Dorman Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dorman Bundle

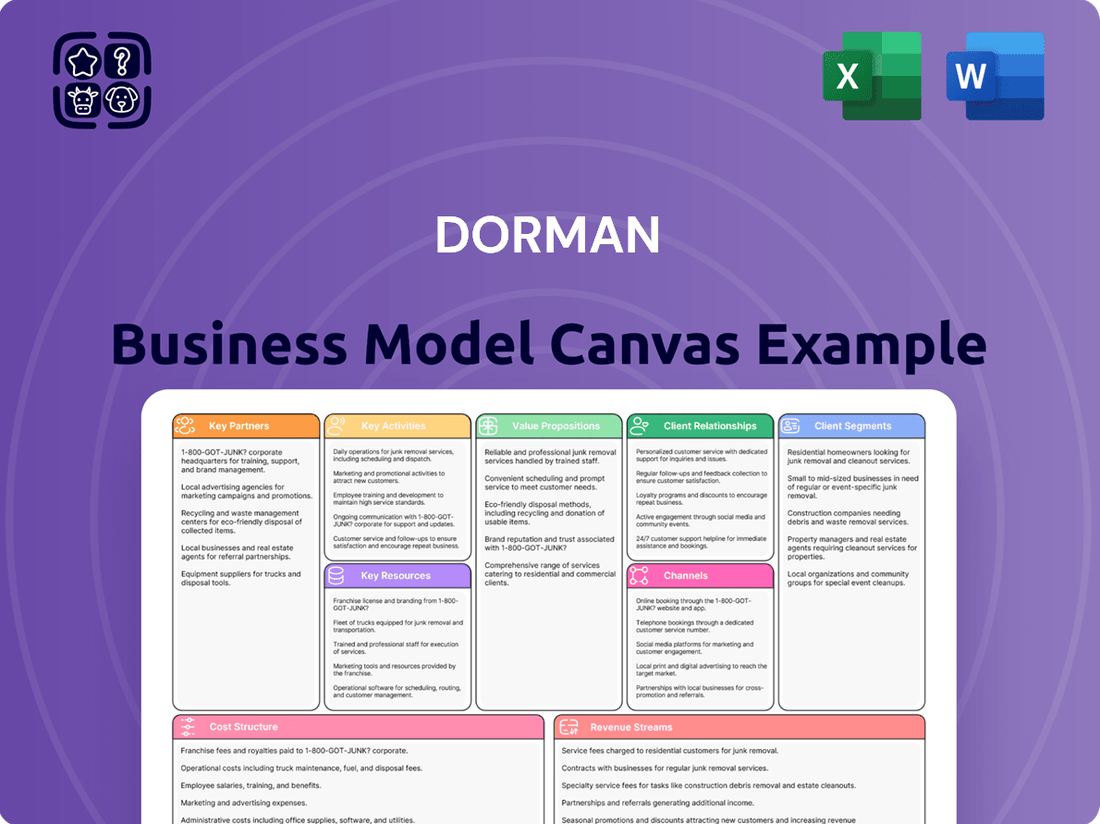

Unlock the complete strategic blueprint behind Dorman's success with our full Business Model Canvas. This detailed document breaks down exactly how Dorman creates and delivers value to its customers, from its key partners to its revenue streams. It's an essential tool for anyone looking to understand market leaders.

Dive deeper into Dorman's core competencies and customer relationships. Our comprehensive Business Model Canvas provides a clear, actionable view of their operational efficiency and competitive advantages. This is your chance to gain insights from a proven industry player.

Ready to accelerate your own business strategy? Download the full Dorman Business Model Canvas in editable formats to benchmark your plans or inspire new approaches. See how every element of their business model contributes to their market position.

Partnerships

Dorman leverages a global network of third-party manufacturers, primarily in low-cost regions, to produce its vast catalog of over 100,000 unique parts, maintaining an asset-light model. These relationships are deep partnerships, involving co-development and stringent quality assurance protocols, ensuring product reliability. This strategy allows Dorman to focus on its core competencies of engineering and distribution, evidenced by its 2023 net sales of over $1.7 billion. Such alliances maintain cost competitiveness and production flexibility, adapting quickly to market demands without significant capital expenditures on manufacturing facilities.

Dorman Products Inc. relies heavily on strategic partnerships with major aftermarket retailers like AutoZone, O'Reilly Auto Parts, and Advance Auto Parts, which are primary sales channels. These relationships are crucial for securing prominent shelf space, facilitating joint marketing initiatives, and accessing valuable point-of-sale data that informs product development. As of 2024, these key retailers collectively operate thousands of locations across North America, ensuring Dorman's extensive product portfolio is readily available. This strong collaboration ensures that professional automotive technicians and DIY consumers can consistently access Dorman’s parts for vehicle repairs and maintenance.

Dorman leverages a vast network of warehouse distributors, crucial for reaching independent repair shops and smaller, regional parts stores across North America. These WDs serve as vital intermediaries, offering localized inventory and efficient last-mile delivery services. This tiered distribution model significantly broadens Dorman's market reach, complementing its direct sales to major national retail chains. For example, Dorman’s 2024 financial reports highlight the continued importance of its aftermarket distribution channels, with WDs contributing substantially to its strong market presence.

Logistics and 3PL Providers

Dorman relies on robust partnerships with third-party logistics (3PL) providers and major freight carriers to manage its intricate global supply chain. These partners are crucial for the efficient movement of parts, from overseas manufacturing hubs to Dorman’s distribution centers and onward to customers across North America. In 2024, maintaining strong 3PL relationships is vital for Dorman, especially as global freight costs remain dynamic, impacting operational efficiency. Efficient logistics directly support high service levels and optimize inventory management, crucial for timely delivery and cost control.

- Dorman’s supply chain handles over 100,000 unique parts, requiring sophisticated 3PL coordination.

- Logistics costs, including freight, can represent a significant portion of operational expenses, impacting net income.

- Strategic partnerships help Dorman maintain a fill rate of over 90% for critical parts.

- The company leverages 3PL expertise to navigate complex customs regulations and optimize delivery routes.

Technology and Data Providers

Dorman collaborates extensively with technology partners for crucial enterprise resource planning (ERP) and sophisticated supply chain management software. These alliances are essential for effectively managing Dorman's vast inventory, which encompasses over 100,000 distinct SKUs as of their 2024 operations. Ensuring data accuracy through these systems is paramount, enabling precise inventory tracking and efficient order fulfillment.

Accurate electronic catalog data, maintained via these partnerships, is vital for technicians and retailers. It allows them to quickly identify and order the correct automotive parts, a critical factor for Dorman's market efficiency. This technological backbone supports their ability to process millions of transactions annually, maintaining a competitive edge.

- Dorman utilizes ERP systems to manage over 100,000 SKUs, reflecting their broad product offering in 2024.

- Supply chain software partnerships optimize logistics, reducing fulfillment times.

- Accurate electronic cataloging ensures correct part identification, crucial for customer satisfaction.

- These collaborations underpin Dorman's operational efficiency, contributing to their reported net sales of $1.7 billion in fiscal year 2023, expected to grow in 2024.

Dorman’s key partnerships span global third-party manufacturers for its 100,000+ parts, major aftermarket retailers like AutoZone for sales, and warehouse distributors for broader reach. Strategic alliances with 3PL providers ensure efficient logistics, while technology partners manage inventory and electronic cataloging. These collaborations are crucial for Dorman’s asset-light model and market efficiency, supporting its expected 2024 growth.

| Partnership Type | Key Contribution | 2024 Impact Data | ||

|---|---|---|---|---|

| Manufacturers | Vast product catalog | Over 100,000 unique parts | ||

| Retailers | Market access | Thousands of North American locations | ||

| Logistics (3PL) | Supply chain efficiency | Over 90% fill rate for critical parts |

What is included in the product

A detailed breakdown of Dorman's operational strategy, showcasing its approach to key business components like customer segments, value propositions, and revenue streams.

This model offers a structured view of Dorman's competitive advantages and market positioning within the automotive aftermarket industry.

The Dorman Business Model Canvas offers a structured framework that simplifies complex business strategies, alleviating the pain of disorganization and unclear direction.

By providing a visual and organized representation of key business elements, it resolves the frustration of fragmented planning and facilitates clearer communication.

Activities

Dorman's New Product Development & Engineering stands as its core activity, embodying the 'First to the Aftermarket' strategy. Teams of engineers diligently identify failure-prone original equipment parts and re-engineer them, often creating improved designs that are more durable or easier to install. This relentless innovation engine continues to be a primary driver of growth and margin expansion. As of their 2024 outlook, Dorman consistently launches thousands of new SKUs annually, reflecting their commitment to market leadership.

Dorman orchestrates an extensive global supply chain, managing relationships with hundreds of diverse suppliers across multiple international regions to source its broad product portfolio. This intricate process involves rigorous supplier qualification, strategic negotiation, and stringent quality control protocols to ensure the integrity of over 100,000 unique SKUs. Effectively managing this complex network, particularly amidst 2024's evolving logistics challenges, is crucial for maintaining optimal product availability and controlling costs. Their robust supply chain management is key to delivering high fill rates and supporting their aftermarket leadership.

Dorman's Quality Assurance and Control are fundamental, with a dedicated team and robust processes ensuring all products meet or exceed OE specifications and their stringent internal standards. For instance, throughout 2024, activities consistently included rigorous initial sample testing, in-process inspections at manufacturing sites globally, and final quality checks at distribution centers before shipment. This unwavering commitment to product excellence is crucial for maintaining the strong brand trust professional technicians place in Dorman, supporting their continued market leadership.

Marketing & Brand Management

Dorman actively markets its brand and sub-brands like OE Solutions and HELP! to its core customer segments, emphasizing its role as the premier problem-solver in the automotive aftermarket. This involves creating extensive technical content, installation videos, and training materials for technicians, alongside managing robust digital platforms. The goal is to build significant brand equity and reinforce their market leadership. In 2024, Dorman continues to leverage digital channels to reach a broad base of over 100,000 professional technicians and DIY enthusiasts globally.

- Dorman's product catalog exceeds 160,000 unique SKUs, underscoring the vast scope of products requiring marketing support.

- The company regularly releases hundreds of new products annually, each requiring focused marketing efforts.

- Digital engagement through platforms like YouTube, where Dorman features thousands of installation videos, remains a core strategy.

Inventory & Distribution Management

Dorman's Inventory and Distribution Management is crucial, handling a vast and complex inventory across its extensive network of distribution centers. Key activities include sophisticated demand forecasting and precise inventory planning, essential for managing their long-tail product assortment. Efficient warehouse operations ensure high fill rates for customer orders, which is a significant competitive advantage for the company. This robust system supports Dorman's ability to consistently supply over 100,000 unique parts, as highlighted in their 2024 operational reviews.

- Demand forecasting leverages advanced analytics for over 100,000 SKUs.

- Efficient warehouse operations support high fill rates, crucial for customer satisfaction.

- Strategic inventory planning minimizes stockouts while managing a long-tail product range.

- Dorman's distribution network includes multiple facilities, enhancing delivery speed and reach.

| Activity Area | Key Metric | 2024 Data Point |

|---|---|---|

| Product Development | New SKUs Launched | Thousands annually |

| Supply Chain & Inventory | SKUs Managed | >100,000 unique parts |

| Marketing Reach | Target Audience | >100,000 professionals/DIY |

Dorman’s core activities include re-engineering OE parts, launching thousands of new SKUs annually to drive innovation and market leadership. They manage an extensive global supply chain for over 100,000 unique parts, ensuring quality and availability. Effective brand marketing, reaching over 100,000 technicians and DIY enthusiasts, reinforces their problem-solver image. Sophisticated inventory and distribution systems maintain high fill rates for their vast product catalog, exceeding 160,000 SKUs as of 2024.

What You See Is What You Get

Business Model Canvas

The Dorman Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the complete file. Once your order is processed, you will gain full access to this exact, professionally formatted Business Model Canvas, ready for immediate use and customization.

Resources

Dorman's most significant resource is its immense and continuously expanding product catalog, which included over 150,000 unique SKUs by 2024.

This extensive catalog features numerous proprietary designs and engineered solutions, establishing a formidable intellectual property moat built over decades.

The associated data, encompassing precise vehicle fitment information and comprehensive cross-references, is critical for the entire distribution channel.

This data ensures accurate part identification and supports efficient inventory management across the automotive aftermarket.

Dorman’s in-house engineering, design, and product management teams are pivotal human resources. Their deep expertise in reverse-engineering and material science drives continuous development of unique, improved parts. This talent fuels the OE Solutions value proposition, enabling over 3,000 new product introductions in 2024. These capabilities ensure Dorman remains a leader in automotive aftermarket innovation.

Dorman Products leverages its sophisticated global sourcing network, a cornerstone resource built on established, long-term relationships with diverse manufacturers worldwide. This extensive network, vital for Dorman's 2024 operations, provides significant manufacturing scale, cost advantages, and flexible sourcing capabilities that competitors find challenging to replicate. It enables the company to maintain an asset-light business model, effectively controlling a vast virtual factory without the overhead of owned production facilities. This strategic asset contributes to Dorman's ability to offer over 100,000 unique parts.

Distribution Center Network

Dorman’s strategically located distribution centers across North America are a crucial physical asset, enabling timely and efficient delivery to its vast retail and wholesale customer base.

This sophisticated infrastructure, vital for servicing a continent-wide market, ensures rapid fulfillment of automotive aftermarket parts. As of early 2024, Dorman operates a network including master and regional distribution centers, significantly bolstering its supply chain efficiency.

- North American footprint: The network spans critical locations across the continent.

- Timely delivery: Strategic placement facilitates quick order fulfillment.

- Scale and sophistication: A robust system supports continent-wide customer service.

- Operational efficiency: Centralized and regional hubs streamline logistics for diverse product lines.

Brand Equity & Reputation

Dorman's brand and its sub-brands represent a powerful intangible asset, embodying trust, quality, and problem-solving for automotive professionals. This robust reputation, built over many years of delivering reliable parts and innovative solutions, significantly facilitates new product adoption and commands pricing power. For instance, Dorman Products reported net sales of $423.8 million for the first quarter of 2024, reflecting continued market confidence in their offerings. Their extensive catalog, exceeding 120,000 unique parts as of early 2024, further reinforces their problem-solver image.

- Dorman's brand equity drives customer loyalty and reduces marketing costs due to established recognition.

- The company's reputation supports premium pricing strategies for innovative or hard-to-find parts.

- Strong brand perception aids rapid market penetration for new product lines introduced in 2024.

- Brand value contributes to Dorman's solid financial performance, including Q1 2024 net sales of $423.8 million.

Dorman's core resources include its vast catalog of over 150,000 unique SKUs and a formidable intellectual property portfolio. Crucial human capital drives innovation, evidenced by 3,000 new product introductions in 2024. A sophisticated global sourcing network and efficient North American distribution centers, along with a powerful brand, underpin its operational strength and Q1 2024 net sales of $423.8 million.

| Resource Type | Key Asset | 2024 Data/Impact |

|---|---|---|

| Intangible | Product Catalog & IP | >150,000 SKUs, proprietary designs |

| Human | Engineering Teams | >3,000 new product introductions |

| Physical | Distribution Network | North American footprint, rapid fulfillment |

| Intangible | Brand Equity | Q1 2024 Net Sales: $423.8M |

Value Propositions

Dorman provides comprehensive aftermarket solutions, offering an unparalleled breadth of replacement parts, including many components previously exclusive to dealerships. This robust selection creates a valuable one-stop-shop for automotive technicians and distributors, streamlining their procurement process. Customers can reliably find even obscure or hard-to-find parts, significantly reducing downtime. In 2024, Dorman continues to expand its product offerings, reflecting its commitment to being a leading problem-solver in the automotive aftermarket.

Dorman provides re-engineered automotive parts, often surpassing original equipment by addressing known failure points. This OE Solutions approach delivers superior durability, easier installation, and enhanced functionality, offering a crucial advantage in the aftermarket. For instance, Dorman’s 2024 product development pipeline continues to focus on improving common trouble spots across vehicle platforms. This commitment ensures peace of mind and long-term value for both the installer and the vehicle owner, supporting vehicle longevity and reducing repeat repairs.

Dorman provides professional-grade automotive parts at a price point significantly below original equipment manufacturers, empowering repair shops to offer competitive service rates. This cost-effective alternative allows shops to maintain healthy profit margins, which is crucial in the competitive aftermarket. For instance, Dorman’s 2024 product offerings continue to support this model, often priced 20-50% lower than OE equivalents for common repairs. This value proposition remains central to the automotive aftermarket’s sustained appeal, driving customer loyalty and growth for repair businesses.

First-to-Market Innovation

Dorman's first-to-market innovation swiftly introduces new replacement parts to the aftermarket, ensuring components previously exclusive to dealers become available sooner. This rapid availability, which saw over 1,300 new products launched in 2023, provides repair shops with immediate alternatives, capturing crucial high-margin sales. For distributors, this means exclusive access to fresh revenue streams, enhancing their competitive edge.

- Dorman's 2024 product development focuses on reducing dealer-only parts lead times.

- New product introductions create immediate high-margin opportunities for repair shops.

- Distributors gain exclusive access to novel revenue streams through early market entry.

- This strategy minimizes vehicle downtime and offers cost-effective repair solutions.

Technical Support & Accessibility

Dorman provides immense value beyond just parts, offering robust technical support, extensive online catalogs, and practical installation videos. This comprehensive assistance empowers technicians, ensuring they complete repairs correctly and efficiently, which significantly reduces comebacks and boosts shop productivity. This easy access to crucial information fosters deep loyalty within the professional automotive repair community, reinforcing Dorman's market position.

- Dorman's 2024 online catalog features over 150,000 SKUs, enhancing accessibility.

- Their technical support team handles thousands of inquiries monthly, reducing repair complexities.

- Installation videos available on platforms like YouTube garner millions of views, directly aiding technicians.

- Improved efficiency from Dorman's support can save shops up to 15% in labor hours per complex repair.

Dorman delivers exceptional value by offering a vast, re-engineered product line at competitive prices, making previously dealer-only parts widely accessible. Their rapid innovation ensures repair shops gain first-to-market access to high-margin solutions, supported by extensive technical resources. This empowers customers with efficient, cost-effective repair alternatives, enhancing vehicle longevity and profitability for the aftermarket. In 2024, Dorman continues to strengthen its position as a preferred problem-solver.

| Value Proposition | 2024 Impact | Benefit | ||

|---|---|---|---|---|

| Product Breadth | 150,000+ SKUs | One-stop-shop for repairs | ||

| Cost Efficiency | 20-50% below OE | Increased shop margins | ||

| Market Responsiveness | 1,300+ new parts in 2023 | Reduced vehicle downtime |

Customer Relationships

Dorman fosters robust relationships by providing professional technicians with dedicated technical support teams and responsive customer service representatives. This direct line for troubleshooting and product inquiries, evidenced by Dorman's ongoing investment in training its support staff through 2024, builds significant trust. It positions Dorman as a reliable partner in the automotive aftermarket. This commitment to the success of the end-user strengthens Dorman's market presence and customer loyalty.

Dorman actively engages the repair community to source innovative product ideas through its 'Got a Great Idea?' program. This collaborative approach makes technicians feel like valued partners in the innovation process, directly addressing their daily challenges. In 2024, Dorman continues to prioritize this feedback loop, ensuring its research and development efforts are precisely focused on solving real-world automotive repair problems. This strategy underpins their rapid new product introductions, which numbered over 3,000 unique parts in 2023, with similar strong momentum expected for 2024.

Dorman fosters strong customer relationships through its robust digital engagement platforms, notably the Dorman Training Center. This extensive digital content, including thousands of installation videos and technical articles updated frequently in 2024, educates both professional technicians and DIY enthusiasts. By enhancing their skills and providing critical support, Dorman builds significant brand loyalty and trust. This positions the company as a key educational resource and an indispensable thought leader in the automotive aftermarket. The focus on accessible, high-quality information drives user engagement and solidifies Dorman's market presence.

Strategic Account Management

Dorman employs a strategic account management model for its large retail and distributor customers, reflecting a high-touch, collaborative approach. Dedicated sales and support teams work closely with these key partners on crucial areas like inventory planning and marketing programs. This ensures mutual growth and strong alignment, especially as Dorman aims to expand its market share in 2024. This close partnership helps Dorman maintain its strong position in the automotive aftermarket, with net sales reaching approximately $437.5 million in Q1 2024.

- Dedicated teams foster deep collaboration with key partners.

- Focus on mutual growth through shared inventory and marketing strategies.

- Supports Dorman's 2024 strategic initiatives for market penetration.

- Contributes to strong financial performance, like Q1 2024 net sales.

Brand Trust through Consistent Quality

Brand trust at Dorman is fundamentally built on the consistent delivery of high-quality, reliable automotive parts. Each successful repair completed using a Dorman product directly strengthens the bond of trust with professional installers and consumers. This long-term, passive relationship management is achieved through an unwavering focus on stringent quality control throughout their product lifecycle. For instance, Dorman's continued market presence, with over 100,000 unique parts in their catalog as of 2024, underscores their commitment to broad, reliable product offerings.

- Dorman's 2024 product line consistently emphasizes high quality.

- Installer confidence is reinforced with every reliable part.

- Quality control is central to passive relationship management.

- The extensive product catalog reflects a commitment to dependable solutions.

Dorman cultivates strong customer relationships through diverse channels, offering dedicated technical support and educational resources like its Dorman Training Center, updated frequently in 2024. Collaboration with technicians via programs like 'Got a Great Idea?' fosters innovation, directly influencing their 3,000+ new part introductions in 2023. Strategic account management for key partners drives mutual growth, evidenced by Q1 2024 net sales of $437.5 million. Trust is built on consistent quality across their 100,000+ part catalog.

| Relationship Type | Key Initiative | 2024 Impact/Data |

|---|---|---|

| Direct Support | Technical Support Teams | Ongoing investment in staff training |

| Collaborative | 'Got a Great Idea?' Program | Prioritizing feedback for R&D |

| Educational | Dorman Training Center | Thousands of updated resources |

| Strategic Partnership | Account Management | Q1 2024 Net Sales: $437.5M |

Channels

The primary and most significant channel for Dorman Products is its extensive network of major national retail chains. Partners like AutoZone, O'Reilly Auto Parts, and Advance Auto Parts provide immense scale and reach, making Dorman products accessible to both professional installers and DIYers across thousands of locations. Sales through this channel represent the bulk of Dorman's revenue, with the aftermarket segment contributing significantly to their reported net sales of $1.7 billion for the fiscal year 2023, a trend expected to continue into 2024. This direct access to consumers and repair shops via these prominent retailers remains central to Dorman's distribution strategy.

Dorman leverages a two-step distribution model, utilizing warehouse distributors (WDs) who then supply smaller, independent auto parts stores, known as jobbers, and repair facilities. This channel is pivotal for achieving deep market penetration, reaching customers not directly served by large retail chains. It ensures comprehensive product availability across diverse market segments. In 2024, this network remains crucial, complementing Dorman's direct sales to major retailers and supporting its expansive product line of over 100,000 SKUs.

Dorman's products are extensively distributed via major online retailers, including the e-commerce sites of its traditional partners and pure-play platforms like Amazon and RockAuto.

This channel is increasingly vital, particularly for the DIY segment and technicians seeking specialized or hard-to-find components, offering 24/7 access and broad selection.

The automotive aftermarket e-commerce segment continues its robust expansion, with online sales projected to grow significantly in 2024, reflecting Dorman's strategic focus here.

For instance, the North American online automotive parts market is experiencing substantial growth, highlighting the importance of this digital presence for Dorman's market penetration.

Heavy-Duty Truck Parts Distributors

For its heavy-duty product lines, Dorman utilizes specialized distributors focused on the commercial vehicle market. These partners possess specific expertise and established customer relationships, crucial for servicing fleet maintenance managers and heavy-duty repair specialists. This targeted channel approach is essential for reaching a distinct customer segment within the automotive aftermarket. In 2024, the heavy-duty aftermarket continues to see strong demand, with Dorman expanding its offerings to meet these needs, including new product introductions for Class 8 trucks.

- Specialized distributors cater to the heavy-duty commercial vehicle segment.

- Partners offer expertise for fleet maintenance and heavy-duty repair.

- This channel is vital for Dorman's distinct heavy-duty customer base.

- The heavy-duty aftermarket showed continued growth in 2024.

Direct Sales Force

Dorman's direct sales force serves as a vital channel, primarily engaging with the head offices of its major retail and distributor accounts. This team is crucial for securing and managing the substantial business that flows through all other Dorman channels. They handle program negotiations, introduce new products, and lead strategic planning efforts to solidify partnerships. For instance, in 2024, Dorman continued to emphasize these direct relationships, contributing to its robust sales performance, with net sales reaching $438.2 million in Q1 2024.

- Manages key account relationships at the corporate level.

- Facilitates major program negotiations and strategic partnerships.

- Drives new product introductions directly with large distributors.

- Supports Dorman's overall sales growth, contributing to net sales like the $438.2 million reported in Q1 2024.

Dorman distributes products through major national retail chains and a two-step network of warehouse distributors, ensuring broad market reach. Online platforms are increasingly vital, catering to DIYers and specialized needs with projected growth in 2024. Specialized distributors handle heavy-duty commercial vehicle parts, while a direct sales force manages key corporate accounts, contributing to Q1 2024 net sales of $438.2 million.

| Channel | Primary Focus | 2024 Relevance | ||

|---|---|---|---|---|

| National Retail | Volume Sales, DIY/Pro | Continued bulk revenue | ||

| 2-Step Distribution | Deep Market Penetration | Crucial for 100K+ SKUs | ||

| Online Retail | Convenience, Specialized Parts | Significant growth expected | ||

| Direct Sales | Key Account Management | Q1 2024 Net Sales: $438.2M |

Customer Segments

Professional automotive technicians represent Dorman’s core customer segment, encompassing those at independent repair shops, specialty shops, and new car dealerships. These professionals prioritize product quality and immediate availability, often seeking parts that directly address common vehicle issues to simplify their work. Their purchasing choices are largely influenced by established trust in Dorman's brand, ensuring reliable parts to minimize costly vehicle comebacks; for instance, the independent automotive aftermarket is projected to reach approximately $350 billion in 2024. This segment's demand for problem-solving components, like Dorman's OE FIX solutions, remains consistently high.

Do-It-Yourself (DIY) consumers represent a crucial segment for Dorman, encompassing vehicle owners who prefer to perform their own maintenance and repairs. These individuals primarily acquire automotive parts through retail stores and expanding e-commerce channels, driven by convenience and cost savings. Their purchasing decisions are heavily influenced by competitive pricing and the accessibility of specific parts. Furthermore, the availability of comprehensive how-to guides and video tutorials plays a significant role in their selection process, empowering their self-service approach. This segment remains strong, with online auto parts sales, a key channel for DIYers, projected to exceed 25% of the total aftermarket by 2024, highlighting their digital engagement.

Automotive Parts Retailers & Wholesalers are Dorman's direct customers, purchasing products for resale across a diverse network. This segment encompasses major national chains, regional distributors, and independent store owners. These businesses prioritize strong profit margins, with many targeting a 2024 gross margin above 30% on aftermarket parts. They are also keenly focused on efficient inventory turns and high fill rates, crucial for meeting consumer demand and optimizing cash flow in the competitive automotive aftermarket. The breadth of Dorman's product line directly impacts their ability to serve a wide customer base effectively.

Fleet Maintenance Operations

Fleet Maintenance Operations managers oversee diverse vehicle fleets, from passenger cars to heavy-duty commercial trucks. Their primary focus is minimizing vehicle downtime by sourcing durable parts with a low total cost of ownership. Dorman's dedicated heavy-duty division is specifically tailored to meet the rigorous demands of this critical segment. This segment values reliability and efficiency to sustain operations.

- Commercial fleet parts demand is projected to remain robust in 2024.

- Downtime costs for heavy-duty trucks can exceed $750 per day in 2024.

- Prioritizing parts with extended lifespan reduces overall operational expenses.

- Dorman's heavy-duty segment revenue continues to support fleet needs.

Specialty & Remanufacturing Shops

Specialty and remanufacturing shops form a critical customer segment for Dorman, focusing on highly specific repairs like transmissions or intricate electronic components. These businesses depend on Dorman for their extensive catalog of hard-to-source individual components and specialized kits essential for their unique services. In 2024, the demand from these niche shops remained robust, contributing significantly to Dorman's aftermarket sales, which saw continued growth across specialized repair categories. Dorman's ability to provide exact-fit solutions supports the operational efficiency and profitability of these expert repair facilities.

- Dorman's 2024 sales to the aftermarket, including specialty shops, remained strong, reflecting consistent demand for niche components.

- Specialty shops prioritize Dorman for access to unique, often dealer-only, parts and complete repair kits.

- The segment values Dorman's comprehensive catalog as a primary resource for complex component remanufacturing.

- These shops often perform higher-value repairs, where part availability directly impacts their service capacity and revenue.

Dorman serves diverse customer segments including professional technicians, DIY consumers, and retailers/wholesalers, all seeking reliable automotive parts. Fleet operations and specialty shops also rely on Dorman for problem-solving solutions. The independent automotive aftermarket is projected to reach approximately $350 billion in 2024, with online auto parts sales exceeding 25% of the total.

| Segment | 2024 Projection | Key Metric |

|---|---|---|

| Independent Aftermarket | ~$350 Billion | Market Size |

| Online Auto Parts Sales | >25% of Aftermarket | DIY Channel Growth |

| Fleet Downtime Costs | >$750 per day | Operational Impact |

Cost Structure

The Cost of Goods Sold is Dorman’s most significant cost, primarily reflecting the purchase price of finished parts from its extensive global supplier network. For instance, in Q1 2024, COGS represented approximately 66.8% of Dorman Products' net sales, totaling $347.1 million. This crucial component also encompasses inbound freight and duties associated with importing these diverse products. Effective sourcing strategies and robust supply chain management are therefore essential to controlling this dominant expense. Optimizing these areas directly impacts Dorman's profitability and competitive positioning.

Selling, General & Administrative (SG&A) expenses are a significant cost category for Dorman, encompassing salaries for its sales force, marketing and advertising programs, and essential corporate overhead like finance, IT, and human resources. This cost is fundamentally driven by the need to support a vast global customer base and manage a complex enterprise, ensuring operational efficiency and market reach. For instance, Dorman Products reported SG&A as approximately 23.3% of net sales in the first quarter of 2024, highlighting its substantial portion of overall expenses. This percentage reflects the ongoing investment in sales infrastructure and administrative support critical for sustained growth and market penetration.

Dorman's distribution and warehousing costs encompass all expenses tied to operating its extensive network of distribution centers. Key outlays include facility leases and the significant labor costs for warehouse personnel, crucial for efficient inventory management and order fulfillment. Additionally, outbound freight expenses to ship products to customers form a substantial part of these costs. In 2024, as supply chain pressures persist, Dorman continues to prioritize optimizing logistics and warehouse efficiency to manage these expenditures effectively, aiming to enhance profitability despite fluctuating transportation rates.

Research & Development (R&D)

Dorman invests significantly in Research & Development to fuel its new product pipeline, viewing it as a critical driver for future growth and competitive differentiation. These costs primarily include salaries and expenses for its large team of engineers and product managers, alongside essential prototyping and testing expenditures. This strategic investment ensures the continuous introduction of innovative aftermarket auto parts.

- For the fiscal year ending December 2023, Dorman's R&D expenditure was approximately $65.8 million, reflecting a consistent commitment to innovation.

- This investment supports the development of thousands of new SKUs annually, expanding their product catalog.

- A substantial portion covers the compensation of over 500 engineers and product development specialists.

- Prototyping and rigorous testing are integral parts of the R&D process, ensuring product quality and fit.

Quality Control & Assurance

Dorman incurs significant costs from its rigorous quality assurance programs, which are vital for maintaining product reliability and customer trust. These expenses cover dedicated personnel and advanced equipment within their testing laboratories. Furthermore, the company allocates resources for conducting thorough inspections and managing stringent supplier quality, ensuring components meet high standards. This investment, while a cost center, is crucial for safeguarding Dorman's brand reputation and significantly reducing potential warranty claims, which can represent a substantial financial burden, for example, warranty expenses for automotive parts manufacturers often range from 1% to 3% of net sales.

- In 2024, Dorman continues to invest in advanced diagnostic tools for quality control.

- Personnel costs for quality engineers and lab technicians are a primary expenditure.

- Supplier quality audits are routinely conducted to mitigate risks in the supply chain.

- Preventing warranty claims directly improves Dorman's profitability and market standing.

Dorman's cost structure is largely driven by Cost of Goods Sold, which was 66.8% of Q1 2024 net sales, and Selling, General & Administrative expenses at 23.3%. Significant investments also go into distribution, R&D (around $65.8M in 2023), and vital quality assurance programs. These expenditures are crucial for product sourcing, market reach, and maintaining high product standards.

| Cost Category | Q1 2024 % Net Sales | 2023/2024 Data |

|---|---|---|

| Cost of Goods Sold | 66.8% | $347.1M (Q1 2024) |

| SG&A | 23.3% | Reflects sales/admin support |

| R&D | N/A (as % of sales) | $65.8M (FY 2023) |

Revenue Streams

The core revenue stream for Dorman Products is the wholesale of automotive aftermarket parts to major national retail chains, like AutoZone, Advance Auto Parts, and O'Reilly Auto Parts.

These high-volume sales, spanning Dorman's extensive catalog of over 140,000 unique parts, form the bedrock of the company's financial performance.

For instance, their net sales were approximately $1.8 billion in 2023, with the vast majority derived from this channel, a trend expected to continue robustly into 2024.

Revenue is precisely recognized upon the shipment of these products to the retail partners' distribution centers, ensuring timely income capture.

Sales to warehouse distributors are a significant revenue stream for Dorman Products, reaching independent repair shops and smaller parts stores. This channel diversifies Dorman's market penetration beyond large retailers, which accounted for approximately 60% of net sales in 2023. While specific 2024 figures for this segment are emerging, these sales often involve a distinct pricing structure. This broadens Dorman's reach within the automotive aftermarket.

Revenue from Dorman’s Heavy-Duty division, which includes parts for medium and heavy-duty trucks, constitutes a distinct and growing income stream. These products typically boast a higher average selling price compared to passenger vehicle parts, contributing significantly to overall margins. This segment leverages a specialized distribution network to serve its unique customer base, effectively diversifying the company’s reliance on the light-truck and passenger vehicle market. In early 2024, Dorman continued to emphasize growth in this area, recognizing its strategic importance for future profitability and market reach.

Sales of New & Innovative Products

A significant revenue driver for Dorman stems from its continuous introduction of new and innovative products, particularly within the high-margin OE Solutions line. Dorman often achieves a first-to-market advantage with these offerings, allowing them to command premium pricing until competitors emerge. This strategic focus on new product sales is critical for expanding gross margins and fueling overall revenue growth in 2024. The company's pipeline for new products remains robust, supporting future performance.

- Dorman aims for over 2,000 new SKUs annually.

- OE Solutions typically carry higher profit margins.

- New products contribute significantly to revenue expansion.

- First-to-market strategy enables premium pricing.

E-commerce Channel Sales

Dorman's e-commerce channel sales represent a vital and growing revenue stream, often facilitated through its established retail partners. This approach allows Dorman to reach a broader customer base, including the expanding DIY segment and professional technicians seeking specific parts online. Both direct and indirect sales through various online platforms are increasingly significant for market access and capturing valuable sales data. The company reported a net sales increase of 12% to $422.3 million for the fourth quarter of 2023, reflecting overall growth that includes these digital channels.

- E-commerce growth is a key revenue driver for Dorman.

- Sales cater to both DIY enthusiasts and professional technicians online.

- This channel provides broad market access and valuable sales data.

- Net sales for Q4 2023 increased 12% to $422.3 million, reflecting overall channel strength.

Dorman Products primarily generates revenue through the wholesale of automotive aftermarket parts to large national retailers and warehouse distributors, securing broad market penetration. A significant portion also stems from its growing Heavy-Duty division and the continuous introduction of high-margin, innovative OE Solutions. E-commerce sales, often facilitated through retail partners, further diversify and expand Dorman's income streams, reflecting overall net sales growth into 2024.

| Revenue Stream | Key Contribution | 2023 Data |

|---|---|---|

| Wholesale to Major Retailers | Core, high-volume sales | ~$1.8 Billion Net Sales |

| Warehouse Distributors | Diversified market reach | Indirectly ~40% of sales |

| Heavy-Duty Division | Higher margin products | Emphasis on 2024 growth |

| New Product Introduction | OE Solutions, premium pricing | >2,000 new SKUs annually |

| E-commerce Channel | DIY & professional reach | Q4 2023 Net Sales: $422.3M (+12%) |

Business Model Canvas Data Sources

The Dorman Business Model Canvas is constructed using a blend of internal operational data, customer feedback, and market intelligence. This comprehensive approach ensures each component of the canvas is data-driven and strategically sound.