized project managers, bypassing traditional consulting firms. Even large general consulting firms, with their broad service portfolios and established client bases, pose a substitute threat by integrating project management into wider strategic offerings. The DIY approach, supported by accessible online training and templates, further diminishes the need for external project management support.

| Substitute Type | Key Characteristics | Impact on Dovre Group | 2024 Market Data/Trends |

|---|---|---|---|

| Internal Project Management Capabilities | In-house expertise development, strategic focus | Reduced demand for external services | Increased enterprise investment in PM training |

| Project Management Software | AI-driven tools, user-friendly interfaces | Potential replacement for specific consulting tasks | Market valued at $5.9 billion in 2023, growing |

| Gig Economy/Freelancers | Flexible engagement, cost-effectiveness | Direct competition for talent acquisition | Global freelance platform market ~$3.7 trillion |

| General Business Consultants | Integrated service offerings, existing relationships | Bundled solutions compete with specialized services | Global management consulting market ~$330 billion |

| DIY Approach | Self-upskilling, templates, cost savings | Decreased reliance on external providers | E-learning market projected over $400 billion |

Entrants Threaten

The significant capital required to establish a global project management firm like Dovre Group, with its extensive international presence and specialized industry focus, acts as a formidable barrier. This includes substantial outlays for infrastructure, advanced technology, and skilled personnel across multiple regions, making it challenging for newcomers to achieve comparable scale and operational breadth.

Success in sectors like energy, infrastructure, and maritime hinges on specialized industry knowledge, navigating complex regulations, and obtaining critical certifications. Newcomers face substantial hurdles, needing significant investment to build or acquire this essential expertise.

Dovre Group's established position is reinforced by deeply entrenched client relationships and a robust reputation for consistently delivering successful projects. This history of reliability makes it difficult for newcomers to gain traction.

New entrants must overcome the significant hurdle of establishing trust and demonstrating their competence to potential clients, a process that demands substantial time and investment. For instance, securing a major infrastructure project, a core area for Dovre Group, often requires a proven track record that new firms simply haven't had the opportunity to build.

Talent Acquisition and Retention Challenges

The project management industry is experiencing a significant global talent shortage, creating hurdles for both existing players and potential newcomers. This makes it difficult for new entrants to attract and retain the highly skilled professionals necessary to compete effectively. Established firms often have an advantage due to their ability to offer more attractive compensation packages and robust career progression paths, making it harder for new companies to poach top talent.

For instance, a 2024 survey by the Project Management Institute (PMI) indicated that over 70% of project managers reported difficulty finding qualified candidates. This scarcity directly impacts the threat of new entrants; any new company would face substantial recruitment costs and time investment to build a competent team.

- Global Talent Scarcity: The project management sector faces a worldwide shortage of experienced professionals.

- Retention Advantage for Incumbents: Established companies can leverage better compensation and career development to retain talent, deterring new entrants.

- High Recruitment Costs: New entrants must invest heavily in attracting scarce talent, increasing their initial operational expenses.

- Impact on Competition: The difficulty in acquiring skilled personnel limits the ability of new firms to quickly scale and challenge established market players.

Regulatory and Compliance Hurdles

Operating in sectors like energy and infrastructure, where Dovre Group is active, means dealing with intricate regulatory landscapes and compliance demands that vary significantly by region. For instance, in 2024, companies entering the European energy market faced evolving emissions standards and renewable energy mandates, requiring substantial upfront investment in understanding and adhering to these rules.

New players must allocate considerable resources to legal and compliance teams, as well as to ensuring their operations meet all pertinent standards. This investment directly increases the barrier to entry, making it more challenging and costly for newcomers to establish a foothold against established firms like Dovre Group.

- Regulatory Complexity: Navigating diverse and evolving regulations in energy and infrastructure is a significant deterrent.

- Compliance Costs: New entrants face substantial expenses for legal expertise and ensuring adherence to standards.

- Geographic Variation: Compliance requirements differ across countries, adding layers of complexity and cost for global operations.

The threat of new entrants for Dovre Group is moderate, primarily due to high capital requirements and specialized knowledge needed in sectors like energy and infrastructure. Established client relationships and a strong reputation also present significant barriers.

New companies face considerable challenges in acquiring scarce, highly skilled talent, with a 2024 PMI survey showing over 70% of project managers finding it difficult to source qualified candidates. This talent scarcity translates into high recruitment costs and extended timeframes for new entrants to build competent teams, impacting their ability to compete effectively.

Navigating complex and region-specific regulatory landscapes, particularly in the energy sector with evolving standards as seen in Europe in 2024, demands substantial investment in legal and compliance expertise. These compliance costs further elevate the barrier to entry, making it harder for newcomers to establish a foothold against established players like Dovre Group.

| Barrier Type | Impact on New Entrants | Example Data (2024) |

| Capital Requirements | High | Global project management firms require significant investment in infrastructure and technology. |

| Specialized Knowledge & Certifications | High | Access to critical certifications and deep industry expertise is essential for energy and maritime sectors. |

| Reputation & Client Relationships | High | Dovre Group's track record of successful project delivery builds trust, a difficult asset for newcomers to replicate. |

| Talent Acquisition | High | 70%+ difficulty in finding qualified project managers (PMI 2024) leads to high recruitment costs for new firms. |

| Regulatory Compliance | High | Evolving regulations in European energy markets in 2024 necessitate significant investment in compliance expertise. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Dovre Group is built upon a foundation of diverse and credible data. We leverage company annual reports, investor presentations, and press releases to understand internal strategies and performance. This is complemented by industry-specific market research reports, competitor analyses, and economic indicators from reputable sources to provide a comprehensive view of the competitive landscape.