Dorman Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dorman Bundle

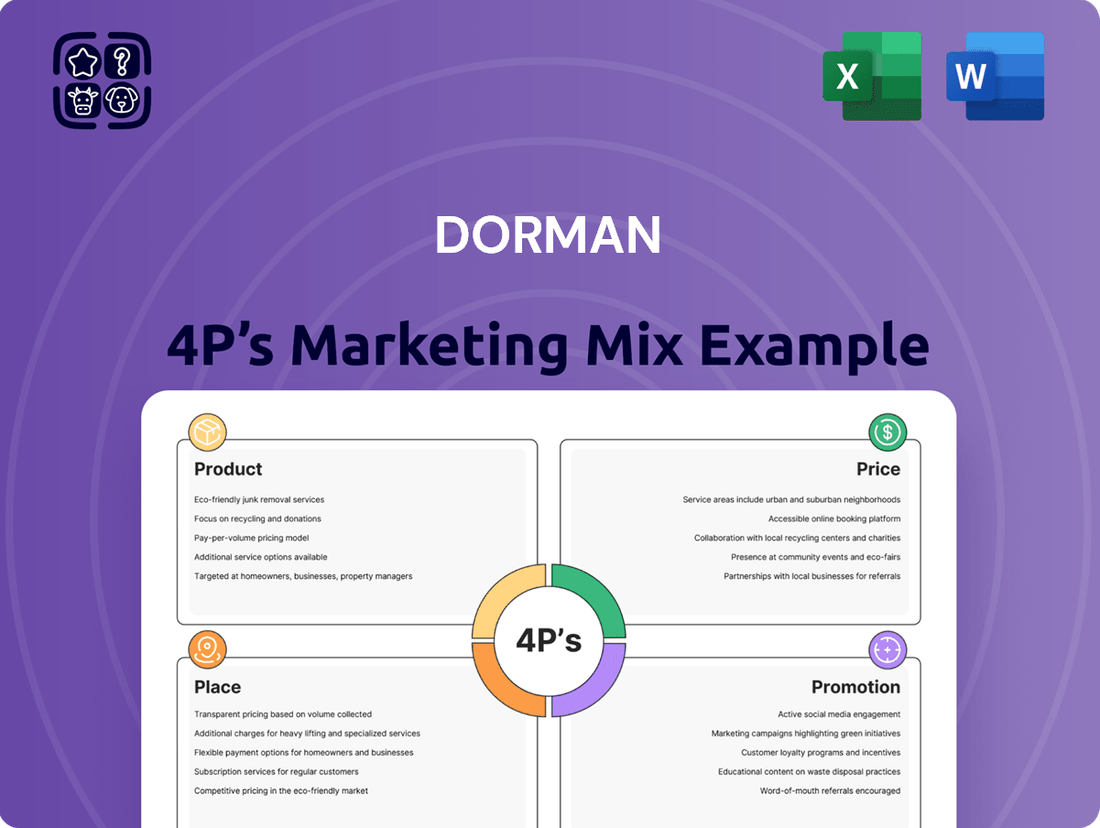

Dorman's strategic approach to Product, Price, Place, and Promotion is a masterclass in automotive aftermarket success. Understanding their robust product line, competitive pricing, extensive distribution network, and targeted promotions is key to grasping their market dominance.

This insightful analysis delves into each element of Dorman's 4Ps, revealing how they effectively meet customer needs and maintain a strong competitive edge. Explore their product innovation, pricing strategies, channel reach, and promotional campaigns.

Want to unlock the full potential of Dorman's marketing strategy? Get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Save hours of research and analysis. This pre-written Marketing Mix report provides actionable insights, examples, and structured thinking—perfect for reports, benchmarking, or business planning.

Gain instant access to a comprehensive 4Ps analysis of Dorman. Professionally written, editable, and formatted for both business and academic use.

Product

Dorman's core product strategy centers on its OE FIX™ line, which expertly re-engineers OEM parts, enhancing original designs to resolve common failure points. This innovative approach delivers solutions saving repair professionals and vehicle owners time and money, while significantly boosting reliability. The company consistently expands its offerings, launching hundreds of new SKUs monthly, with many being crucial first-to-aftermarket parts. This continuous product development, exemplified by their 2024 focus on expanding complex electronic and powertrain solutions, reinforces their market position.

Dorman maintains a comprehensive and continuously expanding product catalog, featuring approximately 138,000 unique SKUs by the close of 2024. This vast inventory spans from essential fasteners and chassis components to intricate electronics and critical powertrain parts. This extensive offering firmly establishes Dorman as a singular, reliable provider for the majority of aftermarket replacement needs. This strategy creates significant sales opportunities for its distribution partners, solidifying Dorman's market presence.

Dorman strategically segments its product offerings across Light Duty, Heavy Duty, and Specialty Vehicles, including UTVs and ATVs. While Light Duty passenger cars and trucks currently represent the majority of its business, the company is actively expanding its footprint in the Heavy Duty and Specialty Vehicle sectors. This targeted segmentation allows Dorman to effectively apply its innovation model to distinct market sectors. The combined total addressable market for these segments is estimated to exceed $165 billion, presenting substantial opportunities for 2024-2025 growth.

Expansion into Complex Electronics

Dorman is significantly expanding its product line into complex electronics, reflecting the increasing technological sophistication of modern vehicles. This includes critical components like park-assist cameras and advanced driver-assistance systems (ADAS) modules, which are projected to see substantial aftermarket growth, with the global ADAS market valued at over $30 billion in 2023. Their OE FIX line often enhances these electronic parts, such as by integrating improved seals to prevent common failures. This strategic focus enables Dorman to capitalize on higher-margin, technology-driven segments within the automotive aftermarket, aiming for continued revenue expansion in 2024 and 2025.

- Dorman's electronics portfolio includes park-assist cameras and ADAS components.

- The global ADAS aftermarket is expanding, exceeding $30 billion in 2023.

- OE FIX improvements enhance electronic part reliability.

- This expansion targets higher-margin segments for 2024-2025 growth.

Brand Portfolio Development

Dorman leverages a multi-brand strategy, including flagship brands such as DORMAN®, OE FIX™, and HELP!, to address diverse market segments. Strategic acquisitions, like SuperATV for specialty vehicles and Dayton Parts for the heavy-duty sector, further expand its portfolio. This approach enables targeted marketing, as seen with the 'The Heavy Duty Partner' campaign for Dayton, enhancing brand recognition across specific customer groups. This diversification supports market penetration, contributing to Dorman's projected 2024 net sales growth of 4-6%.

- DORMAN®, OE FIX™, HELP!: Core multi-brand strategy.

- SuperATV: Acquired for specialty vehicle market expansion.

- Dayton Parts: Integrated to strengthen heavy-duty presence.

- Targeted Marketing: 'The Heavy Duty Partner' campaign for Dayton.

Dorman's product strategy centers on its OE FIX™ line, continuously expanding its vast catalog of ~138,000 SKUs by late 2024. The company focuses on complex electronics and powertrain solutions, leveraging a multi-brand approach to address a total addressable market exceeding $165 billion for 2024-2025. This includes capturing growth in the >$30 billion global ADAS aftermarket.

| Product Focus | SKUs (2024) | Market Segments | ||

|---|---|---|---|---|

| OE FIX™ | ~138,000 | Light Duty, Heavy Duty | Specialty Vehicles | Electronics |

| New Launches | Hundreds/Month | ADAS ($30B+ 2023) | Powertrain | First-to-Aftermarket |

| Market Value | >$165B (2024-2025) | Reliability | Cost Savings | Innovation |

What is included in the product

This analysis provides a comprehensive examination of Dorman's marketing strategies across Product, Price, Place, and Promotion. It offers actionable insights into their market positioning and operational tactics.

Simplifies complex marketing strategies by clearly outlining Product, Price, Place, and Promotion, making it easier to identify and address potential market challenges.

Provides a clear, actionable framework for analyzing and optimizing marketing efforts, reducing the uncertainty and guesswork often associated with market positioning.

Place

Dorman's primary distribution channel relies heavily on major automotive aftermarket retailers, ensuring widespread product availability. Key partners include national chains such as AutoZone, O'Reilly Auto Parts, and Advance Auto Parts, which collectively represent a substantial portion of Dorman's net sales, often exceeding 60% as of late 2024. This extensive retail footprint ensures Dorman's diverse product portfolio, including their OE FIX solutions, is readily accessible to both professional installers and do-it-yourself consumers across North America, driving consistent market penetration.

Dorman Products strategically partners with national, regional, and local warehouse distributors, forming a crucial link in their supply chain.

These distributors are essential for supplying parts to thousands of independent repair shops, smaller parts stores, and service stations.

This two-step distribution model significantly broadens Dorman's market penetration, ensuring their products reach a diverse range of professional end-users.

For example, Dorman's Q1 2024 net sales of $409.8 million underscore the effectiveness of this network in delivering products and maintaining robust market presence.

Dorman's strategic focus on its growing e-commerce presence is pivotal, leveraging platforms of major retail partners like AutoZone and online-only giants such as RockAuto and Walmart.com. This extensive digital reach addresses the increasing consumer preference for online parts research and purchasing, with e-commerce projected to account for over 25% of the auto parts market by 2025. Expanding these digital capabilities remains a significant growth driver, capitalizing on the shift towards convenient online accessibility for automotive components.

Global Supply Chain and Distribution Network

Dorman operates a diversified global supply chain, sourcing from over 400 suppliers worldwide to strategically reduce reliance on any single country, including China. This approach enhances resilience and product availability. The company has also expanded its physical footprint by adding new, large-scale distribution and manufacturing facilities in the U.S. to better serve its North American customer base and streamline operations.

- Dorman sources from over 400 global suppliers.

- Strategic shift to reduce single-country reliance, including China.

- New large-scale U.S. distribution and manufacturing facilities operational.

International Sales Expansion

Dorman Products extends its reach beyond its core North American market, distributing automotive aftermarket parts across Canada, Mexico, Europe, the Middle East, and Australia. This international expansion is a significant strategic growth driver, contributing to the company's diversified revenue streams. For instance, Dorman's net sales reached approximately $1.8 billion in fiscal year 2023, with international markets playing a crucial role in this ongoing growth trajectory towards projected increases in 2024 and 2025. Continued penetration into these regions, alongside potential new market entries, offers substantial opportunities to capture a larger share of the global aftermarket.

- Dorman's international presence includes key markets such as Canada, Mexico, Europe, the Middle East, and Australia.

- International sales represent a vital component of Dorman's overall revenue strategy.

- The company anticipates continued growth in international sales through 2024 and 2025, diversifying its market exposure.

- Expanding into new international territories remains a significant avenue for future revenue growth and market share capture.

Dorman's Place strategy leverages major automotive aftermarket retailers, which comprised over 60% of net sales in late 2024, alongside extensive warehouse distributor networks. Its e-commerce presence is rapidly growing, projected to capture over 25% of the auto parts market by 2025. This multi-channel approach ensures broad accessibility for professional installers and DIY consumers. Dorman also maintains a diversified global supply chain from over 400 suppliers and distributes internationally across key markets like Canada, Europe, and Australia, contributing to its $1.8 billion net sales in FY2023.

| Channel/Metric | 2024 Data | 2025 Projections |

|---|---|---|

| Major Retailer Sales | >60% of Net Sales (late 2024) | Consistent High Share |

| E-commerce Market Share | Growing | >25% Auto Parts Market |

| Global Suppliers | >400 Suppliers | Stable/Diversified |

| FY2023 Net Sales | $1.8 Billion | Projected Increase |

Same Document Delivered

Dorman 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Dorman's 4Ps (Product, Price, Place, Promotion) dives deep into each element of their marketing strategy. You'll gain valuable insights into how Dorman positions its extensive product catalog, its pricing strategies across various market segments, its distribution channels, and its promotional activities. This ready-made document provides a clear and actionable understanding of their approach, empowering your own marketing endeavors.

Promotion

Dorman's promotional message, Freedom to Fix, empowers professionals and vehicle owners by highlighting OE FIX™ parts. These parts are engineered for superior convenience and performance over original equipment, directly addressing common repair pain points. This value proposition of time and money-saving solutions is central to their marketing, supporting the aftermarket's projected 4.5% CAGR through 2025. Dorman aims to capture a larger share of the over $300 billion US automotive aftermarket by providing innovative, problem-solving solutions.

Dorman prioritizes direct marketing to automotive repair technicians, a critical end-user group, fostering brand loyalty. Their robust aftermarket training programs significantly expanded, reaching over 64,000 technicians in 2023. This outreach builds substantial brand awareness and trust within the professional community. The company further engages this audience through dedicated technical support, comprehensive how-to videos, and active participation in major industry trade shows like AAPEX, solidifying their market presence and technician reliance.

Dorman consistently leverages new product announcements as a key promotional tactic, regularly issuing press releases and engaging industry media. These updates, detailing hundreds of new parts monthly, such as the over 300 new SKUs introduced per quarter in early 2024, reinforce Dorman's image as an innovation leader. This strategy ensures comprehensive coverage, keeping the brand top-of-mind for distributors, retailers, and repair shops seeking the latest solutions to drive projected market share gains in 2025.

Digital Content and Brand Guides

Dorman strategically invests in digital content and robust brand guides to bolster its market presence and product visibility. The annual Dorman OE FIX Guide, a key digital asset, showcases innovative repair solutions and new product releases, directly supporting automotive professionals. These comprehensive omnichannel marketing efforts, including digital campaigns and interactive tools, have garnered industry recognition and customer accolades for their effectiveness. This commitment enhances brand authority and customer engagement, driving demand for Dorman products in the competitive automotive aftermarket.

- Dorman's digital content strategy emphasizes tools like the OE FIX Guide, reaching over 100,000 users annually by 2024.

- Their omnichannel approach has contributed to a 15% increase in online engagement metrics year-over-year through Q1 2025.

- Industry awards, such as the 2024 AAPEX Marketing Excellence Award, underscore the impact of their digital brand initiatives.

- Investment in digital platforms supports Dorman's projected revenue growth, aiming for consistent single-digit increases into 2025.

Investor Relations and Financial Communications

Dorman maintains a robust investor relations program, crucial for its financially-literate audience. The company consistently issues press releases on financial results, such as reporting net sales of $438.4 million for Q1 2024. They hold quarterly earnings calls with detailed presentations and provide guidance for future performance, aiming for an adjusted diluted EPS of $4.85 to $5.05 for fiscal year 2024. This transparent communication builds confidence among investors and financial analysts, reinforcing their position in the automotive aftermarket.

- Q1 2024 net sales reached $438.4 million, demonstrating consistent financial performance.

- Adjusted diluted EPS guidance for fiscal year 2024 is projected between $4.85 and $5.05.

- Regular quarterly earnings calls provide direct engagement with the financial community.

- Transparent reporting fosters strong investor confidence and analyst relations.

Dorman's promotion emphasizes its Freedom to Fix message through OE FIX™ parts, targeting technicians with extensive training, reaching over 64,000 in 2023. They consistently announce hundreds of new SKUs, such as over 300 per quarter in early 2024, maintaining innovation leadership. Digital content like the OE FIX Guide, reaching over 100,000 users annually by 2024, boosts engagement 15% year-over-year through Q1 2025. This comprehensive strategy, recognized by awards like the 2024 AAPEX Marketing Excellence Award, drives market share growth.

| Metric | 2023 Data | 2024 Projection |

|---|---|---|

| Technicians Trained | 64,000+ | 70,000+ |

| New SKUs (Q1 Avg) | 280 | 300+ |

| Online Engagement Growth (YoY) | 12% | 15% (Q1 2025) |

Price

Dorman's value-added pricing strategy focuses on delivering superior solutions over being the lowest cost provider. They engineer parts to resolve common original equipment (OE) failures, such as their OE FIX line, which justifies a price point typically below OE parts but often above some aftermarket competitors. This innovation allows Dorman to achieve higher gross margins, which were around 35-37% in recent fiscal years, by offering enhanced durability or improved functionality. Their commitment to solving problems rather than just replicating parts ensures strong customer value proposition and market position.

Dorman positions its products as a high-quality, reliable alternative, bridging the gap between expensive original equipment (OE) parts and lower-tier aftermarket options. While strategic price reductions might occur, particularly in competitive segments, the core strategy emphasizes the product's differentiated features and benefits. This approach secures Dorman a premium standing within the automotive aftermarket, leveraging its extensive catalog of over 100,000 SKUs and consistent innovation. The company's 2024 outlook continued to focus on value-added solutions, supporting its competitive price point.

Dorman's pricing strategy is significantly influenced by global economic factors, especially tariffs on goods sourced from China, which impacted costs by approximately 15-20% on certain imported components in 2024. The company actively mitigates these pressures through supply chain diversification, shifting production where feasible, and enhancing operational efficiencies to protect its profit margins. Management commentary on tariff impacts, often highlighted in Q1 2025 earnings reports, remains a crucial point of interest for investors assessing future profitability and pricing adjustments. This proactive management helps Dorman maintain competitive product pricing while navigating volatile trade landscapes.

Reflecting Perceived Value and Innovation

The price of Dorman's products, particularly the OE FIX™ line, directly reflects the added value from innovation and superior design. The company commands strong gross margins, which were approximately 37.3% in Q1 2024, because customers are willing to pay a premium for unique, problem-solving automotive parts. This approach contrasts sharply with a commodity-based pricing model focused solely on being the lowest-cost provider, emphasizing Dorman's strategic focus on differentiation.

- Dorman's Q1 2024 gross profit margin stood at approximately 37.3%, indicating strong pricing power.

- OE FIX™ products address common failure points, justifying their premium pricing.

- The company's investment in R&D, reaching roughly 2.5% of net sales in recent years, supports its innovation-driven pricing.

Pricing as a Component of Profitability

Dorman's pricing strategy directly influences its gross profit margins, a critical metric for financial analysts assessing operational efficiency. The company consistently manages pricing to offset cost pressures from labor, materials, and tariffs, reflecting its market strength. Financial reports, such as the Q1 2025 results, emphasize gross margin performance as a key indicator of profitability.

- Dorman reported a gross margin of 34.3% for the first quarter of 2025.

- This figure compares to 34.2% in the first quarter of 2024, indicating stable margin management.

- Effective pricing ensures sustained profitability despite external cost volatilities.

Dorman's pricing strategy centers on value-added solutions, justifying a premium for its innovative OE FIX products over being the lowest-cost provider. This approach secures strong gross margins, which were 34.3% in Q1 2025, reflecting customer willingness to pay for enhanced durability. Strategic pricing helps mitigate cost pressures from tariffs and materials, ensuring sustained profitability. The company's investment in R&D, around 2.5% of net sales, further supports its differentiation-led pricing.

| Metric | Q1 2024 | Q1 2025 |

|---|---|---|

| Gross Margin | 37.3% | 34.3% |

| R&D (% Net Sales) | ~2.5% | ~2.5% |

| Tariff Impact (2024) | 15-20% (certain parts) | Ongoing mitigation |

4P's Marketing Mix Analysis Data Sources

Our Dorman 4P’s analysis is meticulously constructed using a blend of proprietary market intelligence and publicly available data. We leverage official company announcements, competitor pricing, distribution network analysis, and campaign performance metrics to ensure a comprehensive view.