DoorDash Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DoorDash Bundle

Unlock the strategic blueprint behind DoorDash's success with our comprehensive Business Model Canvas. Discover how they connect restaurants, consumers, and couriers to create a thriving ecosystem, driving value and capturing market share in the competitive food delivery landscape. Ideal for aspiring entrepreneurs and industry analysts seeking actionable insights.

Partnerships

DoorDash's foundation is built upon a vast network of restaurant partners, encompassing everything from neighborhood diners to major national brands. These crucial relationships ensure a diverse selection of food options, a key driver for customer acquisition and retention.

Beyond traditional restaurants, DoorDash has strategically broadened its merchant base to include grocery stores, convenience stores, and a growing array of other retail businesses. This diversification not only expands the platform's utility but also taps into new revenue streams and customer needs.

As of early 2024, DoorDash continues its aggressive expansion, actively onboarding new merchants to further diversify its marketplace. The company's commitment to growth means constantly seeking to broaden its offerings beyond just prepared meals, reflecting a dynamic approach to merchant partnerships.

The Dasher Network is the backbone of DoorDash's delivery capabilities, comprising millions of independent contractors. These Dashers are essential for executing the last-mile delivery, directly impacting customer satisfaction and operational efficiency. DoorDash actively works to retain and motivate this crucial workforce by offering flexible work schedules and various incentive programs.

In 2024, DoorDash continued to emphasize its commitment to its Dasher community, recognizing their pivotal role. The company invests in resources aimed at enhancing the Dasher experience, including improved app functionality and access to support services. These efforts are designed to ensure a consistent and high-quality delivery service for consumers and restaurant partners alike.

DoorDash partners with key technology providers to enhance its platform, integrating services like Stripe for payments and Google Maps for navigation. These collaborations are crucial for efficient operations and customer experience, with AI and machine learning solutions also playing a growing role in areas like demand forecasting and delivery route optimization.

The strategic acquisition of SevenRooms in 2023 for $120 million highlights DoorDash's commitment to deepening its integration within the hospitality sector. This move allows DoorDash to offer more comprehensive technology solutions to restaurants, thereby strengthening its position in the local commerce ecosystem and potentially driving new revenue streams.

Strategic Retail and Grocery Partners

DoorDash's strategic retail and grocery partnerships are crucial for its growth beyond restaurant delivery. By onboarding chains like Wegmans, Dollar General, and The Home Depot, DoorDash significantly diversifies its service offerings. This expansion taps into new customer needs and increases order volume, solidifying its position as a comprehensive delivery platform. For instance, in 2024, DoorDash continued to expand its grocery footprint, aiming to capture a larger share of the rapidly growing online grocery market, which saw substantial year-over-year growth.

These collaborations are key to DoorDash's diversification strategy, enabling it to reach a broader customer base and increase overall marketplace utilization. The inclusion of non-food retailers like Camping World and The Vitamin Shoppe further broadens the appeal and utility of the DoorDash platform. This strategic move allows DoorDash to leverage its logistics network for a wider array of goods, driving revenue and customer loyalty.

- Expanded Product Categories: DoorDash now offers groceries, convenience items, retail goods, and more, moving beyond its initial restaurant focus.

- Increased Order Frequency: Partnerships with diverse retailers encourage more frequent use of the platform by customers seeking a variety of products.

- New Customer Acquisition: Collaborations with popular retail brands attract customers who may not have previously used DoorDash for food delivery.

- Logistics Optimization: By integrating more types of deliveries, DoorDash can potentially optimize its delivery routes and driver utilization across a wider range of services.

Marketing and Loyalty Program Partners

DoorDash actively cultivates key partnerships to bolster its marketing efforts and enrich its DashPass loyalty program. These collaborations are designed to drive customer acquisition, foster loyalty, and increase overall engagement within the DoorDash platform.

- Ibotta Collaboration: DoorDash has partnered with Ibotta, a leading cash-back rewards platform. This alliance enables personalized promotions and offers to be delivered to users, encouraging repeat business and expanding DoorDash's reach within Ibotta's substantial user base.

- Lyft Ride Discounts: In another strategic move, DoorDash has teamed up with Lyft to offer exclusive ride discounts to DashPass members. This partnership provides added value to subscribers and taps into Lyft's extensive network to attract new customers to DoorDash.

- Strategic Value: These partnerships are crucial for DoorDash's growth strategy, allowing it to leverage the customer bases and marketing channels of complementary businesses. For instance, in 2023, DoorDash reported a significant increase in new customer sign-ups attributed to such co-marketing initiatives, although specific figures tied to individual partnerships are often proprietary.

DoorDash's key partnerships extend beyond restaurants to include a wide array of retailers, enhancing its marketplace and logistics capabilities. Collaborations with grocery chains like Kroger and Albertsons, and convenience stores such as 7-Eleven, significantly broaden its service offerings and customer reach. These alliances are vital for DoorDash's strategy to become a comprehensive local commerce platform, not just a food delivery service. By integrating diverse retail partners, DoorDash aims to increase order frequency and capture a larger share of the growing online delivery market.

The company also leverages partnerships with technology providers to optimize its operations and customer experience. Integrations with payment processors and mapping services are essential for seamless transactions and efficient deliveries. Furthermore, strategic marketing collaborations and loyalty program integrations, like the one with Ibotta, are crucial for customer acquisition and retention, driving engagement and repeat business.

| Partnership Type | Key Partners | Strategic Impact |

| Restaurant Networks | National chains, local eateries | Diverse food selection, customer acquisition |

| Retail & Grocery | Kroger, Albertsons, Dollar General, The Home Depot | Marketplace diversification, increased order volume |

| Technology Providers | Stripe, Google Maps | Operational efficiency, enhanced customer experience |

| Marketing & Loyalty | Ibotta, Lyft | Customer acquisition, increased engagement |

What is included in the product

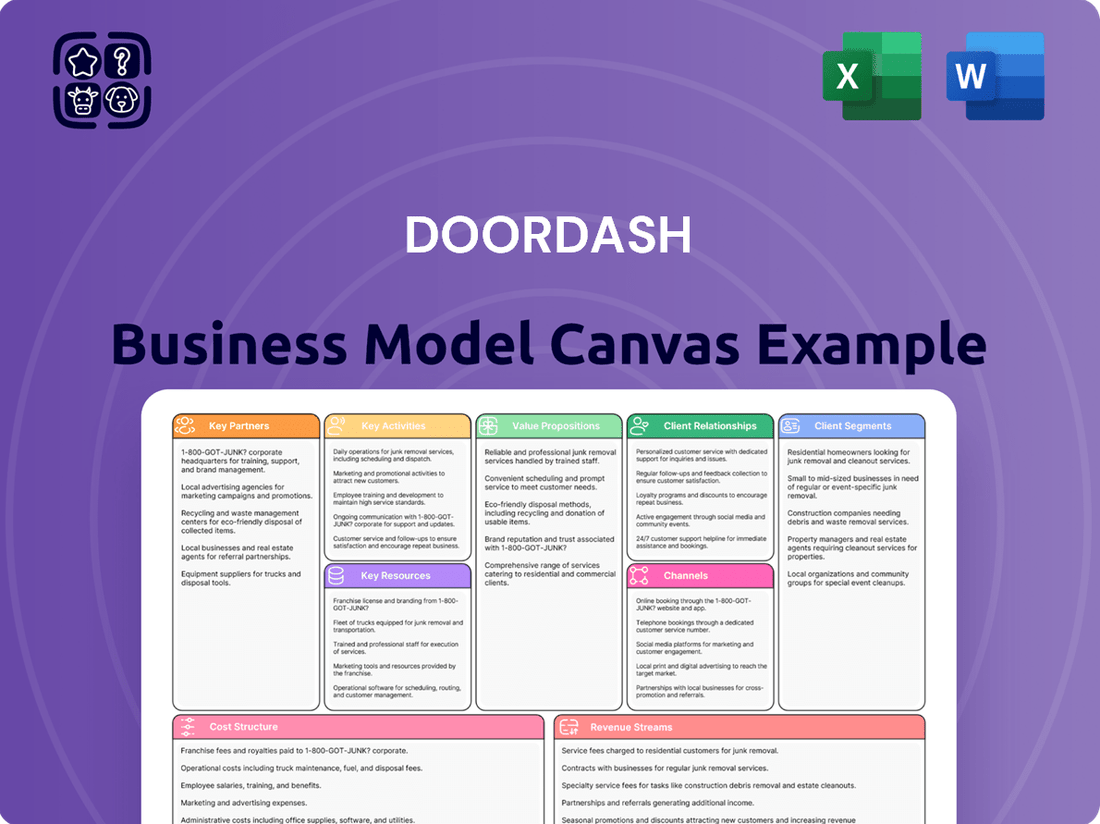

This DoorDash Business Model Canvas provides a detailed overview of its operations, covering key customer segments like diners and merchants, its multi-sided platform value proposition, and the channels through which it connects them. It outlines revenue streams from commissions and delivery fees, essential resources like its app and driver network, and key activities such as logistics and marketing.

DoorDash's Business Model Canvas acts as a pain point reliever by clearly mapping out how it addresses the frustrations of both hungry customers seeking convenient food delivery and restaurants struggling with customer reach.

It provides a structured, one-page snapshot that highlights DoorDash's solutions for these key pain points, making its value proposition easily understandable.

Activities

DoorDash's platform development and maintenance are central to its operations, focusing on enhancing the user experience across its consumer, merchant, and Dasher apps. This includes ongoing updates to improve interface navigation and functionality. For instance, in 2024, DoorDash continued to invest heavily in AI-driven features to optimize delivery logistics and personalize recommendations for users.

Key activities involve refining algorithms for efficient delivery routing and accurate demand forecasting, crucial for minimizing wait times and maximizing driver earnings. The company also prioritizes platform stability and security, ensuring a reliable service for millions of users. In the first quarter of 2024, DoorDash reported a 21% year-over-year increase in total orders, highlighting the platform's scalability and the importance of its continuous development.

DoorDash's core activity involves actively acquiring and managing a diverse range of merchants, from traditional restaurants to grocery stores and convenience retailers. This process includes onboarding new partners, meticulously maintaining their digital presence with accurate menus and delivery options, and offering them tools and support to foster their growth on the platform.

As of the first quarter of 2024, DoorDash reported having approximately 340,000 active merchants on its platform, a significant increase that underscores its aggressive expansion in merchant acquisition. This growth is crucial for providing a wide selection to consumers and ensuring a robust marketplace.

DoorDash's success hinges on a robust system for recruiting and managing its vast network of independent contractors, known as Dashers. This isn't a one-time task; it's a continuous cycle of attracting new drivers, getting them up to speed, and keeping them engaged and productive.

To ensure enough drivers are available to meet customer orders, DoorDash actively recruits and onboard drivers. For instance, in early 2024, DoorDash continued to emphasize its flexible earning opportunities, a key draw for its driver base. The company also focuses on retaining drivers through various incentive programs and support systems, aiming to maintain a healthy supply-demand balance for deliveries.

Order Fulfillment and Logistics Optimization

DoorDash’s order fulfillment and logistics optimization is central to its operations, ensuring timely and efficient delivery of food and other goods. This involves sophisticated technology for real-time order tracking, intelligent dispatching of Dashers, and dynamic route planning to reduce delivery times and costs. In 2023, DoorDash reported facilitating over 2 billion orders, highlighting the sheer scale of its logistics network.

- Order Processing: Seamlessly handles order intake from various restaurant partners and customers.

- Dasher Dispatch: Utilizes algorithms to match orders with available Dashers based on proximity and efficiency.

- Route Optimization: Employs advanced mapping and traffic data to create the most efficient delivery routes, aiming to minimize travel time and fuel consumption.

- Logistics Network Management: Continuously refines its network of Dashers and restaurant partners to enhance service speed and reliability.

Customer Support and Relationship Management

DoorDash's customer support is a cornerstone of its operations, ensuring a smooth experience for consumers, merchants, and Dashers alike. This involves swift resolution of issues, from order discrepancies to app functionality problems, directly impacting user satisfaction and retention.

Relationship management is equally vital, fostering loyalty and engagement. DoorDash utilizes programs like DashPass, which offers benefits such as $0 delivery fees on eligible orders, to incentivize repeat business. Personalized communication further strengthens these bonds, making users feel valued.

In 2024, DoorDash continued to invest in its support infrastructure. The company reported that its average customer support response time for critical issues was under 2 minutes across its primary channels, a testament to its focus on efficiency. Furthermore, DashPass membership grew by 15% year-over-year, indicating the program's effectiveness in customer retention.

- Responsive Support: Providing timely assistance to consumers, merchants, and Dashers to resolve issues and enhance overall experience.

- Loyalty Programs: Implementing initiatives like DashPass to encourage repeat business and build customer loyalty.

- Personalized Engagement: Utilizing data to offer tailored communications and promotions, strengthening customer relationships.

- Issue Resolution: Focusing on efficient problem-solving to maintain high satisfaction rates across all user groups.

DoorDash's key activities revolve around platform development, merchant acquisition, Dasher management, order fulfillment, and customer support. These functions are interconnected, ensuring a seamless experience from order placement to delivery. The company's focus on technology, logistics, and user satisfaction drives its operational efficiency and market growth.

In 2024, DoorDash continued to enhance its AI capabilities for logistics and personalization. The company reported over 2 billion orders facilitated in 2023, showcasing the scale of its operations. By the first quarter of 2024, DoorDash had approximately 340,000 active merchants, demonstrating its aggressive expansion strategy.

| Key Activity | Description | 2023/2024 Data Point |

| Platform Development | Enhancing user experience and optimizing logistics through AI. | Continued investment in AI features in 2024. |

| Merchant Acquisition | Onboarding and supporting a diverse range of partners. | ~340,000 active merchants in Q1 2024. |

| Dasher Management | Recruiting, onboarding, and retaining independent contractors. | Emphasis on flexible earning opportunities in early 2024. |

| Order Fulfillment | Efficiently processing and delivering orders. | Over 2 billion orders facilitated in 2023. |

| Customer Support & Relationship Management | Resolving issues and fostering loyalty through programs like DashPass. | DashPass membership grew 15% YoY; < 2 min response time for critical issues in 2024. |

What You See Is What You Get

Business Model Canvas

The DoorDash Business Model Canvas you're previewing is the actual document you will receive upon purchase. This isn't a generic template or a sample; it's a direct representation of the comprehensive analysis you'll gain access to. Upon completing your order, you will download this exact file, allowing you to fully explore DoorDash's strategic framework.

Resources

DoorDash's proprietary technology platform, featuring intuitive mobile apps and a robust website, is the backbone of its operations. This sophisticated system, powered by advanced algorithms, efficiently manages logistics, predicts demand, and optimizes delivery routes. In 2024, DoorDash continued to refine these algorithms, aiming to reduce delivery times and improve the experience for all users.

DoorDash's network of merchants, encompassing restaurants, grocery stores, and convenience stores, is a critical asset. This vast array of partnered businesses directly fuels customer acquisition and retention by offering unparalleled choice and convenience. As of the first quarter of 2024, DoorDash reported over 300,000 active merchants on its platform across North America and internationally.

The vast and adaptable network of independent delivery drivers, known as Dashers, is a cornerstone of DoorDash's operations. Their sheer number and readiness to accept deliveries are critical for meeting customer demand efficiently.

In the first quarter of 2024, DoorDash reported that its platform facilitated over 600 million orders. This massive volume underscores the essential role of a robust Dasher workforce in processing and delivering these orders promptly.

The flexibility of the Dasher model allows DoorDash to scale its delivery capacity up or down based on real-time order volume, a key advantage in managing operational costs and ensuring service availability during peak hours.

Brand Recognition and User Base

DoorDash's powerful brand recognition is a cornerstone of its business, making it a go-to platform for food delivery. This strong brand, built through consistent marketing and reliable service, attracts both new customers and keeps existing ones engaged.

The company boasts an impressive user base, a critical asset for its operations. In 2024, DoorDash reported over 42 million monthly active users, demonstrating its vast reach and customer engagement. This large pool of users is essential for driving order volume for restaurants on the platform.

Furthermore, the loyalty program membership significantly bolsters DoorDash's key resources. With 22 million DashPass and Wolt+ members in 2024, these subscribers represent a dedicated segment of the user base. This membership drives repeat business and creates powerful network effects, benefiting both consumers and merchants.

- Brand Recognition: DoorDash is a widely recognized and trusted name in the food delivery industry.

- Large User Base: Over 42 million monthly active users in 2024 highlight significant customer reach.

- Loyalty Program Strength: 22 million DashPass/Wolt+ members in 2024 indicate strong customer retention and loyalty.

- Network Effects: The substantial user and merchant base fosters positive network effects, enhancing platform value.

Data and Analytics

DoorDash's data and analytics are a cornerstone of its operations, transforming raw information into actionable intelligence. The company meticulously gathers data on everything from what consumers order and when they order it, to how efficiently deliveries are made and how merchants are performing. This comprehensive data collection fuels continuous platform enhancements and drives personalized customer experiences.

In 2024, DoorDash's commitment to leveraging data is evident in its ongoing efforts to optimize delivery routes and expand its service offerings. For instance, the company's sophisticated algorithms analyze real-time traffic, order volume, and driver availability to ensure timely deliveries. This analytical prowess is crucial for maintaining customer satisfaction and operational efficiency in a competitive market.

- Consumer Insights: DoorDash collects data on millions of orders, revealing trends in food preferences, popular times for ordering, and geographic demand patterns.

- Merchant Performance: The platform tracks merchant sales, order accuracy, and customer reviews, providing valuable feedback for businesses on the platform.

- Delivery Logistics: Real-time data on driver locations, traffic conditions, and delivery times allows for dynamic optimization of the delivery network.

- Platform Improvement: Insights derived from this data are used to refine the user interface, improve search functionality, and develop new features that enhance the overall DoorDash experience.

DoorDash's key resources are multifaceted, encompassing its proprietary technology, extensive merchant network, vast driver fleet, strong brand, and significant user base. These elements collectively enable the company to facilitate millions of deliveries efficiently and effectively.

The company’s technological infrastructure, including its mobile apps and website, is crucial for managing logistics and optimizing delivery routes. DoorDash’s network of over 300,000 active merchants as of Q1 2024 provides customers with a wide selection of options, driving platform usage.

The independent contractor model for Dashers allows for flexible scaling of delivery capacity to meet fluctuating demand, a critical operational advantage. In Q1 2024, DoorDash processed over 600 million orders, highlighting the essential role of this adaptable workforce.

DoorDash's brand recognition and a substantial user base, with over 42 million monthly active users in 2024, are vital for customer acquisition and retention. The loyalty program, boasting 22 million DashPass and Wolt+ members in 2024, further strengthens customer engagement and drives repeat business.

| Key Resource | Description | 2024 Data/Significance |

|---|---|---|

| Proprietary Technology | Platform for logistics, demand prediction, route optimization. | Continuous refinement of algorithms for faster deliveries. |

| Merchant Network | Restaurants, grocery, convenience stores. | Over 300,000 active merchants (Q1 2024). |

| Dasher Network | Independent delivery drivers. | Facilitated over 600 million orders (Q1 2024). |

| Brand Recognition | Trusted name in food delivery. | Drives customer acquisition and retention. |

| User Base | Customers utilizing the platform. | Over 42 million monthly active users (2024). |

| Loyalty Program | DashPass and Wolt+ members. | 22 million members (2024), indicating strong loyalty. |

Value Propositions

DoorDash provides consumers with incredible convenience, letting them order meals, groceries, and even everyday items from a vast network of local merchants. This service saves valuable time and effort, offering a diverse product selection right at their fingertips, all without needing to leave their homes.

In 2024, DoorDash continued to solidify its position by expanding its grocery delivery services, partnering with major retailers. This move directly addresses the growing consumer demand for one-stop shopping convenience, blending restaurant dining with essential household needs.

DoorDash offers merchants an expansive online marketplace, connecting them with a broader customer base than their brick-and-mortar presence alone allows. This digital storefront is crucial for growth, especially in 2024, as consumers increasingly rely on delivery services for convenience.

This partnership directly translates to increased sales for restaurants and other businesses. By leveraging DoorDash's platform, merchants can efficiently manage delivery logistics, freeing them to focus on their core operations and product quality.

Beyond just sales, DoorDash provides merchants with valuable data analytics. These insights into customer ordering habits and preferences empower businesses to refine their offerings and marketing strategies, fostering better customer relationships and driving repeat business.

DoorDash offers its Dashers unparalleled flexibility, allowing them to choose their own hours and work locations. This autonomy is a key draw, enabling individuals to supplement existing income or pursue work that fits their lifestyle. In 2024, DoorDash continued to be a significant platform for gig economy workers seeking this kind of adaptable earning potential.

Efficient and Reliable Delivery Service

DoorDash's commitment to efficient and reliable delivery is central to its value proposition. They achieve this through sophisticated logistics technology and a vast network of independent contractors, known as Dashers. This infrastructure is designed to get food and other goods to customers quickly and dependably.

In 2024, DoorDash continued to refine its delivery algorithms, aiming for faster pickup and drop-off times. The company reported significant improvements in on-time delivery rates across key markets. This operational efficiency directly translates to a better experience for both customers and merchants.

- On-Time Delivery: DoorDash prioritizes minimizing wait times for customers.

- Logistics Optimization: Advanced technology helps manage driver routes and order batching.

- Dasher Network: A large, flexible workforce ensures capacity to meet demand.

- Reliability: Consistent service builds trust with consumers and restaurant partners.

DashPass Benefits and Savings

DashPass offers substantial savings for DoorDash users who order frequently. Subscribers receive free delivery on eligible orders, a significant perk that directly reduces the cost of each meal. In 2024, DoorDash reported that DashPass members saved an average of $20 per month on delivery fees, demonstrating a clear financial benefit.

Beyond free delivery, DashPass also provides reduced service fees on qualifying orders. This dual benefit makes dining through DoorDash more affordable and predictable. The program is designed to foster loyalty by making it financially advantageous for customers to consistently choose DoorDash for their food delivery needs, thereby increasing order frequency.

- Free Delivery: Eliminates delivery fees on eligible orders.

- Reduced Service Fees: Lowers additional charges on qualifying purchases.

- Increased Affordability: Makes frequent ordering more cost-effective.

- Customer Loyalty: Encourages repeat business through tangible savings.

DoorDash's value proposition centers on unparalleled convenience for consumers, offering a vast selection of goods delivered directly to their doors. For merchants, it provides an expanded digital storefront and access to a wider customer base, significantly boosting sales opportunities. The platform also offers Dashers flexible earning potential, a critical factor in the gig economy. In 2024, DoorDash continued to enhance its logistics, reporting improved on-time delivery metrics, which directly benefits all user groups.

| Value Proposition | Target Segment | Key Benefit | 2024 Data Point |

|---|---|---|---|

| Convenience & Variety | Consumers | Access to wide range of restaurants, groceries, and retail items delivered | Expansion into new categories like alcohol and pet supplies |

| Increased Sales & Reach | Merchants | Expanded customer base and additional revenue streams | Reported significant growth in merchant partnerships |

| Flexible Earning Opportunities | Dashers | Autonomy in setting work hours and locations | Continued to be a major platform for gig economy workers |

| Cost Savings & Loyalty | DashPass Subscribers | Reduced delivery and service fees on eligible orders | DashPass members saved an average of $20 per month on fees |

Customer Relationships

DoorDash primarily engages customers through its self-service app and website, offering a streamlined experience for browsing menus, placing orders, and tracking deliveries in real-time. This digital interface empowers users to manage their entire interaction independently, from account setup to payment processing.

In 2023, DoorDash reported that its platform facilitated over 2 billion orders, highlighting the significant reliance customers place on these self-service channels for convenience and accessibility. The company continuously invests in app and website enhancements to improve user experience and drive engagement.

DoorDash leverages automated notifications and tracking to keep customers informed, offering real-time updates on order status and Dasher location. This transparency is crucial for building trust and giving customers a sense of control, especially as delivery volumes surged. In 2023, DoorDash reported over 2.3 billion total orders, highlighting the scale at which these systems operate and the importance of clear communication for customer satisfaction.

DoorDash provides a multi-channel approach to customer support, including in-app chat, email, and phone options. This ensures that consumers, merchants, and Dashers can get help with inquiries or issues. In 2023, DoorDash reported handling millions of customer support interactions, demonstrating the scale of their service operations.

DashPass Subscription Program

The DashPass subscription program is DoorDash's primary engine for cultivating strong customer loyalty. By providing perks like free delivery and reduced service fees, it directly incentivizes frequent usage, turning casual users into dedicated patrons. This subscription model is key to building a predictable revenue stream and fostering a community of engaged customers who rely on DoorDash for their everyday needs.

DashPass significantly boosts customer retention and lifetime value. For instance, in the first quarter of 2024, DoorDash reported that DashPass members were considerably more active than non-members, driving a substantial portion of their order volume. This program is not just about discounts; it's about creating a value proposition that makes DoorDash the preferred choice for food delivery.

- Loyalty Driver: DashPass offers tangible benefits like free delivery and reduced fees, encouraging repeat purchases and strengthening the bond with frequent users.

- Increased Engagement: Subscribers tend to order more often, contributing to higher order frequency and overall platform utilization.

- Predictable Revenue: The subscription fees provide a stable and recurring revenue stream, enhancing financial predictability for DoorDash.

- Competitive Advantage: A robust subscription program helps differentiate DoorDash in a competitive market, attracting and retaining customers.

Personalized Marketing and Promotions

DoorDash leverages its vast customer data, combined with AI, to deliver highly personalized marketing and promotions. This means customers receive recommendations and offers tailored to their past orders and preferences, making their experience feel more individual. For example, in 2024, DoorDash continued to refine its AI algorithms to predict customer behavior, leading to more effective targeted campaigns.

This personalized approach directly strengthens customer relationships by making them feel understood and valued. By offering relevant discounts and promotions, DoorDash encourages repeat business and fosters loyalty. This data-driven strategy is crucial for maintaining engagement in a competitive market.

- Data-Driven Personalization: DoorDash uses AI to analyze customer order history and preferences for targeted promotions.

- Enhanced Customer Experience: Personalized recommendations and discounts make the platform more appealing and convenient.

- Increased Engagement: Tailored offers encourage repeat orders and continued use of the DoorDash service.

- Strengthened Loyalty: By demonstrating an understanding of individual needs, DoorDash builds stronger, more lasting customer relationships.

DoorDash's customer relationships are primarily managed through its user-friendly self-service app and website, which facilitate seamless ordering and real-time tracking. The company reinforces these relationships with personalized marketing, leveraging AI to offer tailored promotions and recommendations based on customer data. This approach aims to enhance user experience and foster loyalty.

The DashPass subscription program is a cornerstone of DoorDash's customer relationship strategy, offering benefits like free delivery and reduced fees to incentivize repeat business and build loyalty. In 2023, DoorDash reported over 2.3 billion total orders, underscoring the scale of customer interaction and the importance of these loyalty-building initiatives.

DoorDash also maintains customer relationships through a multi-channel support system, including in-app chat, email, and phone options, ensuring prompt resolution of issues. This commitment to accessible support is vital for customer retention, especially given the platform's extensive order volume.

DoorDash's AI-driven personalization efforts, which were further refined in 2024, aim to make customers feel understood and valued. By offering relevant discounts and promotions, the company encourages repeat purchases and strengthens its bond with users, creating a more engaging and individualized experience.

Channels

The DoorDash mobile application serves as the primary gateway for customers to engage with the platform. Through the app, users can effortlessly explore a vast network of restaurants and merchants, place orders for food and other goods, and monitor their deliveries in real-time, ensuring a seamless and convenient experience.

Designed with user-friendliness at its core, the app boasts an intuitive interface, making it accessible to a broad audience regardless of their technical proficiency. This focus on ease of use is crucial for DoorDash's strategy to capture a wide customer base, driving order volume and revenue.

In 2024, DoorDash reported that its mobile app accounted for the vast majority of its orders, underscoring its critical role in the business. The company continues to invest heavily in app development, aiming to enhance features like personalized recommendations and loyalty programs to further boost customer engagement and retention.

The DoorDash website serves as a crucial digital channel, offering users the ability to place orders and manage their accounts directly from desktop or laptop computers. This provides an alternative to the popular mobile app, catering to a broader range of customer preferences and accessibility needs.

In 2024, DoorDash continued to see significant engagement across its digital platforms. While specific website traffic figures are proprietary, the company reported over 15 million active users across its app and website in the first quarter of 2024, highlighting the importance of both digital touchpoints for order volume and customer retention.

The Dasher App is the core operational tool for DoorDash's delivery network, enabling drivers to efficiently accept, manage, and complete orders. It provides essential features like route navigation and direct communication channels with customers and support teams.

This application is critical for managing DoorDash's vast network of independent contractors. In 2024, DoorDash reported having over 2 million Dashers globally, all relying on this app to facilitate millions of deliveries daily.

Merchant Portal/App

The Merchant Portal/App is DoorDash's primary channel for its restaurant partners, acting as a digital hub for managing their operations on the platform. It allows businesses to control their online menus, update pricing, and set delivery zones and hours. This is crucial for maintaining an accurate and appealing storefront for customers.

This channel is also where merchants access vital performance metrics, offering insights into sales, popular items, and customer feedback. DoorDash also provides marketing tools through the portal, such as promotional offers and sponsored listings, enabling restaurants to boost visibility and drive more orders. For example, in Q1 2024, DoorDash reported that over 300,000 merchants were actively using its platform, highlighting the portal's widespread adoption.

Key functionalities of the Merchant Portal/App include:

- Menu Management: Real-time updates to item availability, descriptions, and pricing.

- Order Processing: Receiving, confirming, and managing incoming customer orders.

- Performance Analytics: Access to sales data, customer insights, and delivery efficiency reports.

- Marketing Tools: Options for running promotions, loyalty programs, and targeted advertising campaigns.

Direct Integrations and APIs

DoorDash provides direct integrations and APIs, such as DoorDash Drive, allowing larger businesses to connect their own order management systems directly to DoorDash's delivery network. This streamlines operations for merchants by automating order flow and delivery dispatch.

These integrations are crucial for partners wanting to leverage DoorDash's logistics without overhauling their existing technology. For example, a restaurant with a robust online ordering system can use the API to send orders directly to DoorDash for fulfillment.

- Seamless System Connection: Enables merchants to link their point-of-sale (POS) or order management systems directly with DoorDash.

- DoorDash Drive Utilization: Facilitates the use of DoorDash's logistics network for merchants' own delivery orders, not just those placed through the DoorDash app.

- Operational Efficiency Gains: Reduces manual order entry and improves the speed of delivery fulfillment for integrated partners.

- Scalability for Large Merchants: Provides a robust solution for enterprise-level partners requiring high-volume, integrated delivery services.

DoorDash utilizes a multi-channel approach to reach its diverse user base. The core channels include the customer-facing mobile app and website, the Dasher app for delivery personnel, and the Merchant Portal for restaurant partners.

These digital touchpoints are essential for facilitating orders, managing logistics, and supporting business operations. DoorDash actively invests in these channels to enhance user experience and operational efficiency, as evidenced by their continuous app development and platform feature expansions.

In 2024, DoorDash reported over 15 million active users across its app and website in Q1, demonstrating the significant reach of its customer-facing digital channels. Furthermore, the company supported over 300,000 merchants on its platform in the same period, highlighting the critical role of the Merchant Portal.

DoorDash also offers APIs and direct integrations, like DoorDash Drive, for larger businesses to connect their systems directly to the delivery network, streamlining order flow and delivery dispatch for partners. This B2B channel is vital for scaling operations and serving enterprise clients efficiently.

Customer Segments

Individual consumers represent DoorDash's most extensive customer base. These are everyday people looking for quick and easy ways to get food, groceries, and other items delivered right to their doorsteps, whether at home or at work. They prioritize convenience, a wide selection of options, and fast delivery times.

In 2024, DoorDash continued to solidify its position as a go-to platform for these consumers. The company reported a significant increase in active users, demonstrating the ongoing demand for its services. For instance, DoorDash's Gross Order Volume (GOV) saw robust growth throughout the year, reflecting the sheer volume of transactions from this segment.

DashPass subscribers represent a core customer segment for DoorDash, characterized by their frequent platform usage and commitment to cost savings through the subscription. These individuals are typically loyal users who value the reduced delivery fees and exclusive perks offered by DashPass, leading to higher order frequency and a greater overall lifetime value for DoorDash.

As of late 2023, DoorDash reported that DashPass members accounted for a significant portion of their total orders, demonstrating the program's success in driving customer retention and engagement. For instance, in the first quarter of 2024, DoorDash saw continued growth in its subscriber base, with DashPass members contributing to a substantial increase in Gross Order Volume (GOV).

Restaurants, from cozy local diners to massive international chains, represent a core customer segment for DoorDash. These businesses partner with DoorDash to tap into a wider customer base, boost their sales, and offload the complexities of managing their own delivery fleets. In 2024, DoorDash reported a significant portion of its revenue coming from its restaurant partnerships, underscoring the vital role these establishments play in its ecosystem.

Non-Restaurant Merchants (Groceries, Convenience, Retail)

DoorDash's non-restaurant merchant segment, including groceries, convenience stores, and general retail, is a rapidly expanding area for the company. This diversification is crucial for sustained growth beyond its initial food delivery focus. By Q1 2024, DoorDash reported that its Marketplace GO segment, which includes these non-restaurant verticals, saw significant order volume increases, demonstrating strong customer adoption.

This segment allows a wider range of businesses to access DoorDash's extensive delivery network. For instance, major grocery chains and smaller convenience stores alike utilize the platform to reach customers seeking immediate delivery of everyday essentials. This strategic move helps DoorDash capture a larger share of the overall e-commerce delivery market.

- Grocery Delivery Growth: DoorDash has seen substantial year-over-year growth in grocery orders, with many national chains now integrated into the platform.

- Convenience Store Expansion: Partnerships with convenience stores have broadened the types of goods available for rapid delivery, catering to impulse purchases and immediate needs.

- Retail Diversification: The platform is increasingly used by various retail sectors, from electronics to pet supplies, showcasing its versatility.

- Marketplace GO Performance: In the first quarter of 2024, DoorDash's Marketplace GO segment experienced a notable increase in gross order volume, underscoring the segment's growing importance.

Businesses Requiring White-Label Delivery (DoorDash Drive)

This customer segment includes businesses that have established their own online ordering platforms or in-house order management systems but lack their own delivery fleet. DoorDash Drive serves as their white-label delivery partner, enabling them to offer delivery without the overhead of managing drivers. This allows these businesses to scale their delivery operations efficiently while preserving their brand identity and direct customer interactions.

DoorDash Drive's white-label service is particularly attractive to restaurants and retailers looking to expand their reach. For instance, a restaurant with a popular online ordering website can seamlessly integrate DoorDash Drive to fulfill orders placed directly through their site. This strategy was evident in DoorDash's 2023 performance, where their logistics network facilitated millions of deliveries for partners, showcasing the demand for such integrated solutions.

- Businesses with Existing Ordering Systems: Companies that have invested in their own websites or apps for customer orders.

- Need for Delivery Fulfillment: These businesses require a reliable logistics network to get their products to customers.

- White-Label Solution: DoorDash Drive allows them to use DoorDash's drivers and technology under their own brand.

- Maintaining Customer Relationships: This model ensures that the end customer still feels like they are interacting directly with the original business, not a third-party delivery service.

DoorDash serves a diverse customer base, primarily individual consumers seeking convenience and variety in food and grocery delivery. This segment is the largest, driving significant order volume. The DashPass subscription program further engages frequent users by offering cost savings and exclusive perks, fostering loyalty and increasing order frequency.

Cost Structure

DoorDash's primary cost revolves around compensating its Dashers, which forms the largest part of its expenses. This compensation includes base pay for each delivery, customer tips, and various bonuses designed to motivate and keep enough drivers active on the platform. For instance, in Q1 2024, DoorDash's total operating expenses were $3.5 billion, with a significant portion allocated to Dasher payouts and related operational costs.

DoorDash dedicates substantial resources to its technology backbone, a significant cost driver. This encompasses ongoing research and development to innovate and improve its core platform, including the user-facing apps and the sophisticated algorithms that power its logistics. In 2023, the company reported research and development expenses of $789 million, reflecting this commitment.

Maintaining and enhancing this complex technological ecosystem is an ongoing financial undertaking. This includes the costs associated with cloud hosting services, essential for managing vast amounts of data and ensuring platform reliability, as well as the salaries for a large team of engineers and data scientists who build and refine the technology. These operational expenses are critical for staying competitive in the fast-paced delivery market.

DoorDash invests heavily in sales and marketing to fuel growth, with significant spending on digital marketing, promotions, and referral programs. These efforts are crucial for acquiring new customers, merchants, and delivery drivers, as well as building brand recognition. In 2023, DoorDash's total operating expenses were $5.5 billion, with a substantial portion allocated to sales and marketing.

Operations and Customer Support

DoorDash incurs significant costs in its operations and customer support functions. These expenses cover the essential infrastructure and personnel needed to keep the platform running smoothly for consumers, merchants, and delivery drivers, known as Dashers.

Key operational costs include maintaining customer service centers, employing support staff to assist with inquiries and issues from all user segments, and managing the administrative overhead associated with running a large-scale logistics and technology company. In 2023, DoorDash reported total operating expenses of $6.5 billion, a substantial portion of which is dedicated to these operational and support activities.

- Customer Service Centers: Costs associated with physical locations, technology, and staffing for handling customer inquiries.

- Support Staff: Salaries and benefits for employees assisting consumers, merchants, and Dashers with various issues.

- Administrative Overhead: General and administrative expenses, including IT infrastructure, legal, finance, and HR functions.

- Technology Maintenance: Ongoing costs for maintaining and upgrading the platform, apps, and internal systems.

Payment Processing Fees and Regulatory Costs

DoorDash faces significant expenses from payment processing fees, typically ranging from 2% to 3.5% of each transaction value, depending on the payment gateway used. These fees are a direct cost of facilitating customer orders and driver payouts. For example, in 2023, payment processing fees represented a substantial portion of their cost of revenue.

Beyond transaction costs, DoorDash incurs considerable expenses to comply with a complex web of regulations. This includes adhering to minimum wage laws for its delivery drivers, which vary significantly by city and state. The company also manages costs related to background checks, insurance requirements, and data privacy regulations, all of which add to its operational overhead.

- Payment Processing Fees: DoorDash pays fees to third-party payment processors for each transaction, impacting overall profitability.

- Regulatory Compliance: Costs associated with adhering to labor laws, such as minimum wage mandates for couriers, are a significant expense.

- Gig Worker Regulations: Compliance with evolving regulations concerning independent contractor status and worker benefits adds to operational costs.

DoorDash's cost structure is heavily influenced by its extensive network of delivery drivers, known as Dashers. These individuals are compensated through a model that includes base pay per delivery, customer tips, and performance-based bonuses, ensuring sufficient driver availability. In the first quarter of 2024, DoorDash reported total operating expenses of $3.5 billion, with a significant portion dedicated to these driver payouts and associated operational costs.

The company also allocates substantial funds to its technological infrastructure, encompassing research and development for platform enhancements and algorithmic improvements. In 2023, DoorDash's research and development expenses amounted to $789 million, underscoring its commitment to innovation. These costs are essential for maintaining a competitive edge in the dynamic delivery market.

Sales and marketing are another major expense category, with investments in digital advertising, promotions, and customer acquisition strategies. These efforts are vital for expanding its user base among consumers, merchants, and Dashers. In 2023, DoorDash's total operating expenses reached $6.5 billion, with a considerable allocation towards sales and marketing initiatives.

| Cost Category | 2023 Expenses (Approximate) | Key Drivers |

|---|---|---|

| Dasher Compensation | Billions | Base pay, tips, bonuses |

| Technology & R&D | $789 million | Platform development, algorithms |

| Sales & Marketing | Billions | Customer & merchant acquisition |

| Operations & Support | Billions | Customer service, admin overhead |

| Payment Processing | Significant % of revenue | Transaction fees |

Revenue Streams

DoorDash generates significant revenue by charging partner restaurants and other merchants a commission for every order facilitated through its platform. This commission structure is a cornerstone of their business model, directly linking their success to the sales volume of their merchant partners.

These commission rates commonly fall within the 15% to 30% range of the total order value. The specific percentage often depends on the service tier or plan the merchant selects, with higher tiers potentially offering enhanced visibility or additional services in exchange for a greater commission share.

For context, in the first quarter of 2024, DoorDash reported gross order volume (GOV) of $21.4 billion. If we conservatively estimate an average commission rate of 20% on this GOV, it would translate to approximately $4.28 billion in potential commission revenue for that quarter alone, highlighting the substantial impact of this revenue stream.

Customers pay a delivery fee for each order placed through DoorDash. These fees are a primary revenue source, directly offsetting the operational costs associated with getting food from restaurants to consumers. In 2023, DoorDash's total revenue reached $8.6 billion, with delivery fees playing a significant role in this figure.

The typical delivery fee ranges from $1.99 to $5.99. However, this price can fluctuate based on several factors. Distance to the restaurant, current customer demand, and the implementation of surge pricing during peak hours or inclement weather can all influence the final delivery fee, sometimes pushing it higher.

DoorDash levies service fees on its customers, typically ranging from 10% to 15% of the order's subtotal. These fees are crucial for offsetting operational expenses, investing in technological advancements, and managing payment processing costs.

DashPass Subscription Fees

DashPass is a significant revenue driver for DoorDash, bringing in consistent income through monthly or annual subscription fees. Members enjoy perks like free delivery on eligible orders and lower service fees, which encourages repeat business and builds a loyal customer base.

In the first quarter of 2024, DoorDash reported that over 30% of its total orders were DashPass orders. This highlights the program's success in driving order volume and customer engagement.

- Recurring Revenue: Subscription fees create a predictable income stream, smoothing out revenue fluctuations.

- Customer Loyalty: The benefits offered incentivize members to use DoorDash more frequently.

- Order Volume: DashPass members tend to place more orders, increasing overall platform activity.

- Growth Potential: Continued expansion of the DashPass program can lead to substantial revenue growth.

Advertising Services and Promotions

DoorDash provides advertising and promotional services to both its merchant partners and consumer packaged goods (CPG) companies. This allows these businesses to secure prominent placement and increased visibility for their offerings directly on the DoorDash platform, reaching a vast customer base actively seeking food and convenience items.

This advertising segment is a significant and increasingly lucrative revenue source for DoorDash. In the first quarter of 2024, DoorDash reported total revenue of $1.7 billion, with advertising contributing a substantial portion to this growth. The company has focused on enhancing its ad tech capabilities, allowing for more targeted and effective campaigns for its partners, which in turn drives higher ad spend.

- Advertising Services: Merchants can pay for sponsored listings, banner ads, and featured placement within search results and category pages.

- Promotional Placements: CPG brands can sponsor specific menu items, offer exclusive deals, or participate in curated collections promoted to users.

- High-Margin Revenue: Compared to commission-based delivery fees, advertising services offer a higher profit margin for DoorDash.

- Growth Driver: DoorDash's investment in its advertising platform is a key strategy for expanding its revenue streams beyond core delivery services.

DoorDash offers additional services beyond food delivery, including grocery and convenience item delivery. This expansion diversifies their revenue by tapping into a broader market of consumer needs and increasing the frequency of platform usage.

In 2023, DoorDash's total revenue was $8.6 billion. This figure reflects the success of their diversified offerings, with non-food delivery categories contributing to overall growth and providing new avenues for revenue generation.

The company also generates revenue through various fees and charges for value-added services. These can include fees for specific delivery options, partnerships with businesses for logistics, or data analytics services provided to merchants.

| Revenue Stream | Description | 2023 Data Point |

|---|---|---|

| Commissions from Merchants | Percentage of order value charged to restaurants and merchants. | Gross Order Volume (GOV) of $21.4 billion in Q1 2024. |

| Delivery Fees | Charges paid by customers for delivery services. | Total Revenue of $8.6 billion in 2023. |

| Service Fees | Fees charged to customers on order subtotals. | Part of the overall revenue contributing to operational costs. |

| DashPass Subscriptions | Recurring fees for membership benefits. | Over 30% of orders were DashPass orders in Q1 2024. |

| Advertising and Promotions | Revenue from sponsored listings and marketing services. | Total Revenue of $1.7 billion in Q1 2024, with advertising as a key contributor. |

| New Verticals (Grocery, etc.) | Revenue from delivering non-food items. | Contributes to the overall $8.6 billion total revenue in 2023. |

Business Model Canvas Data Sources

The DoorDash Business Model Canvas is informed by a blend of operational data, customer feedback, and market analysis. This ensures each component, from value propositions to cost structures, is grounded in real-world performance and consumer behavior.